Fill Out Your Mi 1040Es Form

The MI-1040ES form plays a crucial role for individuals in Michigan who expect to owe taxes above a certain threshold when they file their annual return. Designed by the Michigan Department of Treasury, this form facilitates the payment of estimated income tax for the tax year. It is important to understand the eligibility criteria: primarily, if you anticipate owing more than $500, you need to consider making estimated payments. Notably, farmers, fishermen, and seafarers have special provisions, allowing them to qualify under different criteria. As you prepare to file, be mindful of the payment deadlines, including April 15, June 15, September 15, and January 18 of the following year, which will help you stay on top of your financial obligations. Filing this form requires careful attention to detail, particularly regarding Social Security numbers and payment methods, whether you opt for electronic payments or traditional checks. Ensuring that you provide accurate information and adhere to the instructions can prevent delays and complications down the line. In summary, the MI-1040ES serves not just as a tax form but as a tool for responsible financial planning.

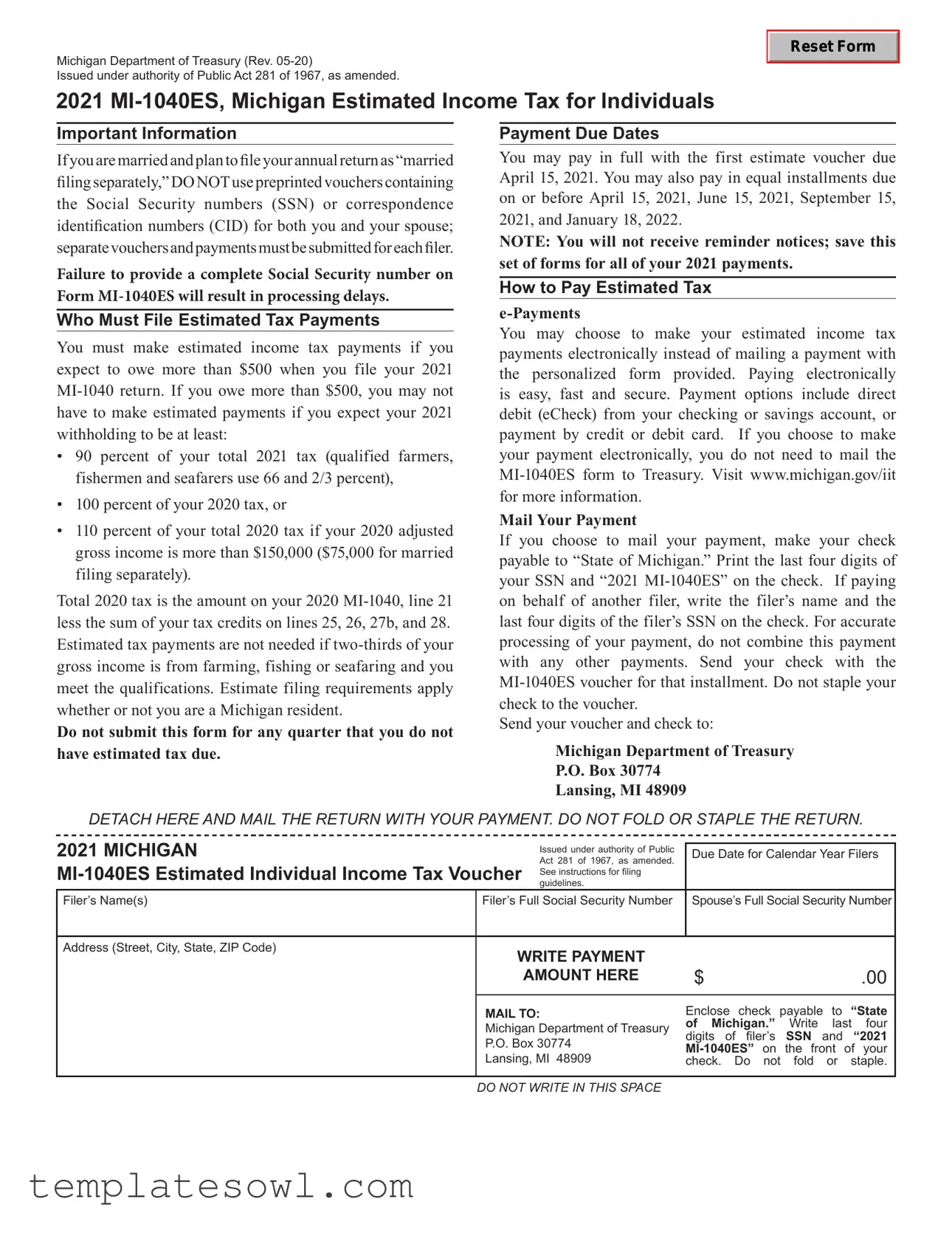

Mi 1040Es Example

Michigan Department of Treasury (Rev.

Issued under authority of Public Act 281 of 1967, as amended.

Reset Form

2021

Important Information

If you are married and plan to file your annual return as “married filing separately,” DO NOTusepreprinted vouchers containing the Social Security numbers (SSN) or correspondence identification numbers (CID) for both you and your spouse; separatevouchers and payments must be submitted for each filer.

Failure to provide a complete Social Security number on Form

Who Must File Estimated Tax Payments

You must make estimated income tax payments if you expect to owe more than $500 when you file your 2021

•90 percent of your total 2021 tax (qualified farmers, fishermen and seafarers use 66 and 2/3 percent),

•100 percent of your 2020 tax, or

•110 percent of your total 2020 tax if your 2020 adjusted gross income is more than $150,000 ($75,000 for married filing separately).

Total 2020 tax is the amount on your 2020

Do not submit this form for any quarter that you do not have estimated tax due.

Payment Due Dates

You may pay in full with the first estimate voucher due April 15, 2021. You may also pay in equal installments due on or before April 15, 2021, June 15, 2021, September 15, 2021, and January 18, 2022.

NOTE: You will not receive reminder notices; save this set of forms for all of your 2021 payments.

How to Pay Estimated Tax

You may choose to make your estimated income tax payments electronically instead of mailing a payment with the personalized form provided. Paying electronically is easy, fast and secure. Payment options include direct debit (eCheck) from your checking or savings account, or payment by credit or debit card. If you choose to make your payment electronically, you do not need to mail the

Mail Your Payment

If you choose to mail your payment, make your check payable to “State of Michigan.” Print the last four digits of your SSN and “2021

Send your voucher and check to:

Michigan Department of Treasury

P.O. Box 30774

Lansing, MI 48909

DETACH HERE AND MAIL THE RETURN WITH YOUR PAYMENT. DO NOT FOLD OR STAPLE THE RETURN.

2021 MICHIGAN |

Act 281 of 1967, as amended. |

|

|||

Due Date for Calendar Year Filers |

|||||

|

Issued under authority of Public |

|

|

|

|

|

|

|

|

||

|

See instructions for filing |

|

|

|

|

Filer’s Name(s) |

Filer’s Full Social Security Number |

Spouse’s Full Social Security Number |

|||

|

|

|

|

|

|

Address (Street, City, State, ZIP Code) |

WRITE PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

AMOUNT HERE |

$ |

|

|

.00 |

|

|

|

|||

|

MAIL TO: |

Enclose check payable to “State |

|||

|

Michigan Department of Treasury |

of Michigan.” |

Write |

last |

four |

|

P.O. Box 30774 |

digits of filer’s |

SSN |

and |

“2021 |

|

|||||

|

Lansing, MI 48909 |

||||

|

check. Do not |

fold |

or staple. |

||

|

|

|

|

|

|

DO NOT WRITE IN THIS SPACE

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The MI-1040ES form is issued under the authority of Public Act 281 of 1967, as amended. |

| Eligibility Criteria | You must file the MI-1040ES if you expect to owe more than $500 when you file your 2021 MI-1040 return. |

| Filing Status Notice | If you are married and filing separately, use separate vouchers for each filer to avoid processing delays. |

| Estimated Payment Exemptions | Estimated payments are unnecessary if at least two-thirds of your gross income comes from farming, fishing, or seafaring. |

| Payment Due Dates | Payments are due on April 15, June 15, September 15, and January 18 of the following year. |

| Payment Options | You can pay electronically via direct debit or credit/debit card, or by mailing a check. |

| Mailing Instructions | When mailing a payment, write the last four digits of your SSN and “2021 MI-1040ES” on the check. |

| Accuracy in Payments | Avoid combining your payment with any other payments to ensure accurate processing. |

| Electronic Payment Benefits | Electronic payments provide a fast, secure, and convenient way to make estimated tax payments. |

| Important Reminders | No reminder notices will be sent; keep copies of your forms for your records. |

Guidelines on Utilizing Mi 1040Es

If you anticipate owing more than $500 in state income taxes for the year, it’s essential to fill out and submit the MI-1040ES form. This process allows you to make estimated tax payments to the Michigan Department of Treasury. Payments can be made electronically or via mail, depending on your preference.

- Gather Required Information: Make sure you have your Social Security number, your spouse’s Social Security number (if applicable), and your address ready.

- Provide Your Personal Details: Fill in your name, Social Security number, and if married filing separately, also fill in your spouse's information. Write your address including street, city, state, and ZIP code.

- Calculate Your Payment: Determine the estimated payment amount owed for the quarter and write it in the box labeled “WRITE PAYMENT AMOUNT HERE.”

- Prepare Your Payment: If choosing to pay by check, remember to make it payable to “State of Michigan.”

- Complete Your Check: On your check, write the last four digits of your Social Security number and “2021 MI-1040ES.” If paying on someone else’s behalf, include their name and last four digits of their SSN.

- Send Your Payment: Send the completed voucher and your check to the provided address: Michigan Department of Treasury, P.O. Box 30774, Lansing, MI 48909. Ensure not to fold or staple the forms.

- Repeat as Necessary: If you owe estimated taxes for additional quarters, repeat these steps for each installment due on April 15, June 15, September 15, and January 18 of the following year.

Ensure you retain a copy of the submitted form and payment for your records. If you prefer electronic payments, visit the Michigan Department of Treasury’s website for convenient options.

What You Should Know About This Form

What is the MI-1040ES form and who needs to use it?

The MI-1040ES form is the Michigan Estimated Income Tax form designed for individuals who expect to owe tax when they file their annual income tax return. If you anticipate owing more than $500 in taxes for the year, you are required to make estimated tax payments. This obligation remains regardless of your residency status in Michigan. It is important to file this form if your tax liability exceeds this threshold, as failing to do so may result in penalties and interest charges.

What are the payment due dates for the MI-1040ES estimated payments?

You have a couple of options when it comes to payment timing. You can pay the full estimated tax amount with your first voucher, due on April 15, 2021, or you can opt to make payments in installments. These installments are due on April 15, June 15, September 15, and January 18 of the following year. Keep in mind that you will not receive any reminders about these payments, so it is crucial to keep track of the due dates and save your form set for future reference.

How can I pay my estimated tax using the MI-1040ES form?

You have two primary methods for making payments: electronically or by mail. For those who prefer electronic payments, you can utilize options such as direct debit from your bank account or payment by credit or debit card. Simply visit the Michigan Department of Treasury's website for more information. If you choose to mail your payment, ensure that you make the check payable to “State of Michigan” and include relevant information to assist in accurate processing.

What information do I need to provide when mailing my payment?

When mailing your payment with the MI-1040ES form, be sure to include your name, the last four digits of your Social Security number, and “2021 MI-1040ES” on your check. If you are paying on behalf of someone else, include their name along with the last four digits of their Social Security number. Make sure to send your check along with the corresponding voucher for that installment, without stapling them together. Failure to provide complete information could lead to processing delays.

Are there any exceptions to filing estimated payments with the MI-1040ES?

Yes, certain exemptions exist. Individuals whose income primarily comes from farming, fishing, or seafaring may not need to file estimated payments if they meet specific criteria. As long as at least two-thirds of your gross income is derived from these activities, estimated tax payments might not be necessary. Always review your financial situation to determine if you fall into this exemption category.

What happens if I do not provide a complete Social Security number on the MI-1040ES?

Failure to provide a complete and accurate Social Security number when submitting the MI-1040ES form will lead to significant processing delays. This could impact your estimated payments and potentially incur penalties, so it is crucial to double-check all entries. Ensure that all personal information is complete and correct to prevent issues with your tax filings.

Common mistakes

When filling out the MI-1040ES form, many individuals make common errors that can lead to processing delays or payment complications. One major mistake is providing incorrect Social Security numbers. It is crucial to accurately enter your own SSN and, if applicable, your spouse’s SSN. If you file separately and use preprinted vouchers with both names, this can result in confusion and misallocated payments.

Another frequent error involves calculating estimated tax payments incorrectly. Many filers fail to understand the thresholds that determine whether they need to make estimated payments. If you expect to owe more than $500 when you file your return, you must make payments. However, there are specific conditions under which you may not need to pay, such as when your withholding meets certain percentages of your total tax liability.

People often overlook the payment due dates and can miss critical deadlines. For the MI-1040ES form, payments are typically due on April 15, June 15, September 15, and January 18 of the following year. Unlike other tax forms, there are no reminder notices sent out. This means individuals need to keep track of these dates to avoid late fees or penalties.

Additionally, some filers combine their payments with other tax payments, which can lead to confusion in processing. It is essential to make separate payments for the MI-1040ES. When mailing in your payment, you should write only the last four digits of your SSN and clearly state "2021 MI-1040ES" on your check. This ensures the Treasury Department can process your payment swiftly and accurately.

Finally, another common mistake is neglecting to read the comprehensive instructions on the form. Every year, there may be slight changes in the process. By overlooking these details, you run the risk of making miscalculations or failing to include necessary information, both of which could hold up the processing of your estimated tax payments.

Documents used along the form

In addition to the MI-1040ES form, several other documents are commonly used during the tax filing process in Michigan. Understanding these forms can help ensure compliance and accuracy when filing your income tax. The following list outlines these documents and their purposes.

- MI-1040 Form: This is the standard Michigan Individual Income Tax Return form, which taxpayers submit to report their income and calculate their tax liability. It is generally filed annually and must be submitted if you are an individual taxpayer in Michigan.

- MI-1040CR Form: This form is the Michigan Homestead Property Tax Credit Claim. It allows eligible residents to claim a credit against their property taxes based on income and property taxes paid, offering potential savings for homeowners.

- MI-W4 Form: This is the Michigan Employee's Withholding Exemption Certificate. Employees use it to determine the amount of tax withheld from their paychecks, ensuring that the correct amount is paid throughout the year. This form is essential for proper withholding.

- MI-1040ES Payment Vouchers: These vouchers are used for making estimated tax payments. Taxpayers use them if they expect to owe more than $500 in taxes, ensuring they meet their tax obligations throughout the year.

- Schedule 1 (MI-1040): This schedule is used to report additional income and adjustments to income, such as business profits or losses, capital gains, and more. It helps in calculating the total income for tax purposes.

Being familiar with these forms can simplify the tax filing process, ensuring that taxpayers fulfill their obligations while maximizing potential benefits. Accurate completion of the MI-1040ES and its associated forms helps avoid processing delays and potential penalties.

Similar forms

The MI-1040ES form, which is used for estimating income tax payments in Michigan, has similarities to other tax-related documents. Here are four forms that share characteristics with the MI-1040ES:

- 1040-ES (U.S. Estimated Tax for Individuals): This federal form serves a similar purpose, allowing U.S. taxpayers to estimate and pay their federal income tax for the upcoming year. Both forms require taxpayers to assess their expected income and tax liability to avoid penalties.

- W-4 (Employee’s Withholding Certificate): The W-4 form provides employers with information to withhold the correct amount of federal income tax from employees’ paychecks. Like the MI-1040ES, it involves estimating tax obligations, although one is used for withholding while the other is for estimated payments.

- Schedule C (Profit or Loss from Business): For self-employed individuals, Schedule C is used to report income and expenses. This form is similar to the MI-1040ES in that it requires a preview of income to determine anticipated tax obligations. Both involve forward-looking tax calculations to ensure sufficient payments.

- MI-1040 (Michigan Individual Income Tax Return): The MI-1040 is the annual income tax return form. The MI-1040ES is a preliminary form for estimated payments, while the MI-1040 is the final return that reconciles total income, deductions, and tax payments. Both forms are essential for overall tax compliance in Michigan.

Dos and Don'ts

When filling out the MI-1040ES form, it’s crucial to adhere to specific guidelines to ensure proper processing and avoid delays. Below are important dos and don'ts to keep in mind:

- DO ensure that you supply a complete Social Security number on the form. This helps prevent processing delays.

- DO use separate vouchers if you and your spouse are filing as “married filing separately.” Each filer must submit their own voucher.

- DO check if you are required to make estimated payments based on your expected tax liability for the year.

- DO pay your estimated taxes on or before the due dates to avoid penalties. These dates are April 15, June 15, September 15, and January 18 of the following year.

- DO consider electronic payment options. Paying electronically can be faster and more secure than mailing a check.

- DON'T combine payments. Each payment should be submitted separately to prevent any processing errors.

- DON'T staple your check to the voucher. This can hinder the processing of your payment.

- DON'T submit the form for quarters in which you do not owe estimated taxes. Only file when necessary.

Misconceptions

Here’s a list of common misconceptions about the MI-1040ES form, along with explanations to clarify the details for you:

- Misconception 1: You can use the same voucher for both spouses when filing jointly.

- Misconception 2: You only need to make estimated payments if you owe more than $1,000.

- Misconception 3: Payments must be submitted quarterly only.

- Misconception 4: You cannot pay your estimated tax electronically.

- Misconception 5: You have to use special envelopes or forms when mailing payments.

- Misconception 6: You do not need to keep records if you pay electronically.

If you are married and filing separately, each spouse must use their own separate vouchers. Using preprinted vouchers with both Social Security numbers will lead to processing issues.

In Michigan, you need to make estimated payments if you expect to owe more than $500 when filing your annual return.

You can pay in full with the first estimate voucher or opt for equal installments. The due dates are April 15, June 15, September 15, and January 18 of the following year.

Electronic payments are encouraged and are fast, easy, and secure. You can set up direct debits or use a credit/debit card without mailing the MI-1040ES form.

Regular envelopes are fine. However, be sure not to fold or staple the return when mailing it, and do not combine it with other payments for accurate processing.

Even if you pay electronically, it’s important to keep copies of your payments and the MI-1040ES for your records. You won’t receive reminder notices, so staying organized is key.

Key takeaways

Understanding the MI-1040ES form is crucial for efficient tax management in Michigan. Here are nine key takeaways for completing and using this form.

- Separate Vouchers for Couples: If you are married and filing separately, do not use preprinted vouchers with both Social Security numbers. Each spouse must submit separate vouchers.

- Income Threshold for Payments: Estimated payments are necessary only if you expect to owe more than $500 when filing your tax return.

- Withholding Alternatives: If you anticipate your 2021 withholding will meet certain percentages of your tax, you may not need to make estimated payments.

- Exemption for Certain Income Types: Individuals whose income comes primarily from farming, fishing, or seafaring might not need to file estimated payments under specific conditions.

- Payment Schedule: Payments can be made either in full or in installments. The first payment is due by April 15, 2021, with subsequent payments due on June 15, September 15, and January 18, 2022.

- No Reminder Notices: Taxpayers will not receive reminders for payment due dates; thus, it is essential to keep track of these dates independently.

- Electronic Payments: e-Payments offer a fast, secure option. If using this method, there is no need to mail the MI-1040ES form.

- Mailing Instructions: If mailing a payment, ensure the check is made out to "State of Michigan" and includes the last four digits of your Social Security number along with the form identifier.

- Do Not Combine Payments: For efficient processing, do not combine your MI-1040ES payments with any other tax payments.

Browse Other Templates

Writing a Disciplinary Action on an Employee - The warning decision may influence future employment decisions regarding the employee.

Kitten:opriuem-o0u= Tabby:uc4odmp4wrg= Cat - This form also serves as an acknowledgment of the state’s regulations regarding animal importation.

Why Did Angie's List Change Its Name - Feedback on pricing guides others in their choices.