Fill Out Your Loan Modification Agreement Form

When navigating the complexities of home financing, a Loan Modification Agreement can serve as a crucial tool for both borrowers and lenders. This type of agreement aims to alter the terms of an existing mortgage to provide relief or adjust the repayment structure in response to changing financial conditions. Central to the Loan Modification Agreement is the recognition that the original mortgage terms may no longer be feasible for the borrower. The form lays out essential details, including the borrower's and lender's identities, the original mortgage and note dates, and the specific property being financed. Among its pivotal elements, it addresses the unpaid principal balance, outlines the interest rates—which can be variable—and stipulates the modified monthly payment amounts, along with payment due dates. The agreement emphasizes that while the loan's terms may be adjusted, the underlying obligations and rights of both parties remain intact, ensuring legal protections for lenders while allowing borrowers to manage their financial responsibilities more effectively. Furthermore, borrowers are often responsible for any costs arising from the modification process, including recording fees and potential legal expenses, which reinforces the need for clear comprehension of all terms set forth in the document.

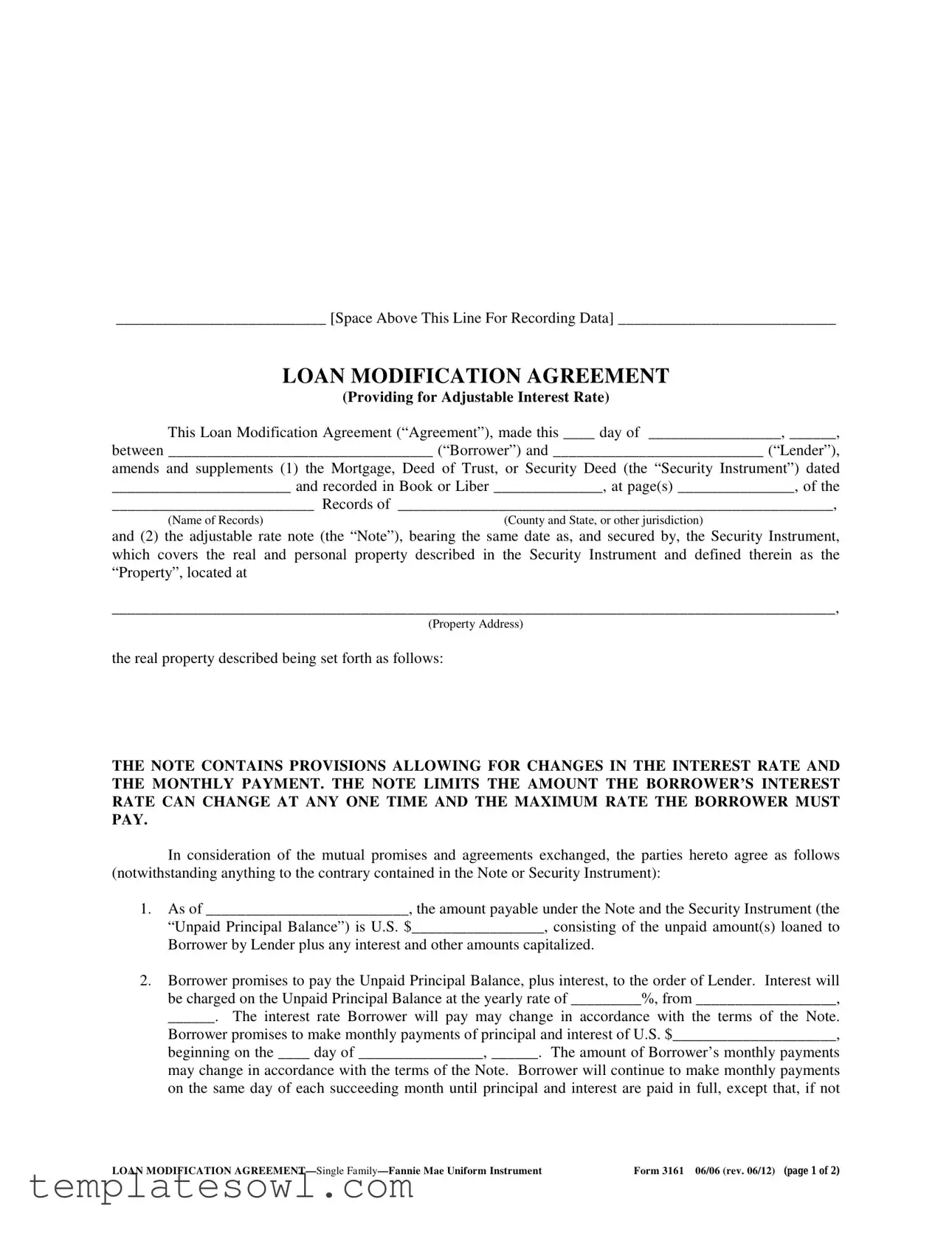

Loan Modification Agreement Example

___________________________ [Space Above This Line For Recording Data] ____________________________

LOAN MODIFICATION AGREEMENT

(Providing for Adjustable Interest Rate)

This Loan Modification Agreement (“Agreement”), made this ____ day of _________________, ______,

between __________________________________ (“Borrower”) and ___________________________ (“Lender”),

amends and supplements (1) the Mortgage, Deed of Trust, or Security Deed (the “Security Instrument”) dated

_______________________ and recorded in Book or Liber ______________, at page(s) _______________, of the

__________________________ Records of ________________________________________________________,

(Name of Records) |

(County and State, or other jurisdiction) |

and (2) the adjustable rate note (the “Note”), bearing the same date as, and secured by, the Security Instrument, which covers the real and personal property described in the Security Instrument and defined therein as the “Property”, located at

_____________________________________________________________________________________________,

(Property Address)

the real property described being set forth as follows:

THE NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN THE INTEREST RATE AND THE MONTHLY PAYMENT. THE NOTE LIMITS THE AMOUNT THE BORROWER’S INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE THE BORROWER MUST PAY.

In consideration of the mutual promises and agreements exchanged, the parties hereto agree as follows (notwithstanding anything to the contrary contained in the Note or Security Instrument):

1.As of __________________________, the amount payable under the Note and the Security Instrument (the “Unpaid Principal Balance”) is U.S. $_________________, consisting of the unpaid amount(s) loaned to Borrower by Lender plus any interest and other amounts capitalized.

2.Borrower promises to pay the Unpaid Principal Balance, plus interest, to the order of Lender. Interest will be charged on the Unpaid Principal Balance at the yearly rate of _________%, from __________________,

______. The interest rate Borrower will pay may change in accordance with the terms of the Note. Borrower promises to make monthly payments of principal and interest of U.S. $_____________________, beginning on the ____ day of ________________, ______. The amount of Borrower’s monthly payments may change in accordance with the terms of the Note. Borrower will continue to make monthly payments on the same day of each succeeding month until principal and interest are paid in full, except that, if not

LOAN MODIFICATION |

Form 3161 06/06 (rev. 06/12) (page 1 of 2) |

sooner paid, the final payment of principal and interest shall be due and payable on the ____ day of

________________, ______, which is the present or extended Maturity Date.

3.If on the Maturity Date, Borrower still owes amounts under the Note and the Security Instrument, as amended by this Agreement, Borrower will pay these amounts in full on the Maturity Date.

4.Borrower understands and agrees that

(a)All the rights and remedies, stipulations, and conditions contained in the Security Instrument relating to default in the making of payments under the Security Instrument shall also apply to default in the making of the modified payments hereunder.

(b)All covenants, agreements, stipulations, and conditions in the Note and Security Instrument shall be and remain in full force and effect, except as herein modified, and none of the Borrower’s obligations or liabilities under the Note and Security Instrument shall be diminished or released by any provisions hereof, nor shall this Agreement in any way impair, diminish, or affect any of Lender’s rights under or remedies on the Note and Security Instrument, whether such rights or remedies arise thereunder or by operation of law. Also, all rights of recourse to which Lender is presently entitled against any property or any other persons in any way obligated for, or liable on, the Note and Security Instrument are expressly reserved by Lender.

(c)Nothing in this Agreement shall be understood or construed to be a satisfaction or release in whole or in part of the Note and Security Instrument.

(d)All costs and expenses incurred by Lender in connection with this Agreement, including recording fees, title examination, and attorney’s fees, shall be paid by the Borrower and shall be secured by the Security Instrument, unless stipulated otherwise by Lender.

(e)Borrower agrees to make and execute such other documents or papers as may be necessary or required to effectuate the terms and conditions of this Agreement which, if approved and accepted by Lender, shall bind and inure to the heirs, executors, administrators, and assigns of the Borrower.

______________________________ (Seal) |

______________________________ (Seal) |

By: ________________________________ |

______________________________ (Seal) |

|

|

____________________________________ |

|

Date of Lender’s Signature |

|

___________________________ [Space Below This Line for Acknowledgements] __________________________

LOAN MODIFICATION |

Form 3161 06/06 (rev. 06/12) (page 2 of 2) |

Form Characteristics

| Fact Name | Description |

|---|---|

| Agreement Purpose | The Loan Modification Agreement is designed to amend the original loan terms between the borrower and lender, particularly when utilizing an adjustable interest rate. |

| Governing Law | The Loan Modification Agreement is governed by applicable state laws and regulations, which may vary by jurisdiction. |

| Unpaid Principal Balance | The amount owed by the borrower, as stated in the agreement, constitutes the unpaid principal balance, including any accrued interest and capitalized fees. |

| Interest Rate Changes | This agreement allows for changes in the interest rate and monthly payment amounts, consistent with the original note's provisions. |

| Monthly Payments | Borrowers are required to make monthly payments, which may change over time as dictated by the terms outlined in the loan agreement. |

| Final Payment Date | The agreement specifies a maturity date, by which any remaining balance must be paid in full to avoid penalties. |

| Borrower Obligations | Borrowers must adhere to all existing covenants and stipulations from the original loan documents, as they remain enforceable unless modified in this agreement. |

| Cost Responsibility | All costs associated with the modification process, including recording fees and legal expenses, are the responsibility of the borrower unless otherwise agreed upon. |

Guidelines on Utilizing Loan Modification Agreement

Filling out the Loan Modification Agreement form is a crucial step toward adjusting your loan terms. Once completed, it will need to be submitted to the lender for review and approval. The form sets the framework for your new repayment structure, ensuring both parties are clear on the revised terms.

- Write the date on the first line where it states “______ day of _________________, ______.”

- In the next blank, fill in your name as the “Borrower.”

- Enter the name of your lender in the space provided after "between” in the second paragraph.

- Record the date of the mortgage, deed of trust, or security deed that you are modifying.

- Indicate where the original document was recorded by filling in the book or liber number, and the page number.

- Provide both the name of the records and the county/state where the records are held.

- On the following line, write the address of the property that is being modified.

- State the unpaid principal balance that you currently owe in U.S. dollars.

- Fill in the yearly interest rate you will be charged on the unpaid balance.

- Enter the start date for this modified interest rate.

- Indicate the amount you will need to pay each month, starting from the specified due date.

- Specify the due date for your final payment of the principal and interest.

- Make sure to read the clauses carefully, then confirm your understanding and agreement in the specified area.

- Sign the form where indicated for the borrower, including any necessary seals according to your state’s requirements.

- Have the lender or authorized representative sign where indicated, and include their seal.

What You Should Know About This Form

What is a Loan Modification Agreement?

A Loan Modification Agreement is a legal document that alters the terms of an existing loan. It is primarily used when a borrower is struggling to keep up with their mortgage payments. This agreement can adjust interest rates, extend the length of the loan, or change monthly payment amounts, providing some relief to the borrower while ensuring the lender's interests are maintained.

Who is involved in a Loan Modification Agreement?

The agreement involves two main parties: the Borrower and the Lender. The Borrower is the individual or entity responsible for repaying the loan, while the Lender is the financial institution or person that provided the loan. Both parties must agree to the terms of the modification.

How do interest rates change in a Loan Modification Agreement?

Interest rates in a Loan Modification Agreement can fluctuate based on pre-established conditions. These conditions are outlined in the original loan documents and include provisions for adjustable rates. It is essential for the Borrower to understand these terms, as they dictate how the adjusted interest rate will be determined over time.

What happens if I can’t make the modified payments?

If you cannot make the modified payments as agreed in the Loan Modification Agreement, the same default provisions in your original loan documents apply. This means the Lender may pursue foreclosure or other remedies as stated in the original Mortgage or Deed of Trust. Communication with the Lender is crucial; they may be able to offer additional assistance or options if financial difficulties arise.

Are my obligations under the original loan affected by the modification?

No, the modification does not release you from your obligations under the original loan. While the terms may change, the original Mortgage or Security Instrument remains in effect along with all its covenants and conditions. The Borrower remains liable for the payment of the loan as stipulated.

Will I incur any costs when modifying my loan?

Yes, there may be costs associated with the modification, including but not limited to recording fees, title examination, and attorney’s fees. Typically, these costs will be your responsibility as outlined in the agreement. The Lender will often secure these expenses against the property, ensuring they are covered in the event of default.

How long will the Loan Modification Agreement last?

The duration of the Loan Modification Agreement is determined by the terms set within the document. Generally, the agreement will specify changes to the loan's maturity date and the payment schedule. It is crucial to read the agreement carefully to understand when the loan will be due in full and the terms associated with that date.

Can I modify my loan again in the future?

Yes, it is possible to modify your loan again in the future depending on your financial situation and the lender’s policies. However, repeated modifications may be scrutinized by lenders. Each situation is assessed on a case-by-case basis, and it’s always best to have open communication with your lender about your ongoing financial needs.

Common mistakes

Filling out a Loan Modification Agreement can be a daunting task. Many individuals encounter common pitfalls that can lead to delays or complications in the modification process. Understanding these mistakes can make a significant difference in securing loan modifications smoothly and effectively.

One frequent mistake is failing to provide accurate personal information. Borrowers often assume that their lender already has their information on file. However, it is crucial to double-check that names, addresses, and contact details are correct on the form. Inaccurate information can delay processing and muddy communication.

Another common blunder is not completing all required sections. Each part of the form is essential for a reason. Omitting details can result in rejection of the application or a request for additional paperwork. Take the time to read through the form thoroughly and ensure that every field is filled out accurately.

Many people also overlook the importance of the Maturity Date. Borrowers should be certain of the date when their remaining balance is due, as it affects payment terms and conditions. Mistakes in this section could lead to further financial obligations or uncertainties down the line.

Inadequate documentation is another key error. Lenders require certain supporting documents, like proof of income or tax returns, to review a modification request. Failing to provide necessary documentation can stall approval or lead to outright denial of the modification.

Some borrowers neglect to read the terms carefully. It is vital to understand the implications of adjustable rates and how they can change over time. If borrowers are not aware of these provisions, they might agree to terms that can result in larger payments than anticipated.

A significant mistake involves not consulting with a professional. Many individuals try to navigate the process alone or rely on outdated information. Seeking advice from a financial advisor or an attorney can clarify uncertainties and help borrowers present their case more effectively to lenders.

Additionally, borrowers sometimes overestimate their negotiating power. While it's natural to want the best terms possible, lenders operate within strict guidelines. Unrealistic expectations can lead to frustration for both parties during negotiations.

Lastly, some individuals forget to retain copies of the finalized agreement and any correspondence. Keeping your own records ensures that you have proof of the agreed terms, should any disputes arise in the future. It’s always wise to document your agreements and communications.

By being aware of these common mistakes, borrowers can enhance their chances of successfully navigating the Loan Modification Agreement process. Ensuring accuracy, understanding terms, and seeking professional help will go a long way in achieving the desired modifications without unnecessary complications.

Documents used along the form

When considering a Loan Modification Agreement, several other documents often accompany it to ensure a thorough and compliant process. Each of these documents plays a crucial role in clarifying the terms and protecting the interests of both the borrower and the lender. Below is a list of these relevant forms and a brief description of each.

- Mortgage or Deed of Trust: This document secures the loan by giving the lender a claim on the property if the borrower defaults. It details the terms of the loan and outlines the repayment plan.

- Adjustable Rate Note (ARN): This note specifies the interest rate structure of the loan, including how and when rates may change. It clearly states the borrower's obligations regarding payments.

- Financial Disclosure Statement: This form provides a comprehensive overview of the borrower's financial situation, helping the lender assess the borrower's capacity to repay the modified loan.

- Notice of Default: This document informs the borrower of any missed payments and initiates the default process. It serves as a formal warning and may outline steps for resolution.

- Loan Modification Application: Borrowers complete this application to formally request a change to the terms of their existing loan. It includes necessary information like loan number, property details, and the requested modifications.

- Forbearance Agreement: If a borrower struggles to meet payment obligations, this document may delay or reduce payments temporarily while allowing the borrower to catch up.

- Property Valuation Report: Lenders often require an appraisal to determine the current market value of the property. This document ensures that the loan modification is backed by accurate, up-to-date property information.

- Title Search Report: This report provides information about any existing claims or liens against the property. It is essential to confirm that the property can be legally modified without complications.

These documents collectively contribute to the effectiveness of the Loan Modification Agreement. Each serves a distinct purpose and aids both parties in understanding their rights and responsibilities in the modification process. Properly preparing and reviewing these forms can prevent misunderstandings and ensure successful loan modification outcomes.

Similar forms

- Forbearance Agreement: Similar to a Loan Modification Agreement, a Forbearance Agreement allows a borrower to temporarily stop or reduce payments. This document provides terms that can prevent foreclosure, offering a temporary solution while the borrower stabilizes their finances.

- Repayment Plan: A Repayment Plan outlines how a borrower will pay back missed payments over time. Like a Loan Modification Agreement, it adjusts the original loan terms, but focuses primarily on making up for past due amounts rather than changing the loan’s overall terms.

- Deed in Lieu of Foreclosure: This document transfers property ownership back to the lender as an alternative to foreclosure. While a Loan Modification Agreement aims to keep the borrower in their home, a Deed in Lieu is a more drastic step often taken when modification options are exhausted.

- Loan Assumption Agreement: This agreement allows a new borrower to take over the existing loan from the original borrower. Both documents facilitate a change in terms or responsibility but differ in the regard that the Loan Assumption Agreement involves a third party actively assuming the loan.

- Short Sale Agreement: A Short Sale Agreement permits a borrower to sell their property for less than the outstanding loan balance with lender approval. Similar to a Loan Modification Agreement, it offers a way out of financial distress, but the goal is to sell the property rather than retain it with modified payments.

Dos and Don'ts

When filling out the Loan Modification Agreement form, follow these guidelines to ensure accuracy and compliance.

- Do: Read each section carefully before filling it out. Understanding the content is essential.

- Do: Provide accurate and complete personal information. Incomplete forms can delay processing.

- Do: Double-check all figures, especially the Unpaid Principal Balance and interest rate. Accuracy is critical.

- Do: Sign and date the agreement where indicated. An unsigned document may be considered invalid.

- Do: Keep a copy of the completed form for your records. This will help you track your modification process.

- Don't: Rush through the form. Mistakes may lead to complications in your modification request.

- Don't: Leave any fields blank. Fill out every required section to avoid unnecessary delays.

- Don't: Ignore the terms outlined in the agreement. Ensure you are aware of your obligations before signing.

- Don't: Forget to consult with a financial advisor if you have questions. It's important to understand the implications.

- Don't: Submit the form without verifying the lender’s required documents. Each lender may have different requirements.

Misconceptions

Several misconceptions exist regarding the Loan Modification Agreement form. These misunderstandings can lead to confusion for both borrowers and lenders. Below are four common misconceptions explained.

- All loan modifications lower monthly payments. Many borrowers assume that a loan modification will automatically result in a lower monthly payment. However, the purpose of the modification is to adjust loan terms, which can lead to different outcomes, including changes in the interest rate or extended loan term that might maintain or even increase the monthly payment.

- Loan modifications erase debt. Another misconception is that a loan modification cancels out the borrower’s debt. In reality, the borrower is still responsible for repaying the modified loan amount. Adjustments are made to the terms of the existing loan rather than eliminating any of the principal owed.

- The Lender must approve all borrower requests for modifications. Some borrowers believe they can demand changes to their loan terms without Lender approval. Loan modifications require mutual consent, and the Lender has discretion regarding what terms may be changed and under what circumstances.

- Loan modification agreements are permanent. Many individuals think that once a loan modification is executed, the new terms will last indefinitely. However, modifications can be subject to specific conditions and may be reviewed by the Lender periodically. If the borrower defaults under the modified terms, the Lender may revert to original loan terms or pursue other actions.

Key takeaways

When filling out the Loan Modification Agreement form, consider the following key takeaways:

- Accurate Information is Crucial: Ensure all personal data, including names, addresses, and dates, are filled out correctly. Any inaccuracies can delay the process.

- Understand Terms of Agreement: Familiarize yourself with the implications of adjusting the interest rate and monthly payments. Changes to these terms can impact long-term financial commitments.

- Maturity Date Awareness: Note the maturity date of the loan. It is important to know when the final payment is due to avoid default.

- Maintaining Existing Obligations: Recognize that all prior obligations under the original loan documents remain in effect unless specifically changed in this Agreement.

- Costs and Fees: Be prepared to cover any associated costs with the modification process, including fees for recording and legal services.

Browse Other Templates

Nurse Skills Checklist Template - Ensures competency in documentation practices for patient care.

Power of Attorney Form Nj Dmv - The application can be submitted to the Motor Vehicle Commission.

How to List Jobs on Resume - Specialized in sourcing quality products for a boutique, ensuring diverse inventory availability for shoppers.