Fill Out Your Mvu 26 Form

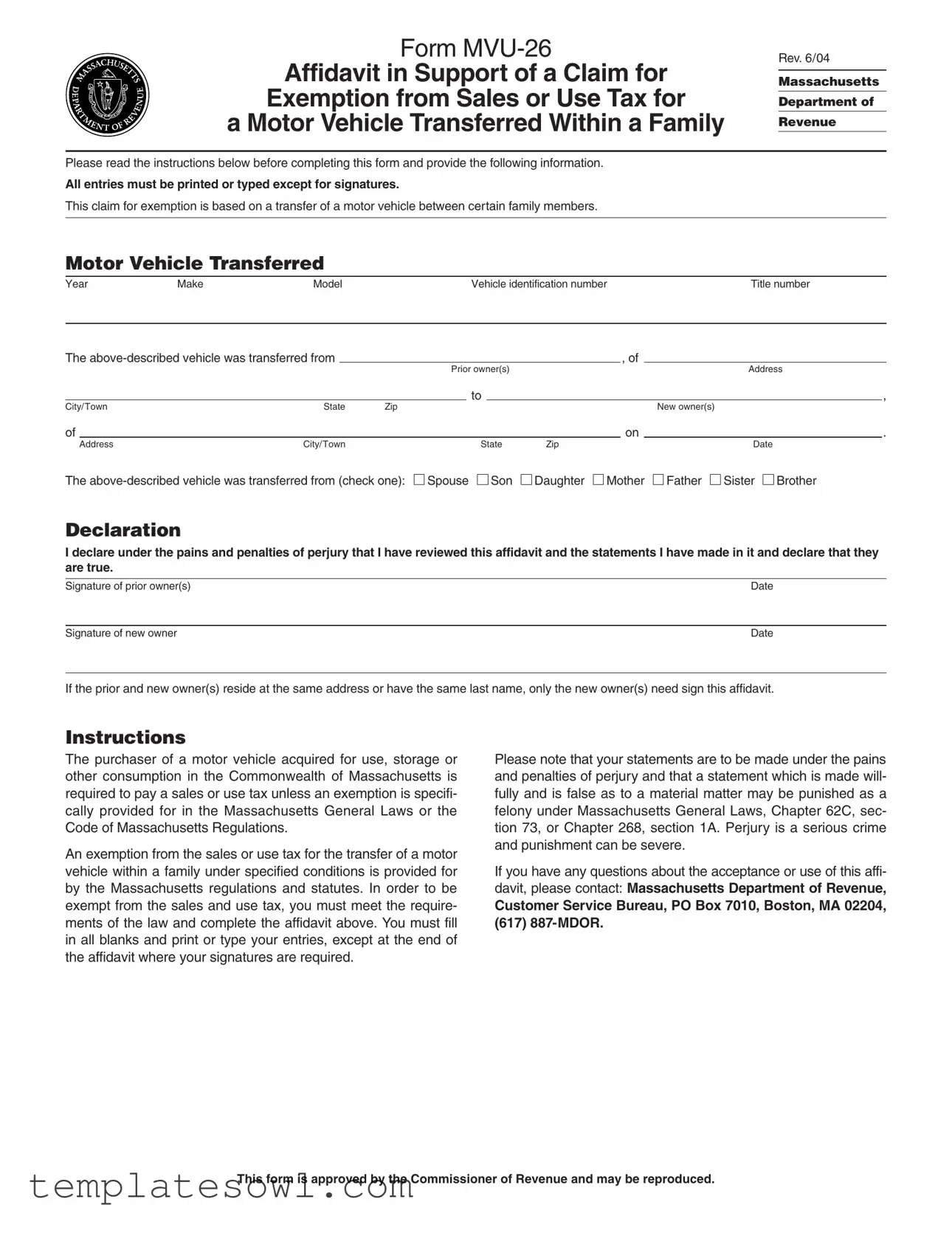

The Mvu 26 form, officially titled "Affidavit in Support of a Claim for Exemption from Sales or Use Tax for a Motor Vehicle Transferred Within a Family," serves a vital role in facilitating tax exemptions during vehicle transfers among family members in Massachusetts. This form, revised as of June 2004, outlines specific criteria under which individuals can claim exemption from the sales or use tax that is typically levied on motor vehicle transactions. To utilize this form, family members must accurately provide details regarding the vehicle, such as its year, make, model, vehicle identification number (VIN), and title number. Key information regarding both the prior and new owners, including names and addresses, must also be included. The form allows for transfers between specific family relationships, such as from a spouse, son, daughter, or parent. A declaration section demands that both parties affirm the truthfulness of their statements under penalty of perjury, highlighting the seriousness of accurate reporting. Completing the Mvu 26 form is essential for those seeking to avoid unnecessary taxes while ensuring compliance with Massachusetts laws. Additionally, this affidavit must be carefully filled out, as it requires all entries to be printed or typed, except for signatures. Understanding the purpose and requirements of the Mvu 26 form is crucial for navigating family vehicle transfers smoothly and legally.

Mvu 26 Example

Form

Affidavit in Support of a Claim for

Exemption from Sales or Use Tax for

a Motor Vehicle Transferred Within a Family

Rev. 6/04

Massachusetts

Department of

Revenue

Please read the instructions below before completing this form and provide the following information.

All entries must be printed or typed except for signatures.

This claim for exemption is based on a transfer of a motor vehicle between certain family members.

Motor Vehicle Transferred

Year |

Make |

Model |

Vehicle identification number |

Title number |

The |

|

|

|

|

|

|

|

|

, of |

|

|

|

|

|

||

|

|

|

|

|

Prior owner(s) |

|

|

|

|

|

Address |

|||||

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

|

|

, |

City/Town |

State |

Zip |

|

|

|

|

|

|

|

|

New owner(s) |

|

|

|

||

of |

|

|

|

|

|

|

|

|

|

|

on |

|

|

|

|

. |

|

Address |

City/Town |

|

|

|

State |

Zip |

|

|

|

|

Date |

|

|

||

The |

Spouse |

|

Son |

Daughter |

Mother |

Father |

Sister |

Brother |

||||||||

Declaration

I declare under the pains and penalties of perjury that I have reviewed this affidavit and the statements I have made in it and declare that they are true.

Signature of prior owner(s) |

Date |

|

|

Signature of new owner |

Date |

If the prior and new owner(s) reside at the same address or have the same last name, only the new owner(s) need sign this affidavit.

Instructions

The purchaser of a motor vehicle acquired for use, storage or other consumption in the Commonwealth of Massachusetts is required to pay a sales or use tax unless an exemption is specifi- cally provided for in the Massachusetts General Laws or the Code of Massachusetts Regulations.

An exemption from the sales or use tax for the transfer of a motor vehicle within a family under specified conditions is provided for by the Massachusetts regulations and statutes. In order to be exempt from the sales and use tax, you must meet the require- ments of the law and complete the affidavit above. You must fill in all blanks and print or type your entries, except at the end of the affidavit where your signatures are required.

Please note that your statements are to be made under the pains and penalties of perjury and that a statement which is made will- fully and is false as to a material matter may be punished as a felony under Massachusetts General Laws, Chapter 62C, sec- tion 73, or Chapter 268, section 1A. Perjury is a serious crime and punishment can be severe.

If you have any questions about the acceptance or use of this affi- davit, please contact: Massachusetts Department of Revenue,

Customer Service Bureau, PO Box 7010, Boston, MA 02204, (617)

This form is approved by the Commissioner of Revenue and may be reproduced.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The MVU-26 form is used to claim an exemption from sales or use tax for a motor vehicle transferred between family members in Massachusetts. |

| Governing Law | This form is governed by the Massachusetts General Laws and the Code of Massachusetts Regulations, which outline exemptions for family vehicle transfers. |

| Signature Requirement | Signatures of both prior and new owners are typically required. However, if they share the same address or last name, only the new owner's signature is necessary. |

| Legal Implications | The declaration made in the form is under the pains and penalties of perjury, and providing false information may result in felony charges under Massachusetts law. |

Guidelines on Utilizing Mvu 26

Filling out the MVU-26 form is essential for claiming an exemption from sales or use tax when transferring a motor vehicle within a family. Attention to detail is important to ensure all necessary information is correctly provided. Follow the steps below to complete the form accurately.

- Print or type your entries throughout the form, except where signatures are required.

- Begin by entering the details of the motor vehicle being transferred:

- Year

- Make

- Model

- Vehicle identification number

- Title number

- Identify the prior owner's information:

- Name

- Address

- City/Town

- State

- Zip

- Provide the new owner's information:

- Name

- Address

- City/Town

- State

- Zip

- Indicate the date of transfer.

- Check the appropriate box to indicate the relationship between the prior owner and the new owner:

- Spouse

- Son

- Daughter

- Mother

- Father

- Sister

- Brother

- Read the declaration statement and acknowledge it by signing as the prior owner and the new owner. Ensure that if both owners live at the same address or share the same last name, only the new owner needs to sign.

- Date the signatures appropriately.

After filling out the form, you may want to contact the Massachusetts Department of Revenue if you have any questions regarding the affidavit's acceptance or use. Make sure all information is accurate to avoid potential issues.

What You Should Know About This Form

What is Form MVU-26?

Form MVU-26 is an affidavit used in Massachusetts to claim an exemption from sales or use tax for a motor vehicle transferred between certain family members. This form must be filled out and signed by both the prior owner and the new owner to legally document the exemption claim.

Who can use Form MVU-26?

This form may be used by family members, specifically spouses, children (sons and daughters), and parents (mothers and fathers), as well as siblings (sisters and brothers) who transfer ownership of a motor vehicle to each other. The transfer must be made under the conditions outlined in Massachusetts law.

What is required to complete Form MVU-26?

To complete Form MVU-26, both the prior owner and new owner must fill in all necessary details, including the vehicle's year, make, model, identification number, title number, and the relevant addresses. Both parties must sign the affidavit. If the prior and new owners share the same address or last name, only the new owner needs to sign.

What happens if the information provided is false?

Providing false information on Form MVU-26 is a serious offense. The affidavit is signed under the pains and penalties of perjury, which means that anyone submitting false statements may face severe penalties, including criminal charges in accordance with Massachusetts General Laws.

How do I submit Form MVU-26?

Once completed and signed, Form MVU-26 must be submitted to the Massachusetts Department of Revenue. It is important to keep a copy for your records. Additional documentation may be required depending on your situation, so be sure to check any specific instructions related to your transfer.

Is there a deadline for submitting Form MVU-26?

While there is no explicit deadline for submitting Form MVU-26, it is advisable to complete and submit the form as soon as possible after the vehicle transfer. This helps ensure that the transfer is properly documented for tax purposes and avoids potential issues related to tax exemptions.

What is the purpose of the exemption?

The exemption from sales or use tax is designed to ease the financial burden on families transferring vehicles amongst themselves. This exemption acknowledges the close relationships and shared responsibilities within families, thereby allowing for a seamless transfer without the added tax burden.

Where can I get more information about Form MVU-26?

For more detailed information about Form MVU-26, you may contact the Massachusetts Department of Revenue’s Customer Service Bureau. They can provide guidance and clarify any questions you may have regarding the form or the exemption process.

Can I reproduce Form MVU-26?

Yes, Form MVU-26 is approved for reproduction by the Commissioner of Revenue. Feel free to print it as needed to facilitate the vehicle transfer process between family members.

Common mistakes

Many people make common mistakes when filling out the MVU-26 form. Understanding these errors can help ensure a smoother process for claiming an exemption from the sales or use tax for a motor vehicle transferred within a family.

One frequent mistake is leaving fields blank. The form requires specific information, including the year, make, model, vehicle identification number, and title number. If any of these entries are missing, the form may be considered incomplete, delaying the processing of the exemption claim.

Another error involves incorrect signatures. Only the new owner(s) need to sign if both the prior and new owner(s) have the same address or last name. Failing to follow this instruction can lead to unnecessary complications. It is essential to double-check the signing requirements based on the relationship and residency of the individuals involved.

Failure to use the correct names of family members is also a concern. The form asks for the prior owner(s) and new owner(s) to declare their relationship. If this relationship is not accurately stated, it might result in a denial of the exemption claim.

Additionally, neglecting to review the information before submission can lead to mistakes. Families should carefully review the completed form to ensure all facts align with their circumstances. A simple oversight in the details could lead to the rejection of the form.

Lastly, many people overlook the warnings about perjury. The declaration at the bottom of the form emphasizes that any false information can result in severe penalties. It is crucial to read and understand this statement, as it highlights the seriousness of providing accurate information.

Documents used along the form

The MVU-26 form is an important document used to claim an exemption from sales or use tax for the transfer of motor vehicles within a family in Massachusetts. Several other forms and documents may accompany the MVU-26 to ensure a smooth process. Understanding each of these documents can provide clarity and assist in the completion of necessary legal procedures.

- MVU-1 Form: This form is a Vehicle Registration Application. It is used to register a motor vehicle that is being transferred to a new owner. This document requires details about the vehicle and the new owner, ensuring proper registration within the Massachusetts Registry of Motor Vehicles.

- RMV-1 Form: The RMV-1 form is a standard application for registration and title. It must be completed and submitted for the official transfer of vehicle ownership. This form gathers crucial information including the previous owner's and new owner's details as well as vehicle specifications.

- Title Certificate: This document serves as proof of ownership of a motor vehicle. It must be provided when transferring ownership to indicate that the prior owner has the legal right to sell or transfer the vehicle. A clear title is essential to the exemption process.

- Affidavit of Family Relationship: This document may be required to verify the familial relationship between the parties involved in the vehicle transfer. It helps establish eligibility for the sales or use tax exemption by confirming that the transfer is indeed within a family.

- Bill of Sale: A bill of sale is a legal document that records the sale of the vehicle between the seller and buyer. This document can serve as proof of the transaction, outlining the terms of the sale and confirming the details of both parties.

- Massachusetts Sales Tax Exemption Form: If applicable, this form is submitted to request a formal exemption from the sales tax. It is vital for ensuring compliance with the state's tax regulations and confirming eligibility for any exemption being claimed.

These documents play a crucial role in the process of transferring vehicle ownership while ensuring compliance with Massachusetts regulations. Properly utilizing each document can help avoid issues during the exemption claim process.

Similar forms

The MVU-26 form, which serves as an affidavit for claiming an exemption from sales or use tax for a motor vehicle transfer within a family in Massachusetts, shares similarities with other legal documents used in similar contexts. Here are six such documents:

- Form MVU-24: This form is also aimed at motor vehicle transactions but focuses on sales tax exemptions for vehicles transferred due to gifts, rather than family transfers. Like the MVU-26, it requires the declaration of ownership and signatures from the parties involved.

- Form MVU-25: Similar to the MVU-26, this affidavit addresses the exemption of sales tax for motor vehicles acquired through divorce settlements. Both documents require detailed vehicle information and confirmation of the relationship between the parties involved.

- Form 1099-G: This form reports certain types of government payments and can be used to track exemptions, including taxes related to vehicle transfers. Both forms necessitate accurate reporting of transactions and signatures to verify the information provided.

- Form W-4: While this form is primarily for withholding allowances on income, it also requires affirmation of accuracy and truthful declarations. Both the W-4 and the MVU-26 highlight the applicant’s responsibility to provide true statements under penalty of law.

- Form 1040: This is the U.S. Individual Income Tax Return that may address various exemptions, including those related to vehicle ownership. Both forms require detailed personal information and compliance with legal standards for exemption claims.

- Power of Attorney Forms: These forms allow individuals to designate someone to act on their behalf in legal matters, sometimes including vehicle transactions. Like the MVU-26, they must be signed and may require declarations regarding the authority of the agent acting on behalf of the principal.

Understanding these similarities can help individuals navigate the process of vehicle transfers and any associated tax exemptions more effectively.

Dos and Don'ts

When filling out the MVU-26 form, it is crucial to follow the guidelines to ensure that your claim for exemption from sales or use tax is processed smoothly. Below are some important do’s and don’ts to consider:

- Do read the instructions carefully before completing the form.

- Do print or type all entries, except signatures.

- Do ensure that all blanks are filled in accurately.

- Do declare the owner relationship involved in the transfer correctly.

- Do verify the vehicle identification number and title number are correct.

- Don't leave any sections of the form incomplete.

- Don't provide false statements as this may lead to charges of perjury.

Misconceptions

The following is a list of common misconceptions regarding the MVU-26 form, which is used to claim an exemption from sales or use tax for a motor vehicle transferred within a family in Massachusetts.

- Only spouses can transfer vehicles without tax. This is incorrect. The MVU-26 allows for transfers between various family members, including parents, children, and siblings.

- All vehicle transfers are exempt from sales or use tax. Not every transfer qualifies. Only transfers that meet specific requirements outlined in Massachusetts regulations are exempt.

- You do not need to fill all sections of the form. Each section of the MVU-26 must be completed thoroughly, including details about the vehicle and both parties involved in the transfer.

- The form only needs the prior owner's signature. Both the prior owner(s) and new owner(s) must sign the affidavit unless they share the same address or last name.

- Filling out the form incorrectly has no consequences. Providing false information can lead to serious legal consequences, including charges of perjury.

- This form can be submitted at any time after transfer. It is essential to submit the MVU-26 form as soon as possible after the vehicle transfer to ensure that the exemption is applied properly.

- The form does not require any proof of relationship. While the form itself does not require supporting documents, be prepared to show proof of family relationship if requested by the Department of Revenue.

- Electronic submission of the form is mandatory. The MVU-26 can be submitted in person or by mail. There is no requirement for electronic submission.

Understanding these misconceptions can assist individuals in properly navigating the MVU-26 process and ensuring compliance with Massachusetts tax law.

Key takeaways

When completing the MVU-26 form for claiming an exemption from sales or use tax for a motor vehicle transferred within a family, consider the following key takeaways:

- Eligibility Criteria: The exemption can only be claimed for transfers between specific family members, such as spouses, parents, and siblings.

- Complete Information: All sections of the form must be filled out accurately, including details such as the vehicle identification number and the names and addresses of both the prior and new owners.

- Pains and Penalties of Perjury: Understand that signing the affidavit means you affirm the truthfulness of the statements made. False statements can lead to serious legal consequences, including felony charges.

- Signatures Required: Both the prior owner and the new owner must sign the form unless they share the same last name or reside at the same address; in that case, only the new owner's signature is necessary.

- Print or Type: Entries must be clearly printed or typed throughout the form, with signatures the only exception to this requirement.

- Contact Information: For any questions related to the form, you can reach out to the Massachusetts Department of Revenue for assistance.

Browse Other Templates

Pizza Hut Application Online - Starting and ending pay information can impact salary considerations during hiring.

Surety Indemnity Agreement - This bond operates within established federal guidelines, ensuring legitimacy.

Necc Transcript - Students can specify recent attendance dates to ensure their transcript reflects current academic status.