Fill Out Your Mw 507 Example Form

Understanding the Maryland Form MW507 is essential for ensuring proper income tax withholding from your paycheck. This form serves a significant purpose: it allows your employer to accurately calculate the amount of Maryland state tax to withhold based on your individual circumstances. Each year, and whenever your personal or financial situation changes, consider completing a new MW507. One of the key components involves reporting the number of personal exemptions you claim, which directly affects your withholding amount. For individuals whose income exceeds certain thresholds, additional calculations may be necessary through the Personal Exemption Worksheet. The MW507 also provides mechanisms for additional withholding to cover any anticipated tax liabilities. Additionally, eligibility for exemption from withholding is outlined, such as for students, seasonal employees, and nonresidents working in Maryland. This form also caters to military spouses, allowing them to claim exemption under specific conditions laid out by the Servicemembers Civil Relief Act. Employers have their own responsibilities, including maintaining accurate records and properly submitting the form to the Compliance Division when necessary. Employees must remain vigilant about their exemptions and promptly update their form if their circumstances change. Fulfilling these obligations ensures compliance with Maryland tax laws and helps optimize tax withholding throughout the year.

Mw 507 Example Example

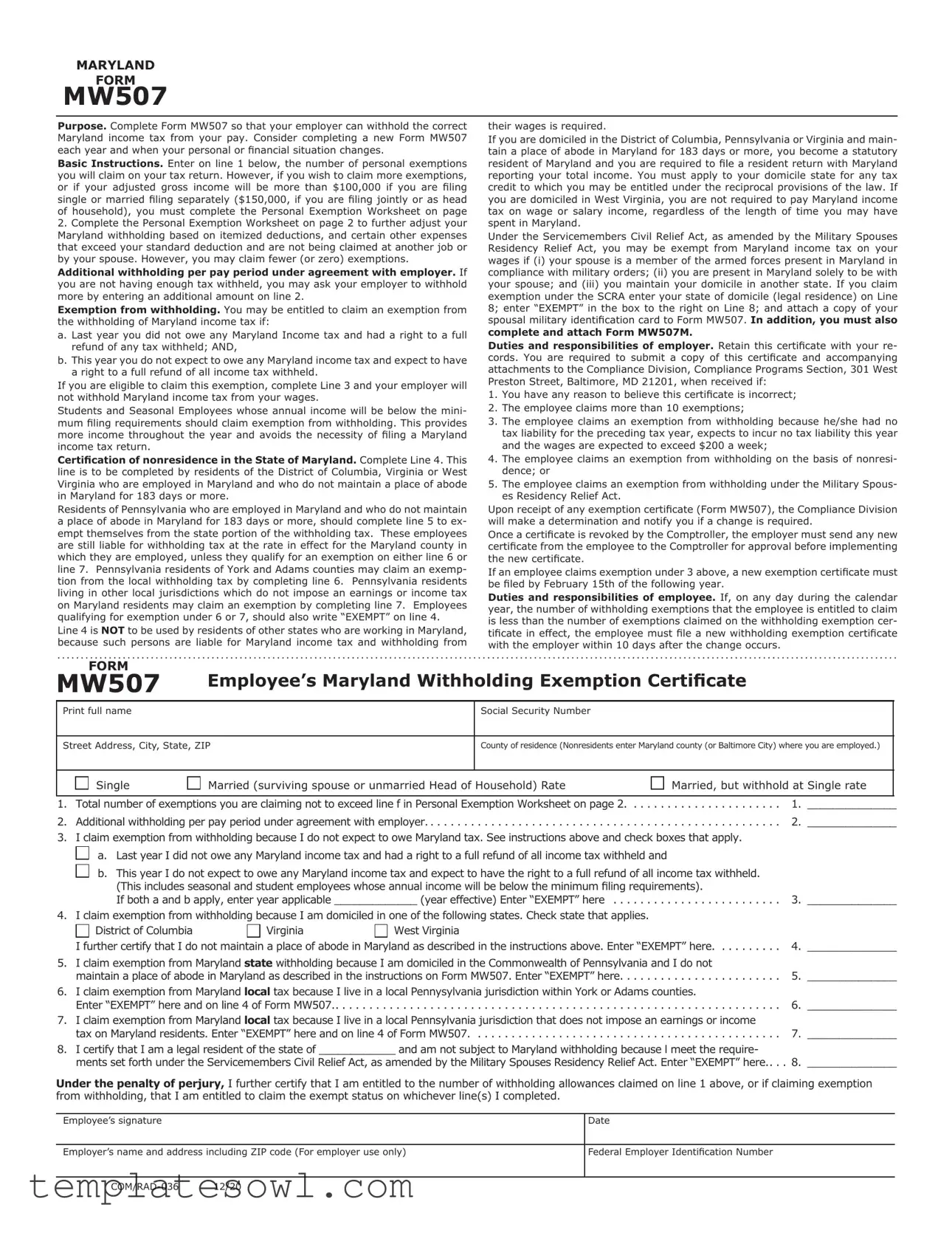

MARYLAND

FORM

MW507

Purpose. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial situation changes.

Basic Instructions. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or married filing separately ($150,000, if you are filing jointly or as head of household), you must complete the Personal Exemption Worksheet on page

2.Complete the Personal Exemption Worksheet on page 2 to further adjust your Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deduction and are not being claimed at another job or by your spouse. However, you may claim fewer (or zero) exemptions.

Additional withholding per pay period under agreement with employer. If you are not having enough tax withheld, you may ask your employer to withhold more by entering an additional amount on line 2.

Exemption from withholding. You may be entitled to claim an exemption from the withholding of Maryland income tax if:

a. Last year you did not owe any Maryland Income tax and had a right to a full refund of any tax withheld; AND,

b. This year you do not expect to owe any Maryland income tax and expect to have a right to a full refund of all income tax withheld.

If you are eligible to claim this exemption, complete Line 3 and your employer will not withhold Maryland income tax from your wages.

Students and Seasonal Employees whose annual income will be below the mini- mum filing requirements should claim exemption from withholding. This provides more income throughout the year and avoids the necessity of filing a Maryland income tax return.

Certification of nonresidence in the State of Maryland. Complete Line 4. This line is to be completed by residents of the District of Columbia, Virginia or West Virginia who are employed in Maryland and who do not maintain a place of abode in Maryland for 183 days or more.

Residents of Pennsylvania who are employed in Maryland and who do not maintain a place of abode in Maryland for 183 days or more, should complete line 5 to ex- empt themselves from the state portion of the withholding tax. These employees are still liable for withholding tax at the rate in effect for the Maryland county in which they are employed, unless they qualify for an exemption on either line 6 or line 7. Pennsylvania residents of York and Adams counties may claim an exemp- tion from the local withholding tax by completing line 6. Pennsylvania residents living in other local jurisdictions which do not impose an earnings or income tax on Maryland residents may claim an exemption by completing line 7. Employees qualifying for exemption under 6 or 7, should also write “EXEMPT” on line 4.

Line 4 is NOT to be used by residents of other states who are working in Maryland, because such persons are liable for Maryland income tax and withholding from

their wages is required.

If you are domiciled in the District of Columbia, Pennsylvania or Virginia and main- tain a place of abode in Maryland for 183 days or more, you become a statutory resident of Maryland and you are required to file a resident return with Maryland reporting your total income. You must apply to your domicile state for any tax credit to which you may be entitled under the reciprocal provisions of the law. If you are domiciled in West Virginia, you are not required to pay Maryland income tax on wage or salary income, regardless of the length of time you may have spent in Maryland.

Under the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act, you may be exempt from Maryland income tax on your wages if (i) your spouse is a member of the armed forces present in Maryland in compliance with military orders; (ii) you are present in Maryland solely to be with your spouse; and (iii) you maintain your domicile in another state. If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter “EXEMPT” in the box to the right on Line 8; and attach a copy of your spousal military identification card to Form MW507. In addition, you must also complete and attach Form MW507M.

Duties and responsibilities of employer. Retain this certificate with your re- cords. You are required to submit a copy of this certificate and accompanying attachments to the Compliance Division, Compliance Programs Section, 301 West Preston Street, Baltimore, MD 21201, when received if:

1.You have any reason to believe this certificate is incorrect;

2.The employee claims more than 10 exemptions;

3.The employee claims an exemption from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week;

4.The employee claims an exemption from withholding on the basis of nonresi- dence; or

5.The employee claims an exemption from withholding under the Military Spous- es Residency Relief Act.

Upon receipt of any exemption certificate (Form MW507), the Compliance Division will make a determination and notify you if a change is required.

Once a certificate is revoked by the Comptroller, the employer must send any new certificate from the employee to the Comptroller for approval before implementing the new certificate.

If an employee claims exemption under 3 above, a new exemption certificate must be filed by February 15th of the following year.

Duties and responsibilities of employee. If, on any day during the calendar year, the number of withholding exemptions that the employee is entitled to claim is less than the number of exemptions claimed on the withholding exemption cer- tificate in effect, the employee must file a new withholding exemption certificate with the employer within 10 days after the change occurs.

FORM |

|

MW507 |

Employee’s Maryland Withholding Exemption Certificate |

Print full name

Social Security Number

Street Address, City, State, ZIP

County of residence (Nonresidents enter Maryland county (or Baltimore City) where you are employed.)

Single

Married (surviving spouse or unmarried Head of Household) Rate

Married, but withhold at Single rate

1. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2 |

1._ ______________ |

2.Additional withholding per pay period under agreement with employer.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2._ ______________

3.I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions above and check boxes that apply.

|

a. Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax withheld and |

|

||

|

b. This year I do not expect to owe any Maryland income tax and expect to have the right to a full refund of all income tax withheld. |

|

||

|

(This includes seasonal and student employees whose annual income will be below the minimum filing requirements). |

|

||

|

If both a and b apply, enter year applicable _____________ (year effective) Enter “EXEMPT” here |

3._ ______________ |

||

4. |

I claim exemption from withholding because I am domiciled in one of the following states. Check state that applies. |

|

||

|

District of Columbia |

Virginia |

West Virginia |

|

|

I further certify that I do not maintain a place of abode in Maryland as described in the instructions above. Enter “EXEMPT” here |

4._ ______________ |

||

5. |

I claim exemption from Maryland state withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not |

5._ ______________ |

||

|

maintain a place of abode in Maryland as described in the instructions on Form MW507. Enter “EXEMPT” here |

|||

6. |

I claim exemption from Maryland local tax because I live in a local Pennysylvania jurisdiction within York or Adams counties. |

|

||

|

Enter “EXEMPT” here and on line 4 of Form MW507 |

. . . . . . . . . 對 |

6._ ______________ |

|

7. |

I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income |

|

||

|

tax on Maryland residents. Enter “EXEMPT” here and on line 4 of Form MW507 |

7._ ______________ |

||

8. |

I certify that I am a legal resident of the state of ____________ and am not subject to Maryland withholding because l meet the require- |

|

||

|

ments set forth under the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. Enter “EXEMPT” here.. |

8._ ______________ |

||

Under the penalty of perjury, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on whichever line(s) I completed.

Employee’s signature

Date

Employer’s name and address including ZIP code (For employer use only)

Federal Employer Identification Number

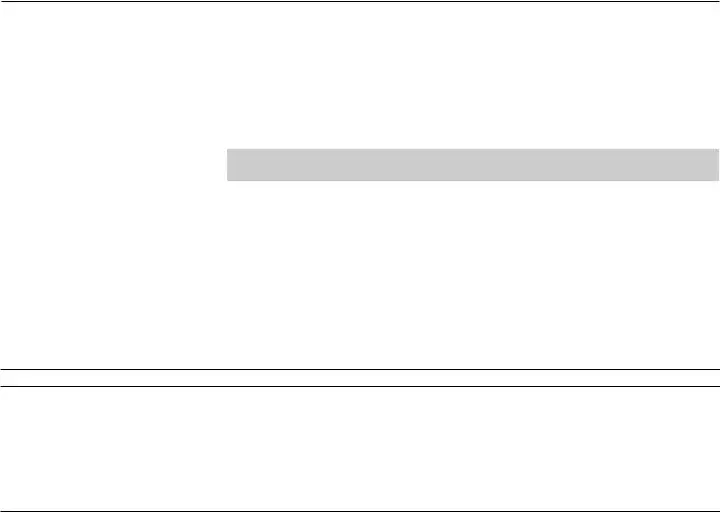

MARYLAND |

page 2 |

FORM |

|

MW507 |

|

|

Personal Exemptions Worksheet |

|

|

Line 1

a. Multiply the number of your personal exemptions by the value of each exemption from the table below. (Generally the value of your exemption will be $3,200; however, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reduced. Do not claim any personal exemptions you currently claim at another job, or any exemptions being claimed by your spouse. To qualify as your dependent, you must be entitled to an exemption for the dependent on your federal income tax return for the corresponding tax year. NOTE: Dependent taxpayers may not claim themselves as

an exemption.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . a. ______________

b.Multiply the number of additional exemptions you are claiming for dependents age 65 or over by the value of

each exemption from the table below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b. ______________

c.Enter the estimated amount of your itemized deductions (excluding state and local income taxes) that exceed the amount of your standard deduction, alimony payments, allowable childcare expenses, qualified retirement contributions, business losses and employee business expenses for the year. Do not claim any additional amounts you currently claim at another job or any amounts being claimed by your spouse. NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,550

and a maximum of $2,300... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . c. ______________

d.Enter $1,000 for additional exemptions for taxpayer and/or spouse age 65 or over and/or blind.. . . . . . . . . d. ______________

e. Add total of lines a through d.. . |

. . . . . . . . . . . . . . . . 對 . . . . . . . . . . e. ______________ |

f.Divide the amount on line e by $3,200. Drop any fraction. Do not round up. This is the maximum

number of exemptions you may claim for withholding tax purposes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . f. ______________

If your federal AGI is |

If you will file your tax return |

||

|

|

||

|

|

Single or Married Filing Separately |

Joint, Head of Household |

|

|

Your Exemption is |

or Qualifying Widow(er) |

|

|

|

Your Exemption is |

$100,000 or less |

$3,200 |

$3,200 |

|

Over |

But not over |

|

|

$100,000 |

$125,000 |

$1,600 |

$3,200 |

$125,000 |

$150,000 |

$800 |

$3,200 |

$150,000 |

$175,000 |

$0 |

$1,600 |

$175,000 |

$200,000 |

$0 |

$800 |

In excess of $200,000 |

$0 |

$0 |

|

FEDERAL PRIVACY ACT INFORMATION

Social Security numbers must be included. The mandatory disclosure of your Social Security number is authorized by the provisions set forth in the

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | Form MW507 allows employers to withhold the correct Maryland income tax from employees' paychecks based on personal exemptions. |

| Annual Update | It is recommended that employees complete a new Form MW507 annually or whenever their personal or financial situation changes. |

| Exemption Eligibility | Employees may claim an exemption from withholding if they owed no Maryland taxes last year and expect the same this year. |

| Residency Certification | Line 4 must be completed by nonresidents from specified states (D.C., Virginia, West Virginia) employed in Maryland, confirming they don't maintain a Maryland abode. |

| Seasonal Employees | Students and seasonal employees with annual income below the minimum filing requirements should claim an exemption from withholding to avoid filing a tax return. |

| Servicemembers Relief | Under the Servicemembers Civil Relief Act, military spouses may claim an exemption from Maryland income tax if they qualify under specific criteria. |

| Employer Duties | Employers must retain the MW507 form and submit it to the Compliance Division under certain conditions related to exemption claims. |

| Exemption Revocation | If an exemption is revoked by the Comptroller, employers need to obtain a new exemption certificate from the employee prior to withholding any new amounts. |

Guidelines on Utilizing Mw 507 Example

To complete the Maryland Form MW507, follow these detailed steps. The process requires gathering your personal and financial information to accurately calculate the number of exemptions for which you qualify. Ensure that all necessary fields are filled out completely to facilitate correct income tax withholding by your employer.

- Print your full name on the designated line at the top of the form.

- Provide your Social Security Number in the corresponding field.

- Enter your street address, including city, state, and ZIP code.

- Indicate your county of residence. If you are a nonresident, enter the Maryland county where you work.

- Select your filing status by marking the appropriate checkbox: Single, Married (surviving spouse), or Head of Household, or Married but withholding at the Single rate.

- Line 1: Enter the total number of exemptions you are claiming. Refer to the Personal Exemption Worksheet on page 2 if needed.

- Line 2: If you need additional withholding per pay period, enter that amount here.

- Line 3: If eligible for exemption from withholding, check both boxes under this line and enter the applicable year. Write "EXEMPT." in the provided space.

- Line 4: If you are domiciled in D.C., Virginia, or West Virginia, check the proper box and enter "EXEMPT."

- Line 5: If you live in Pennsylvania and do not maintain an abode in Maryland, enter "EXEMPT" here.

- Line 6: If you reside in York or Adams County, Pennsylvania, check the box and write "EXEMPT."

- Line 7: For other Pennsylvania localities that do not impose income tax, mark the appropriate box and indicate "EXEMPT."

- Line 8: If claiming exemption under the Servicemembers Civil Relief Act, write your state of domicile and "EXEMPT," and attach the necessary identification.

- Sign and date the form at the bottom, certifying all information is accurate.

- Fill in your employer's name and address including the ZIP code.

- Provide the employer's Federal Employer Identification Number in the space provided.

After you complete the form, submit it to your employer. They will use this information to determine how much Maryland income tax to withhold from your wages. The form may need to be updated regularly to reflect any changes in your financial or personal circumstances, including changes in exemptions or residency status.

What You Should Know About This Form

What is the purpose of the MW507 Example Form?

The MW507 Example Form is used to inform your employer of how much Maryland income tax to withhold from your paycheck. By completing this form, you ensure that the right amount of money is taken out for state taxes. It’s advisable to fill out a new form each year or whenever there are changes in your personal or financial circumstances.

How do I determine the number of exemptions I can claim?

To claim exemptions, first, enter the number of personal exemptions you will report on your income tax return on line 1 of the MW507 Form. If you wish to claim additional exemptions or your adjusted gross income is expected to exceed specified thresholds, such as $100,000 for single filers or $150,000 for joint filers, you will need to complete the Personal Exemption Worksheet on page 2. This additional step helps tailor your withholding based on your actual financial situation.

Who can claim an exemption from withholding?

You may qualify for an exemption from Maryland income tax withholding if you meet specific criteria. To qualify, you must have not owed any Maryland income tax last year and expect no tax liability this year. This situation allows you to complete line 3 on the form. Additionally, certain categories of workers, such as students and seasonal employees whose incomes fall below minimum filing requirements, may also claim this exemption, thereby receiving more of their income throughout the year.

What do I need to do if my personal circumstances change?

If your number of withholding exemptions decreases at any point during the year, you are required to submit a new MW507 Form to your employer within 10 days following the change. This ensures that the correct amount of income tax is withheld from your wages going forward. Not keeping your exemptions updated may result in over- or under-withholding, which can affect your tax responsibilities at the end of the year.

What are the employer’s responsibilities regarding the MW507?

Employers have several key duties when it comes to the MW507 Form. They should retain a copy of the completed certificate with their records and submit it to the appropriate compliance division if certain conditions arise (e.g., the employee claims more than 10 exemptions or indicates an exemption from withholding). Upon receiving a new exemption certificate, employers must ensure that they do not implement the changes until they have received approval from the relevant tax authority. They must also stay informed about any changes regarding employees' status that may require a new form to be completed.

Common mistakes

Filling out the Maryland MW507 form can be a straightforward task, but many people make common mistakes that could lead to incorrect tax withholding. One major error is failing to review the eligibility requirements for claiming exemptions. Applicants often overlook the need to determine if they owed Maryland taxes in the previous year. If you didn’t owe and expect a refund, you may qualify for exemption. Without confirming this, you might inadvertently misfile.

Another mistake is miscomputing the number of personal exemptions. It’s crucial to accurately calculate your exemptions based on your situation. People sometimes claim more exemptions than they are entitled to, which can lead to unexpected tax bills later on. It's important to follow the Personal Exemption Worksheet on page 2 carefully to avoid this mistake.

Additionally, many individuals make errors when completing Line 3 regarding exemption claims. If you check this box, you must ensure that both conditions are met: not owing taxes last year and not expecting to owe taxes this year. Failing to understand the requirement can result in noncompliance.

Furthermore, some filers incorrectly skip the Personal Exemption Worksheet entirely. This step is essential if your adjusted gross income exceeds certain thresholds. Completing this worksheet helps adjust withholding correctly. Neglecting it can jeopardize your ability to claim the right number of exemptions, ultimately impacting your take-home pay.

Another area of concern is the handling of additional withholding. People might not indicate an additional withholding on Line 2 if they feel under-withheld. This omission can lead to a financial strain when tax season arrives. If you need more taxes withheld, specify the amount to protect yourself from owing a large sum at year-end.

Many also misunderstand the requirements for certification of nonresidence on Line 4. This section is specifically for residents of certain neighboring states. If you work in Maryland but maintain a home in one of these states, you must carefully adhere to the guidelines laid out to avoid complications.

Finally, individuals often forget to sign and date the form. This is a crucial step that’s sometimes overlooked in the process. Without your signature, the form is not valid, and your employer cannot process your withholding correctly. Always double-check that your form is complete, and remember to review it before submission.

Documents used along the form

The MW507 form is an essential document for Maryland employees, allowing them to manage the correct withholding of state income tax from their paychecks. However, this is not the only form used in conjunction with it. There are several additional forms and documents that employees and employers may need to consider based on specific circumstances. Below is a list of six key forms that often accompany the MW507.

- Form MW507M: This form is required for employees claiming exemption under the Servicemembers Civil Relief Act. It includes additional details and must be attached to the MW507, along with a copy of the military spouse's identification card, to demonstrate eligibility for tax exemption.

- IRS Form W-4: The federal equivalent of the MW507, this form helps employers determine how much federal income tax to withhold from an employee's paycheck. Employees may need to update both forms simultaneously to ensure alignment between federal and state withholding.

- Personal Exemption Worksheet: This worksheet, part of the MW507 documentation, allows individuals to calculate their personal exemptions based on their specific financial situation, including deductions and multiple jobs.

- Form 502:** This is Maryland’s individual income tax return. After the tax year concludes, individuals use this form to report total income and determine if they owe any taxes or are due a refund based on their withholdings throughout the year.

- Form MW508: This document is used by employees to request additional withholding amount from their paychecks. When less tax is withheld than necessary, employees can submit this form to ensure proper amounts are reported and paid.

- Form MW519: For part-time employees or seasonal workers, this form helps to manage income tax withholding for individuals whose earnings fall below minimum filing requirements. It certifies that certain criteria apply, prompting employers to reduce or eliminate withholding.

These forms, each serving distinct purposes, collectively help to maintain accurate tax withholding, compliance with state laws, and ensure employees meet their tax obligations efficiently. Understanding these documents enhances an employee’s ability to navigate their tax responsibilities and optimize their financial planning.

Similar forms

Form W-4 (Employee's Withholding Certificate): This form helps employers determine the correct amount of federal income tax to withhold from an employee's wages. Similar to Form MW507, it requires the employee to indicate personal exemptions and any additional withholding amounts. Both forms aim to adjust tax withholdings based on individual circumstances.

Form IT-2104 (Employee's Withholding Allowance Certificate - New York): This form is used by employees in New York to communicate their withholding allowances to their employer. Like MW507, it accounts for personal exemptions and allows for additional withholding, reflecting the same goal of correctly managing state income tax withholdings.

Form DE 4 (California Employee's Withholding Allowance Certificate): This California form allows employees to declare their withholding allowances and ensure appropriate state income tax withholding. It shares similarities with MW507 by permitting employees to claim exemptions and specify additional withholdings, aimed at achieving accurate tax deductions.

Form 8879 (IRS e-file Signature Authorization): While primarily used for e-filing tax returns, this form requires taxpayers to verify their identity and the accuracy of their tax return. Like MW507, it involves personal information and certifications related to tax liability, underscoring the importance of correct tax reporting and withholding.

Dos and Don'ts

When filling out the Maryland Form MW507, there are several do's and don'ts to ensure the process goes smoothly. Here’s a helpful guide:

- Do complete a new form annually or whenever your financial situation changes.

- Do accurately enter the number of personal exemptions being claimed on line 1.

- Do use the Personal Exemption Worksheet if your income exceeds specified thresholds.

- Do check if you qualify for an exemption from withholding and fill out that section if eligible.

- Don't claim exemptions that are being claimed on another job or by your spouse.

- Don't forget to sign and date the form; an unsigned form is not valid.

- Don't use line 4 if you are a resident of a state other than D.C., Virginia, or West Virginia.

- Don't leave any required fields blank; incomplete forms can delay processing.

Misconceptions

- Misconception 1: The MW507 form can only be completed once a year.

- Misconception 2: If I am exempt from federal tax withholding, I am automatically exempt from Maryland tax withholding.

- Misconception 3: Residents of Virginia or West Virginia do not need to worry about Maryland taxes if they work in Maryland.

- Misconception 4: Once I claim an exemption, I do not need to file a new MW507 unless I stop working.

This is not true. You should consider completing a new MW507 whenever your personal or financial situation changes. This keeps your tax withholding aligned with your current circumstances.

This belief is incorrect. Maryland has its own rules for tax withholding. You must meet specific criteria to claim exemption from Maryland withholding, regardless of your federal status.

This is misleading. Such residents may need to complete specific lines on the MW507 to avoid Maryland income tax withholding, especially if they stay in Maryland for 183 days or more.

This is not accurate. If your situation changes and you qualify for fewer exemptions, you must file a new MW507 within 10 days of that change. Keeping your information up to date is essential.

Key takeaways

Here are some key takeaways when filling out and using the MW507 Example form:

- Purpose: Use Form MW507 to help your employer withhold the right amount of Maryland income tax from your paycheck.

- Annual Review: Check and complete the form annually or whenever your financial situation changes.

- Personal Exemptions: Indicate the number of exemptions you plan to claim on line 1. More exemptions may require a worksheet from page 2.

- Additional Withholding: If more tax is needed, specify an extra amount for your employer to withhold on line 2.

- Exemption Claims: To claim exemption, both previous and current tax years must show that you owe no tax and expect a full refund.

- Nonresidence Certification: Complete necessary lines if you live outside of Maryland and work within the state.

- Seasonal Employees: Consider claiming exemption to avoid unnecessary tax withholding or filing if your income falls below certain limits.

- Submission Requirements: Employers must retain the form and may need to submit it to the Compliance Division under certain circumstances.

- Duty to Update: Employees must file a new form within 10 days if their exemption status changes during the year.

- MILITARY EXEMPTION: Military spouses can claim exemption by providing certain information and both spouses' military IDs.

Browse Other Templates

How to File for Custody in Oklahoma - The application is an important legal step in child welfare cases.

Affidavit Template California - The DE-305 is a mandatory form required by California courts.