Fill Out Your Mv 349 1 Form

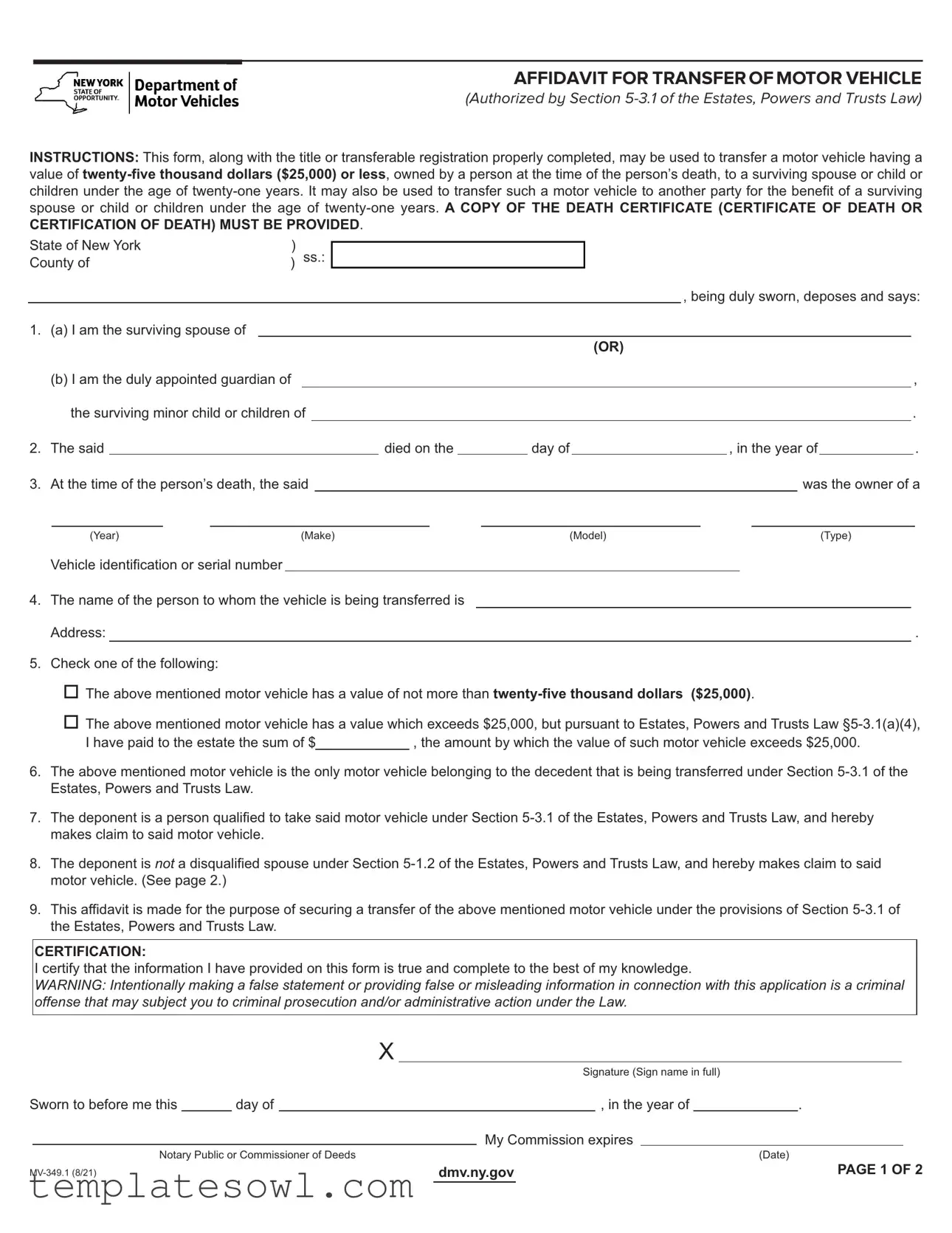

The MV 349 1 form, officially known as the Affidavit for Transfer of Motor Vehicle, plays a crucial role in the process of transferring vehicle ownership after the death of its owner in New York. This form is specifically designed for motor vehicles valued at $25,000 or less, simplifying the transfer of ownership to a surviving spouse or minor children under twenty-one. Along with the completed title or transferable registration, it requires a copy of the death certificate to validate the claim. The form allows for the transfer to another party for the benefit of the surviving family members, emphasizing the importance of ensuring that the assets of the deceased are appropriately managed. The individual filing the affidavit must affirm their relationship to the deceased, provide pertinent details about the vehicle, and assert that they are qualified to take ownership under the applicable law. Additional sections clarify that a statement made on this form is held to the highest standard of truthfulness, with penalties for false information. Overall, the MV 349 1 form is a vital legal document that facilitates the smooth transition of vehicle ownership during a difficult time, ensuring that surviving family members can navigate the necessary procedures without undue burden.

Mv 349 1 Example

AFFIDAVIT FOR TRANSFER OF MOTOR VEHICLE

(Authorized by Section

INSTRUCTIONS: This form, along with the title or transferable registration properly completed, may be used to transfer a motor vehicle having a value of

State of New York |

) |

County of |

) ss.: |

, being duly sworn, deposes and says:

1.(a) I am the surviving spouse of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(OR) |

|

|

|

|

|

|

|

|

|

|

(b) I am the duly appointed guardian of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|||||||

|

|

the surviving minor child or children of |

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||||||

2. |

The said |

|

|

|

|

died on the |

|

|

|

day of |

|

|

, in the year of |

|

. |

||||||||||

3. |

At the time of the person’s death, the said |

|

|

|

|

|

|

|

|

was the owner of a |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Year) |

(Make) |

|

|

(Model) |

|

|

|

|

|

(Type) |

|||||||||||||

|

Vehicle identification or serial number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4. |

The name of the person to whom the vehicle is being transferred is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

||||||

5.Check one of the following:

•The above mentioned motor vehicle has a value of not more than

•The above mentioned motor vehicle has a value which exceeds $25,000, but pursuant to Estates, Powers and Trusts Law

I have paid to the estate the sum of $ |

|

, the amount by which the value of such motor vehicle exceeds $25,000. |

6.The above mentioned motor vehicle is the only motor vehicle belonging to the decedent that is being transferred under Section

7.The deponent is a person qualified to take said motor vehicle under Section

8.The deponent is not a disqualified spouse under Section

9.This affidavit is made for the purpose of securing a transfer of the above mentioned motor vehicle under the provisions of Section

CERTIFICATION:

I certify that the information I have provided on this form is true and complete to the best of my knowledge.

WARNING: Intentionally making a false statement or providing false or misleading information in connection with this application is a criminal offense that may subject you to criminal prosecution and/or administrative action under the Law.

X

|

|

|

|

|

|

Signature (Sign name in full) |

|

|

|

|||

Sworn to before me this |

|

day of |

|

|

|

, in the year of |

|

|

. |

|

||

|

|

|

|

|

|

My Commission expires |

|

|

|

|

||

|

Notary Public or Commissioner of Deeds |

|

|

|

|

|

(Date) |

|||||

|

|

|

dmv.ny.gov |

|

PAGE 1 OF 2 |

|||||||

§

(a)A husband or wife is a surviving spouse within the meaning, and for the purposes of

(1)A final decree or judgment of divorce, of annulment or declaring the nullity of a marriage or dissolving such marriage on the ground of absence, recognized as valid under the law of this state, was in effect when the deceased spouse died.

(2)The marriage was void as incestuous under section five of the domestic relations law, bigamous under section six thereof, or a prohibited remarriage under section eight thereof.

(3)The spouse had procured outside of this state a final decree or judgment of divorce from the deceased spouse, of annulment or declaring the nullity of the marriage with the deceased spouse or dissolving such marriage on the ground of absence, not recognized as valid under the law of this state.

(4)A final decree or judgment of separation, recognized as valid

under the law of this state, was rendered against the spouse, and such decree or judgment was in effect when the deceased spouse died.

(5)The spouse abandoned the deceased spouse, and such abandonment continued until the time of death.

(6)A spouse who, having the duty to support the other spouse, failed

or refused to provide for such spouse though he or she had the means or ability to do so, unless such marital duty was resumed and continued until the death of the spouse having the need of support.

PAGE 2 OF 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | AFFIDAVIT FOR TRANSFER OF MOTOR VEHICLE |

| Governing Law | Authorized by Section 5-3.1 of the Estates, Powers and Trusts Law |

| Eligibility Criteria | Applicable for motor vehicles valued at $25,000 or less owned by deceased persons. |

| Beneficiaries | Transfer can be made to a surviving spouse or minor children under 21. |

| Death Certificate Requirement | A copy of the death certificate must accompany the form. |

| Affidavit Purpose | This affidavit secures the transfer of the motor vehicle as per the law. |

| Disqualification Criteria | Certain conditions may disqualify a spouse from being a transfer recipient. |

| Value Verification | Value of the vehicle must be confirmed as not exceeding $25,000 or a payment made for excess. |

| Notary Requirement | The affidavit must be notarized for it to be valid. |

Guidelines on Utilizing Mv 349 1

Filling out the MV 349 1 form is a necessary step for transferring ownership of a motor vehicle after the death of the owner. This process involves providing accurate information about the deceased and the vehicle, along with relevant documentation such as a death certificate. Once the form is completed, it needs to be signed before a notary public or commissioner of deeds.

- Obtain the MV 349 1 form, along with the title or transferable registration of the vehicle.

- Begin by providing your name in the first line, indicating whether you are the surviving spouse or the guardian of minor children.

- Fill in the full name of the deceased person in the space provided.

- Document the date of death, including the day, month, and year.

- Specify the details of the vehicle: list the year, make, model, and type, as well as the vehicle identification or serial number.

- Enter the name and address of the person receiving the vehicle.

- Check the appropriate box to indicate the vehicle’s value. If it exceeds $25,000, provide the amount you paid to the estate.

- Confirm that this is the only vehicle being transferred by checking the relevant box.

- Affirm your qualification to take the vehicle by confirming your status, stating that you are not a disqualified spouse.

- State that this affidavit is made to secure the transfer under the law.

- Sign the document in the designated area. Ensure that the signature is your full name.

- Visit a notary public or commissioner of deeds to have your affidavit sworn. Fill in the date and the notary's commission expiration date.

What You Should Know About This Form

What is the purpose of the MV-349.1 form?

The MV-349.1 form is an affidavit used for transferring ownership of a motor vehicle from a deceased person to a surviving spouse or minor children under the age of twenty-one. It is specifically designed for vehicles valued at $25,000 or less. This form simplifies the transfer process, allowing families to manage the vehicle's ownership efficiently in the aftermath of a loss. Additionally, the form can facilitate the transfer of the vehicle to another party for the benefit of the surviving spouse or children as well.

What are the requirements to use the MV-349.1 form?

To utilize the MV-349.1 form, certain conditions must be met. First, the form should only be used if the motor vehicle has a value of $25,000 or lower. Additionally, a death certificate must accompany the form to verify the passing of the vehicle’s owner. The person completing the form must be either the surviving spouse or the appointed guardian of the deceased's minor children. Lastly, the motor vehicle being transferred must be the only one belonging to the decedent undergoing this process, as per Section 5-3.1 of the Estates, Powers and Trusts Law.

How does one determine the value of the motor vehicle?

The value of the motor vehicle can be determined through various methods, such as using online valuation tools or consulting professional appraisers. It is essential to consider the vehicle's make, model, year, and condition to ascertain its market value accurately. If the motor vehicle's value exceeds $25,000, the form can still be utilized if the individual transferring ownership pays the estate the amount by which the vehicle’s value exceeds this threshold. This will be specified in the appropriate section of the form.

What happens if false information is provided on the MV-349.1 form?

Providing false information on the MV-349.1 form can lead to serious consequences. It is considered a criminal offense, and individuals may be subject to prosecution or administrative actions. This aspect ensures that the integrity of the process is maintained, protecting the rights of all parties involved. Therefore, it is crucial to complete the affidavit with accurate and truthful information.

Is notarization required for the MV-349.1 form?

Yes, notarization is a requirement for the MV-349.1 form. The individual completing the affidavit must sign the form in front of a notary public or a commissioner of deeds. This step adds an extra layer of legitimacy to the document, confirming that the information provided is sworn to be true. The notary will also record the date of the signing and their commission expiration date, further validating the affidavit's legal standing.

Common mistakes

Completing the MV-349.1 form can seem straightforward, but many individuals make critical errors that can delay the transfer process of a motor vehicle. One common mistake is failing to provide a copy of the death certificate. This document is not optional; it is a necessary component of the application. Without it, the form is incomplete, and the transfer cannot proceed.

Another frequent error involves the valuation of the vehicle. Some individuals mistakenly assert that their vehicle is worth less than twenty-five thousand dollars ($25,000) when, in fact, it exceeds that amount. Providing inaccurate information can lead to legal complications or even criminal charges. It is essential to obtain an accurate valuation of the vehicle before completing the form.

The section regarding the name and address of the person receiving the vehicle also presents a trap for many. Incomplete or incorrect information here can lead to confusion or disputes later on. Ensure that the recipient’s full name and current address are clearly stated to avoid potential ownership disputes.

In addition to providing correct information, people often overlook the importance of signing the document where indicated. A missing signature can render the entire form void. It is crucial to sign in full, as specified, to confirm your acknowledgment of the statements made in the affidavit.

Finally, some individuals neglect to read the entire form carefully before submission. Rushing through the process can lead to simple clerical mistakes that might prolong the transfer. Each section of the MV-349.1 has specific requirements; ensuring every part is accurately completed is vital for a smooth transfer process.

Documents used along the form

When transferring a motor vehicle after the death of the owner, several documents may be involved in addition to the MV 349.1 form. Each document serves a unique purpose to facilitate the process, ensuring compliance with legal requirements.

- Vehicle Title: This is a legal document that establishes ownership of the vehicle. It must be signed over from the deceased owner to the beneficiary. Proper completion of this document is crucial for the transfer process.

- Death Certificate: This document serves as official proof of the deceased individual's passing. A copy must accompany the MV 349.1 form, substantiating the claim for vehicle transfer.

- Affidavit of Heirship: In cases lacking a will, this form can clarify the rightful heirs to the estate, including the vehicle. It may also help resolve any disputes about ownership, especially when multiple beneficiaries are involved.

- Power of Attorney: If someone is acting on behalf of a surviving spouse or minor child, this document authorizes them to handle the transaction. It ensures that the person completing the transfer has the legal authority to do so.

Understanding these additional forms can streamline the process of transferring a motor vehicle. Each document plays a critical role in ensuring that the transfer complies with state laws and accurately reflects the intentions of the deceased owner.

Similar forms

-

Application for Title Transfer: This document is used to officially request the transfer of a vehicle's title from one owner to another. Similar to the Mv 349 1 form, it requires identifying information about the vehicle and parties involved, ensuring the proper legal transfer of ownership.

-

Affidavit of Heirship: When someone passes away, this affidavit attests to the heirs of their estate. It provides details on the deceased and their relationships, akin to the Mv 349 1 form's function in transferring vehicle ownership to heirs.

-

Bill of Sale: A bill of sale is a record of the sale of a vehicle. This document, while typically used for vehicle purchases, serves a similar purpose by transferring ownership, much like the Mv 349 1 form when the owner has died.

-

Letter of Administration: In cases where a will is not present, this document grants someone the authority to manage and distribute the deceased’s assets. It parallels the Mv 349 1 form as both enable legal action regarding property transfers in the event of death.

-

Last Will and Testament: A will outlines how a person wishes to distribute their assets after death. While a will can dictate who inherits a vehicle, the Mv 349 1 form operationalizes the transfer of that vehicle directly.

-

Power of Attorney: This document allows one individual to act on behalf of another. Though generally not associated with death, it can facilitate vehicle transfers, mirroring the intentions behind the Mv 349 1 form.

-

Certificate of Death: Required for many legal transactions post-death, a death certificate verifies an individual’s passing, which forms the basis for completing the Mv 349 1 form.

-

Transfer of Title Affidavit: Similar to the Mv 349 1 form, this document allows for the transfer of a vehicle's title when faced with certain situations, often used when proper title documentation is unavailable.

-

Estate Tax Return: While this return deals with taxes related to the deceased’s estate, it often accompanies asset transfers and informs decisions about properties and vehicles, paralleling the function of the Mv 349 1 form.

-

Vehicle Registration Application: This form is used to officially register a vehicle after ownership has changed. It serves a similar purpose to the Mv 349 1 form by ensuring that the new owner is recognized legally.

Dos and Don'ts

When filling out the MV 349.1 form, certain actions can help ensure the process goes smoothly. Here are ten things to do and not to do:

- Do: Clearly and accurately fill in all required fields.

- Do: Provide a copy of the death certificate with the application.

- Do: Verify that the vehicle's value is $25,000 or less, or include the necessary payment documentation if it exceeds that amount.

- Do: Indicate your relationship to the deceased correctly, whether you are a surviving spouse or guardian of a minor.

- Do: Ensure that your signature is legible and matches the name provided on the form.

- Don’t: Leave any sections blank; this could delay the processing of your application.

- Don’t: Forget to have the form notarized before submission.

- Don’t: Submit without ensuring that all information is true and complete, as inaccuracies can lead to criminal charges.

- Don’t: Attempt to transfer the vehicle if there are disqualifying factors present in your relationship with the deceased.

- Don’t: Ignore any specific instructions provided for the completion of the form.

Misconceptions

- Misconception 1: The Mv 349 1 form can be used for vehicles worth any amount.

In reality, this form is specifically for motor vehicles valued at twenty-five thousand dollars ($25,000) or less.

- Misconception 2: You can transfer the vehicle without a death certificate.

A copy of the death certificate is mandatory when using this form to transfer ownership.

- Misconception 3: Only spouses can use the form.

The form can also be used by guardians on behalf of minor children, allowing for flexibility in transfers.

- Misconception 4: You only need the form to transfer ownership.

An accurately completed title or transferable registration is also required alongside the Mv 349 1 form.

- Misconception 5: The transfer takes effect immediately upon submitting the form.

The transfer is not complete until all required documents, including the title and death certificate, are submitted.

- Misconception 6: The form can be used to transfer any motor vehicle owned by the deceased.

This affidavit only applies to the one motor vehicle that meets the specific criteria outlined in the Estates, Powers and Trusts Law.

- Misconception 7: There are no penalties for false information provided on the form.

Providing false information can lead to criminal prosecution or administrative action, so accuracy is crucial.

Key takeaways

When dealing with the MV 349 1 form, it is essential to understand its purpose and the requirements for completing it accurately. Here are nine key takeaways to consider:

- This form is used to transfer ownership of a motor vehicle valued at $25,000 or less, from a deceased person to a surviving spouse or eligible minor children.

- A death certificate must accompany the form; without this document, the process cannot proceed.

- The transfer can also be made to another party for the benefit of a surviving spouse or children under 21 years old.

- Accurate details about the deceased, such as their name and date of death, must be provided clearly on the form.

- Be prepared to provide information on the vehicle, including the year, make, model, and vehicle identification number.

- A declaration of the vehicle's value must be included; it should not exceed $25,000 unless the estate has been compensated for the excess value.

- If you are not the surviving spouse, you must be the duly appointed guardian of the minor children to complete this transfer.

- The affidavit must clearly state that this is the only vehicle of the deceased being transferred under the relevant law.

- It is imperative to certify that the information provided is truthful; false statements may lead to criminal charges.

Taking the time to understand these points will facilitate a smoother transfer process. Always double-check all entries for accuracy, and seek assistance if you are uncertain about any aspect of the form.

Browse Other Templates

Fax Transmission Cover,Confidential Fax Document,Facsimile Cover Page,Fax Information Sheet,Confidential Communication Form,Transmission Cover Sheet,Fax Privacy Notice,Facsimile Information Cover,Protected Health Information Fax,Fax Confidentiality N - It contains vital contact information for both the sender and recipient regarding questions.

Fictitious Business Name Renewal Form,Fictitious Name Permit Renewal Notification,California Fictitious Name Update Application,Permit Renewal for Fictitious Medical Practice,Fictitious Name Permit Hold Release Form,California Fictitious Name Mainten - This form contributes to consumer protection through proper licensing notification.

How to Become a Medicaid Provider in Florida - A welcome statement sets the tone for the application process.