Fill Out Your L 01A Form

The L 01A form plays a vital role in the formation of a limited liability company (LLC) in North Carolina, specifically when a business entity is undergoing conversion. Key aspects of this form include identifying the new LLC's name, ensuring it complies with state naming conventions, and disclosing the name of the converting entity alongside its governing laws. Additionally, the form requires details about the type of converting business, whether it's a domestic or foreign corporation, partnership, or limited liability partnership. Essential information about the LLC's registered office and initial registered agent must also be provided, ensuring there is a reliable contact for legal and official correspondence. The form includes options for defining the management structure of the LLC, allowing for either a member-managed or manager-managed configuration. Lastly, the document stipulates potential dissolution dates and allows for additional provisions that the LLC may wish to include. All these elements coupled with a filing fee constitute a comprehensive submission to the Secretary of State, marking the formal establishment of a new limited liability company in North Carolina.

L 01A Example

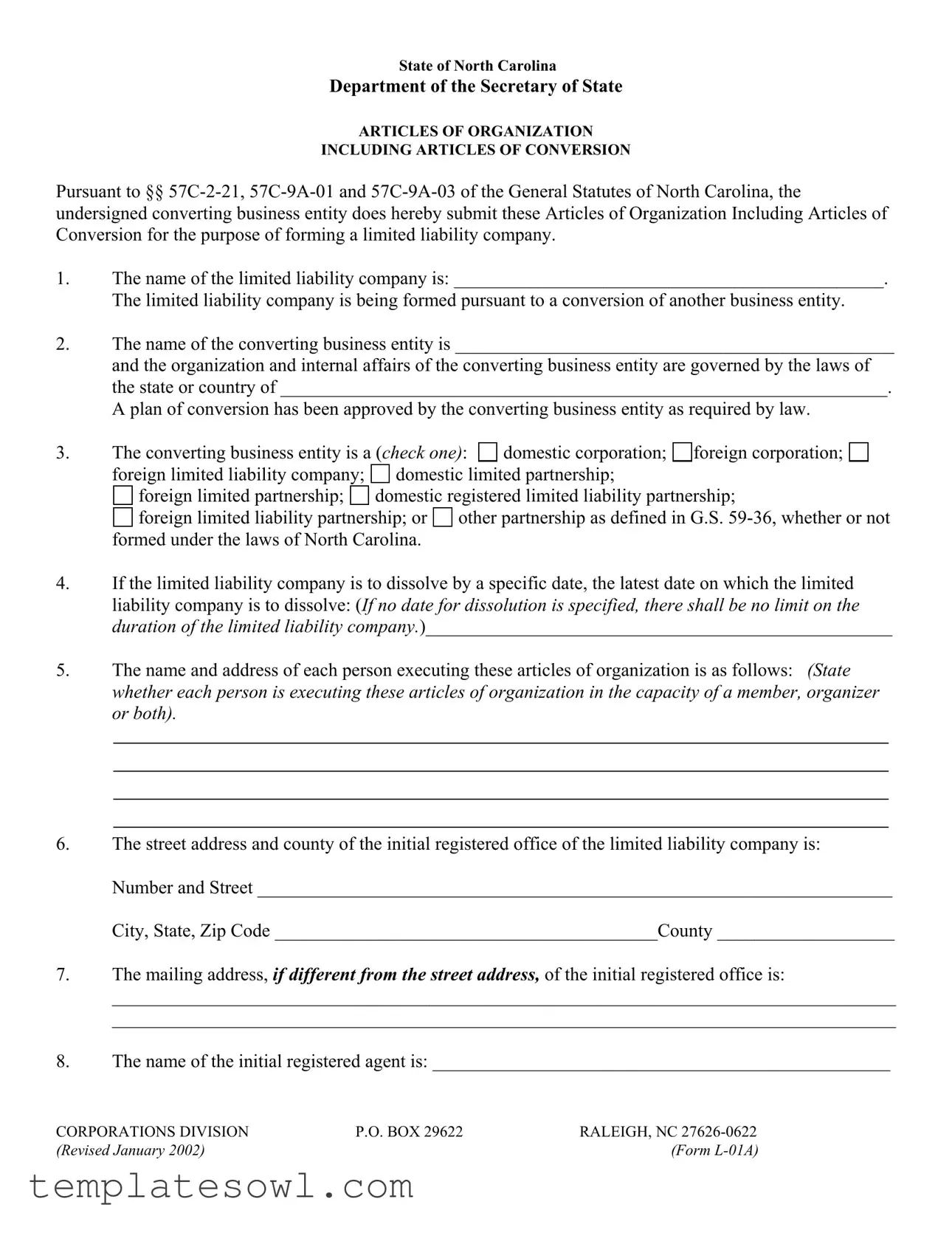

State of North Carolina

Department of the Secretary of State

ARTICLES OF ORGANIZATION

INCLUDING ARTICLES OF CONVERSION

Pursuant to §§

1.The name of the limited liability company is: ______________________________________________. The limited liability company is being formed pursuant to a conversion of another business entity.

2.The name of the converting business entity is _______________________________________________

and the organization and internal affairs of the converting business entity are governed by the laws of the state or country of _________________________________________________________________. A plan of conversion has been approved by the converting business entity as required by law.

3. |

The converting business entity is a (check one): |

domestic corporation; |

foreign corporation; |

||

|

foreign limited liability company; |

domestic limited partnership; |

|

||

|

foreign limited partnership; |

domestic registered limited liability partnership; |

|||

|

foreign limited liability partnership; or |

other partnership as defined in G.S. |

|||

|

formed under the laws of North Carolina. |

|

|

|

|

4.If the limited liability company is to dissolve by a specific date, the latest date on which the limited liability company is to dissolve: (If no date for dissolution is specified, there shall be no limit on the duration of the limited liability company.)__________________________________________________

5.The name and address of each person executing these articles of organization is as follows: (State whether each person is executing these articles of organization in the capacity of a member, organizer or both).

6.The street address and county of the initial registered office of the limited liability company is: Number and Street ____________________________________________________________________

City, State, Zip Code _________________________________________County ___________________

7.The mailing address, if different from the street address, of the initial registered office is:

____________________________________________________________________________________

____________________________________________________________________________________

8.The name of the initial registered agent is: _________________________________________________

CORPORATIONS DIVISION |

P.O. BOX 29622 |

RALEIGH, NC |

(Revised January 2002) |

|

(Form |

9.Principal office information: (Select either a or b.)

a. |

The limited liability company has a principal office. |

•The street address and county of the principal office of the limited liability company is:

Number and Street_____________________________________________________________________

City, State, Zip Code_____________________________________________County________________

•The mailing address, if different from the street address, of the principal office of the limited liability company is: _________________________________________________________________________

____________________________________________________________________________________

b.

The limited liability company does not have a principal office.

The limited liability company does not have a principal office.

10.Check one of the following:

(i)

(i)

(ii)

(ii)

11.Any other provisions which the limited liability company elects to include are attached.

12.These articles will be effective upon filing, unless a date and/or time is specified:

___________________________________

This is the____ day of _______________, 20______.

____________________________________

____________________________________

Signature

____________________________________

Type or Print Name and Title

NOTES:

1.Filing fee is $125. This document must be filed with the Secretary of State.

CORPORATIONS DIVISION |

P.O. BOX 29622 |

RALEIGH, NC |

(Revised January 2002) |

|

(Form |

Instructions for Filing

ARTICLES OF ORGANIZATION

INCLUDING ARTICLES OF CONVERSION

(Form

Item 1 Enter the complete company name, which must include a limited liability company ending required by N.C.G.S. §

Item 2 Enter the complete name of the business entity that is converting to a limited liability company. Also, enter the name of the state or country that governs the organization and internal affairs of the converting business entity.

Item 3 Identify what type of business entity is converting to a limited liability company.

Item 4 Enter the latest date on which the limited liability company may dissolve. If no date for dissolution is specified, there shall be no limit on the duration of the limited liability company. (See N.C.G.S

Item 5 Enter the name and address of each person who executes the articles of organization and whether they are executing them in the capacity of a member or of an organizer or both. You must state "member," "organizer" or "member and organizer". Unless the articles of organization provide otherwise, each person executing the articles of organization in the capacity of a member of the limited liability company becomes a member at the time that the filing by the Secretary of State of the articles of organization of the limited liability company becomes effective. (See N.C.G.S. §

Item 6 Enter the complete street address of the registered office and the county in which it is located.

Item 7 Enter the complete mailing address of the registered office only if mail is not delivered to the street address shown in Item 6 or if the registered agent prefers to have mail delivered to a P.O. Box or Drawer.

Item 8 Enter the name of the registered agent. The registered agent must be either an individual who resides in North Carolina; a domestic business corporation, nonprofit corporation, or limited liability company whose business office is identical with the registered office; or a foreign corporation, nonprofit corporation or limited liability company authorized to transact business or conduct affairs in North Carolina whose business office is identical with the registered office.

Item 9 Select item “a” if the limited liability company has a principal office. Enter the complete street address of the principal office and the county in which it is located. If mail is not delivered to the street address of the principal office or if you prefer to receive mail at a P.O. Box or Drawer, enter the complete mailing address of the principal office.

Select item “b” if the limited liability company does not have a principal office.

Item 10 Unless the articles of organization provide otherwise, all members shall be managers of the LLC, together with any other persons designated as managers in, or in accordance with, the articles of organization or the LLC’s written operating agreement. If the articles of organization provide that all members are not necessarily managers by virtue of their status as members, then those persons designated as managers in, or in accordance with, the articles of organization or the written operating agreement shall manage the LLC, except for such period during which no designation has been made or is in effect, in which case all members shall be managers.

Item 11 N.C.G.S.

Item 12 The document will be effective on the date and at the time of filing, unless a delayed date or an effective time (on the day of filing) is specified. If a delayed effective date is specified without a time, the document will be effective at 11:59:59 p.m. Raleigh, North Carolina time on the day specified. If a delayed effective date is specified, the document will be effective on the day and at the time specified. A delayed effective date may be specified up to and including the 90th day after the day of filing.

Date and Execution

Enter the date the document was executed.

In the blanks provided enter:

•The name of the converting business entity executing the Articles of Organization.

•The signature of the representative of the organizing entity.

•The name of the

•The title of the entity executing the Articles of Organization (i.e. Organizer, Member or both)

•The document may, but need not, contain an acknowledgment, verification, or proof.

ATTENTION: Limited liability companies wishing to render a professional service as defined in N.C.G.S.

CORPORATIONS DIVISION |

P.O. BOX 29622 |

RALEIGH, NC |

(Revised January 2002) |

|

(Form |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The L 01A form is used to submit Articles of Organization, which facilitate the creation of a limited liability company (LLC) in North Carolina through the conversion of another business entity. |

| Governing Laws | This form adheres to North Carolina General Statutes §§ 57C-2-21, 57C-9A-01, and 57C-9A-03, which outline the legal requirements for the formation and conversion of LLCs. |

| Filing Fee | A filing fee of $125 is required when submitting the L 01A form to the North Carolina Secretary of State's office. |

| Execution | Each article must be executed by individuals who may serve as members or organizers, ensuring that all necessary parties are recognized in the formation process of the LLC. |

Guidelines on Utilizing L 01A

Filling out the L 01A form is an essential step for converting a business entity into a limited liability company in North Carolina. Completing this form accurately will ensure that the conversion process proceeds smoothly and complies with state regulations.

- Company Name: Write the full name of the limited liability company, making sure to include the required ending (such as “LLC”).

- Converting Business Entity: Enter the name of the business entity that is being converted and the state or country that governs it.

- Type of Entity: Check the appropriate box to identify the type of business entity converting to a limited liability company.

- Dissolution Date: If applicable, specify the latest date on which the limited liability company will dissolve.

- Executors’ Information: List the name and address of each person executing the articles, specifying whether they are a member, organizer, or both.

- Registered Office Address: Provide the complete street address and county of the initial registered office.

- Mailing Address: If different from the street address, enter the mailing address for the initial registered office.

- Registered Agent: Fill in the name of the registered agent, ensuring they meet state requirements.

- Principal Office Information: Select whether the limited liability company has a principal office. If yes, provide the address.

- Management Structure: Indicate whether the LLC is member-managed or manager-managed by checking the appropriate option.

- Additional Provisions: Note any other provisions being included, and attach them if necessary.

- Effective Date: Enter the date and specify if the articles will be effective upon filing or if a different date is requested.

- Date and Signature: Sign and print the name of the person executing the articles, along with their title.

What You Should Know About This Form

What is the L 01A form?

The L 01A form is used to file Articles of Organization Including Articles of Conversion in the state of North Carolina. This form facilitates the formation of a limited liability company (LLC) that results from the conversion of an existing business entity, such as a corporation or partnership. It lays out essential details about the new LLC, including its name and the converting business entity.

Who needs to use the L 01A form?

Anyone looking to convert a business entity into a limited liability company in North Carolina should use the L 01A form. This includes domestic corporations, foreign corporations, and various types of partnerships. If you have an existing business structure and want to transform it into an LLC, this form is your go-to document.

What information must be provided on the L 01A form?

The form requires several specific details: the name of the new LLC, the name of the converting entity, the governing laws of that entity, the type of original entity, and the addresses of both the registered office and the principal office. Additionally, you'll need to identify the initial registered agent and whether the LLC will be member-managed or manager-managed.

What is the filing fee for the L 01A form?

The filing fee for the L 01A form is $125. This fee must be submitted along with the completed form to the North Carolina Secretary of State’s office. It's important to prepare for this expense when planning your business conversion.

How long will it take for the L 01A form to process?

While processing times can vary, once you submit your L 01A form and fee, it typically takes a few business days for your filing to be processed. Filing may take longer during peak periods, so it’s always wise to submit your form early if your timeline is tight.

Can the LLC have a specific dissolution date?

Yes, the L 01A form provides a section where you can specify a particular dissolution date for your LLC. If you do not indicate a date, your LLC will be set up with no specified end date, allowing it to exist indefinitely unless you decide to dissolve it later.

What should I include in the Articles of Organization?

Your Articles of Organization should contain basic information such as the LLC's name, the converting business entity's name, responsible parties, registered office address, and whether it is member-managed or manager-managed. Additionally, any optional provisions can also be attached, as long as they comply with North Carolina law.

What happens after I file the L 01A form?

Once your L 01A form is submitted and processed, your new LLC will officially be recognized in North Carolina. The filing becomes effective upon approval, unless you've indicated a specific future date. After that, you will need to comply with ongoing requirements like maintaining good standing with the state and following any operational guidelines for LLCs.

Common mistakes

Making mistakes when filling out the L-01A form can cause significant delays in establishing a limited liability company in North Carolina. One common error is failing to include the required designation in the company name. The name must have a proper ending such as "Limited Liability Company," "L.L.C.," or "Ltd. Liability Co." Omitting this detail can lead to rejection of the application.

Another frequent oversight occurs when individuals do not provide the complete name of the converting business entity. It is essential to include both the full name and the correct jurisdiction governing that entity. Inaccuracies here can create confusion and hinder the processing of the application.

A third mistake involves selecting the incorrect type of business entity for conversion. The form requires that you check one box that specifically identifies whether it is a domestic corporation, foreign corporation, or any other type. Misidentifying this status may cause delays and additional paperwork as the state reviews the filing.

In the section regarding the registered office, some applicants fail to specify the complete street address and county. Providing only partial information can lead to issues with receiving official communications, which may ultimately impact the company’s status.

Additionally, many people overlook the importance of clearly stating the role of each individual executing the articles. The capacity must be explicitly mentioned, whether as a member, organizer, or both. Leaving this out can render the filing invalid and require resubmission.

Finally, some individuals neglect to specify an effective date for their limited liability company upon filing. If no date is provided, the filing becomes effective immediately. However, if a delayed effective date is desired, it must be clearly stated to avoid confusion about when the business is officially established.

Documents used along the form

The L 01A form, used for creating a limited liability company (LLC) in North Carolina through a conversion process, often requires additional forms and documents. These supplementary documents provide necessary information and support to ensure a smooth filing. Understanding each of these documents can be invaluable for anyone looking to establish an LLC properly.

- Operating Agreement: This document outlines the internal rules and procedures governing the LLC. It details the rights and responsibilities of members, management structure, and how profits will be distributed.

- Certificate of Good Standing: Often required by the state, this certificate proves that the converting business entity is compliant with state regulations. It typically verifies that all fees are paid and annual reports are filed.

- Plan of Conversion: This document explains the terms and conditions under which the conversion takes place. It provides a roadmap for transitioning from one business entity to an LLC, including any necessary approvals.

- Registered Agent Appointment Form: This form designates a registered agent for the LLC. The registered agent is responsible for receiving legal documents and official correspondence on behalf of the company.

- Member Consent Forms: These forms are often used to document that all members have agreed to the conversion. They serve as evidence of consent and can help prevent disputes later on.

- Initial Report: Some states require an initial report shortly after the formation of the LLC. This report typically includes details about the LLC's business activities and management structure.

- Filing Fee Payment Receipt: After submitting the L 01A form, a receipt for the filing fee must be retained. This receipt serves as confirmation that the document has been filed and fees have been paid.

- Bylaws: Similar to the operating agreement, although not always required for LLCs, bylaws can clarify the operating procedures and decision-making processes within the company.

Incorporating all necessary documents along with the L 01A form will ensure a well-prepared submission. This approach will help in avoiding delays in the formation of your LLC, thus allowing you to focus on building your business right from the start.

Similar forms

The L 01A form is utilized for the purpose of forming a limited liability company (LLC) through the conversion of another business entity. Several other documents serve similar functions for different types of business formations or conversions. Below is a list of these documents and their similarities with the L 01A form:

- Articles of Incorporation: Like the L 01A form, this document is required to formally establish a corporation. It includes essential details such as the corporation’s name, purpose, and initial registered agent, similar to the information needed for LLC formation.

- Certificate of Formation: This document is specifically used for creating a limited liability company in other jurisdictions. It shares similar requirements to the L 01A form, including the details of the business and the names of the individuals involved.

- Certificate of Conversion: Used to convert an existing business entity to another type of business entity, including an LLC. Both the Certificate of Conversion and the L 01A form require information about the converting entity and its designation after conversion.

- Operating Agreement: This document outlines the management structure and operational procedures for an LLC. While the L 01A form is focused on formation, the Operating Agreement is a critical document for the functioning of the entity once established.

- Bylaws: For corporations, bylaws serve as the governing document, detailing rules and procedures. Much like the L 01A form, which requires similar foundational information, bylaws establish how a corporation will operate.

- Application for Certificate of Authority: This document allows foreign LLCs to conduct business in another state. It parallels the L 01A form in that both require registration with state authorities and contain similar organizational details.

- Partnership Agreement: Used to set the terms of a business partnership, this document shares similarities with the L 01A form, as both outline the nature of ownership and roles of the involved parties in the business structure.

Dos and Don'ts

When filling out the L 01A form, it is important to adhere to specific guidelines to ensure the submission is valid and accepted. Below is a list of recommendations on what to do and avoid.

- Do: Enter the complete name of the limited liability company, including the required suffix such as "LLC".

- Do: List the full name of the converting business entity as well as the governing state or country.

- Do: Clearly identify the type of business entity that is converting to a limited liability company.

- Do: Provide the complete street address for the initial registered office and the county it is located in.

- Do: Include the names and addresses of all individuals executing the articles, specifying their capacity.

- Don't: Do not leave any required fields blank as this may delay processing.

- Don't: Avoid using abbreviations in the name of the limited liability company except as allowed by law.

- Don't: Do not forget to check the correct management structure of the LLC when completing the form.

- Don't: Avoid listing a principal office address unless it exists; otherwise, select the option stating no principal office is established.

- Don't: Do not misstate the capacity of the individuals signing the articles, such as failing to indicate if they are a member or organizer.

Misconceptions

There are several misconceptions surrounding the L 01A form. Here are four common ones:

- All business types can use the L 01A form. This is not true. The form is intended specifically for converting existing business entities into limited liability companies. It cannot be used for forming new businesses without a conversion.

- Once submitted, the L 01A form guarantees immediate approval. Approval of the form does not happen automatically. It must be filed with the Secretary of State, and the processing time can vary.

- A conversion means dissolving the previous business. This is misleading. While a conversion does change the business structure, the original entity does not dissolve until the conversion process is completed and approved.

- The filing fee is negotiable. This is a misconception. The filing fee for the L 01A form is fixed at $125 and cannot be altered.

Key takeaways

- Prior to submitting the L 01A form, ensure the company name includes a proper ending that complies with North Carolina statutes, such as "limited liability company" or its abbreviations.

- Clearly identify the converting business entity along with the governing laws of its original formation. This information is crucial for the conversion process.

- It is important to determine the type of entity that is converting. This may include options like domestic or foreign corporations, or various types of partnerships.

- In case there is a need for a specific dissolution date for the limited liability company, that date must be indicated. If no date is specified, the company will have no limit on its duration.

- Provide the name and address of each person executing the form and clarify their capacity as either a member or organizer. This information validates their authority in the organization.

Browse Other Templates

Nys Llc Dissolution - Corporations must ensure they have complied with all outstanding obligations before dissolution.

Dwc Separator Sheet - Useful for internal tracking and document audits.

Wd 10 - Contractor details, including name and contact information, are required.