Fill Out Your Md 656 Form

The MD 656 form serves as an essential document for taxpayers in Maryland seeking to settle tax liabilities through the Offer in Compromise program. This form provides individuals and businesses with the opportunity to propose a payment plan to the Comptroller of Maryland, allowing them to potentially resolve their tax debts under more favorable terms. Included in the form are several key components, such as the taxpayer's name, address, and Social Security numbers, which are necessary for identification purposes. It addresses various reasons for submission, such as doubt regarding the liability owed, insufficient resources to pay the full amount, or exceptional circumstances that pose economic hardship. Taxpayers must specify the types of taxes involved, including Income Tax, Sales and Use Tax, and others, along with the corresponding tax periods. As part of the submission process, individuals must articulate their reasoning in detail and provide supporting financial documentation, ensuring the Comptroller can make an informed decision. Furthermore, the form outlines important conditions, including a waiver of the right to contest tax liabilities once accepted, thereby underscoring the necessity for careful consideration before submission. Overall, the MD 656 form acts as a pivotal instrument for taxpayers aiming to navigate their tax obligations more effectively.

Md 656 Example

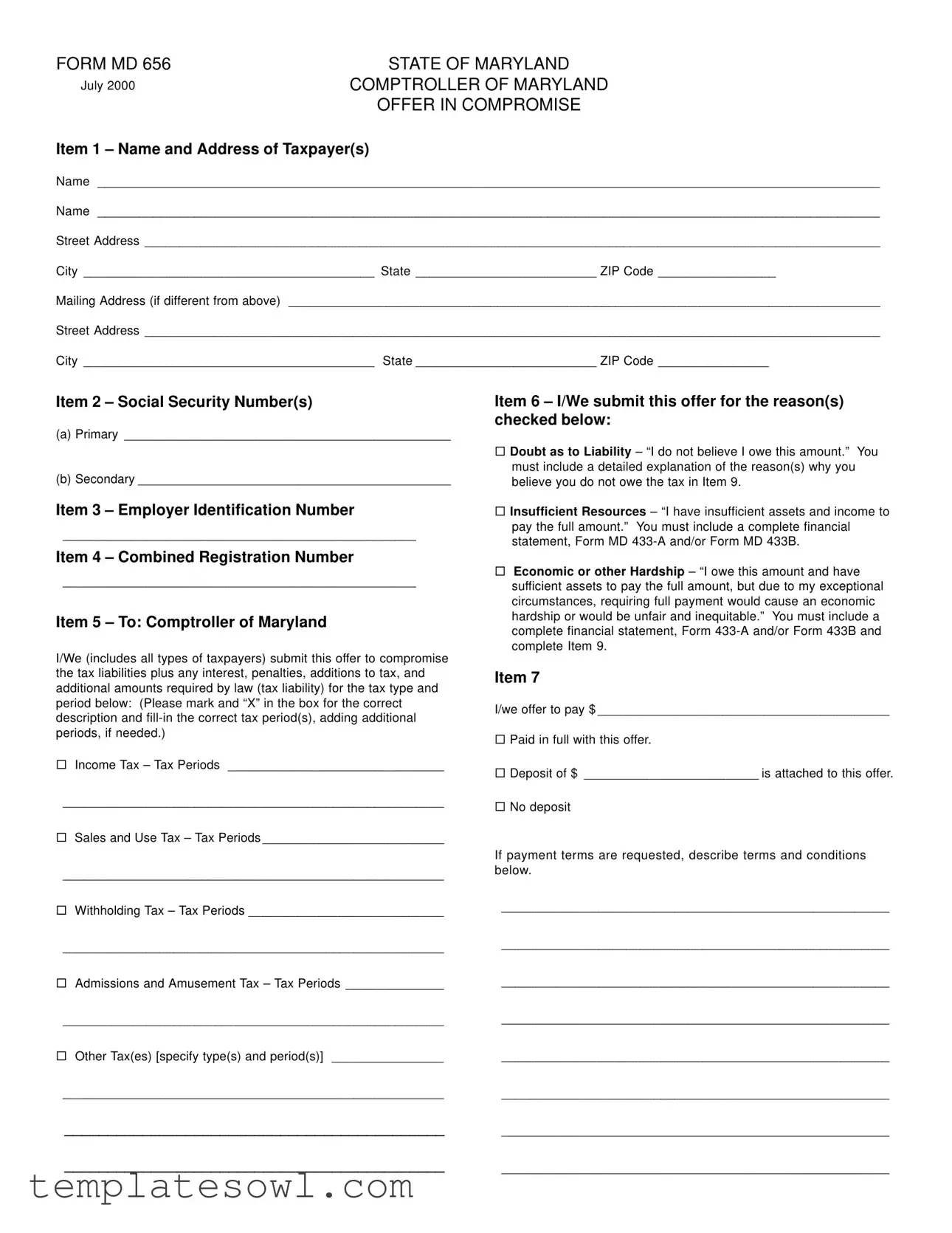

FORM MD 656 |

STATE OF MARYLAND |

July 2000 |

COMPTROLLER OF MARYLAND |

|

OFFER IN COMPROMISE |

Item 1 – Name and Address of Taxpayer(s)

Name _________________________________________________________________________________________________________________

Name _________________________________________________________________________________________________________________

Street Address __________________________________________________________________________________________________________

City __________________________________________ State __________________________ ZIP Code _________________

Mailing Address (if different from above) _____________________________________________________________________________________

Street Address __________________________________________________________________________________________________________

City __________________________________________ State __________________________ ZIP Code ________________

Item 2 – Social Security Number(s)

(a)Primary _______________________________________________

(b)Secondary _____________________________________________

Item 3 – Employer Identification Number

___________________________________________________

Item 6 – I/We submit this offer for the reason(s) checked below:

!Doubt as to Liability – “I do not believe I owe this amount.” You must include a detailed explanation of the reason(s) why you believe you do not owe the tax in Item 9.

!Insufficient Resources – “I have insufficient assets and income to pay the full amount.” You must include a complete financial statement, Form MD

Item 4 – Combined Registration Number

___________________________________________________

Item 5 – To: Comptroller of Maryland

I/We (includes all types of taxpayers) submit this offer to compromise the tax liabilities plus any interest, penalties, additions to tax, and additional amounts required by law (tax liability) for the tax type and period below: (Please mark and “X” in the box for the correct description and

!Income Tax – Tax Periods _______________________________

_______________________________________________________

!Sales and Use Tax – Tax Periods __________________________

_______________________________________________________

!Withholding Tax – Tax Periods ____________________________

_______________________________________________________

!Admissions and Amusement Tax – Tax Periods ______________

_______________________________________________________

!Other Tax(es) [specify type(s) and period(s)] ________________

_______________________________________________________

____________________________________________

____________________________________________

!Economic or other Hardship – “I owe this amount and have sufficient assets to pay the full amount, but due to my exceptional circumstances, requiring full payment would cause an economic hardship or would be unfair and inequitable.” You must include a complete financial statement, Form

Item 7

I/we offer to pay $ __________________________________________

!Paid in full with this offer.

!Deposit of $ _________________________ is attached to this offer.

!No deposit

If payment terms are requested, describe terms and conditions below.

________________________________________________________

________________________________________________________

________________________________________________________

________________________________________________________

________________________________________________________

________________________________________________________

________________________________________________________

________________________________________________________

Item 8 – By submitting this offer, I/we understand and agree to the following conditions:

(a)I/we voluntarily submit all payments made on this offer.

(b)Comptroller of Maryland will apply payments made under the terms of this agreement in the best interests of the state.

(c)If the Comptroller of Maryland rejects the offer or I/we withdraw the offer, Comptroller of Maryland will return any amount paid with the offer. If I/ we agree in writing, Comptroller of Maryland will apply the amount paid with the offer to the amount owed. If I/we agree to apply the payment, the date the offer is rejected or withdrawn will be considered the date of payment. I/we understand that the Comptroller of Maryland will not pay interest on any amount I/we submit with the offer.

(d)Comptroller of Maryland will keep all payments and credits made, received, or applied to the amount being compromised before this offer was submitted. Comptroller of Maryland will also keep any payments made under the terms of an installment agreement while this offer is pending.

(e)I/we understand that I/we remain responsible for the full amount of the tax liability unless the Comptroller of Maryland accepts the offer in writing and I/we have met all the terms and conditions of this offer.

(f)Once Comptroller of Maryland accepts the offer in writing, I/we waive the right to contest, in court or otherwise, the amount of the tax liability.

(g)If I/we fail to meet any of the terms and conditions of the offer, the offer is in default, and the Comptroller of Maryland may:

(i)immediately file suit or levy to collect the entire unpaid balance of the offer, without further notice of any kind;

(ii)immediately file suit or levy to collect the original amount of the tax liability, without further notice of any kind.

If I/we fail to comply with all provisions of state law relating to filing my/our returns and paying my/our required taxes for three (3) years from the date Comptroller of Maryland accepts the offer, the Comptroller of Maryland may treat the offer as defaulted and reinstate the unpaid balance. The Comptroller of Maryland will continue to add interest, as required by law, on the amount the Comptroller of Maryland determines is due after default. The Comptroller of Maryland will add interest from the date the offer is defaulted until I/we completely satisfy the amount owed.

Item 9 – Explanation of Circumstances

I am requesting an offer in compromise for the reason(s) listed below:

Note: If you are requesting compromise based on doubt as to liability, explain why you don’t believe you owe the tax. If you believe you have special circumstances affecting your ability to fully pay the amount due, explain your situation. You may attach additional sheets if necessary.

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________

The within offer in compromise is accepted.

Under penalties of perjury, I declare that I have examined this offer, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of Tax Administrator |

Signature of Taxpayer proponent |

Date |

|

|

Date |

Signature of Taxpayer proponent |

Date |

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Md 656 form allows taxpayers in Maryland to submit an offer in compromise to resolve their tax liabilities, including any interest and penalties. |

| Eligibility | Individuals and entities can use this form if they believe they owe less in taxes than assessed, have insufficient resources, or face economic hardship. |

| Submission Conditions | By submitting the Md 656, taxpayers agree to terms that include acceptance by the Comptroller and limits on contesting the tax liability. |

| Governing Laws | This form is governed by Maryland state tax laws, including the Maryland Code for Taxation. |

Guidelines on Utilizing Md 656

After completing the MD 656 form, you'll need to submit it to the Comptroller of Maryland for review. They will assess the information and determine if they can accept your offer in compromise. Here's a simple guide to help you fill out the form correctly.

- Provide your name and address. Fill in your first name, last name, and any other relevant names in the designated areas. Include your street address, city, state, and ZIP code. If you have a different mailing address, fill that in as well.

- Add Social Security Numbers. Enter the primary and secondary Social Security numbers where indicated.

- List your Employer Identification Number. Write your EIN in the provided space.

- Complete the registration number. If you have a combined registration number, fill it in here.

- Specify why you are submitting the offer. Check the appropriate box for either doubt as to liability, insufficient resources, economic or other hardship, or other reasons. Remember to provide any required additional information or documentation specified.

- Identify the tax type and periods. Mark an "X" in the box for the tax type you are addressing, such as income tax or sales and use tax, and indicate the relevant tax periods.

- State your offer amount. Clearly state the dollar amount you are offering to pay.

- Indicate payment options. Decide if you will pay in full with the offer or if you are attaching a deposit. Specify any terms if you are requesting payment terms.

- Read and understand the conditions. Review the conditions provided to ensure you understand your responsibilities and the implications of your offer.

- Explain your circumstances. In Item 9, provide a detailed explanation of your situation, outlining why you believe your offer is justified. If needed, attach extra sheets.

- Sign and date the form. Ensure to sign where required and include the date.

What You Should Know About This Form

What is Form MD 656 and who should use it?

Form MD 656 is the Offer in Compromise form used by taxpayers in Maryland who wish to settle their tax liabilities with the state for less than the full amount owed. It is intended for individuals or entities facing financial difficulties or disputes regarding the amount of taxes owed. By submitting this form, taxpayers can propose a reduced payment based on their current financial situation or contest the liability itself.

What are the reasons I can submit an Offer in Compromise?

There are three primary reasons taxpayers may submit an Offer in Compromise using Form MD 656. First, you might have "Doubt as to Liability," which means you believe you do not owe the tax due to specific reasons, requiring a detailed explanation. Second, if you have "Insufficient Resources," you can demonstrate that your financial situation does not allow you to pay the full amount. Lastly, "Economic or Other Hardship" indicates that even though you can technically pay, doing so would impose an unfair burden on you due to exceptional circumstances.

What information do I need to provide on Form MD 656?

When filling out Form MD 656, you need to include personal information such as your name, address, Social Security number, and Employer Identification Number if applicable. You will also specify your tax liability by indicating the type of tax and relevant periods you wish to compromise. Moreover, you'll provide a proposed amount of payment and can choose to include either a deposit or the full payment upfront. Detailed explanations for your offer, along with financial statements, may also be required depending on the reason for your submission.

What happens after I submit the Form MD 656?

Once you submit the form, the Comptroller of Maryland will review your offer. If the offer is accepted, you will receive notification and be required to adhere to specific terms outlined in the form. It is important to note that if your offer is either rejected or you choose to withdraw it, any payments made may be returned. Additionally, you remain responsible for the full amount owed unless the offer is successfully accepted.

Will I be charged interest on the amount I submit with Form MD 656?

No, the Comptroller of Maryland will not pay interest on any amount submitted with your offer. However, if your offer is defaulted, meaning you fail to meet the terms set forth after acceptance, interest will begin to accrue on any unpaid balances from the date of default until the full amount is satisfied. Therefore, it is critical to fulfill all conditions outlined in the acceptance of your Offer in Compromise.

Common mistakes

Filling out the MD 656 form can seem straightforward, but many individuals encounter pitfalls that may complicate or hinder their offer in compromise. One common mistake is skipping over the detailed explanation section found in Item 9. Taxpayers often underestimate the importance of providing a thorough narrative detailing their reasons for believing they do not owe the taxes. Not including adequate justification can lead to immediate rejection of the offer.

Another frequent error involves submitting incomplete or inaccurate financial information. When applying under the "Insufficient Resources" or "Economic or other Hardship" categories, failing to attach the necessary financial statements, such as Form MD 433-A or MD 433-B, is a critical oversight. Without these documents, the Comptroller's office cannot properly evaluate your financial situation, which could result in a denial of the offer.

Additionally, selecting the wrong tax type or period can derail an otherwise valid submission. When filling out the MD 656, it is essential to mark the correct box that applies to your situation and to double-check that the tax periods listed are accurate. Mislabeled tax types or incomplete periods create confusion and can lead to delays or rejection of your offer, thus making your task more complicated.

Furthermore, many individuals forget about the importance of following up on their submission. After submitting the form, it’s crucial to monitor the status of the offer. Some people assume no news is good news, but delays can happen. Proactively checking in can help ensure that your case is being handled and that you have provided all needed documentation.

Finally, a mistake often made is overlooking the significance of understanding the terms and conditions outlined in Item 8 of the form. Many taxpayers fail to grasp that once the offer is accepted, they must adhere to the obligations laid out, such as timely filing of future tax returns and payments. Violating these terms can result in losing the compromise and facing the original liabilities again. Understanding the full scope of the agreement is crucial for success in resolving your tax issues.

Documents used along the form

The Maryland Form MD 656 serves as a means for taxpayers to negotiate a settlement with the Comptroller of Maryland regarding outstanding tax liabilities. It is commonly accompanied by several other forms and documents that help provide necessary information and support for the request. Below are five important documents often used in conjunction with the MD 656 form.

- Form MD 433-A: This form is a financial statement that details the taxpayer's income, expenses, assets, and liabilities. It helps illustrate the taxpayer's financial situation and is crucial for supporting claims of insufficient resources or economic hardship.

- Form MD 433-B: Similar to Form MD 433-A, this document is also a financial statement but may be used to provide additional detail or clarification about the taxpayer's financial standing. It is especially useful for demonstrating the ability to pay in cases of economic hardship.

- Form MD 712: This form is a Request for a Confession of Judgment. If the taxpayer anticipates difficulties in making payments, it serves as a way to arrange for potential future defaults while protecting the rights of both the taxpayer and the state.

- Documentary Evidence of Hardship: Supporting documentation is vital for substantiating claims made in the offers. This may include bank statements, pay stubs, medical bills, or any other relevant financial documents that support the assertion of economic or personal hardship.

- Cover Letter: A cover letter can provide a concise summary of the request. It often outlines the necessity for the compromise offer, and highlights any pertinent details, making it easier for the reviewing officer to understand the context of the submission.

Providing these additional forms and documents along with the MD 656 can enhance the chances of a successful compromise request. Each item plays a role in creating a comprehensive picture of the taxpayer’s financial circumstances, thereby facilitating a more informed evaluation by the Comptroller's office.

Similar forms

- IRS Form 656: Similar to the MD 656, this federal form allows taxpayers to make an offer in compromise to settle their tax debts with the Internal Revenue Service. Both forms seek to verify taxpayer information, tax periods, and the reasons for the offer. The IRS Form 656 also includes options for amounts that can be paid as well as agreements regarding future compliance.

- Form 433-A: Like the MD 656, Form 433-A provides a detailed financial statement. It is usually required when submitting an offer in compromise to the IRS to demonstrate ability or inability to pay tax debts. This form closely aligns with the MD 656's requirement for a complete financial disclosure when stating insufficient resources or economic hardship.

- IRS Form 4852: This form serves as a substitute for missing Forms W-2 or 1099. When submitting tax returns, taxpayers facing discrepancies can refer to Form 4852. The MD 656 form, although different in purpose, similarly requires accurate financial information to support claims made in the offer, demonstrating thoroughness in tax documentation.

- Form 843: This IRS form requests an abatement or refund of tax penalties. Both it and the MD 656 form involve formal requests to the taxing authority and require substantial justification of the claims being presented. They share the essence of communication with tax authorities while attempting to alleviate taxpayer burdens.

Dos and Don'ts

When it comes to filling out the MD 656 form, attention to detail is crucial. Here are some important dos and don'ts to consider.

- Do carefully read the instructions provided with the form. Understanding the requirements will help ensure you provide all necessary information.

- Do provide accurate personal information, including names, addresses, and Social Security numbers. Mistakes here can delay your application.

- Don't leave any fields blank. If a question does not apply to you, indicate "N/A" to show you've considered it.

- Don't submit incomplete financial statements. Ensure you complete any required financial forms, such as Form MD 433-A or 433-B, to support your claim.

Taking the time to carefully follow these guidelines can make a significant difference in the outcome of your offer in compromise.

Misconceptions

When dealing with the Md 656 form, several misconceptions can arise. Understanding these can help taxpayers make informed decisions. Below are ten common myths, clarified for better comprehension.

- The Md 656 is only for individuals. Many people think this form is exclusively for individuals, but it can be submitted by any type of taxpayer, including businesses.

- A successful offer means you won’t owe any taxes. Some assume that if the offer is accepted, they will not owe any taxes at all. However, an accepted offer typically means a reduction in what is owed, but there may still be a balance remaining.

- You cannot include penalties and interest in your offer. This myth suggests that only the principal tax can be amended. In fact, the Md 656 can address tax liabilities, interest, and penalties.

- Your chances of acceptance are low if you owe a large amount. It is a common belief that high tax liabilities make acceptance unlikely, but the Comptroller evaluates each offer based on individual circumstances, not just the amount owed.

- You must pay your entire offer upfront. While many offers require an initial payment, some may allow for a deposit with payment terms, depending on the taxpayer's financial situation.

- Submitting the Md 656 means you should stop paying all taxes. This misconception can lead to future issues. It is critical to continue paying taxes while your offer is pending to avoid defaulting.

- Once your offer is submitted, you cannot communicate with the Comptroller. Many believe that submitting the form ends all communication, but it is essential to stay in touch for updates or additional requests.

- You will automatically be notified of the acceptance or rejection of your offer. While the Comptroller should notify you, some may not be aware that it is also wise to regularly check the status of their offer.

- All offers are negotiated down to a low payment. The idea that all offers result in vastly reduced payments is misleading. Each case is unique, and outcomes can vary significantly.

- Your situation does not matter as much as the form itself. Many underestimate the importance of the rationale provided in the form. Clear, detailed explanations in Item 9 can significantly influence the decision on the offer.

By debunking these misconceptions, individuals can approach the Md 656 form with better understanding and clearer expectations.

Key takeaways

When filling out the Maryland Form MD 656 for an Offer in Compromise, understanding the process is essential. Here are some key takeaways to keep in mind:

- The form requires accurate personal information, including names, addresses, and Social Security numbers of all taxpayers involved.

- Choose the correct reason for your offer. Options include "Doubt as to Liability," "Insufficient Resources," or "Economic or Other Hardship." Justify your choice in the corresponding sections.

- A complete financial statement, such as Form MD 433-A or MD 433-B, must accompany the offer if claiming insufficient resources or economic hardship.

- Be clear about the tax liabilities you are addressing. Specify the tax type and periods accurately to avoid delays in processing.

- Payment terms must be stated. You have the option to include a deposit or submit payment in full along with the form. Understand that failing to meet terms can result in default.

By adhering to these guidelines, you increase your chances of a successful negotiation with the Comptroller of Maryland. Accurate information and thorough explanations are vital components for consideration of your offer.

Browse Other Templates

Where Can You Get Tax Forms - This draft assists taxpayers in navigating complex tax matters.

Loan Rehabilitation - Section 6 defines key terms used throughout the form, such as public assistance and reasonable payments.