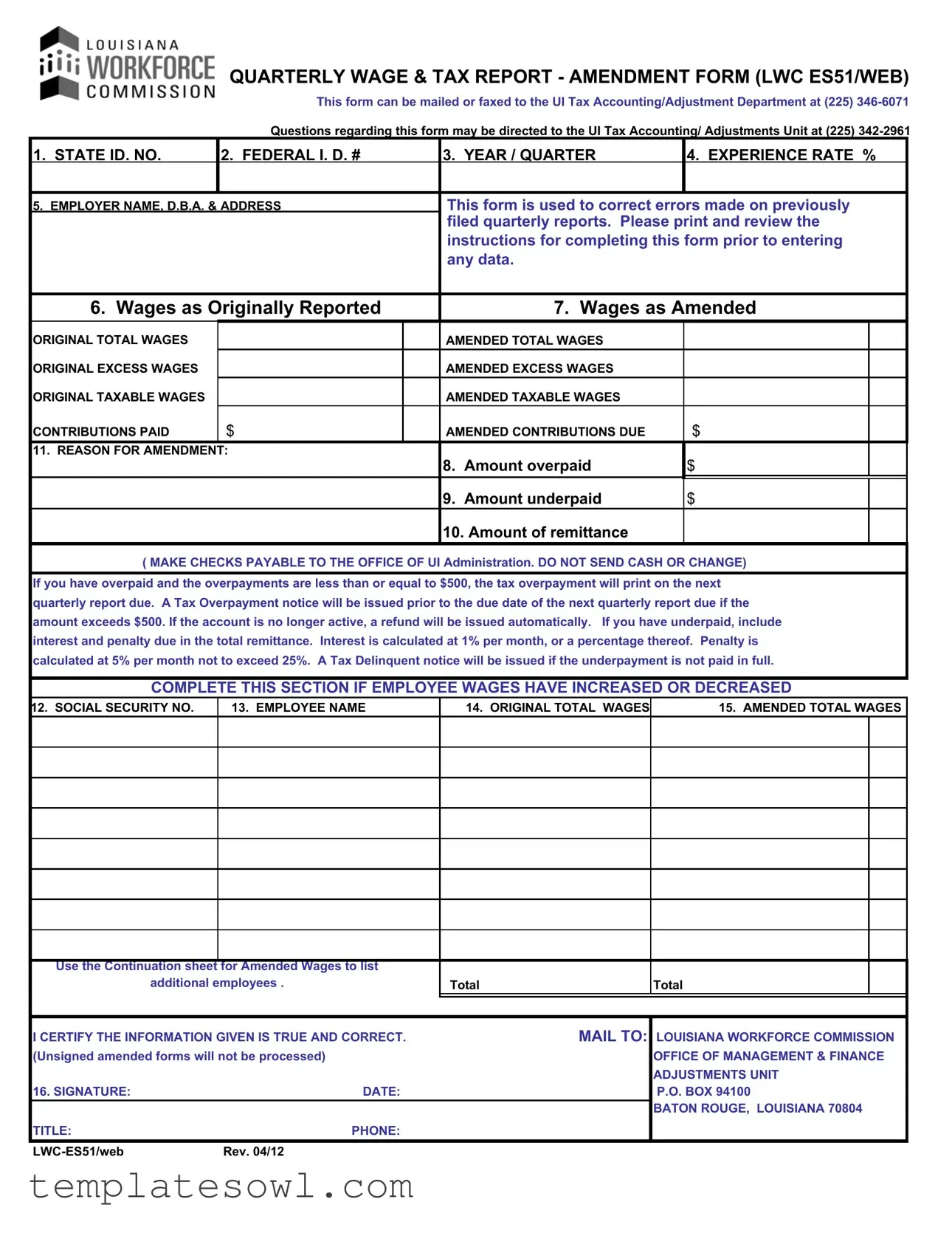

Fill Out Your Lwc Es51 Form

The LWC ES51 form, also referred to as the Quarterly Wage & Tax Report Amendment Form, plays a vital role for employers in Louisiana looking to rectify discrepancies on their previously filed quarterly reports. If mistakes were made regarding wages, taxes, or the employment status of workers, this form provides a structured avenue for amendment. Key elements such as the State ID number, Federal I.D. number, and details about wages—both original and amended—are essential for a complete and accurate submission. Additionally, employers must specify the reason for the changes and provide relevant payment adjustments, especially if there are overpayments or underpayments to account for. Lengthy legal verbs may cloud the process, but the intention is clear: ensure that payroll and tax records accurately reflect the business’s contributions. Upon submission, employers will find that the resolution of any overpayment will be automatically reflected in the next quarterly report, while underpayment issues may necessitate additional calculations for interest and penalties. Understanding the nuances of this form can lead to smoother operations and healthier compliance with state regulations.

Lwc Es51 Example

QUARTERLY WAGE & TAX REPORT - AMENDMENT FORM (LWC ES51/WEB)

This form can be mailed or faxed to the UI Tax Accounting/Adjustment Department at (225)

Questions regarding this form may be directed to the UI Tax Accounting/ Adjustments Unit at (225)

1. STATE ID. NO. |

2. FEDERAL I. D. # |

3. |

YEAR / QUARTER |

4. EXPERIENCE RATE % |

||

|

|

|

|

|

|

|

5. EMPLOYER NAME, D.B.A. & ADDRESS |

This form is used to correct errors made on previously |

|||||

|

|

|

filed quarterly reports. Please print and review the |

|||

|

|

|

instructions for completing this form prior to entering |

|||

|

|

|

any data. |

|

|

|

|

|

|

||||

6. Wages as Originally Reported |

|

7. Wages as Amended |

||||

|

|

|

|

|

|

|

ORIGINAL TOTAL WAGES |

|

|

AMENDED TOTAL WAGES |

|

|

|

ORIGINAL EXCESS WAGES |

|

|

AMENDED EXCESS WAGES |

|

|

|

ORIGINAL TAXABLE WAGES |

|

|

AMENDED TAXABLE WAGES |

|

|

|

CONTRIBUTIONS PAID |

$ |

|

AMENDED CONTRIBUTIONS DUE |

$ |

|

|

11. REASON FOR AMENDMENT: |

|

|

|

|

||

|

|

|

8. |

Amount overpaid |

$ |

|

|

|

|

|

|

|

|

|

|

|

9. |

Amount underpaid |

$ |

|

|

|

|

10. Amount of remittance |

|

|

|

( MAKE CHECKS PAYABLE TO THE OFFICE OF UI Administration. DO NOT SEND CASH OR CHANGE)

If you have overpaid and the overpayments are less than or equal to $500, the tax overpayment will print on the next quarterly report due. A Tax Overpayment notice will be issued prior to the due date of the next quarterly report due if the amount exceeds $500. If the account is no longer active, a refund will be issued automatically. If you have underpaid, include interest and penalty due in the total remittance. Interest is calculated at 1% per month, or a percentage thereof. Penalty is calculated at 5% per month not to exceed 25%. A Tax Delinquent notice will be issued if the underpayment is not paid in full.

COMPLETE THIS SECTION IF EMPLOYEE WAGES HAVE INCREASED OR DECREASED

12. SOCIAL SECURITY NO. |

13. EMPLOYEE NAME |

14. ORIGINAL TOTAL WAGES |

15. AMENDED TOTAL WAGES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use the Continuation sheet for Amended Wages to list |

|

|

|

||

additional employees . |

|

Total |

|

Total |

|

|

|

|

|||

|

|

|

|

|

|

I CERTIFY THE INFORMATION GIVEN IS TRUE AND CORRECT. |

MAIL TO: |

LOUISIANA WORKFORCE COMMISSION |

|||

(Unsigned amended forms will not be processed) |

|

|

|

OFFICE OF MANAGEMENT & FINANCE |

|

|

|

|

|

ADJUSTMENTS UNIT |

|

16. SIGNATURE: |

DATE: |

|

P.O. BOX 94100 |

||

|

|

|

|

BATON ROUGE, LOUISIANA 70804 |

|

TITLE: |

PHONE: |

|

|

|

|

|

|

|

|

|

|

Rev. 04/12 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | QUARTERLY WAGE & TAX REPORT - AMENDMENT FORM (LWC ES51/WEB) |

| Purpose | This form corrects errors on previously filed quarterly reports. |

| Contact for Questions | For inquiries, contact the UI Tax Accounting/Adjustments Unit at (225) 342-2961. |

| Submission Method | The form can be mailed or faxed to the UI Tax Accounting/Adjustment Department at (225) 346-6071. |

| Relevant Information Fields | It includes fields for State ID, Federal ID, year/quarter, employer details, and wage information. |

| Overpayments Handling | If overpaid and the amount is less than or equal to $500, the tax overpayment will be reflected in the next report. |

| Legal Considerations | Interest on underpayments is 1% per month; penalties are 5% per month, not exceeding 25%. |

| Signature Requirement | The form must be signed. Unsigned forms will not be processed. |

| Mailing Address | Mail to: Louisiana Workforce Commission, Office of Management & Finance, Adjustments Unit, P.O. Box 94100, Baton Rouge, Louisiana 70804. |

Guidelines on Utilizing Lwc Es51

The LWC ES51 form is used to amend previously filed quarterly wage and tax reports with the Louisiana Workforce Commission. After completing this form, it can be mailed or faxed to the appropriate department. Ensure all information is accurate and well-checked before submission.

- Obtain the Form: Download or print the LWC ES51 form from the Louisiana Workforce Commission website.

- Fill in State ID Number: Enter your State ID number in the designated field.

- Provide Federal ID Number: Input your Federal ID number.

- Specify Year and Quarter: Indicate the year and quarter the report refers to.

- Enter Experience Rate: Fill in the experience rate percentage.

- Complete Employer Information: Write the employer's name, doing business as (D.B.A), and the business address.

- Report Wages: List wages as originally reported and amended, including total wages and excess wages.

- Complete Contribution Details: Provide the contributions paid and amended contributions due.

- State Reason for Amendment: Clearly indicate the reason for amending the report.

- Enter Payment Information: Include details about any amounts overpaid or underpaid, and specify the total amount of remittance.

- Complete Employee Information: For employees with wage changes, fill out their Social Security number, name, original total wages, and amended total wages.

- Certification: Sign the form to certify that the information is accurate and complete.

- Date the Form: Write the date of completion.

- Provide Title and Phone Number: Add your title and contact number.

- Submit the Form: Send the completed form to the Louisiana Workforce Commission via mail or fax to the provided contacts.

What You Should Know About This Form

What is the purpose of the LWC ES51 form?

The LWC ES51 form, also known as the Quarterly Wage & Tax Report - Amendment Form, is specifically designed to correct errors that may have occurred in previously filed quarterly reports. If an employer discovers inaccuracies in wage reports or tax calculations submitted in prior quarters, they can use this form to amend their records. It helps ensure that wage and tax information is accurate and up-to-date in the Louisiana Workforce Commission's system.

How can I submit the LWC ES51 form?

You can submit the LWC ES51 form either by mail or by fax. If you choose to mail it, send the completed form to the Louisiana Workforce Commission, Office of Management & Finance, Adjustments Unit at P.O. Box 94100, Baton Rouge, Louisiana, 70804. If you prefer faxing, reach the UI Tax Accounting/Adjustment Department at (225) 346-6071. Make sure to check the form for any errors before submission to avoid any delays in processing.

What should I do if I overpaid or underpaid my taxes?

If you have overpaid your taxes, and the amount is $500 or less, the overpaid amount will show up on the next quarterly report. In cases where the overpayment exceeds $500, you will receive a Tax Overpayment notice before the due date of your next report. Conversely, if you underpaid your taxes, you will need to include the interest and penalty with your remittance. Interest is charged at 1% per month, and penalties accumulate at 5% per month, up to a maximum of 25% of the underpaid amount.

What is required for completing the form?

When filling out the LWC ES51 form, it is crucial to provide detailed information accurately. This includes your state ID number, federal ID number, employer name and address, along with the year and quarter for which you are amending the report. You’ll also need to include specific details about wages originally reported versus amended wages. Finally, remember to sign the form as unsound forms will not be processed, and ensure you review all instructions before entering any data.

Common mistakes

Completing the LWC ES51 form can seem straightforward, but mistakes often occur that can delay processing and cause complications. One common mistake is failing to provide the correct state identification number. This number is crucial for accurately identifying the employer's account, and any errors can lead to processing delays. Double-check this information before submitting the form.

Another common error involves the federal identification number. Employers sometimes mix up their state and federal IDs. Before sending the form, ensure both numbers are correctly listed and match your records. Additionally, neglecting to specify the year and quarter can lead to confusion. Correct date representation is critical, as it helps the Louisiana Workforce Commission (LWC) pinpoint the period in question.

Inaccurate wage reporting is a significant mistake that can have financial implications. When filling out both wages as originally reported and amended wages, ensure that they are accurate and reflect the necessary corrections. Another frequent issue arises with the reason for the amendment. Failing to provide a clear and concise reason can hinder the understanding of the form's purpose, leading to further inquiries.

Employers often overlook the requirement to sign the form. Unsigned amended forms will not be processed, which can waste time and resources. Remember to include the signature, date, title, and phone number where you can be reached if there are questions about the submission.

Finally, ensure that payments are appropriately calculated. It's common for individuals to miscalculate overpayments and underpayments. If applicable, include any penalties and interest due in the total remittance. The complexity of these calculations often leads to mistakes. Always double-check figures before submitting the form to ensure all financial obligations are met.

Documents used along the form

The LWC ES51 form, also known as the Quarterly Wage & Tax Report - Amendment Form, is essential for correcting previously reported quarterly wages and taxes. When making amendments, several related documents may be required to ensure compliance and clarity. Here are four important forms and documents often used alongside the LWC ES51.

- Quarterly Wage and Tax Report (LWC ES-1): This form reports the total wages paid and taxes owed by the employer for each quarter. It provides a comprehensive overview of wage data, allowing the employer to document their tax obligations accurately.

- Employee Earnings Record: This internal document tracks an employee’s wages throughout the year. It maintains detailed records of earnings, deductions, and taxes withheld. This data is crucial for both year-end reporting and potential amendments.

- Tax Payment Remittance Form: Employers use this form to submit any payments due on underreported taxes. It includes details about the amounts owed and ensures that payments are processed correctly and promptly.

- Amendment Notice: This document notifies the Louisiana Workforce Commission of any reported changes outside the standard filing timeline. It serves as a formal declaration of amendments and helps maintain accurate records with the state.

Using these forms in conjunction with the LWC ES51 can streamline the amendment process and ensure correct reporting of wages and taxes. Proper documentation aids in compliance and reduces the risk of penalties or notices from state agencies.

Similar forms

- Employer’s Quarterly Federal Tax Return (Form 941): Like the LWC ES51, this form is used by employers to report wages paid and taxes withheld from employees. Both forms require detailed wage information and are filed quarterly, addressing employer compliance with tax laws.

- State Unemployment Insurance Tax Report: This document serves a similar purpose to the LWC ES51. It reports wages and calculates unemployment taxes. Employers amend this report as needed, just like they do for the LWC ES51 when corrections are required.

- Wage and Tax Statement (Form W-2): While primarily used at the end of the year, W-2s and the LWC ES51 are both focused on accurately reporting wages. Any discrepancies in reported wages can lead to amendments on both forms.

- IRS Form 940 (Employer's Annual Federal Unemployment Tax Return): This annual form addresses unemployment taxes at the federal level. The LWC ES51 focuses on state-level corrections, but they both deal with the employer's responsibility to report unemployment contributions.

- State Employment and Training Tax Report: Similar to the LWC ES51, this report is concerned with employment taxes and contributes to funding training programs. Both documents ensure employers remain compliant with their tax obligations.

Each of these documents plays a critical role in ensuring that employers are accurately reporting and amending wage information to meet state and federal requirements.

Dos and Don'ts

When filling out the LWC ES51 form, it's essential to follow specific guidelines to ensure accurate processing. Here are five things to keep in mind.

- Do: Review the instructions carefully before entering any information.

- Do: Ensure all numbers are accurate and match the original report.

- Do: Include all necessary signatures; unsigned forms will not be processed.

- Do: Provide a clear reason for the amendment in the designated section.

- Do: Submit the form

Misconceptions

Here are ten common misconceptions about the LWC ES51 form, the Quarterly Wage & Tax Report Amendment Form, explained in straightforward terms.

- It’s only for large employers. Many believe that only large companies need to use this form. In reality, any employer who files a quarterly wage report can amend it using this form, regardless of size.

- You can submit it by email. Some might think that submission via email is acceptable. However, the form must be mailed or faxed to the appropriate department for processing.

- It’s only used for overpayments. Others may think the form is only necessary when an employer has overpaid. This is incorrect. It is also used to correct underpayments and other errors.

- Filing an amendment guarantees a refund. There’s a misconception that filing the amendment will automatically result in a refund. While refunds can occur for overpayments, various conditions apply, such as the overpayment amount being over $500.

- You can include cash payments. Some employers might think they can send cash with the form. This is not the case. All remittances must be made by check, payable to the Office of UI Administration.

- Certain amendments don’t require a reason. It is mistaken to believe that all amendments can be made without explanation. Each amendment request must include a reason for changes.

- Unsigned forms will still be processed. Some assume that an unsigned form will still get through. Unfortunately, this is not true. Unsigned forms will not be processed at all.

- You can neglect late penalties. It’s a common misunderstanding that if an underpayment is identified, penalties don’t apply. Interest and penalties should be included with the total remittance to avoid additional charges.

- Amending the form can be delayed. Many may think that they can delay amending the form without consequence. Prompt filing is crucial, especially to avoid potential penalties or further complications.

- All changes can be made on the main form. Some individuals believe they can list all employee changes on the main form. For additional employees, a continuation sheet is required to document further wage amendments.

Understanding these misconceptions can help ensure that the amendment process proceeds smoothly and accurately for all employers who need to make changes.

Key takeaways

When working with the LWC ES51 form, it’s essential to maintain accuracy and follow the established procedures. Here are key takeaways to help you navigate the process:

- Purpose of the Form: The LWC ES51 is specifically designed for making corrections to errors in previously filed quarterly wage reports.

- Contact Information: For questions or assistance, you can reach the UI Tax Accounting/Adjustments Unit at (225) 342-2961.

- Filing Options: You have the option to mail or fax the completed form to the UI Tax Accounting/Adjustment Department at (225) 346-6071.

- Complete All Sections: Ensure that all relevant fields are filled out accurately, including the state ID number, federal ID number, and the year/quarter.

- Amended Wages: Carefully differentiate between your originally reported wages and the amended figures to prevent further discrepancies.

- Overpayments and Underpayments: If you have overpaid or underpaid taxes, be sure to enter these amounts. Interest and penalties may apply; interest accumulates at 1% per month and penalties at 5% per month, not exceeding 25%.

- Certification Requirement: The form must be signed and dated by the authenticating party. Forms submitted without a signature will not be processed.

- Document Submission: Send your completed form to the Louisiana Workforce Commission, Office of Management & Finance, Adjustments Unit, P.O. Box 94100, Baton Rouge, Louisiana 70804.

- Using Continuation Sheets: For additional employees with increased or decreased wages, utilize the provided continuation sheet for amended wages.

Understanding these key aspects of the LWC ES51 form can enhance your compliance efforts and streamline the amendment process. Remember, accuracy is paramount to prevent delays or complications.

Browse Other Templates

How to Fill Post Office Saving Account Opening Form Pdf - Standing instructions can be provided, indicating any regular transactions you want managed automatically.

Nj Certified Payroll - The NJ Payroll Certification form includes space to document employee demographics for compliance purposes.

Silverscript Plus - Sign the form to certify urgency if the patient's health is at risk.