Fill Out Your Llc 5 Form

When considering the intricacies of establishing a foreign limited liability company (LLC) in California, the LLC 5 form emerges as a pivotal document. This comprehensive application is designed to register a foreign LLC, ensuring compliance with state regulations and facilitating business operations in California. Central to the submission is the requirement of a current Certificate of Good Standing from the home jurisdiction of the LLC, which validates the entity’s active status. Alongside the form, applicants must remit a filing fee of $70, with an optional certification fee of $5. To streamline the submission process, the completed cover sheet should accompany the paperwork, as it serves as a point of communication should further clarification be necessary. Detailed sections of the form necessitate specific information, including the exact name of the LLC, its formation date, and jurisdiction, all of which must align with the attached Certificate of Good Standing. Additionally, applicants must provide business addresses that do not include P.O. Boxes, along with the information of a designated agent for service of process, thereby ensuring that official communications can be duly received. Signing the form not only affirms the accuracy of the information provided but also signifies the applicant's authorization to act on behalf of the LLC. Understanding the components of the LLC 5 form is essential for anyone looking to navigate the complexities of registering a foreign LLC in the Golden State.

Llc 5 Example

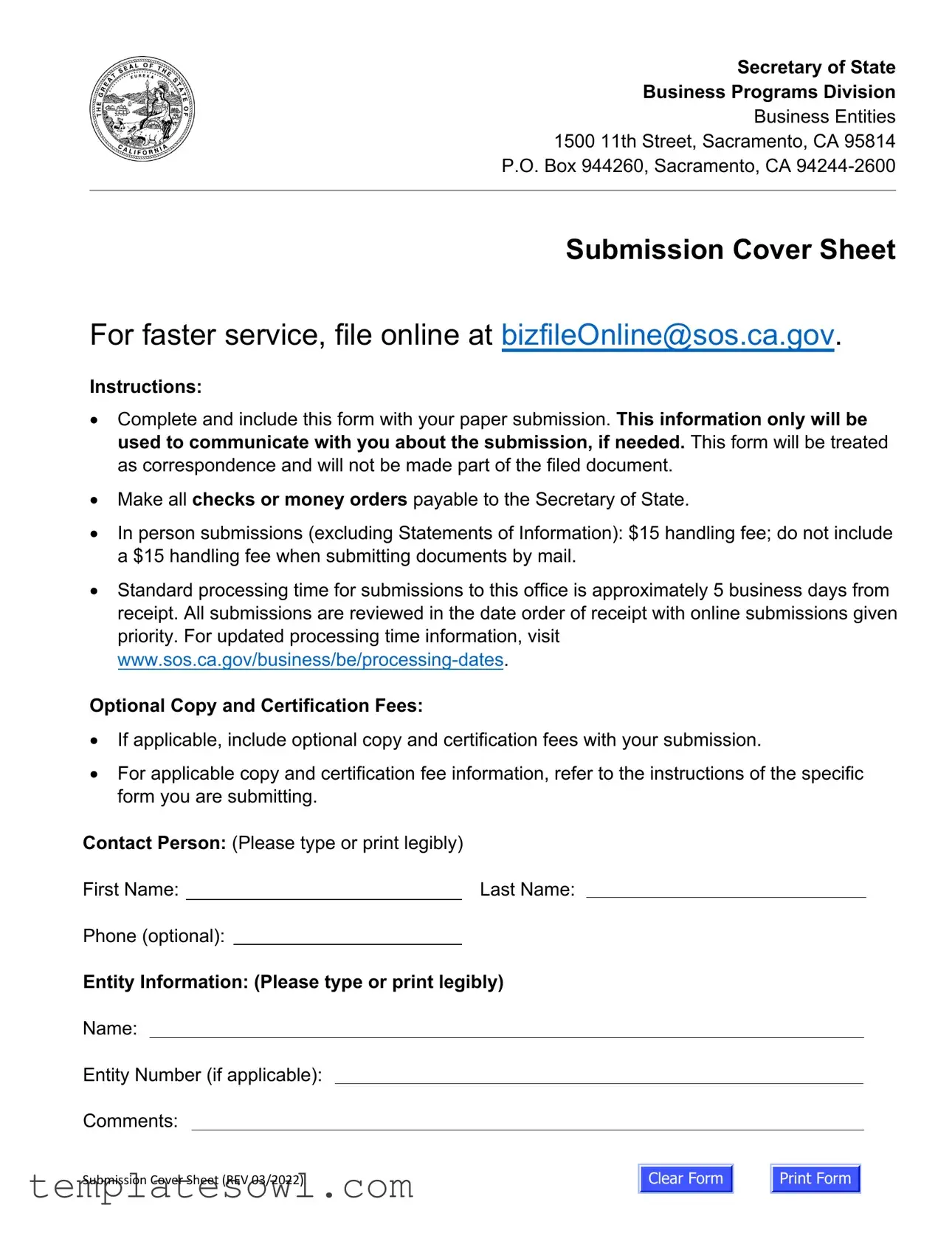

Secretary of State

Business Programs Division

Business Entities

1500 11th Street, Sacramento, CA 95814

P.O. Box 944260, Sacramento, CA

Submission Cover Sheet

For faster service, file online at bizfileOnline@sos.ca.gov.

Instructions:

•Complete and include this form with your paper submission. This information only will be used to communicate with you about the submission, if needed. This form will be treated as correspondence and will not be made part of the filed document.

•Make all checks or money orders payable to the Secretary of State.

•In person submissions (excluding Statements of Information): $15 handling fee; do not include a $15 handling fee when submitting documents by mail.

•Standard processing time for submissions to this office is approximately 5 business days from receipt. All submissions are reviewed in the date order of receipt with online submissions given priority. For updated processing time information, visit

Optional Copy and Certification Fees:

•If applicable, include optional copy and certification fees with your submission.

•For applicable copy and certification fee information, refer to the instructions of the specific form you are submitting.

Contact Person: (Please type or print legibly)

First Name: |

|

Last Name: |

Phone (optional):

Entity Information: (Please type or print legibly)

Name:

Entity Number (if applicable):

Comments:

Submission Cover Sheet (REV 03/2022)

Clear Form

Print Form

Secretary of State |

Application to Register a Foreign Limited

Liability Company (LLC)

Must be submitted with a current Certificate of Good Standing issued by the government agency where the LLC was formed.

Filing Fee – $70.00

Certification Fee (Optional) – $5.00

Note: Registered LLCs in California may have to pay minimum $800 tax to the California Franchise Tax Board each year. For more information, go to https://www.ftb.ca.gov.

This Space For Office Use Only

1a. LLC Name (Enter the exact name of the LLC as listed on your attached Certificate of Good Standing.)

1b. California Alternate Name, If Required (Only enter an alternate name if the LLC name in 1a not available in California.)

2. LLC History (Ensure that the formation date and jurisdiction match the attached Certificate of Good Standing.)

a. Date LLC was formed in home jurisdiction (MM/DD/YYYY)

/ /

b. Jurisdiction (State, foreign country or place where this LLC is formed.)

c.Authority Statement (Do not alter Authority Statement)

This LLC currently has powers and privileges to conduct business in the state, foreign country or place entered in Item 2b.

3. Business Addresses (Enter the complete business addresses. Items 3a and 3b cannot be a P.O. Box or “in care of” an individual or entity.)

a. Street Address of Principal Executive Office - Do not enter a P.O. Box |

City (no abbreviations) |

|

State |

Zip Code |

|

|

|

|

|

|

|

b. Street Address of Principal Office in California, if any - Do not enter a P.O. Box |

City (no abbreviations) |

|

State |

Zip Code |

|

|

|

|

CA |

|

|

|

|

|

|

|

|

c. Mailing Address of Principal Executive Office, if different than item 3a |

City (no abbreviations) |

|

State |

Zip Code |

|

|

|

|

|

|

|

4. Service of Process (Must provide either Individual OR Corporation.) |

|

|

|

|

|

INDIVIDUAL – Complete Items 4a and 4b only. Must include agent’s full name and California street address. |

|

|

|

||

|

|

|

|

|

|

a. California Agent's First Name (if agent is not a corporation) |

Middle Name |

Last Name |

|

|

Suffix |

|

|

|

|

|

|

b. Street Address (if agent is not a corporation) - Do not enter a P.O. Box |

City (no abbreviations) |

|

State |

Zip Code |

|

|

|

|

CA |

|

|

CORPORATION – Complete Item 4c only. Only include the name of the registered agent Corporation. |

|

|

|

|

|

|

|

|

|

|

|

c. California Registered Corporate Agent’s Name (if agent is a corporation) – Do not complete Item 4a or 4b |

|

|

|

|

|

|

|

|

|

|

|

5.Read and Sign Below (Title not required.)

By signing, I affirm under penalty of perjury that the information herein is true and correct and that I am authorized to sign on behalf of the foreign LLC.

__________________________________________________________

Signature

Clear Form

____________________________________________________

Type or Print Name

|

2022 California Secretary of State |

Print Form |

bizfileOnlne.sos.ca.gov |

|

|

Form Characteristics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Purpose | The LLC-5 form is used to register a foreign limited liability company (LLC) in California. |

| 2 | Filing Fee | A filing fee of $70.00 is required to process the LLC-5 form submission. |

| 3 | Certification Fee | An additional optional certification fee of $5.00 can be paid for a certified copy of the filing. |

| 4 | Required Documentation | Submission of a current Certificate of Good Standing from the LLC's home jurisdiction is mandatory. |

| 5 | Processing Time | Standard processing time for the submitted documents is approximately 5 business days. |

| 6 | Tax Obligations | Registered LLCs in California are subject to a minimum annual tax of $800 to the California Franchise Tax Board. |

| 7 | Agent Requirement | A California Agent must be designated for service of process, which can be an individual or a corporate agent. |

| 8 | Legal Affirmation | By signing the form, the applicant affirms the truthfulness of the information under penalty of perjury. |

Guidelines on Utilizing Llc 5

After gathering the necessary documents and information, you can begin filling out the LLC 5 form. This form is important for registering a foreign Limited Liability Company in California. You will need to provide details about the LLC, the business addresses, and the individual or corporation serving as an agent for service of process.

- Obtain a current Certificate of Good Standing from the jurisdiction where the LLC was formed.

- Fill in the LLC Name in Item 1a. Use the exact name as listed on the Certificate of Good Standing.

- If needed, enter a California Alternate Name in Item 1b.

- Provide the Date LLC was formed in Item 2a in MM/DD/YYYY format.

- Enter the Jurisdiction of the LLC’s formation in Item 2b.

- Read and ensure the Authority Statement in Item 2c is accurate.

- List the Principal Executive Office Address in Item 3a. Do not use a P.O. Box.

- Complete the Principal Office Address in California in Item 3b, if applicable. Again, do not use a P.O. Box.

- If different from Item 3a, provide the Mailing Address in Item 3c.

- Choose either an Individual or Corporation for service of process in Item 4.

- If you choose an Individual, fill out Items 4a and 4b with the agent's details.

- If you choose a Corporation, fill out Item 4c with the name of the registered agent corporation.

- Read and sign the form in Item 5, affirming under penalty of perjury that the information is true and correct.

- Prepare the filing fee of $70.00 and any optional certification fees, if applicable.

- Submit the completed form along with the Certificate of Good Standing to the Secretary of State’s office.

What You Should Know About This Form

What is the LLC-5 form?

The LLC-5 form is used to apply for registration as a foreign limited liability company (LLC) in California. If your LLC was formed outside of California but you wish to do business within the state, this form is essential for compliance. It must be submitted along with a current Certificate of Good Standing from the state where the LLC originated.

What are the filing fees associated with the LLC-5 form?

The total cost for submitting the LLC-5 form is $70. If you want an optional certification of your submitted documents, there is an additional fee of $5. It’s essential to prepare the payment correctly; checks or money orders should be made out to the Secretary of State. Keep in mind that registered LLCs in California may also need to pay an annual minimum tax of $800 to the California Franchise Tax Board.

How long does it take for my submission to be processed?

After you submit your LLC-5 form, the processing time is generally around five business days. However, online submissions are prioritized, meaning they may be processed faster than paper submissions. To ensure you know the most accurate timeframe, visit the Secretary of State's website for updated processing time information.

What information do I need to provide on the LLC-5 form?

You will need to provide various details, including the exact name of your LLC as it appears on your Certificate of Good Standing, business addresses, and the agent for service of process. If you are using an alternate name in California, that should also be listed. Ensure all provided information is accurate, and avoid using any P.O. Box addresses for the principal offices.

What is the purpose of the Certificate of Good Standing?

The Certificate of Good Standing serves as proof that your LLC is legally registered and compliant in its home state. It confirms that your entity is authorized to conduct business and has met all necessary obligations, such as taxes and filings. This document is critical, as it must be attached to your LLC-5 form when submitting your application.

Can someone else submit the LLC-5 form on my behalf?

Yes, someone else can submit the LLC-5 form for you. However, you, as the applicant, must ensure that they have all the necessary documents and information to complete the submission accurately. The person submitting should be aware of the details, especially regarding the Certificate of Good Standing and the specific requirements for your LLC.

What if I make a mistake on the LLC-5 form?

If you realize you've made a mistake on your submitted form, don't panic. Depending on the nature of the error, you might need to file a correction or submit an amended form. It’s crucial to provide accurate and truthful information, as signing the form affirms its correctness under penalty of perjury.

Where do I file the LLC-5 form?

You can file the LLC-5 form either online or by mail. For online submissions, you would use the bizfileOnline portal provided by the Secretary of State. If you prefer to mail your submission, send it to the Business Programs Division at the Secretary of State's office in Sacramento. Remember to include the appropriate fees and your Certificate of Good Standing with your submission.

Common mistakes

Filling out the LLC 5 form can be a straightforward process, but several common mistakes can lead to delays or complications. Being aware of these pitfalls can save time and frustration.

One frequent error is not entering the exact name of the LLC as it appears on the Certificate of Good Standing. This certificate provides essential verification, and any discrepancies can cause your application to be rejected. Always double-check the spelling and ensure the name aligns with official documents.

Another mistake people make is failing to provide complete business addresses. Items 3a and 3b should contain detailed addresses without using a P.O. Box or the phrase "in care of." Incomplete addresses can lead to issues with communication and processing, so ensure the details are accurate and clear.

In the section about the LLC's history, it’s crucial to correctly input the formation date and jurisdiction. These details must match the attached Certificate of Good Standing. Inconsistencies can raise red flags, prompting further inquiries or additional paperwork.

The agent for service of process is another area where mistakes often occur. When providing information about an individual agent, it is important to include the full name and exact California street address. Omitting any part of this information or using a P.O. Box can result in your submission being incomplete.

Many applicants overlook the signature section. Signing the form affirms that the information provided is true and correct. Make sure the signature is legible and that the signer is authorized to act on behalf of the LLC.

When it comes to payment, failing to include the appropriate filing fees can delay the process. The filing fee for the LLC 5 form is $70. Ensure that any checks or money orders are made out to the Secretary of State, as failing to do this can lead to returned documents.

Additionally, some may not realize the importance of the optional copy and certification fees. These fees should be included if requesting copies, and being aware of these costs ahead of time helps in planning for the total submission amount.

Lastly, people sometimes forget to check updated processing times before submission. The standard turnaround is approximately five business days, but this can change. Staying informed can manage expectations and help in planning further steps after submission.

Documents used along the form

When submitting the LLC 5 form, several additional documents may be required or useful in the registration process of a Foreign Limited Liability Company (LLC). Below is a list of such forms and documents.

- Certificate of Good Standing: This document verifies that the LLC is in compliance with the regulations of its home jurisdiction. It must be current and attached with the LLC 5 form.

- LLC Operating Agreement: This internal document outlines the management structure and operating procedures of the LLC. While it is not always required for registration, it can be beneficial for internal governance.

- Statement of Information (Form LLC-12): This form provides updated information about the LLC's addresses and managers. For foreign LLCs, it may be required within 90 days of registration in California.

- Statement of Information (Form SI-100): California businesses must file this document annually. It updates the Secretary of State on any changes to the business address, business type, and management.

- Application for Tax Exemption (if applicable): This form is required if the LLC qualifies for tax-exempt status. It is submitted to the Internal Revenue Service or similar state agencies.

- Internal Revenue Service Form SS-4: This is the application for an Employer Identification Number (EIN). Most LLCs need an EIN for tax purposes, even if they do not plan to employ staff.

- Business License Application: Depending on the location and type of business activities, the LLC may need to apply for a business license in the state or local jurisdiction.

These documents play an important role in ensuring compliance and maintaining good standing for the LLC. It is crucial to verify requirements to avoid delays in the registration process.

Similar forms

-

Articles of Organization: Similar to the LLC-5 form, the Articles of Organization serves as the foundational document needed to establish an LLC in a state. It outlines basic information about the business, including its name and address, just like the LLC-5 form requires the name and details of a foreign LLC.

-

Certificate of Good Standing: This document verifies that an LLC has been established and is compliant with state regulations. Like the LLC-5 form, it is typically required to demonstrate the legitimacy and operational status of a business. The LLC-5 requires a current Certificate of Good Standing to be submitted along with it.

-

Foreign LLC Registration Form: This form is used similarly to the LLC-5 for registering foreign limited liability companies in new states. Both documents require general information about the business and may require similar supporting documentation to prove the LLC is in good standing.

-

Statement of Information: Under certain circumstances, both documents require basic details about the entity, management structure, and business activities. This ensures that the state has current data regarding the LLC’s operations and compliance.

-

Operating Agreement: Although not always legally required, both the LLC-5 form and the Operating Agreement outline the structure and management of the LLC. The Operating Agreement details ownership and operational procedures, providing clarity in the functioning of the business, similar to the information collected in the LLC-5.

-

Application for Authority: This document is executed when a foreign entity seeks to operate in a new state. Like the LLC-5, it fulfills legal requirements for foreign entities and gathers essential details about the business, including contact information and business address.

Dos and Don'ts

When filling out the LLC-5 form, there are specific actions that can help ensure a smooth process and others that can cause delays or issues. Here’s a guide for you.

- Do: Read all instructions carefully before starting.

- Do: Ensure the LLC name matches exactly with the Certificate of Good Standing.

- Do: Double-check the formation date and jurisdiction for accuracy.

- Do: Include complete and accurate business addresses without using P.O. Boxes.

- Do: Confirm that the agent for service of process has a valid California address.

- Do: Include the filing fee of $70.00 with your submission.

- Do: Affix your signature clearly and ensure it’s legible.

- Do: Provide contact information in case they need to reach you.

- Do: Use black or blue ink when filling out the form by hand.

- Do: Submit your application either online or by mail, as per your preference.

- Don’t: Alter or change the authority statement in any way.

- Don’t: Include a handling fee if you are mailing your documents.

- Don’t: Leave blank spaces on the form; fill in all required information.

- Don’t: Forget to provide a current Certificate of Good Standing.

- Don’t: Use abbreviations for cities and states in the addresses.

- Don’t: Submit forms without verifying that payment is correct.

- Don’t: Include optional fees unless they are required or desired.

- Don’t: Enter a P.O. Box for the business addresses.

- Don’t: Assume your documents will be processed immediately; expect up to 5 business days.

- Don’t: Forget to check for updated processing times on the official website.

By following these dos and don’ts, you can streamline the submission of your LLC-5 form. Take your time, and make sure everything is correct before sending it off.

Misconceptions

Understanding the LLC-5 form is essential for anyone looking to register a foreign limited liability company in California. However, several misconceptions may cloud the process. Here are seven common myths about the LLC-5 form:

- The LLC-5 form is only needed for foreign companies. This form specifically pertains to foreign LLCs, but its existence does not imply it's irrelevant for domestic entities. Domestic LLCs should be aware of their filing requirements as well.

- Filing the LLC-5 guarantees instant approval. Even with correct information, processing takes time. The standard processing time is approximately five business days, and this can vary based on workload.

- A certificate of good standing is unnecessary if registered in California. In fact, a current Certificate of Good Standing from the home jurisdiction is mandatory for submission. Failing to include this will result in delays.

- Only one agent can be designated for service of process. While the form requires at least one agent, businesses can designate multiple agents provided they meet the required criteria. Ensure all agents are reliable and accessible.

- The filing fee is the only cost involved. In addition to the $70 filing fee, there may be optional copy and certification fees. It's important to understand all potential costs before submitting the form.

- An online submission is not an option. While an in-person submission is allowed, online filing is available for quicker processing. Utilize the online platform for faster service if possible.

- Once submitted, no follow-up is needed. After submission, it's wise to monitor the status. You can check processing times online to understand when you might expect feedback.

Being informed and addressing these misconceptions can streamline the registration process and reduce potential hindrances. Take the time to understand the requirements to ensure a smoother experience.

Key takeaways

Here are some key takeaways about filling out and using the LLC 5 form:

- Submission Requirements: Include the LLC 5 form with your paper submission. This helps ensure effective communication regarding your application.

- Processing Fees: A filing fee of $70 is required, along with optional certification fees of $5 if needed.

- Submission Methods: Online submissions are prioritized and will be processed faster. When submitting in person, a $15 handling fee applies, while mailed submissions do not incur this fee.

- Contact Information: Provide complete and accurate contact details and business addresses. Avoid using P.O. Boxes for these items.

Browse Other Templates

Renew Registration Pa - Do not send cash with the MV-371 application.

Workers Comp New Mexico - Employers should anticipate the cost implications of the Workers' Compensation Fee based on employee numbers.

Post Office Forms - False information may lead to penalties, including fines.