Fill Out Your Mcs 90 Form

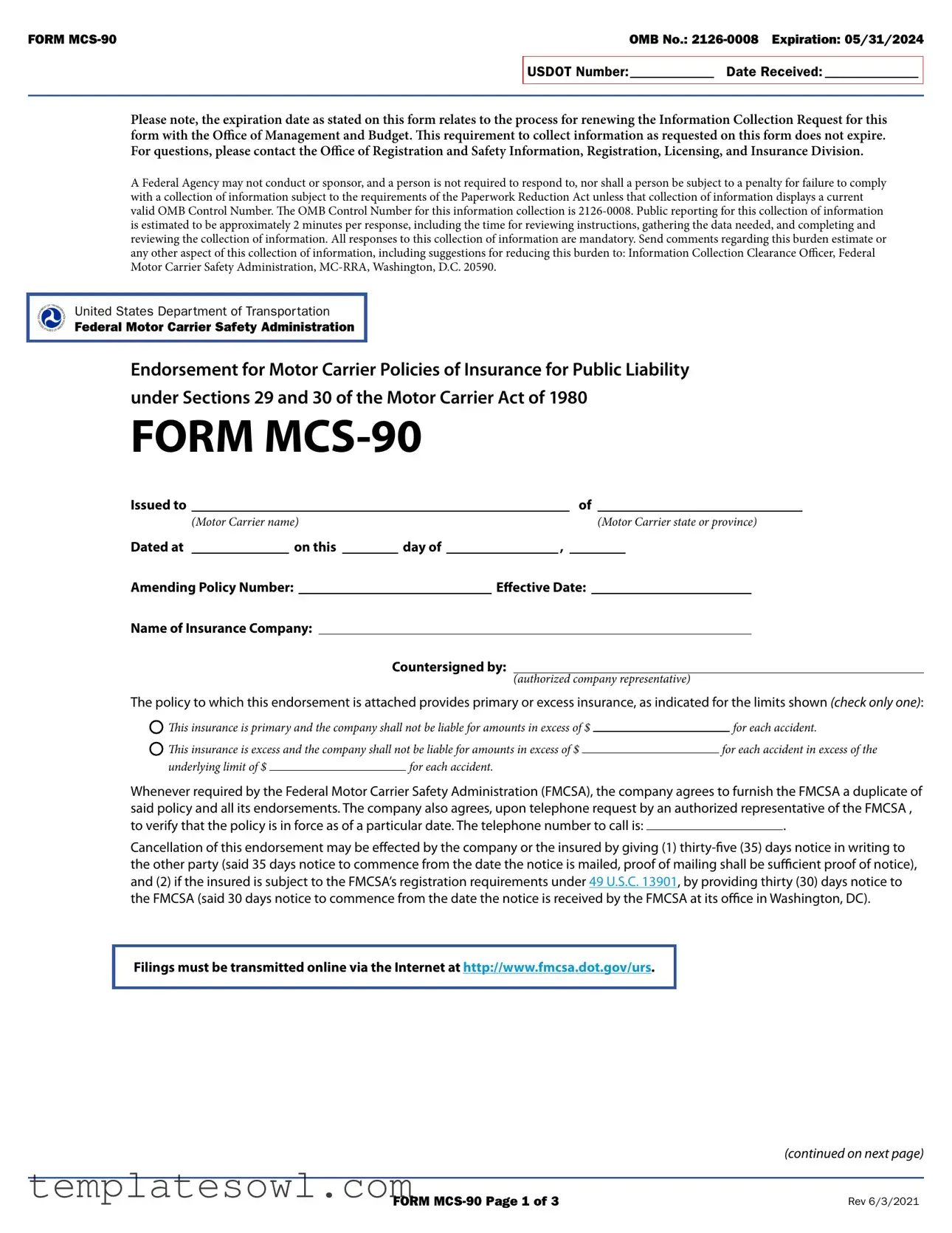

The MCS-90 form plays a crucial role in ensuring that motor carriers comply with federal regulations regarding public liability insurance. This endorsement specifically addresses the requirements outlined in the Motor Carrier Act of 1980, mandating that motor carriers maintain adequate insurance coverage for bodily injury and property damage. While the form itself has an expiration date for the information collection request, it’s important to note that the obligations it enforces do not expire. When completing the MCS-90, carriers must disclose their insurance policy details, including the effective date, the insurance company’s name, and specific limits of liability for different types of cargo and operations. The form delineates between primary and excess insurance, ensuring that all parties clearly understand their coverage. Additionally, the motor carrier must provide this information to the Federal Motor Carrier Safety Administration (FMCSA) when required. With the complexities involved in motor carrier operations and insurance compliance, having the MCS-90 properly filled out and available can offer significant peace of mind and legal protection for carriers operating within the intricate landscape of transportation regulations.

Mcs 90 Example

RM |

OMB No.: |

||||

|

|

|

|

|

|

|

USDOT Number: |

|

Date Received: |

||

|

|

|

|

|

|

|

|

|

|

|

|

Please note, the expiration date as stated on this form relates to the process for renewing the Information Collection Request for this form with the Office of Management and Budget. This requirement to collect information as requested on this form does not expire. For questions, please contact the Office of Registration and Safety Information, Registration, Licensing, and Insurance Division.

A Federal Agency may not conduct or sponsor, and a person is not required to respond to, nor shall a person be subject to a penalty for failure to comply with a collection of information subject to the requirements of the Paperwork Reduction Act unless that collection of information displays a current valid OMB Control Number. The OMB Control Number for this information collection is

United States Department of Transportation

Federal Motor Carrier Safety Administration

Endorsement for Motor Carrier Policies of Insurance for Public Liability under Sections 29 and 30 of the Motor Carrier Act of 1980

FORM

|

Issued to |

|

|

|

|

|

|

|

|

|

|

|

|

|

of |

|

|

|

|

|

|

|

||

(Motor Carrier name) |

|

|

|

|

|

|

|

|

|

Alabama |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Motor Carrier state or province) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alaska |

|

|

|

|

||

|

Dated at |

|

|

|

on this |

|

|

day of |

|

|

|

|

, 2020Alberta |

|

|

|

|

|||||||

12:00 noon |

1st |

|

January |

|

|

|

|

|

|

|

||||||||||||||

|

|

12:15 pm |

|

2nd |

|

|

|

February |

|

|

|

2021American Samoa |

|

|

|

|

||||||||

|

Amending Policy Number: |

|

|

|

|

|

|

Effective Date: |

Arizona |

|

|

|

|

|||||||||||

|

|

12:30 pm |

|

3rd |

|

|

|

March |

|

|

|

2022 |

|

|

|

|

|

|

||||||

|

|

12:45 pm |

|

4th |

|

|

|

April |

|

|

|

|

2023Arkansas |

|

|

|

|

|||||||

|

Name of Insurance Company: |

|

|

|

|

|

|

|

|

|

|

|

|

British Columbia |

|

|

|

|

||||||

|

5th |

|

|

|

May |

|

|

|

2024 |

|

|

|

|

|

|

|||||||||

|

|

1:00 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

1:15 pm |

|

6th |

|

|

|

June |

|

|

|

|

2025California |

|

|

|

|

|||||||

|

|

1:30 pm |

|

7th |

|

|

|

July |

|

|

|

|

|

|

|

Colorado |

|

|

|

|

||||

|

|

1:45 pm |

|

8th |

Countersigned by: |

|

|

|

|

|

|

Connecticut |

|

|

|

|

||||||||

|

|

|

|

|

|

August |

|

(authorized company representative) |

|

|

|

|

||||||||||||

|

|

2:00 pm |

|

9th |

|

|

|

September |

|

|

|

|

Delaware |

|

|

|

|

|||||||

|

The policy to which this endorsement is attached provides primary or excess insurance, as indicated for the limits shown (check only one): |

|||||||||||||||||||||||

|

|

2:15 pm |

|

10th |

|

|

|

October |

|

|

|

|

|

|

District of Columbia |

|||||||||

|

This insurance is primary and the company shall not be liable for amounts in excess of $ |

|

Florida |

|

for each accident. |

|||||||||||||||||||

|

|

2:30 pm |

|

11th |

|

|

|

November |

|

|

|

|

Georgia |

|

|

|

|

|||||||

|

This insurance is excess and the company shall not be liable for a ounts in excess of $ |

|

|

for each accident in excess of the |

||||||||||||||||||||

|

|

2:45 pm |

|

12th |

|

|

|

December |

|

|

|

|

Guam |

|

|

|

|

|||||||

|

underlying li it of $ |

|

|

|

|

|

|

for each accident. |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

3:00 pm |

|

13th |

|

|

|

|

|

|

|

|

|

|

|

Hawaii |

|

|

|

|

||||

|

|

3:15 pm |

|

14th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Whenever required by the Federal Motor Carrier Safety Administration (FMCSA), the c mpany agrees to furnish the FMCSA a duplicate of |

|||||||||||||||||||||||

|

|

3:30 pm |

|

15th |

|

|

|

|

|

|

|

|

|

|

|

Idaho |

|

|

|

|

||||

|

said policy and all its endorsements. The company also agrees, upon telephone request by an authorized representative of the FMCSA , |

|||||||||||||||||||||||

|

|

3:45 pm |

|

16th |

|

|

|

|

|

|

|

|

|

|

|

Illinois |

|

|

|

|

||||

|

to verify that the policy is in force as of a particular date. The telephone number to call is: |

|

|

|

|

. |

|

|||||||||||||||||

|

|

4:00 pm |

|

17th |

|

|

|

|

|

|

|

|

|

|

|

Indiana |

|

|

|

|

|

|

||

|

Cancellation of this endorsement may be effected by the company or the insuredIowaby giving (1) |

|||||||||||||||||||||||

|

|

4:15 pm |

|

18th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

the other party (said 35 days notice to commence from the date the notice is mailed,Kansasproof of mailing shall be sufficient proof of notice), |

|||||||||||||||||||||||

|

|

4:30 pm |

|

19th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

and (2) if the insured is subject to the FMCSA’s registration requirements under 49KentuckyU.S.C. 13901, by providing thirty (30) days notice to |

|||||||||||||||||||||||

|

|

4:45 pm |

|

20th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

the FMCSA (said 30 days notice to commence from the date the notice is receivedLouisianaby the FMCSA at its office in Washington, DC). |

|||||||||||||||||||||||

|

|

5:00 pm |

|

21st |

|

|

|

|

|

|

|

|

|

|

|

Maine |

|

|

|

|

||||

|

|

5:15 pm |

|

22nd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manitoba |

|

|

|

|

||||||

|

|

5:30 pm |

|

23rd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marshall Islands |

|

|

|

|

||||||

|

|

5:45 pm |

|

24th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Filings must be transmitted online via the Internet at http://www.fmcsa.dot.gov/ursMaryland. |

|

|

|

|

|||||||||||||||||||

|

|

6:00 pm |

|

25th |

|

|

|

|

|

|

|

|

|

|

|

Massachusetts |

|

|

|

|

|

|||

|

|

6:15 pm |

|

26th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michigan |

|

|

|

|

||||||

|

|

6:30 pm |

|

27th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Micronesia |

|

|

|

|

||||||

|

|

6:45 pm |

|

28th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota |

|

|

|

|

||||||

|

|

7:00 pm |

|

29th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mississippi |

|

|

|

|

||||||

|

|

7:15 pm |

|

30th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Missouri |

|

|

|

|

||||||

|

|

7:30 pm |

|

31st |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Montana |

|

|

|

|

||||||

|

|

7:45 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska |

|

|

|

|

|||||

|

|

8:00 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada |

|

|

|

|

|||||

|

|

8:15 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Brunswick |

|

|

|

|

|||||

|

|

8:30 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(continued on next page) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Hampshire |

|

|

|||||||

|

|

8:45 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey |

|

|

|

|

|||||

|

|

9:00 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Mexico |

|

|

|

|

|||||

|

|

9:15 pm |

|

|

FORM |

|

|

|

|

|

|

|

Rev 6/3/2021 |

|||||||||||

|

|

|

|

|

|

|

|

New York |

|

|

|

|||||||||||||

|

|

9:30 pm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

9:45 pm |

Newfoundland and Labrador |

RM |

OMB No.: |

|

|

DEFINITIONS AS USED IN THIS ENDORSEMENT

Accident includes continuous or repeated exposure to conditions or which results in bodily injury, property damage, or environmental damage which the insured neither expected nor intended.

Motor Vehicle means a land vehicle, machine, truck, tractor, trailer, or semitrailer propelled or drawn by mechanical power and used on a highway for transporting property, or any combination thereof.

Bodily Injury means injury to the body, sickness, or disease to any person, including death resulting from any of these.

Property Damage means damage to or loss of use of tangible property.

The insurance policy to which this endorsement is attached provides automobile liability insurance and is amended to assure compliance by the insured, within the limits stated herein, as a motor carrier of property, with Sections 29 and 30 of the Motor Carrier Act of 1980 and the rules and regulations of the Federal Motor Carrier Safety Administration (FMCSA).

In consideration of the premium stated in the policy to which this endorsement is attached, the insurer (the company) agrees to pay, within the limits of liability described herein, any final judgment recovered against the insured for public liability resulting from negligence in the operation, maintenance or use of motor vehicles subject to the financial responsibility requirements of Sections

29 and 30 of the Motor Carrier Act of 1980 regardless of whether or not each motor vehicle is specifically described in the policy and whether or not such negligence occurs on any route or in any territory authorized to be served by the insured or elsewhere. Such insurance as is afforded, for public liability, does not apply to injury to or death of the insured’s employees while engaged in the course of their employment, or property transported by the insured, designated as cargo. It is understood and agreed that no condition, provision, stipulation, or limitation contained in the policy, this endorsement, or any other endorsement thereon,

Environmental Restoration means restitution for the loss, damage, or destruction of natural resources arising out of the accidental discharge, dispersal, release or escape into or upon the land, atmosphere, watercourse, or body of water, of any commodity transported by a motor carrier. This shall include the cost of removal and the cost of necessary measures taken to minimize or mitigate damage to human health, the natural environment, fish, shellfish, and wildlife.

Public Liability means liability for bodily injury, property damage, and environmental restoration.

or violation thereof, shall relieve the company from liability or from the payment of any final judgment, within the limits of liability herein described, irrespective of the financial condition, insolvency or bankruptcy of the insured. However, all terms, conditions, and limitations in the policy to which the endorsement is attached shall remain in full force and effect as binding between the insured and the company. The insured agrees to reimburse the company for any payment made by the company on account of any accident, claim, or suit involving a breach of the terms of the policy, and for any payment that the company would not have been obligated to make under the provisions of the policy except for the agreement contained in this endorsement.

It is further understood and agreed that, upon failure of the company to pay any final judgment recovered against the insured as provided herein, the judgment creditor may maintain an action in any court of competent jurisdiction against the company to compel such payment.

The limits of the company’s liability for the amounts prescribed in this endorsement apply separately to each accident and any payment under the policy because of anyone accident shall not operate to reduce the liability of the company for the payment of final judgments resulting from any other accident.

(continued on next page)

FORM

RM |

OMB No.: |

|

|

SCHEDULE OF LIMITS — PUBLIC LIABILITY

Type of carriage |

Commodity transported |

January 1, 1985 |

|

|

|

(1) |

Property (nonhazardous) |

$750,000 |

gross vehicle weight rating of 10,001 or more pounds). |

|

|

(2)

Hazardous substances, as defined in 49 CFR 171.8, |

$5,000,000 |

transported in cargo tanks, portable tanks, or hopper- type vehicles with capacities in excess of 3,500 water gallons; or in bulk Division 1.1, 1.2, and 1.3 materials, Division 2.3, Hazard Zone A, or Division 6.1, Packing Group I, Hazard Zone A material; in bulk Division 2.1 or 2.2; or highway route controlled quantities of a Class 7 material, as defined in 49 CFR 173.403.

(3) |

Oil listed in 49 CFR 172.101; hazardous waste, |

$1,000,000 |

commerce, in any quantity; or in intrastate commerce, |

hazardous materials, and hazardous substances |

|

in bulk only; with a gross vehicle weight rating of |

defined in 49 CFR 171.8 and listed in 49 CFR 172.101, |

|

10,001 or more pounds). |

but not mentioned in (2) above or (4) below. |

|

|

|

|

(4) |

Any quantity of Division 1.1, 1.2, or 1.3 material; any |

$5,000,000 |

commerce, with a gross vehicle weight rating of less |

quantity of a Division 2.3, Hazard Zone A, or Division |

|

than 10,001 pounds). |

6.1, Packing Group I, Hazard Zone A material; or |

|

|

highway route controlled quantities of a Class 7 |

|

|

material as defined in 49 CFR 173.403. |

|

*The schedule of limits shown does not provide coverage. The limits shown in the schedule are for information purposes only.

FORM

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The MCS-90 form serves as an endorsement to insurance policies for motor carriers, ensuring compliance with public liability insurance requirements under federal law. |

| Governing Law | This form is governed by the Motor Carrier Act of 1980, specifically Sections 29 and 30, which outline financial responsibility standards. |

| Information Collection | Responses to the information collection on this form are mandatory and not contingent on the expiration of the form itself, which is valid until May 31, 2024. |

| Insurance Coverage | The form indicates whether the insurance provided is primary or excess. This distinction affects the insurer's liability limits in the event of an accident. |

| Accident Definition | An accident includes both intentional and unintentional damages that result in bodily injury or property damage, as defined under the terms of the endorsement. |

| Cancellation Notice | Cancellation of the MCS-90 endorsement requires a written notice of 35 days to the other party and 30 days to the FMCSA, ensuring due process for both the insured and the insurer. |

| Reporting Burden | Public reporting for this endorsement is estimated to take approximately 2 minutes per response, facilitating quick compliance with federal guidelines. |

Guidelines on Utilizing Mcs 90

Completing the MCS-90 form is essential for motor carriers to demonstrate compliance with federal insurance requirements under the Motor Carrier Act. It is crucial to provide accurate information to avoid potential penalties. Follow these steps to ensure the form is filled out correctly.

- Begin by entering the USDOT Number in the designated field. This number is unique to your motor carrier operations.

- Fill in the date received to indicate when the form was submitted.

- In the line labeled 'Issued to', write the name of the motor carrier.

- Specify the state or province where the motor carrier operates.

- Provide the date on which the form is being filled out.

- Write the name of the insurance company that is providing the coverage.

- Indicate the effective date of the insurance policy on the form.

- Check the box to specify whether the insurance is primary or excess. Only check one box.

- Leave space for the authorized company representative's signature and date.

- Ensure that all information is reviewed for accuracy before submission.

- Transmit the completed MCS-90 form online via the FMCSA website.

Upon submission, you will receive a confirmation. Retain a copy for your records, as it is important to keep documentation of compliance with the federal requirements.

What You Should Know About This Form

What is the purpose of the MCS-90 form?

The MCS-90 form serves as an endorsement for motor carrier insurance policies. It is required for motor carriers operating under the regulations set forth by the Federal Motor Carrier Safety Administration (FMCSA). This form ensures that a motor carrier has sufficient public liability insurance coverage, as mandated by Sections 29 and 30 of the Motor Carrier Act of 1980. Essentially, it provides assurance that the carrier can manage claims for bodily injury, property damage, and environmental restoration resulting from accidents involving their vehicles.

Who must complete the MCS-90 form?

The MCS-90 form must be completed by insurance companies that provide liability coverage for motor carriers. It is also essential for motor carriers themselves, who must ensure the endorsement is attached to their policies. This form primarily applies to carriers engaged in for-hire and private transport, particularly those operating vehicles with a gross vehicle weight rating of 10,001 pounds or more. Thus, both the motor carrier and the insurer have responsibilities involving this documentation.

What kind of coverage does the MCS-90 form guarantee?

The MCS-90 guarantees coverage for public liability, including bodily injury, property damage, and costs associated with environmental restoration resulting from accidents. There are specific limits for different types of carriage, depending on the kind of goods transported and whether they are hazardous. The limits stated in the form are crucial, as they define the insurance company's liability in the event of an accident. However, it is important to note that this form does not cover injuries or damages to the insured's employees or any property considered as cargo.

Is there an expiration date for the MCS-90 form?

The MCS-90 form itself does not expire; however, the corresponding OMB control number on the form has an expiration date for administrative purposes. This means that while the requirement to maintain insurance coverage and submit the form remains active, the actual administrative processing for the form may evolve. The current expiration date associated with the OMB number is indicated as May 31, 2024, but insurance policies and their endorsements must be kept up-to-date regardless of this date.

What happens if a motor carrier needs to cancel their insurance coverage under the MCS-90?

If a motor carrier wishes to cancel their insurance coverage, the company or the insured must provide written notice. For cancellation to be effective, a notice period of thirty-five (35) days is required. Additionally, if the insured is subject to FMCSA registration requirements, they must also notify the FMCSA with a thirty (30) day notice. This process ensures that proper notification is observed, thereby upholding compliance with federal regulations.

How is the MCS-90 form submitted?

The MCS-90 form must be submitted online through the FMCSA’s website. This streamlined process enhances efficiency, allowing for quicker access and processing of motor carrier insurance forms. It is important for both motor carriers and insurance companies to utilize the appropriate platform for submissions to avoid delays in compliance with federal requirements.

Common mistakes

When completing the MCS-90 form, there are several common mistakes that can lead to delays or complications. Here are eight notable errors to avoid.

One frequent mistake is failing to include the correct USDOT Number. This number is crucial for identification and tracking purposes. Ensure that the number you provide matches the record in the Federal Motor Carrier Safety Administration's database. An incorrect number can result in confusion or processing delays.

Another common error involves the policy effective date. The effective date should reflect when the insurance coverage begins. Leaving this blank or inputting the wrong date can lead to complications in proving coverage at the time of an accident.

A third mistake is not properly indicating the type of insurance coverage being provided in the endorsement. This section requires you to clearly check whether the insurance is primary or excess. Misunderstanding this can create significant liability issues down the line.

People often forget to enter the name of the insurance company accurately. Leaving this field incomplete or misspelling the name can result in the insurance not being recognized during critical times, such as during an accident investigation.

Many applicants also neglect the section requiring the signature of an authorized representative. This signature is essential for validating the document. Without it, the endorsement may be considered incomplete and unenforceable.

Another mistake involves not reviewing the completion instructions before submission. The form can be complex, and omitting a key piece of information might result in rejection. Always read through the instructions carefully to ensure complete accuracy.

A seventh issue arises when applicants provide outdated information. The expiration date of the insurance policy or endorsements may change. Always double-check to make sure all details are current and relevant at the time of filling out the form.

Lastly, applicants sometimes neglect to retain a copy of the completed MCS-90 form. Keeping a copy for your records can ease issues in the future and serves as proof of compliance with federal requirements.

Avoiding these mistakes can streamline the submission process and ensure compliance with federal regulations.

Documents used along the form

The MCS-90 form is an essential document for motor carriers that provides proof of liability insurance under the Motor Carrier Act. It is typically used alongside several other forms to ensure compliance with federal regulations governing the transportation of goods. Understanding these associated documents can streamline the registration process and help maintain proper insurance coverage.

- Certificate of Insurance (COI): This document provides evidence of insurance coverage for a specific vehicle or transportation operation. It includes details such as policy limits, coverage types, and the named insured. A COI is often requested by shippers or other parties requiring proof of coverage before engaging in transport services.

- Form BMC-91: This form is known as the Motor Carrier Cargo Insurance Form. It demonstrates that a motor carrier has the necessary cargo insurance coverage required under federal regulations. It’s important for protecting the interests of shippers by covering cargo loss or damage during transportation.

- Form BMC-34: This is a Broker's Surety Bond. Required for freight brokers, this form ensures that the broker keeps the interests of clients and carriers secure. It helps protect against financial losses resulting from the broker's failure to pay carriers or abide by contractual agreements.

- Form MCS-82: This is the Motor Carrier and Freight Forwarder Registration Form. Carriers use this form to register with the Federal Motor Carrier Safety Administration (FMCSA). Proper registration is a key legal requirement for operating as a motor carrier in interstate commerce.

- Form MC-150: This is the Motor Carrier Identification Report. It's needed for creating or updating a motor carrier's USDOT number. The information provided changes from time to time, ensuring compliance with regulatory requirements and improved safety standards.

These documents, used alongside the MCS-90 form, help create a complete framework for compliance with transportation regulations. Properly managing and submitting these forms will ensure operational stability and legal coverage within the freight transportation industry.

Similar forms

The MCS-90 form is an important document related to motor carrier insurance, but there are several other forms that serve similar purposes in the realm of transportation and insurance. Each of these forms addresses different aspects of liability and compliance. Here are four documents that are comparable to the MCS-90:

- Form BMC-91: This is a similar form used by motor carriers that specifically pertains to the federal filing of proof of insurance. It provides evidence that a carrier has liability coverage that meets federal requirements under the Motor Carrier Act. Unlike the MCS-90, which serves as an endorsement, the BMC-91 serves as a standalone proof of insurance documentation.

- Form BMC-91X: Like the BMC-91, this form is used for motor carriers but serves as an alternative form for filing financial responsibility for a one-time shipment. This document outlines financial liability in a more variable manner, allowing for more flexibility in certain situations. Both forms aim to ensure compliance with federal regulations but cater to different operational contexts.

- Form MC-500: This document is a certificate of insurance used for filing proof of insurance and providing verification to the Federal Motor Carrier Safety Administration (FMCSA). It is comparable to the MCS-90 in that it details insurance coverage but may be utilized in different filing scenarios, often simplifying the verification process for carriers.

- Form MCS-150: This is a Motor Carrier Identification Report required for all motor carriers operating in interstate commerce. While the MCS-90 focuses on insurance liability, the MCS-150 includes information about the carrier's operational status and safety records. Both forms are essential to comply with federal regulations and ensure that the motor carrier is financially responsible.

Dos and Don'ts

When filling out the MCS-90 form, there are some important dos and don'ts to keep in mind.

- Do read the instructions carefully before starting.

- Do provide accurate information about the motor carrier.

- Do check that your USDOT number is correct.

- Do ensure that the insurance policy number is correctly filled in.

- Do sign the form as required.

- Don’t leave any required fields blank.

- Don’t provide false information on the form.

- Don’t forget to keep a copy of the completed form for your records.

- Don’t submit the form without verifying all entries for accuracy.

Misconceptions

- Misconception 1: The MCS-90 form is a regular insurance policy.

- Misconception 2: The MCS-90 form only applies to for-hire carriers.

- Misconception 3: Completing the MCS-90 form is optional.

- Misconception 4: Insurance coverage under the MCS-90 is unlimited.

- Misconception 5: The MCS-90 form covers all types of liability.

- Misconception 6: The MCS-90 form expires with the insurance policy.

- Misconception 7: Changes in insurance policies do not require filing a new MCS-90.

The MCS-90 form is actually an endorsement that attaches to a primary insurance policy. It acts as proof that certain financial responsibility requirements are met according to federal regulations.

This form also applies to private carriers under specific conditions. If a private carrier is involved in interstate commerce and meets particular vehicle weight ratings, the MCS-90 endorsement becomes necessary.

In reality, filing the MCS-90 form is a federal requirement for commercial vehicles operating in interstate commerce. Non-compliance can result in penalties and inability to operate legally.

The MCS-90 specifies certain limits on liability coverage. Although it does provide substantial coverage, the amount can vary based on the type of cargo and vehicle weights involved.

This form primarily addresses public liability, which includes bodily injury, property damage, and environmental restoration. It does not cover injuries to the insured's employees or damage to the insured's own cargo.

The MCS-90 does not expire in the same way that regular insurance policies do. It remains valid as long as the underlying insurance policy is in force and meets federal regulations.

Whenever there are significant changes to the insurance policy, such as amendments or changes in coverage limits, it is necessary to submit a revised MCS-90 form to reflect these updates. Failing to do so can lead to compliance issues.

Key takeaways

Filling out the MCS-90 form is a crucial step for motor carriers. It serves as an endorsement for insurance policies related to public liability. Below are key takeaways to consider when using this form:

- Mandatory Requirement: All motor carriers operating in the U.S. are required to fill out this form as part of their insurance policies for public liability.

- Primary or Excess Coverage: The insurance policy must indicate whether it provides primary or excess coverage for public liability.

- Notification of Cancellation: If an insurance policy is canceled, the insurer must notify the FMCSA and the insured with sufficient notice—35 days for the other party and 30 days for FMCSA.

- Accurate Information: Ensure that all fields, including the motor carrier's name, insurance company, and effective dates, are filled out accurately.

- Policy Limits: Be aware of the specific liability limits associated with the type of carriage being conducted.

- Two-Minute Estimate: Completing the MCS-90 typically takes about two minutes, which includes reviewing instructions and gathering necessary data.

- Duplicate Submission: The insurer must submit a duplicate of the policy and any endorsements to the FMCSA when requested.

- State Compliance: This form must adhere to federal regulations, but states may have additional requirements for motor carrier insurance.

- Environmental Liability: The policy also covers liability for environmental restoration, which includes costs associated with damages from hazardous materials.

- Legal Action: If the insurance company fails to pay a judgment, the injured party may sue the company to compel payment, ensuring accountability in case of negligence.

By understanding these takeaways, motor carriers can navigate the MCS-90 form more effectively and ensure compliance with federal regulations.

Browse Other Templates

Sysco Shop Portal - Detail the nature of any specialized services you require from Sysco.

Mi Tierra Coffee - Include ending pay and the supervisor's name from your last job.