Fill Out Your Llc 1011 Form

The LLC-1011 form is a critical document for anyone looking to establish a limited liability company in Virginia. This form outlines essential information about the company, including its name, registered agent, and office locations, all of which are required by Virginia law. To begin, the company name must incorporate specific phrases or abbreviations, ensuring it stands out in the state’s records. The registered agent's qualifications are just as important, reflecting the individual or entity responsible for receiving legal documents on behalf of the LLC. Furthermore, the form requires detailing both a registered office address and a principal office address, the latter being the location where the main business activities occur and where important company records are maintained. Lastly, the form must be signed by one or more organizers, affirming the information provided is accurate and truthful. Properly completing and submitting the LLC-1011 is the first step in legally forming your limited liability company in Virginia.

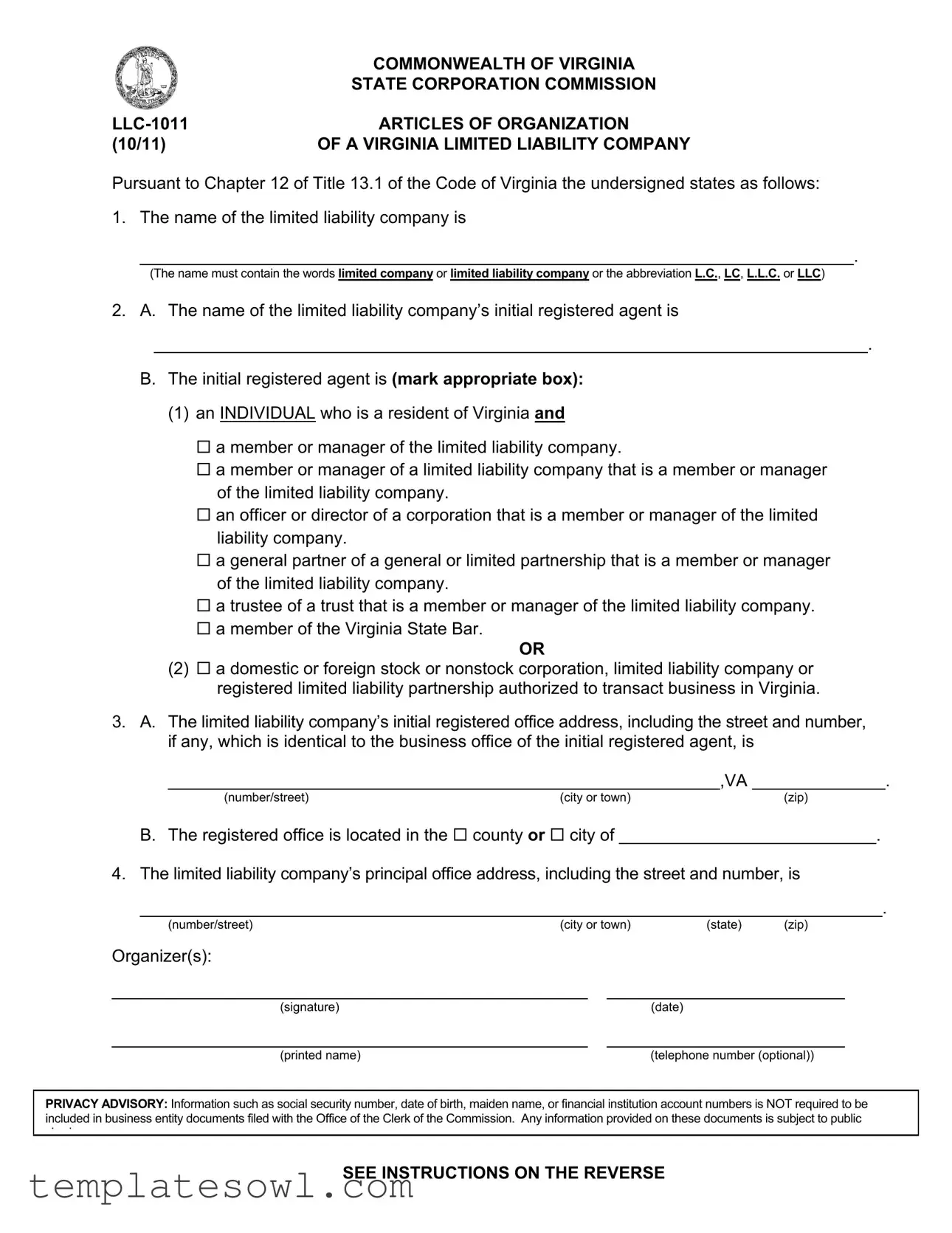

Llc 1011 Example

|

COMMONWEALTH OF VIRGINIA |

|

STATE CORPORATION COMMISSION |

ARTICLES OF ORGANIZATION |

|

(10/11) |

OF A VIRGINIA LIMITED LIABILITY COMPANY |

Pursuant to Chapter 12 of Title 13.1 of the Code of Virginia the undersigned states as follows:

1. The name of the limited liability company is

___________________________________________________________________________.

(The name must contain the words limited company or limited liability company or the abbreviation L.C., LC, L.L.C. or LLC)

2.A. The name of the limited liability company’s initial registered agent is

___________________________________________________________________________.

B.The initial registered agent is (mark appropriate box):

(1)an INDIVIDUAL who is a resident of Virginia and

a member or manager of the limited liability company.

a member or manager of a limited liability company that is a member or manager of the limited liability company.

an officer or director of a corporation that is a member or manager of the limited liability company.

a general partner of a general or limited partnership that is a member or manager of the limited liability company.

a trustee of a trust that is a member or manager of the limited liability company.

a member of the Virginia State Bar.

OR

(2) a domestic or foreign stock or nonstock corporation, limited liability company or registered limited liability partnership authorized to transact business in Virginia.

3.A. The limited liability company’s initial registered office address, including the street and number, if any, which is identical to the business office of the initial registered agent, is

__________________________________________________________,VA ______________.

(number/street) |

(city or town) |

(zip) |

B. The registered office is located in the county or city of ___________________________.

4.The limited liability company’s principal office address, including the street and number, is

______________________________________________________________________________.

(number/street) |

(city or town) |

(state) |

(zip) |

|

Organizer(s): |

|

|

|

|

__________________________________________________ |

_________________________ |

|||

|

(signature) |

|

(date) |

|

__________________________________________________ |

_________________________ |

|||

|

(printed name) |

|

(telephone number (optional)) |

|

PRIVACY ADVISORY: Information such as social security number, date of birth, maiden name, or financial institution account numbers is NOT required to be included in business entity documents filed with the Office of the Clerk of the Commission. Any information provided on these documents is subject to public i i

SEE INSTRUCTIONS ON THE REVERSE

NOTES

Articles of organization can be completed and filed online, or submitted in PDF format to the Clerk’s Office for review and filing, by visiting our website at https://sccefile.scc.virginia.gov/NewEntity. (A user account is required.) This form can also be downloaded from our website at www.scc.virginia.gov/clk/dom_llc.aspx.

The articles must be in the English language, typewritten or printed in black, legible and reproducible.

This form contains the minimum number of provisions required by Virginia law to be set forth in the articles of organization of a Virginia limited liability company. If additional provisions are desired, then the complete articles of organization, including the additional provisions, must be typewritten on white, opaque paper, 8 1/2" by 11" in size, using only one side of a page, and be free of visible watermarks and background logos. A minimum of a 1" margin must be provided on the left, top and bottom margins of a page and 1/2" at the right margin. This form may not be filed with an attachment.

INSTRUCTIONS TO FORM

Name: The limited liability name must contain the words "limited company" or "limited liability company," or the abbreviation "L.C.," "LC," "L.L.C.," or "LLC." The proposed name must be distinguishable upon the records of the Commission. See §

Registered agent: Paragraph 2.A. Provide the name of the registered agent. The limited liability company may not serve as its own registered agent. See §§

Paragraph 2.B. Check one box to indicate the qualification of the registered agent. Only an individual or entity that meets one of the qualifications may serve as the limited liability company’s registered agent. The sole duty of the registered agent is to forward to the limited liability company at its last known address any process, notice or demand that is served on the registered agent. See §

Registered office: Paragraph 3.A. The location of the registered office must be identical to the business office of the registered agent. The address of the registered office must include a street address. A rural route and box number may only be used if no street address is associated with the registered office’s location. A post office box is only acceptable for towns/cities that have a population of 2,000 or less if no street address or rural route and box number are associated with the registered office’s location.

Paragraph 3.B. Provide the name of the county or independent city where the registered office is physically located. Counties and independent cities in Virginia are separate local jurisdictions.

Principal office: The principal office is the office where the principal executive offices of the limited liability company are located. See §

Paragraph 4. The principal office address must include a street and number, if one is associated with the principal office’s location. A rural route and box number may only be used if no street address is associated with the principal office’s location. A post office box is not acceptable given the statutory provisions set forth above as described at the beginning of this paragraph.

Organizer(s): The articles must be signed by one or more organizers and the printed name of the organizer must be set forth next to each signature. See §

It is a Class 1 misdemeanor for any person to sign a document he or she knows is false in any material respect with intent that the document be delivered to the Commission for filing. See §

Submit the original, signed articles to the Clerk of the State Corporation Commission, P.O. Box 1197, Richmond, Virginia

Form Characteristics

| Fact Name | Description |

|---|---|

| Name Requirement | The limited liability company's name must include "limited company," "limited liability company," or the abbreviations "L.C.," "LC," "L.L.C.," or "LLC." |

| Initial Registered Agent | The initial registered agent can be an individual or a corporation authorized to conduct business in Virginia. |

| Registered Office Location | The registered office must match the business office address of the registered agent. |

| Organizers | One or more organizers must sign the articles of organization with their printed names beside the signatures. |

| Filing Fee | A fee of $100 is required to file the LLC-1011 form with the State Corporation Commission. |

| Privacy Advisory | Personal information like social security numbers is not required on the form and is subject to public disclosure. |

| Principal Office | The principal office is where the main executive offices are located and must include a valid street address. |

| Availability Check | Prospective names must be checked for availability via the State Corporation Commission’s website. |

| Document Submission | The completed form can be filed online or submitted in PDF format to the Clerk’s Office for review. |

| Governing Law | The LLC-1011 form is governed by Chapter 12 of Title 13.1 of the Code of Virginia. |

Guidelines on Utilizing Llc 1011

Filling out the LLC-1011 form is an essential step for setting up a limited liability company in Virginia. This form collects necessary information about your business and its registered agent. Following the steps below will guide you through this process effectively.

- Provide the name of your limited liability company in the first section. Ensure it includes the words "limited company" or "limited liability company," or abbreviations like "L.C.," "L.L.C.," or "LLC".

- In the second section, supply the name of the initial registered agent. This person or entity will receive legal documents on behalf of the company.

- Check the appropriate box to indicate whether the registered agent is an individual or a corporation eligible to serve as a registered agent in Virginia.

- In the third section, enter the registered office address. This address must match the business office of the registered agent.

- Indicate whether the registered office is located in a city or county. Specify the name of the jurisdiction.

- Next, fill out the principal office address of the limited liability company. This is where the company's main operations will take place.

- Provide the organizer's name and signature. The organizer is the person responsible for filing the form.

- Add the date of signing and, if desired, a telephone number for optional contact.

Once completed, submit the original form to the Clerk of the State Corporation Commission. Include a check for the filing fee of $100, made out to the State Corporation Commission. The form can be submitted either online or by mailing it directly. This will initiate your LLC in Virginia, setting the foundation for your business's future operations.

What You Should Know About This Form

What is the LLC-1011 form?

The LLC-1011 form, or the Articles of Organization, is a document required for establishing a limited liability company in Virginia. It must be filed with the State Corporation Commission to legally form the LLC.

What information is needed to complete the LLC-1011 form?

You need to provide the company name, initial registered agent information, registered office and principal office addresses, and the organizer's name and signature. Make sure the company name includes "limited liability company" or the appropriate abbreviation.

Can the LLC serve as its own registered agent?

No, an LLC cannot serve as its own registered agent. The registered agent must be an individual resident of Virginia or a corporation authorized to do business in the state.

What is the registered office address?

The registered office address must match the business office of the registered agent. It must be a street address and may not be a post office box, except under certain conditions. Ensure that you include city, county, and zip code.

How do I check if my desired LLC name is available?

You can check name availability on the State Corporation Commission's website or call the Clerk’s Office Call Center for assistance. It's vital that your name is distinguishable from existing businesses.

What filing fee is associated with the LLC-1011 form?

The filing fee for submitting the LLC-1011 form is $100. This should be paid via check made out to the State Corporation Commission, and cash should not be sent.

Is the information on the LLC-1011 form public?

Yes, the information submitted in the form is public. However, sensitive information such as Social Security numbers is not required and should be excluded to protect privacy.

Can I submit the LLC-1011 form online?

Yes, the form can be completed and submitted online or as a PDF. A user account is needed for online submission, and paper forms should be sent to the Clerk’s Office for filing.

What happens if I submit incorrect information on the LLC-1011 form?

Submitting false information knowingly can result in serious legal consequences. Ensure all information is accurate before filing to avoid potential issues or delays with your LLC registration.

Common mistakes

When filling out the LLC-1011 form in Virginia, mistakes can be costly and time-consuming. To avoid delays and complications, it’s important to know the common pitfalls that many individuals face during the process.

Error 1: Incorrect Name Format - The name of the limited liability company (LLC) must include specific language such as "limited company" or "limited liability company." Failing to use the proper terms or abbreviations leads to immediate rejection of the application. Ensuring that the chosen name meets these requirements is crucial in the initial stages.

Error 2: Deficient Registered Agent Information - Every LLC must designate a registered agent who meets specific qualifications. This agent cannot be the LLC itself, and individuals often neglect to verify whether their registered agent meets the legal standards outlined in the form. Not marking the correct box next to the agent’s title can also result in complications.

Error 3: Mismatched Addresses - The registered office address must match the agent’s business office exactly. Any discrepancies, such as using a P.O. Box instead of a physical street address, can lead to rejection. Applicants sometimes mistakenly believe that they can use a P.O. Box, but unless certain conditions are met, this can be problematic.

Error 4: Omitting County or City Information - When specifying the location of the registered office, it is essential to indicate the correct county or city. Forgetting to fill this section or providing incorrect information can cause processing delays. Local jurisdictions in Virginia are distinct, and clarity in this detail ensures the application is routed correctly.

Error 5: Unclear Principal Office Address - Alongside the registered office, applicants must provide an address for their principal office. This address should reflect where management activities occur, and using a rural route number or a P.O. Box can lead to issues. It’s important to include a complete street address.

Error 6: Signature and Organizer Details - The articles must be signed by one or more organizers, with each signature accompanied by a printed name. Failing to adhere to this requirement can render the application invalid. Legible signatures and clear identification of the organizers are essential to fulfill this requirement correctly.

Error 7: Ignoring Filing Fees - Applications should include a check for the required filing fee of $100, made payable to the State Corporation Commission. Some applicants forget to include this fee or send cash, both of which can delay processing time. A simple oversight in financial details can hold up a formation that could be easily expedited.

By being aware of these errors, prospective LLC owners can navigate the complexities of the LLC-1011 form more effectively. Paying attention to detail and following the guidelines can significantly streamline the formation process, laying a strong foundation for a new business venture.

Documents used along the form

When preparing to establish a Limited Liability Company (LLC) in Virginia, various forms and documents accompany the LLC-1011 form. Each document serves a specific purpose and is important for compliance with state regulations. Below is a list of forms often needed along with a brief description of each.

- LLC-1020: Certificate of Formation - This document formally establishes the LLC by registering it with the state. It includes the name of the LLC, the registered office address, and details about the registered agent.

- LLC-1050: Application for a Certificate of Authority - If an LLC is formed in another state and wishes to do business in Virginia, this form is necessary to acquire authorization through registration.

- LLC-1053: Statement of Change of Registered Agent - Should the LLC need to change its registered agent or their office address, this form must be filed to update the information with the state.

- LLC-1080: Annual Registration Fee Form - Every year, LLCs must file this form to pay the annual registration fee and remain compliant with state requirements.

- LLC Operating Agreement - Although not required by law, this internal document outlines the management structure and operating procedures agreed upon by the members of the LLC.

- IRS Form SS-4: Application for Employer Identification Number (EIN) - An EIN is needed for tax purposes. This form is essential for hiring employees, opening bank accounts, and filing taxes.

- Business Licenses - Various local and state licenses may be required for an LLC to operate legally, depending on the nature of the business and its location.

- Payroll Forms - If the LLC will have employees, forms such as W-4s for employee withholding are necessary to comply with federal and state employment laws.

- Minutes of the First Meeting - Documenting the decisions made during the organization’s first meeting provides a formal record and can help clarify the structure and operations of the LLC from the outset.

Understanding and preparing these documents helps ensure a smoother process in establishing and maintaining a Limited Liability Company. Compliance with regulations is crucial for the successful operation of your LLC, and being organized will facilitate all necessary filings.

Similar forms

- Articles of Incorporation: Similar to the LLC 1011, this document establishes a corporation's existence in the state and includes key details like the company name, registered agent, and business address.

- Operating Agreement: While the LLC 1011 officially forms a limited liability company, the Operating Agreement outlines the internal rules and structure of the company, detailing member responsibilities and profit-sharing arrangements.

- Certificate of Formation: This document is essentially another term for the Articles of Organization. It formally establishes a limited liability company and specifies its name, registered agent, and address, similar to the LLC 1011.

- Bylaws: While not required for an LLC, bylaws can serve a similar purpose to an Operating Agreement by detailing how the company will be run, addressing member roles, and outlining decision-making processes.

- Business License Application: This application is often needed to legally operate a business in a specific area. Like the LLC 1011, it requires essential company information, including the business structure and owner details.

- Annual Report: This document updates the state on the business's status and any changes since formation. It maintains transparency, mirroring the transparency established by the LLC 1011.

- Statement of Information: Similar to an Annual Report, this document provides updated information about the company, including changes to business addresses, management, and registered agent, ensuring that state records remain current.

Dos and Don'ts

Things to Do When Filling out the LLC 1011 Form:

- Choose a name that includes "limited liability company" or "LLC."

- Provide the full name of the registered agent.

- Ensure the registered office address matches the agent’s business office location.

- Include a street address for both the registered and principal office.

- Use legible, typewritten, or printed text in black ink.

- Sign the form with the organizer's name and date.

- Submit the original signed articles to the appropriate Clerk’s Office.

- Check the availability of the LLC name before submission.

- Include a filing fee of $100 with your documents.

Things to Avoid When Filling out the LLC 1011 Form:

- Do not use a name that does not meet the naming requirements.

- Do not attempt to serve as your own registered agent.

- Do not use a post office box as an address unless conditions apply.

- Avoid leaving any sections blank; all required information must be filled in.

- Do not file the form with any attachments.

- Do not include personal information like social security numbers.

- Do not send cash for the filing fee.

- Do not sign the form if you know any information is false.

- Avoid using watermarked or logo background paper for submission.

Misconceptions

Here are some common misconceptions about the LLC 1011 form:

- Misconception 1: Anyone can be the registered agent.

- Misconception 2: The LLC's name can be anything.

- Misconception 3: A P.O. Box is an acceptable registered office address.

- Misconception 4: There are no requirements for the principal office address.

- Misconception 5: You can submit the form with additional attachments.

- Misconception 6: Filing online is complicated.

- Misconception 7: You don't need to provide a phone number.

- Misconception 8: You can use any type of paper for the form.

Only individuals or entities that meet specific qualifications can serve as a registered agent. The LLC itself cannot act as its own agent.

The name must include "limited liability company" or its abbreviations like "LLC." It also needs to be distinguishable from existing names on record.

A post office box is only acceptable for towns with populations of 2,000 or less and only if no street address is associated.

The principal office address must include a street address, and a P.O. Box is not acceptable under Virginia law.

The form cannot be filed with any attachments. If you want to include extra provisions, they must be typewritten separately.

The process to file online is straightforward. You can access the necessary forms on the official website and complete them easily.

While providing a telephone number is optional, it can help facilitate communication if any issues arise during the filing process.

The form must be completed on white, opaque paper and adhere to specific size and margin requirements. This ensures it's suitable for filing.

Key takeaways

Understanding the LLC-1011 form is crucial for any individual or group looking to establish a Limited Liability Company in Virginia. Here are some key takeaways to assist you in completing this essential paperwork:

- Choose a Suitable Name: Your LLC's name must include "limited liability company" or its abbreviations. Ensure it's unique by checking its availability on the state website.

- Select Your Registered Agent: The form requires you to name a registered agent, who can be an individual or a business entity authorized to operate in Virginia. Your LLC cannot act as its own agent.

- Address Requirements: The registered office address must be the same as that of your registered agent. Include a physical street address; P.O. boxes are typically not acceptable.

- Principal Office Location: This should be where the main operational activities of your LLC occur. Like the registered office, ensure you provide a valid street address.

- Filling the Form: The articles of organization must be typewritten or clearly printed in black. Keep margins neat and avoid using attachments.

- Signer Information: One or more individuals—called organizers—must sign the document. Each must also print their name and may optionally provide a phone number.

- Filing Fees: Be prepared to submit a $100 filing fee with your completed form. Payments should be made via check, never cash.

Completing the LLC-1011 form accurately can lay the groundwork for a successful business venture. Remember, these details are vital; take your time to ensure everything is correct and complete.

Browse Other Templates

Form 1007 - For Schedule E, total rents received from non-owner-occupied units must be entered.

Sc Restraining Order Requirements - A court-ordered protection can offer significant relief from worrying about your safety.

Blumberg Lease - Backup documentation, such as an inventory for furnished properties, may accompany this lease.