Fill Out Your It 214 Form

The IT-214 form, officially known as the Claim for Real Property Tax Credit, is designed for New York State homeowners and renters seeking financial relief through tax credits. Specifically, this form allows eligible individuals to claim credits based on their real property taxes or rent paid. To successfully navigate the process, claimants must provide essential information, including personal details and residency status. The form requires individuals to confirm their eligibility by answering a series of yes or no questions that assess their residency, property ownership, and income levels. Understanding the income thresholds is crucial; for instance, if the combined household income exceeds $18,000, the claimant will not qualify for the credit. Homeowners and renters will also need to calculate the amount of real property taxes paid or the total rent charge, respectively. After determining eligibility and calculating potential credits, the form concludes with an instruction on how to claim the credit, either through direct deposit or via a paper check. For those who could benefit from it, navigating the IT-214 can lead to significant savings on real property taxes or rent, making it a valuable tool for many residents of New York State.

It 214 Example

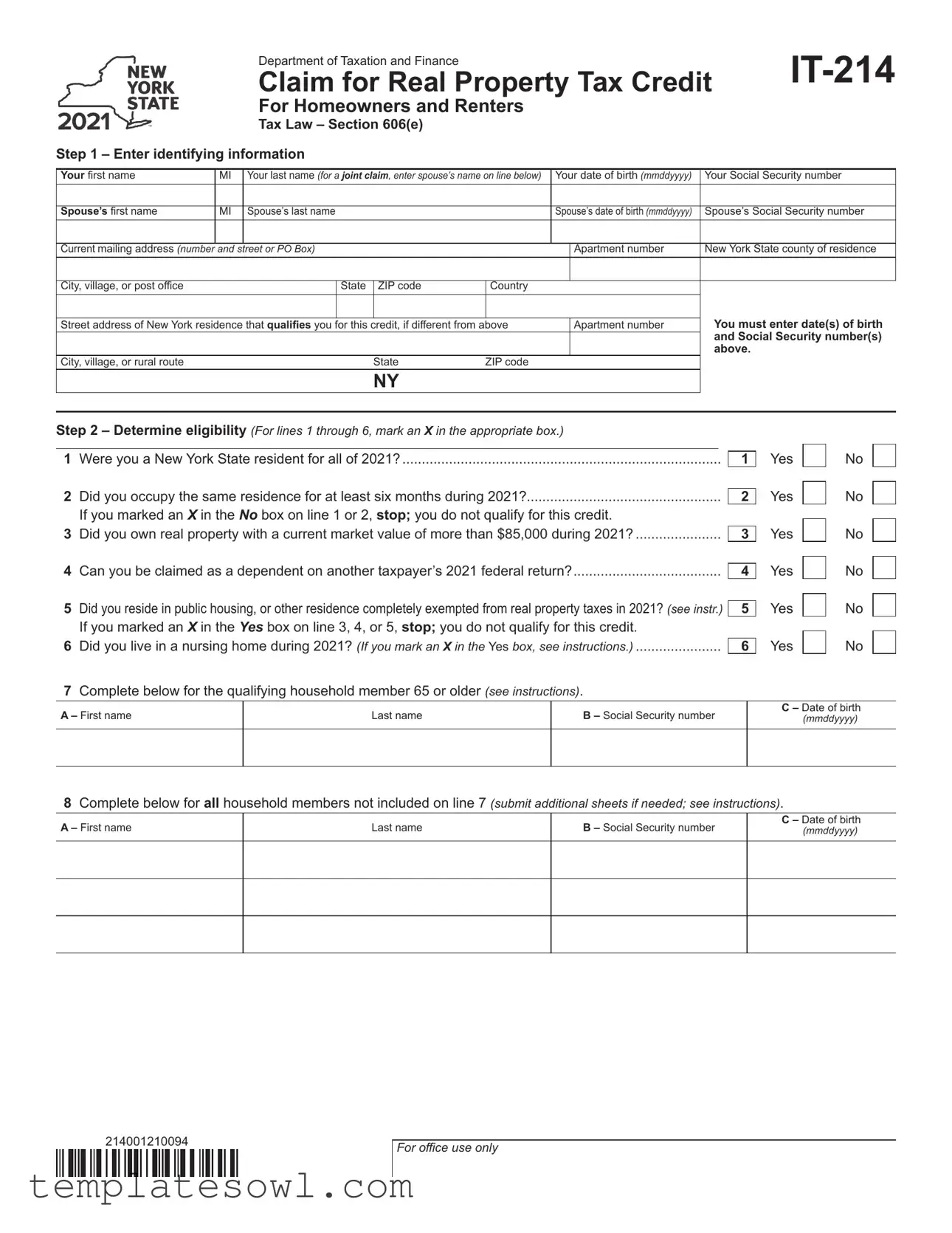

Department of Taxation and Finance

Claim for Real Property Tax Credit

For Homeowners and Renters

Tax Law – Section 606(e)

Step 1 – Enter identifying information

Your first name |

MI |

Your last name (for a joint claim, enter spouse’s name on line below) |

Your date of birth (mmddyyyy) |

Your Social Security number |

||||

|

|

|

|

|

|

|

|

|

Spouse’s first name |

MI |

Spouse’s last name |

|

Spouse’s date of birth (mmddyyyy) |

Spouse’s Social Security number |

|||

|

|

|

|

|

|

|

|

|

Current mailing address (number and street or PO Box) |

|

|

Apartment number |

New York State county of residence |

||||

|

|

|

|

|

|

|

|

|

City, village, or post office |

|

|

State |

ZIP code |

Country |

|

|

|

|

|

|

|

|

|

|

|

You must enter date(s) of birth |

Street address of New York residence that qualifies you for this credit, if different from above |

|

Apartment number |

||||||

|

|

|

|

|

|

|

|

and Social Security number(s) |

|

|

|

|

|

|

|

|

above. |

City, village, or rural route |

|

|

State |

ZIP code |

|

|

|

|

NY

Step 2 – Determine eligibility (For lines 1 through 6, mark an X in the appropriate box.)

1Were you a New York State resident for all of 2021?...................................................................................

2Did you occupy the same residence for at least six months during 2021?..................................................

If you marked an X in the No box on line 1 or 2, stop; you do not qualify for this credit.

3Did you own real property with a current market value of more than $85,000 during 2021?.......................

4Can you be claimed as a dependent on another taxpayer’s 2021 federal return?......................................

5Did you reside in public housing, or other residence completely exempted from real property taxes in 2021? (see instr.). If you marked an X in the Yes box on line 3, 4, or 5, stop; you do not qualify for this credit.

6Did you live in a nursing home during 2021? (If you mark an X in the Yes box, see instructions.).......................

7Complete below for the qualifying household member 65 or older (see instructions).

1

2

3

4

5

6

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

A – First name

Last name

B – Social Security number

C – Date of birth

(mmddyyyy)

8Complete below for all household members not included on line 7 (submit additional sheets if needed; see instructions).

A – First name

Last name

B – Social Security number

C – Date of birth

(mmddyyyy)

214001210094

For office use only

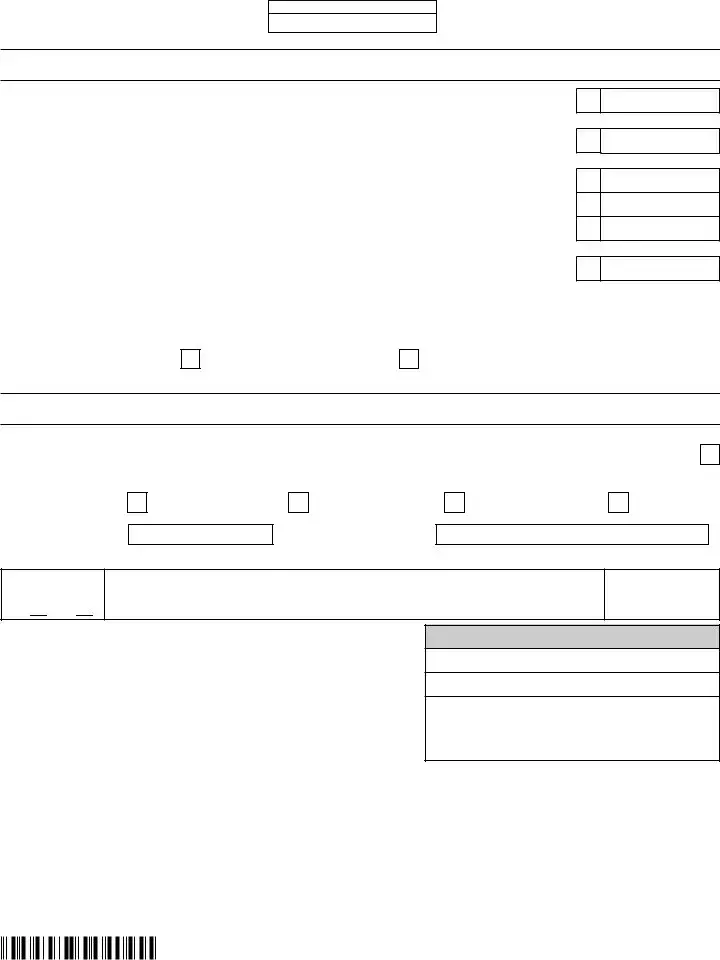

Page 2 of 3

Step 3 – Determine household gross income

Enter the total of all amounts, even if not taxable, that you, your spouse (if married), and all other household members received during 2021.

9 |

........................................................................................Federal adjusted gross income (see instructions) |

|

9 |

.00 |

||||

10 |

New York State additions to federal adjusted gross income |

|

10 |

.00 |

||||

11 |

Social Security payments not included on line 9 |

|

11 |

.00 |

||||

12 |

Supplemental Security Income (SSI) payments |

|

12 |

.00 |

||||

13 |

Pensions and annuities (including railroad retirement benefits) not included on lines 9 through 12 |

13 |

.00 |

|||||

14 |

Cash public assistance and relief |

|

14 |

.00 |

||||

15 |

Other income |

|

|

|

15 |

.00 |

||

16 |

Household gross income (add lines 9 through 15; see instructions) |

|

16 |

.00 |

||||

|

If line 16 is more than $18,000, stop; you do not qualify for this credit. |

|

|

|

||||

17 |

Enter rate from Table 1 (see instructions) |

|

17 |

|

|

|||

|

|

|

|

|

|

|

|

|

18 |

Multiply line 16 by line 17 |

|

18 |

.00 |

||||

|

|

|

|

|

|

|||

Step 4 – Compute real property tax |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Renters |

19 |

Enter the total amount of rent you and all members of your household paid |

|

|

|

||

|

19 |

.00 |

||||||

|

only |

|

during 2021. (Do not include any subsidized part of your rental charge.) |

|||||

|

|

|

|

|

||||

|

|

20 |

Adjusted rent – If line 19 includes charges for: |

Enter on line 20 |

|

|

|

|

|

|

|

heat, gas, electricity, furnishings, and board |

50% (.5) of line 19 |

|

|

|

|

|

|

|

heat, gas, electricity, and furnishings |

75% (.75) of line 19 |

|

|

|

|

|

|

|

heat, gas, and electricity |

80% (.8) of line 19 |

|

|

|

|

|

|

|

heat or heat and gas |

85% (.85) of line 19 |

|

|

|

|

|

|

|

20 |

.00 |

||||

|

|

|

none of the above |

100% of line 19 |

||||

|

|

|

|

|

|

|

|

|

|

|

21 |

Average monthly adjusted rent (divide line 20 by the number of months you paid rent) |

21 |

.00 |

|||

|

|

|

If line 21 is more than $450, stop; you do not qualify for this credit. |

|

|

|

||

|

|

22 |

22 |

.00 |

||||

|

|

Multiply line 20 by 25% (.25); enter here and on line 28 |

................................................... |

|||||

|

|

|

|

|

|

|

|

|

Homeowners |

|

|

|

|

|

|

|

|

23 |

Real property taxes paid during 2021 (see instructions) |

|

23 |

.00 |

||||

|

only |

|

||||||

|

|

|

.00 |

|||||

|

|

24 |

Special assessments |

|

24 |

|||

|

|

25 |

Add lines 23 and 24 |

|

25 |

.00 |

||

|

|

26 |

Exemption for homeowners 65 and over (optional - see instructions) |

26 |

.00 |

|||

|

|

27 |

Add lines 25 and 26; enter here and on line 28 |

|

27 |

.00 |

||

|

|

|

|

|

|

|

|

|

214002210094

Your Social Security number

Step 5 – Compute credit amount |

|

|

28 |

Renters: Enter amount from line 22. Homeowners: Enter amount from line 27 (see instructions) |

28 |

|

If line 28 is zero or less, stop; no credit is allowed. |

|

29 |

Enter amount from line 18 |

29 |

|

If line 29 is equal to or more than line 28, stop; you do not qualify for this credit. |

|

30 |

Subtract line 29 from line 28 |

30 |

31 |

Multiply line 30 by 50% (.5) (However, if you entered an amount on line 26, multiply line 30 by 25% (.25).) |

31 |

32 |

Credit limit (see instructions; enter amount from chart) |

32 |

33Enter the amount from line 32 or 31, whichever is less. This is the credit for your household.

|

(If more than one member of your household is filing Form |

........................................... 33 |

||

• If you are filing this claim with your New York State income tax return: |

|

|||

|

|

Enter the line 33 amount on Form |

|

|

• If you are not filing this claim with a New York State income tax return (see instructions): |

||||

|

|

Mark one refund choice: |

direct deposit (fill in line 34) - or - |

paper check |

.00

.00

.00

.00

.00

.00

Step 6 – Enter account information for direct deposit (see instructions)

If the funds for your refund would go to an account outside the U.S., mark an X in this box (see instructions) .......................................

34Direct deposit (see instructions): Complete the following to have your refund deposited directly to your bank account.

34a Account type:

34b Routing number

Personal checking - or -

Personal savings - or -

34c Account number

Business checking - or -

Business savings

designee? (see instr.)

Yes

No

No

Print designee’s name |

Designee’s phone number |

|

( ) |

Email:

Personal identification

number (PIN)

|

|

|

||||

▼ Paid preparer must complete ▼ |

Preparer’s NYTPRIN |

NYTPRIN |

||||

(see instructions) |

|

|

|

excl. code |

|

|

Preparer’s signature |

|

Preparer’s printed name |

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours, if |

|

|

Preparer’s PTIN or SSN |

|||

|

|

|

|

|

|

|

Address |

|

|

Employer identification number |

|||

|

|

|

|

|

|

|

|

|

|

|

Date |

||

|

|

|

|

|

|

|

Email: |

|

|

|

|

|

|

▼ Taxpayer(s) must sign here ▼

Your signature

Your occupation

Spouse’s signature and occupation (if joint claim)

Date |

Daytime phone number |

|

( ) |

Email: |

|

•If you are filing a NYS income tax return, submit this form with your return.

•If you are not filing a NYS income tax return, mail this form to:

NYS TAX PROCESSING, PO BOX 15192, ALBANY NY

214003210094

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The IT-214 form is used to claim a Real Property Tax Credit for homeowners and renters in New York State, as outlined in Tax Law – Section 606(e). |

| Eligibility Criteria | To qualify, you must be a New York State resident for the full year and meet specific income limits and property value criteria. Failure to meet these can lead to disqualification. |

| Income Limit | Your household gross income must not exceed $18,000 to qualify for the credit, regardless of other amounts received. |

| Renters' Available Credit | For renters, the credit is based on rent paid during the year. If your average monthly adjusted rent exceeds $450, you will not qualify. |

| Filing Instructions | If you file a New York State income tax return, submit the IT-214 form with that return. If not filing a tax return, mail it separately to NYS TAX PROCESSING, PO BOX 15192, ALBANY NY 12212-5192. |

Guidelines on Utilizing It 214

Filling out the IT-214 form is a straightforward process. It's important to gather your personal information and financial details before starting. Follow these steps to complete the form correctly.

- Enter your identifying information. Include your first name, middle initial, last name, date of birth, and Social Security number. If filing jointly, also enter your spouse's information.

- Provide your current mailing address and the street address of the New York residence that qualifies you for this credit. If the addresses are different, be sure to fill in both.

- Determine your eligibility by marking 'X' in the appropriate boxes for questions 1 through 6. Stop filling out the form if you answer 'No' to the first two questions or if you answer 'Yes' to questions 3, 4, or 5.

- If applicable, provide information for qualifying household members aged 65 or older, as well as information for all other household members.

- Calculate your household gross income. Fill in your federal adjusted gross income and any additional required amounts. Add these amounts to find your total household gross income.

- For renters, enter the total rent paid. Make adjustments for any included charges as instructed. If the average monthly adjusted rent exceeds $450, stop filling out the form.

- If you are a homeowner, enter the total real property taxes paid during the year and any special assessments.

- Compute the credit amount using the provided steps and tables. Stop if no credit is allowed based on your results.

- If applicable, fill out the direct deposit information for your refund. Provide account details and mark if the account is outside the U.S.

- Sign the form where indicated. If filing jointly, your spouse must also sign. Include any preparer information, if necessary.

What You Should Know About This Form

What is the IT-214 form and who needs to use it?

The IT-214 form is a Claim for Real Property Tax Credit specifically designed for homeowners and renters in New York State. If you’re a resident who paid real property taxes or rent in 2020 and meet certain criteria, you might be eligible for this credit. It’s aimed at helping those who need financial relief due to property taxes. This credit can reduce your overall taxes or assist in generating a refund. Understanding your eligibility is the first step before filling out this form.

How do I determine my eligibility for the IT-214 credit?

To qualify for the IT-214 credit, several conditions must be met. Firstly, you need to have been a resident of New York State for all of 2020. It’s also important that you occupied the same residence for at least six months during that year. You must own real property with a current market value exceeding $85,000 or not be claimed as a dependent on someone else's federal return for 2020. Additionally, residing in public housing fully exempt from property taxes would disqualify you. If any of these criteria do not match your situation, unfortunately, you will not qualify for the credit.

What information do I need to provide on the IT-214 form?

When filling out the IT-214 form, you'll start by entering your personal identifying information. This includes your name, date of birth, and Social Security number. If you’re married, you should also provide similar information for your spouse. Next, you must provide your current mailing address and details about the residence qualifying for this credit. It’s crucial to include accurate income information as well, which comprises your federal adjusted gross income and other specific sources of income. Depending on whether you are a homeowner or renter, you'll also input different data concerning property taxes or rent paid. Make sure to double-check all entries to avoid delays in processing your claim.

What should I do if I’m not filing a New York State income tax return?

If you are not filing a New York State income tax return but want to claim this credit, you will need to mail your completed IT-214 form directly to NYS Tax Processing, P.O. Box 15192, Albany, NY 12212-5192. Within the form, mark your choice for receiving the refund – either by direct deposit or a paper check. Ensure that you follow the instructions carefully, as submitting an incomplete or incorrectly filled out form might cause delays in receiving your credit. Filing on time is essential to guarantee that you get your rightful credit without unnecessary waiting.

Common mistakes

Filling out the IT-214 form can be a straightforward process, but certain mistakes frequently occur that may lead to complications or the denial of a claim for the Real Property Tax Credit. One common mistake is failing to provide complete identifying information. Omitting important details such as your Social Security number or date of birth can delay processing or result in rejection. Each household member's information must be accurately filled out, as inaccuracies can raise red flags.

Another error involves the eligibility determination section. Applicants sometimes do not fully understand how to answer the questions related to residency and income. For instance, marking “No” incorrectly on whether you were a New York State resident for the entire tax year can disqualify you from receiving the credit. Similarly, miscalculating your household gross income is a frequent issue. Line 16 requires a total that includes all forms of income, and overlooking a source can push your income above the threshold unknowingly.

Additionally, errors can arise in the computation of the credit amount. Renters, for example, need to input the correct total amount of rent paid, excluding any subsidized rent portions. If a qualifying household member is 65 or older, homeowners must account for any exemptions accurately. Misunderstanding the calculation parameters for adjusted rent or tax paid can result in an incorrect claim amount.

Finally, many individuals overlook the direct deposit option or fail to provide correct account information for receiving their refunds. Incomplete banking details can cause delays in receiving funds. Moreover, applicants sometimes forget to sign the form, which is essential for validation. Such oversights are easily preventable, yet they can significantly impact the timeliness of your credit claim. Checking your work before submitting can help avoid these common pitfalls.

Documents used along the form

The IT-214 form is an essential document for homeowners and renters in New York seeking a real property tax credit. To successfully navigate this process, there are additional forms and documents often needed. Below is a list of relevant documents that may be required or helpful in conjunction with the IT-214 form. It is crucial to ensure you have the correct paperwork together to avoid any delays in processing your claim.

- IT-201: This is the New York State personal income tax return form. If you are filing your IT-214 with your income tax return, you will need to report the credit amount from the IT-214 on the IT-201 form.

- W-2 Forms: These forms summarize your annual wages and the taxes withheld from your paycheck. They are important for proving your income and must be included to accurately determine eligibility for the tax credit.

- Schedule C (if applicable): If you are self-employed, this document details your business’s income and expenses. It will provide a clearer picture of your total income for the household gross income calculation.

- Federal Adjusted Gross Income Worksheets: these are tools for calculating your federal adjusted gross income. This figure is critical for determining eligibility and must be accurate on your IT-214 form.

- Proof of Residency: Documents such as utility bills, lease agreements, or mortgage statements can serve as proof of your primary residence. This verification is essential for confirming that you qualify for the credit based on residence criteria.

Having these forms and documents ready can help streamline your application process. Gather what you need to support your claim for the tax credit effectively. Missing or incomplete paperwork may cause delays or denials, so it's best to be thorough and prepared.

Similar forms

Form IT-201: This is the New York State personal income tax return form. Both IT-214 and IT-201 require identification information and assess eligibility for tax benefits. They both include sections for income reporting and can lead to potential refunds based on financial status.

Form IT-150: This is the New York State resident income tax return form for those with simpler financial situations. Like IT-214, it identifies the taxpayer and requires income details. Both forms are used to claim credits or refunds.

Form IT-195: This form is used to apply for the New York State earned income credit. It shares similar eligibility requirements with IT-214 and also includes household income considerations.

Form IT-201-X: This is the amended personal income tax return form. If corrections are needed, both IT-201-X and IT-214 facilitate adjustments for previously claimed credits or incorrect filings.

Form NYS-45: This form is used by employers to report income tax withholdings. Like IT-214, it is associated with state tax obligations and reporting requirements but focuses on the employer-employee relationship.

Dos and Don'ts

When filling out the IT-214 form, adhering to specific guidelines can greatly simplify the process. Below is a list of recommended practices and pitfalls to avoid:

- Do: Carefully read all instructions before starting the form.

- Do: Verify that all names and Social Security numbers are entered correctly.

- Do: Double-check your eligibility by answering each question in Step 2 accurately.

- Do: Ensure you are consistently using the same address for your current mailing and qualifying residence.

- Do: Calculate your household gross income precisely and include all applicable sources.

- Don’t: Leave any fields blank; complete every section applicable to you.

- Don’t: Forget to sign and date the form; an unsigned form will be rejected.

- Don’t: Include any confidential or sensitive information that isn’t required, such as bank account numbers in the undesignated areas.

- Don’t: Submit the form without confirming that your eligibility criteria are met.

Following these guidelines can enhance your experience and ensure that your claim is processed smoothly. Take the time to be thorough, and it can pay off in your tax benefits.

Misconceptions

There are several misconceptions about the IT-214 form, which is used to claim the Real Property Tax Credit for homeowners and renters in New York State. Understanding these misconceptions can help ensure that eligible individuals successfully claim their credits.

- Only homeowners can file the IT-214 form. This is not true. Renters are also eligible to file the IT-214 to claim the same credit, as long as they meet the necessary requirements.

- Income limits are not a factor for eligibility. Many people think that anyone can qualify regardless of their income. However, if a household's gross income exceeds $18,000, they do not qualify for the credit.

- The IT-214 form is only for tax purposes. While the form is used for tax credit claims, it also helps assess individual housing situations, providing data valuable for future tax planning.

- You cannot qualify if you were a renter for part of the year. This is misleading. You can qualify as long as you occupied the same residence for at least six months within the tax year.

- The form can be submitted at any time. In reality, there are deadlines for filing this form. It must be submitted by the due date of your tax return, including extensions.

- Only people aged 65 or older can claim the credit. This misconception stems from the inclusion of a section for qualifying household members aged 65 and older. However, younger homeowners and renters can also apply if they meet other eligibility criteria.

- All rental payments qualify for the credit. Not all rental payments are eligible. Only the portion not subsidized and that aligns with the guidelines set in the instructions counts toward the total rent amount.

Key takeaways

Filling out the IT-214 form can seem daunting, but understanding its key aspects can simplify the process immensely. Here are some important takeaways to keep in mind:

- Identify Yourself Clearly: Ensure that you accurately fill in your personal information, including your date of birth and Social Security number. This applies to both you and your spouse if it's a joint claim.

- Check Residency Requirements: You must confirm that you were a New York State resident for the entire year before proceeding. This is crucial for qualifying for the credit.

- Occupancy Duration Matters: Make sure you have occupied the same residence for a minimum of six months in the qualifying year.

- Assess Property Value: If you owned real property with a current market value of more than $85,000, you will not qualify for the credit.

- Income Limits Apply: Your household gross income must not exceed $18,000. Be meticulous in adding all sources of income.

- Separate Rent Costs: If your household is renting, list only the rent you paid during the year. Avoid including any subsidized amounts.

- Calculate Adjusted Rent: Understand how to compute adjusted rent based on utilities and other factors. This will determine your eligibility for the credit.

- Submit with Tax Returns: If you are also filing a New York State income tax return, submit the IT-214 form along with it. Alternatively, follow instructions for sending it separately.

- Direct Deposit Option: If you'd prefer your refund quickly, fill in your bank details to opt for direct deposit. Ensure accuracy to avoid delays.

Browse Other Templates

Optum Rx Appeal Form - Monday to Friday, the service operates from 5 am to 10 pm Pacific time.

Cosmetology License Renewal California - You can contact the Board for any questions regarding your renewal application.