Fill Out Your Med 1 Form

The Med 1 form plays an essential role in helping individuals claim tax relief for health expenses in the United States. This comprehensive document allows taxpayers to report qualified medical costs that may be offset against their taxable income. The form requires personal details, including names and addresses of those for whom the expenses were paid. The key areas covered include routine health expenses, non-routine dental treatments, and necessary therapies for dependents. Taxpayers must navigate certain restrictions, such as exclusions for costs already reimbursed by insurance or public authorities. It's vital to track all related receipts carefully, as these documents need to be retained for potential inspection. Notably, there are specific limits on claims based on the year of incurred expenses, and the form contains sections dedicated to declaring income details and certifying the accuracy of the information provided. Understanding the Med 1 form is critical for anyone looking to maximize their tax relief on health-related costs.

Med 1 Example

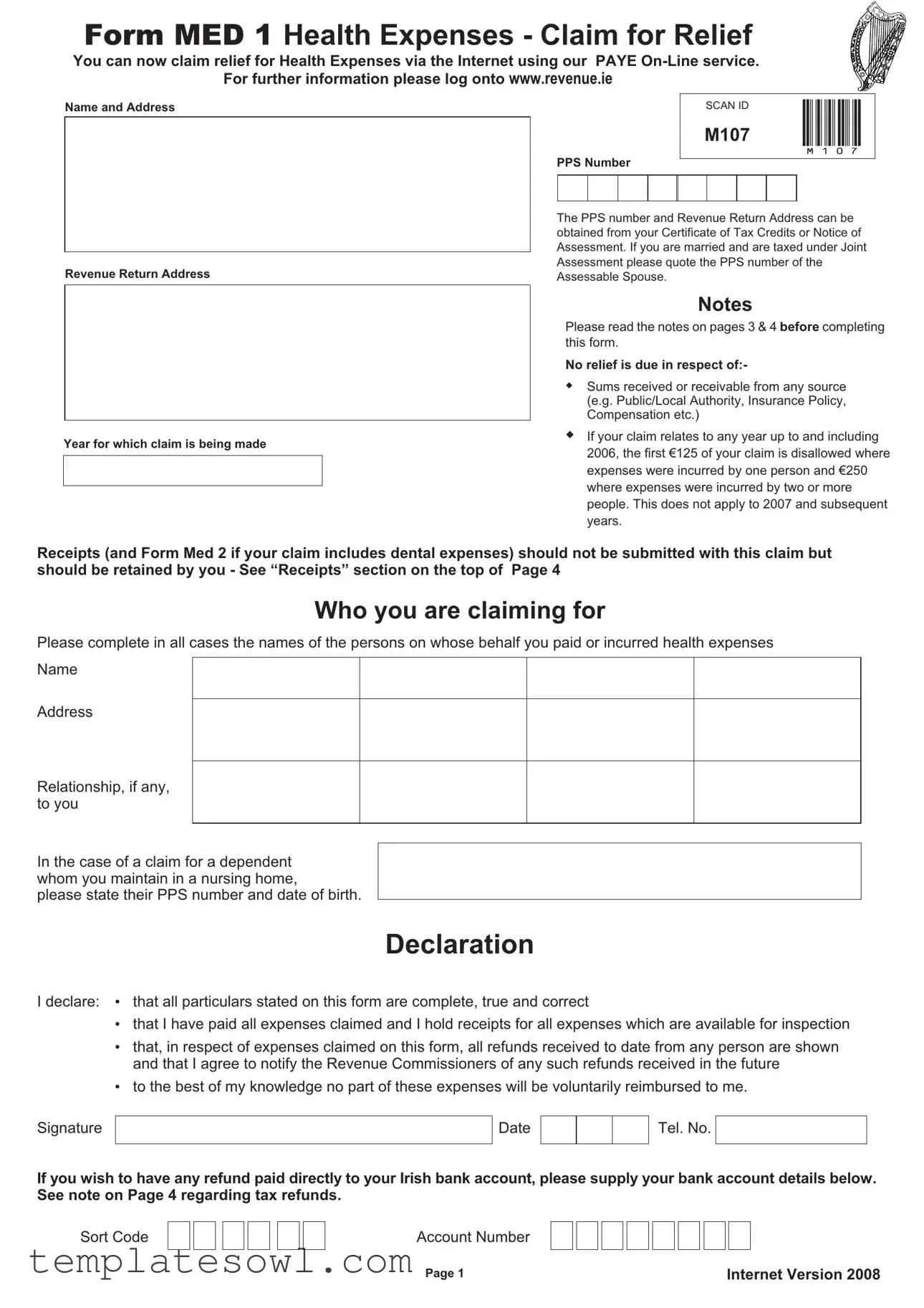

FORM MED 1 Health Expenses - Claim for Relief

You can now claim relief for Health Expenses via the Internet using our PAYE

Name and Address |

|

|

|

|

|

|

SCAN ID |

M107 |

|||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

M107 |

|

|||

|

|

|

|

|

|

|

|

||||

|

PPS Number |

|

|

||||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The PPS number and Revenue Return Address can be |

||||||||||

|

obtained from your Certificate of Tax Credits or Notice of |

||||||||||

|

Assessment. If you are married and are taxed under Joint |

||||||||||

|

Assessment please quote the PPS number of the |

||||||||||

Revenue Return Address |

Assessable Spouse. |

|

|||||||||

Year for which claim is being made

Notes

Please read the notes on pages 3 & 4 before completing this form.

No relief is due in respect of:-

Sums received or receivable from any source (e.g. Public/Local Authority, Insurance Policy, Compensation etc.)

If your claim relates to any year up to and including 2006, the first €125 of your claim is disallowed where expenses were incurred by one person and €250 where expenses were incurred by two or more people. This does not apply to 2007 and subsequent years.

Receipts (and Form Med 2 if your claim includes dental expenses) should not be submitted with this claim but should be retained by you - See “Receipts” section on the top of Page 4

Who you are claiming for

Please complete in all cases the names of the persons on whose behalf you paid or incurred health expenses

Name

Address

Relationship, if any, to you

In the case of a claim for a dependent whom you maintain in a nursing home,

please state their PPS number and date of birth.

Declaration

I declare: • that all particulars stated on this form are complete, true and correct

•that I have paid all expenses claimed and I hold receipts for all expenses which are available for inspection

•that, in respect of expenses claimed on this form, all refunds received to date from any person are shown and that I agree to notify the Revenue Commissioners of any such refunds received in the future

•to the best of my knowledge no part of these expenses will be voluntarily reimbursed to me.

Signature

Date

Tel. No.

If you wish to have any refund paid directly to your Irish bank account, please supply your bank account details below. See note on Page 4 regarding tax refunds.

Sort Code

Account Number

Page 1 |

Internet Version 2008 |

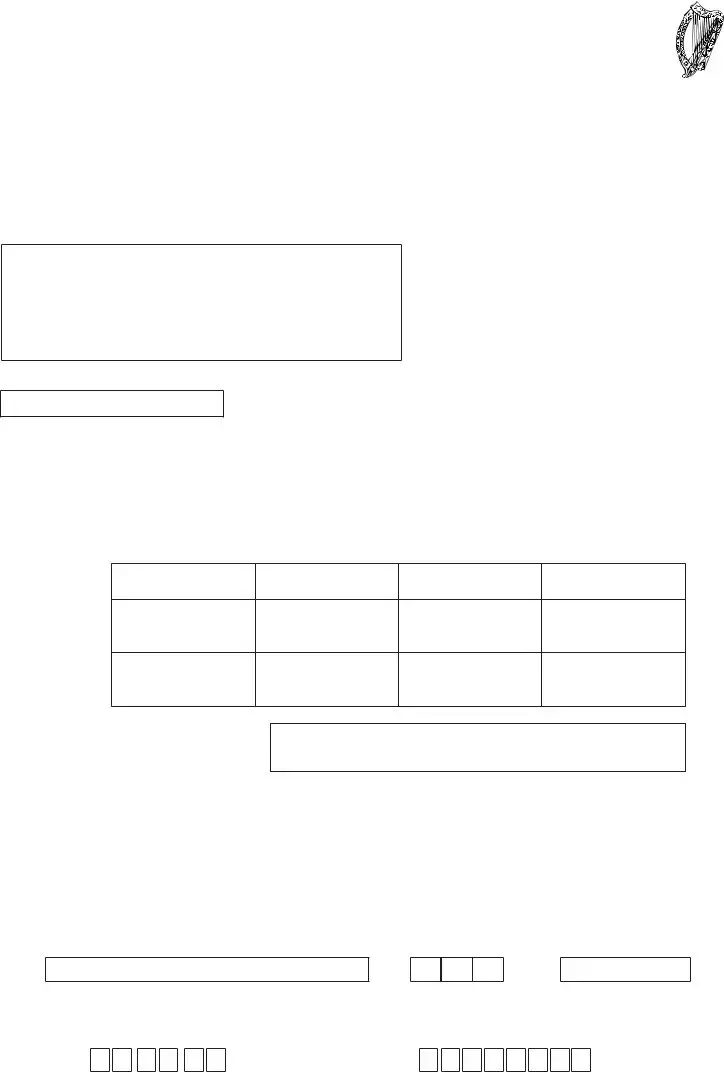

Income Details of ClaimantPPS No.

Please enter details of Income that was subject to PAYE in the year of claim (these can be obtained from your P60 or final payslip). If you or your spouse had more than one employment/pension on the 31st of December please list the Total Pay and Total

Tax Deducted for each employment/pension on a separate sheet. |

Self |

Spouse |

|

Name of Employer/Pension Provider

Total Pay

Total Tax Deducted

Routine Health Expenses (SEE NOTES)

Maintenance or treatment in an approved nursing home

Nursing Home

Name and Address

£

£

(1)

£

£

£

(2) |

||

(a) Services of a doctor/consultant |

|

|

£ |

|

|

|

|

|

£

(b) |

Total outlay on prescribed drugs/medicines for the year |

£ |

|

|

|

(c) |

Educational Psychological Assessment |

|

|

|

|

|

|

|

|||

|

for a dependent child (see note overleaf) |

£ |

|

|

|

(d) |

Speech and Language Therapy for a |

|

|

|

|

|

|

|

|||

|

dependent child (see note overleaf) |

£ |

|

|

|

(e) |

Orthoptic or similar treatment |

|

|

|

|

|

|

|

|||

|

(on referral from a doctor or other qualifying practitioner) |

£ |

|

|

|

(f) |

Diagnostic procedures |

|

|

|

|

|

|

|

|||

£ |

|

|

|||

(g) |

Physiotherapy or similar treatment |

|

|

|

|

|

|

|

|||

£ |

|

|

|||

|

(on referral from a doctor or other qualifying practitioner) |

|

|

|

|

|

|

|

|

||

(h) |

Expenses incurred on any medical, surgical |

|

|

|

|

£ |

|

|

|||

|

or nursing appliance |

|

|

|

|

|

|

|

|

||

(i) |

Maintenance or treatment in a hospital |

|

|

|

|

£ |

|

|

|||

(j) |

Other Qualifying Expenses |

|

|

|

|

|

|

|

|||

£ |

|

|

|||

|

(provide brief details below) |

|

|

|

|

|

Total (a) to (j) |

(3) |

|||

|

|

|

|||

|

|

|

|||

|

|

TOTAL HEALTH EXPENSES |

|

||

|

|

|

(1 + 2 + 3) |

|

|

|

|

|

|

|

|

Deductions - (If none write "NONE")

Sums received or receivable in respect of any of the above expenses

(i)from any public or local authority e.g. Health Service Executive

(ii)under any policy of insurance e.g. VHI, Quinn Healthcare, VIVAS Health, etc.

(iii)other e.g. compensation claim

TOTAL DEDUCTIONS

AMOUNT ON WHICH TAX RELIEF IS CLAIMED (Total Health Expenses less Total Deductions)

£

£

£

£

£

£

£

Page 2

Individuals for whom tax relief may be claimed

You may claim a refund of tax in respect of medical expenses paid or incurred by you:

On your own behalf

From 2007 and subsequent years on behalf of any other person (no restrictions)

For 2006 and prior years on behalf of a dependent (see definition below)

For 2006 and prior years on behalf of a relative (see definition below)

A personal representative of a deceased person can claim for medical expenses incurred by the deceased. Such expenses are treated as if they were paid immediately before the death of the deceased person.

Dependent - A dependent is defined as:

A relative of the individual, or

Any other person being -

i)An individual who, at any time during the year of assessment, is of the age of 65 years or over, or

ii)An individual who is permanently incapacitated by reason of mental or physical infirmity.

Relative - A relative is defined as:

Husband, wife, ancestor, lineal descendant, brother or sister

Mother or father of the individual’s spouse

Brother or sister of the individual’s spouse

Spouse of the individual’s son or daughter

A child, not being the child of the individual, who for the year of assessment

i)Is in the custody of the individual and is maintained by the individual, at the individual’s own expense for the whole or part of the year of assessment, AND

ii)Is under 18 years of age, OR

iii)If over 18 years of age, at the commencement of the year of assessment, is receiving full time instruction at any university, college, school or other educational establishment.

Qualifying Medical Expenses

The headings under which expenses qualify are listed on Page 2 of this form. You must have paid or incurred the amounts claimed on treatment prescribed by or on the advice of a qualifying practitioner. Drugs and medicines can only be claimed where supplied on the prescription of a practitioner.

Maternity Care - The cost of providing routine health care in respect of pregnancy is allowable.

Educational Psychological Assessment for a dependent child - Must be carried out by an educational psychologist who is entered on a register maintained by the Minister for Education and Science for the purposes of this relief in accordance with guidelines set down by that Minister with the consent of the Minister for Finance.

Speech and Language Therapy for a dependent child - Must be carried out by a speech and language therapist who is approved of for the purposes of this relief by the Minister for Health and Children in accordance with guidelines set down by that Minister with the consent of the Minister for Finance.

Consumable products - Relief can be claimed for the costs incurred on products manufactured specifically for coeliacs and diabetics where this expenditure is incurred on the advice of a medical practitioner.

Listed on the reverse of the Form Med 2 (Dental)

Available on Revenue’s website WWW.REVENUE.IE under Publications

Available from Revenue’s Forms and Leaflets service by phoning LoCall 1890 30 67 06

Available from your Regional PAYE LoCall Service whose number is listed on Page 4

Available from any Revenue Office.

Expenses that do not qualify

The cost of sight testing and the provision and maintenance of spectacles and contact lenses

Routine dental treatment which is defined as “the extraction, scaling and filling of teeth and the provision and repair of artificial teeth and dentures”.

Page 3

Receipts for expenses claimed

Please ensure that you only claim for amounts for which you hold receipts (and Form Med 2 if the claim includes

Deductions for sums received or receivable in respect of Health Expenses

You cannot claim relief in respect of sums already received or due to be received from:

Any public or local authority e.g. Health Service Executive

Any Policy of Insurance

Any other source e.g. Compensation

You must give details of such amounts and deduct them from the amount claimed on the claim form.

Drugs & Medicines: Since the 01/01/05 you can claim tax relief for expenditure of amounts up to £85 from calendar month for prescribed medication. Expenditure in excess of £85 per month is recoverable from the Health Service Executive under the Drugs Payment Scheme. Prior to 01/01/05 the monthly excess figure on expenditure incurred was:-

01/01/04 - 31/12/04 - £78 |

01/01/03 - 31/12/03 - £70 |

Year for which you claim

Relief is normally claimed for expenses paid in each tax year (1st January to 31st December). However, you may elect to claim in respect of expenses incurred in the tax year even though they may be paid later. If you so elect, all amounts claimed for the year must relate to amounts incurred in the year.

If your subscription year for medical insurance (VHI, Quinn Healthcare, VIVAS Health, etc.) does not coincide with the tax year you may submit Form Med1 for the subscription year. However, claims for subsequent tax years must also be based on your subscription year.

Calculation of relief

Relief is given at the highest rate of income tax at which you are chargeable for the year of claim.

Where to send your claim form

Completed claim forms should be sent to your Revenue office. Use any envelope and write “FREEPOST” above the address. (If your claim is selected for examination under an audit programme and you do not want your own Revenue office to know the nature of the medical condition, you can ask your Inspector to have the claim examined by another Revenue office).

Penalties

Any person who knowingly makes a false statement for the purpose of obtaining a repayment of Income Tax is liable to heavy penalties.

Refunds

Tax refunds can be paid by cheque to your address or by transfer to your Irish bank account. It is not possible to make a refund directly to a foreign bank account.

Further information

Customers can get further information by visiting our website WWW.REVENUE.IE. Alternatively PAYE customers can contact their Regional Paye LoCall Service (within ROI only) whose number is listed below:

Border Midlands West Region |

1890 777 425 |

East & South East Region |

1890 444 425 |

||

|

Cavan, Donegal, Galway, Leitrim, |

|

|

Carlow, Kildare, Kilkenny, Laois, |

|

|

Longford, Louth, Mayo, Monaghan, |

|

|

Meath, Tipperary, Waterford, |

|

|

Offaly, Roscommon, Sligo, Westmeath |

|

Wexford, Wicklow |

|

|

Dublin Region |

1890 333 425 |

South West Region |

1890 222 425 |

||

|

Dublin (City and County) |

|

|

Clare, Cork, Kerry, Limerick |

|

Please note that the rates charged for the use of 1890 (LoCall) numbers may vary among different service providers.

If you are calling from outside the Republic of Ireland, please telephone 00 353 (1) 647 4444.

Business customers should contact their own tax district, the telephone number for which can be found on any correspondence from Revenue.

Page 4

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Med 1 form allows individuals to claim tax relief on eligible health expenses. |

| Eligibility | Claims can be made on expenses incurred for oneself or on behalf of dependents, with specific rules for different tax years. |

| Non-Qualifying Expenses | Expenses related to reimbursement or sums received from public authorities or insurance policies are not eligible for relief. |

| PPS Number Requirement | A Personal Public Service (PPS) number is needed for the claim, available on tax credit certificates or assessments. |

| Deductions | Deductions apply to any sums received that relate to claimed health expenses, which must be shown on the form. |

| Retention of Receipts | Receipts for health expenses must be retained for at least 6 years, but should not be submitted with the claim. |

| Usage of Payee Online System | Claimants can submit their Med 1 form online using the PAYE On-Line service for convenience. |

| Tax Relief Rate | Relief is calculated at the highest income tax rate that applies to the claimant for the year of the claim. |

| Governing Laws | The form and its processes are governed by tax legislation specific to Ireland, including the Taxes Consolidation Act. |

Guidelines on Utilizing Med 1

The Med 1 form allows individuals to request tax relief on eligible health expenses. Completing this form is a straightforward process, but it’s essential to follow each step carefully to ensure accuracy and compliance. The following instructions will guide you through filling out the Med 1 form effectively.

- Gather necessary information, including your PPS number and the Revenue Return Address, which can be found on your Certificate of Tax Credits or Notice of Assessment.

- Write your Name and Address in the designated fields on the form.

- Indicate the Year for which you are claiming relief. It should match the tax year of your health expenses.

- If you are married and taxed jointly, enter the PPS number of the spouse who is assessable.

- In the section titled "Who you are claiming for," list the names and addresses of those for whom you incurred health expenses. Include your relationship to each individual.

- If claiming for a dependent in a nursing home, provide their PPS number and Date of Birth.

- Complete the declaration by stating that all information is complete, true, and correct. Sign and date the form.

- Provide your phone number for any follow-up regarding your claim.

- If you want your tax refund deposited directly into your Irish bank account, include the Sort Code and Account Number.

- Fill out the income details from your P60 or final payslip, ensuring you capture any income subject to PAYE for both yourself and your spouse, if applicable.

- In the "Routine Health Expenses" section, list expenses such as nursing home fees, medical treatments, and prescribed medications. Calculate the total.

- Account for any deductions by noting sums received from public authorities, insurance, or other compensation sources. Subtract these amounts from your total health expenses.

- Review the entire form for accuracy, ensuring all required information is complete.

- Finally, send the completed Med 1 form to your designated Revenue office using the “FREEPOST” option for mailing.

After submitting your Med 1 form, it will be processed by the Revenue office. You will receive a notification regarding your claim status and any potential tax refund. Keeping your receipts for health expenses is crucial, as they may be requested for verification in the future. Ensure you retain them for a period of six years. If you have further questions or require assistance, resources are available through the Revenue website or customer support lines.

What You Should Know About This Form

What is the Med 1 form used for?

The Med 1 form is used to claim tax relief for health expenses that you have incurred. It allows you to report various medical expenditures that can reduce your taxable income, leading to potential refunds or lower tax obligations.

Who can I claim health expenses for?

You can claim health expenses for yourself, your spouse, and any dependents. The definition of a dependent includes relatives and individuals over 65 or those who are permanently incapacitated.

What types of expenses can be claimed?

Qualifying expenses include routine health treatment, prescribed drugs, dental care (through Form Med 2), hospital costs, and certain therapies for dependent children. You must provide receipts for all claimed expenses.

Can I claim expenses incurred for a family member?

Yes, you can claim for expenses incurred on behalf of a family member, provided these expenses are deemed qualifying. Ensure that you have paid or incurred these costs and keep records of them.

What receipts do I need to keep?

You should retain receipts for all expenses you claim, including Form Med 2 for dental expenses. While you do not submit them with the claim, you must keep them for at least six years in case your claim is audited.

Is there a minimum amount that can be claimed?

If your claim is for expenses incurred in 2006 or earlier, the first €125 for one person or €250 for multiple people is disallowed. However, for expenses claimed from 2007 onwards, this threshold no longer applies.

How is tax relief calculated?

Tax relief is calculated based on the highest rate of income tax you are charged for the year of the claim. This means the more you earn, the higher the potential relief on the medical expenses you can claim.

Where do I send the completed Med 1 form?

The completed Med 1 form should be sent to your local Revenue office. You can use any envelope, simply write “FREEPOST” above the address to avoid postage charges.

What happens if I receive a refund?

Refunds can be issued as a cheque to your address or transferred to your Irish bank account. However, you cannot receive refunds directly to a foreign bank account.

How can I get more information about the Med 1 form?

You can find more information on the Revenue website at www.revenue.ie or by contacting the PAYE LoCall service specific to your region in Ireland. They can answer any specific questions you may have regarding the form or your claim.

Common mistakes

Filling out the Med 1 form can be a straightforward process, but common mistakes can lead to delays or even denied claims. One frequent error is not including the correct PPS number for the claimant or dependents. This number is essential as it identifies your tax records. If you or your spouse has multiple PPS numbers, it’s vital to double-check that you are using the right one. Misplacing this information can cause unnecessary complications in processing your claim.

Another common mistake involves the declaration section. It’s crucial to ensure that all declarations are signed and dated correctly. Many people overlook this step or fail to understand its significance. If this section is incomplete or missing, Revenue may reject your claim outright. Adhering to this simple requirement is fundamental for a successful submission.

Many claimants also misinterpret the guidelines regarding total deductions. It's important to provide accurate details about any sums received from other sources, such as local authorities or insurance policies. Claims must reflect net expenses after these deductions. Forgetting to account for refunds can lead to penalties and might severely impact your eligibility for relief.

Lastly, some individuals fail to keep receipts for all claimed expenses. While submission of receipts isn't required with the initial claim, you should retain them for up to six years. Revenue may request this documentation for verification. Missing receipts can quickly jeopardize your claim, underscoring the need for careful record-keeping throughout the year.

Documents used along the form

The Med 1 form is essential for claiming tax relief on health expenses. When submitting this form, there are other documents often required or useful. Below is a list of these forms and their purposes.

- Form Med 2: This form is used to claim relief for non-routine dental expenses. It must be completed and certified by a dentist for the claim to be processed alongside the Med 1 form.

- P60: This document summarizes an employee’s gross pay and taxes deducted for the year. It is important for determining the amount of tax relief that may be claimed.

- Notice of Assessment: This is issued by the tax authority and details the individual’s tax liability. It aids in verifying the income reported on the Med 1 form.

- Certificate of Tax Credits: This document shows the tax credits available to the taxpayer. It contains the PPS number and Revenue Return Address required for the Med 1 form.

- Bank Account Details: While not a formal document, providing bank account information is crucial if the claimant wishes to receive a refund directly to their bank account.

- Receipts: Although not submitted with the Med 1 claim, receipts for all claimed expenses must be retained for inspection. They provide proof of payment when claims are audited.

- Income Tax Returns: Previous tax return documents may be helpful for providing additional context or information on prior claims or income details.

- Medical Certificates: These may be required to substantiate claims for specific treatments or conditions to ensure they meet the criteria for tax relief.

These supporting documents enhance the completeness and accuracy of the Med 1 claim, ensuring a smoother processing experience. Keep them organized for quick access when needed.

Similar forms

- Med 2 Form: The Med 2 form is also used to claim health expenses, specifically for non-routine dental treatment. Similar to the Med 1 form, it requires detailed information about the expenses incurred and must be retained rather than submitted with the claim.

- Form 1040: The Form 1040 is used to file annual income taxes in the U.S. Like the Med 1 form, it requires taxpayers to report income and deductions, including medical expenses. Both forms aim to reduce the taxpayer's burden by allowing claims for qualified expenses.

- Schedule A (Form 1040): This form allows taxpayers to itemize deductions, including certain medical expenses. Similar to the Med 1 form, it requires individuals to provide a list of qualifying expenses and their total, along with supporting documentation such as receipts.

- Form 8862: This form is used to claim the Earned Income Credit after a denial. Like the Med 1 form, it requires the taxpayer to carefully outline circumstances that justify the claim. Both forms involve additional scrutiny to ensure accuracy.

- Form 8889: Used to report Health Savings Accounts (HSAs), this form requires claimants to detail contributions and distributions. Both forms serve the purpose of documenting and claiming rebates related to health expenses, requiring detailed financial information.

- Form 8379: This form is for injured spouses requesting a refund of joint tax refund withheld to pay a spouse's debt. Similar to the Med 1 form, it asks for specific information about financial contributions and personal details to substantiate the claim.

Dos and Don'ts

Things You Should Do:

- Read the notes on pages 3 and 4 before completing the form.

- Ensure all information is complete, true, and correct to avoid penalties.

- Keep all receipts for at least six years for potential inspection.

- List the names and relationships of those for whom you are claiming health expenses.

- Provide accurate bank account details if you want your refund deposited directly.

Things You Shouldn't Do:

- Do not send receipts with your claim; retain them for your records.

- Avoid claiming for expenses that have already been reimbursed from other sources.

- Do not forget to include the PPS number of dependents when required.

- Refrain from including any non-qualifying expenses, such as routine dental treatments.

- Do not leave out income details subject to PAYE as this can affect your claim.

Misconceptions

Misconceptions about the Med 1 form can lead to confusion when claiming health expense relief. Here are ten common misunderstandings:

- You must submit all receipts with the Med 1 form. Many people believe they need to attach receipts. However, receipts should be kept for six years but not sent with the claim.

- You can claim for any medical expense. Not all expenses qualify for relief. Only those prescribed or advised by a qualifying practitioner are eligible for a claim.

- Claims can be made for any year without restrictions. Claims for health expenses incurred in 2006 or earlier have specific restrictions, especially regarding dependencies.

- All health-related costs are eligible. Routine dental treatments and sight tests are not allowed, which surprises many applicants.

- Tax relief is automatic. You must actively claim for relief by completing the Med 1 form; it is not applied automatically.

- Only individuals can claim. A personal representative can claim for a deceased person’s medical expenses if incurred before their death.

- You can only claim for your own expenses. Depending on the year, you can claim for others, including dependents or relatives.

- Refunds can be sent to any bank account. Refunds can only be transferred to an Irish bank account, not to foreign accounts.

- You can claim for non-prescribed medications. Relief is only available for medication prescribed by a qualified practitioner.

- The claim process is the same every year. There are different rules and thresholds for various years. Always check current guidelines before filing your claim.

Understanding these points can improve the claim process and ensure accurate submissions.

Key takeaways

Key Takeaways for Filling Out and Using the Med 1 Form:

- Ensure that you have your PPS number and Revenue Return Address ready when filling out the form.

- Do not submit receipts with your claim. Keep them for a minimum of six years, as you may be required to provide them later.

- Only claim for expenses you have actually paid. You must be able to validate these through receipts.

- Remember to include all deductions for any amounts received from public authorities or insurance policies. This will affect the total amount of your claim.

- The form allows claims for expenses incurred in the tax year, even if they are paid in a different year, but all related amounts must be from that year.

- Tax relief is typically given at the highest rate of income tax applicable to you, so consider your current tax situation when estimating potential refunds.

Browse Other Templates

Get Title From Dmv - Immediate family purchases may have different documentation requirements under the FS-6T guidelines.

Loan on Line - Electronic deposits are increasingly preferred for their security and efficiency.