Fill Out Your Llc 2 Form

The LLC-2 form serves as a crucial document for limited liability companies (LLCs) looking to amend their Articles of Organization in California. This form allows businesses to update important details such as their name, management structure, or purpose statement. To submit the form electronically, follow a clearly defined set of steps: complete and print the fillable PDF, add a wet signature, scan the signed file, and upload it through eForms Online. Note that electronic and digital signatures are not acceptable. Alternatively, businesses can choose to submit the form by mail or in person, with specific instructions on filing fees and additional handling charges for in-person submissions. Once submitted, the California Secretary of State will review the amendment for legal compliance and notify the filer via email regarding the approval or any necessary corrections. It’s essential for businesses to ensure their LLC is active, understand name restrictions, and keep in mind that a separate Statement of Information form may be required for certain changes. As businesses navigate the amendment process, it’s advisable to seek guidance from a qualified attorney to tailor the requirements to their unique situations.

Llc 2 Example

This form can be submitted electronically through eForms Online:

1.Complete and print the fillable PDF form.

2.Sign the form (i.e. wet signature; electronic and digital signatures are not acceptable).

3.Scan and save the signed document to your personal computer, tablet or phone:

•PDF file format only;

•10 MB file size maximum;

•PDF must be unlocked and not password protected.

4.Upload your completed and signed PDF form and submit electronically through eForms Online.

Your submission will be reviewed for legal compliance and you will receive an email with an approval or a notice to correct your submission.

If you prefer submitting this form via mail or in person, fill out the Submission Cover Sheet and attach it to your filing. Note: In person submissions require an additional $15 handling fee.

eForms Instructions BE (EST 11/2020) |

2020 California Secretary of State |

|

bizfile.sos.ca.gov |

Instructions for Completing the

Amendment to the Articles of Organization (Form

To amend the Articles of Organization of a limited liability company (LLC), you must file an Amendment to the Articles of Organization (Form

Before submitting the completed form, you should consult with a private attorney for advice about your specific business needs.

You must file a Statement of Information (Form

name or address of the LLC's manager(s) or agent for service of process, which can be filed online at llcbizfile.sos.ca.gov/SI.

To file this Form

Operating Agreements are to be maintained by the LLC and are not filed with the California Secretary of State.

Fees:

Filing Fee: The fee for filing the Amendment to the Articles of Organization (Form

Faster Service Fee:

-Counter and guaranteed expedite services are available only for documents submitted in person (drop off) to our Sacramento office.

-Counter Drop Off: A separate,

-Guaranteed Expedite Drop Off: For more urgent submissions, documents can be processed within a guaranteed timeframe for a

this faster processing service through our Preclearance and Expedited Filing Services, go to

Copies: Upon filing, we will return one (1) plain copy of your filed document for free, and will certify the copy upon request and payment of a $5 certification fee. To obtain additional copies or certified copies of this filed Amendment to the Articles of Organization, include payment for copy fees and certification fees at the time the Amendment to the Articles of Organization is submitted. Additional copy fees are $1.00 for the first page and $.50 for each attachment page. For certified copies, there is an additional $5.00 certification fee, per copy.

Payment Type: Check(s) or money orders should be made payable to the Secretary of State. Do not send cash by

mail. If submitting the document in person in our Sacramento office, payment also may be made by credit card (Visa or Mastercard®).

Processing Dates: For current processing dates, go to

If you are not completing this form online, please type or legibly print in black or blue ink. Complete the Amendment to the Articles of Organization (Form

Item |

|

|

Instruction |

|

Tips |

1. |

|

|

Enter the name of the LLC exactly as it |

|

To ensure you have the exact name of the LLC, look to |

|

|

|

appears on the records of the California |

|

your registration document filed with the California |

|

|

|

Secretary of State including the entity |

|

Secretary of State and any name change amendments. |

|

|

|

identifier (ex: “Jones & Company, LLC” or |

|

|

|

|

|

“Smith Construction, a Limited Liability |

|

|

|

|

|

Company”). |

|

|

|

|

|

|

|

|

2. |

|

|

Enter the |

|

To ensure you have the correct Entity (File) Number look |

|

|

|

to your registration document filed with the California |

||

|

|

|

issued to the LLC by the California |

|

|

|

|

|

|

Secretary of State. |

|

|

|

|

Secretary of State at the time of |

|

|

|

|

|

|

|

|

|

|

|

registration. |

|

|

|

|

|

|

|

|

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

|

|

Secretary of State Records can be accessed online |

||||

|

|

through our Business Search at |

||||

|

|

BusinessSearch.sos.ca.gov. While searching the |

||||

|

|

Business Search, be sure to identify your LLC correctly |

||||

|

|

including the jurisdiction that matches your LLC. |

||||

|

|

|

||||

3. |

If you are changing the name of the LLC, |

California Corporations Code section 17701.08 requires: |

||||

|

enter the new name of the LLC exactly as |

|

- The LLC name must include: LLC, L.L.C., Limited |

|||

|

you want it is to appear on the records of |

|

||||

|

|

Liability Company, Limited Liability Co., Ltd. Liability |

||||

|

the California Secretary of State including |

|

||||

|

|

Company, or Ltd Liability Co. |

||||

|

the entity identifier (ex: “Jones & Company, |

|

||||

|

|

- The LLC name may not include: bank, trust, |

||||

|

LLC” or “Smith Construction, a Limited |

|

||||

|

Liability Company”). |

|

trustee, incorporated, inc., corporation, or corp. |

|||

|

|

|

- The LLC name may not include: insurer, insurance |

|||

|

|

|

company, or any other words suggesting that the |

|||

|

|

|

LLC is in the business of issuing policies of |

|||

|

|

|

insurance and assuming insurance risks. |

|||

|

|

|

- The name is not likely to mislead the public and is |

|||

|

|

|

distinguishable from other LLCs of record or |

|||

|

|

|

reserved with the California Secretary of State. |

|||

|

|

There are legal limitations on what name can be used for |

||||

|

|

the LLC. For general LLC name requirements and |

||||

|

|

restrictions or for information on reserving an LLC name |

||||

|

|

prior to submitting Form |

||||

|

|

|||||

|

|

A name reservation is not required to submit Form |

||||

|

|

A preliminary search of LLC names already of record can |

||||

|

|

be made online through our Business Search at |

||||

|

|

BusinessSearch.sos.ca.gov. Please note: The Business |

||||

|

|

Search is not intended to serve |

as a formal name |

|||

|

|

|

availability search. For information on checking or |

|

||

|

|

|

reserving a name, go to www.sos.ca.gov/busines |

s/be/ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

||||

4. |

If the management structure of the LLC is |

Every LLC is required to have at least one member. If |

||||

|

changing, check the applicable box to |

no manager is appointed or elected, all members are |

||||

|

indicate if the LLC will be managed by "one |

managers. |

||||

|

manager," "more than one manager" or "all |

A member(s) is the owner of the company similar to a |

||||

|

limited liability company member(s)." |

|||||

|

Only one box may be checked. |

shareholder(s) in a corporation. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

The purpose statement is required. Do not |

|

|

|

|

|

|

alter. |

|

|

|

|

|

|

|

|

||||

6. |

If applicable, list other amendments to |

You must file a Statement of Information (Form |

||||

|

the Articles of Organization on only one |

change the LLC’s business address(es), or to change the |

||||

|

side of a standard |

name or address of the LLC's manager(s) or agent for |

||||

|

paper (8 1/2" x 11"), clearly marked as an |

service of process, which can be filed online at |

||||

|

attachment to Form |

llcbizfile.sos.ca.gov/SI. |

||||

|

extra page(s) to the completed Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

If amending existing text, list both the |

|

|

|

|

|

|

current text followed by the new text as |

|

|

|

|

|

|

amended by this filing. |

|

|

|

|

|

|

|

|

|

|

||

|

|

2021 California Secretary of State |

||||

bizfile.sos.ca.gov

Signature |

|

Sign and type or print the name of the |

If you need more space for signatures: |

|

|

signor(s). |

- Place the additional signatures on only one side of |

|

|

|

|

|

|

Unless a greater number is provided for in |

a standard |

|

clearly marked as an attachment to Form |

||

|

|

the Articles of Organization, this Form |

|

|

|

and attach the extra page(s) to the completed Form |

|

|

|

||

|

|

||

|

|

manager, if the LLC is |

|

|

|

- All attachments are part of this document. |

|

|

|

or at least one member, if the LLC is |

|

|

|

If Form |

|

|

|

information is true and correct. |

|

|

|

who signs on behalf of the entity should note their name |

|

|

|

|

|

|

|

Do not use a |

and position/title and the entity name. Example: If a |

|

|

signature. |

limited liability company ("Smith LLC") is the manager, |

|

|

|

the signature of the person signing on behalf of the Smith |

|

|

|

LLC should be reflected as Joe Smith, Manager of Smith |

|

|

|

LLC, Manager. |

|

|

|

If Form |

|

|

|

sign as follows: ___________ , trustee for ___________ |

|

|

|

trust (including the exact name of the trust and date of |

|

|

|

the trust, if applicable). Example: Mary Todd, trustee of |

|

|

|

the Lincoln Family Trust (U/T |

|

|

|

Multiple Form |

|

|

|

returned without being filed – use only one form. |

|

|

|

|

Legal Authority: General statutory filing provisions are found in Section 17702.02. All statutory references are to the California Corporations Code, unless otherwise stated.

Statement of Information: A Statement of Information must be filed with the California Secretary of State within 90 days after filing the Articles of Organization and every two years thereafter during the applicable filing period (Section 17702.09). A Statement of Information can be filed online at llcbizfile.sos.ca.gov/SI or by submitting Form

Additional Resources: For a list of other agencies you may need to contact to ensure proper compliance, go to

www.sos.ca.gov/business/be/resources. Note: The California Secretary of State does not license LLCs. For licensing requirements, please contact the city and/or county where the principal place of business is located and/or the state agency with jurisdiction over the activities of the LLC.

2021 California Secretary of State |

|

|

bizfile.sos.ca.gov |

Secretary of State |

|

Amendment to Articles of |

|

|

|

Organization of a |

|

Limited Liability Company (LLC) |

|

|

|

IMPORTANT — Read Instructions before completing this |

|

form. Filing Fee – $30.00 |

|

Copy Fees – First page $1.00; each attachment page $0.50; |

|

Certification Fee - $5.00 |

|

Note: You must file a Statement of Information (Form

manager(s) and/or agent for service of process, which can be filed online at llcbizfile.sos.ca.gov/SI.

Above Space For Office Use Only

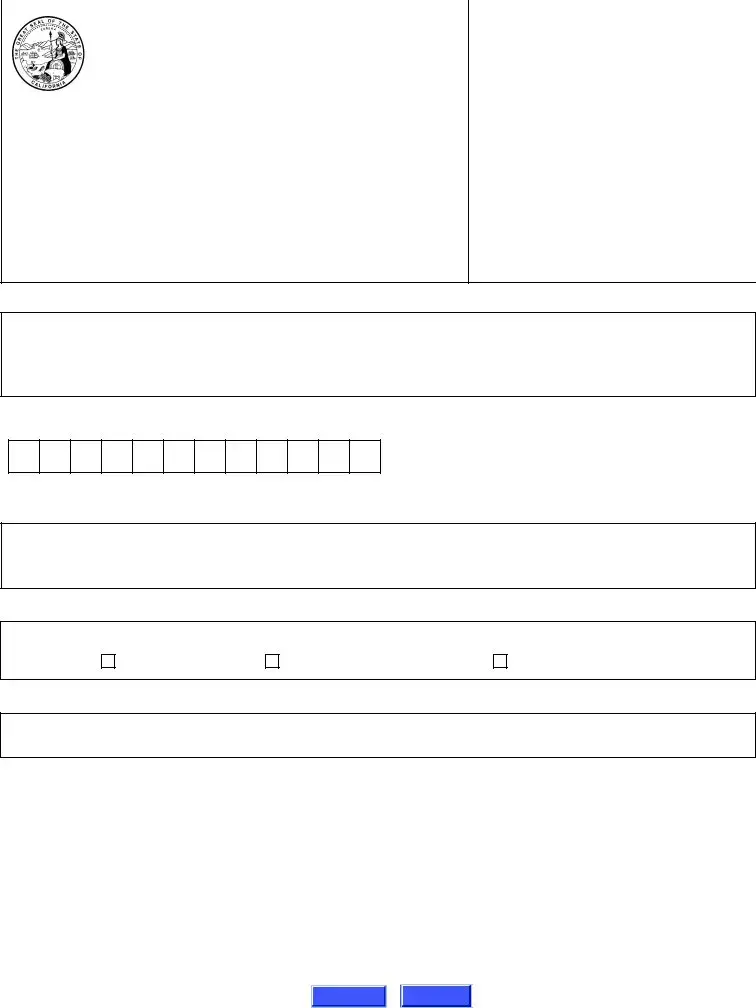

1.LLC Exact Name (Enter the exact name on file with the California Secretary of State.)

2.LLC

3.New LLC Name (If Amending) (See Instructions – List the proposed LLC name exactly as it is to appear on the records of the California Secretary of State. The name must contain an LLC identifier such as LLC or L.L.C. “LLC” will be added, if not included.)

4.Management (If Amending) (Select only one box)

The LLC will be managed by:

One Manager

More than One Manager

All LLC Member(s)

5.Purpose Statement (Do not alter Purpose Statement.)

The purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the California Revised Uniform Limited Liability Company Act.

6.Additional Amendment(s) set forth on attached pages, if any, are incorporated herein by reference and made part of this Form

Signature

By signing, I affirm under penalty of perjury that the information herein is true and correct and that I am authorized by California law to sign.

_____________________________________________________________ |

__________________________________________________________ |

Sign here |

Print your name here |

Clear Form

Print Form

2021 California Secretary of State

bizfile.sos.ca.gov

Form Characteristics

| Fact Name | Description |

|---|---|

| Submission Method | This form must be completed and printed before submission. An electronic submission through eForms Online is permitted, which requires a scanned copy of a wet signature. |

| Filing Fee | Submitting the LLC-2 incurs a filing fee of $30. If filed in person, an additional $15 handling fee applies. |

| Legal Compliance | Once submitted, the form is reviewed for legal compliance. An email notification confirms approval or requests corrections. |

| Governing Law | This form is governed under the California Corporations Code, specifically Section 17702.02. |

Guidelines on Utilizing Llc 2

Completing the LLC 2 form is a straightforward process that allows you to amend the Articles of Organization for your limited liability company. Once you have filled out the form and followed each step, you can submit it electronically or via mail. Be sure to gather all required attachments and verify your entries for accuracy.

- Enter the exact name of your LLC as it appears on the records with the California Secretary of State.

- Input the 12-digit Entity (File) Number assigned to your LLC. You can find this number on your registration document.

- If changing the name, write the new name exactly as it should appear, ensuring it includes an appropriate LLC identifier.

- Indicate the management structure by selecting one box: "One Manager," "More than One Manager," or "All LLC Member(s)." Only one option can be selected.

- Write the Purpose Statement exactly as it appears in the instructions without any alterations.

- If there are additional amendments, list them on a separate piece of standard letter-sized paper (8½" x 11") and attach it to the form.

- Sign the form and print your name below the signature. Ensure the signature is not computer-generated.

- If applicable, include any additional signatures on a separate page clearly marked as an attachment to the LLC-2 form.

- Scan and save the signed document in PDF format, ensuring it is unlocked and not password protected.

- Upload the completed form on eForms Online or prepare it along with the Submission Cover Sheet for mail/in-person submission.

After submitting the form, expect to receive an email about its legal compliance. You’ll either get an approval or a notice highlighting any necessary corrections.

What You Should Know About This Form

What is the LLC-2 form used for?

The LLC-2 form is an Amendment to the Articles of Organization for limited liability companies (LLCs) in California. It is used when a company needs to make changes to its original Articles, such as modifying its name or management structure. Submitting this form ensures that the California Secretary of State has the most current information about your LLC.

How do I file the LLC-2 form?

You can file the LLC-2 form electronically through the eForms Online portal or by mailing it in. If you choose to submit electronically, first complete and print the fillable PDF form, sign it with a wet signature (electronic signatures are not accepted), then scan and upload it in PDF format. If mailing, you must include a Submission Cover Sheet and can submit in person for an additional handling fee.

What are the fees associated with filing the LLC-2?

The basic filing fee for the LLC-2 form is $30. If you submit in person, a non-refundable counter drop-off fee of $15 will apply for priority processing. For urgent submissions requiring guaranteed processing, additional fees may apply. Be aware that other copy and certification fees are also applicable, such as $5 for certified copies.

Do I need to consult an attorney before filing the LLC-2?

It's recommended to consult with a private attorney, especially to discuss your specific business needs and ensure compliance with all legal requirements. This step can provide you with valuable insights and help avoid potential issues when filing.

What happens after I submit the LLC-2 form?

After submitting the LLC-2 form, your submission will be reviewed for legal compliance. You will receive an email notification confirming approval or indicating any necessary corrections. It's essential to closely monitor your email to address any issues promptly.

Can I amend my LLC’s business address using the LLC-2 form?

No, if you wish to change the business address of your LLC, you must file a separate Statement of Information (Form LLC-12). The LLC-2 form is specifically for amendments to the Articles of Organization, not for changing addresses or management details.

Are there restrictions on the name changes I make on the LLC-2?

Yes, when changing the LLC's name, there are specific legal requirements. The new name must contain identifiers like “LLC” or “Limited Liability Company” and cannot have words that mislead the public or suggest the business is in insurance or banking unless it is licensed to operate in those fields. It’s crucial to check these restrictions before submitting your new name.

What if I need additional copies of my filed document?

Upon filing the LLC-2, you will receive one plain copy for free. If you require additional copies or certified copies, you must include the applicable fees with your submission. The fees for copies are $1.00 for the first page and $0.50 for each additional page, plus a $5.00 certification fee if you want the document certified.

Common mistakes

When filling out the LLC-2 form, many individuals make common mistakes that can lead to delays or rejections in processing their amendment request. One frequent error involves not entering the LLC's name exactly as it appears on the records. It’s important to ensure that all characters, including spaces and punctuation, match the official registration document. This oversight may seem minor but can cause significant issues during processing.

Another mistake is regarding the 12-digit Entity (File) Number. Applicants often either forget this number or miswrite it. This number is crucial as it uniquely identifies the LLC in the state’s records. A quick check against the registration documents can prevent this kind of error. The correct filing number is necessary to establish the legitimacy of the submitted document.

People also tend to overlook the requirement for a signature. It's essential to sign the form with a wet signature instead of a digital or electronic one. Failing to do so can lead to automatic rejection. Further, the signature must be from someone authorized, which typically is a member or manager of the LLC. Not adhering to these guidelines means that the form will not be processed.

Lastly, completing the purpose statement is something commonly mishandled. The purpose statement should remain unchanged, and individuals sometimes try to modify it or provide additional information. This statement must be left as prescribed in the instructions, and any alteration can lead to complications. It’s advisable to carefully review all sections of the form and consult with legal counsel if there are uncertainties to avoid these mistakes.

Documents used along the form

When filing the LLC 2 form, there are several other documents commonly utilized to ensure comprehensive compliance and proper organization of a limited liability company (LLC). Each of these documents plays a significant role in maintaining the legal and operational status of the LLC. Below are some frequently used forms and their brief descriptions.

- Statement of Information (Form LLC-12): This form is essential for updating the LLC's business addresses or changing the name or address of its managers. It must be filed within 90 days of submitting the Articles of Organization and every two years thereafter.

- Operating Agreement: Although not filed with the California Secretary of State, this internal document outlines the management structure, responsibilities, and operational procedures of the LLC. It is crucial for clarifying how decisions are made within the company.

- Submission Cover Sheet: This form accompanies documents submitted via mail or in-person filings. It helps the Secretary of State's office to process submissions efficiently and identifies the nature of the filing.

- Application for Name Reservation: While not mandatory, this application can be filed to reserve an LLC name before submitting the LLC-2. It helps ensure that the chosen name is available and meets state regulations.

- Certificate of Good Standing: This certificate verifies that the LLC is in compliance with its state filing requirements and is legally operating. It can be requested from the Secretary of State as proof of the company's good standing.

- Request for Certified Copies: If certified copies of submitted documents are needed, this request form allows LLCs to obtain official copies from the Secretary of State’s office, often required for banking or legal purposes.

- Amendment to the Operating Agreement: Should any changes to the internal management or operational guidelines occur, an amendment to the operating agreement may be necessary. This document should detail the specific alterations to the initial agreement.

Utilizing these forms in conjunction with the LLC 2 can help ensure the proper management and compliance of an LLC. Maintaining accurate and up-to-date documents is vital for the legal standing and operational success of a business entity.

Similar forms

- Form LLC-12 (Statement of Information): This form is required to update the LLC’s business address or to change the name or address of its managers or agents. Similar to Form LLC-2, it involves official information about the LLC that needs to be filed with the California Secretary of State.

- Form LLC-1 (Articles of Organization): This document is essential for the initial formation of an LLC. While Form LLC-2 amends existing information, Form LLC-1 establishes the basics, such as the LLC's name and address, making both forms critical in the lifecycle of an LLC.

- Form LLP-1 (Registration of Limited Liability Partnership): This form is similar in its purpose of officially registering a business entity in California. Like the LLC-2, it requires specific details about the business structure and governance.

- Form PC (Professional Corporation Articles of Incorporation): This document is used to form a professional corporation, similar in nature to LLC formations. Both forms require detailed information about the entity’s structure and compliance with California law.

- Form RRF-1 (Registration of a Foreign Nonprofit Corporation): This form registers a foreign nonprofit in California. While focused on nonprofit entities, it shares the essence of compliance and documentation with the LLC-2 form, reflecting the need for official filings with the Secretary of State.

Dos and Don'ts

When filling out the LLC-2 form, there are important guidelines to follow. Here are five key dos and don’ts:

- Do double-check the LLC name. Make sure it matches exactly as recorded with the California Secretary of State.

- Don’t use a digital or electronic signature. You must provide a wet signature.

- Do save your signed document in PDF format. Ensure it is unlocked and not password protected.

- Don’t neglect to consult with a legal advisor before submitting. This can help you avoid potential issues.

- Do check that your LLC is active. If it is suspended, this form can be filed only to list a new LLC name.

Follow these guidelines to ensure your submission is complete and compliant.

Misconceptions

- Anyone can submit Form LLC-2 electronically without prior approval. This is not true. The form must be reviewed for legal compliance, and you will receive either an approval or a notice to correct your submission.

- Digital signatures are allowed on Form LLC-2. Many people think digital or electronic signatures are acceptable, but this is incorrect. A wet signature is required.

- You can submit the form without checking if your LLC is active. An active status is necessary to file Form LLC-2. If your LLC is suspended, the form can only be filed to list a new name.

- There’s no need for supporting documents with Form LLC-2. That’s a common misconception. Depending on the amendments, you may need to file additional statements or forms along with the LLC-2.

- There are no fees associated with filing Form LLC-2. Many people overlook this. The filing fee is $30, with additional fees for faster service or extra copies.

- Copy and certification requests can be completed after filing. In fact, you need to include those requests and payment at the time you submit Form LLC-2 for them to be processed.

- Form LLC-2 can be processed without any extra steps. It's important to remember that you must fill out the Submission Cover Sheet when submitting by mail or in person.

- Any person can sign the Form LLC-2 as the manager. This isn't entirely accurate. The form must be signed by a designated manager or member of the LLC, and proper titles must be noted if it’s a business entity.

Key takeaways

When it comes to submitting the LLC-2 form for amending the Articles of Organization of your limited liability company, understanding the process is key. Here are some essential takeaways to help you navigate the task smoothly:

- Ensure Active Status: Before filing, confirm that your LLC is active with the California Secretary of State. If it's suspended, certain conditions apply for amendments.

- Complete the Form Accurately: Accuracy matters. Fill in the LLC's name exactly as it appears in official records—no variations!

- Signature Requirement: A wet signature is mandatory. Electronic signatures won't cut it, so be prepared to physically sign the document.

- File Online or by Mail: You can submit the LLC-2 electronically through eForms Online. If you opt for mail, include a Submission Cover Sheet and note that in-person submissions incur extra fees.

- Consult Legal Expertise: Before finalizing your submission, it's wise to consult with an attorney about your specific needs, particularly if complex changes are involved.

- Simplify Your Attachments: If you're making multiple amendments, clearly mark any additional pages as attachments and keep them legible and one-sided.

- Understand the Fees: Be aware of the filing fee ($30) and any extra charges if submitted in person or for expedited processing. Planning for these costs will help you budget effectively.

By paying attention to these details, you can facilitate a smoother application process and ensure compliance with California regulations.

Browse Other Templates

Declaration of Hearing Reschedule Intent - The form includes options for temporary emergency orders to be addressed or not.

What Is a Strip Map - Properly completed forms prevent travel complications.

Trampoline Waiver for Neighbors - You are aware that serious injury can occur, emphasizing the importance of this release form.