Fill Out Your Llc 35 15 Form

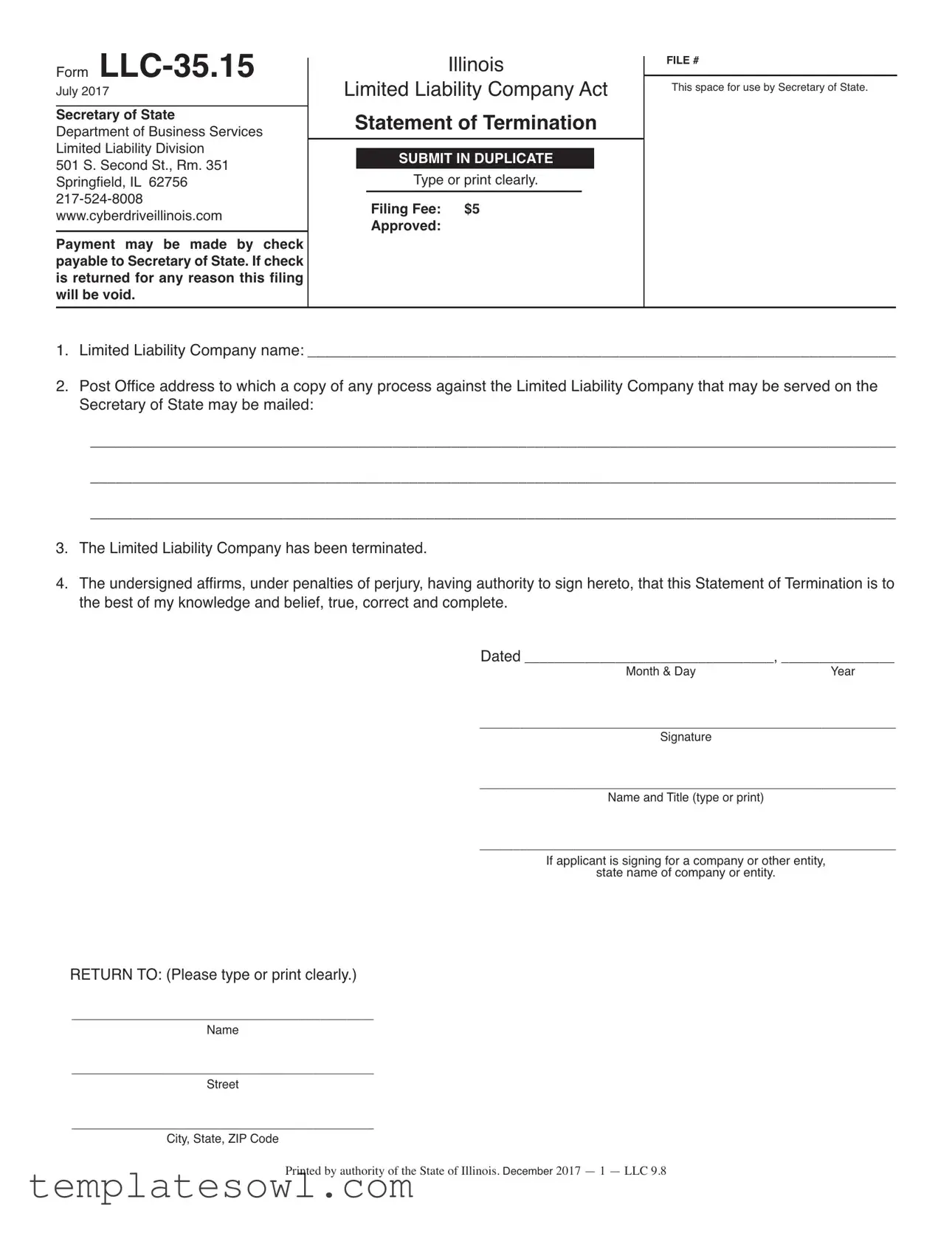

For those managing or involved with a limited liability company in Illinois, understanding the LLC-35.15 form is crucial. This form, officially called the Statement of Termination, is essential for any LLC that has made the decision to dissolve or terminate its operations. It must be filed with the Secretary of State's Department of Business Services and must be submitted in duplicate, ensuring proper record-keeping. The filing incurs a fee of $5, a small price to pay for dissolving an entity legally and correctly. Parties filing this form must provide the LLC's name and a mailing address for legal correspondence. The form requires the undersigned to affirm, under penalties of perjury, the accuracy of the information provided. This adds a layer of accountability to the process. It is crucial to remember that if a payment check is returned for any reason, the filing will be rendered void. Thus, attention to detail and accuracy in both the details and payment method can prevent unnecessary complications during the termination process.

Llc 35 15 Example

Form

July 2017

Secretary of State Department of Business Services Limited Liability Division

501 S. Second St., Rm. 351 Springfield, IL 62756

Payment may be made by check payabletoSecretaryofState.Ifcheck is returned for any reason this filing will be void.

Illinois

Limited Liability Company Act

Statement of Termination

SUBMIT IN DUPLICATE

Type or print clearly.

Filing Fee: $5

Approved:

FILE #

This space for use by Secretary of State.

1.Limited Liability Company name: ____________________________________________________________________

2.Post Office address to which a copy of any process against the Limited Liability Company that may be served on the Secretary of State may be mailed:

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

3.The Limited Liability Company has been terminated.

4.The undersigned affirms, under penalties of perjury, having authority to sign hereto, that this Statement of Termination is to the best of my knowledge and belief, true, correct and complete.

Dated _________________________________, _______________

Month & Day Year

______________________________________________________________

Signature

______________________________________________________________

Name and Title (type or print)

______________________________________________________________

If applicant is signing for a company or other entity,

state name of company or entity.

RETURN TO: (Please type or print clearly.)

_____________________________________________

Name

_____________________________________________

Street

_____________________________________________

City, State, ZIP Code

PrintedbyauthorityoftheStateofIllinois.December

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is officially known as LLC-35.15, designated for the termination of a Limited Liability Company in Illinois. |

| Governing Law | This form is governed by the Illinois Limited Liability Company Act. |

| Filing Fee | A filing fee of $5 must accompany the submission of this termination form. |

| Submission Requirements | The form must be submitted in duplicate to ensure processing and acknowledgment by the Secretary of State. |

| Mailing Address | A designated post office address for service of process must be included in the form. |

| Authority to Sign | The individual signing the form must possess the authority to do so and affirms the statement's accuracy under penalties of perjury. |

| Return Address | A return address should be clearly printed on the form for further correspondence after the filing is processed. |

Guidelines on Utilizing Llc 35 15

Filling out the LLC 35 15 form can seem daunting, but with a structured approach, it’s manageable. This form is essential for officially terminating a Limited Liability Company in Illinois. Gather your information and ensure that everything is accurate before submission.

- Start with the company name. In the first section, clearly type or print the name of the Limited Liability Company as it appears in your records.

- Provide a mailing address. In the second section, write the Post Office address where any legal documents or processes against the company should be sent. Ensure this address is current and complete.

- Confirm termination. Clearly indicate that the Limited Liability Company has been terminated by checking or marking the appropriate box in the form.

- Affirm and date the statement. You will need to sign the statement, affirming under penalties of perjury that all information is accurate. Include the date in the format of Month, Day, and Year.

- Print your name and title. After your signature, type or print your name along with your title for clarity. If you are signing on behalf of the company, state the company or entity's name in the designated area.

- Return the form. Lastly, provide the name and complete mailing address to which a copy of the form should be sent, ensuring that it is typed or printed clearly.

After completing the form, make two copies as you’ll need to submit it in duplicate. Don’t forget to include the filing fee of $5, payable by check to the Secretary of State. Once everything is ready, send your form to the address specified to finalize the termination process for your Limited Liability Company.

What You Should Know About This Form

What is the LLC 35 15 form?

The LLC 35 15 form is a document used in Illinois to officially terminate a Limited Liability Company (LLC). Under the Illinois Limited Liability Company Act, this form serves as a Statement of Termination, indicating that the LLC has ceased operations and desires to dissolve its legal existence. It must be submitted in duplicate to ensure that the state maintains a complete record of the termination.

How do I fill out the LLC 35 15 form?

To fill out the LLC 35 15 form, begin by providing the name of your Limited Liability Company at the top. Next, you will need to list a Post Office address where any legal documents related to your LLC can be sent. Ensure that this address is accurate, as it will be used for official correspondence. You will also confirm that your LLC has been terminated and print your name, title, and date in the designated sections. Remember to sign the form, affirming that all information is truthful to the best of your knowledge.

Is there a filing fee for the LLC 35 15 form?

Yes, there is a filing fee of $5 associated with the LLC 35 15 form. Payment must be made via check, which should be made payable to the Secretary of State. It’s crucial to ensure that the check clears, as any check that is returned for insufficient funds will result in the filing being void.

Where should I submit the LLC 35 15 form?

The completed LLC 35 15 form should be submitted to the Secretary of State’s Department of Business Services, specifically the Limited Liability Division. The physical mailing address is 501 S. Second St., Rm. 351, Springfield, IL 62756. Make sure to send it in duplicate to meet the filing requirements of the state.

What happens after I submit the LLC 35 15 form?

After submitting the LLC 35 15 form, the Secretary of State will process your termination request. If everything is in order, your LLC will be officially dissolved, and you will receive confirmation from the state. Keep in mind that it is essential to retain this confirmation as proof that your LLC is no longer active and is legally terminated.

Can I still operate my LLC after submitting the termination form?

No, once you submit the LLC 35 15 form, your LLC is considered terminated. Therefore, it cannot legally conduct any business or engage in any activities under its name. If you wish to operate a business again, you would need to create a new LLC or reinstate the previous one if applicable, following the appropriate processes set by the state.

What are the consequences of not filing the LLC 35 15 form?

Failing to file the LLC 35 15 form when your LLC is no longer operational can lead to legal complications. The state may continue to consider your LLC as an active entity, which may result in ongoing annual fees, penalties, or taxes. Additionally, you may remain liable for any obligations or debts attributed to the LLC. Filing for termination helps protect your personal assets and ensures that you are not held accountable for an entity that no longer exists.

Common mistakes

Filling out the LLC-35.15 form requires attention to detail. One common mistake is failing to **print clearly**. If the text is illegible, it could lead to processing delays or rejections. Always use a pen with dark ink to ensure clarity.

Another mistake involves providing an incomplete address for the service of process. The form explicitly asks for the complete Post Office address. Omitting any part of the address, including the city or ZIP code, can result in complications regarding official communications.

Some individuals neglect to check the box indicating that the Limited Liability Company has been terminated. This important step is often overlooked, but it is crucial for the form to reflect the company's current status accurately.

Signatures frequently become a point of error. The individual signing must have the authority to do so. Failing to appropriately designate their title or the name of the company/entity they represent can cause issues. Make sure all signatures are valid and correctly represent the involved parties.

Date errors are surprisingly common. When filling out the section for the date, it’s essential to provide the full date, including the month, day, and year. A missing or incorrect date can halt the processing of the form.

Another frequent oversight is not submitting the required duplicate copy of the form. The instructions specify that the form must be submitted in duplicate. Therefore, failing to provide this can delay the processing time significantly.

Paying attention to the payment details is key too. Incorrect payment methods or bounced checks can render the filing void. Ensure that the payment accompanies the form and is made out correctly, as per the provided instructions.

Many individuals also forget to review the penalties associated with providing inaccurate information. The affirmation section emphasizes the responsibility of the signer. False information can lead to legal consequences, and understanding this can help prevent misleading statements.

Finally, always double-check that all required fields are completed before submission. Leaving any fields blank, especially those clearly marked, could lead to immediate rejection of the form. Each item on the LLC-35.15 is designed to capture essential information; overlooking any could have repercussions.

Documents used along the form

The LLC-35.15 form serves as a formal Statement of Termination for Limited Liability Companies (LLCs) in Illinois. In conjunction with this form, several other documents can be required or beneficial for a comprehensive understanding and execution of the termination process. Below is a list of additional forms and documents that frequently accompany the LLC-35.15. Each has its unique purpose and is crucial for ensuring compliance with state regulations.

- Articles of Organization: This document establishes the existence of the LLC. It outlines the name, address, and purpose of the company, along with initial members' names.

- Operating Agreement: While not required by law, this internal document details the management structure and operating procedures of the LLC, helping to guide decision-making and clarifying member roles.

- Certificate of Good Standing: This certificate confirms that the LLC is compliant with state regulations and has paid all necessary fees and taxes. It may be required during the dissolution process.

- Final Tax Returns: Filing a final tax return is essential for winding up the LLC's finances. It helps ensure that the LLC has settled all tax obligations up to its termination date.

- Statement of Closure: This document may be filed to officially declare the cessation of the business activities of the LLC, informing interested parties of the termination.

- Transfer of Assets: A record of how the LLC's assets were distributed or transferred upon termination. This helps maintain clear records for tax and legal purposes.

- Member Consent: A documented agreement among members regarding the decision to terminate the LLC, which can serve as evidence of consensus if needed.

- Notice to Creditors: This is a formal notification to all creditors of the LLC regarding its pending termination, allowing them an opportunity to settle any outstanding debts.

Obtaining and filing these documents alongside the LLC-35.15 form can help facilitate a smooth termination process for an LLC. It ensures that all obligations are met and that members fully understand the implications of the dissolution. Each document serves a distinct yet integral role in maintaining proper legal and financial records during this transition.

Similar forms

-

Articles of Organization: This document is essential for starting a Limited Liability Company (LLC). Like the LLC 35 15 form, the Articles of Organization establish official recognition of the business with the state. It details the LLC's name, address, and management structure, setting the stage for its existence.

-

Certificate of Good Standing: This document serves as verification that an LLC is authorized to conduct business and complies with state regulations. Similar to the termination statement, it provides official proof of a company’s operational status, reassuring potential clients or partners of its legitimacy.

-

Operating Agreement: The Operating Agreement outlines how the LLC will be governed. This document is comparable to the LLC 35 15 in that both lay out important internal policies and formal acknowledgments, though the Operating Agreement goes further by detailing the rights and responsibilities of members.

-

Annual Report: Much like the Statement of Termination, the Annual Report keeps the state informed of the LLC's status. While the LLC 35 15 signals the end of a business, the Annual Report serves to maintain active status, helping to confirm that the company is still operating as intended.

Dos and Don'ts

Things to Do When Filling Out the LLC 35 15 Form:

- Type or print clearly to ensure readability.

- Double-check the Limited Liability Company name for accuracy.

- Provide a complete and correct mailing address for service of process.

- Sign and date the form before submission to validate it.

- Submit the form in duplicate to meet the filing requirement.

Things Not to Do When Filling Out the LLC 35 15 Form:

- Do not leave any required fields blank; all sections must be completed.

- Avoid using informal language or abbreviations in the document.

- Do not forget to include the filing fee of $5 with the submission.

- Never submit the form without ensuring all information is true and complete.

- Do not submit a check that could be returned for insufficient funds.

Misconceptions

-

Misconception 1: The LLC-35-15 form is only necessary for financial reasons.

Some individuals believe that this form serves primarily financial purposes, but its primary function is to officially terminate a Limited Liability Company. This process ensures that the company is legally dissolved and prevents any future liabilities.

-

Misconception 2: Filing the LLC-35-15 form cancels all company obligations immediately.

Many assume that submitting the form instantaneously releases them from all legal obligations. However, liabilities might still exist depending on prior agreements, and the dissolution must comply with the governing laws of the state.

-

Misconception 3: It is unnecessary to submit the form in duplicate.

People often overlook the requirement to submit the LLC-35-15 form in duplicate. This is essential as one copy will serve as a confirmation of termination, which could be important for record-keeping and future reference.

-

Misconception 4: Once the form is filed, the company can still operate.

Some believe that after filing the termination form, the company can continue its activities. In reality, once the LLC-35-15 is submitted and accepted, the company is no longer legally allowed to engage in business operations.

-

Misconception 5: There are no consequences for filing the form improperly.

Individuals might think that mistakes made on the form will not lead to any repercussions. However, inaccuracies or incomplete information can render the filing void, complicating the termination process and potentially leading to continued liabilities.

Key takeaways

When filling out and using the LLC-35.15 form, consider the following key takeaways:

- Submission in Duplicate: Always submit two copies of the form to ensure that one copy is for your records.

- Clear Information: Type or print all information clearly to avoid any potential delays or issues with processing.

- Filing Fee: A filing fee of $5 is required. Payments can be made by check, payable to the Secretary of State.

- Address for Process: Provide a Post Office address where any legal documents can be mailed, ensuring that it is current.

- Termination Confirmation: By signing the form, you affirm that the Limited Liability Company has been officially terminated.

- Signature Requirement: The form must be signed by an individual who has the authority to represent the LLC, confirming the truthfulness of the information provided.

- Stay Informed: Familiarize yourself with the Illinois Limited Liability Company Act to understand your obligations and rights regarding company termination.

Browse Other Templates

Da 2823 - The form captures key event details like location and time of incident.

Daily Tracker Template - Incorporate self-care moments into your day.