Fill Out Your Mv 371 Form

The MV-371 form serves as a crucial tool for retirees in Pennsylvania, enabling them to access a reduced processing fee for vehicle registration. This streamlined application process is designed specifically for individuals who are retired and receiving Social Security or other pension payments. To qualify, applicants must confirm that their total gross income from all sources remains below $19,200, ensuring that this benefit reaches those who are in genuine financial need. Essential data such as the applicant's name, birth date, and vehicle details must be provided, facilitating accurate processing. Additionally, the MV-371 requires the applicant to certify their status and financial information, affirming their role as the primary driver and vehicle owner. It is vital that potential applicants understand the eligibility requirements, including specific income limits and the necessity of submitting this form alongside their vehicle registration application, accompanied by the applicable fee. Retirees looking to save on their vehicle registration costs can find empowerment through this straightforward application, which underscores a commitment to supporting their community in practical and tangible ways.

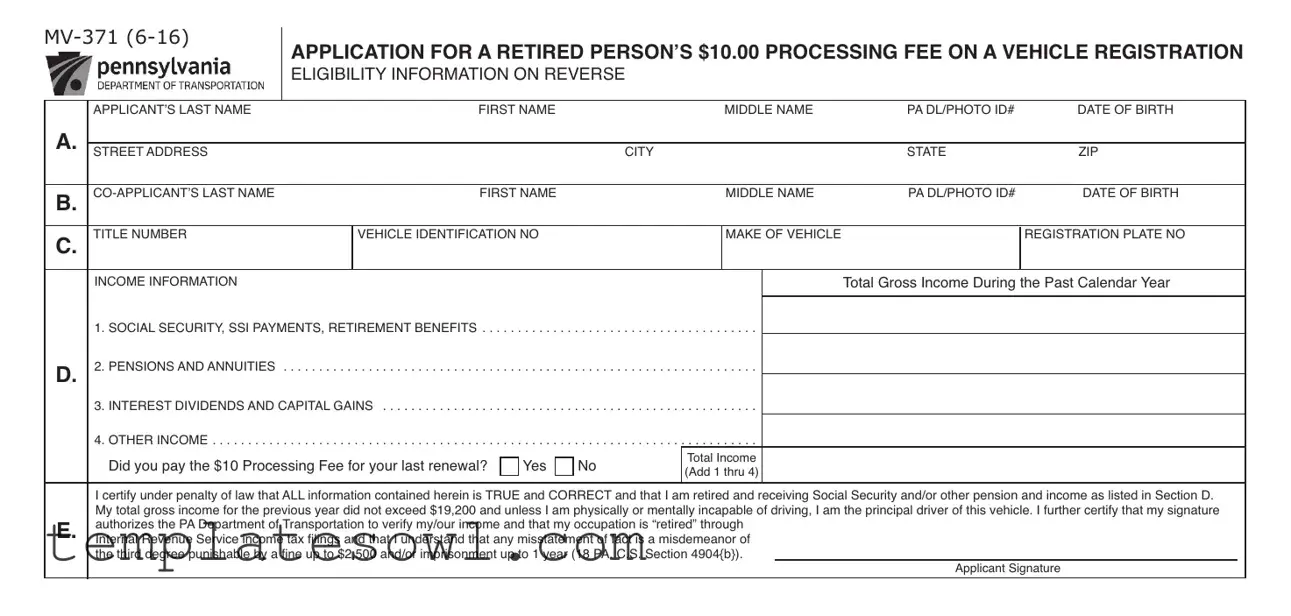

Mv 371 Example

|

APPLICATION FOR A RETIRED PERSON’S $10.00 PROCESSING FEE ON A VEHICLE REGISTRATION |

|

|||||||||||||||

|

|

||||||||||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

ELIGIBILITY INFORMATION ON REVERSE |

|

|

|

|

|

|

|

|

|

|||

|

A. |

|

APPLICANT’S LAST NAME |

|

|

FIRST NAME |

|

|

|

MIDDLE NAME |

PA DL/PHOTO ID# |

|

DATE OF BIRTH |

|

|||

|

|

|

|

|

|||||||||||||

|

|

STREET ADDRESS |

|

|

|

|

CITY |

|

|

|

|

STATE |

|

ZIP |

|

||

|

B. |

|

|

|

FIRST NAME |

|

|

|

MIDDLE NAME |

PA DL/PHOTO ID# |

|

DATE OF BIRTH |

|

||||

|

C. |

|

TITLE NUMBER |

|

|

VEHICLE IDENTIFICATION NO |

|

|

|

MAKE OF VEHICLE |

|

|

REGISTRATION PLATE NO |

|

|||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

INCOME INFORMATION |

|

|

|

|

|

|

|

|

|

Total Gross Income During |

|

the Past Calendar Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

D. |

|

. . . . . .1. SOCIAL SECURITY, SSI PAYMENTS, RETIREMENT BENEFITS |

. . . . . . . |

. . . . . . . . . . . . . . . |

. . . . . . |

. . . . . |

|

|

|

|

|

|

||||

|

|

2. PENSIONS AND ANNUITIES |

|

. . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . |

. . . . . . |

. . . . . |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

3. INTEREST DIVIDENDS AND CAPITAL GAINS |

. . . . . . . |

. . . . . . . . . . . . . . . |

. . . . . . |

. . . . . |

|

|

|

|

|

|

||||

|

|

|

4. OTHER INCOME |

|

|

|

|

|

. |

Total. . . . Income. |

|

|

|

|

|

|

|

|

|

|

|

. . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|||

|

|

|

Did you pay the $10 Processing Fee for your last renewal? |

Yes |

No |

|

(Add 1 thru 4) |

|

|

|

|

|

|

||||

|

|

|

I certify under penalty of law that ALL information contained herein is TRUE and CORRECT and that I am retired and receiving Social Security and/or other pension and income as listed in Section D. |

|

|||||||||||||

|

E. |

|

My total gross income for the previous year did not exceed $19,200 and unless I am physically or mentally incapable of driving, I am the principal driver of this vehicle. I further certify that my signature |

|

|||||||||||||

|

|

authorizes the PA Department of Transportation to verify my/our income and that my occupation is “retired” through |

|

|

|

|

|

||||||||||

|

|

Internal Revenue Service income tax filings and that I understand that any misstatement of fact is a misdemeanor of |

|

|

|

|

|

||||||||||

|

|

|

the third degree punishable by a fine up to $2,500 and/or imprisonment up to 1 year (18 PA. C.S. Section 4904{b}). |

Applicant Signature |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ELIGIBILITY REQUIREMENTS AND INSTRUCTIONS FOR THE $10.00 PROCESSING FEE

1. You must be retired and receiving Social Security or other pension payments as described in Section D on the front of this application, regardless of age.

If you receive only unemployment compensation or public assistance, or are a student or other individual who is not retired, you do not qualify.

2. Total gross income from all sources must not exceed $19,200. Other income includes Business/Rental Income, Wages, Public Assistance and Unemployment Compensation.

3. To be eligible for the retired status processing fee, the applicant must meet the qualifications above and the applicant must be listed as an owner on the vehicle’s registration. The vehicle may be owned jointly, however, the applicant must be the principal operator of the vehicle, unless physically or mentally incapable of operating the vehicle. The vehicle must be a passenger car or truck with a registered gross weight of not more than 9,000 lbs. Only one vehicle per qualified applicant may be registered for the retired status processing fee.

4. This application must be submitted in conjunction with Form

5. NOTE: Individuals should list their PA Driver’s License (PA DL) or Photo ID# in the space provided. Return the completed application with your vehicle registration application and include a $10 check or money order made payable to PA Department of Transportation. DO NOT SEND CASH.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | MV-371: Application for a Retired Person’s $10.00 Processing Fee on a Vehicle Registration |

| Eligibility Age | No minimum age is required; applicants must be retired and receiving Social Security or pension payments. |

| Income Limit | The applicant's total gross income must not exceed $19,200 per year. |

| Submission Requirements | This application must accompany Form MV-1, MV-4ST, MV-105, MV-120, or MV-140 for processing. |

| Processing Fee | A non-refundable processing fee of $10 is required, to be paid via check or money order. |

| Principal Operator | The applicant must be the principal driver of the vehicle, with exceptions only if physically or mentally unable to drive. |

| Governing Law | Pennsylvania law stipulates the requirements for this application under 18 PA. C.S. Section 4904(b). |

Guidelines on Utilizing Mv 371

Filling out the MV-371 form is a straightforward process that helps determine eligibility for a retired person's $10.00 processing fee on a vehicle registration. After completing the form, it will need to be submitted along with your vehicle registration application and payment. Be sure to double-check all provided information for accuracy before sending the documents.

- Obtain the MV-371 form, ensuring you have the most recent version.

- Fill in the applicant's personal information in section A:

- Last Name

- First Name

- Middle Name

- PA Driver's License/Photo ID number

- Date of Birth

- Street Address

- City

- State

- Zip Code

- Complete section B with the co-applicant's information, if applicable, using the same fields as section A.

- In section C, provide the vehicle details:

- Title Number

- Vehicle Identification Number (VIN)

- Make of Vehicle

- Registration Plate Number

- In section D, report your total gross income for the past calendar year by detailing each source of income:

- Social Security, SSI Payments, Retirement Benefits.

- Pensions and Annuities.

- Interest, Dividends, and Capital Gains.

- Other Income.

- Calculating the total income, write this figure in the Total Income box provided.

- Indicate whether you paid the $10 Processing Fee for your last renewal by marking “Yes” or “No.”

- Read the certification statement and sign the application, confirming the accuracy of the information included.

- Ensure that the income does not exceed $19,200 and that you meet the eligibility requirements outlined on the form.

- Submit the completed MV-371 form with the appropriate vehicle registration application and include a $10 check or money order made payable to the PA Department of Transportation. Do not send cash.

What You Should Know About This Form

What is the MV-371 form used for?

The MV-371 form is an application for retired individuals to apply for a reduced processing fee of $10. This fee applies to vehicle registrations for certain retirees, provided they meet specific eligibility criteria.

Who is eligible to use the MV-371 application?

To qualify, applicants must be retired and receiving Social Security, pension payments, or other specified income. Total gross income must not exceed $19,200. Additionally, you must be the principal operator of the vehicle, which should be a passenger car or truck weighing no more than 9,000 lbs.

What information do I need to provide on the MV-371 form?

You'll need to supply personal information, such as your name, address, date of birth, and Pennsylvania driver's license or photo ID number. Income details, including amounts from Social Security, pensions, dividends, and other income, are required. Be ready to confirm that your total income does not exceed $19,200 as well.

Can I apply if I have a part-time job?

Yes, you may apply for the reduced fee if you are retired from your principal occupation but hold part-time employment. However, if your only source of income is unemployment compensation or public assistance, you will not qualify.

How many vehicles can I register under this reduced fee?

The program allows only one vehicle per qualified applicant to be registered with the retired status processing fee. This ensures that the benefit is focused on individual qualifying retirees.

Do I need to submit any other forms with MV-371?

Yes, you must submit the MV-371 along with one of the following forms: MV-1, MV-4ST, MV-105, MV-120, or MV-140. It is essential to include these forms to process your application successfully.

How do I pay the processing fee?

The processing fee of $10 should be paid via check or money order made payable to the PA Department of Transportation. Do not send cash with your application to ensure your payment is secure.

What happens if I provide false information on the MV-371 form?

Providing false information is taken seriously. It is classified as a misdemeanor of the third degree, which could lead to significant fines of up to $2,500 or imprisonment for up to one year, according to Pennsylvania law.

Where do I send my completed MV-371 application?

Once completed, return the MV-371 form along with your vehicle registration application and payment to the appropriate address for the Pennsylvania Department of Transportation. Ensure all documents are accurately filled out to avoid delays.

Common mistakes

When filling out the MV-371 form, several common mistakes can lead to delays or rejection of the application. One significant error is providing inaccurate income information. Applicants must report their total gross income from all sources. Misjudging income can be damaging, especially if applicants fail to consider all streams, like part-time work or other benefits. Listing an incorrect amount, whether too high or too low, may result in disqualification.

Another frequent mistake involves misunderstanding the eligibility criteria. The form clearly states that individuals must be retired and receiving Social Security or other pension payments. Yet, some applicants still assume that being partially employed or only qualifying for unemployment compensation is sufficient. This misunderstanding can lead to wasted time and effort when applicants realize they do not meet the qualifications.

In addition, failing to sign the application is a common oversight. Applicants must certify the accuracy of the information provided by signing the form. Without a signature, the application is incomplete. This requirement enforces the seriousness of providing true and correct information. Neglecting to sign, however, may mean the application cannot be processed.

Finally, many applicants forget to include the processing fee or fail to submit an acceptable payment method. The form specifies a $10 check or money order made to the PA Department of Transportation. Sending cash is not permitted and will ultimately lead to rejection of the application. Therefore, ensuring the payment accompanies the application is crucial to avoid unnecessary delays.

Documents used along the form

The MV-371 form is often submitted alongside several other forms that facilitate vehicle registration for retired individuals. Understanding these forms can ease the application process.

- MV-1: This is the standard application for a new Pennsylvania vehicle registration. It captures essential details about the vehicle and its owner.

- MV-4ST: This form is used for the sale or transfer of a vehicle. It verifies the transaction between the seller and buyer.

- MV-105: This is the application for a replacement title. If the original title is lost or damaged, this form must be filled out to obtain a new one.

- MV-120: This document helps with the registration of a vehicle that was previously registered in another state. It allows for a smooth transition to Pennsylvania registration.

- MV-140: This form is the request for a vehicle inspection. It is necessary for registering certain types of vehicles, especially if modifications have been made.

- PennDOT Verification: While not a form, this process allows the Pennsylvania Department of Transportation to verify the applicant's information, ensuring that all details, including income, are accurate.

- Payment Receipt: A receipt showing payment of the $10 processing fee is necessary for confirming that the fee has been paid as part of the application submission.

Completing the paperwork carefully and ensuring all required forms are included will help expedite the vehicle registration process. Keeping all documents organized is essential for a smooth experience.

Similar forms

The MV-371 form is an application designed for retired individuals seeking a reduced processing fee for vehicle registration. It shares similarities with several other documents that also serve specific official purposes. Here’s a detailed look at nine forms that relate closely to the MV-371:

- Form MV-1: This is the application for a Pennsylvania vehicle registration. Like the MV-371, it requires personal identification details and vehicle information, making both essential for registering a vehicle in Pennsylvania.

- Form MV-4ST: This is a request for exemption from certain taxes when registering a vehicle. Similar to MV-371, it also requires income verification to determine eligibility for tax exemptions or reduced fees.

- Form MV-105: This document pertains to vehicle title applications. Just as the MV-371 verifies applicant details and vehicle information, the MV-105 ensures that ownership of the vehicle is transferred properly.

- Form MV-120: This form is an application for a free vehicle registration for certain eligible drivers. Both MV-120 and MV-371 focus on providing financial relief to specific groups based on income levels and retirement status.

- Form MV-140: This is a request for a special registration plate, which often requires the applicant to prove membership in an eligible group. Like MV-371, it assesses eligibility based on personal status and type of vehicle owned.

- Form MV-41: This form is used for reporting a lost or stolen title. The MV-371, like the MV-41, relates to maintaining accurate vehicle registration records and requires identification details.

- Form DL-143: This is an application for a duplicate driver’s license. Both forms involve personal verification, ensuring accurate identity and compliance with Pennsylvania vehicle requirements.

- Form DL-54A: This form is used for registering a vehicle and obtaining an identification card. Similar to MV-371, it requires financial and personal information, reinforcing eligibility criteria.

- Form MV-120E: This is related to the exemption from emissions inspection fees for certain vehicles. Like the MV-371 application, it assesses eligibility based on specific applicant circumstances.

Each of these forms underscores the importance of clear identification and eligibility verification in the vehicle registration process. Understanding these documents can help streamline the application process for retired individuals seeking benefits related to vehicle registration.

Dos and Don'ts

When filling out the MV-371 form, there are some things you should keep in mind to ensure a smooth process. Here’s a list of dos and don’ts to follow:

- Do provide accurate personal information.

- Do ensure your total gross income does not exceed $19,200.

- Do list all sources of income mentioned in Section D.

- Do include your PA Driver’s License or Photo ID number.

- Don't attempt to omit or misrepresent any income information.

- Don't submit the form without all necessary accompanying documents.

- Don't forget to include the $10 processing fee, made out to the PA Department of Transportation.

- Don't send the application with cash; use a check or money order instead.

Following these guidelines will help streamline your application process and increase your chances of approval.

Misconceptions

Here are nine misconceptions about the MV-371 form:

- Only seniors can apply. Many people believe that only older adults are eligible for the processing fee. However, you must be retired and receiving Social Security or pension benefits, regardless of your age.

- Part-time work disqualifies you. It is a common misunderstanding that any form of part-time employment disqualifies an applicant. In fact, part-time work is permitted if you are retired from your principal occupation.

- You can have multiple vehicles registered. Some people assume they can register multiple vehicles under the retired status processing fee. This is incorrect. Only one vehicle per qualified applicant may receive this fee.

- The income limit is flexible. Many believe the income limit has some leeway. This is not true. Total gross income from all sources must not exceed $19,200.

- Any type of vehicle qualifies. There is a misconception that any vehicle qualifies for the retired status processing fee. In reality, the vehicle must be a passenger car or truck with a registered gross weight of not more than 9,000 lbs.

- Submissions are independent. Some applicants think they can submit the MV-371 without any additional forms. However, it must be submitted alongside specific forms, such as MV-1, MV-4ST, or MV-140.

- Cash payments are accepted. It is incorrect to assume that cash payments are allowed. Applicants must send a check or money order made payable to the PA Department of Transportation.

- Only the primary applicant's information is needed. Some people think that only the primary applicant's details should be included. However, if there is a co-applicant, their information must also be provided.

- The fee is refundable. There may be misconceptions regarding the refundability of the $10 processing fee. The fee is generally not refundable once submitted, regardless of the circumstances.

Key takeaways

When completing and using the MV-371 form, ensure you keep these key takeaways in mind:

- The MV-371 form is designed for retirees seeking a $10 processing fee on vehicle registration. It requires personal and income information, making accuracy crucial.

- Applicants must certify they are retired and receive social security or pension payments. Part-time work is acceptable if they have officially retired from their main job.

- To qualify, total gross income must not exceed $19,200 annually. This includes all income sources, such as pensions and rental income.

- The vehicle registration should list the applicant as an owner, and they must be the primary driver unless they have a physical or mental incapacity.

- Submission of the MV-371 must accompany a completed vehicle registration form (like MV-1, MV-4ST, etc.), along with a $10 fee, which should be made via check or money order, never cash.

Browse Other Templates

Strayer Transcripts - A standard processing fee helps maintain the service of transcript requests.

Fort Hood Vehicle Safety Checklist,III Corps Vehicle Examination Form,Fort Hood Auto Compliance Report,Fort Hood Vehicle Inspection Report,III Corps Motor Vehicle Assessment,Fort Hood Driver Safety Evaluation,Fort Hood Vehicle Condition Survey,III Co - It encourages the use of a first aid kit and flares.

Game Xchange - Active, adaptable behavior may be a strong asset for this role.