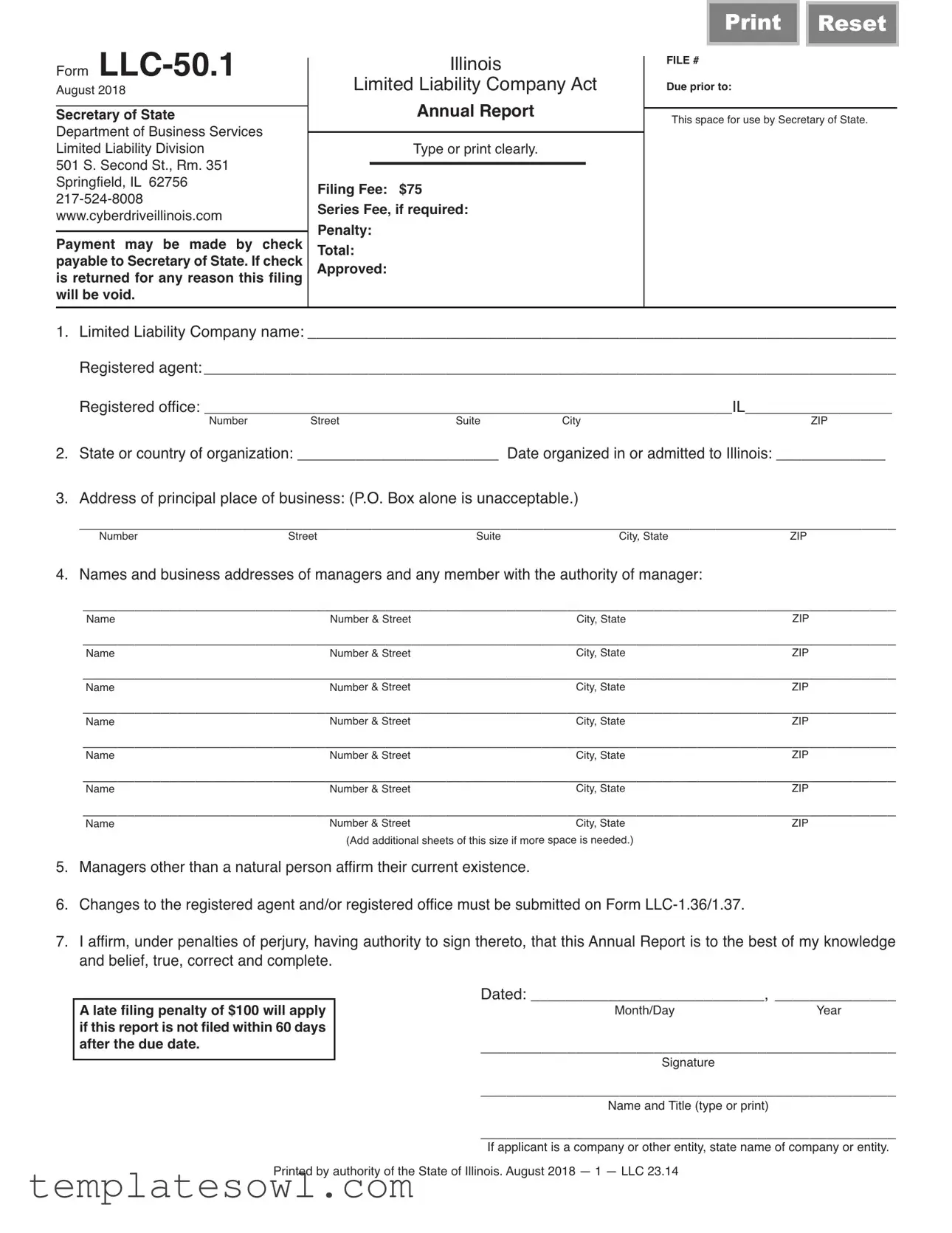

Fill Out Your Llc 50 1 Form

Filing the LLC-50.1 form is an essential step for Limited Liability Companies in Illinois to keep their registration current. This form serves as the Annual Report required by the Secretary of State, ensuring that all necessary information about the LLC is up to date. Among the key pieces of information included are the LLC’s name, its registered agent, and business address. Companies must also provide details about their principal place of business and the names and addresses of managers or members who possess managerial authority. It's worth noting that correct filing comes with a fee of $75, and if a check is returned for any reason, the submission will become void. Additionally, should there be any changes to the registered agent or office locations, a different form, the LLC-1.36/1.37, must be used. Taking care to file within the required timeline is crucial; missing the deadline can result in a late fee of $100. Essentially, the LLC-50.1 form plays a vital role in maintaining compliance with state regulations, and ensuring that all information remains accurate and readily accessible to the public.

Llc 50 1 Example

|

|

Illinois |

|

|

Reset |

|||||

Form |

|

FILE # |

|

|

|

|||||

August |

Limited Liability Company Act |

Due prior to: |

|

|

||||||

|

2018 |

|

|

Annual Report |

|

|

|

|||

Secretary of State |

|

|

|

|

|

|

||||

|

|

This space for use by Secretary of State. |

||||||||

Department of Business Services |

|

|

|

|

|

|

|

|

|

|

|

|

Type or print clearly. |

|

|

|

|

||||

Limited Liability Division |

|

|

|

|

|

|||||

501 S. Second St., Rm. 351 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Springfield, IL 62756 |

Filing Fee: $75 |

|

|

|

|

|||||

|

|

|

|

|

||||||

www.cyberdriveillinois.com |

Series Fee, if required: |

|

|

|

|

|||||

Payment may be made by check |

Penalty: |

|

|

|

|

|||||

payable to Secretary of State. If check |

Total: |

|

|

|

|

|||||

is returned for any reason this filing |

Approved: |

|

|

|

|

|||||

will be void. |

|

|

|

|

|

|

|

|

||

1.Limited Liability Company name: ____________________________________________________________________

Registered agent: ________________________________________________________________________________

Registered office: _____________________________________________________________IL_________________ |

||||

Number |

Street |

Suite |

City |

ZIP |

2. State or country of organization: ________________________ |

Date organized in or admitted to Illinois: _____________ |

|||

3. Address of principal place of business: (P.O. Box alone is unacceptable.) |

|

|

||

_______________________________________________________________________________________________ |

||||

Number |

Street |

Suite |

City, State |

ZIP |

4. Names and business addresses of managers and any member with the authority of manager: |

|

||

______________________________________________________________________________________________ |

|||

Name |

Number & Street |

City, State |

ZIP |

______________________________________________________________________________________________ |

|||

Name |

Number & Street |

City, State |

ZIP |

______________________________________________________________________________________________ |

|||

Name |

Number & Street |

City, State |

ZIP |

______________________________________________________________________________________________ |

|||

Name |

Number & Street |

City, State |

ZIP |

______________________________________________________________________________________________ |

|||

Name |

Number & Street |

City, State |

ZIP |

______________________________________________________________________________________________ |

|||

Name |

Number & Street |

City, State |

ZIP |

______________________________________________________________________________________________ |

|||

Name |

Number & Street |

City, State |

ZIP |

|

(Add additional sheets of this size if more space is needed.) |

|

|

5. Managers other than a natural person affirm their current existence. |

|

|

|

6. Changes to the registered agent and/or registered office must be submitted on Form |

|

||

7. I affirm, under penalties of perjury, having authority to sign thereto, that this Annual Report is to the best of my knowledge |

||||

|

and belief, true, correct and complete. |

|

Dated: ___________________________, ______________ |

|

|

A late filing penalty of $100 will apply |

|

||

|

|

Month/Day |

Year |

|

|

if this report is not filed within 60 days |

|

________________________________________________ |

|

|

after the due date. |

|

||

|

|

|

Signature |

|

|

|

|

|

|

|

|

________________________________________________ |

||

|

|

|

Name and Title (type or print) |

|

|

|

________________________________________________ |

||

|

|

|

If applicant is a company or other entity, state name of company or entity. |

|

|

Printed by authority of the State of Illinois. August 2018 — 1 — LLC 23.14 |

|

||

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | LLC-50.1, the Annual Report for Illinois Limited Liability Companies. |

| Governing Law | Limited Liability Company Act of Illinois. |

| Filing Deadline | This form is due prior to the annual report deadline for the year of filing. |

| Filing Fee | The fee for filing the LLC-50.1 form is $75. |

| Late Fee | A penalty of $100 applies if the form is not filed within 60 days after the due date. |

| Change Submission | To change the registered agent or registered office, use Form LLC-1.36 or LLC-1.37. |

| Principal Office Requirements | A P.O. Box alone is unacceptable for the principal place of business. |

| Signature Requirement | The form must be signed under penalties of perjury by a person with signatory authority. |

| Organization Date | The date organized in or admitted to Illinois needs to be provided on the form. |

| Contact Information | For assistance, the contact number is 217-524-8008. |

Guidelines on Utilizing Llc 50 1

When completing the LLC-50.1 form, it's essential to provide accurate and complete information to ensure successful filing. Following the steps below will help avoid potential delays or issues.

- Begin with the Limited Liability Company name: Enter the official name of your limited liability company in the designated space.

- Registered agent details: Fill in the name of the registered agent, which is the individual or entity designated to receive official documents on behalf of the LLC.

- Registered office address: Provide the complete street address for the registered office, including the suite number, city, and ZIP code.

- State or country of organization: Indicate the state or country where the LLC was originally organized.

- Date organized: Enter the date when the business was organized or admitted to operate in Illinois.

- Principal place of business: Specify the address of the principal place of business. Ensure that this is not a P.O. Box alone.

- Managers and members: List the names and business addresses of all managers and any members with the authority of a manager. Add additional sheets if necessary.

- Affirm current existence: Confirm that any managers that are not natural persons are currently existing.

- Additional changes: Note that any changes to the registered agent or registered office require submission on separate forms, LLC-1.36/1.37.

- Affirmation and signature: Sign and date the form. Print your name and title and provide the name of the company or entity if applicable.

- Payment: Include the filing fee of $75 payable to the Secretary of State. Make sure that the check is valid to avoid voiding the filing.

What You Should Know About This Form

What is the LLC-50.1 form?

The LLC-50.1 form is the Annual Report required for Limited Liability Companies (LLCs) registered in Illinois. It provides essential information about the company, including its name, registered agent, and management structure.

When is the LLC-50.1 form due?

The form is due prior to the 2018 Annual Report deadline. If the report is not filed within 60 days after the due date, a late filing penalty of $100 will apply.

What is the filing fee for the LLC-50.1 form?

The filing fee for submitting the LLC-50.1 form is $75. Payment can be made by check payable to the Secretary of State.

Who can be a registered agent?

A registered agent can be an individual or a business entity authorized to conduct business in Illinois. This agent will receive legal documents on behalf of the LLC. The name and address of the registered agent must be included in the form.

What information must be included in the LLC-50.1 form?

Key information required includes the LLC's name, the registered agent's name and address, the address of the principal place of business, and the names and addresses of managers or members with managerial authority.

How are changes to the registered agent or registered office submitted?

If there are changes to the registered agent or the registered office, these changes must be filed using Forms LLC-1.36 or LLC-1.37, rather than being included in the LLC-50.1 form.

What happens if the filing fee check is returned?

If the check used for the filing fee is returned for any reason, the filing will be considered void. It is important to ensure that sufficient funds are available to cover the payment.

Common mistakes

Filling out the LLC-50.1 form can seem straightforward, but mistakes often happen. One common error is failing to use the correct company name. The name must exactly match what is registered with the Secretary of State. If there are any discrepancies, the form could be rejected. Ensuring that you have the correct legal name is vital to avoid delays.

Another frequent mistake is not providing a valid registered agent. The registered agent serves as the point of contact for official documents. If the designated agent does not have a valid address or does not consent to serve in this role, the filing could be deemed incomplete. It’s crucial to confirm the agent’s willingness and address before submission.

People also often forget to include the complete address of the principal place of business. A P.O. Box alone is not acceptable. The form requires a physical address. If this requirement is overlooked, the filing may not be processed as required. Make sure to double-check that the address includes numbers, streets, and zip codes.

Finally, one significant error is neglecting to sign and date the form. The affirmation statement must be signed under penalties of perjury, indicating that the information provided is true and correct. Without a signature, the form cannot be considered valid. Always remember to sign, date, and include your printed name before sending off the form.

Documents used along the form

When filing an LLC-50.1 form in Illinois, several other documents and forms may also be needed to complete compliance and registration requirements. Each document serves a specific purpose and helps maintain the proper legal standing of the LLC.

- LLC-1 Form: This form is used to establish a new Limited Liability Company in Illinois. It includes information about the company’s name, registered agent, and address.

- LLC-1.36/1.37 Form: This form is necessary for changing the registered agent or registered office of an existing Limited Liability Company. It ensures the state has the most up-to-date information.

- LLC-50.2 Form: This is the document used to file the annual report for LLCs that have been registered for one year or more. It provides updated information on the company and its management.

- Articles of Organization: This document outlines the basic details of the LLC, including its name, purpose, and the names of its members. This is often required for formation and is filed with the state.

- Operating Agreement: Although not submitted to the state, this internal document details the management structure and operating procedures of the LLC. It defines the roles of members and management.

- State Business License: Depending on the nature of the business, an LLC might be required to obtain specific local or state business licenses or permits to operate legally.

- Employer Identification Number (EIN): This is a federal tax identification number required for tax purposes. It is often necessary for opening a bank account or hiring employees.

- Annual Franchise Tax Report: This report is filed annually in some states as a way for businesses to confirm their status and pay annual taxes assessed based on business activity.

Completing the LLC-50.1 form and accompanying documents accurately ensures compliance with state requirements and helps in the smooth operation of the business. It is essential to gather and submit all necessary forms for maintaining an LLC's good standing.

Similar forms

-

Articles of Organization: Like the LLC-50.1 form, this document is essential for forming a Limited Liability Company in Illinois. It establishes the company's name, registered agent, and business address, serving as the foundational legal document for the LLC.

-

Annual Report (for Corporations): Similar to the LLC-50.1, this document must be filed annually. It updates the state on the corporation's business activities, registered agent, and addresses, ensuring ongoing compliance with state law.

-

Certificate of Good Standing: This document certifies that an LLC is properly registered and compliant with state regulations. It often accompanies the LLC-50.1 during various business transactions to prove legal standing.

-

Operating Agreement: While not typically required to be filed with the state, this internal document outlines the management structure and operational procedures of the LLC. It complements the information provided in the LLC-50.1 by detailing how the entity will be governed.

-

Change of Registered Agent Form (LLC-1.36/1.37): This form is specifically used to update the registered agent or office of an LLC. Its purpose is closely related to item 6 in the LLC-50.1, ensuring that the company remains compliant with reporting requirements.

-

Bylaws (for Corporations): Similar to the Operating Agreement for LLCs, bylaws outline the rules and procedures for managing a corporation. They provide clarity on governance, just as the LLC-50.1 offers a snapshot of an LLC’s current status.

-

Foreign LLC Registration: If an LLC wishes to operate in a state other than where it was formed, it must register as a foreign LLC. This process requires documentation that shares many elements with the LLC-50.1, focusing on the office address and agents.

Dos and Don'ts

When filling out the LLC-50.1 form, keep these important do's and don'ts in mind:

- Do type or print your information clearly to avoid any misunderstandings.

- Don't use a P.O. Box as your address for the principal place of business; a physical address is required.

- Do ensure that all names, addresses, and titles are accurate and up to date.

- Don't forget to sign the form; an unsigned form will not be accepted.

- Do submit any changes to the registered agent and/or registered office on the appropriate form (LLC-1.36/1.37).

- Don't delay your filing; late submissions can incur a $100 penalty.

- Do keep a copy of the filed form for your records and any potential future needs.

Misconceptions

Understanding the LLC 50.1 form can be a bit confusing due to the myths surrounding it. Here’s a list of common misconceptions that can help clarify what’s truly required.

- Anyone can file the LLC 50.1 form at any time. This form is due with your annual report. Filing after the deadline incurs a late fee.

- The LLC 50.1 form can be completed online. While some forms can be filed electronically, this specific form must be printed and submitted by mail.

- Filing the form is only necessary if changes occur. In reality, even if there are no changes, annual reporting is still required.

- You don't need to list all managers and members. Every manager and any member with authority must be included to ensure complete compliance.

- The filing fee is just $75, no more. If your LLC has multiple series, a separate fee applies for each series that requires filing.

- A registered agent can be anyone. The registered agent must have a physical address in Illinois and be available during business hours.

- It’s okay to use just a P.O. Box for your address. A P.O. Box alone is not acceptable; provide a physical address as well.

- Payment can be made in any form. Payments must be made via check payable to the Secretary of State; other forms of payment may not be accepted.

By debunking these misconceptions, you can navigate the process more easily and ensure your LLC remains in good standing. Remember, when in doubt, consult the Illinois Secretary of State's website for the latest information and guidance!

Key takeaways

Here are key takeaways about filling out and using the LLC-50.1 form in Illinois:

- Purpose: This form is essential for filing the annual report for your Limited Liability Company (LLC) in Illinois.

- Filing Fee: A fee of $75 is required when submitting the form. If your payment is returned, the filing will be void.

- Deadline: Ensure the form is submitted on time. The annual report is due before the end of the year for which it is being filed.

- Registered Agent: Provide the name and address of your registered agent. This is the person or entity that receives legal documents on behalf of your LLC.

- Business Address: Include a physical address for the principal place of business. P.O. Boxes are not acceptable.

- Manager Information: List the names and addresses of all managers and any member who has managerial authority.

- Affirmation Required: You must affirm that the information provided is true and complete. This includes signing the report under penalties of perjury.

- Changes: If there are changes to your registered agent or registered office, use Form LLC-1.36 or LLC-1.37 to report them.

- Late Penalty: A penalty of $100 will apply if the report is filed more than 60 days late.

By following these guidelines, you can ensure that your LLC remains in good standing with the State of Illinois.

Browse Other Templates

Air National Guard Retirement - It’s mandatory to include the correct service branches on the form.

Printable Form 4473 - Applicants can indicate a name change, address update, or request a duplicate license on this form.

Mitigation Inspection - A secondary water resistance feature is evaluated to enhance protection against water intrusion during storms.