Fill Out Your Mps 93 Form

The MPS 93 form is an essential document for policyholders of William Penn Life Insurance Company of New York, facilitating various important requests related to their insurance policies. This multipurpose form streamlines processes such as changing an address, updating the beneficiary designation, or altering the premium payment. Policyholders can also use this form to request a duplicate policy, policy certificate, or a policy loan. Each of these functions is crucial for maintaining accurate records and ensuring that the benefits of the policy are received by the right individuals in a timely manner. Certain sections require clear instructions, including signature requirements to verify the requests being made. It's important to note that this form must be filled out carefully, with specific emphasis placed on providing the correct details for each request, as any inaccuracies could lead to delays or complications. Completion of the MPS 93 form empowers policyholders to manage their insurance needs effectively and ensures that their interests are safeguarded throughout their interaction with the company.

Mps 93 Example

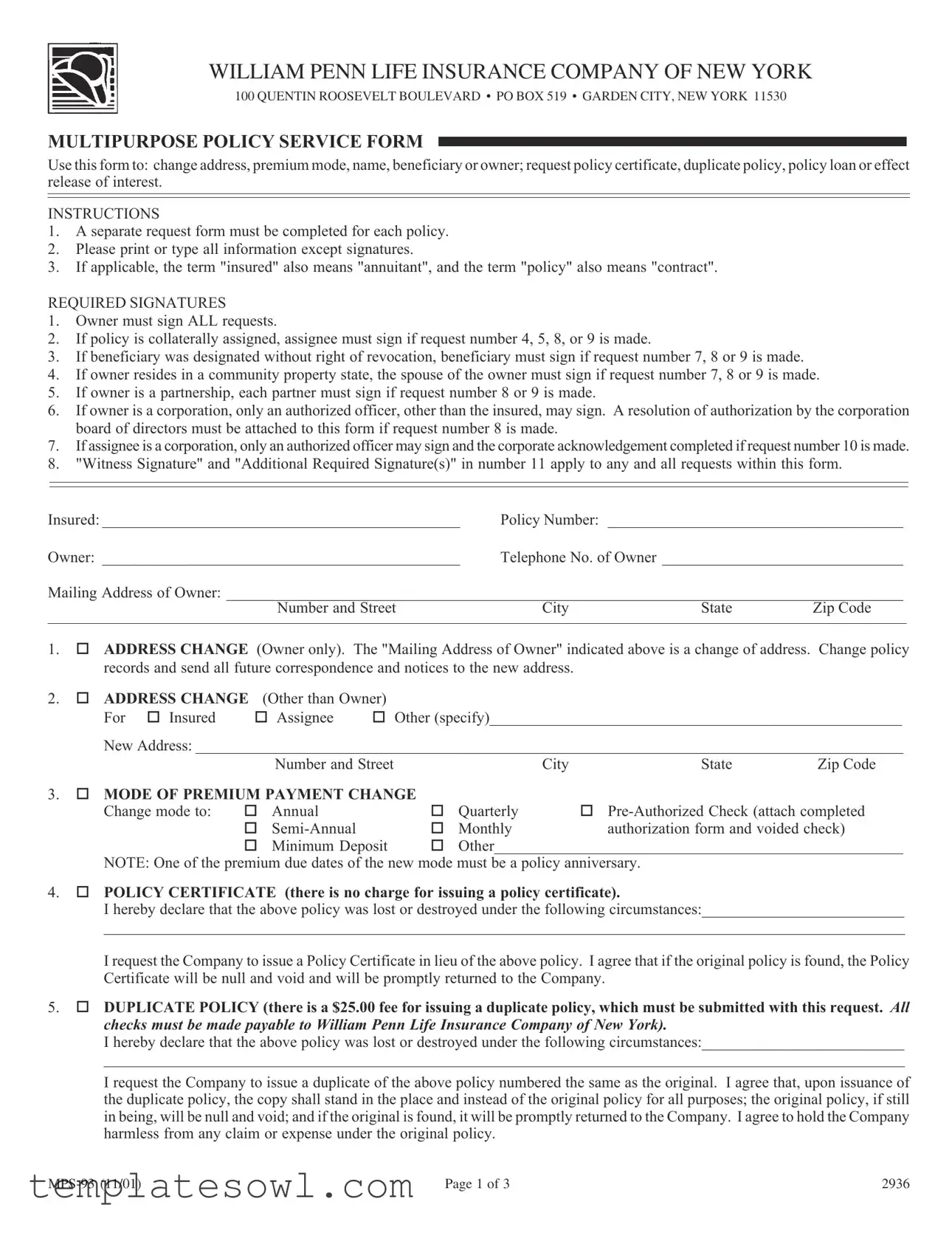

WILLIAM PENN LIFE INSURANCE COMPANY OF NEW YORK

100 QUENTIN ROOSEVELT BOULEVARD • PO BOX 519 • GARDEN CITY, NEW YORK 11530

MULTIPURPOSE POLICY SERVICE FORM

Use this form to: change address, premium mode, name, beneficiary or owner; request policy certificate, duplicate policy, policy loan or effect release of interest.

INSTRUCTIONS

1.A separate request form must be completed for each policy.

2.Please print or type all information except signatures.

3.If applicable, the term "insured" also means "annuitant", and the term "policy" also means "contract".

REQUIRED SIGNATURES

1.Owner must sign ALL requests.

2.If policy is collaterally assigned, assignee must sign if request number 4, 5, 8, or 9 is made.

3.If beneficiary was designated without right of revocation, beneficiary must sign if request number 7, 8 or 9 is made.

4.If owner resides in a community property state, the spouse of the owner must sign if request number 7, 8 or 9 is made.

5.If owner is a partnership, each partner must sign if request number 8 or 9 is made.

6.If owner is a corporation, only an authorized officer, other than the insured, may sign. A resolution of authorization by the corporation board of directors must be attached to this form if request number 8 is made.

7.If assignee is a corporation, only an authorized officer may sign and the corporate acknowledgement completed if request number 10 is made.

8."Witness Signature" and "Additional Required Signature(s)" in number 11 apply to any and all requests within this form.

Insured: ______________________________________________ |

Policy Number: ______________________________________ |

Owner: ______________________________________________ |

Telephone No. of Owner _______________________________ |

Mailing Address of Owner: _______________________________________________________________________________________

Number and Street |

City |

State |

Zip Code |

|

|

|

|

1.! ADDRESS CHANGE (Owner only). The "Mailing Address of Owner" indicated above is a change of address. Change policy records and send all future correspondence and notices to the new address.

2.! ADDRESS CHANGE (Other than Owner)

For ! Insured ! Assignee ! Other (specify)_____________________________________________________

New Address: ___________________________________________________________________________________________

Number and Street |

City |

State |

Zip Code |

3.! MODE OF PREMIUM PAYMENT CHANGE

Change mode to: |

! |

Annual |

! |

Quarterly |

! |

|

! |

! |

Monthly |

authorization form and voided check) |

!Minimum Deposit ! Other____________________________________________________

NOTE: One of the premium due dates of the new mode must be a policy anniversary.

4.! POLICY CERTIFICATE (there is no charge for issuing a policy certificate).

I hereby declare that the above policy was lost or destroyed under the following circumstances:__________________________

______________________________________________________________________________________________________

I request the Company to issue a Policy Certificate in lieu of the above policy. I agree that if the original policy is found, the Policy Certificate will be null and void and will be promptly returned to the Company.

5.! DUPLICATE POLICY (there is a $25.00 fee for issuing a duplicate policy, which must be submitted with this request. All checks must be made payable to William Penn Life Insurance Company of New York).

I hereby declare that the above policy was lost or destroyed under the following circumstances:__________________________

______________________________________________________________________________________________________

I request the Company to issue a duplicate of the above policy numbered the same as the original. I agree that, upon issuance of the duplicate policy, the copy shall stand in the place and instead of the original policy for all purposes; the original policy, if still in being, will be null and void; and if the original is found, it will be promptly returned to the Company. I agree to hold the Company harmless from any claim or expense under the original policy.

Page 1 of 3 |

2936 |

6.! NAME CHANGE OR CORRECTION

Change the name of: |

! Insured |

! Owner |

! Other (specify) _________________________________________ |

|

From: _____________________________________________ |

To: _______________________________________________ |

|||

Reason: ! Marriage |

! Divorce |

! Court Order |

! Other (specify) ___________________________________ |

|

Signature (former name) ______________________________ |

Signature (present name) _____________________________ |

|||

NOTES: 1. For all name changes, other than by marriage, attach a certified copy of the legal document (such as court order, adoption papers). Change cannot be processed without such proof.

2.If name is that of a corporation, submit certified resolution of the board of directors changing its name and copy of document indicating change officially recorded with state of incorporation.

7.! BENEFICIARY CHANGE - When completed by the Company, this change constitutes an endorsement to your policy.

I hereby revoke all previous beneficiary designations and settlement options for the above policy. The beneficiary designation shall be as shown below. The rights of the beneficiary will be subject to the rights of any assignee of record.

PRINT NAME OF BENEFICIARY(IES), ADDRESS, DATE OF BIRTH AND RELATIONSHIP TO THE INSURED:

Primary:

Contingent:

Unless otherwise provided, the proceeds of the policy are to be paid in one sum. Unless otherwise provided, if two or more beneficiaries are named in a class (Primary or Contingent) all members of the class who survive the insured will SHARE equally in any payment(s) due.

8.! OWNERSHIP CHANGE - ABSOLUTE ASSIGNMENT

For the value received, I hereby give all rights and privileges incident to ownership of the above policy, including the right to surrender for cash value, to:

New Owner: ________________________________________ Social Security Number: _____________________________

Mailing Address: ________________________________________________________________________________________

Number and Street |

City |

State |

Zip Code |

All future correspondence and notices, unless otherwise specified, will be sent to the "Mailing Address" indicated above. CAUTION: This change of ownership does not change the existing beneficiary designation; the new Owner may change the beneficiary without that person's consent unless designated without right of revocation.

9.! POLICY LOAN AGREEMENT

Make a policy loan: a. ! For full amount

b.! For ______________________ or full amount available (if less)

c.! To pay premium due _____________________ for policy number ______________________

Make check payable to (A or B only): ________________________________________________________________________

Loan Agreement

In consideration of the loan, the undersigned hereby assign, transfer and set over to the Company, its successors and assigns, the said policy and all benefits now due or which may hereafter become due thereon, to secure the repayment of said loan and interest thereon. In consideration of said Company waiving the deposit of said policy with it, its rights shall in no manner whatsoever be prejudiced by such waiver.

10.! RELEASE OF INTEREST

a. By: ! Collateral Assignee ! Beneficiary ! Other (specify) _________________________________________

For the value received, I hereby release all rights, title and interest in the above policy.

b.! SPOUSE/FORMER SPOUSE IN COMMUNITY PROPERTY STATE

I (print full name) _____________________________________________________, spouse/former spouse of the owner of the above policy, hereby release all rights, title and interest which I may have had in this policy now or in the future, by virtue of the Community Property Laws of the State of _________________________________________.

___________________________________________________________________________________________________

Signature of Assignee, Beneficiary, Spouse/Former Spouse, Other |

Date |

Page 2 of 3 |

2936 |

11.! BY MY SIGNATURE BELOW, I ACKNOWLEDGE THAT: I understand that this request is subject to the provisions and conditions of the above policy and that the Company may request additional information or impose additional requirements. I agree that my signature shall apply to each request which has been checked on this form and further agree that no request will become effective which is not checked. I certify that the above Policy is not pledged or assigned to any other person or corporation, except where stated in the request, that the contract is not in any way pledged as security for moneys advanced or value received, and that no proceedings in bankruptcy are pending.

Signed at |

_____________________________________ |

Date _______________________________________________ |

|

|

City and State |

|

|

_____________________________________________ |

___________________________________________________ |

||

Witness' Signature |

|

Owner's Signature |

|

(Attests to all required signatures within this form) |

|

||

_____________________________________________ |

___________________________________________________ |

||

Witness' Address - Number and Street |

|

New Owner's Signature, If Applicable |

|

_____________________________________________ |

___________________________________________________ |

||

City |

State |

Zip Code |

Additional Required Signature, If Any |

|

|

|

(Apply to any item in this form where required) |

__________________________________________________

Additional Required Signature, If Any

(Apply to any item in this form where required)

CORPORATE ACKNOWLEDGEMENT

COUNTY OF _________________________________________

ss:

STATE OF ___________________________________________

On the _______________________________________ day of ________________________________, 19______, before me personally came

_____________________________________________________________, who being by me duly sworn, did depose and say that he resides in

_____________________________________________________; that he is the ______________________________________________ of

_____________________________________, the corporation described in and which executed this release; that he knows the seal of said

corporation;thatthesealaffixedtosaidassignmentissuchcorporateseal;thatitwassoaffixedbyorderoftheBoardofDirectorsofsaidcorporation and that he signed his name thereto by like order.

Notary Public__________________________________________ |

My Commission Expires________________________________ |

FOR COMPANY USE ONLY

The above request for change is acknowledged and has been completed by the Company at its Home Office. This acknowledgement applies only to the policy specified in the form. Presentation of the policy for completion of this change has been waived.

Date Completed: _______________________________________ |

By: ________________________________________________ |

|

(Title) |

Page 3 of 3 |

2936 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The MPS 93 form operates under the insurance laws of New York State. |

| Purpose | This form is utilized for various policy modifications, including address changes, premium adjustments, and beneficiary updates. |

| Required Signatures | The owner must sign all requests; additional signatures may be needed based on specific transactions or policy assignments. |

| Address Changes | Separate sections exist for the owner and other parties, indicating clear processes to update contact information. |

| Policy Certificate Issuance | There is no fee for the issuance of a policy certificate, although conditions apply regarding lost or destroyed policies. |

| Duplicate Policy Fee | A $25 fee is associated with requesting a duplicate policy, and payment must accompany the request. |

| Name Change Process | Legal documentation is required for name changes, particularly in instances of divorce or marriage. |

| Ownership Changes | The form allows for the absolute assignment of policy ownership, encompassing rights to cash value and beneficiary changes. |

| Loan Agreement | Policy loans can be requested, with specific sections to indicate the loan amount and purpose. |

| Community Property Considerations | In community property states, the spouse's signature is necessary for certain requests related to ownership or beneficiary changes. |

Guidelines on Utilizing Mps 93

Completing the MPS 93 form correctly is crucial for making changes to your policy or requesting specific services from the William Penn Life Insurance Company. The process requires careful attention to detail, as each item on the form must be filled out appropriately. Follow these steps to ensure your submission is complete and accurate.

- Gather all necessary information about your policy, including the policy number and personal details of the owner and insured.

- Print or type the requested information in the designated fields, ensuring clarity and legibility.

- Fill in the owner’s name, the owner’s telephone number, and the mailing address, ensuring that it is accurate and complete.

- Select the specific change or request you want to make by checking the appropriate boxes (e.g., address change, beneficiary change, etc.).

- If applicable, provide details about the changes, including any required signatures based on the ownership structure of the policy. Make sure to collect all necessary signatures as indicated in the instructions.

- For any name changes, attach a certified copy of the legal documents that support the name change.

- For a duplicate policy request, include the $25.00 fee and write a brief statement about the lost or destroyed policy.

- Ensure that the witness signature and additional required signatures, if needed, are completed at the end of the form.

- Review the entire form to confirm that all sections are filled out correctly and that no required signatures are missing.

- Submit the completed form to the address provided for processing.

What You Should Know About This Form

What is the MPS 93 form used for?

The MPS 93 form, issued by William Penn Life Insurance Company of New York, is a multipurpose policy service form. Policyholders can use it to change personal information such as address, name, and beneficiary. Additionally, it allows requests for a policy certificate, a duplicate of the policy, or the initiation of a policy loan.

Who needs to sign the MPS 93 form?

All requests on the MPS 93 form require the owner's signature. In certain cases, additional signatures may be necessary. For instance, if the policy is collaterally assigned, the assignee must sign for specific requests. If an owner resides in a community property state, their spouse's signature is required for certain requests. Corporate and partnership owners must adhere to specific signing requirements as outlined in the form.

Can I change my address using this form?

Yes, the MPS 93 form allows you to change your address. You can either update the mailing address for the owner or for the insured or assignee. Ensure you clearly indicate which address you are changing and provide the full new address in the designated section.

How do I request a duplicate policy?

To request a duplicate policy, fill out the appropriate section of the MPS 93 form. You must declare that the original policy was lost or destroyed. Additionally, a fee of $25.00 is required, and a check must be submitted with your request, made payable to William Penn Life Insurance Company of New York.

What is required for a name change on the policy?

The name change section of the MPS 93 form allows you to change the name of the insured or owner. You will need to specify the reason for the change—such as marriage or divorce—and provide signatures for both the former and new names. If the change is not due to marriage, appropriate legal documentation must be submitted with the form.

Can I change the beneficiary using the MPS 93 form?

Yes, the beneficiary section allows you to revoke previous designations and appoint new beneficiaries. All completed changes will be endorsed on your policy, and the designations will reflect as specified in the form.

What if I need to take a policy loan?

This form includes a section for requesting a policy loan. You can choose to borrow the full amount or a specified lesser amount. You will need to indicate to whom the check should be made payable and agree to assign the policy to secure the loan repayment.

Is there a fee for obtaining a policy certificate?

No, there is no charge for issuing a policy certificate when you declare that the original policy was lost or destroyed. Simply complete that section of the MPS 93 form to make your request.

What documentation is needed for an ownership change?

To change the ownership of a policy, you will need to complete the ownership change section of the MPS 93 form. If applicable, ensure that any required signatures, such as from partners or corporate officers, are provided. The new owner's mailing address must also be specified to receive future correspondence.

How will I know if my requests have been processed?

The MPS 93 form includes a section for company use, indicating that the changes have been acknowledged and completed. You will receive this acknowledgment from the company once your requests have been processed at their home office.

Common mistakes

When filling out the MPS 93 form, one common mistake people make is overlooking the required signatures. Each request section has specific signature requirements. For instance, if the policy is collaterally assigned, the assignee must sign for certain requests. Missing the appropriate signatures can delay processing and lead to complications down the line.

Another frequent error occurs when individuals fail to clearly print or type all the information requested. The instructions explicitly state to print or type except for signatures. When information is difficult to read, the company may not be able to process the request accurately. Incomplete or illegible information can lead to unnecessary back-and-forth communication.

Some people underestimate the importance of providing supporting documentation. For example, if a name change is requested for reasons other than marriage, a certified copy of the legal document is necessary. Without that proof, the change cannot be processed. Ignoring this requirement can result in stalled requests.

Moreover, individuals sometimes confuse different sections of the form. Each request has unique terms and conditions. Not understanding these can lead to incorrect selections, like choosing the wrong mode for premium payment or misunderstanding what is needed for a duplicate policy request. Carefully reading each section is crucial to avoid these pitfalls.

Lastly, failing to double-check the form before submission is a common oversight. It's essential to review all filled-out sections to ensure there are no errors or omissions. Taking the time to verify that each part of the form is completed correctly can prevent many problems and save time during processing.

Documents used along the form

The MPS 93 form is often used for various requests related to insurance policies. However, several other documents are typically required alongside it to ensure all changes are processed smoothly. Here’s a brief overview of some of those documents.

- Ownership Change Form: This document is used when the ownership of the policy is transferred from one person or entity to another. It outlines the details of the new owner and ensures that future correspondence regarding the policy is directed to them.

- Beneficiary Designation Form: This form allows the policyholder to specify or change beneficiaries who will receive the policy benefits upon the insured's passing. It is important to clearly state both primary and contingent beneficiaries.

- Premium Payment Authorization Form: This document authorizes the insurance company to automatically deduct premium payments from a bank account. It includes information about the account holder and payment schedule preferences.

- Release of Interest Form: Required if a collateral assignee, beneficiary, or spouse needs to give up their rights to the policy. This ensures that all interested parties are properly acknowledged in the transaction.

Using these additional forms in conjunction with the MPS 93 will help manage an insurance policy effectively, ensuring that all necessary changes are documented and authorized. Each of these documents serves a distinct purpose, contributing to a smooth process for the policyholder.

Similar forms

- Change of Address Form: Like the MPS 93, this document allows individuals to update their address details to ensure that important communications reach the correct location.

- Beneficiary Designation Form: This form enables policyholders to name or change the beneficiaries of their policy. It includes a revocation of any previous designations, mirroring the beneficiary change section in the MPS 93.

- Ownership Transfer Form: This document facilitates the transfer of ownership of a policy from one individual to another. Similar to the MPS 93, it includes essential information about the new owner.

- Policy Loan Request Form: Just as the MPS 93 allows for requesting a policy loan, this form is specifically tailored for those looking to borrow against their policy's cash value.

- Name Change Form: This document is used to officially update the name of the policyholder or insured. The process outlined echoes the name change provisions of the MPS 93.

- Policy Surrender Form: This form is needed for individuals wishing to surrender their policy for its cash value. Similar to the MPS 93, it requires the policyholder’s consent.

- Release of Interest Form: Used to release claims to a policy, it shares similarities with section 10 of the MPS 93, where rights and interests in a policy are released.

- Premium Payment Change Request: This document aligns with the MPS 93’s section for changing payment modes, detailing how a policyholder wishes to adjust their premium payments.

- Certificate Request Form: This form requests a certificate for a policy that may have been lost, much like the policy certificate request highlighted in the MPS 93.

Dos and Don'ts

When filling out the MPS 93 form, there are certain actions you should take and others to avoid. Adhering to these practices can streamline the process and help ensure your requests are completed efficiently.

- Do read all instructions thoroughly before beginning to fill out the form.

- Do print or type all information clearly, except for signatures.

- Do ensure you are signing in all the required places, including obtaining necessary signatures from beneficiaries or assignees.

- Do submit any required documents, like a certified copy of a marriage certificate when changing a name due to marriage.

- Do complete a separate request form for each policy you wish to change.

- Don’t leave any sections blank. Incomplete forms can lead to delays.

- Don’t use corrections fluid or other means to alter information on the form.

- Don’t forget to include the fee for a duplicate policy if you are requesting one.

- Don’t disregard the specific requirements for corporate signatories if you are acting on behalf of a corporation.

- Don’t hesitate to contact the insurance company for clarification if you encounter any uncertainties while filling out the form.

By following these do's and don’ts, you can help ensure that your requests are processed smoothly and efficiently. If you have further questions or need assistance, do not hesitate to ask for help.

Misconceptions

- Misconception 1: The MPS 93 form is only for changing the owner of a policy.

- Misconception 2: It is not necessary to include signatures for all parties involved.

- Misconception 3: The MPS 93 form can be used for any life insurance policy, regardless of the issuing company.

- Misconception 4: Submitting the form is all that's required to process a request.

This form is quite versatile. While it does facilitate ownership changes, it also allows for updates to addresses, beneficiary designations, premium payment modes, and more. One can address multiple needs with just a single form.

In fact, signatures are mandatory for various requests outlined in the form. Whether it’s the owner, beneficiary, or assignee, each individual must sign depending on the specific changes being requested. Ignoring this requirement can result in delays or denials.

This form specifically applies to policies issued by William Penn Life Insurance Company of New York. Other insurance providers have their own forms and procedures. Always ensure that you are using the correct document for your specific policy.

While the submission of the form initiates the process, additional requirements may exist. The company may request further information or documentation based on the nature of the changes being made. Always check the instructions carefully to ensure compliance.

Key takeaways

Filling out and using the MPS 93 form requires attention to detail. Here are key takeaways for effective use:

- One Form Per Policy: A separate MPS 93 form is necessary for each policy you wish to modify. Do not attempt to combine requests for multiple policies.

- Accuracy is Critical: It is essential to print or type all the information clearly, except for signatures. Mistakes can delay processing.

- Required Signatures: The owner must sign all requests. Additional signatures may be necessary based on the type of request, such as beneficiary or corporate signatures.

- Proof of Changes: When changing names or ownership, be ready to provide supporting documentation. For example, a certified copy of a court order is required for name changes that aren’t due to marriage.

- Be Mindful of Fees: Some requests incur fees, such as the $25 fee for a duplicate policy. Include payment with requests that require it.

Browse Other Templates

Dwc Separator Sheet - Provides a clear audit trail for document handling.

Marine Corps Family Care Documentation,Service Member Family Support Form,Military Family Care Assurance Worksheet,Dependent Care Responsibility Plan,Family Care Preparedness Document,Service Member Caregiver Designation Form,Family Assistance Planni - The form prompts consideration of various logistical issues, including education and relocation.

Duplicate Vehicle Registration Request,Replacement Registration Card Application,Lost Plate Replacement Form,Vehicle Registration Update Request,Registration Plate Replacement Application,Weight Class Sticker Replacement Form,Illegible Plate Authoriz - This document is crucial for maintaining your vehicle's legal registration.