Fill Out Your Lwc 77 Form

The LWC 77 form, also known as the Separation Notice Alleging Disqualification, serves as a crucial document in the unemployment compensation process in Louisiana. Employers must utilize this form when an employee is separated from their job under specific circumstances that may disqualify them from receiving unemployment benefits. These circumstances include leaving employment without good cause, being discharged for misconduct, or facing unemployment due to a labor dispute. It is essential for employers to complete the form accurately and submit it electronically within 72 hours of the employee's separation. The form requires careful attention to detail, with various fields needing completion according to the instructions provided. If errors occur during submission, the system will display an error message, prompting necessary corrections before resubmission. Once submitted successfully, employers should retain a copy of the "SUBMISSION ACCEPTED" page for their records and provide a copy of the notice to the affected worker, alongside related instructions. This efficient process underscores the significance of timely and precise reporting in the realm of unemployment insurance, ensuring that both employee rights and employer responsibilities are upheld. Furthermore, the form not only aids in determining qualifications for benefits but also protects employers’ rights throughout the often complex unemployment claims process.

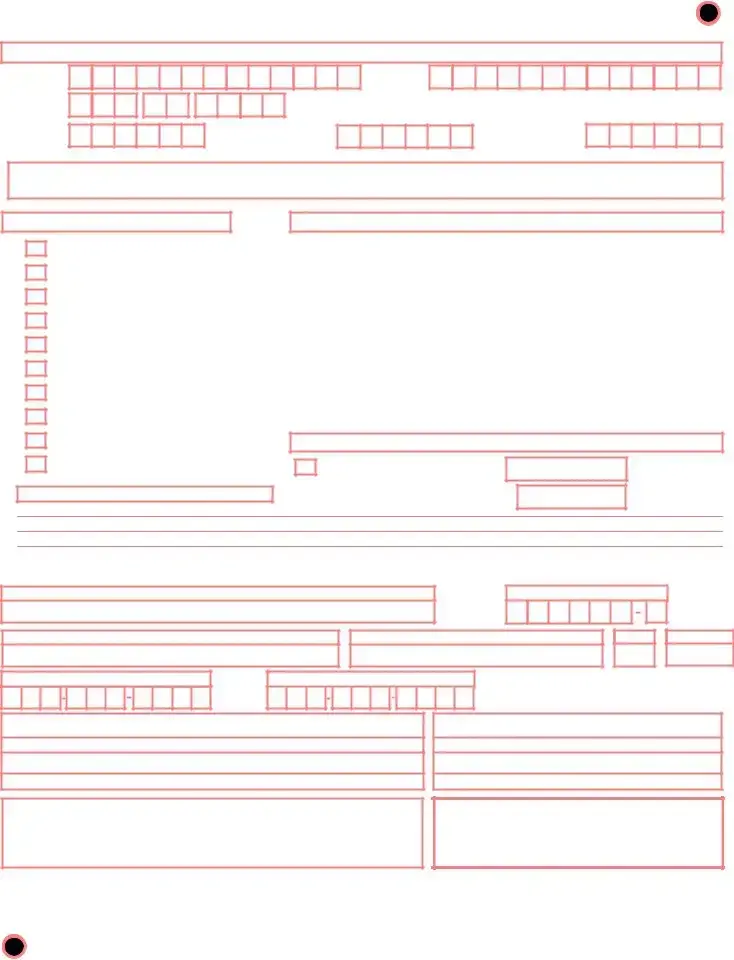

Lwc 77 Example

Form LWC 77 Separation Notice Overview |

Page 1 of 1 |

Form LWC 77 Separation Notice Alleging Disqualification

Thank you for accessing this Louisiana Workforce Commission Interactive Form. The following is

a brief overview of how the form functions.

Complete all required entries according to instructions in the Field Comments/Explanation at the top of the page each time an item is clicked. After the last entry, click "SUBMIT". If errors are detected, a message will return with further instructions. Correct the error then click "SUBMIT" again. When the form has been completed successfully, a "SUBMISSION ACCEPTED" page will return. Print this "SUBMISSION ACCEPTED" page for your records.

A Separation Notice Alleging Disqualification should be completed for each worker who leaves your employ without good cause connected with his work, is discharged for misconduct connected with the employment, or is unemployed because of a labor dispute.

Submit within 72 hours after each employee has been separated from work.

We encourage you to complete and submit the form online, however; you may download and print a blank copy of

this form and/or instructions.

Give a copy to the worker along with "Instructions to the Worker" and Form LWC 87

or, if delivery is impossible, mail to his last known address within 72 hours.

Keep a copy for your records.

Once you have submitted this form electronically, there is no need to mail a copy to LWC.

PROCEED

https://www.laworks.net/Form77/ |

6/18/2012 |

($3 |

|

1@($(5 |

|

'4':"A<BC |

|

:(+*1<DA<BC |

|

".<<B0CEFDFF |

|

!!"!#$#$%!&'#(!#(!!$!(!)($ %*$!$&!!%!#+$),(%!$'

$#+.0

$.($$0

1%$

#)$!!)1%! $#!2!)3$

(4#(%!

%(5

6

(2)*

!

|

(!) ) |

9 |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

8 |

|

||

|

|

|

|

|

||||

|

|

7 64 |

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

$ |

|

9 |

|

|

8 |

|

|

|

|

|

|

|

|||

|

|

! |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

:( |

|

9 |

|

|

8 |

|

|

|

|

|

|

|

|||

|

|

!) ) |

|

9 |

|

|

8 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

+( |

|

9 |

|

|

8 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

3!

GG#!)GG(( 9

;!((*&(!##!)( 9 %##%$#H

;$)##&$!$()(%%#%&##%

($$';(#$)##(!#%#!$)#$'

(

(

&).

'

"2.

4

+(

6!

"##$%&&!#'&('!+!&#<#(' =$)#$)#>;($#?#

!)&#<#(*$))(!'

#(%

5#"6&$7

($3 1@($(5

4$:"A<BC :(+*1*<DA<BC ".<<B0CEFDFF

".),)) /)..,)0

*000770801*

1$1!!++,(!$#(!%(!$$#&!)(!)&#(+ $($$&##&*$#+$($$$&##&*(!)%$(!%('

"!+!#1*($3* 4$:"A<BC*:(+*(

<DA<BC&#<#(!)#%&'=(!$$)#&!+&## >;($66#?*!)%!*!#!&&#<#('

I!$)(!$'

;2##&J(!!)($';##

$!$()$*!$#"!'

2&J$!$()(%';&)(####(%* !$#"!'

2##&&)(!)'

2##&&#'

2##&!&'

;<3#$#"!!$'

#/+#!!+#$%#

,(!$!+&#(+$(%(%!(%!$#+ &##!)#(!%'

)/8"9+#!$#+##$ %(+#,(!$#(!%$($ $$&##&'

#.+$!!##!#

!'

!)

)( +$!!#

##&#$$%!($(+'

+##&,(!%($#

('

+#!*#!()$(!)*"$

(%($*#$)$%(*!)

$%($%!)!)$%('

($(!!DD&*!"!$!(# (%#(&$#&'6##(!))#(!!%$!('

;CE3!$#'+!)'

6#$#(!%!!(+%)$!)(#K(%!)#

##!'6#$#(!%##!#&"<<BDCEFDFF

!#1*($3* 4$:"A<BC*:(+*(<DA<BC'

+%$(!)*)(#(!+:(3!(3

$)(+&';)(!$!%*)()#

!$!#3!!3DFFDCDBBF'5#(2!)$()&* )()%,(!%*#

(!)(&&#(+$(%(%!(%! $#+&#)(!)*

(&$#+$($$$&#)(&*

(!$$(%!&!)!%!

(%!&*$%)#1#!)

$*

(&+!%(#%!#$#)( &!)*)(&+(!)$%

()#!&'

;)(+&!)#(+#)()%!)

,(!%'

;$+#)(,(!*#($3&!!$#

%))(!)3*$*$$+#)(

#)()(!)($!%';)(+&##

!+)(@%+#3*$*!

)(5!);($1!$'

462;$)2 4)#!)($!!$%' #($3&!!)(#!)(&#)($!'

2=;62$#$:(3!(3#3!!

3DFFDCDBBF'

APPEAL RIGHTS

You have the right to appeal any determination the Agency makes with respect to your benefit rights. You may file an appeal: (1) by mail to the LWC Appeals Unit at P. O. Box 91146, Baton Rouge, LA

The appeal must be postmarked (if mailed) or faxed or filed online within 15 days of the mailing date on the disqualification determination to the last address of record. If the legal

DO NOT DELAY YOUR APPEAL. If your appeal is filed late without good cause, your appeal rights may be lost. If your appeal is late, you should be prepared to explain the reason during the hearing with the Administrative Law Judge.

There is no charge for an appeal to the Appeals Tribunal.

INTERSTATE BENEFITS

If you worked in another state other then Louisiana in the last 18 months, you could be eligible to file against that state. You may contact the Unemployment Insurance Call Center @

WAGE REPORTING

Wages are reportable for UI purposes during the week the wages are earned not when they are paid. Each week when you request payment, you will be asked “Did you work between (date) and

report earnings. Cash wages,

BENEFITS ARE TAXABLE

All unemployment benefits are fully taxable. Federal income tax is

choose to have 10% of your weekly benefits withheld for federal income tax purposes.

5

not |

|

withheld |

(date) |

|

. |

|

” |

|

If |

|

you |

from |

|

|

worked |

your |

|

benefits |

any |

|

|

|

day |

|

between |

automatically |

those |

. |

|

However, |

two |

|

|

|

dates |

|

you |

you |

|

may |

must |

accuracy |

BUSINESS |

|

|

of |

|

all |

|

of |

|

your |

|

|

AND |

answers |

CAREER |

. |

|

Any |

|

person |

SOLUTIONS |

|

|

who |

|

knowingly |

|

FILE AND MANAGE YOUR UNEMPLOYMENT

INSURANCE (UI) CLAIM

FROM THE PRIVACY OF YOUR OWN HOME

UNEMPLOYMENT INSURANCE

To file a new unemployment claim, reopen an existing claim, file weekly unemployment benefits, or to get answers about your Unemployment Insurance (UI) online, visit:

www.laworks.net

The Louisiana Workforce Commission highly encourages Online Claims Filing as the fastest method of filing a

New, Additional or Reopened Claim

If you do not have access to the Internet,

you can manage your Unemployment Insurance over the telephone. The toll free number is:

7:00 AM – 7:00 PM, Monday – Thursday

7:00 AM – 5:00 PM, Friday

(Note: This number can be extremely busy during high peaks of unemployment around the state)

CENTER LOCATIONS

On our Website click on Downloads

Locate Download Categories

Under Workforce Development Click on Miscellaneous

FRAUDULENT CLAIMS

When filing a claim for UI benefits, you are responsible for the

fails to disclose a material fact in order to obtain or increase any benefits shall be guilty of fraud and subject to full repayment of benefits and a disqualification for one year per R.S. 23:1601 (8).

6

WORKER’S CLAIM

INFORMATION

For

Unemployment Insurance

Administered By:

LOUISIANA

WORKFORCE COMMISSION

(LWC)

OFFICE OF

UNEMPLOYMENT INSURANCE

____________________________________

NOTICE TO EMPLOYER — In accordance with Section 1621 of The Employment Security Law, you are requested to give this pamphlet to a worker who is separated from your employment permanently or for an indefinite period.

This leaflet gives a general explanation of the benefit rights of an unemployed worker in accordance with the Louisiana Employment Security Law. This explanation does not have the effect of law, ruling, or regulation.

___________________________________________

LWC 87W

(R 04/11)

WWW.LAWORKS.NET

FOREWORD

This leaflet is designed to provide you, the worker, with a brief explanation of your rights under the Louisiana Employment Security Law. As it is impossible to cover all conditions, which may affect your claim, you may consult a representative of the Louisiana Workforce Commission (LWC) at

Remember unemployment insurance is the worker’s protection against hardship and suffering through lack of earnings during periods of forced unemployment. THE WORKER IN

LOUISIANA PAYS NOTHING FOR THIS PROTECTION. The employers’ pay to the state of Louisiana, contributions on wages paid to workers, which creates and maintains the funds from which benefits are paid.

SERVICES PROVIDED WORKERS

LWC provides a twofold service to the worker. (1) It tries to place the unemployed worker in a job. (2) It pays unemployment insurance to jobless workers who are eligible and can qualify for benefits as prescribed by the state law.

REGISTERING FOR WORK AND FILING A CLAIM

The worker who has become unemployed should go to the nearest

Business and Career Solutions Center (center locations are found on our website see section 6 for more information) to register for work as so instructed when filing a claim. You may file a claim for unemployment insurance by following the directions found in section (6) of this brochure. When filing your claim, it is necessary that you furnish the following information:

1.Your federal Social Security Number.

2.Your name and correct mailing address.

3.The names and addresses of your employers for the past 18 months.

4.The complete reason for your unemployment and the last day you worked.

AMOUNT OF BENEFITS

The weekly amount of unemployment insurance, which you may receive, can vary from $10 – $247. This amount is known as your “weekly benefit amount” and is fixed by law. You must have earned a minimum of $1,200.00 in the base period and wages must have been earned in at least two of the four quarters in the base period in order to qualify for benefits (see section 3).

ESTABLISHING A CLAIM FOR BENEFITS

To establish a claim for benefits, you must show, at the time of filing your claim for benefits, that:

1. You are unemployed.

2

2.You left your job through no fault of your own.

3.You have been paid wages by employers subject to the Louisiana Employment Security Law during the base period equal to at least one and

WHAT YOU MUST DO TO RECEIVE BENEFITS

1. You must register for work as so required.

2. You must make at least one (1) active work search during each week that you claim benefits.

3. You must be able and available for work (meaning there is nothing to prevent you from accepting suitable work).

4.You must make a weekly claim for benefits through the Easy Call system at

5.You must report all gross earnings during the week when earned, even if you are not paid that week.

**All of the above requirements must be met; otherwise, you cannot receive benefits.

PARTIAL CLAIMS

Benefits for partial unemployment are paid to workers who are still in the employ of their regular employer, but who, because of lack of work, are employed less than a full workweek and earn less than their weekly benefit amount.

BASE PERIOD

Unemployment Insurance is paid on wages you earned in a past

Here is a simple way to figure out your base period:

|

If you file your claim |

|

Your base period will be |

||||||

|

|

between: |

|

|

|

|

between: |

|

|

|

January and March |

October of the year before last |

|||||||

|

|

|

|

|

and September of last year |

||||

|

April and June |

January and December of |

|||||||

|

|

|

|

|

|

|

last year |

||

|

July and September |

April of last year and March of |

|||||||

|

|

|

|

|

|

|

this year |

||

October and December |

July of last year and June of |

||||||||

|

|

|

|

|

|

|

this year |

||

WAITING PERIOD

Louisiana Unemployment Insurance Law provides that the first week of benefits that would otherwise be payable, is to be held as the “Week of Waiting.” No matter how long you have waited to file after becoming unemployed, you must serve a week of waiting before you can begin drawing unemployment benefits for subsequent weeks.

3

DISQUALIFICATIONS

Although you may meet the eligibility requirements for unemployment insurance, you may still be DISQUALIFIED. The Louisiana Employment Security Law requires the assessing of a disqualification if:

1.You left your employment without good cause attributable to a substantial change made to your employment by your employer.

2.You are discharged for misconduct connected with your employment.

3.You fail to (a) apply for available suitable work, (b) accept suitable work when offered, or (c) return to your customary self- employment.

4.For any week you are unemployed due to a labor dispute which is in active progress at the factory, establishment, or other premises at which you are, or were, employed.

5.For any week or part thereof you are receiving or seeking benefits under an unemployment compensation law of another state or of the United States.

6.For any week or part thereof you are receiving or have received:

a.Wages in lieu of notice.

b.Compensation under the Workers’ Compensation Law.

c.Payments under any pension plan, toward the cost of which the base period employer is contributing or has contributed in your behalf.

d.Bonus pay.

e.Vacation pay.

f.Severance or dismissal pay.

g.Holiday pay.

7.You fraudulently seek or receive benefits to which you are not entitled.

8.You have not earned a certain specified amount after the beginning date of the benefit year of your prior claim, provided you received benefits during the benefit year of that claim.

(If you are disqualified for any of the reasons listed in 1, 2, or 3 above, you will be denied benefits until you have been paid wages for work in covered employment equivalent to at least ten times your weekly benefit amount subsequent to the week of the disqualifying conditions. If you are disqualified under #2 above, and such misconduct has resulted in damage to the employer, no benefits can be paid to you based on wage credits earned with that employer).

4

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of LWC 77 | The LWC 77 form is used to notify the Louisiana Workforce Commission about a worker's separation from employment alleging disqualification. |

| Submission Timeline | Employers must submit the form within 72 hours after an employee has been separated from work. |

| Online Submission | It's encouraged to complete and submit the form electronically to streamline processing. |

| Print Submission | If electronic submission isn't possible, a print version can be completed and sent by mail to the employee’s last known address. |

| Record Keeping | Employers should keep a copy of the submitted form and the "SUBMISSION ACCEPTED" page for their records. |

| Governing Law | This form is governed by the Louisiana Employment Security Law, specifically R.S. 23:1601 (8). |

| Employee Rights | Employees have the right to appeal determinations made regarding their benefits within 15 days of the mailing date. |

| Taxability of Benefits | All unemployment benefits received are taxable as income, and options for withholding federal taxes are available. |

Guidelines on Utilizing Lwc 77

Filling out the LWC 77 form is a straightforward process that requires attention to detail and adherence to specific instructions. Once you've gathered the necessary information, your next steps involve completing the form accurately and promptly submitting it within the required timeframe.

- Access the LWC 77 form online at this link.

- Review the field comments and explanations at the top of the form. These provide guidance on what information is needed for each section.

- Fill out all required fields on the form. Make sure to provide accurate information regarding the employee's separation.

- After completing the form, double-check it for any errors or omissions. Ensuring accuracy is crucial for proper processing.

- Click the "SUBMIT" button when you are confident that your entries are correct.

- If there are any errors, follow the prompts to correct them, then click "SUBMIT" again.

- Once successfully submitted, a "SUBMISSION ACCEPTED" confirmation page will appear. Print this page for your records.

- Remember to provide a copy of the submission to the worker along with "Instructions to the Worker" and Form LWC 87, or mail it to their last known address if needed.

Timely submission of this form is important. Be sure to adhere to the 72-hour guideline to avoid any potential issues with compliance.

What You Should Know About This Form

What is the LWC 77 Form and when should it be used?

The LWC 77 Form, also known as the Separation Notice Alleging Disqualification, is used by employers in Louisiana to notify the Louisiana Workforce Commission (LWC) when an employee has been terminated or has left their job without good cause. This form must be submitted within 72 hours of the employee's separation. It's essential for documenting instances where employees may not be eligible for unemployment benefits due to reasons like misconduct or leaving without just cause. Every employer should familiarize themselves with this important tool to ensure compliance with state regulations.

How do I complete and submit the LWC 77 Form?

Completing the LWC 77 Form is straightforward. Begin by accessing the interactive form online. Follow the instructions provided at the top of the page to fill in the required entries accurately. As you click on each item, ensure you provide the necessary information. If mistakes are detected, the system will alert you with further instructions—simply correct the error and try again. After the last entry, click "SUBMIT." If successful, a confirmation page will appear. It's a good practice to print this confirmation for your records, as it serves as proof of submission.

What happens if I don’t submit the LWC 77 Form on time?

Timeliness in submitting the LWC 77 Form is crucial. If you fail to submit this form within the mandated 72-hour period, it could impact both your business and the former employee's ability to claim unemployment benefits. Late submissions might lead to complications or disputes concerning the employee’s eligibility for benefits. To avoid these pitfalls, make it a priority to file the form as soon as possible after an employee's separation.

What should I do with the completed LWC 77 Form after submission?

After submitting the LWC 77 Form electronically, there’s no need to mail a physical copy to the LWC. However, it’s essential to keep a copy of the submitted form for your records, along with the "SUBMISSION ACCEPTED" confirmation page. Additionally, you are required to provide a copy of the form and "Instructions to the Worker" to the separated employee or send it to their last known address if they are unavailable. This helps ensure transparency and fairness during the unemployment process.

Common mistakes

Filling out the LWC 77 form can seem simple, but there are common mistakes that can lead to delays or complications. Understanding these errors can help ensure proper filing and compliance with the Louisiana Workforce Commission (LWC).

One common mistake is failing to complete all required entries. The form includes specific fields that must be filled out. Carefully following the instructions at the top of the page is crucial. Omitting even a single required entry can result in an error message, which then requires a correction before submission.

Another frequent error involves waiting too long to submit the form. The law stipulates that separation notices must be submitted within 72 hours after an employee’s departure. Delaying this process not only risks potential non-compliance but can also complicate the claims process for the former employee.

Some individuals make the mistake of not providing a copy of the form to the worker. It's essential to give a copy of the completed LWC 77, along with instructions, to the separated employee. If in-person delivery is not possible, the form should be mailed to the employee’s last known address within the same 72-hour window. This helps ensure the worker understands their rights and the process moving forward.

Additionally, many people overlook printing the "SUBMISSION ACCEPTED" page after completing the online form. This confirmation serves as proof of timely submission. Keeping this for your records helps protect both you and the employee in the event of any discrepancies or delays in processing.

A further mistake involves the failure to check for errors before submitting the form. Before hitting the “SUBMIT” button, review all entries again. Many errors can be avoided simply by proofreading the information to catch typos or incorrect data. If the system flags an error, correct it promptly and resubmit.

Lastly, some individuals do not maintain a copy of the submitted form for their records. Keeping your own record is vital. It can serve as a reference during any future inquiries about the separation notice. In the event that an appeal or dispute arises, having documentation readily available can ease the process significantly.

Documents used along the form

When submitting the LWC 77 form, there are several additional documents that may be necessary or helpful in the process of managing separation and unemployment claims. Understanding these forms can ensure that you meet all requirements efficiently and accurately.

- LWC 87 - Instructions to the Worker: This document provides crucial guidance to the employee about their rights and options following separation. It outlines how they can apply for unemployment benefits, detailing steps they need to take.

- LWC 87W - Notice to Employer: This notice is meant to inform employers about their responsibilities to provide information to separated workers. It explains the implications of employee separation under the Louisiana Employment Security Law.

- Form W-2: This form is essential for tax purposes. It reports the wages earned and taxes withheld for each employee during the year. It's crucial for separated employees when filing their taxes and claiming benefits.

- Form 1099: Similar to the W-2, this form is used for reporting income received as an independent contractor. It's applicable if the worker was self-employed or worked outside of traditional employment structures.

- Unemployment Insurance Claim (UI Claim): While this form is filed separately, it's critical for workers seeking benefits. It provides the details necessary for the Louisiana Workforce Commission to process a claim for unemployment benefits.

- Separation Agreement: This document, if applicable, outlines the terms of the employee's departure. It can include severance packages or stipulations that may affect unemployment claims.

- Clarification Documents: Occasionally, additional documentation may be requested by the Louisiana Workforce Commission to verify employment details or address disputes arising from the separation.

Utilizing these documents alongside the LWC 77 can significantly streamline the process and improve the likelihood of a successful outcome. It's important to act promptly in preparing and submitting these forms to adhere to the deadlines stipulated in labor laws.

Similar forms

The LWC 77 form serves as a Separation Notice Alleging Disqualification, primarily used in Louisiana's unemployment system. Various documents share similar functions to the LWC 77. Below is a list of ten such documents, along with brief explanations of how they relate to the LWC 77 form.

- Form LWC 87: This form is also issued by the Louisiana Workforce Commission and provides workers with information regarding their rights and benefits upon separation from employment. Like the LWC 77, it is essential for informing employees about their status and options.

- Form LWC 87W: This is a worker’s claim information notice that specifically addresses the benefit rights of separated workers. It complements the LWC 77 by giving detailed information about the benefits workers may receive.

- Form LWC 78: This document is a notice for employers regarding wage reporting and unemployment claims. Similar to the LWC 77, it serves to make employers aware of their responsibilities concerning employee separations and their implications for unemployment benefits.

- Form LWC 88: Issued to explain the process of filing unemployment claims, this form is related to the LWC 77 by helping workers understand how to claim benefits after separation.

- Form LWC 1000: This is an appeals form for unemployment claims. Like the LWC 77, it is crucial for maintaining clear communication about employee rights and the recourse available to them following a disqualification.

- Form LWC 102: Used for filing a grievance regarding unemployment claims, this document relates to the LWC 77 by outlining additional procedures workers can follow if they disagree with the information provided.

- Form LWC 93: This form serves as a verification of employment. It is relevant to the LWC 77 as it provides the necessary background that may influence a worker's claim after separation.

- Form LWC 14: This document outlines a worker’s responsibilities when receiving unemployment benefits and could come into play after a worker has received a notice like the LWC 77.

- Form LWC 7: This is a request for further information related to unemployment benefits. Similar to the LWC 77, it serves to clarify employee entitlements and obligations.

- Form LWC 77S: This is a simplified version of the Separation Notice, designed for quicker completion. It addresses the same fundamental principles as the LWC 77 but caters to cases with fewer complexities.

Each of these documents plays a role in the wider unemployment insurance system by ensuring that both workers and employers are equipped with the necessary information regarding separations, rights, and the processes that follow.

Dos and Don'ts

When filling out the LWC 77 form, it's crucial to adhere to the guidelines to ensure accuracy and compliance. Here are nine things you should and shouldn't do:

- Do: Complete all required entries as specified in the instructions at the top of the form.

- Do: Submit the form within 72 hours after the employee has been separated from work.

- Do: Print the "SUBMISSION ACCEPTED" page for your records upon successful completion of the form.

- Do: Provide a copy of the form and "Instructions to the Worker" to the separated employee.

- Do: Ensure that all information is accurate to avoid delays and issues with benefits.

- Don't: Forget to correct any errors before resubmitting the form if prompted.

- Don't: Submit a paper copy of the form if you have already submitted it electronically.

- Don't: Delay in providing the necessary documentation to the worker or mailing it if required.

- Don't: Disregard the importance of accurate wage reporting, as this may lead to penalties.

- Don't: Assume that the submission of the form is optional; it is essential for compliance.

Misconceptions

Understanding the LWC 77 form can help ensure that employers and employees navigate unemployment situations smoothly. However, several misconceptions often arise. Here’s a closer look at ten common misunderstandings regarding the LWC 77 Separation Notice:

- It's not necessary to submit the form immediately. Many believe they can wait to submit the LWC 77 form, but it must be submitted within 72 hours after an employee separates from work.

- Only voluntarily terminated employees require this notice. Some think this form is only needed when an employee resigns, yet it's essential for any separation, including discharges for misconduct or during labor disputes.

- You must mail a physical copy after submitting online. A common myth suggests that after electronic submission, a mailed copy is necessary. This is incorrect. Once submitted electronically, no further mailing is required.

- The employee does not need to receive a copy. It’s important to provide a copy of the LWC 77 and instructions to the worker. Keeping them informed is a key part of the process.

- Errors in submission can be ignored. Some believe that minor errors won’t matter. However, if there are mistakes, the form must be corrected and resubmitted to ensure proper processing.

- The form is optional if the worker was laid off. This is a misconception. Regardless of the reason for termination, submission of the LWC 77 is required when applicable.

- It’s okay to submit the form after 72 hours as long as you explain. Unfortunately, late submissions could lead to complications, and timely filing is crucial to maintaining compliance.

- All notices can be submitted through a single online portal. While online submission is encouraged, some forms need to be processed separately, and users might need to check which route is required for each document.

- Restrictions do not apply if multiple employees are separated simultaneously. Each separation needs its own LWC 77 form, even if several employees are affected at once. Failing to file each notice individually can lead to issues.

- Employees will automatically know how to proceed with a Separation Notice. Assuming employees are aware of their rights and responsibilities after separation can be misleading. It’s vital to provide clear instructions to them to facilitate their transition.

Clarifying these misconceptions can significantly ease the administrative processes and support both employers and employees effectively. Proper completion and timely submission of the LWC 77 form help ensure compliance with Louisiana’s unemployment regulations.

Key takeaways

Understanding the LWC 77 Form: The LWC 77 form, or Separation Notice Alleging Disqualification, is essential for employers in Louisiana to communicate the circumstances surrounding an employee's departure.

- Timeliness is Crucial: Submit the form within 72 hours after an employee separates from work. This requirement helps ensure the accuracy of the unemployment claims process.

- Accuracy in Reporting: Carefully fill out all required sections as instructed. Errors can lead to delays in processing or incorrect determinations.

- Electronic Submission: Completing the form online is encouraged. After submission, a "SUBMISSION ACCEPTED" page will confirm that you have successfully filed.

- Paper Copies: If you choose to fill out a paper version, provide a copy to the employee along with the "Instructions to the Worker" and Form LWC 87.

- Record Keeping: Always retain a copy of the submitted form and any related documents for your records. This may be important if issues arise later.

- Disqualification Reasons: The form should be used when an employee is separated for reasons like misconduct, leaving without good cause, or unemployment due to labor disputes.

- Employee Notification: Ensure that the transitioning employee is aware of their rights and next steps. This includes providing forms and information about potential appeals.

- No Duplicate Mailing: Once you have submitted the form electronically, you are not required to mail a paper copy to the Louisiana Workforce Commission.

Browse Other Templates

Deposition Record Request Form,Business Records Subpoena,Civil Procedure Subpoena Form,California Deposition Record Order,Subpoena for Business Documentation,Production of Business Records Notice,Court Subpoena for Records,Business Records Disclosure - Objections and motions to quash may impact the requirement to produce records.

Ammunition Usage Report,Training Ammunition Statement,Munitions Expenditure Record,Live Fire Consumption Log,Consumption Verification Form,Ammunition Accountability Certificate,Range Activity Reporting Form,Munitions Consumption Declaration,Training - Timely submission of the form is crucial for accounting purposes.

How to Renew Perc Card - Required forms can be downloaded from the IDFPR website, making access to necessary documents straightforward.