Fill Out Your Lc 1 1 0 Form

The LC 1 1 0 form is a crucial document for establishing a Limited Liability Company (LLC) in Connecticut. It serves several essential functions, guiding business owners through the necessary steps to legally register their company. To start, the form requires the name of the LLC, which must include a designation such as "LLC" or "Limited Liability Company." A description of the business activities is also mandatory, ensuring transparency regarding the entity's purpose. Additionally, the form specifies a principal office address that cannot be a P.O. Box, as well as an optional mailing address. The appointment of a statutory agent, responsible for receiving legal documents, is another key component. This agent can either be an individual resident of Connecticut or a registered business entity. Furthermore, the form necessitates details about at least one manager or member of the LLC, reaffirming the importance of clear organizational structure. Lastly, the signing of the form executes a declaration affirming the accuracy of the information provided, under penalty of law. Understanding these aspects lays the groundwork for successfully navigating the requirements of forming an LLC in Connecticut.

Lc 1 1 0 Example

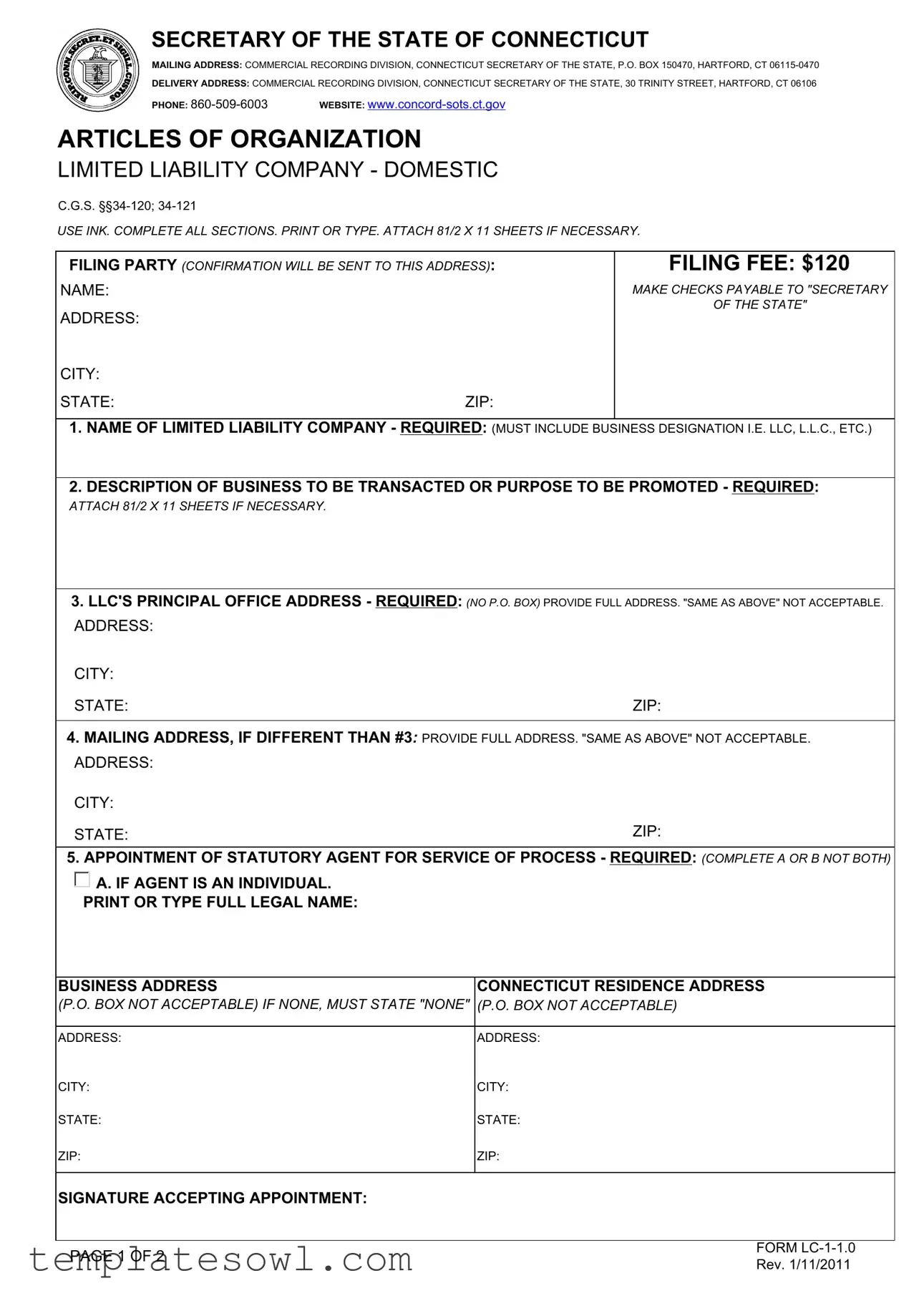

SECRETARY OF THE STATE OF CONNECTICUT

MAILING ADDRESS: COMMERCIAL RECORDING DIVISION, CONNECTICUT SECRETARY OF THE STATE, P.O. BOX 150470, HARTFORD, CT

DELIVERY ADDRESS: COMMERCIAL RECORDING DIVISION, CONNECTICUT SECRETARY OF THE STATE, 30 TRINITY STREET, HARTFORD, CT 06106

PHONE: |

WEBSITE: |

ARTICLES OF ORGANIZATION

LIMITED LIABILITY COMPANY - DOMESTIC

C.G.S.

USE INK. COMPLETE ALL SECTIONS. PRINT OR TYPE. ATTACH 81/2 X 11 SHEETS IF NECESSARY.

FILING PARTY (CONFIRMATION WILL BE SENT TO THIS ADDRESS):

NAME:

ADDRESS:

CITY:

STATE:ZIP:

FILING FEE: $120

MAKE CHECKS PAYABLE TO "SECRETARY

OF THE STATE"

1.NAME OF LIMITED LIABILITY COMPANY - REQUIRED: (MUST INCLUDE BUSINESS DESIGNATION I.E. LLC, L.L.C., ETC.)

2.DESCRIPTION OF BUSINESS TO BE TRANSACTED OR PURPOSE TO BE PROMOTED - REQUIRED:

ATTACH 81/2 X 11 SHEETS IF NECESSARY.

3.LLC'S PRINCIPAL OFFICE ADDRESS - REQUIRED: (NO P.O. BOX) PROVIDE FULL ADDRESS. "SAME AS ABOVE" NOT ACCEPTABLE.

ADDRESS:

CITY:

STATE: |

ZIP: |

4.MAILING ADDRESS, IF DIFFERENT THAN #3: PROVIDE FULL ADDRESS. "SAME AS ABOVE" NOT ACCEPTABLE.

ADDRESS:

CITY:

STATE: |

ZIP: |

5. APPOINTMENT OF STATUTORY AGENT FOR SERVICE OF PROCESS - REQUIRED: (COMPLETE A OR B NOT BOTH)

A. IF AGENT IS AN INDIVIDUAL.

A. IF AGENT IS AN INDIVIDUAL.

PRINT OR TYPE FULL LEGAL NAME:

BUSINESS ADDRESS |

CONNECTICUT RESIDENCE ADDRESS |

(P.O. BOX NOT ACCEPTABLE) IF NONE, MUST STATE "NONE" |

(P.O. BOX NOT ACCEPTABLE) |

|

|

ADDRESS: |

ADDRESS: |

CITY: |

CITY: |

STATE: |

STATE: |

ZIP: |

ZIP: |

|

|

SIGNATURE ACCEPTING APPOINTMENT:

PAGE 1 OF 2

FORM

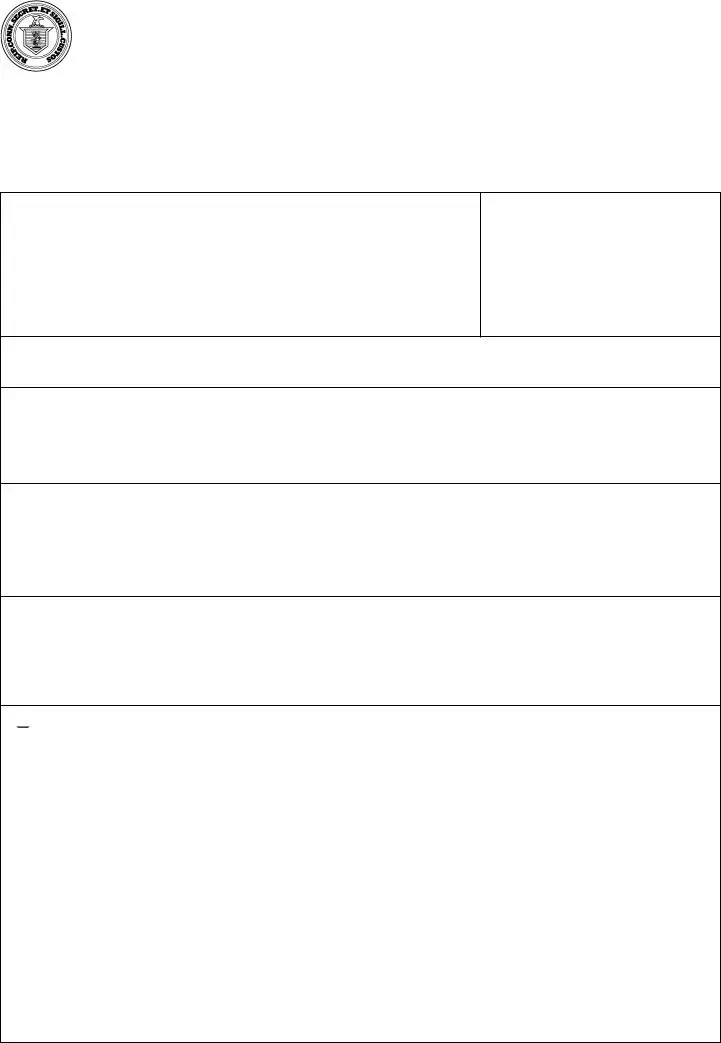

B. IF AGENT IS A BUSINESS:

B. IF AGENT IS A BUSINESS:

PRINT OR TYPE NAME OF BUSINESS AS IT APPEARS ON OUR RECORDS:

(P.O.BOX UNACCEPTABLE)

ZIP:

6.MANAGER OR MEMBER

ATTACH 81/2 X 11 SHEETS IF NECESSARY.

TITLE

BUSINESS ADDRESS

(No. P.O Box)

IF NONE, MUST STATE "NONE"

RESIDENCE ADDRESS:

(No. P.O Box)

7. MANAGEMENT - PLACE A CHECK NEXT TO THE FOLLOWING STATEMENT ONLY IF IT APPLIES

MANAGEMENT OF THE LIMITED LIABILITY COMPANY SHALL BE VESTED IN A MANAGER OR MANAGERS

MANAGEMENT OF THE LIMITED LIABILITY COMPANY SHALL BE VESTED IN A MANAGER OR MANAGERS

8.EXECUTION: (SUBJECT TO PENALTY OF FALSE STATEMENT)

DATED THIS |

|

DAY OF |

, 20 |

|

|

|

|

|

|

NAME OF ORGANIZER

(PRINT OR TYPE)

SIGNATURE

AN ANNUAL REPORT WILL BE DUE YEARLY IN THE ANNIVERSARY MONTH THAT THE ENTITY WAS FORMED/REGISTERED AND CAN BE EASILY FILED ONLINE @

CONTACT YOUR TAX ADVISOR OR THE TAXPAYER SERVICE CENTER AT THE DEPARTMENT OF REVENUE SERVICES AS TO ANY POTENTIAL TAX LIABILITY RELATING TO YOUR BUSINESS, INCLUDING QUESTIONS ABOUT THE BUSINESS ENTITY TAX.

TAX PAYER SERVICE CENTER: (800)

PAGE 2 OF 2 |

FORM |

|

Rev. 1/11/2011 |

||

|

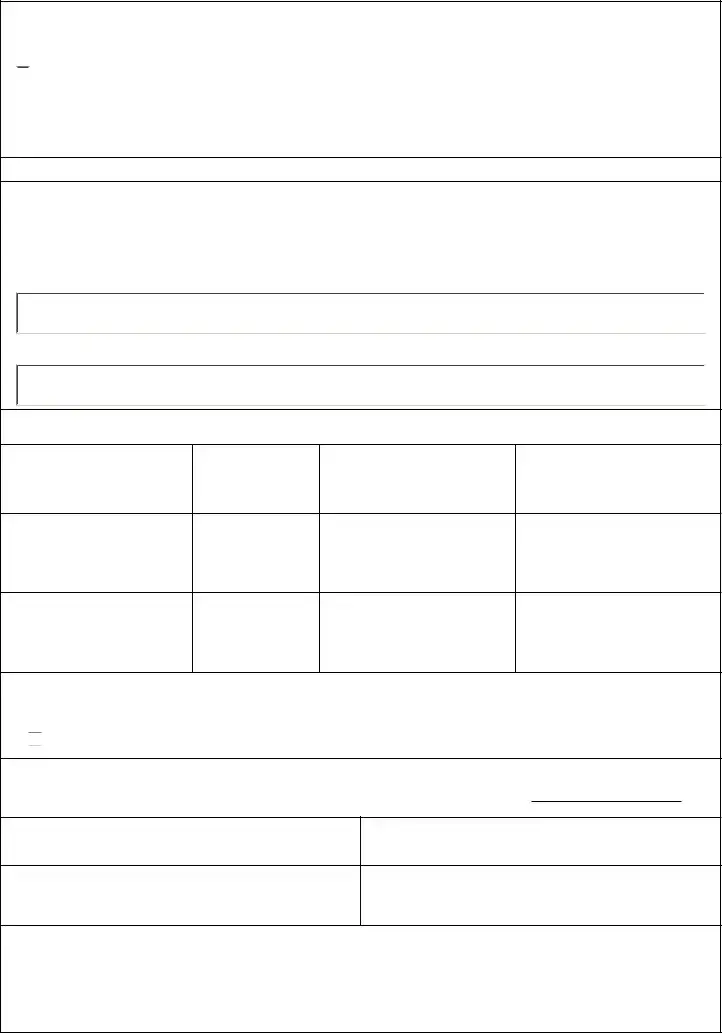

INSTRUCTIONS

1.Name of Limited Liability

2.Nature of

3.Principal

4.Mailing

5.Appointment of statutory agent for

OWN AGENT. An individual or entity (other than this LLC) must be appointed to accept legal process, notice or demand served upon the limited liability company. The agent may be EITHER:

a. Any individual who is a resident of Connecticut, including a manager or member of the LLC.

•An individual must provide the complete street address of his or her business and a Connecticut residence address.

(If no business address, must state none).

•The agent must sign accepting the appointment.

OR

b. One of the following business types, on record with this office, with a Connecticut address:

•A Connecticut corporation, limited liability company, limited liability partnership or statutory trust.

•A foreign corporation, limited liability company, limited liability partnership or statutory trust, which has obtained a certificate of authority to transact business in Connecticut and has a Connecticut address on file with this office.

•Provide the Connecticut principal office address in the block designated for “Business address”. The agent must sign accepting the appointment and the person signing on behalf of a business must print his/her name and title next to his/her signature.

6.Manager or member

may be included on an attached 8 ½ x 11 sheet.)

7.Management: If the limited liability company is to be managed by its member(s) do not check the box.

8.

is true. *THE LIMITED LIABILITY COMPANY MAY NOT BE ITS OWN ORGANIZER BUT A MANAGER/MEMBER MAY BE THE ORGANIZER.

.***YOU ARE REQUIRED TO FILE ARTICLES OF DISSOLUTION IF YOU DISSOLVE YOUR BUSINESS. ***

NOTE: LLC’s may have as many managers/members as they wish. However, only three will be shown on the database.

Additional names will be available by requesting copies of the original filing.

INSTRUCTIONS |

DO NOT SCAN THIS PAGE |

FORM

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Fee | The fee to file the LC 1 1 0 form is $120. Payment should be made to the "Secretary of the State." |

| Governing Law | This form is governed by the Connecticut General Statutes, specifically C.G.S. §§ 34-120 and 34-121. |

| Agent Requirement | The limited liability company must appoint a statutory agent for service of process, which cannot be the LLC itself. |

| Principal Office Address | The form requires a complete physical address for the LLC's principal office—P.O. Box addresses are not acceptable. |

Guidelines on Utilizing Lc 1 1 0

After you've gathered all necessary information, it's time to fill out the Lc 1 1 0 form. This involves providing details like your business name, purpose, address, and agent information. Make sure to follow the instructions carefully to avoid any delays in processing your application.

- Start with the Filing Party Information: Fill in your name, address, city, state, and ZIP code. This is where the confirmation will be sent.

- Enter the Filing Fee: Note that the filing fee is $120. Payable to "Secretary of the State."

- Name of Limited Liability Company: Write the name of your LLC. Ensure it includes a business designation (e.g., LLC, L.L.C.).

- Description of Business: Provide a brief description of the business activities or purpose. If necessary, attach additional sheets.

- Principal Office Address: List the physical address of your LLC's principal office. Don't use a P.O. Box.

- Mailing Address: Fill in the mailing address if it's different from the principal office. Again, avoid using a P.O. Box.

- Appointment of Statutory Agent: Choose whether the agent is an individual or a business. Complete the relevant section with full addresses and signatures.

- Manager or Member Information: Provide details for at least one manager or member of the LLC, including names, titles, and addresses.

- Management Information: Indicate if management will be vested in a manager or managers by checking the appropriate box.

- Execution: The organizer must print their name, sign the form, and date it. Ensure this is done under penalty of false statement.

What You Should Know About This Form

What is the LC 1 1 0 form, and why is it necessary?

The LC 1 1 0 form, also known as the Articles of Organization for a Limited Liability Company (LLC), is essential for setting up a domestic LLC in Connecticut. This document outlines fundamental details about your business, including its name, purpose, and the addresses of its principal office and statutory agent for service of process. Filing this form with the Connecticut Secretary of the State is a legal requirement to officially register your LLC and gain limited liability protection for your personal assets.

What information is required to complete the LC 1 1 0 form?

To properly complete the LC 1 1 0 form, several key pieces of information are needed. First, you must provide the name of your LLC, which must include a business designation like "LLC." Next, a general description of the business's purpose is required. Additionally, you will need to list your LLC's principal office address and, if applicable, a separate mailing address. The form also requires the appointment of a statutory agent for service of process—someone who will receive legal documents on behalf of the LLC. Lastly, you must include details about at least one manager or member of the LLC along with their respective addresses.

How much does it cost to file the LC 1 1 0 form?

The filing fee for the LC 1 1 0 form is $120. This fee must be paid when submitting your form. Payments should be made payable to the "Secretary of the State" of Connecticut. It is essential to ensure that the fee is included with your application to avoid any processing delays.

What happens after submitting the LC 1 1 0 form?

Once you have submitted the LC 1 1 0 form and the corresponding payment, the Secretary of the State’s office will review your filing. If everything is in order, they will process your application and send you a confirmation of your LLC's formation. This confirmation serves as official proof that your business is now registered with the state. It's important to note that after your LLC is established, you must file an annual report on the anniversary of your LLC's formation to maintain good standing.

Common mistakes

Filling out the LC-1-1.0 form for a limited liability company involves several important sections, and many individuals make common mistakes during this process. One frequent error occurs in the naming of the business. It is crucial that the name selected not only includes an appropriate designation such as LLC or Limited Liability Company but is also distinguishable from other registered business names. Failing to ensure that the name is unique can lead to delays or rejection of the application.

Another mistake seen often relates to providing the principal office address. The form explicitly states that a P.O. Box is not acceptable for this section. Instead, individuals must include a full street address. When applicants write “same as above” or provide inadequate address details, this can further complicate the filing process. Each entry should be carefully completed to avoid unnecessary complications.

Completing the section for the statutory agent can also present challenges. Applicants sometimes mistakenly believe they can name the LLC itself as its agent, which is not permitted. The law requires that the appointed agent be a separate entity or individual. Furthermore, if the agent is an individual, both a business and residential address must be provided. Omitting either of these can result in setbacks.

Listing the manager or member information is a critical part of the application that should not be overlooked. It is essential to include at least one manager or member along with their details. Occasionally, individuals neglect to state ‘none’ when applicable. Each section must be filled out thoroughly to ensure all required information is presented clearly to the state.

Finally, the execution section needs careful attention. The organizer must print their full legal name and provide a signature. Errors such as incomplete or illegible names, or signatures, might lead to healing delays. Being meticulous in this section will aid in the quick processing of the filed documents.

Documents used along the form

When establishing a limited liability company (LLC) in Connecticut, the LC-1.1.0 form is essential. However, several other documents and forms may also be necessary or beneficial throughout the process. Below are some commonly used forms that facilitate the LLC formation and ongoing management.

- Operating Agreement: This internal document outlines the management structure and operating procedures of the LLC. While not always required by law, having an operating agreement helps clarify roles and responsibilities among members, which can prevent disputes in the future.

- Employer Identification Number (EIN) Application (Form SS-4): An EIN is crucial for tax purposes and is essential if the LLC plans to hire employees. This form can be completed online through the IRS website and provides a unique number for the business.

- Statement of Information: Required in some states, this document provides key information about the LLC, including its name, principal office address, and the names of its members or managers. It keeps the state informed about changes in the LLC’s structure or management.

- Business License Application: Depending on the type and location of the business, a local or state business license may be necessary to operate legally. This application process ensures compliance with local regulations.

- Initial Report: Some states require LLCs to file an initial report to provide updated information to the state shortly after formation. This report may include names, addresses, and other pertinent details about the LLC’s management and structure.

- Annual Report: To maintain good standing, LLCs often must file an annual report with the state. This typically includes updated information about the business, such as addresses and the names of members or managers.

- Certificate of Good Standing: This document demonstrates that the LLC complies with state regulations and is allowed to conduct business. It is often needed when applying for loans or entering contracts.

- Dissolution Form: If the decision is made to close the LLC, this form officially dissolves the company. It outlines the intent to cease business operations and ensures that the entity is properly removed from state records.

Understanding these additional documents will help navigate the formation and management of an LLC more effectively. Each form plays a unique role in ensuring compliance, operational clarity, and legal protection, making them indispensable for anyone looking to establish and maintain a successful business entity.

Similar forms

The LC 1 1 0 form is a legal document utilized for forming a Limited Liability Company (LLC) in Connecticut. Various other documents serve similar purposes, often relating to the establishment or management of business entities. Below is a list of six documents that share similarities with the LC 1 1 0 form, along with an explanation of how they are related.

- Articles of Incorporation: This document is essential for forming a corporation, similar to how the LC 1 1 0 is required for LLCs. Both documents detail vital information about the entity, such as its name, purpose, and principal office address.

- Certificate of Organization: While resembling the LC 1 1 0 form in intent, this document is often used in other states for the same purpose. It contains foundational aspects like the entity's name and address, which parallels the information found in the LC 1 1 0 form.

- Operating Agreement: This internal document outlines how an LLC will be managed. Although it is not submitted to the state, it is crucial for LLC functioning and complements the LC 1 1 0 by defining roles and responsibilities of members and managers.

- Bylaws: Applicable for corporations, bylaws govern the management structure and operations. Just as the LC 1 1 0 form establishes the LLC's basic structure, bylaws provide a detailed framework for decision-making and conducting business.

- Business License Application: Before starting business operations, obtaining a business license is often necessary. This document, required in many localities, parallels the LC 1 1 0 in that it formalizes the establishment of a legal business presence.

- Annual Report: Similar in context to the LC 1 1 0, this document is filed annually to keep the state informed about an LLC’s status, including changes in management or address. Both forms require the disclosure of key information about the business entity.

Understanding these documents can provide insight into the structural and regulatory aspects of establishing a business. Each plays a role in ensuring compliance with state requirements and sets the foundation for business operations.

Dos and Don'ts

Filling out the Lc 1 1 0 form correctly is crucial for establishing a Limited Liability Company (LLC) in Connecticut. Here are some essential do's and don'ts to guide you through the process.

- Do use ink to fill out the form to ensure legibility.

- Do make sure to complete all required sections. Missing information can lead to delays.

- Do provide a physical address for the LLC. P.O. Boxes are not acceptable in the address fields.

- Do ensure that the name you choose for your LLC includes a business designation, such as "LLC" or "L.L.C."

- Don't write "SAME AS ABOVE" for addresses. Always provide the full address details.

- Don't try to appoint your LLC as its own statutory agent, as this is not permissible.

- Don't forget to sign and date the form; your signature certifies the accuracy of the information provided.

Misconceptions

Here are some common misconceptions about the LC 1 1 0 form:

- 1. You can use a P.O. Box for the LLC's principal office address. This is incorrect. The form requires a physical street address, as P.O. Boxes are not acceptable.

- 2. You can appoint the LLC itself as its statutory agent. This is false. The law states that another individual or entity must be designated as the agent.

- 3. The business name does not need a designation like LLC or L.L.C. Actually, including a designation is mandatory. The name must clearly indicate that it’s a limited liability company.

- 4. You don’t need to provide a mailing address. While it's optional to provide a different mailing address, including it can ensure you receive important documents.

- 5. You can skip listing all managers or members. This is a misconception. You must list at least one manager or member of the LLC on the form.

- 6. The purpose of the business can be vague. In reality, the form requires a clear description of the business purpose. The purpose cannot be overly general.

- 7. You don’t need to get signatures from the agents or members. This is not true. The agent must sign to accept the appointment, and organizers must sign the form.

- 8. The filing fee is optional. Incorrect. A fee of $120 is required when submitting the form. Payment must be included with your application.

Key takeaways

Filing the LC 1 1 0 form is a crucial step in establishing your Limited Liability Company (LLC) in Connecticut. Here are some key takeaways to guide you through the process:

- Accurate Information: Ensure all details are accurate. Mistakes may lead to delays in processing.

- Required Sections: Fill in all required sections completely. Missing parts can result in rejection of your submission.

- Payment of Fees: The filing fee is $120. Make checks payable to the "Secretary of the State."

- Unique LLC Name: The name you choose must be distinguishable from other active LLCs in Connecticut and include a designation like “LLC”.

- Business Purpose: Clearly describe the nature of your business. A general statement is sufficient as long as it aligns with allowable activities under Connecticut law.

- No P.O. Boxes: When providing addresses, do not use P.O. boxes. Ensure to give the full street address for both the principal office and, if applicable, mailing address.

- Statutory Agent: Appoint a statutory agent who is either an individual resident of Connecticut or a registered business. This agent cannot be the LLC itself.

- Manager or Member Information: You must provide information for at least one manager or member of the LLC, including their business and residence address.

- Management Structure: Indicate how the LLC will be managed. This is an important decision that affects your operational structure.

- Execution Requirement: The organizer of the LLC must sign the document to certify that all information is true, understanding that false statements carry penalties.

By keeping these key points in mind, you can navigate the process of completing and submitting the LC 1 1 0 form with greater confidence and clarity. This submission gets you one step closer to successfully establishing your LLC in Connecticut.

Browse Other Templates

Oscar Ballot Template - Select the film edited most skillfully this year.

Voyager Credit Card - If questions arise about the Fleet Card program, contact your U.S. Bank Sales Representative.

Ssi Payee - The emphasis on a payee's expenditures ensures that funds are utilized for the beneficiary's benefit.