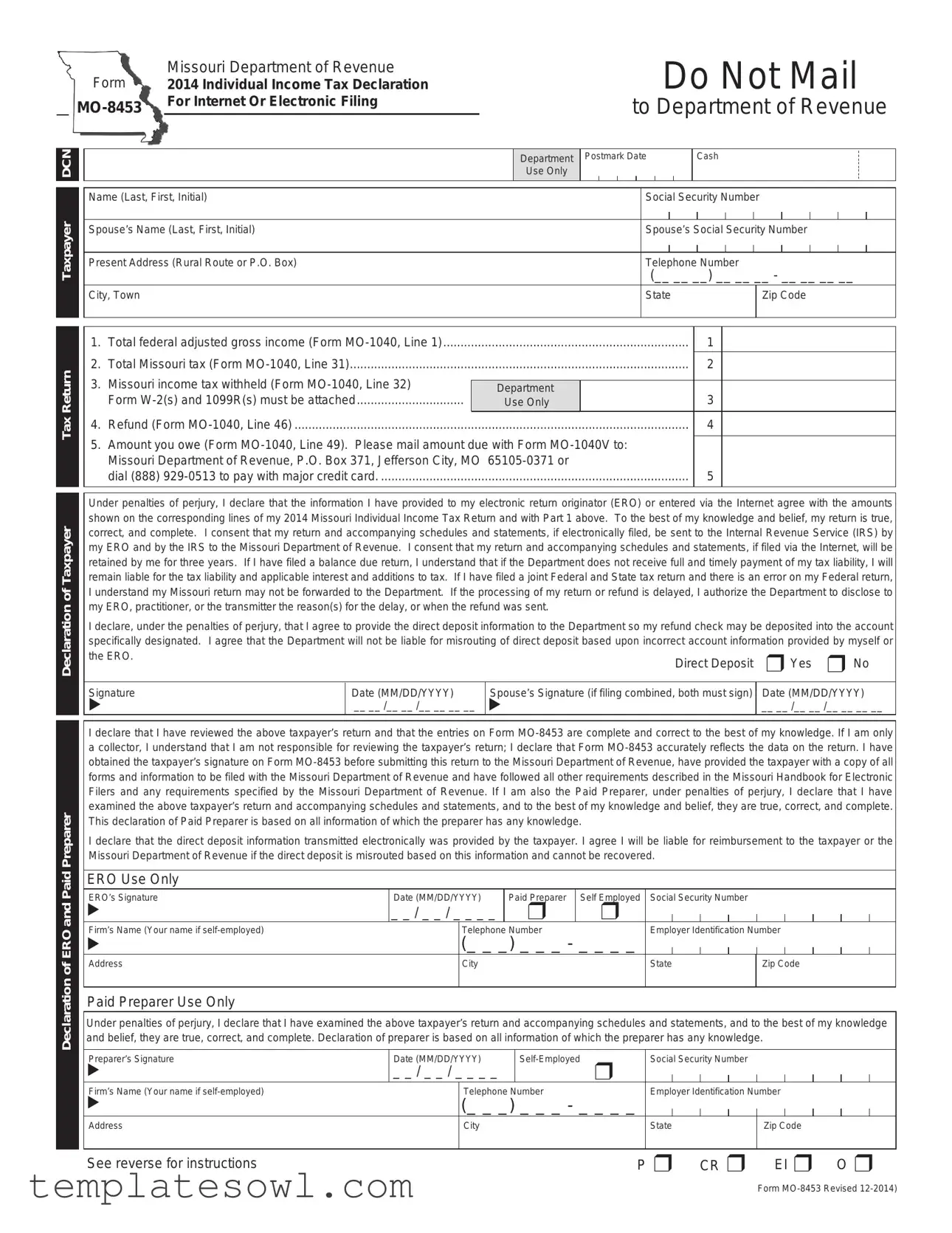

Fill Out Your Mo 8453 Form

The MO 8453 form is an essential document in the process of filing individual income tax returns in Missouri, particularly for those who choose to file electronically. This form serves as a declaration of the taxpayer's income and tax information, ensuring all data aligns with the filed returns. It requires personal details such as the taxpayer's name, Social Security number, and contact information. Additionally, the form asks for critical tax return details, including federal adjusted gross income, Missouri taxes, and information regarding any refund or balance owed. Taxpayers must declare that the information provided is correct, and their consent is necessary for the relevant authorities to file their returns. Moreover, if the taxpayer is using a paid preparer or an electronic return originator (ERO), these professionals must also sign the form, attesting to the accuracy of the data. Importantly, taxpayers should not mail this form to the Department of Revenue but rather retain it along with their supporting documents, such as W-2s, as proof of submission and compliance.

Mo 8453 Example

|

|

|

|

|

Form |

Missouri Department of Revenue |

|

|

|

|

|

2014 Individual Income Tax Declaration |

|

|

|

|

For Internet Or Electronic Filing |

|||

|

|

|

|

|||

|

|

|

|

|

|

|

|

DCN |

|

|

|

|

|

|

|

|

|

|

Name (Last, First, Initial) |

|

|

Taxpayer |

|

|

|||

|

|

|

Spouse’s Name (Last, First, Initial) |

|||

|

|

|

|

|

||

|

|

|

|

|

Present Address (Rural Route or P.O. Box) |

|

|

|

|

|

|

City, Town |

|

|

|

|

|

|

|

|

Do Not Mail

to Department of Revenue

Department |

Postmark Date |

Cash |

Use Only |

|

|

|

|

|

Social Security Number

Spouse’s Social Security Number

Telephone Number

(__ __ __) __ __ __ - __ __ __ __

State |

Zip Code |

|

|

Tax Return

1. |

Total federal adjusted gross income (Form MO‑1040, Line 1) |

....................................................................... |

1 |

2. |

Total Missouri tax (Form MO‑1040, Line 31) |

2 |

|

3. |

Missouri income tax withheld (Form MO‑1040, Line 32) |

Department |

|

|

Form |

Use Only |

3 |

4. |

Refund (Form MO‑1040, Line 46) |

4 |

|

5.Amount you owe (Form MO‑1040, Line 49). Please mail amount due with Form

dial (888) |

5 |

Declaration of Taxpayer

Declaration of ERO and Paid Preparer

Under penalties of perjury, I declare that the information I have provided to my electronic return originator (ERO) or entered via the Internet agree with the amounts shown on the corresponding lines of my 2014 Missouri Individual Income Tax Return and with Part 1 above. To the best of my knowledge and belief, my return is true, correct, and complete. I consent that my return and accompanying schedules and statements, if electronically filed, be sent to the Internal Revenue Service (IRS) by my ERO and by the IRS to the Missouri Department of Revenue. I consent that my return and accompanying schedules and statements, if filed via the Internet, will be retained by me for three years. If I have filed a balance due return, I understand that if the Department does not receive full and timely payment of my tax liability, I will remain liable for the tax liability and applicable interest and additions to tax. If I have filed a joint Federal and State tax return and there is an error on my Federal return, I understand my Missouri return may not be forwarded to the Department. If the processing of my return or refund is delayed, I authorize the Department to disclose to my ERO, practitioner, or the transmitter the reason(s) for the delay, or when the refund was sent.

I declare, under the penalties of perjury, that I agree to provide the direct deposit information to the Department so my refund check may be deposited into the account specifically designated. I agree that the Department will not be liable for misrouting of direct deposit based upon incorrect account information provided by myself or

the ERO. |

|

Direct Deposit |

r Yes r No |

|

|

||

|

|

|

|

Signature |

Date (MM/DD/YYYY) |

Spouse’s Signature (if filing combined, both must sign) |

Date (MM/DD/YYYY) |

t |

__ __ /__ __ /__ __ __ __ |

t |

__ __ /__ __ /__ __ __ __ |

I declare that I have reviewed the above taxpayer’s return and that the entries on Form MO‑8453 are complete and correct to the best of my knowledge. If I am only a collector, I understand that I am not responsible for reviewing the taxpayer’s return; I declare that Form MO‑8453 accurately reflects the data on the return. I have obtained the taxpayer’s signature on Form MO‑8453 before submitting this return to the Missouri Department of Revenue, have provided the taxpayer with a copy of all forms and information to be filed with the Missouri Department of Revenue and have followed all other requirements described in the Missouri Handbook for Electronic Filers and any requirements specified by the Missouri Department of Revenue. If I am also the Paid Preparer, under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. This declaration of Paid Preparer is based on all information of which the preparer has any knowledge.

I declare that the direct deposit information transmitted electronically was provided by the taxpayer. I agree I will be liable for reimbursement to the taxpayer or the Missouri Department of Revenue if the direct deposit is misrouted based on this information and cannot be recovered.

ERO Use Only

ERO’s Signature |

Date (MM/DD/YYYY) |

Paid Preparer |

Self Employed |

Social Security Number |

|

|

|

|

|

||||

t |

_ _ / _ _ / _ _ _ _ |

r |

r |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Firm’s Name (Your name if |

|

Telephone Number |

Employer Identification Number |

||||||||||

t |

|

(_ _ _) _ _ _ - _ _ _ _ |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||

Address |

|

City |

|

|

State |

Zip Code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid Preparer Use Only

Under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer is based on all information of which the preparer has any knowledge.

Preparer’s Signature |

Date (MM/DD/YYYY) |

|

Social Security Number |

|

|

|

|

|

|||||

t |

_ _ / _ _ / _ _ _ _ |

|

r |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Firm’s Name (Your name if |

|

Telephone Number |

|

Employer Identification Number |

|||||||||

t |

|

(_ _ _) _ _ _ - _ _ _ _ |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

City |

|

|

State |

|

|

|

Zip Code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See reverse for instructions |

|

|

|

P r |

|

CR r |

EI r O r |

||||||

Form

Instructions

Name, Address, and Social Security Number — If the taxpayer received a

Payment of Balance Due

Payment of tax due must be made by April 15, 2015, in order to avoid additions to tax and interest.

The taxpayer must submit Form

Declaration of Taxpayer

Please select appropriate Direct Deposit box.

The Form

Declaration of Electronic Return Originator (ERO) and Paid Preparer

The Form MO‑8453 must be signed by the ERO. A paid preparer must sign in the space provided for “Paid Preparer Use Only”, unless the paid preparer is also the ERO, then only the “ERO Use Only” space should be completed and the paid preparer box checked.

Form

Form

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The MO-8453 form serves as a declaration for electronic filing of the Missouri Individual Income Tax Return. |

| Filing Method | This form must not be mailed; it is intended to be used for electronic submissions only. |

| Signature Requirement | The form requires the taxpayer's signature and, if applicable, the spouse's signature for joint filings. |

| Income Reporting | Taxpayers must report federal adjusted gross income directly from Form MO-1040. |

| Payment Instructions | Balance due can be paid online or by calling a designated number provided on the form. |

| Declaration of ERO | The Electronic Return Originator (ERO) must declare the accuracy of the form and confirm all data aligns with the tax return. |

| Direct Deposit | Taxpayers can opt for direct deposit of refunds, but must check the appropriate box on the form. |

| Retention of Documents | Both the ERO and the taxpayer must retain the MO-8453 and related documents for at least three years. |

Guidelines on Utilizing Mo 8453

After gathering your financial information, you will need to accurately fill out the MO 8453 form as part of your Missouri Individual Income Tax filing process. This form serves as a declaration and verifies your tax return when filed electronically. Completing the form correctly is crucial for compliance with state regulations.

- Begin by entering your name, starting with your last name, followed by your first name and middle initial.

- Fill in your Social Security number in the format _ _ _ - _ _ - _ _ _ _.

- Provide your spouse’s name in the same format as yours, if applicable, followed by their Social Security number.

- Enter your present address, making sure to include any apartment number or rural route information.

- Include your telephone number in the format (_ _ _) _ _ _ - _ _ _ _.

- Fill in the city, state, and ZIP code of your address.

- Part 1 requires specific amounts to be entered from your Form MO-1040:

- Line 1: Total federal adjusted gross income from Form MO-1040, Line 1.

- Line 2: Total Missouri tax from Form MO-1040, Line 31.

- Line 3: Missouri income tax withheld (attach Form W-2(s) and 1099R(s)).

- Line 4: Enter the refund amount from Form MO-1040, Line 46.

- Line 5: Fill in the amount owed from Form MO-1040, Line 49.

- In Part 2, read the declaration carefully. Check the appropriate box for Direct Deposit and sign and date the form, making sure both you and your spouse sign if filing jointly.

- If applicable, Part 3 requires the signature of the Electronic Return Originator (ERO) and/or Paid Preparer. They must complete their respective sections.

- Ensure all required documents, especially W-2 forms, are attached. Make sure to keep a copy of your submitted form and documents for your records.

Direct your attention to ensuring all information matches your previous filings and tax forms. Once completed, the form is not to be mailed, but retained electronically or by your ERO as instructed.

What You Should Know About This Form

What is the purpose of the MO 8453 form?

The MO 8453 form serves as a declaration for taxpayers who file their Missouri Individual Income Tax returns electronically. It verifies that the information on the electronic submission matches what the taxpayer has provided. This form is crucial because it ensures accuracy and compliance with state tax regulations. Additionally, it allows the taxpayer to consent to the electronic filing of their return and enables the Missouri Department of Revenue to obtain necessary details about the return, such as income and tax liability.

Who needs to sign the MO 8453 form?

Both the taxpayer and their spouse, if filing jointly, must sign the MO 8453 form. This signature confirms that they understand their tax situation and agree that the information provided is correct. Furthermore, if a paid preparer or Electronic Return Originator (ERO) is involved in filing the return, they also need to sign the form. Their signatures verify that all entries on the form are complete and accurate based on the information available to them.

What should I do with the MO 8453 form after signing it?

Do not mail the MO 8453 form to the Missouri Department of Revenue. Instead, keep it with your records. If a paid preparer filed your return, they are responsible for retaining this form as part of their documentation. It's important to maintain this form for at least three years, as it may be needed for any future inquiries about your tax return.

What happens if I do not file the MO 8453 form?

If you fail to submit the MO 8453 form when required, your electronic tax return may not be processed correctly. This could lead to delays in receiving any refund or issues with your tax liability. Additionally, without the MO 8453, the Missouri Department of Revenue may not accept your electronic filing, which could result in penalties or additional interest if your return is considered late. It is crucial to ensure that the form is completed and retained to avoid complications.

Common mistakes

Filling out the Missouri Form MO-8453 can seem straightforward, but many make critical errors that can cause delays or issues with their tax filings. One common mistake is incorrect personal information. It’s essential to double-check that names and Social Security numbers are entered accurately. If the name on the form doesn’t match the name on the taxpayer's documents, it can create significant problems down the line.

Another frequent error involves the financial details provided. Entering wrong figures for total federal adjusted gross income, Missouri tax, or the amount owed can lead to miscalculations. It’s vital to carefully transfer numbers from the appropriate lines of the MO-1040 to ensure accuracy. Even a small mistake can result in an unfair tax bill or an unexpected refund amount.

Many taxpayers forget to sign the form. The declaration of the taxpayer is essential; without a signature, the entire document is invalid. If filing jointly, both partners must sign. Overlooking this simple requirement can delay the processing of the return and, subsequently, any refunds due.

Another pitfall is neglecting the completion of the Direct Deposit section. If taxpayers want their refunds delivered quickly and securely, they should check the appropriate box and provide accurate bank information. Incorrect account details can lead to misrouted funds, which could take time to rectify.

Lastly, taxpayers often overlook the need to attach essential documentation. Form MO-8453 requires supporting materials, like Form W-2s and 1099s. Failure to include these documents can halt the processing of the return. Ensuring all required forms are attached is crucial for a smooth filing process.

Documents used along the form

The MO-8453 form is an important part of filing your Missouri Individual Income Tax Return electronically. To complete your filing, there are several other documents that might be needed. Below is a list of forms commonly used alongside the MO-8453. Each plays a specific role in ensuring your tax return is accurate and properly submitted.

- Form MO-1040: This is the main individual income tax return form for Missouri residents. It details your income, deductions, and credits, which ultimately determine your tax liability.

- Form W-2: This form reports your wage and tax information from your employer. It is crucial for determining the amount of income you earned and how much tax has already been withheld from your paychecks.

- Form 1099: If you have income from sources other than employment, like freelance work or interest, this form shows how much you received. It's important for reflecting your total income accurately.

- Form MO-1040V: This is a payment voucher. If you owe money when filing, this form should accompany your payment by mail to ensure it is processed correctly.

- Form MO-8453-OL: This is an electronic filing declaration. It may be used to affirm that your tax return is being filed electronically and that all information is correct.

- Form MO-CR: Used for claiming various tax credits available to Missouri taxpayers. Fill this out if you qualify for credits that could reduce your overall tax burden.

- Form MO-A: The part-year resident and nonresident income tax return form. If you moved to or from Missouri during the year, you would need this form to report your income accurately.

- Form MO-8862: This form is for taxpayers who have been denied the Earned Income Tax Credit (EITC) in previous years and are now seeking to claim it again. It's a way to demonstrate eligibility for that credit.

- Form 8888: If you want to split your tax refund into multiple accounts, this form allows you to specify where you want your refund to be deposited.

- Schedule A (Form 1040): This is for itemized deductions and may be necessary if you are opting to deduct expenses rather than take the standard deduction.

Gathering these documents will help streamline the filing process and ensure that your return is complete. Always double-check that you have everything you need before submitting your forms. This will help avoid delays or rejections in processing your tax return.

Similar forms

- Form 1040 - This is the standard individual income tax return used by U.S. taxpayers to report their annual income. Like MO-8453, it includes sections for reporting income, deductions, and tax owed, making them both essential for tax filing.

- Form 1040X - Used to amend a previously filed Form 1040, it allows taxpayers to correct errors. MO-8453 helps taxpayers declare their intent to file electronically, ensuring all information aligns with their actual tax returns.

- Form W-2 - The wage and tax statement provided by employers, detailing employee earnings and withholdings. Similarly, MO-8453 requires attaching W-2s to support the income figures reported on the state tax return.

- Form 1099 - Commonly issued for independent contractors and freelancers, this form details income received outside of traditional employment. Like W-2s, it provides essential income data referenced in both MO-8453 and state tax returns.

- Form MO-1040 - This is Missouri’s individual income tax return, where taxpayers report their income to the state. MO-8453 directly relates to this form, serving as a declaration that the electronically filed information is accurate.

- Form MO-1040V - A payment voucher accompanying the MO-1040 when there is a balance due. Similar to how MO-8453 confirms the filing specifics, MO-1040V provides payment instructions to accompany the tax return.

- Form 4868 - The application for automatic extension of time to file a U.S. individual income tax return. Both MO-8453 and Form 4868 deal with declarations and timelines of filing, especially in situations when immediate submission isn't feasible.

- Form 1120 - This is the U.S. Corporation Income Tax Return, where corporations report their income. Both forms require accurate financial reporting, aiming to ensure compliance with tax obligations.

- Form 843 - Used to claim a refund or request an abatement of certain taxes. Similar to how MO-8453 supports the overall tax reporting process, Form 843 involves declarations that could impact a taxpayer's liability or refund amount.

- Form 8862 - This form is used to claim the Earned Income Credit after it was disallowed in a previous year. Like MO-8453, it's focused on ensuring that claims for credits and deductions are legitimate and supported by necessary documentation.

Dos and Don'ts

When filling out the MO-8453 form, there are several key actions to take and avoid. These guidelines help ensure your submission is accurate and compliant.

- Do double-check your name and Social Security number for accuracy.

- Do ensure your address matches that on the electronically filed Form MO-1040.

- Do enter the federal adjusted gross income correctly from Form MO-1040.

- Do provide all required supporting documentation, such as Form W-2s and 1099Rs.

- Do sign and date the form before submission, as required.

- Don’t forget to check the appropriate Direct Deposit box if you want your refund deposited electronically.

- Don’t leave any lines blank; enter “0” where appropriate.

- Don’t mail the form; it should only be retained by you or your ERO.

- Don’t submit the form without verifying that it reflects the correct information from your tax return.

- Don’t ignore payment deadlines. Ensure that any balance due is paid promptly to avoid penalties.

Misconceptions

Many people have misunderstandings about the MO-8453 form. Here are some common misconceptions clarified:

- It's necessary to mail the form: The MO-8453 form is specifically designed for electronic filing. Taxpayers should not send this form to the Missouri Department of Revenue. Instead, it is meant to be retained by the taxpayer or the electronic return originator (ERO).

- Only self-prepared returns require the MO-8453: This form is required for any electronically filed tax returns, whether prepared by the taxpayer themselves or by a professional preparer. If a paid preparer is involved, they still need to complete and sign the form.

- The form is just a summary of taxes: While the MO-8453 includes important tax information, it also serves as a declaration of agreement. By signing it, taxpayers confirm that their electronic tax return is accurate and complete, as per the information provided.

- Filing the MO-8453 is optional: This is a misconception. Taxpayers must complete and sign the MO-8453 to authenticate their return when filing electronically. Failing to do so may result in delays or issues with processing their return.

Key takeaways

- Form MO-8453 is an important document for taxpayers filing their individual income tax electronically in Missouri.

- It should not be mailed to the Department of Revenue. Instead, it is submitted electronically.

- Ensure all personal information, including names and Social Security numbers, is accurate and complete.

- Part 1 of the form requires key financial figures from Form MO-1040, including federal adjusted gross income and Missouri tax amounts.

- Payment information for any taxes owed must be submitted separately using Form MO-1040V accompanied by the payment.

- Signing the form is a declaration that the information provided is accurate and true, which carries legal penalties for false statements.

- Direct deposit options for refunds should be designated on the form, but taxpayers must ensure account information is correct.

- An Electronic Return Originator (ERO) or paid preparer must also sign the form to confirm accuracy and completeness of the tax return.

- Taxpayers should retain a copy of Form MO-8453 and any supporting documents for at least three years after filing.

Browse Other Templates

Buyers Guide - Investigate the suspension systems for any signs of wear or damage.

Unemployment Office Indiana - Employers must include their Indiana SUTA (State Unemployment Tax Act) number when submitting the form.

How to Fill Out an Application - Read the certification statement carefully; your signature confirms accuracy and completeness.