Fill Out Your It 203 Att Form

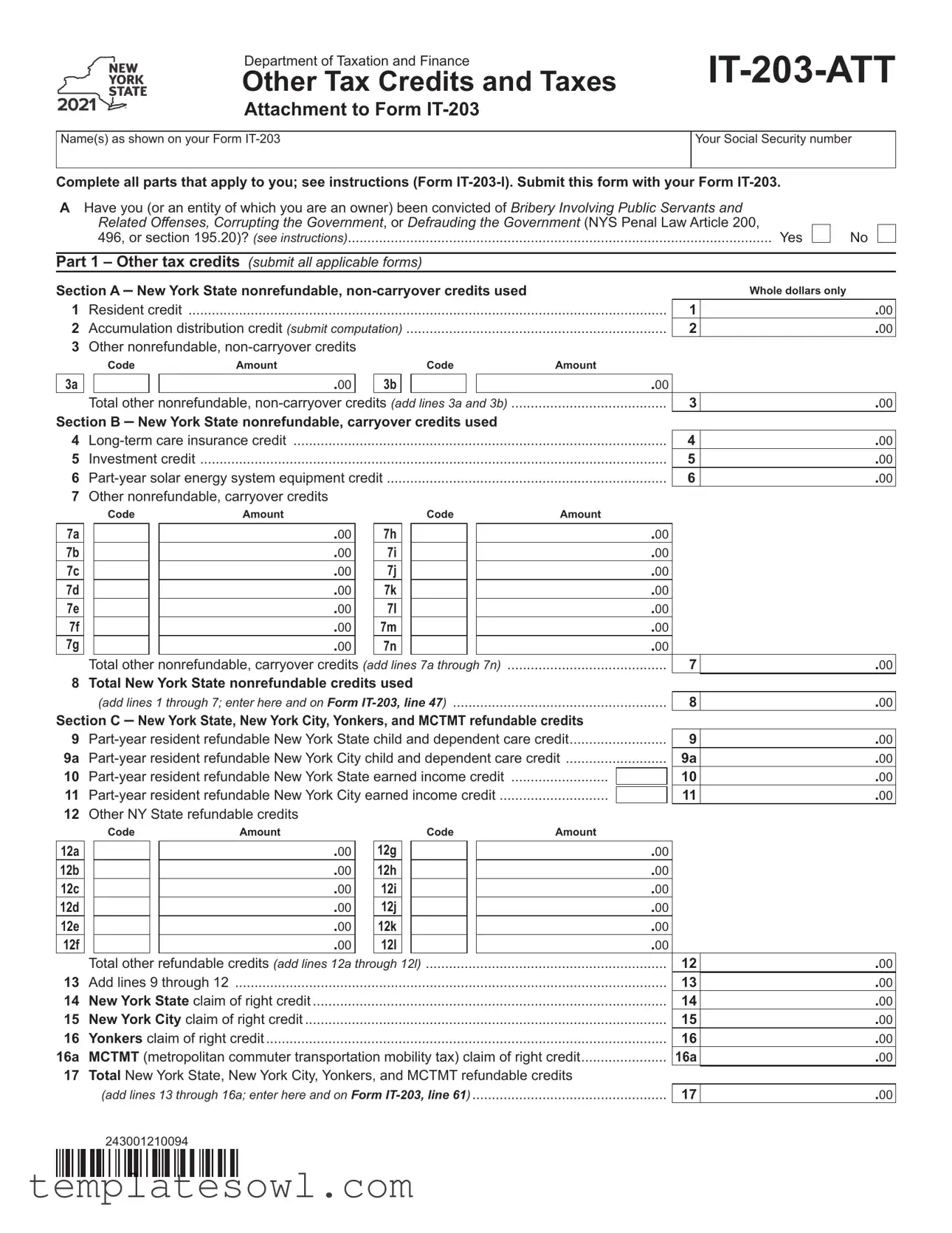

The IT-203-ATT form serves as an important attachment for taxpayers filing the New York State IT-203 form, specifically designed to report various tax credits and additional tax liabilities. It must be submitted alongside the IT-203, ensuring that all relevant credits are properly documented. This form includes crucial sections for both refundable and nonrefundable credits. For example, completions under Part 1 allow taxpayers to detail their New York State nonrefundable credits, including the resident credit and various other tax benefits applicable for the tax year. Part 2 focuses on other New York State taxes, such as the tax on capital gains and additional charges that may impact the taxpayer’s total liability. Furthermore, individuals must disclose any past legal issues regarding bribery or government corruption, which may affect their ability to claim certain credits. Each section requires careful consideration to ensure accurate reporting, as the calculations can significantly influence the total tax owed or refunded. Assisting taxpayers in navigating the complexities of this form can lead to better financial outcomes during tax season.

It 203 Att Example

Department of Taxation and Finance

Other Tax Credits and Taxes

Attachment to Form

Name(s) as shown on your Form

Your Social Security number

Complete all parts that apply to you; see instructions (Form

AHave you (or an entity of which you are an owner) been convicted of Bribery Involving Public Servants and

|

Related Offenses, Corrupting the Government, or Defrauding the Government (NYS Penal Law Article 200, |

Yes |

No |

|

496, or section 195.20)? (see instructions) |

Part 1 – Other tax credits (submit all applicable forms)

Section A – New York State nonrefundable, non‑carryover credits used |

|

Whole dollars only |

|

1 |

Resident credit |

1 |

.00 |

2 |

Accumulation distribution credit (submit computation) |

2 |

.00 |

3Other nonrefundable,

|

|

Code |

Amount |

|

|

Code |

Amount |

|||||||

3a |

|

|

|

|

.00 |

|

|

3b |

|

|

|

|

.00 |

3 |

|

Total other nonrefundable, |

......................................... |

||||||||||||

Section B – New York State nonrefundable, carryover credits used |

|

|

||||||||||||

4 |

|

|

|

|

4 |

|||||||||

5 |

Investment credit |

........................................................................................................................ |

|

|

|

|

|

|

|

5 |

||||

6 |

........................................................................ |

|

|

|

|

6 |

||||||||

7Other nonrefundable, carryover credits

.00

.00

.00

.00

|

|

Code |

Amount |

|

|

|

Code |

Amount |

|

|

|

|

|||

7a |

|

|

|

.00 |

|

7h |

|

|

|

|

|

.00 |

|

|

|

7b |

|

|

|

.00 |

|

7i |

|

|

|

|

|

.00 |

|

|

|

7c |

|

|

|

.00 |

|

7j |

|

|

|

|

|

.00 |

|

|

|

7d |

|

|

|

.00 |

|

7k |

|

|

|

|

|

.00 |

|

|

|

7e |

|

|

|

.00 |

|

7l |

|

|

|

|

|

.00 |

|

|

|

7f |

|

|

|

.00 |

|

7m |

|

|

|

|

|

.00 |

|

|

|

7g |

|

|

|

.00 |

|

7n |

|

|

|

|

|

.00 |

|

|

|

|

Total other nonrefundable, carryover credits (add lines 7a through 7n) |

.......................................... |

|

|

7 |

.00 |

|||||||||

8 |

Total New York State nonrefundable credits used |

|

|

|

|

|

|||||||||

|

........................................................ (add lines 1 through 7; enter here and on Form |

|

|

8 |

.00 |

||||||||||

Section C – New York State, New York City, Yonkers, and MCTMT refundable credits |

|

|

|

|

|||||||||||

9 |

.........................Part‑year resident refundable New York State child and dependent care credit |

|

|

9 |

.00 |

||||||||||

9a |

...........................Part‑year resident refundable New York City child and dependent care credit |

|

|

9a |

.00 |

||||||||||

10 |

Part‑year resident refundable New York State earned income credit |

.......................... |

|

|

10 |

.00 |

|||||||||

11 |

|

|

11 |

.00 |

|||||||||||

12Other NY State refundable credits

12a

12b

12c

12d

12e

12f

13

14

15

16

16a

17

|

Code |

Amount |

|

|

|

Code |

Amount |

|

|

|

|||

|

|

|

|

.00 |

|

12g |

|

|

|

|

.00 |

|

|

|

|

|

|

.00 |

|

12h |

|

|

|

|

.00 |

|

|

|

|

|

|

.00 |

|

12i |

|

|

|

|

.00 |

|

|

|

|

|

|

.00 |

|

12j |

|

|

|

|

.00 |

|

|

|

|

|

|

.00 |

|

12k |

|

|

|

|

.00 |

|

|

|

|

|

|

.00 |

|

12l |

|

|

|

|

.00 |

|

|

Total other refundable credits (add lines 12a through 12l) |

|

|

12 |

.00 |

|||||||||

Add lines 9 through 12 |

................................................................................................................ |

|

|

|

|

|

|

|

13 |

.00 |

|||

............................................................................................New York State claim of right credit |

|

|

|

|

|

|

14 |

.00 |

|||||

..............................................................................................New York City claim of right credit |

|

|

|

|

|

|

15 |

.00 |

|||||

........................................................................................................Yonkers claim of right credit |

|

|

|

|

|

|

16 |

.00 |

|||||

......................MCTMT (metropolitan commuter transportation mobility tax) claim of right credit |

16a |

.00 |

|||||||||||

Total New York State, New York City, Yonkers, and MCTMT refundable credits |

|

|

|

||||||||||

(add lines 13 through 16a; enter here and on Form |

|

|

17 |

.00 |

|||||||||

243001210094

Enter your Social Security number

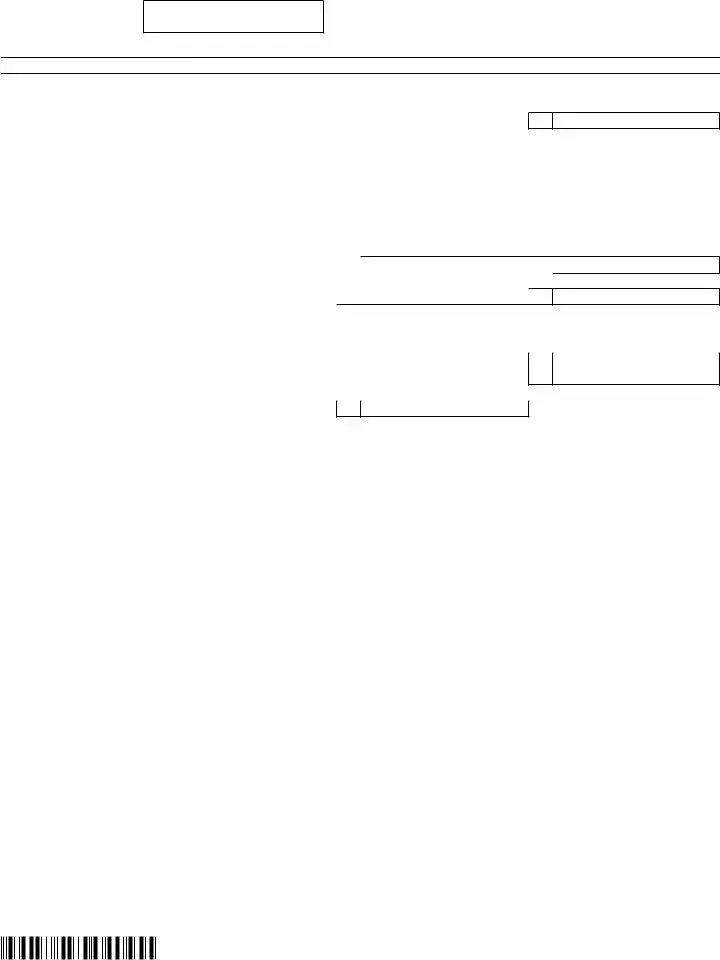

Part 2 – Other New York State taxes (submit all applicable forms)

18NY State tax on capital gain portion of lump‑sum distributions (Form

19Other New York State taxes

18

.00

Code |

Amount |

Code |

Amount |

19a |

|

|

|

.00 |

|

19g |

|

|

|

.00 |

|

|

|

|

19b |

|

|

|

.00 |

|

19h |

|

|

|

|

.00 |

|

|

|

19c |

|

|

|

.00 |

|

19i |

|

|

|

|

.00 |

|

|

|

19d |

|

|

|

.00 |

|

19j |

|

|

|

|

.00 |

|

|

|

19e |

|

|

|

.00 |

|

19k |

|

|

|

|

.00 |

|

|

|

19f |

|

|

|

.00 |

|

19l |

|

|

|

|

.00 |

|

19 |

|

|

Total other New York State taxes (add lines 19a through 19l) |

|

|

|

||||||||||

20 |

Add lines 18 and 19 |

|

|

|

|

|

|

|

|

20 |

|

|||

|

|

|

|

|

|

|

|

|||||||

21 |

...........................Enter amount from Form |

|

|

|

|

21 |

.00 |

|

|

|

||||

22 |

..........................Enter amount from Form |

|

|

|

|

22 |

.00 |

|

|

|

||||

.00

.00

23 |

Subtract line 22 from line 21 (if line 22 is more than line 21, leave blank) |

23 |

.00 |

24 |

..........................................Subtract line 23 from line 20 (if line 23 is more than line 20, leave blank) |

24 |

.00 |

25New York State separate tax on lump‑sum distributions

(Form |

25 |

.00 |

26Resident credit against separate tax on lump‑sum

|

distributions |

26 |

|

.00 |

|

|

27 |

.......................................................................................................Subtract line 26 from line 25 |

|

|

|

27 |

.00 |

28 |

...................................................................................................This line intentionally left blank |

|

|

|

28 |

|

29 |

Add lines 24 and 27 |

|

|

|

29 |

.00 |

30 |

Excess child and dependent care credit |

|

|

|

30 |

.00 |

31 |

..........................................Subtract line 30 from line 29 (if line 30 is more than line 29, leave blank) |

31 |

.00 |

|||

32 |

Excess New York State earned income credit |

|

|

|

32 |

.00 |

33 |

Net other New York State taxes (subtract line 32 from line 31; if line 32 is more than line 31, leave |

|

|

|||

|

blank; otherwise, enter the result here and on Form |

33 |

.00 |

|||

|

|

|

|

|

|

|

243002210094

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The IT-203-ATT form is an attachment used with Form IT-203 for reporting other tax credits and taxes in New York State. |

| Submission Requirement | This form must be submitted alongside the primary Form IT-203. |

| Conviction Disclosure | Taxpayers must disclose if they or an entity they own have been convicted of specific offenses, including bribery or fraud involving the government. |

| Credits Reporting | The form allows taxpayers to report various nonrefundable and refundable tax credits applicable to their situation. |

| Governing Law | New York State Penal Law Article 200, section 496, and section 195.20 govern the disclosure related to convictions. |

| Information Collection | Taxpayers must provide their Social Security number and ensure the accuracy of all credit amounts reported on the form. |

| New York State Taxes | The form includes sections for reporting capital gains and other state taxes, ensuring comprehensive tax reporting. |

Guidelines on Utilizing It 203 Att

Filling out the IT-203-ATT form can seem daunting, but breaking it down into manageable steps will make the process easier. This attachment is essential to report additional tax credits and taxes that pertain to your situation. After gathering the required information, follow these straightforward steps to complete the form accurately.

- Provide Your Personal Information: Start by entering your name as it appears on your Form IT-203, followed by your Social Security number.

- Check for Prior Convictions: Respond to the question about any convictions related to bribery, corruption, or defrauding the government by checking ‘Yes’ or ‘No’.

- Complete Part 1 – Other Tax Credits: Fill in any applicable nonrefundable credits in Section A. Make sure to use whole dollar amounts and include specific codes for each credit.

- Add Up Nonrefundable Credits: In Section B, list applicable nonrefundable carryover credits and add them up for a total in the designated space.

- Calculate Total Nonrefundable Credits: Combine all applicable credits from Sections A and B and enter the total in the box provided.

- Move to Section C: Report any refundable credits, including those specific to New York State and localities. Again, include the relevant codes and amounts.

- Sum Refundable Credits: Add all refundable credits together and place the total in the specified area.

- Proceed to Part 2 – Other New York State Taxes: Enter information regarding any capital gains taxes or other applicable New York State taxes.

- Calculate Total New York State Taxes: Add together all applicable tax amounts from Part 2.

- Complete Remaining Calculations: Follow the instructions through lines 21 to 33, entering amounts from your IT-203 where needed and performing any required calculations.

- Review Your Information: Before submitting, double-check your entries for accuracy and completeness.

By following these steps, you will ensure that your IT-203-ATT form is filled out accurately. Once completed, submit this attachment along with your Form IT-203 to the appropriate tax authorities. This allows for a smoother processing of your tax returns, ensuring you receive any benefits you may be eligible for.

What You Should Know About This Form

What is the IT-203-ATT form used for?

The IT-203-ATT form, also known as the Attachment to Form IT-203, is used by individuals filing New York State non-resident or part-year resident income tax returns. This form allows filers to claim various tax credits, report other New York State taxes, and provide necessary information that might be relevant to their tax situation. It ensures that all applicable credits get included with the primary Form IT-203 when filing your tax return, maximizing potential deductions and credits.

Who needs to file the IT-203-ATT form?

What types of tax credits can be claimed on the IT-203-ATT form?

The IT-203-ATT form allows you to claim several New York State tax credits. These include both nonrefundable and refundable credits. Nonrefundable credits, such as the resident credit and accumulation distribution credit, can lower your tax bill but cannot result in a refund. Refundable credits, like the New York State earned income credit, can reduce your tax liability to zero and may provide you with a refund if there's any excess. Be sure to complete all relevant sections to maximize your claims.

How should the IT-203-ATT form be submitted?

Common mistakes

Completing the IT-203-ATT form can be a straightforward task, but there are common mistakes that can lead to complications in processing your tax return. One of the first mistakes people often make is not providing their complete name and Social Security number. It's essential to ensure that your name appears exactly as it does on your IT-203 form, along with the correct Social Security number. Omitting or incorrectly entering this information can delay the processing of your form.

Another frequent error is failing to read the instructions for each section carefully. The form has specific requirements based on your situation. For instance, not all credits may apply to everyone, and selecting credits without verifying eligibility can lead to mistakes. It’s crucial to complete only the parts that apply to you, as advised in the instructions.

One of the more technical parts of the IT-203-ATT form involves calculating tax credits. Many individuals mistakenly enter amounts in the wrong fields or forget to add together the total credits. Always double-check your calculations, particularly in Section A and Section B, where you are asked to sum certain lines. Errors here could result in claiming too much or too little, impacting your overall tax liability.

Another mistake is using incorrect dollar amounts—people may accidentally use cents instead of whole dollars or vice versa. The form requires input in whole dollars only. Carefully reviewing each number will minimize this possibility and can prevent correction notices from the tax department.

Moreover, some filers overlook the additional forms that may need to be submitted alongside the IT-203-ATT. For example, if you claim certain tax credits, you must submit the applicable computation forms. Failing to include these forms can cause the entire return to be sent back for additional review.

Additionally, the timing of submissions can be a pitfall. Some individuals may forget to submit the IT-203-ATT with their IT-203 form. It's crucial to remember that these forms need to be filed together, ensuring that all relevant information is available for review at the same time.

Lastly, an often-overlooked requirement is to keep a copy of your completed forms. After filing, having a record for your own reference is beneficial if any questions arise regarding your tax return in the future. Not keeping this documentation could complicate matters if your return is audited.

Documents used along the form

The IT-203-ATT form is an essential part of filing your New York State tax return, specifically Form IT-203. It allows taxpayers to claim various tax credits and report other relevant taxes. While this form is crucial, there are several other documents that may accompany it to ensure that your filing is complete and accurate. Understanding these forms can help you navigate the tax process more smoothly.

- Form IT-203: This is the main tax return form for non-residents and part-year residents filing in New York. It reports income earned from New York sources, along with the applicable taxes and credits.

- Form IT-230: Used to report taxes on lump-sum distributions from pension or retirement plans. This form specifies how much of your distribution is subject to state tax.

- Form IT-230-I: This is the instruction guide accompanying Form IT-230. It provides detailed guidance on how to complete the form and calculate the appropriate tax liabilities.

- Form IT-572: This form allows taxpayers to report a credit for taxes paid to other jurisdictions, which can reduce their overall state tax liability.

- Form IT-215: This form is for claiming the New York State Child and Dependent Care Credit. It helps taxpayers calculate the refundable portion of the credit against their tax liability.

- Form IT-196: This is an online form that taxpayers can use to calculate the New York State itemized deductions, which may provide greater savings than the standard deduction.

- Form IT-201: This form is used by residents of New York to file their personal income tax returns. It’s similar to Form IT-203, but primarily for residents.

- Form NYS-1: This is the New York State Employer's Quarterly Report, but it can have implications for personal taxes, particularly for those who are self-employed.

Knowing the relevant forms that correspond with the IT-203-ATT can make the tax filing process less daunting. Each of these documents plays a unique role in your tax return, ensuring that you meet all requirements and maximize any credits available. Always double-check your forms and consult with a tax professional if you have specific concerns about your situation.

Similar forms

-

Form IT-201: This is the primary income tax return form for New York State residents. Like IT-203-ATT, it involves detailed reporting of income, credits, and deductions, but IT-201 is specifically for residents, while IT-203-ATT is an attachment specifying additional credits and taxes.

-

Form IT-150: Similar to IT-203-ATT, this simplified form is used for filing New York State income taxes by those with relatively straightforward tax situations. Both forms address certain credits, although IT-150 is designed for lower-income earners.

-

Form IT-214: This is the form for claiming the New York State School Tax Relief (STAR) exemption. Like IT-203-ATT, it focuses on specific credits, particularly for property owners, ensuring that taxpayers receive available benefits based on their circumstances.

-

Form IT-230: This form is used to report the New York State tax on capital gains from lump-sum distributions. Similar to IT-203-ATT, it requires detailed calculations regarding specific taxes imposed on certain financial activities.

-

Form IT-600: This refers to the New York State Excelsior Jobs Program tax credit application. It parallels IT-203-ATT in that it is focused on calculating and claiming credits, but is tailored for businesses participating in the Excelsior program.

-

Form IT-641: This form is used to apply for the Empire State film production credit. IT-203-ATT and IT-641 are comparable because both address the claiming of credits related to specific industry benefits under New York State tax regulations.

-

Form IT-606: This document is utilized for the New York State credit for taxes paid to other jurisdictions. This is similar to IT-203-ATT in that both involve claiming tax credits that offset state tax liabilities.

-

Form IT-202: This form is for New York State income tax returns for partnerships. Much like IT-203-ATT, it involves a detailed breakdown of various credits, but it focuses on partnership income rather than individual income tax.

Dos and Don'ts

When filling out the IT-203-ATT form, certain practices can make the process smoother and more accurate. Here’s what you should and shouldn’t do:

- Do: Ensure that all names and Social Security numbers are filled out correctly.

- Do: Review the form for completeness before submission.

- Do: Submit any applicable additional forms along with your IT-203-ATT.

- Do: Use whole dollar amounts only when entering credits.

- Do: Double-check any calculations to prevent errors.

- Don't: Leave any sections blank unless indicated otherwise.

- Don't: Enter cents or decimal points; use whole numbers.

- Don't: Forget to sign and date the form before submitting.

- Don't: Submit the form without reading the accompanying instructions.

- Don't: Hesitate to seek assistance if you're unsure about any part of the form.

Misconceptions

- All taxpayers must submit Form IT-203-ATT. This is not true. Only those who qualify for specific tax credits or have additional tax information to report need to submit this form alongside their IT-203.

- Form IT-203-ATT is only for New York state residents. In fact, it can also be used by part-year residents who have earned income in New York and wish to claim certain credits and deductions.

- Using this form is optional if applying for tax credits. This is a misconception. If you're claiming New York State tax credits, you must complete the IT-203-ATT, as it supports your claims and provides necessary details for processing.

- All credits listed on Form IT-203-ATT are automatically granted. This is incorrect. Taxpayers must meet specific eligibility requirements for each credit, and submitting the form does not guarantee approval.

- The form can only be submitted on paper. This is misleading. While paper submission is one option, many taxpayers can electronically file their IT-203 and attach the IT-203-ATT as part of that submission.

- All information must be reported in whole dollars. This can lead to confusion. Although some sections require whole dollar amounts, others may refer to calculations that include cents or require additional forms for accurate reporting.

- Taxpayers can complete the form without consulting the instructions. Relying solely on the form itself can lead to mistakes. Consulting the accompanying instructions (Form IT-203-I) is crucial for accurate completion and understanding of specific requirements.

Key takeaways

Filling out the IT-203-ATT form is essential for individuals claiming certain tax credits and reporting other New York State taxes. Here are key takeaways to consider:

- The IT-203-ATT form must be submitted alongside the main Form IT-203.

- Complete all applicable sections of the form accurately; refer to the instructions provided in Form IT-203-I for guidance.

- Report only whole dollar amounts when entering credits and taxes on the form.

- Section A focuses on nonrefundable, non-carryover credits. Ensure you sum credits correctly before entering the total.

- Section C addresses refundable credits. Review each individual credit type to verify eligibility.

- Including taxable amounts from other New York State taxes is crucial in Part 2. This will help calculate additional tax obligations.

- Pay attention to any specific lines referenced in Form IT-203. Properly transferring these values helps ensure accurate filing.

Familiarizing yourself with these aspects can streamline the process and minimize errors when submitting your tax documents.

Browse Other Templates

National Crop Insurance - Each signature must include printed names, ensuring clarity of identification.

Kcb Bank Loan Application Form Pdf - The application requests the submission of physical addresses for directors or signatories for verification.