Fill Out Your It 2105 Form

The IT-2105 form, known formally as the Estimated Tax Payment Voucher for Individuals, serves a crucial function within the New York State tax system, specifically for those who need to make estimated tax payments. It is vital to understand that this form is not just a piece of paper; it embodies a structured process that allows taxpayers to fulfill their obligations throughout the year. For individuals, especially those with fluctuating incomes such as freelancers or self-employed individuals, making estimated tax payments ensures that there are no unexpected tax bills come April. Each completed voucher facilitates a calculated payment toward various tax obligations, including those for New York State, New York City, Yonkers, and the Metropolitan Commuter Transportation Mobility Tax (MCTMT). When using the IT-2105, accurate personal information is essential—the form requests the full Social Security number and name as they appear on official documentation. This ensures that the payments are correctly credited to the appropriate tax accounts. Additionally, there are specific instructions tailored for married couples who file jointly, urging them to establish separate estimated tax accounts while allowing those accounts to be combined on the joint tax return. Understanding the key aspects of the IT-2105 helps taxpayers navigate the complexities of their financial responsibilities while minimizing the risk of errors that could delay the processing of tax returns.

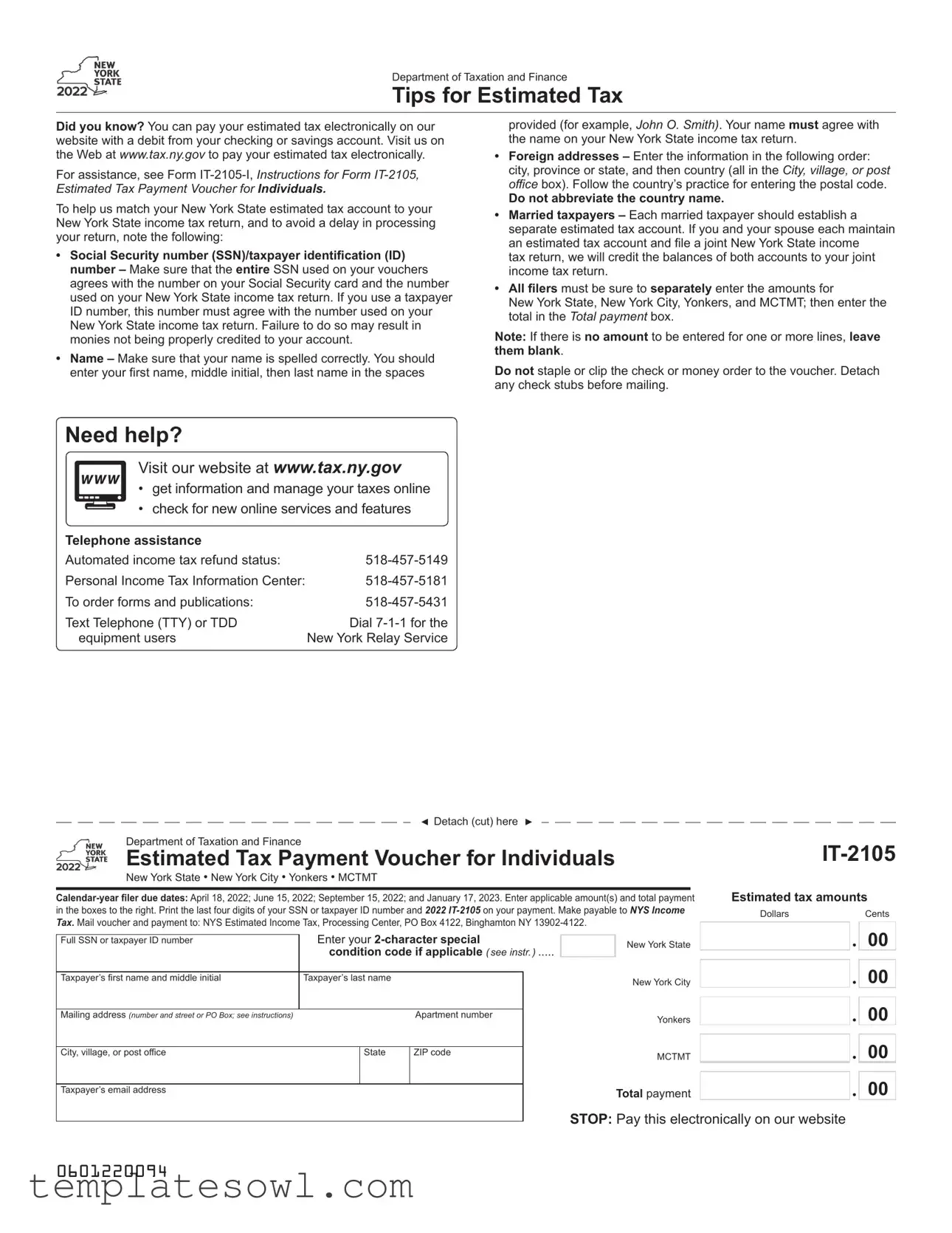

It 2105 Example

Department of Taxation and Finance

Tips for Estimated Tax

Did you know? You can pay your estimated tax electronically on our website with a debit from your checking or savings account. Visit us on the Web at www.tax.ny.gov to pay your estimated tax electronically.

For assistance, see Form IT‑2105‑I, Instructions for Form IT‑2105,

Estimated Tax Payment Voucher for Individuals.

To help us match your New York State estimated tax account to your New York State income tax return, and to avoid a delay in processing your return, note the following:

•Social Security number (SSN)/taxpayer identification (ID) number – Make sure that the entire SSN used on your vouchers agrees with the number on your Social Security card and the number used on your New York State income tax return. If you use a taxpayer ID number, this number must agree with the number used on your New York State income tax return. Failure to do so may result in monies not being properly credited to your account.

•Name – Make sure that your name is spelled correctly. You should enter your first name, middle initial, then last name in the spaces

provided (for example, John O. Smith). Your name must agree with the name on your New York State income tax return.

•Foreign addresses – Enter the information in the following order: city, province or state, and then country (all in the City, village, or post office box). Follow the country’s practice for entering the postal code.

Do not abbreviate the country name.

•Married taxpayers – Each married taxpayer should establish a separate estimated tax account. If you and your spouse each maintain an estimated tax account and file a joint New York State income

tax return, we will credit the balances of both accounts to your joint income tax return.

•All filers must be sure to separately enter the amounts for New York State, New York City, Yonkers, and MCTMT; then enter the total in the Total payment box.

Note: If there is no amount to be entered for one or more lines, leave them blank.

Do not staple or clip the check or money order to the voucher. Detach any check stubs before mailing.

Need help?

Visit our website at www.tax.ny.gov

• get information and manage your taxes online

• check for new online services and features

Telephone assistance |

|

Automated income tax refund status: |

|

Personal Income Tax Information Center: |

|

To order forms and publications: |

|

Text Telephone (TTY) or TDD |

Dial |

equipment users |

New York Relay Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

◄ Detach (cut) here |

► |

|

|

|

|

|

|

||

Department of Taxation and Finance |

|

|

|

|

|

|

|

|

|

||||

Estimated Tax Payment Voucher for Individuals |

|

|

|

||||||||||

New York State • New York City • Yonkers • MCTMT |

|

|

|

|

|

|

|

|

|

|

|||

Calendar‑year filer due dates: April 18, 2022; June 15, 2022; September 15, 2022; and January 17, 2023. Enter applicable amount(s) and total payment |

Estimated tax amounts |

||||||||||||

in the boxes to the right. Print the last four digits of your SSN or taxpayer ID number and 2022 IT‑2105 on your payment. Make payable to NYS Income |

Dollars |

|

|

Cents |

|||||||||

Tax. Mail voucher and payment to: NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton NY |

|

|

|

|

|

|

|||||||

|

|

|

|

|

00 |

||||||||

|

|

Enter your |

|

|

|

|

|

|

|

||||

Full SSN or taxpayer ID number |

|

|

|

|

New York State |

|

|||||||

|

|

condition code if applicable ( see instr. ) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

Taxpayer’s first name and middle initial |

|

Taxpayer’s last name |

|

|

|

|

New York City |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

Mailing address (number and street or PO Box; see instructions) |

|

|

Apartment number |

|

|

|

Yonkers |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

City, village, or post office |

|

State |

ZIP code |

|

|

|

MCTMT |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

Taxpayer’s email address |

|

|

|

|

|

|

Total payment |

|

|

|

|||

|

|

|

|

|

|

|

STOP: Pay this electronically on our website |

||||||

|

|

|

|

|

|||||||||

0601220094

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The IT-2105 form is used for making estimated tax payments for individuals in New York State. |

| Payment Options | You can pay your estimated tax electronically on the New York State Department of Taxation and Finance website. |

| Social Security Number | Ensure your SSN or taxpayer ID number matches what is on your Social Security card and tax return to avoid credit issues. |

| Married Taxpayers | Each married taxpayer should maintain a separate estimated tax account; both accounts can be credited to a joint tax return. |

| Due Dates | Estimated payments are due on April 18, June 15, September 15, and January 17 of the following year. |

| Mailing Information | Send your completed voucher and payment to NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton, NY 13902-4122. |

Guidelines on Utilizing It 2105

Follow these steps to fill out the IT-2105 form accurately. Ensure that you have all necessary information ready before starting. After completing the form, you will submit it along with your estimated tax payment.

- Write your full name. Include your first name, middle initial, and last name in the provided spaces.

- Input your Social Security number (SSN) or taxpayer identification number (ID). Ensure it matches the number on your Social Security card.

- Enter your mailing address. It should include the street number and name, apartment number (if applicable), city or village, state, and ZIP code.

- If you live outside the U.S., provide your foreign address. List the city, province or state, and country without abbreviating the country name.

- Indicate your email address in the designated space.

- Fill in the payment amounts for New York State, New York City, Yonkers, and MCTMT as applicable. Make sure to enter these amounts separately. If there are any lines with no amount, leave them blank.

- Calculate your total payment and enter the sum in the Total payment box.

- Detach any check stubs and write the last four digits of your SSN or taxpayer ID, along with the number "2022 IT-2105," on your payment.

- Mail both the completed voucher and the payment to: NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton NY 13902-4122.

What You Should Know About This Form

What is Form IT-2105 and who needs to use it?

Form IT-2105 is the Estimated Tax Payment Voucher for Individuals in New York State. This form is primarily for individuals who anticipate owing $300 or more in tax for the current year after accounting for withholding and credits. This might include self-employed individuals, freelancers, or those with additional income sources. By submitting this form, taxpayers make estimated tax payments to ensure that they meet their tax obligations and avoid penalties at year-end.

How do I properly fill out Form IT-2105?

Filling out Form IT-2105 correctly is essential for ensuring that your payment is processed without delays. Start by entering your complete Social Security number or taxpayer identification number. It must match the number on your tax return. Next, carefully print your name, ensuring it aligns with the name on your New York State income tax return. For foreign addresses, list the city, state or province, and country in that specific order. Married couples should apply for a separate estimated tax account, but can have both accounts credited to their joint tax return. Finally, provide the amounts for New York State, New York City, Yonkers, and MCTMT taxes in their designated sections before totaling your payment.

When are the due dates for submitting estimated tax payments?

For calendar-year filers, the due dates for submitting estimated tax payments using Form IT-2105 are as follows: April 18, June 15, September 15, and January 17 of the following year. Each date corresponds to payment for specific quarters of the tax year, so it is important to be aware of these deadlines to avoid penalties for late payment.

Can I pay my estimated taxes electronically?

Yes, you can pay your estimated taxes electronically through the New York State Department of Taxation and Finance website. This convenient option allows you to make payments directly from your checking or savings account, ensuring that you meet the payment deadline easily. For guidance and to find more information about the electronic payment process, you can visit the New York State tax website at www.tax.ny.gov.

Common mistakes

Filling out the IT-2105 form is crucial for ensuring that your estimated tax payments are properly credited to your account. However, many individuals make mistakes that can delay processing or lead to payment issues.

One common error is related to the Social Security number (SSN) or taxpayer identification number. It is essential that the SSN used on the voucher matches the number on your Social Security card and your New York State income tax return. If the numbers do not align, funds might not be credited appropriately, which can create complications down the road.

Another frequent mistake involves entering the taxpayer's name incorrectly. The form requires that your name be spelled exactly as it appears on your income tax return. Failing to provide the correct spelling—such as swapping the order of your first name and last name—can also lead to processing delays.

Additionally, individuals often struggle with addressing foreign locations accurately. When providing a foreign address, one must follow the correct order: city, province or state, and then country. It's important to avoid abbreviating the country name and to ensure that postal codes conform to the country’s standards. Inaccuracies here can hinder effective communication with tax authorities.

For married couples, not establishing separate estimated tax accounts is a prevalent oversight. Each spouse should have an individual account if filing jointly. This system allows for proper crediting of each person’s contributions to the joint return, ensuring that no funds are overlooked.

Lastly, a common mistake involves the total payment calculation. All filers must separately list their amounts for New York State, New York City, Yonkers, and MCTMT. It is vital to leave blank any lines where there is no amount—failing to do so can lead to confusion and potential payment discrepancies.

By being mindful of these potential pitfalls, individuals can avoid common errors when completing their IT-2105 form. Attention to detail is key to ensuring smooth processing and accurate crediting of estimated tax payments.

Documents used along the form

The IT-2105 form is essential for individuals in New York State who need to make estimated tax payments. Alongside this form, there are several other documents that typically accompany its submission. This information will help you understand these documents more clearly and ensure that all necessary steps are taken for compliance with tax requirements.

- IT-2105-I: Instructions for Form IT-2105, provides guidance on how to fill out the estimated tax payment voucher correctly. It outlines the specifics of payment amounts, due dates, and general filing procedures.

- IT-201: The New York State Resident Income Tax Return is the primary form used by residents to report their income annually, which may reference the payments made with the IT-2105.

- IT-203: This form is used by non-residents or part-year residents of New York State to file their income tax returns, ensuring they report income accurately while also accounting for estimated payments.

- IT-214: This is the Claim for Real Property Tax Credit form, which may be relevant for individuals seeking to understand how their estimated payments relate to property tax credits.

- IT-150: This form is for New York State Tax Credits for individuals. Knowing about available credits can help taxpayers adjust their estimated tax payments appropriately.

- Form W-2: The Wage and Tax Statement is issued by employers and details the income earned and taxes withheld during the year, providing a crucial reference for estimating tax obligations.

- Form 1099: Various types of 1099 forms may be necessary for reporting other types of taxable income, such as freelance work, which can impact estimated tax calculations.

- NYC-202: The New York City Income Tax Return form is essential for residents of New York City. It may also be influenced by the estimated tax payments made using Form IT-2105.

- Form 1040: The federal income tax return form is relevant for reporting income on a nationwide level, where estimated payments and deductions might also be factored for a complete financial overview.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Filing this form can affect the timing and nature of your estimated tax payments.

Understanding these documents can greatly enhance your preparation efforts when it comes to managing your tax obligations. Ensure that all materials are filled out accurately and submitted on time to avoid any potential delays or penalties related to your estimated taxes.

Similar forms

- Form 1040 - This is the standard individual income tax return form. Similar to IT-2105, both forms are utilized by individuals to report income and calculate tax liabilities. While IT-2105 focuses on estimated tax payments, Form 1040 addresses overall income and tax deductions.

- Form W-4 - This form is used by employees to indicate their tax situation to their employer, determining the amount of federal income tax withheld from their paycheck. Like IT-2105, it is a tool to manage tax obligations, although one relates to withholding and the other to estimated payments.

- Form 4868 - This form allows individuals to request an extension to file their federal tax return. Both it and IT-2105 serve to help taxpayers manage filing timelines and financial responsibilities, although the former extends deadlines while the latter ensures timely tax payments.

- Form 1040-ES - This is similar to IT-2105 in that it allows taxpayers to make estimated tax payments to the IRS. Both forms are designed for individuals who need to pay tax on income that is not subject to withholding.

- Form NYS IT-2106 - This state form is similar to IT-2105 as it is used for reporting and managing estimated tax payments for New York State, ensuring taxpayers meet their obligations. Both forms assist in the process of making tax payments on time.

- Form 941 - This form is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employee paychecks. While IT-2105 is aimed at individuals, both forms share the common purpose of tax payment management in their respective contexts.

- Form 1040-NR - This form is used by non-resident aliens to report their U.S. income. Like IT-2105, it assists individuals in managing tax payments related to their unique tax circumstances.

- Schedule C - This form is used by sole proprietors to report income or loss from their business. While it does not focus on estimated tax payments like IT-2105, it provides critical information that may impact the estimated taxes owed.

- Form IT-201 - This is the New York State Resident Income Tax Return form. Both it and IT-2105 are instrumental for residents in managing and reporting tax obligations, with the former focusing on annual income reporting and the latter on interim estimated payments.

Dos and Don'ts

When you're filling out the IT-2105 form, keep these helpful tips in mind. They will guide you toward a smoother experience and help avoid mistakes that could cost you time and effort.

- Do double-check your Social Security number or taxpayer ID number. Ensure that the number matches what’s on your Social Security card or income tax return.

- Don’t rush through entering your name. Spell it correctly, using your first name, middle initial, and last name in the specified order.

- Do list your foreign address correctly. Write it in the order of city, province or state, and country. Remember, don’t abbreviate the country name.

- Don’t forget about separate accounts for married taxpayers. Each spouse should maintain their own estimated tax account, even if you file a joint return.

- Do clearly separate amounts for taxes. Be sure to fill in the amounts for New York State, New York City, Yonkers, and MCTMT. If a box is empty, leave it blank.

- Don’t attach anything to your payment. Avoid stapling or clipping checks to the voucher, and detach any check stubs before mailing.

Taking these steps will simplify your filing process and help ensure that your tax payments are properly credited. Good luck!

Misconceptions

When it comes to the IT-2105 form, there are several common misconceptions that can lead to confusion. Here are nine misconceptions along with clarifying information to help you navigate the process more smoothly.

-

Misconception 1: The IT-2105 is only for self-employed individuals.

The reality is that anyone who expects to owe tax on income not subject to withholding should file the IT-2105, including employees who earn additional income from sources like freelance work. -

Misconception 2: You must pay estimated taxes quarterly regardless of your situation.

While quarterly payments are standard, not everyone is required to pay estimated taxes. If your total tax due is less than a specific amount, you may not need to make estimated payments. -

Misconception 3: Using the wrong name on the form will not affect your submission.

Inaccuracies in your name can lead to processing delays. It is crucial to ensure your name matches exactly what is on your New York State income tax return. -

Misconception 4: Married couples can share one estimated tax account.

Each spouse must establish a separate estimated tax account. However, both accounts can be credited to a joint income tax return. -

Misconception 5: You cannot pay estimated taxes electronically.

This is false. You can conveniently pay your estimated taxes electronically through the New York State tax website using a debit from your bank account. -

Misconception 6: There’s no need to enter all payment amounts if they are zero.

If a line item doesn’t apply to you, leave it blank instead of entering a zero. This helps avoid confusion in processing your payment. -

Misconception 7: Payments must be sent with a stapled check.

Do not staple or clip your payment to the voucher. This can cause issues during processing. -

Misconception 8: The due dates for estimated tax payments are the same each year.

Due dates can vary slightly from year to year. Always check the current year's deadlines to ensure timely payment. -

Misconception 9: You cannot update your information once it's submitted.

If you notice an error after submission, you can contact the New York State Personal Income Tax Information Center for assistance.

Being informed about these misconceptions can help ensure that you handle your estimated taxes correctly. If ever in doubt, consulting the official guidelines or seeking help can prevent misunderstandings and delays.

Key takeaways

Filing out the IT-2105 form can feel overwhelming, but understanding its key points can make the process smoother. Here are some essential takeaways:

- Electronic Payments: You have the option to pay your estimated tax electronically through the New York State website using a debit from your checking or savings account.

- Matching Information: Ensure your Social Security number or taxpayer ID matches the documents you have on file. Discrepancies can lead to issues with crediting payments.

- Name Accuracy: Double-check that your name is spelled correctly on the form; it should match the name on your tax return.

- Foreign Addresses: If applicable, list your foreign address in the correct order: city, province or state, and country, without abbreviating the country name.

- Separate Accounts for Couples: Married couples should each create a separate estimated tax account if both are filing.\

- Payment Breakdown: Enter separate amounts for New York State, New York City, Yonkers, and MCTMT, then total them accurately on the form.

- No Stapling: Do not staple or clip any checks or money orders to the voucher; only mail the checks or money orders detached from the vouchers.

- Due Dates: Stay aware of the due dates for estimated payments, which include April 18, June 15, September 15, and January 17 for calendar-year filers.

- Contact Information: Don’t hesitate to reach out for help. Use the provided telephone numbers for assistance or to order additional forms.

- Email Field: If you have an email address, consider providing it on the form. This can streamline communication and updates regarding your tax account.

Being informed can alleviate any stress associated with filling out the IT-2105 form. Review each step carefully, and know that help is available if you need it.

Browse Other Templates

California Health Insurance Penalty Exemptions - This form can alleviate some financial burdens associated with healthcare costs.

E-1 Visa Usa Requirements - Registrants must provide accurate details in capital letters and black ink only.

Tsp Army - Use this form to apply for a loan from your TSP account.