Fill Out Your Mllc 6 Form

Navigating the world of business formation can feel overwhelming, but understanding the Maine Limited Liability Company (MLLC) 6 form is an essential step toward establishing your own limited liability company. This form serves as the Certificate of Formation, and it is crucial for anyone looking to formalize their business in Maine. To begin, this document requires a filing fee of $175. You will need to provide essential details such as the name of your company, which must contain specific phrases like “limited liability company” or abbreviations such as “LLC.” The form also allows for flexibility with the filing date—whether you want it to take effect immediately or at a later date of your choosing. Importantly, this form includes sections to designate your company as either a low-profit LLC or a professional LLC. The low-profit designation requires that your business has specific charitable or educational goals, while the professional LLC designation is for those providing licensed services like law, medicine, or accounting. Additionally, you must name a Registered Agent, who will handle legal documents on your company's behalf. Careful completion of the MLLC 6 form ensures that your business aligns with state regulations, paving the way for your venture's success.

Mllc 6 Example

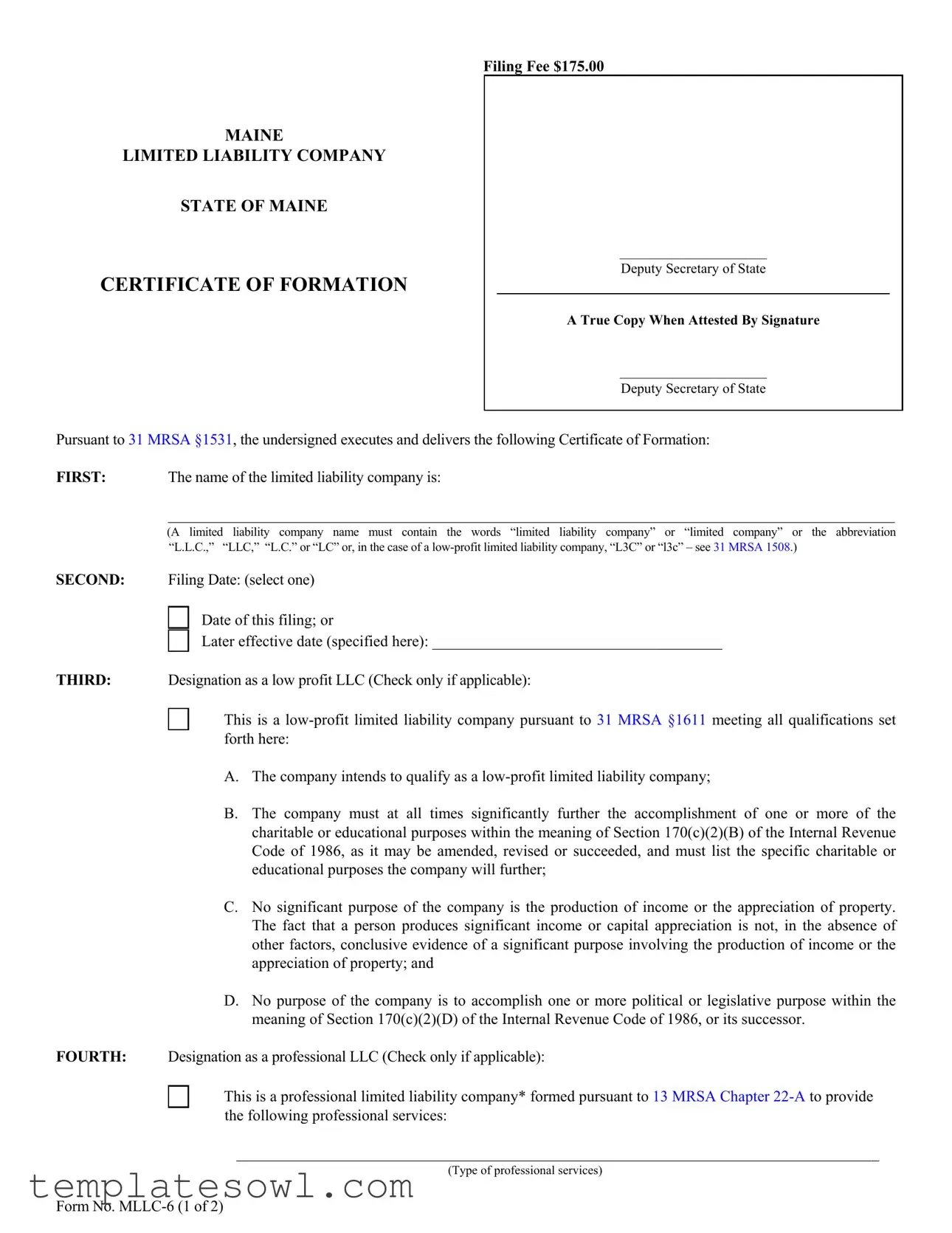

Filing Fee $175.00

MAINE

LIMITED LIABILITY COMPANY

STATE OF MAINE

CERTIFICATE OF FORMATION

_____________________

Deputy Secretary of State

A True Copy When Attested By Signature

_____________________

Deputy Secretary of State

Pursuant to 31 MRSA §1531, the undersigned executes and delivers the following Certificate of Formation:

FIRST: The name of the limited liability company is:

_______________________________________________________________________________________________

(A limited liability company name must contain the words “limited liability company” or “limited company” or the abbreviation “L.L.C.,” “LLC,” “L.C.” or “LC” or, in the case of a

SECOND: Filing Date: (select one)

Date of this filing; or

Later effective date (specified here): _____________________________________

THIRD: Designation as a low profit LLC (Check only if applicable):

This is a

A.The company intends to qualify as a

B.The company must at all times significantly further the accomplishment of one or more of the charitable or educational purposes within the meaning of Section 170(c)(2)(B) of the Internal Revenue Code of 1986, as it may be amended, revised or succeeded, and must list the specific charitable or educational purposes the company will further;

C.No significant purpose of the company is the production of income or the appreciation of property. The fact that a person produces significant income or capital appreciation is not, in the absence of other factors, conclusive evidence of a significant purpose involving the production of income or the appreciation of property; and

D.No purpose of the company is to accomplish one or more political or legislative purpose within the meaning of Section 170(c)(2)(D) of the Internal Revenue Code of 1986, or its successor.

FOURTH: Designation as a professional LLC (Check only if applicable):

This is a professional limited liability company* formed pursuant to 13 MRSA Chapter

__________________________________________________________________________________

(Type of professional services)

Form No.

FIFTH: The Registered Agent is a: (select either a Commercial or Noncommercial Registered Agent)

Commercial Registered AgentCRA Public Number: ____________________

__________________________________________________________________________________

(Name of commercial registered agent) Noncommercial Registered Agent

__________________________________________________________________________________

(Name of noncommercial registered agent)

__________________________________________________________________________________

(physical location, not P.O. Box – street, city, state and zip code)

__________________________________________________________________________________

(mailing address if different from above)

SIXTH: Pursuant to 5 MRSA §105.2, the registered agent listed above has consented to serve as the registered agent for this limited liability company.

SEVENTH: Other matters the members determine to include are set forth in the attached Exhibit ______, and made a part hereof.

**Authorized person(s) |

Dated ________________________________ |

___________________________________________________ |

_________________________________________________ |

(Signature of authorized person) |

(Type or print name of authorized person) |

___________________________________________________ |

_________________________________________________ |

(Signature of authorized person) |

(Type or print name of authorized person) |

*Examples of professional service limited liability companies are accountants, attorneys, chiropractors, dentists, registered nurses and veterinarians. (This is not an inclusive list – see 13 MRSA §723.7)

**Pursuant to 31 MRSA §1676.1.A, Certificate of Formation MUST be signed by at least one authorized person.

The execution of this certificate constitutes an oath or affirmation under the penalties of false swearing under

Please remit your payment made payable to the Maine Secretary of State.

Submit completed form to: |

Secretary of State |

|

|

Division of Corporations, UCC and Commissions |

|

|

101 State House Station |

|

|

Augusta, ME |

|

|

Telephone Inquiries: (207) |

Email Inquiries: CEC.Corporations@Maine.gov |

Form No.

Filer Contact Cover Letter

To: Department of the Secretary of StateTel. (207)

101 State House Station

Augusta, ME

Name of Entity (s):

_______________________________________________________________________

_______________________________________________________________________

List type of filing(s) enclosed (i.e. Articles of Incorporation, Articles of Merger, Articles of Amendment, Certificate of Correction, etc.) Attach additional pages as needed.

________________________________________________________________________

________________________________________________________________________

Special handling request(s): (check all that apply)

Hold for pick up

Expedited filing - 24 hour service ($50 additional filing fee per entity, per service) Expedited filing - Immediate service ($100 additional filing fee per entity, per service)

Total filing fee(s) enclosed: $ ________________

Contact Information – questions regarding the above filing(s), please call or email: (failure to provide a

contact name and telephone number or email address will result in the return of the erroneous filing (s) by the Secretary of State’s office)

___________________________________ |

___________________________________ |

(Name of contact person) |

(Daytime telephone number) |

____________________________________________________

(Email address)

The enclosed filing(s) and fee(s) are submitted for filing. Please return the attested copy to the following address:

______________________________________________________________________________

(Name of attested recipient)

_____________________________________________________________________________________________

(Firm or Company)

_____________________________________________________________________________________________

(Mailing Address)

_____________________________________________________________________________________________

(City, State & Zip)

Form Characteristics

| Fact Name | Details |

|---|---|

| Filing Fee | $175.00 |

| Governing Law | 31 MRSA §1531 |

| Name Requirements | The company name must include "limited liability company", "limited company", or an acceptable abbreviation (L.L.C., LLC, L.C., LC). |

| Filing Date Options | Can be filed with the current date or a specified future effective date. |

| Low-Profit LLC Designation | This can be marked if the company meets criteria under 31 MRSA §1611. |

| Professional LLC | Companies providing specific professional services may designate as a professional LLC under 13 MRSA Chapter 22-A. |

| Registered Agent | The agent can be either a Commercial or Noncommercial Registered Agent. |

| Signature Requirement | At least one authorized person must sign the Certificate of Formation per 31 MRSA §1676.1.A. |

Guidelines on Utilizing Mllc 6

Once you have gathered all necessary information, you can proceed with filling out the MLLC-6 form. Carefully follow these steps to ensure that the form is completed accurately and submitted correctly.

- Start by entering the name of your limited liability company. Remember, it must contain the words “limited liability company” or “limited company,” or the abbreviations “L.L.C.,” “LLC,” “L.C.,” or “LC.”

- Indicate the filing date by selecting one of the two options: either the date of filing or a later effective date, if applicable.

- If your LLC qualifies as a low-profit entity, check the appropriate box and provide the necessary details, including the specific charitable or educational purposes your company aims to further.

- If applicable, designate your LLC as a professional LLC by checking the corresponding box and specifying the type of professional services offered.

- Complete the section to identify your registered agent. Choose either a Commercial or Noncommercial Registered Agent and fill in the required details, including the name and physical address.

- Confirm that the registered agent has consented to serve in this role. This is generally pre-signed by the agent, but it’s good practice to verify.

- If there are any other matters the members wish to include, note them in the provided space and attach any necessary exhibits.

- Ensure that at least one authorized person signs the certificate. Include their printed name and the date.

- Prepare your filing fee of $175.00 made payable to the Maine Secretary of State.

- Lastly, submit the completed MLLC-6 form, along with the payment, to the designated address: Secretary of State, Division of Corporations, UCC and Commissions, 101 State House Station, Augusta, ME 04333-0101.

What You Should Know About This Form

What is the MLLC 6 form?

The MLLC 6 form is the Certificate of Formation for a Maine Limited Liability Company (LLC). This document officially establishes your LLC in the state of Maine, allowing you to operate legally and protect your personal assets from business liabilities. It includes essential information such as the name of the LLC, filing dates, and details about the registered agent.

What is the filing fee for the MLLC 6 form?

The filing fee for the MLLC 6 form is $175.00. This fee must accompany your application to ensure that your LLC registration is processed. Also, remember that this payment should be made payable to the Maine Secretary of State.

What information must be included in the MLLC 6 form?

The MLLC 6 form requires several pieces of information. First, you need to provide the name of your LLC, which must include terms like “limited liability company” or abbreviations such as “LLC.” Next, you’ll choose a filing date and specify whether the entity is a low-profit LLC or a professional LLC, if applicable. Additionally, you must list the registered agent’s name and address. This agent acts as your LLC's official representative in legal matters.

Who can serve as a registered agent for my LLC?

A registered agent can be either a commercial or noncommercial entity. A commercial registered agent often provides professional services for multiple companies. On the other hand, a noncommercial registered agent could be an individual or an organization willing to accept legal documents on behalf of your LLC. The agent must have a physical address in Maine and consent to serve in this capacity.

Can I designate my LLC as a low-profit LLC or professional LLC?

Yes, you can designate your LLC as a low-profit LLC or a professional LLC if you meet the criteria. For a low-profit LLC, your business must aim to significantly further charitable or educational purposes. For a professional LLC, it must be formed to provide specific professional services, such as those offered by accountants or doctors. You will need to check the appropriate box on the form if you’re meeting these criteria.

What should I do if I have further questions about the MLLC 6 form?

If you have more questions regarding the MLLC 6 form or the formation process, you can contact the Secretary of State's office in Maine. They can provide guidance and help clarify any details. You may reach them via phone at (207) 624-7752 or send an email to CEC.Corporations@Maine.gov for assistance.

Common mistakes

Filling out the MLLC 6 form can seem straightforward, but many individuals encounter common pitfalls. One significant mistake is failing to include the required company name format. The name of the limited liability company must clearly state that it is a limited liability company. It should contain the words “limited liability company,” “limited company,” or the acceptable abbreviations such as “LLC.” If this requirement is not met, the filing may be rejected.

Another frequent error involves the filing date. When completing the form, individuals must select either the date of submission or specify a later effective date. Omitting this step can lead to delays or complications in the formation process. It's critical to ensure that this section is completed accurately to avoid unnecessary setbacks.

Additionally, many applicants overlook the designation of their LLC type. If the LLC is to be designated as a low-profit limited liability company or a professional limited liability company, it must be explicitly marked. Failing to check the appropriate box can result in misclassification, which may affect the company’s legal and tax responsibilities.

The registered agent information is another section that commonly contains errors. Applicants may mistakenly provide incomplete details, such as not including the physical address of a noncommercial registered agent. It is essential to provide accurate information as this designated individual or company will be responsible for receiving crucial legal documents on behalf of the LLC. A clear and precise submission is essential for avoiding complications down the line.

Finally, signatures are vital for the form's validity. The MLLC 6 form requires an authorized person to sign it. If the signing step is neglected or if the signatory does not have the authority to do so, it may result in the whole application being invalidated. As a result, verifying that all necessary signatures are present and that the individual signing has the appropriate authority is a crucial step in the filing process.

Documents used along the form

The MLLC 6 form is essential for creating a limited liability company in Maine. Several other documents often accompany this form to ensure compliance with state regulations and clarify the structure and operations of the company. Below is a list of these additional forms and a brief description of each.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It details the rights and responsibilities of the members and guides decision-making processes.

- Certificate of Good Standing: This certificate verifies that the LLC is authorized to do business in the state and has complied with all filing requirements. It is often needed for transactions or to secure funding.

- Registered Agent Consent Form: A document that confirms the registered agent’s agreement to serve in that capacity for the LLC. It ensures that the agent is aware of their responsibilities and has consented in writing.

- Member Admission Agreement: This agreement outlines the terms, conditions, and process for admitting new members into the LLC. It establishes the obligations and rights of both existing and new members.

- Bylaws or Company Policy Manual: These documents govern the internal operations and policies of the LLC. They can cover various topics such as meetings, voting rights, and conflict resolution.

- Tax Registration Form: This form registers the LLC with the state tax authority. It is necessary for obtaining tax identification numbers and ensuring compliance with state tax laws.

- Employment Agreements: When the LLC hires employees, these agreements outline the terms of employment, job responsibilities, and compensation details. They help to protect both the employer and employees.

- Annual Report: This report is typically required by the state to maintain good standing. It includes updated information about the LLC, such as management changes, and verifies that all required fees are paid.

Filing the MLLC 6 form along with the appropriate accompanying documents ensures that the LLC is established properly and remains compliant with state regulations. These additional forms help clarify the company's structure and operations, offering protection and guidance to its members.

Similar forms

- Articles of Incorporation: Similar to the MLLC 6 form, this document is filed to establish a corporation. It outlines the company's name, purpose, and authorized shares, serving a foundational role in the business formation process.

- Articles of Organization: This document is used in many states to form an LLC. Like the MLLC 6 form, it includes essential information about the company, such as its name and registered agent.

- Certificate of Formation: Often interchangeable with the MLLC 6 form, it acts as a legal proof of the LLC's creation. It includes details about the LLC’s structure and purpose.

- Operating Agreement: While not a filing document, this internal agreement outlines the management and operational procedures of an LLC, similar to how the MLLC 6 form details foundational aspects of the business.

- Certificate of Good Standing: This document verifies that an LLC is compliant with state regulations. It serves as a testament to the legitimacy of the business, similar to how the MLLC 6 form initially establishes that legitimacy.

- Annual Report: Required by many states, this document updates the state on the LLC's business activities, similar to how the MLLC 6 form informs the state about the business's formation details.

- Nonprofit Organization Incorporation Form: Used for forming a nonprofit organization, this form shares similarities with the MLLC 6 by detailing the organization's structure and purpose.

- Professional LLC Formation Form: Specifically designed for professional services providers, it parallels the MLLC 6 form for professional LLCs, detailing similar necessary information for registration.

- Amendment Documents: Filed to change existing company information, these documents allow for updates such as name changes or changes in registered agents, similar in function to adjustments that may need to be made after submitting the MLLC 6 form.

Dos and Don'ts

When completing the MLLC 6 form, following specific guidelines can ensure a smoother filing process. The following list provides key actions to take and avoid.

- Do: Include a name that complies with state requirements, such as “limited liability company” or “LLC.”

- Do: Select the correct filing date, whether it is the date of filing or a later effective date.

- Do: Ensure the Registered Agent’s consent is documented and correctly noted on the form.

- Do: Provide complete contact information for all authorized persons signing the document.

- Do: Submit the filing fee of $175.00 with the completed form.

- Don't: Leave any required fields blank, as incomplete forms will be returned.

- Don't: Forget to check the designation if the LLC qualifies as a low-profit or professional limited liability company.

- Don't: Use a P.O. Box for the Registered Agent's physical address; only a street address is acceptable.

- Don't: Ignore the need for at least one authorized person to sign the certificate.

- Don't: Provide inaccurate or incomplete descriptions of any professional services, if applicable.

Misconceptions

Understanding the MLLC 6 form can be challenging due to several common misconceptions. Addressing these can help make the process smoother for those looking to form a limited liability company in Maine. Here are six prevalent misconceptions about the MLLC 6 form and clarifications to set the record straight.

- All LLCs are the same. Many assume that all limited liability companies follow the same regulations. In fact, there are different designations, such as low-profit LLCs and professional LLCs, each with specific requirements and purposes.

- You do not need a registered agent. Some believe that appointing a registered agent is optional. However, every LLC formed must have a registered agent to receive legal documents and notifications, making this a non-negotiable requirement.

- The filing fee is hidden. There is a misconception that filing fees might be obscured. The fee for submitting the MLLC 6 form is clearly stated at $175.00, ensuring transparency in the process.

- The company name doesn't matter much. Some individuals think that the name chosen for their LLC is unimportant. In reality, the name must include specific phrases like “limited liability company” or abbreviations such as “LLC.” This requirement is crucial to comply with Maine law.

- You can file the form without any prior planning. There is an assumption that one can simply fill out the MLLC 6 form without preparation. Proper planning is essential, especially when selecting the company name, appointing a registered agent, and defining the business purpose.

- Once submitted, the LLC is automatically active. Some believe that submitting the MLLC 6 form makes the LLC operational immediately. While the form is necessary for formation, other requirements, such as obtaining necessary licenses or permits, may also be needed to legally operate.

By clarifying these misconceptions, individuals can approach the MLLC 6 form with greater confidence and ensure they meet all necessary criteria for forming their limited liability company effectively.

Key takeaways

- Filing Fee: The fee to file the MLLC 6 form is $175.00.

- Company Name: The name of the LLC must include “limited liability company,” “limited company,” or abbreviations like “LLC.”

- Filing Date: You can choose to file on the date of submission or specify a later effective date.

- Low-Profit Designation: If applicable, you must check the box to qualify as a low-profit LLC and describe your charitable or educational purposes.

- Professional Designation: If applicable, indicate if your LLC provides professional services and specify the type.

- Registered Agent: You need to name a registered agent, either commercial or noncommercial, and provide their details.

- Consent of Registered Agent: The listed registered agent must consent to serve, which is reflected in your filing.

- Authorized Signatures: At least one authorized person must sign the form, making it a legal document under oath.

- Submission Process: Completed forms must be mailed to the Secretary of State’s office in Augusta, Maine.

- Contact Information: Ensure to include a contact name, phone number, and email for any inquiries regarding your filing.

Browse Other Templates

Work Order Completion Form - Clearly state that the property has been returned to its pre-damage state.

Osha Fire Prevention Plan Template - Submission involves completing all aspects of the Fire Safety Plan thoroughly.

What Is Trophon Used for - The manual serves as a reference for troubleshooting equipment efficiently.