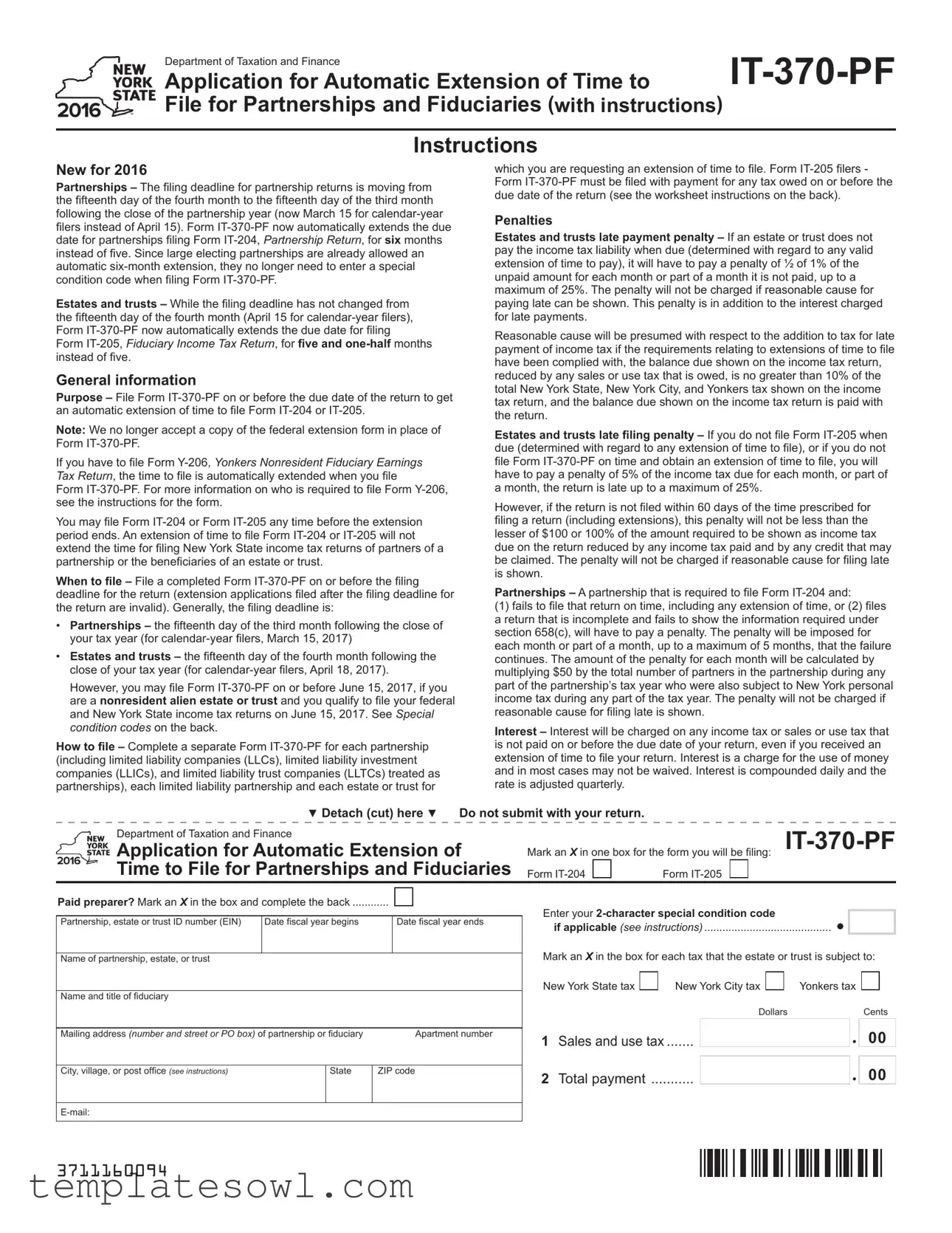

Fill Out Your It 370 Pf Form

The IT-370-PF form serves as a critical tool for partnerships and fiduciaries seeking an automatic extension of time to file necessary tax returns. Introduced by the New York Department of Taxation and Finance, this form allows partnerships to extend the filing deadline for Form IT-204 as well as estates and trusts for Form IT-205. As of 2016, key changes have enhanced its utility, notably shifting the partnerships’ deadline to March 15 and providing an automatic six-month extension. Meanwhile, estates and trusts still adhere to the April 15 deadline, albeit with their extension lengthening to five and a half months. The IT-370-PF form must be submitted before the filing deadline in order to qualify for the extension, and it is imperative to ensure that the information provided matches federal records. A separate form is necessary for each partnership or fiduciary entity, along with the requirement to pay any tax due by the return's deadline. Failure to adhere to the regulations surrounding this form can incur significant financial penalties, emphasizing the importance of timely and accurate submissions. Through the IT-370-PF form, partnerships and fiduciaries can effectively manage their filing timelines while minimizing potential penalties associated with late submissions.

It 370 Pf Example

Department of Taxation and Finance |

|

Application for Automatic Extension of Time to |

|

File for Partnerships and Fiduciaries (with instructions) |

|

|

|

Instructions |

|

New for 2016

Partnerships – The filing deadline for partnership returns is moving from the fifteenth day of the fourth month to the fifteenth day of the third month following the close of the partnership year (now March 15 for

Estates and trusts – While the filing deadline has not changed from the fifteenth day of the fourth month (April 15 for

General information

Purpose – File Form

Note: We no longer accept a copy of the federal extension form in place of Form

If you have to file Form

Form

You may file Form

When to file – File a completed Form

•Partnerships – the fifteenth day of the third month following the close of your tax year (for

•Estates and trusts – the fifteenth day of the fourth month following the close of your tax year (for

However, you may file Form

How to file – Complete a separate Form

which you are requesting an extension of time to file. Form

Penalties

Estates and trusts late payment penalty – If an estate or trust does not pay the income tax liability when due (determined with regard to any valid extension of time to pay), it will have to pay a penalty of ½ of 1% of the unpaid amount for each month or part of a month it is not paid, up to a maximum of 25%. The penalty will not be charged if reasonable cause for paying late can be shown. This penalty is in addition to the interest charged for late payments.

Reasonable cause will be presumed with respect to the addition to tax for late payment of income tax if the requirements relating to extensions of time to file have been complied with, the balance due shown on the income tax return, reduced by any sales or use tax that is owed, is no greater than 10% of the total New York State, New York City, and Yonkers tax shown on the income tax return, and the balance due shown on the income tax return is paid with the return.

Estates and trusts late filing penalty – If you do not file Form

However, if the return is not filed within 60 days of the time prescribed for filing a return (including extensions), this penalty will not be less than the lesser of $100 or 100% of the amount required to be shown as income tax due on the return reduced by any income tax paid and by any credit that may be claimed. The penalty will not be charged if reasonable cause for filing late is shown.

Partnerships – A partnership that is required to file Form

Interest – Interest will be charged on any income tax or sales or use tax that is not paid on or before the due date of your return, even if you received an extension of time to file your return. Interest is a charge for the use of money and in most cases may not be waived. Interest is compounded daily and the rate is adjusted quarterly.

▼Detach (cut) here ▼ Do not submit with your return.

Department of Taxation and Finance |

|

|

|

|

|

Application for Automatic Extension of |

Mark an X in one box for the form you will be filing: |

||||

Time to File for Partnerships and Fiduciaries |

Form |

Form |

|

||

Paid preparer? Mark an X in the box and complete the back |

|

|

|

||

|

|

|

Enter your 2‑character special condition code |

|

|

Partnership, estate or trust ID number (EIN) |

Date fiscal year begins |

Date fiscal year ends |

|

|

|

|

|

|

if applicable (see instructions) |

||

Name of partnership, estate, or trust |

|

|

Mark an X in the box for each tax that the estate or trust is subject to: |

||

|

|

|

|

|

|

|

|

|

New York State tax |

New York City tax |

Yonkers tax |

Name and title of fiduciary |

|

|

|

|

|

|

|

|

|

Dollars |

Cents |

Mailing address (number and street or PO box) of partnership or fiduciary |

Apartment number |

|

|

|

|

|

|

|

1 Sales and use tax |

00 |

|

City, village, or post office (see instructions) |

State |

ZIP code |

|

|

|

|

|

|

2 Total payment |

............ |

00 |

|

|

|

|

|

|

3711160094

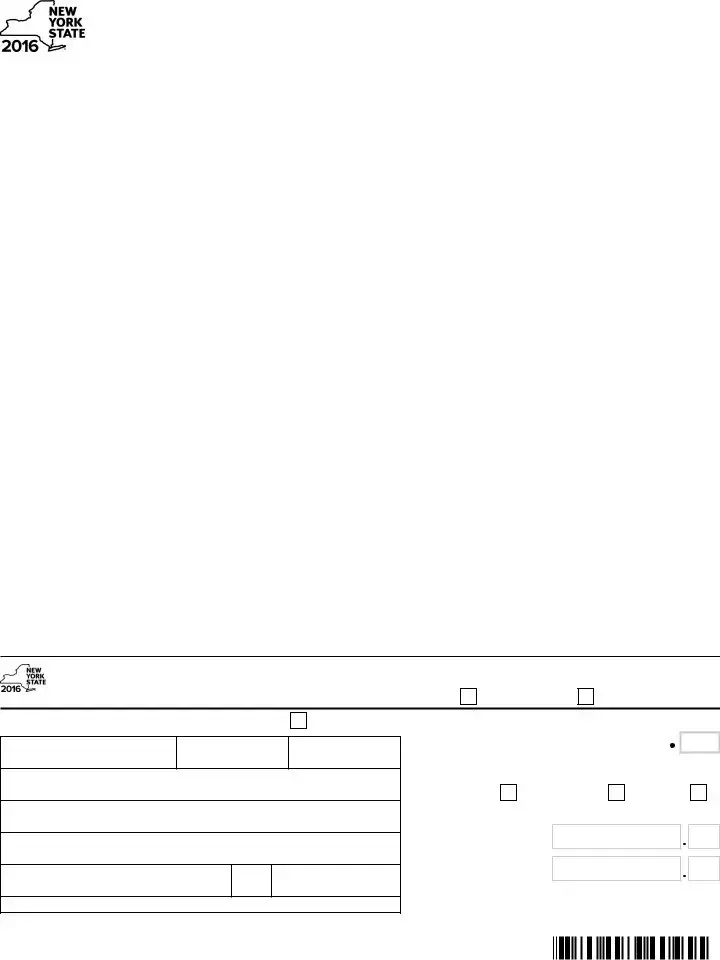

Instructions (continued) |

Fee for payments returned by banks – The law allows the Tax Department to charge a $50 fee when a check, money order, or electronic payment is returned by a bank for nonpayment. However, if an electronic payment is returned as a result of an error by the bank or the department, the department won’t charge the fee. If your payment is returned, we will send a separate bill for $50 for each return or other tax document associated with the returned payment.

Privacy notification

See our website or Publication 54, Privacy Notification.

Specific instructions

Filling in your form – Please use black ink (and never use red ink) when making entries on this form.

Name and address box – Partnerships must enter the employer identification number (EIN), name, and address of the partnership. Estates and trusts must enter the estate’s or trust’s EIN and the name of the estate or trust exactly as shown on federal Form

To ensure that any payment made with this extension is properly credited, this information must agree with the information on the return you are filing. Failure to provide an identification number may invalidate this extension. If the entity does not have an EIN but has applied for one, enter applied for.

Foreign addresses – Enter the information in the following order: city, province or state, and then country (all in the City, village, or post office box). Follow the country’s practice for entering the postal code. Do not abbreviate the country name.

If the entity files on a fiscal year basis, enter the beginning and ending dates of the fiscal year in the appropriate boxes.

Special condition codes – If you are a nonresident alien estate or trust and your filing due date is June 15, 2017, and you need an additional five and

Line 4 – Enter the amount of sales or use tax, if any, that you will be required to report when you file your 2016 return. See the instructions for your NYS fiduciary income tax return for information on how to compute your sales and use tax. Also enter this amount on line 1 on the front of this form.

Line 6 – Enter the amount of 2016 income tax already paid that you expect to enter on Form

Worksheet

1New York State income tax liability for 2016 . 1.

2 |

New York City income tax liability for 2016 .... |

2. |

3 |

Yonkers income tax liability for 2016 |

3. |

4Sales and use tax due for 2016 (enter this

|

amount here and on line 1 on the front) |

4. |

|

|

5 |

Total taxes (add lines 1 through 4) |

5. |

||

6 |

Total 2016 income tax already paid |

6. |

||

7 |

Total payment (subtract line 6 from line 5 and enter this |

|||

|

amount here and on line 2 on the front). If line 6 is more |

|||

|

than line 5, enter 0 |

7. |

||

Note: You may be subject to penalties if you underestimate the balance due.

How to claim credit for payment made with this form

Include the amount paid with Form

Where to file

If you are enclosing a payment with this extension request, mail Form

EXTENSION REQUEST

PO BOX 4125

BINGHAMTON NY

Worksheet instructions

Form

If you enter an amount on lines 1, 2, or 3 of this worksheet, mark an X in the appropriate box on the front of this form.

Line 1 – Enter the amount of your New York State income tax liability for 2016 that you expect to enter on Form

Line 2 – Enter the amount of your New York City income tax liability for 2016 that you expect to enter on Form

Line 3 – Enter the amount of your Yonkers income tax liability for 2016 that you expect to enter on Form

▼ Detach (cut) here ▼

If not enclosing a payment with this extension request, mail Form

EXTENSION REQUEST - NR

PO BOX 4126

BINGHAMTON

For information about private delivery services, see Publication 55, Designated Private Delivery Services.

Need help?: Visit our website at www.tax.ny.gov (for information, forms, and online services)

Personal Income Tax Information Center: |

(518) |

To order forms and publications: |

(518) |

Do not submit with your return.

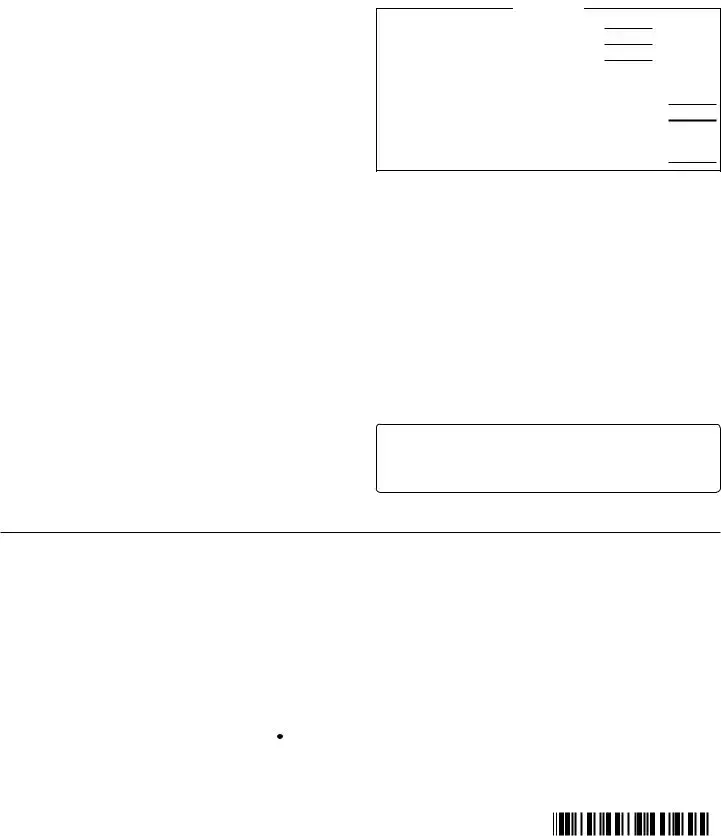

|

|

When completing this section, enter your New York tax preparer registration |

||||||||||

Payment options – An estate or trust must make full payment of any balance |

identification number (NYTPRIN) if you are required to have one. If you are |

|||||||||||

due with this automatic extension of time to file. Pay by check or money order |

not required to have a NYTPRIN, enter in the NYTPRIN excl. code box one |

|||||||||||

made payable in U.S. funds to New York State Income Tax and write the |

of the specified |

|||||||||||

estate’s or trust’s EIN and 2016 Income Tax on it. |

|

|

from the registration requirement. You must enter a NYTPRIN or an exclusion |

|||||||||

Paid preparers – Under the law, all paid preparers must sign and complete |

code. Also, you must enter your federal preparer tax identification number |

|||||||||||

(PTIN) if you have one; if not, you must enter your social security number. |

||||||||||||

the paid preparer section of the form. Paid preparers may be subject to civil |

||||||||||||

|

|

|

|

|

|

|

|

|

||||

and/or criminal sanctions if they fail to complete this section in full. |

|

|

|

|

|

Code |

Exemption type |

Code |

Exemption type |

|||

|

|

|

|

|

|

|

|

01 |

Attorney |

02 |

Employee of attorney |

|

▼ Paid preparer must complete ( see instructions ) ▼ |

Date: |

|

|

|

|

|||||||

Preparer’s signature |

▼Preparer’s NYTPRIN |

|

|

|

|

|

03 |

CPA |

04 |

Employee of CPA |

||

▼ |

|

|

|

|

|

|

|

05 |

PA (Public Accountant) |

06 |

Employee of PA |

|

|

|

|

|

|

|

|

|

|

|

|

||

Firm’s name ( or yours, if |

▼ Preparer’s PTIN or SSN |

|

|

07 |

Enrolled agent |

08 |

Employee of enrolled |

|||||

|

|

|

|

|

|

|

|

|

|

|

agent |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

09 |

Volunteer tax preparer |

10 |

Employee of business |

|

Address |

Employer identification number |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

preparing that |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

business’ return |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

NYTPRIN |

|

See our website for more information about the tax preparer |

||||||||

|

|

excel code |

|

|

|

registration requirements. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

3712160094

Form Characteristics

| Fact Name | Details |

|---|---|

| Filing Deadline | Partnership filings are due by March 15 for calendar-year filers, while estates and trusts must file by April 15. |

| Extension Duration | Form IT-370-PF extends the filing deadline for partnerships for six months and for estates and trusts for five and a half months. |

| Filing Requirements | A separate Form IT-370-PF must be completed for each partnership, limited liability partnership, and each estate or trust requesting an extension. |

| Governing Law | This form is governed under New York State tax laws, specifically pertaining to Article 22 of the New York State Tax Law. |

Guidelines on Utilizing It 370 Pf

Filling out Form IT-370-PF requires careful attention to detail to ensure all information is correct and complete. This form is needed for requesting an automatic extension of time to file returns for partnerships and fiduciaries. Make sure to gather all necessary documentation before starting the process. Here are the steps to complete the form accurately:

- Use black ink to fill out the form. Avoid using red ink.

- At the top, mark an X in the box next to the form you will be filing: IT-204 or IT-205.

- Provide the partnership or fiduciary's Employer Identification Number (EIN) in the designated box.

- Enter the name of the partnership, estate, or trust exactly as shown on the federal Form SS-4.

- Fill in the mailing address for the partnership or fiduciary, including the street address, apartment number (if applicable), city, state, and ZIP code.

- Indicate the structure of the partnership or estate by marking an X in the appropriate box for the taxes it is subject to, such as New York State tax, New York City tax, or Yonkers tax.

- Complete the duration of the fiscal year by entering the starting and ending dates of the fiscal year if applicable.

- If applicable, enter the 2-character special condition code in the specified field.

- Calculate your total payment, including any taxes owed, and write this amount in the appropriate section.

- Provide the name and title of the fiduciary.

- Include your email address in the designated box.

- Once all information is entered, review the form to ensure accuracy and completeness.

- Mail the completed Form IT-370-PF with any payment to the designated address, depending on whether you are enclosing a payment or not.

What You Should Know About This Form

What is Form IT-370-PF?

Form IT-370-PF is an application for an automatic extension of time to file for partnerships and fiduciaries in New York State. It is essential for partnerships filing Form IT-204 and for estates and trusts filing Form IT-205. The form must be submitted on or before the due date of the respective tax returns.

What are the new filing deadlines for partnerships and estates?

For partnerships, the filing deadline has shifted to the fifteenth day of the third month following the close of the partnership year. For example, calendar-year filers will have a deadline of March 15. Estates and trusts maintain their deadline at the fifteenth day of the fourth month, which corresponds to April 15 for calendar-year filers.

How long is the extension provided by Form IT-370-PF?

This form provides a six-month extension for partnership returns, allowing additional time beyond the previous five-month extension. For estates and trusts, the extension is now five and one-half months instead of five. This means new deadlines for filing returns based on these extensions.

How do I file Form IT-370-PF?

To file, complete a separate Form IT-370-PF for each partnership, estate, or trust for which an extension is requested. Mail the completed forms to the appropriate address. Payment for any tax owed must accompany the form if applicable. Ensure the information aligns with the tax return being filed to avoid invalidating the extension.

What happens if I miss the filing deadline for Form IT-370-PF?

If Form IT-370-PF is filed late, the request for an extension may be considered invalid. This can lead to penalties for late filing and late payment of taxes. Deadlines are strict, and therefore timely filing is crucial.

Are there penalties associated with late filing or payment?

Yes, if an estate or trust does not pay taxes owed by the due date, a penalty of ½ of 1% per month can be imposed, with a maximum of 25%. Similarly, late filing can lead to a penalty of 5% per month, also capped at 25%, and additional penalties may apply for significant delays beyond 60 days.

Do I need to submit a federal extension form with IT-370-PF?

No, a federal extension form is no longer accepted as a substitute for Form IT-370-PF. It is essential to adhere strictly to the submission of this state-specific form for an extension.

What if I am a nonresident alien trust or estate?

Nonresident alien estates or trusts qualify for a different deadline. If these entities file Form IT-370-PF on or before June 15, additional time will be granted, extending the due date to November 30.

How can I ensure my payment is credited correctly with Form IT-370-PF?

When making a payment, ensure that the payment details, including the employer identification number (EIN) and the name of the entity, match exactly with the information provided on both Form IT-370-PF and the tax returns filed. Incomplete or incorrect details may lead to issues with crediting the payment.

Where do I send Form IT-370-PF?

Forms must be mailed to designated addresses based on whether payment is included. For submissions without payment, send to EXTENSION REQUEST - NR, PO BOX 4126, BINGHAMTON NY 13902-4126. For those including payment, send to EXTENSION REQUEST, PO BOX 4125, BINGHAMTON NY 13902-4125.

Common mistakes

Filling out the IT-370-PF form can be tricky, and it’s easy to make mistakes that can lead to complications or even penalties. One common error occurs when filers do not meet the required submission deadlines. Both partnerships and fiduciaries need to be aware of their respective deadlines. For partnerships, submitting the form after the fifteenth day of the third month may invalidate the extension. Similarly, estates and trusts must be submitted before the fifteenth day of the fourth month.

Another mistake is providing incorrect or incomplete identification information. Partnerships are required to enter their Employer Identification Number (EIN), and estates or trusts must do the same. Failure to provide accurate identification can invalidate the extension request, potentially leading to unwanted penalties.

Some people incorrectly assume that filing the IT-370-PF form extends the time to pay any taxes owed. This misconception can lead to late payment penalties. While the form does provide an extension for filing, it does not extend the time to settle any tax liabilities. Payments should accompany the form submission to avoid additional fees.

Using red ink is another frequent error, despite clear instructions to use only black ink. If any part of the form is filled out in red, it could lead to processing delays or even rejection of the form.

Additionally, some filers fail to read and understand the section regarding special condition codes. If you qualify for a special condition and do not fill it in, the extension may not be recognized, leading to unforeseen filing issues.

Neglecting to file a separate form for each entity is also a common error. Each partnership, estate, or trust requires its own IT-370-PF form for the extension request; combining them onto a single form can create serious complications.

It is crucial to accurately report any sales or use tax due when completing the form. If this amount is miscalculated, it can lead to an underpayment of taxes, which may incur penalties later on.

Some filers may overlook the importance of verifying the amounts from the worksheet before submitting the IT-370-PF. This worksheet is essential for ensuring accuracy in the reported income tax liabilities. Submitting incorrect figures can result in additional fines or penalties down the line.

Finally, another common mistake includes disregarding the filing instructions, particularly regarding where to send the completed form. Sending the form to the wrong address could cause a delay in processing, possibly resulting in penalties for the late filing.

In conclusion, being diligent and careful when filling out the IT-370-PF form is essential. Understanding the guidelines and avoiding these common errors can save filers from headaches associated with delays and penalties.

Documents used along the form

The IT-370-PF form is an essential document for partnerships and fiduciaries in New York State, used to apply for an automatic extension of time to file their tax returns. Alongside this form, several other documents are frequently utilized in the tax filing process. Each of these forms serves a specific purpose, ensuring that partnerships and estates comply with their tax obligations while allowing them the necessary time to prepare their returns accurately. Below is a detailed list of other forms and documents often associated with the IT-370-PF form.

- Form IT-204: This is the Partnership Return and must be filed by partnerships doing business in New York State. It reports the income, deductions, and credits attributable to the partnership and is due on the fifteenth day of the third month after the end of the tax year.

- Form IT-205: This form is the Fiduciary Income Tax Return, required to be filed by estates and trusts. It details the income and distributions to beneficiaries, and is due on the fifteenth day of the fourth month following the end of the tax year.

- Form Y-206: The Yonkers Nonresident Fiduciary Earnings Tax Return applies to certain estates and trusts that earn income in Yonkers. If applicable, filing Form IT-370-PF also extends the time for filing this return.

- Form IT-370: This is a general extension form used for individuals and corporations in New York. While it is different from IT-370-PF, it may be referenced or required for non-partnership-related extensions.

- Form IT-80: This form is specific to calculating the New York State personal income tax liability for nonresidents and part-year residents. Although not directly linked to partnerships or fiduciaries, it may be relevant for partners or beneficiaries.

- Form W-2: This form is used to report wages paid to employees and the taxes withheld. Partnerships with employees must provide W-2s to report the income of workers, which may influence partnership tax returns.

- Form 1099: This form is utilized to report various types of income other than wages, salaries, and tips. Partnerships may need to issue 1099 forms to report payments made to independent contractors or other payees.

- Form SS-4: This is the application for an Employer Identification Number (EIN) issued by the IRS. Partnerships and estates both need EINs to file tax returns, and obtaining one is essential before completing the IT-370-PF form.

- Form IT-2105: This form is the New York State Estimated Tax Payment Voucher. Partnerships and estates may use it to report and pay estimated tax payments toward their anticipated income tax liability.

These forms collectively facilitate the tax filing processes for partnerships and fiduciaries, providing necessary extensions and ensuring compliance with various tax obligations. Completing these forms accurately and submitting them on time helps to avoid penalties and ensures that businesses and estates can manage their tax matters effectively.

Similar forms

- Form IT-204: This form is the Partnership Return, which partnerships must file to report income, deductions, and credits. Form IT-370-PF allows partnerships to request an automatic extension for filing Form IT-204, similarly extending the deadline automatically for an additional six months.

- Form IT-205: This is the Fiduciary Income Tax Return for estates and trusts. Just like Form IT-370-PF provides an extension for Form IT-204, it extends the time to file Form IT-205 by five and one-half months instead of five.

- Form Y-206: This form is specifically for the Yonkers Nonresident Fiduciary Earnings Tax Return. Filing Form IT-370-PF serves to also extend the deadline for Form Y-206, ensuring that estates and trusts filing for this tax receive the same automatic extension.

- Federal Form 7004: This is the application for an automatic extension of time to file certain business income tax returns with the federal government. While the IT-370-PF specifically applies to state taxes, both forms serve the function of requesting additional time to file, allowing taxpayers time to gather necessary financial information.

Dos and Don'ts

When filling out the IT-370-PF form, consider the following guidelines:

- Ensure that you complete the form on or before the filing deadline to avoid any invalid applications. This form is crucial for requesting an automatic extension of time to file.

- Use black ink only. Entries made in red ink will invalidate your submission.

- Provide the entity's correct employer identification number (EIN). This number must match the information on the return you plan to file.

- Carefully check all entries for accuracy. Mistakes or incomplete information can lead to penalties and complications down the line.

Conversely, here are actions to avoid:

- Do not use a copy of the federal extension form instead of the IT-370-PF form. Such substitutions are no longer accepted.

- Avoid late submissions past the filing deadline, as this will result in an invalid extension application.

- Do not enter foreign address details in an incorrect order. Follow the specified format for clarity.

- Refrain from failing to pay any tax owed on or before the due date. Such actions may incur additional penalties and interest.

Misconceptions

Here are some common misconceptions about the IT-370-PF form, along with clarifications to help you better understand its purpose and requirements:

- Misconception 1: The IT-370-PF form is universally applicable to all taxpayers.

- Misconception 2: Filing the IT-370-PF extends the deadline to pay taxes owed.

- Misconception 3: You can use a federal extension in place of the IT-370-PF form.

- Misconception 4: All partnerships are entitled to the same extension period.

- Misconception 5: The form must be submitted only when tax payments are due.

- Misconception 6: An extension obtained with the IT-370-PF form allows for additional time to file partner or beneficiary tax returns.

- Misconception 7: You can file the IT-370-PF form anytime before the filing deadline.

- Misconception 8: There are no penalties for filing the IT-370-PF form late.

This form is specifically designed for partnerships and fiduciaries, such as estates and trusts. It does not apply to individual taxpayers who file personal income tax returns.

While this form grants an extension to file, it does not extend the deadline to pay taxes. Taxes must still be paid by their original due date to avoid penalties and interest.

This is incorrect. New York State no longer accepts federal extension requests as a substitute for the IT-370-PF form. You must file this specific form to obtain an extension.

While most partnerships now receive a six-month extension with the IT-370-PF form, some larger electing partnerships already had this extension and are not required to indicate a special condition code.

Form IT-370-PF must be submitted even if no tax payment is owed. It serves primarily as an application for an extension to file the necessary returns.

This is a misunderstanding. The extension only applies to the partnership or fiduciary return itself; partners and beneficiaries must still file their individual tax returns on time.

This isn’t accurate. The form must be filed by the original due date of the return. Submissions after this deadline will be considered invalid.

Filing the form after the deadline will lead to penalties. It's important to adhere strictly to due dates to avoid unnecessary costs.

Key takeaways

Understanding the IT-370-PF form is crucial for both partnerships and estates or trusts seeking an extension for filing their tax returns. Here are some key takeaways about filling out and using this important form:

- File On Time: Submit Form IT-370-PF by the original due date to secure an automatic extension for Form IT-204 or IT-205.

- Different Deadlines: Partnerships now have a filing deadline of March 15, while estates and trusts maintain an April 15 deadline (for calendar-year filers).

- Extension Duration: Partnerships receive a six-month extension, while estates and trusts receive a five-and-a-half-month extension.

- Separate Forms Required: A separate Form IT-370-PF must be completed for each partnership or estate/trust requesting an extension.

- No Federal Forms Accepted: New York State does not accept a copy of the federal extension form in place of IT-370-PF.

- Payment Requirements: For Form IT-205 filers, any owed tax must be paid when submitting the extension request.

- Penalties for Late Filing: Failure to file on time can lead to additional penalties, including 5% of the unpaid amount each month, which may accumulate to 25%.

- Interest Accrual: Interest will continue to accumulate on unpaid taxes, regardless of an extension being granted.

- Special Condition Codes: Nonresident alien estates and trusts must use specific codes when filing for an extension due by June 15.

- Mailing Addresses: Ensure to send the completed form to the correct P.O. box based on whether you are enclosing a payment or not.

Staying informed about these aspects of the IT-370-PF form can ensure proper compliance and help avoid penalties.

Browse Other Templates

Security Deposit Demand Letter - This letter reflects professionalism in managing tenant security deposits.

Florida Loss Declaration,Insurance Claim Proof Statement,Insured Property Damage Affidavit,Loss Verification Form,Claim Support Affidavit,Statement of Loss Evidence,Affidavit of Property Damage,Proof of Insurance Loss Statement,Insurance Loss Submiss - Full completion ensures that all aspects of the loss are considered during the claims assessment.

How to Cancel Car Registration in Ga - Attach proof for inoperable or stored vehicles with your application.