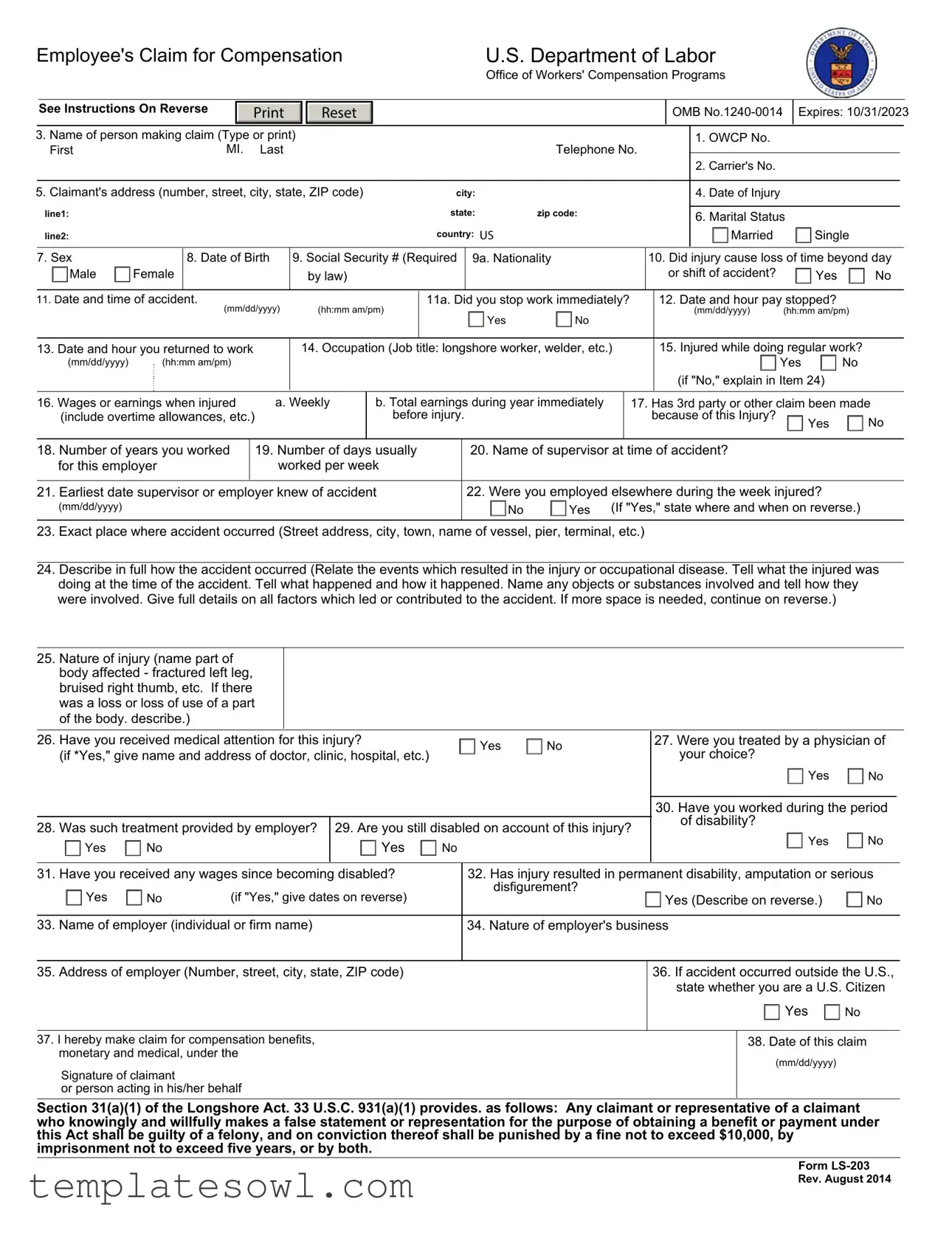

Fill Out Your Ls 203 Form

The LS-203 form serves as an essential tool for employees seeking compensation for work-related injuries or occupational diseases. Designed for use under various acts, including the Longshore and Harbor Workers' Compensation Act and the Defense Base Act, this form facilitates claims for medical and monetary benefits. Claimants must provide critical information, such as their personal details, including name and address, the specifics of the injury, and employment history. Critical questions focus on the accident's nature, such as the date, time, location, and details surrounding how the incident occurred. Additionally, it inquires about the lost work time resulting from the injury and whether medical treatment was sought. The form underscores legal requirements, including the necessity to report any prior compensation claims related to the same incident. An applicant can file a claim within a specific time frame following the injury, emphasizing the importance of prompt and accurate submissions. As claim processing is contingent on the accuracy of the information provided, the LS-203 form plays a pivotal role in determining an individual’s entitlement to compensation benefits.

Ls 203 Example

Employee's Claim for Compensation |

|

|

|

|

U.S. Department of Labor |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office of Workers' Compensation Programs |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

See Instructions On Reverse |

|

|

|

|

Reset |

|

|

|

|

|

|

|

|

|

|

OMB |

|

Expires: 10/31/2023 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Name of person making claim (Type or print) |

|

|

|

|

|

|

|

|

|

|

|

1. OWCP No. |

|

|

|

|

|

|

|||||||||

|

First |

|

MI. |

Last |

|

|

|

|

|

|

|

|

Telephone No. |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

2. Carrier's No. |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5. Claimant's address (number, street, city, state, ZIP code) |

|

|

city: |

|

|

|

|

|

|

4. Date of Injury |

|

|

|

|

|

|

|||||||||||

|

line1: |

|

|

|

|

|

|

|

|

|

|

state: |

zip code: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Marital Status |

|

|

|

|

||||||||

|

line2: |

|

|

|

|

|

|

|

|

|

|

country: US |

|

|

|

|

|

|

Married |

|

Single |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

7. Sex |

|

8. Date of Birth |

9. Social Security # (Required |

9a. Nationality |

|

10. Did injury cause loss of time beyond day |

|||||||||||||||||||||

|

Male |

Female |

|

|

|

|

|

|

by law) |

|

|

|

|

|

|

|

|

|

|

or shift of accident? |

|

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

11. Date and time of accident. |

|

|

|

(hh:mm am/pm) |

|

11a. Did you stop work immediately? |

|

|

12. Date and hour pay stopped? |

|

|

|

|

||||||||||||||

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

Yes |

No |

|

|

|

|

(mm/dd/yyyy) |

(hh:mm am/pm) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

13. Date and hour you returned to work |

|

14. Occupation (Job title: longshore worker, welder, etc.) |

|

|

15. Injured while doing regular work? |

||||||||||||||||||||||

|

(mm/dd/yyyy) |

(hh:mm am/pm) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(if "No," explain in Item 24) |

|

|

|

|

|||

16. Wages or earnings when injured |

a. Weekly |

b. Total earnings during year immediately |

|

17. Has 3rd party or other claim been made |

|||||||||||||||||||||||

|

(include overtime allowances, etc.) |

|

|

|

|

before injury. |

|

|

|

|

because of this Injury? |

|

Yes |

No |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

18. Number of years you worked |

|

19. Number of days usually |

|

20. Name of supervisor at time of accident? |

|

|

|

|

|

|

|||||||||||||||||

|

for this employer |

|

worked per week |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

21. Earliest date supervisor or employer knew of accident |

|

|

|

22. Were you employed elsewhere during the week injured? |

|

|

|

|

|||||||||||||||||||

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

No |

Yes (If "Yes," state where and when on reverse.) |

|

|||||||||||

23.Exact place where accident occurred (Street address, city, town, name of vessel, pier, terminal, etc.)

24.Describe in full how the accident occurred (Relate the events which resulted in the injury or occupational disease. Tell what the injured was doing at the time of the accident. Tell what happened and how it happened. Name any objects or substances involved and tell how they were involved. Give full details on all factors which led or contributed to the accident. If more space is needed, continue on reverse.)

25.Nature of injury (name part of body affected - fractured left leg, bruised right thumb, etc. If there was a loss or loss of use of a part of the body. describe.)

26. |

Have you received medical attention for this injury? |

|

Yes |

No |

|

27. Were you treated by a physician of |

|

|

||||

|

(if *Yes," give name and address of doctor, clinic, hospital, etc.) |

|

|

your choice? |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. Have you worked during the period |

|

|

|

|

|

|

|

|

|

|

|

|

of disability? |

|

|

|

28. |

Was such treatment provided by employer? |

29. Are you still disabled on account of this injury? |

|

No |

|

|

||||||

|

Yes |

|

|

|||||||||

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

31. |

Have you received any wages since becoming disabled? |

|

32. Has injury resulted in permanent disability, amputation or serious |

|

|

|||||||

|

Yes |

No |

(if "Yes," give dates on reverse) |

|

disfigurement? |

Yes (Describe on reverse.) |

No |

|

|

|||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||||||

33. Name of employer (individual or firm name) |

|

|

34. Nature of employer's business |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

35. Address of employer (Number, street, city, state, ZIP code)

36.If accident occurred outside the U.S., state whether you are a U.S. Citizen

Yes

Yes  No

No

37.I hereby make claim for compensation benefits, monetary and medical, under the

Signature of claimant

or person acting in his/her behalf

38. Date of this claim

(mm/dd/yyyy)

Section 31(a)(1) of the Longshore Act. 33 U.S.C. 931(a)(1) provides. as follows: Any claimant or representative of a claimant who knowingly and willfully makes a false statement or representation for the purpose of obtaining a benefit or payment under this Act shall be guilty of a felony, and on conviction thereof shall be punished by a fine not to exceed $10,000, by imprisonment not to exceed five years, or by both.

Form

Rev. August 2014

Instructions

• Use this form to file a claim under any one of the following laws:

Longshore and Harbor Workers' Compensation Act

Defense Base Act

Outer Continental Shelf Lands Act

Nonappropriated Fund Instrumentalities Act

- Applicant may leave items 1. and 2. blank.

Except as noted below, a claim may be filed within one year after the injury or death (33 U.S.C. 913(a)). If compensation has been paid without an

award, a claim may be filed within one year after the last payment. The time for filing a claim does not begin to run until the employee or beneficiary

knows, or should have known by the exercise of reasonable diligence, of the relationship between the employment and the injury. Persons are not

required to respond to this collection of information unless it displays a currently valid OMB control number. The information will be used to determine

an injured worker's entitlement to compensation and medical benefits.

In case of hearing loss, a claim may be filed within one year after receipt by an employee of an audiogram, with the accompanying report thereon, indicating that the employee has suffered a loss of hearing.

In cases involving occupational disease which does not immediately result in death or disability, a claim may be filed within two years after the

employee or claimant becomes aware, or in the exercise of reasonable diligence or by reason of medical advice should have been aware, of the relationship between the employment, the disease, and the death or disability.

To file a claim for compensation benefits, complete and sign this form.

If you have already been assigned an OWCP Case Number, please include your OWCP case number and submit electronically to the file through the DLHWC’s Secure Electronic Access Portal (SEAPortal) https://seaportal.dol.gov/portal/?program_name=LS. Alternatively, to submit the claim by mail, please be sure to include your case number and mail to the Central Mail Receipt site at the address shown below.

If this is a new claim, and you do not have an OWCP Case Number, please submit the form through the Case Create Fax Number (202)

U.S. Department of Labor

Office of Workers’ Compensation Programs

Division of Federal Employees’, Longshore and Harbor Workers' Compensation

400 West Bay Street, Suite 63A, Box 28

Jacksonville, FL 32202

Use the space below to continue answers. Please number each answer to correspond to the number of the item being continued.

Privacy Act Notice

In accordance with the Privacy Act of 1974, as amended (5 U.S.C. 552a) you are hereby notified that (1) the Longshore and Harbor Workers' Compensation Act, as amended and extended (33 U.S.C. 901 et seq.) (LHWCA) is administered by the Office of Workers' Compensation Programs of the U.S. Department of Labor, which receives and maintains personal information on claimants and their immediate families. (2) Information which the Office has will be used to determine eligibility for and the amount of benefits payable under the LHWCA. (3) Information may be given to the employer which employed the claimant at the time of injury, or to the insurance carrier or other entity which secured the employer's compensation liability. (4) Information may be given to physicians and other medical service providers for use in providing treatment or medical/vocational rehabilitation, making evaluations and for other purposes relating to the medical management of the claim. (5) Information may be given to the Department of Labor's Office of Administrative Law Judges (OALJ), or other person, board or organization, which is authorized or required to render decisions with respect to the claim or other matter arising in connection with the claim.

(6)Information may be given to the Federal, state and local agencies for law enforcement purposes, to obtain information relevant to a decision under the LHWCA, to determine whether benefits are being or have been paid properly, and where appropriate, to pursue salary/administrative offset and debt collection actions required or permitted by law. (7) Disclosure of the claimant's Social Security Number (SSN) or tax identifying number (TIN) on this form is mandatory. The SSN and/or TIN and other information maintained by the Office may be used for identification, and for other purposes authorized by law. (8) Failure to disclose all requested information may delay the processing of the claim, the payment of benefits, or may result in an unfavorable decision or reduced level of benefits.

Note: The notice applies to all forms requesting information that you might receive from the Office in connection with the processing and/or adjudication of the claim you filed under the LHWCA and related statutes.

Public Burden Statement

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. Public reporting burden for this collection of information is estimated to average 15 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Use of this form is optional, however furnishing the information is required in order to obtain and/or retain benefits. ( 33 U.S.C.913(a) ). Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, 200 Constitution Avenue, NW, Room

DO NOT SEND THE COMPLETED FORM TO THIS OFFICE

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The LS 203 form is used by employees to file claims for compensation under various acts including the Longshore and Harbor Workers' Compensation Act. |

| Governing Laws | This form is governed by the Longshore and Harbor Workers' Compensation Act, 33 U.S.C. 901 et seq., among others. |

| Filing Deadline | Claims must generally be filed within one year of the injury, though exceptions apply for cases of occupational disease. |

| Confidentiality | The Privacy Act of 1974 protects the personal information provided on the LS 203, ensuring it is used only for assessment of entitlement to benefits. |

| Signature Requirement | A signature is required from either the claimant or an authorized person acting on their behalf for the claim to be valid. |

| Medical Attention | The form inquires whether the claimant has received medical attention for the injury, which is crucial for determining benefits. |

| Social Security Disclosure | Disclosure of the claimant's Social Security Number is mandatory for processing the claim and providing benefits. |

| Permanent Disability | The form allows claimants to report if the injury has resulted in permanent disability, amputation, or serious disfigurement. |

| Employer's Responsibilities | Claimants must provide information about their employer, including the name and nature of the employer’s business, which is relevant for the compensation claim. |

| False Statements Penalty | Making false statements on the LS 203 can lead to penalties, including fines and imprisonment under 33 U.S.C. 931(a)(1). |

Guidelines on Utilizing Ls 203

After gathering all necessary information regarding your injury, the next step is to fill out the LS-203 form. This form is vital for initiating your claim for compensation benefits. You'll provide personal details, information about the injury, and any related earnings or work history.

- Begin by entering your OWCP Number in box 1. Leave box 2 blank if you do not have a Carrier's Number.

- In box 3, type or print the name of the person making the claim, including the first name, middle initial, and last name.

- Provide a telephone number in box 4.

- Fill in the date of your injury in box 5.

- Enter your complete address in box 6, including street number, city, state, and ZIP code.

- Indicate your marital status by checking either 'Married' or 'Single' in box 7.

- In box 8, select your sex by checking 'Male' or 'Female.'

- Input your date of birth in box 9.

- Provide your Social Security Number in box 10.

- Indicate your nationality in box 9a.

- In box 10, answer whether the injury caused you to lose time beyond the day or shift of the accident by circling 'Yes' or 'No.'

- Fill in the date and time of the accident in boxes 11 and 11a.

- State whether you stopped work immediately after the accident in box 12.

- Provide the date and hour your pay stopped in box 13.

- In box 14, enter the date and hour you returned to work.

- Specify your occupation in box 15.

- Indicate if you were injured while doing regular work in box 16.

- List your wages or earnings when injured in box 17, including weekly wages and total earnings for the previous year.

- In box 18, state whether a third-party claim has been made as a result of this injury.

- Enter the number of years you worked for your employer in box 19.

- Specify how many days you usually worked per week in box 20.

- Provide the name of your supervisor at the time of the accident in box 21.

- List the earliest date your supervisor or employer knew of the accident in box 22.

- State if you were employed elsewhere during the week of the injury in box 23.

- Describe exactly where the accident occurred in box 24.

- In box 25, provide a full description of how the accident occurred.

- Specify the nature of the injury in box 26.

- Answer whether you have received medical attention for this injury in box 27.

- Indicate if you were treated by a physician of your choice in box 28.

- State whether you have worked during the period of disability in box 29.

- Confirm if you are still disabled due to the injury in box 30.

- In box 31, enter whether you have received any wages since becoming disabled.

- State whether the injury resulted in permanent disability in box 32.

- Provide the name of your employer in box 33.

- Indicate the nature of your employer's business in box 34.

- Fill in your employer's address in box 35.

- If the accident occurred outside the U.S., indicate if you are a U.S. Citizen in box 36.

- Finally, review all the information for accuracy, then sign in box 37 and date your claim in box 38.

What You Should Know About This Form

What is the LS-203 form?

The LS-203 form, also known as the Employee's Claim for Compensation, is used to file a claim under various federal worker compensation laws. This includes the Longshore and Harbor Workers' Compensation Act, the Defense Base Act, and others. It helps injured workers request monetary and medical benefits due to work-related injuries.

Who needs to fill out the LS-203 form?

Any employee who has sustained an injury while working under the jurisdiction of the applicable federal acts should complete this form. It is specifically designed for those seeking compensation for injuries that occurred during the course of their employment.

What information do I need to provide on the LS-203 form?

The form requires personal details such as your name, contact information, and Social Security Number. You will also need to include specifics about the injury, such as the date and time of the accident, your occupation, and a description of how the accident occurred. Additionally, you'll need to provide information about any medical treatment received and whether the injury has affected your ability to work.

How do I submit the LS-203 form?

The LS-203 form can be submitted electronically through the Secure Electronic Access Portal (SEAPortal) if you have an OWCP case number. Alternatively, if you prefer to submit it by mail, include your case number and send it to the Central Mail Receipt site address provided in the instructions. For new claims without an OWCP number, you can fax the form to the designated case create fax number or mail it to the address listed.

What is the deadline for submitting the LS-203 form?

You generally have one year from the date of your injury to file the claim. If compensation was paid without a formal award, you can file within one year of the last payment. It's important to file as soon as you are aware of the injury and its link to your work.

Can I file the LS-203 form if my injury occurred outside the U.S.?

Yes, you can still file the LS-203 form for injuries that occurred outside of the U.S. However, you must confirm that you are a U.S. citizen when completing the form. Specific guidelines may apply based on the nature and location of your employment at the time of the injury.

What happens after I submit the LS-203 form?

Once submitted, the Office of Workers' Compensation Programs will review your claim to determine your eligibility for benefits. You may be contacted for additional information if necessary. Be prepared to receive updates on the status of your claim throughout this process.

Is there a penalty for providing false information on the LS-203 form?

Yes, knowingly providing false information can lead to severe consequences, including criminal charges. Individuals can face fines up to $10,000 and potential imprisonment. It is crucial to provide accurate and truthful information in all parts of the claim.

What if I need help filling out the LS-203 form?

If you need assistance, consider reaching out to a lawyer who specializes in workers' compensation or contacting a relevant government agency. They can guide you through the process and ensure that the form is filled out correctly.

Where can I find the LS-203 form?

The LS-203 form is available online through the U.S. Department of Labor's website. You can download it, print it, and complete it for submission. Additionally, be sure to check for the latest version to ensure compliance with current regulations.

Common mistakes

When completing the Ls-203 form, a few common mistakes can lead to complications. One common error is failing to provide all necessary personal information. Essential details, such as the employee's Social Security Number, date of birth, and correct address, should be included. Missing information can delay the processing of the claim.

Another mistake involves inaccuracies in the date of injury. Many individuals either misremember or incorrectly mark this date. It is crucial for this date to be precise, as it impacts eligibility for benefits. Additionally, the claimant must accurately document their occupation on the form. Describing the job incorrectly can create confusion regarding the nature of the claim.

Some claimants forget to indicate whether the injury caused a loss of time from work. This section is vital in determining entitlement to compensation. Furthermore, it is important to respond accurately to the questions about prior claims. Claiming a third-party injury when none exists can lead to complications or denials.

Failure to describe the accident thoroughly is another frequent issue. The section requesting details about how the injury occurred needs to be filled out completely. Incomplete descriptions can hinder the evaluation of the claim. It is beneficial to include relevant details about the events leading to the accident, as well as any involved substances or objects.

Additionally, another common mistake is neglecting to confirm medical treatment. Claimants should clearly state whether they sought medical help and provide the physician's details if applicable. This information can be crucial in establishing the extent of the injury and whether ongoing treatment is necessary.

Moreover, some might incorrectly check "No" when asked if they are still disabled due to the injury. This can lead to complications if the claimant is experiencing ongoing issues that may affect their employment. Claimants should evaluate their medical status accurately.

Finally, submitting the form without a signature is another common oversight. A signed form is necessary to validate the claim. Without it, the submission may not be processed. Attention to these common areas of error can help ensure a smoother claims process.

Documents used along the form

The LS-203 form is crucial for initiating a compensation claim under various acts. However, several other documents are commonly utilized alongside it to streamline the claims process. Below is a list of these supplementary forms and documents, each serving a specific purpose in the claims procedure.

- LS-201 - Notice of Injury: This form informs the employer about the injury and serves as an official notification of the incident.

- LS-208 - Statement of Compensation Paid: This document details the compensation an injured worker has received, helping to clarify any benefits already disbursed.

- LS-200 - Employer's Report of Injury: Completed by the employer, this form provides essential information about the injury and the circumstances surrounding it.

- LS-222 - Claim for Compensation: This form is used for claims related to permanent disability or impairment arising from the injury or illness.

- LS-401 - Medical Authorization: This document allows the insurer or claims administrator to obtain medical records concerning the injury to facilitate the claim process.

- LS-840 - Application for Review: If there is a dispute over a decision made regarding the claim, this form is used to request a review by the Office of Workers' Compensation Programs.

- Medical Records: Detailed medical documentation related to the injury can provide critical evidence about the nature and extent of the injury, supporting the claim.

Understanding these additional forms can help streamline the claims process and ensure that all necessary information is submitted accurately. Each document plays a significant role in substantiating the claim and ensuring the injured worker receives the appropriate benefits.

Similar forms

The LS-203 form serves a specific function in the compensation claims process but has similarities with other documents used in similar contexts. Below is a list of four forms that share common purposes or functions.

- Claim for Benefits - Form LS-1: Similar to the LS-203, this form is used to initiate a claim for benefits under the Longshore Act. It collects essential information about the claimant, the injury, and the employer, serving as a fundamental starting point for compensation claims.

- Report of Injury - Form LS-202: This form is utilized for documenting injuries and occupational diseases. Like the LS-203, it emphasizes the details surrounding the incident, helping to establish a clear link between the employment and the injury for the compensation process.

- Application for Employment - Form WH-14: While this form is focused more on job seekers applying for positions, it shares data requirements with the LS-203, such as personal and employment information. Both forms are critical in assessing claims or applications in relation to employment circumstances.

- Notice of Injury or Occupational Disease - Form LS-210: This document serves to inform the Office of Workers' Compensation about an injury. It parallels the LS-203 in its purpose to ensure that incidents are reported timely and accurately, which is essential for the subsequent filing of a claim.

Dos and Don'ts

- Do: Read the form thoroughly and understand each section before filling it out.

- Do: Use clear and legible handwriting or type your responses to ensure clarity.

- Do: Provide accurate and truthful information throughout the form.

- Do: Keep a copy of the completed form for your records.

- Do: Submit the claim promptly, ideally within the designated timeframe.

- Don't: Leave any required fields blank; ensure all necessary information is provided.

- Don't: Use abbreviations or shorthand that could confuse the reader.

- Don't: Submit false information; this can lead to severe consequences.

- Don't: Forget to sign and date the form—this is crucial for processing your claim.

Misconceptions

Misconception 1: The LS-203 form can be submitted at any time.

In reality, claims must be filed within one year after the injury or death. This timeline is crucial to ensure your claim is considered.

Misconception 2: It’s unnecessary to fill out the entire form.

Every section matters. Incomplete forms can lead to delays or denials of your claim.

Misconception 3: You can file for any injury without evidence.

A claim must be supported by details about the injury and events leading to it. Documentation strengthens your case.

Misconception 4: Your employer cannot see the details you submit.

Information may be shared with your employer or insurance carrier, as they're part of the claims process.

Misconception 5: Submitting the LS-203 form guarantees compensation.

Filing does not automatically mean that you will receive benefits. Each claim is evaluated on its merits.

Misconception 6: You can leave items 1 and 2 blank if you're unsure.

While it's possible to skip them, providing your OWCP number and Carrier's number can speed up processing.

Misconception 7: The LS-203 form is only for severe injuries.

This form can be used for any work-related injury or condition, regardless of severity.

Misconception 8: All claims must be submitted by mail.

You can also submit the LS-203 form electronically through the Secure Electronic Access Portal, which is quicker.

Misconception 9: It is not necessary to provide a Social Security number.

Providing your Social Security number is mandatory. It helps in identifying you within the system.

Key takeaways

Here are five key takeaways about filling out and using the LS-203 form for an employee's claim for compensation:

- Timeliness is crucial. Claims must be filed within one year of the injury or death, or within one year of the last compensation payment if applicable.

- Complete all relevant information. Ensure that all fields, especially personal details, date of injury, and nature of the injury, are accurately filled out to prevent delays.

- Submit properly. Forms can be submitted electronically or by mail. If you already have an OWCP number, include it when submitting.

- Be thorough in descriptions. Provide clear and detailed accounts of how the injury occurred. Use Item 24 to explain the circumstances fully.

- Understand the consequences of false information. Misleading or false statements can lead to serious penalties, including fines or imprisonment.

Browse Other Templates

Health Care Proxy Form - This form reinforces your right to make decisions about your health care treatment and end-of-life wishes.

Is Inheritance Considered Income - Information regarding any deceased children must also be recorded on the form.