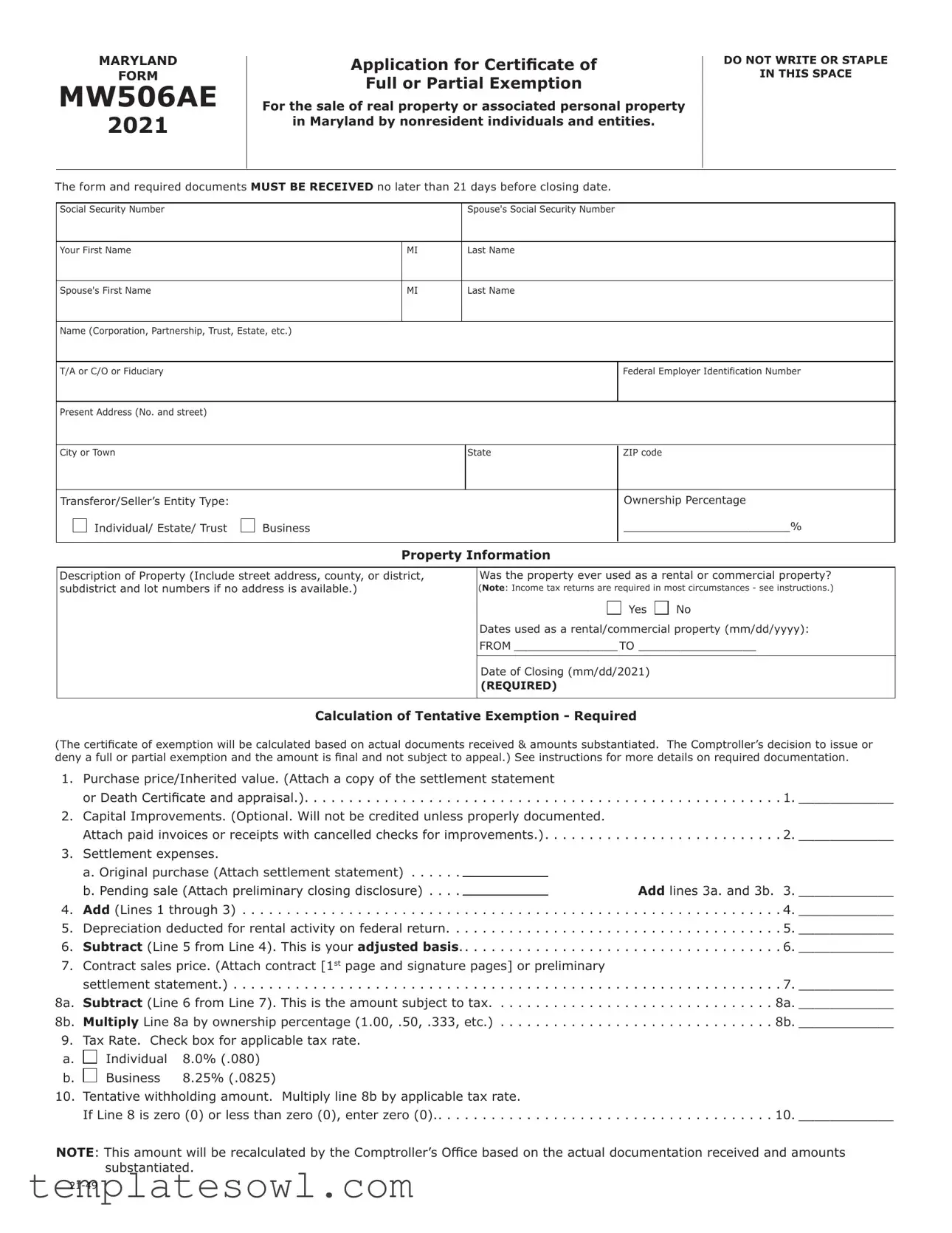

Fill Out Your Mw506Ae Form

The Maryland Form MW506AE is an essential document for individuals and entities looking to sell real property or associated personal property in Maryland while benefiting from possible tax exemptions. Specifically tailored for nonresident sellers, this form allows for an application for a Certificate of Full or Partial Exemption from withholding requirements on the sale proceeds. Timeliness is critical; all applications must be submitted at least 21 days before the closing date to ensure proper processing. The form collects vital information about the seller, including social security numbers, entity types, and property details. It also requires a comprehensive calculation of potential tax liabilities based on purchase prices, capital improvements, and settlement expenses. Additionally, applicants must disclose if the property has ever been used as rental or commercial real estate, along with any relevant dates and accompanying documentation. Special situations, such as transfers due to active-duty military status or inheritances, may require specific information to qualify for exemptions. Understanding the intricacies of the MW506AE can significantly ease the selling process, ensuring compliance while potentially reducing tax burdens.

Mw506Ae Example

MARYLAND

FORM

MW506AE

2021

Application for Certificate of

Full or Partial Exemption

For the sale of real property or associated personal property

in Maryland by nonresident individuals and entities.

DO NOT WRITE OR STAPLE

IN THIS SPACE

The form and required documents MUST BE RECEIVED no later than 21 days before closing date.

Social Security Number |

|

|

Spouse's Social Security Number |

|

|

|

|

|

|

|

|

Your First Name |

MI |

|

Last Name |

|

|

|

|

|

|

|

|

Spouse's First Name |

MI |

|

Last Name |

|

|

|

|

|

|

|

|

Name (Corporation, Partnership, Trust, Estate, etc.) |

|

|

|

|

|

|

|

|

|

|

|

T/A or C/O or Fiduciary |

|

|

|

Federal Employer Identification Number |

|

|

|

|

|

|

|

Present Address (No. and street) |

|

|

|

|

|

|

|

|

|

|

|

City or Town |

|

|

State |

ZIP code |

|

|

|

|

|

|

|

Transferor/Seller’s Entity Type: |

|

Ownership Percentage |

Individual/ Estate/ Trust |

Business |

________________________% |

Property Information

Description of Property (Include street address, county, or district, |

Was the property ever used as a rental or commercial property? |

|

subdistrict and lot numbers if no address is available.) |

(Note: Income tax returns are required in most circumstances - see instructions.) |

|

|

Yes |

No |

|

Dates used as a rental/commercial property (mm/dd/yyyy): |

|

|

FROM________________ TO__________________ |

|

|

|

|

|

Date of Closing (mm/dd/2021) |

|

|

(REQUIRED) |

|

|

|

|

Calculation of Tentative Exemption - Required

(The certificate of exemption will be calculated based on actual documents received & amounts substantiated. The Comptroller’s decision to issue or deny a full or partial exemption and the amount is final and not subject to appeal.) See instructions for more details on required documentation.

1. |

Purchase price/Inherited value. (Attach a copy of the settlement statement |

|

|

|

or Death Certificate and appraisal.) |

對 |

1._____________ |

2. |

Capital Improvements. (Optional. Will not be credited unless properly documented. |

|

|

|

Attach paid invoices or receipts with cancelled checks for improvements.) |

2._____________ |

|

3.Settlement expenses.

a. Original purchase (Attach settlement statement) . . . .

|

b. Pending sale (Attach preliminary closing disclosure) . . . |

|

|

Add lines 3a. and 3b. |

3._____________ |

4. |

Add (Lines 1 through 3) |

. . . . 對 |

. 4._____________ |

||

5. |

Depreciation deducted for rental activity on federal return.. . |

. . . . . . . . . . . . . . . . 對 |

. 5._____________ |

||

6. |

Subtract (Line 5 from Line 4). This is your adjusted basis. . . . . . . . . . . . . . . . . . 對 |

6._____________ |

|||

7. |

Contract sales price. (Attach contract [1st page and signature pages] or preliminary |

|

|||

|

settlement statement.) |

. . . . 對 |

7._____________ |

||

8a. |

Subtract (Line 6 from Line 7). This is the amount subject to tax |

8a._____________ |

|||

8b. |

Multiply Line 8a by ownership percentage (1.00, .50, .333, etc.) |

8b._____________ |

|||

9.Tax Rate. Check box for applicable tax rate.

a.  Individual 8.0% (.080)

Individual 8.0% (.080)

b. |

Business 8.25% (.0825) |

|

|

10. Tentative withholding amount. Multiply line 8b by applicable tax rate. |

|

|

|

|

If Line 8 is zero (0) or less than zero (0), enter zero (0) |

對 . |

10._____________ |

NOTE: This amount will be recalculated by the Comptroller’s Office based on the actual documentation received and amounts substantiated.

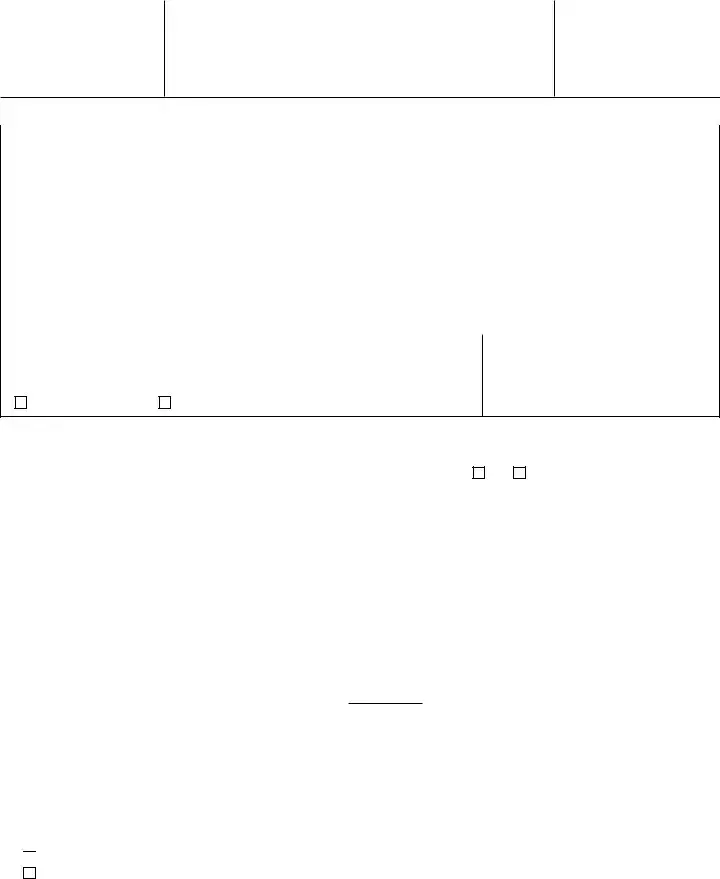

MARYLAND |

Application for Certificate of Full or Partial Exemption |

2021 |

|

|

|

|

|

FORM |

|

|

page 2 |

MW506AE |

|

|

|

|

|

|

|

Transferor/Seller’s Name_______________________________________________________ |

Your Social Security Number/FEIN______________________________ |

||

Special Situations

Check the box in the “Special Situations” column that applies to your situation, if any. If none apply, your exemption will be based only on the amount on the worksheet on page 1. See instructions for required documentation.

Principal Residence. |

Transfer is pursuant to an installment sale under §453 of |

|

the Internal Revenue Code. |

|

|

Principal Residence – |

Transfer of inherited property is occurring within 6 months |

Government Employees. |

of date of death. |

|

|

Transferor/seller is the custodian of an individual retirement |

|

Revenue Code. |

account (IRA). |

|

|

Transferor/seller is receiving zero proceeds from this |

Transfer is pursuant to a specific Internal Revenue Code |

transaction because proceeds are going to another seller/ |

section. See addendum. |

owner (ex. cosignor). |

|

Address of Settlement Agent to Mail Certificate if Issued (See instructions.)

Name of contact person and company

Street Address |

|

City |

State |

ZIP code |

|

|

|

|

|

Telephone number |

Fax number |

|

Email Address |

|

Under the penalties of perjury, I declare that I have examined this application, including any schedules or statements attached, and to the best of my knowledge and belief, it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Your signature |

Date |

Spouse’s signature |

Date |

Telephone number |

|

Check here |

if you authorize |

|

us to contact you by email. |

Email address |

|

Preparer’s PTIN (required by law) |

Signature of preparer other than taxpayer |

Printed name of preparer

Address of preparer

Telephone number of preparer

MARYLAND

FORM

MW506AE

INSTRUCTIONS FOR APPLICATION FOR |

2021 |

CERTIFICATE OF FULL OR PARTIAL EXEMPTION |

|

The Comptroller’s decision to issue or deny a certificate and the amount of

tax is final and not subject to appeal.

GENERAL INSTRUCTIONS

Purpose of Form

Use Form MW506AE to apply for a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of the sale of real property and associated personal property in Maryland by nonresident individuals and nonresident entities. A nonresident entity is defined to mean an entity that: (1) is not formed under the laws of Maryland and (2) is not qualified by or registered with the Department of Assessments and Taxation to do business in Maryland.

Who May File an Application

An individual, fiduciary, C corporation, S corporation, limited liability company, or partnership transferor/seller may file Form MW506AE. Unless the transferors/sellers are spouses filing a joint Maryland income tax return, a separate Form MW506AE is required for each transferor/seller.

IMPORTANT: The completed Form MW506AE and all required documentation must be received by the Comptroller of Maryland no later than 21 days before the closing date of the sale or transfer to ensure timely receipt of a Certificate of Full or Partial Exemption. Applications with no closing date will not be processed.

The Comptroller’s decision to issue or deny a Certificate of Full or Partial Exemption and the determination of the amount of tax to be withheld if a partial exemption is granted are final and not subject to appeal.

SPECIFIC INSTRUCTIONS Transferor/Seller’s Information

Enter the name, address and identification number (Social Security number or federal employer identification number) of the transferor/seller applying for the exemption. If the transferor/seller was issued an individual taxpayer identification number (ITIN) by the IRS, enter the ITIN.

Check the box indicating the transferor/seller’s entity type.

Enter the transferor/seller’s ownership percentage of the property. For example, if there are four equal owners, enter 25% for single application.

Property Information

Enter the description of the property, including the street address(es) for the property as listed with the State Department of Assessments and Taxation (SDAT), including county. If the property does not have a street address, provide the full property account ID numbers used by SDAT to identify the property.

Enter the date of closing for the sale or transfer of the property.

Application will not be processed if left blank.

Enter the property account ID number, if known. If the property is made up of more than one parcel and has more than one property tax account number, include all applicable property account ID numbers.

Check the box to indicate whether the property was used for rental/commercial purposes. Maryland law requires that nonresidents owning real property in Maryland file a nonresident income tax return reporting any rental income or loss. If you checked the rental/commercial box and did not file returns reporting this income or loss, your application will be denied. File all appropriate returns before filing this application.

Relocating Sellers

If you are selling your house through a relocation company, please see the MW506AE – Relo Addendum for further instructions. You must complete the MW506AE – Relo Addendum and attach

it to your submission of the MW506AE.

Calculation of Tentative Exemption/Withholding Amount

Complete the calculation of tentative exemption section.

Line 1. Enter the purchase price of the property. This is the contract amount for the original purchase. DO NOT include settlement costs or other adjustments in this line. If inherited property, use the Date of Death value of the property. You must attach an original settlement statement, property tax printout (available at www.dat. state.md.us), original contract, date of death appraisal, or other proof of original purchase price or inherited value.

Line 2. Enter amount of capital improvements. This line is OPTIONAL. However, you must attach paid invoices or receipts with cancelled checks for improvements. Documentation must include proof of payment, address of property, and work completed.

Line 3. Settlement costs. You must attach a settlement statement for this amount. You may add both settlement costs for purchase and sale of the property if you have a settlement statement for each. If a preliminary settlement statement is not available at time of filing, you must forward as soon as completed in order to be credited for these costs. You may request this from the settlement agent.

Line 4. Add lines 1 through 3.

Line 5. Depreciation. Enter all depreciation already taken for this property, if rental or commercial, on any income tax return. You must attach a depreciation schedule or returns.

Line 6. Adjusted basis. Subtract line 5 from line 4. This is your adjusted basis.

Line 7. Contract Sales Price. Enter contract sales price. You must attach current contract (page 1 and signature pages only) or preliminary settlement statement.

Line 8a. Amount subject to tax. Subtract line 6 from line 7.

Line 8b. Multiply Line 8a by percentage of ownership. Line 9. Tax Rate. Select which tax rate applies.

Line 10. Tentative Withholding Amount. Multiply line 8b by the tax rate. This is the tentative amount of withholding. If zero or less than zero, enter zero. If zero, you may qualify for a full exemption (subject to verification).

Note: This amount will be calculated by the Comptroller’s Office based on actual documentation received.

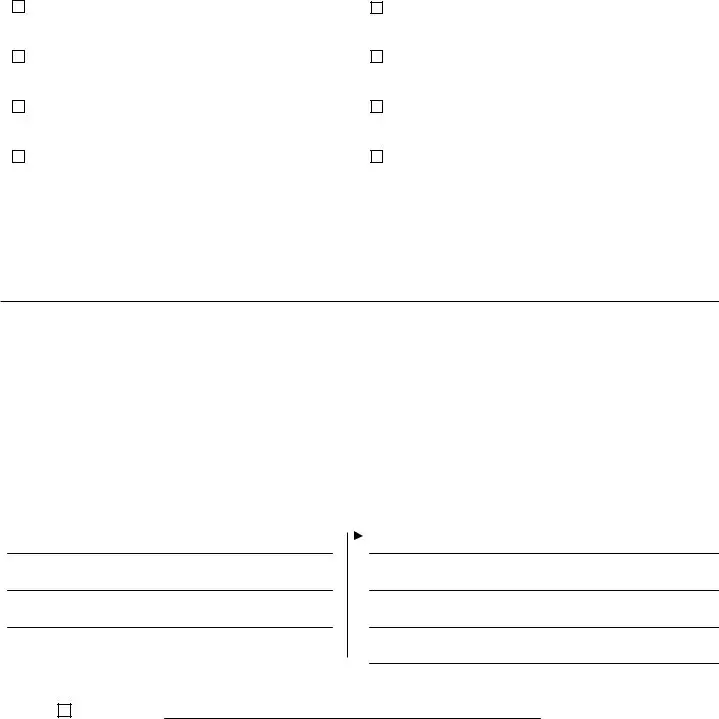

Special Situations

Principal Residence.

Transfer is of your principal residence as defined in §121 of the Internal Revenue Code, which means it has been your principal residence for two of the last five years. Resident income tax returns for that period must have been filed to claim principal residence. This will be verified by the Comptroller’s Office.

Principal Residence –

Transfer is of your principal residence as defined in §121 of the Internal Revenue Code, if you had a move necessitated by government orders or are stationed in Maryland. Attach transfer orders and proof of residency. This may include federal income tax return with Maryland address, utility bills, property tax statements, etc. See Internal Revenue Service Publication 523.

MARYLAND

FORM

MW506AE

INSTRUCTIONS FOR APPLICATION FOR |

2021 |

CERTIFICATE OF FULL OR PARTIAL EXEMPTION |

|

The Comptroller’s decision to issue or deny a certificate and the amount of

tax is final and not subject to appeal.

Required documentation in addition to that on page 1; letter signed by the qualified intermediary, or by the person authorized to sign on behalf of a business entity acting as the qualified intermediary, which states the name(s) of the transferor(s), the property description, that the individual or business will be acting as the qualified intermediary for the transferor(s) as part of a §1031 exchange of the property, whether there will be any boot, and if so, the amount of boot. The amount of any boot must be stated on the application as the taxable amount.

Transferor/seller is receiving zero proceeds from this transaction.

Note: This situation applies when all proceeds go to another

Required documentation in addition to that on page 1; copy of a letter from the transferor/seller to the title company advising they are to receive zero proceeds from the sale and advising to whom the proceeds are to go; a copy of the acknowledgment letter from the title company to the transferor/seller that all proceeds are to go to another

Transfer is pursuant to an installment sale under §453 of the Internal Revenue Code.

Required documentation in addition to that on page 1; copy of contract of sale or copy of settlement sheet from the title company; copy of promissory note to transferor which will be executed by transferee at settlement. That portion of the total payment that the transferor receives at or within sixty (60) days of settlement must be stated on the application as the taxable amount.

Transfer of inherited property is occurring within 6 months of date of death.

Required documentation in addition to that on page 1; provide a copy of the death certificate and a copy of the estimated settlement sheet from the title company.

Transferor/seller is the custodian of an individual retirement account.

Required documentation in addition to that on page 1; provide a copy of the preliminary settlement sheet from the title company, the custodian’s Certificate of Good Standing from its state of incorporation, and a letter from the title company stating that all proceeds will be disbursed to the custodian.

Transfer is pursuant to a specific Internal Revenue Code section. See addendum.

Address to Mail Certificate if Issued

Provide the name and address of the title company or settlement agent to whom we should mail the exemption certificate if issued. If you do not know the identity of the title company or settlement agent at the time you complete this form, you must email the name and address to nrshelp@marylandtaxes.gov as soon as possible. You must provide a mailing address to avoid delay in recording the sale.

Signature(s)

Form MW506AE must be signed by an individual (both taxpayer and spouse, if filing a joint Maryland income tax return), or a responsible corporate officer.

Include a daytime telephone number where you can be reached between 8:00 AM and 5:00 PM.

If you would like to be contacted by email in the event that more information is needed to process your application, include your email address and check the box allowing us to contact you by email. The exemption certificate, if issued, will not be emailed to you.

Your signature(s) signifies that your application, including all attachments, is, to the best of your knowledge and belief, true, correct and complete, under penalties of perjury.

If a power of attorney is necessary, complete Maryland Form 548 and attach to your application.

Where to File

Mail the completed form and all attachments to:

Comptroller of Maryland

Revenue Administration Division

Attn: NRS Exemption Requests

P.O. Box 2031

Annapolis, MD

OR

Email the completed form and all attachments to nrshelp@ marylandtaxes.gov

Note: The email submission will not expedite the processing of your application. If you are emailing large attachments, send multiple smaller emails.

Submit your application via only one method.

Additional Information

For additional information visit www.marylandtaxes.gov, email nrshelp@marylandtaxes.gov or call

MARYLAND |

|

|

|

|

2021 |

|

|

|

|

|

|

||

FORM |

|

|

ADDENDUM FOR APPLICATION FOR |

|

||

MW506AE |

|

CERTIFICATE OF FULL OR PARTIAL EXEMPTION |

|

|||

|

|

|

|

|

|

|

Code Letter |

IRC Section |

Description |

|

Required Documentation |

|

|

|

|

|

|

|||

a |

§ 351 |

Transfer is to a corporation |

Copy of the agreement of sale; Certificate of Good Standing of |

|||

|

|

controlled by the transferor |

transferee issued by the state in which transferee is incorporated; |

|||

|

|

for purposes of § 351 of the |

notarized affidavit executed on behalf of transferee by its President |

|||

|

|

Internal Revenue Code. |

and its Treasurer stating that immediately after the exchange the |

|||

|

|

|

|

|

transferor(s) will own stock in the transferee possessing at least eighty |

|

|

|

|

|

|

percent (80%) of the total combined voting power of all classes of |

|

|

|

|

|

|

transferee’s stock entitled to vote and at least eighty percent (80%) |

|

|

|

|

|

|

of the total number of shares of all other classes of stock of the |

|

|

|

|

|

|

transferee; and an appraisal establishing the fair market value, at |

|

|

|

|

|

|

the time of the exchange, of any property other than stock in the |

|

|

|

|

|

|

transferee which is part of the consideration for the exchange. The |

|

|

|

|

|

|

fair market value of any such other property and/or any money which |

|

|

|

|

|

|

is part of the consideration for the exchange must be stated on the |

|

|

|

|

|

|

application as the taxable amount. |

|

|

|

|

|

|

|

|

b |

§ 361 |

Transfer |

is |

pursuant to a |

Copy of agreement governing the transfer between transferor and |

|

|

|

transferee; Certificates of Good Standing of transferor and transferee |

||||

|

|

described in § 361 of the |

issued by the state(s) in which transferor and transferee are |

|||

|

|

Internal Revenue Code. |

incorporated; copy of the plan or reorganization showing that transferor |

|||

|

|

|

|

|

and transferee are parties to the reorganization; and an appraisal |

|

|

|

|

|

|

establishing the fair market value, at the time of the exchange, of any |

|

|

|

|

|

|

property other than stock or securities in the transferee which is part |

|

|

|

|

|

|

of the consideration for the exchange and will not be distributed by the |

|

|

|

|

|

|

transferor in pursuance of the plan of reorganization. The fair market |

|

|

|

|

|

|

value of any such other property and/or any money which is part of |

|

|

|

|

|

|

the consideration for the exchange must be stated on the application |

|

|

|

|

|

|

as the taxable amount. |

|

|

|

|

|

|||

c |

§ 501(a) |

Transfer is by a |

Copy of determination by the Internal Revenue Service that transferor |

|||

|

|

entity for purposes of § 501(a) |

is a |

|||

|

|

of the Internal Revenue Code |

Code; Certificate of Good Standing of transferor issued by the state |

|||

|

|

and transfer involves limited or |

in which transferor is incorporated; notarized affidavit executed on |

|||

|

|

no unrelated business taxable |

behalf of transferor by its President and by its Treasurer stating that |

|||

|

|

income under § 512 of the |

the transfer involves limited or no unrelated business income under § |

|||

|

|

Internal Revenue Code. |

512 of the Internal Revenue Code. |

|

||

|

|

|

|

|||

d |

§ 721 |

Transfer is to a partnership in |

Copy of agreement governing transfer between transferor and |

|||

|

|

exchange for an interest in the |

transferee; copy of the partnership agreement of the transferee. |

|||

|

|

partnership such that no gain |

|

|

||

|

|

or loss is recognized under § |

|

|

||

|

|

721 of the Internal Revenue |

|

|

||

|

|

Code. |

|

|

|

|

|

|

|

|

|||

e |

§ 731 |

Transfer is by a partnership to |

Copy of agreement governing transfer between transferor and |

|||

|

|

a partner of the partnership in |

transferee; copy of the partnership agreement of the transferor. |

|||

|

|

accordance with § 731 of the |

|

|

||

|

|

Internal Revenue Code. |

|

|

||

|

|

|

|

|||

f |

§ 857 |

Transfer is treated as a transfer |

Copy of agreement governing transfer between transferor and |

|||

|

|

by a real estate investment |

transferee; certified copy of Articles of Incorporation of transferor; |

|||

|

|

trust for purposes of § 857 of |

Certificate of Good Standing of transferor issued by the state in which |

|||

|

|

the Internal Revenue Code. |

transferor is incorporated. |

|

||

g |

§ 1033 |

Transfer is pursuant to a |

Copy of agreement governing transfer between transferor and |

|||

|

|

condemnation and conversion |

government body or authority condemning the property; notarized |

|||

|

|

into a similar property for |

affidavit executed by transferor stating that transferor will identify |

|||

|

|

purposes of § 1033 of the |

and purchase replacement property within the time limits required |

|||

|

|

Internal Revenue Code. |

by § 1033 of the Internal Revenue Code, or copy of contract of sale |

|||

|

|

|

|

|

if transferor has already identified replacement property. If proceeds |

|

|

|

|

|

|

from condemnation exceed price of replacement property, the excess |

|

|

|

|

|

|

must be stated on the application as the taxable amount. |

|

|

|

|

|

|

|

|

h |

§ 1041 |

Transfer |

is |

between spouses |

Copy of marriage license or divorce decree; copy of deed which will |

|

|

|

or incident to divorce for |

be recorded to accomplish the transfer; if incident to divorce, copy of |

|||

|

|

purposes of § 1041 of the |

section of court order or separation agreement governing transfer of |

|||

|

|

Internal Revenue Code. |

the property. |

|

||

i |

§ 1368 |

Transfer is treated as a |

Copy of agreement governing transfer between transferor and |

|||

|

|

transfer by an S corporation |

transferee; copy of approval by the Internal Revenue Service of |

|||

|

|

for purposes of § 1368 of the |

transferor’s |

|||

|

|

Internal Revenue Code. |

transferor issued by the state in which transferor is incorporated. |

|||

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | Form MW506AE is used to apply for a Certificate of Full or Partial Exemption from withholding on the sale of real property by nonresidents in Maryland. |

| Submission Deadline | The completed form must be received by the Comptroller’s office at least 21 days before the property's closing date. |

| Required Documentation | Applicants must submit various documents, such as settlement statements and proof of identification, to support their application. Without these, the application may be denied. |

| Entity Types Allowed | Individuals, fiduciaries, corporations, partnerships, and limited liability companies can file the MW506AE to request an exemption. |

| Governing Laws | This form follows Maryland tax laws regarding nonresident taxation and exemptions applicable to the sale of real estate. |

Guidelines on Utilizing Mw506Ae

Completing the MW506AE form is crucial for non-resident individuals and entities who wish to apply for a Certificate of Full or Partial Exemption pertaining to property sales in Maryland. Ensure that all information is accurate and all necessary documentation is attached, as the submission must be received at least 21 days before the closing date. Follow these steps to fill out the form correctly.

- Personal Information: Enter your Social Security Number and, if applicable, your spouse's Social Security Number. Fill in your first name, middle initial, and last name. Do the same for your spouse.

- Entity Information: If applicable, provide the name of your corporation, partnership, trust, or estate, along with the Federal Employer Identification Number (FEIN).

- Address: Write your current address, including street, city, state, and ZIP code.

- Entity Type: Indicate your transferor/seller entity type and ownership percentage (e.g., Individual, Estate, Trust).

- Property Description: Give the complete description of the property, including address and identification numbers if applicable. Check the box if the property has been used for rental or commercial purposes.

- Rental Use Dates: If applicable, provide the dates the property was used as a rental or commercial property.

- Closing Date: Enter the date of closing in the required format (mm/dd/yyyy).

- Calculation of Tentative Exemption: Fill out the calculation lines, starting from the purchase price/inherited value on line 1. Attach all required supporting documents for each corresponding line.

- Tax Rate Selection: Mark the box corresponding to the applicable tax rate for individuals or businesses.

- Tentative Withholding Amount: Complete the calculation for the tentatively withheld amount based on the previously filled lines.

- Special Situations: Indicate if any special situations apply by checking the appropriate boxes and providing further necessary documentation.

- Settlement Agent Information: Specify the name, address, and contact information of the settlement agent to whom the exemption certificate should be mailed.

- Signatures: Both the taxpayer (and spouse, if applicable) should sign and date the form. Include a daytime phone number and email address if desired.

- Submission: Mail or email the completed form and attached documents to the specified address or email for processing.

Following these steps ensures every detail is accounted for, which helps facilitate a smoother processing of your exemption application by the Comptroller’s Office. Always keep copies of your submissions and any correspondence related to this process for your records.

What You Should Know About This Form

What is the purpose of the MW506AE form?

The MW506AE form is used to apply for a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of selling real property in Maryland. This applies specifically to nonresident individuals and entities involved in such transactions. Completing this form correctly is crucial for securing the appropriate tax exemption during the sale process.

Who is eligible to file the MW506AE form?

Eligibility to file the MW506AE form extends to various types of transferor/sellers, including individuals, fiduciaries, C corporations, S corporations, limited liability companies, and partnerships. However, if the transferors are married and wish to file a joint Maryland income tax return, each spouse must file a separate form for their respective ownership shares in the property.

What information is required when filling out the MW506AE form?

You will need to provide personal details such as your Social Security Number and the name of the corporation or entity, if applicable. Additionally, descriptions of the property, including its address and the dates it was used as a rental or commercial property, must be included. Financial information, particularly regarding the purchase price, settlement expenses, and any depreciation already claimed, will also be necessary.

What documentation is required for submission with the MW506AE form?

Attachments must include relevant supporting documents, such as settlement statements, appraisals, receipts for capital improvements, and income tax returns if the property was used as a rental. Each document plays a key role in substantiating your claim for a tax exemption and in determining the amount of potential withholding.

What is the deadline for submitting the MW506AE form?

The completed MW506AE form, along with all required documentation, must be received by the Comptroller of Maryland at least 21 days before the scheduled closing date of the property sale. Submitting your application on time is essential to ensure that you receive the exemption certificate without delays.

What happens if the MW506AE application is denied?

If the application for the Certificate of Full or Partial Exemption is denied, the decision is final and not subject to appeal. In such cases, the standard withholding tax requirements will apply to the sale proceeds. It is important to carefully follow instructions and ensure all required documentation is accurate to minimize the risk of denial.

Common mistakes

Filling out the MW506AE form is an important step for anyone selling real property in Maryland, especially nonresident individuals and entities. However, many people make mistakes that can delay or even derail their exemption requests. Here are ten common missteps to be wary of.

1. Missing the Deadline: One fundamental error is failing to submit the form within the required timeframe. The application must be received no later than 21 days before the closing date. Procrastination can lead to complications, so it's wise to act early.

2. Incomplete Information: Applicants often skip sections or fail to provide complete details, such as the property description or ownership percentage. Every field matters; leaving any blank could invite rejection, so double-check all entries.

3. Incorrect Social Security Numbers: One slip of the finger can lead to significant problems. Providing wrong Social Security numbers can cause mismatches in the system, complicating verification. Ensure numbers are accurate and check them carefully.

4. Neglecting to Attach Required Documentation: Often, applicants forget to include necessary attachments, like settlement statements or proof of inheritance. Each type of exemption has specific documentation requirements, so gather these before submission.

5. Ignoring Rental Property Requirements: If the property was ever used for rental purposes, applicants must have filed the appropriate income tax returns reporting that income. Skipping this step could result in automatic denial.

6. Failing to Specify the Right Entity Type: Selecting the correct type of entity is crucial. Whether it's an individual, partnership, or corporation, inaccuracies can lead to confusion, further delaying the process.

7. Miscalculating Tax Liabilities: Applicants sometimes struggle with calculations in the tentatively withholding section. Simple math errors can significantly affect the outcome, so it's advisable to verify all totals before sending the form.

8. Poorly Described Property Information: Detailed property descriptions are essential. Failing to provide complete information, such as lot numbers or specific addresses, can lead to processing delays.

9. Leaving Signature Line Blank: Remember, without signatures, the application is incomplete. If there’s more than one seller, make sure everyone involved signs the form. It might seem minor, but it’s essential.

10. Overlooking Special Situations: Many applicants fail to check the "Special Situations" section that may apply to their circumstances. If you qualify for any particular tax protections, you must check the appropriate box and follow the instructions.

By avoiding these common pitfalls, you can streamline the process, ensuring that your exemption request is processed smoothly and efficiently. Taking the time to review your application can save you headaches down the road!

Documents used along the form

When dealing with real estate transactions in Maryland, several key forms accompany the MW506AE form, which is essential for obtaining a Certificate of Full or Partial Exemption. Understanding these associated documents can streamline the process and help ensure compliance. Below is a list of the most commonly used forms alongside the MW506AE.

- Settlement Statement: This document outlines the final details of a real estate transaction, including the purchase price, closing costs, and any adjustments made. It provides proof of the actual amounts involved in the transaction and validates calculations made in the MW506AE form.

- Death Certificate: In cases where property transfer occurs due to inheritance, a death certificate is necessary to verify the transferor’s relationship to the deceased and the timing of the transfer.

- Preliminary Settlement Disclosure: This form details the estimated closing costs for the sale and provides an overview of financial obligations that will be handled at closing, helping buyers and sellers understand what to expect.

- Deed: The deed is the legal document that transfers property ownership from the seller to the buyer. It must be completed and recorded after the sale and is crucial for establishing the new owner’s legal rights.

- IRS Form 548: If a power of attorney is needed during the application process, this form allows someone to act on the transferor's behalf. It’s important for ensuring that the legal authority is properly documented.

- MW506AE – Relo Addendum: For those involving relocation companies, this addendum provides additional instructions for transferring property and must be included with the MW506AE form to ensure compliance.

Being familiar with these additional forms can significantly ease the process of applying for the necessary exemptions. Gathering all relevant documents promptly will help avoid delays as you move forward with your real estate transaction in Maryland. Always ensure that your forms are filled out accurately to facilitate a smooth closing process.

Similar forms

- IRS Form 8949: Similar to the Mw506Ae form, this IRS form is used to report sales and other dispositions of capital assets. Both require detailed information about properties or assets being sold, along with supporting documentation for the sales price.

- Maryland Form 502: This state income tax form is filed by individuals in Maryland and may have connections to capital gains from property sales. Similar to the Mw506Ae, it seeks comprehensive information regarding property transactions and ensures that proper documentation is submitted to validate tax obligations.

- Form 1099-S: This form relates to the reporting of proceeds from real estate transactions. Like the Mw506Ae, it necessitates detailed information about the sale, including the seller's information and property description. Both forms aim to ensure compliance with tax obligations concerning property sales.

- Maryland Form MW506: This form is also a tax withholding form used for real estate transactions in Maryland, specifically for resident sellers. While the Mw506Ae applies to nonresidents seeking exemption, the two forms share similar structures and purposes in reporting property sales and calculating potential tax liabilities.

Dos and Don'ts

When tackling the MW506AE form, it's important to approach the task with care and attention. Here are some key dos and don'ts to keep in mind.

- Do double-check all personal details before submitting. Accuracy is key!

- Do ensure that all required documents are attached, such as the settlement statement or death certificate if applicable.

- Do verify that your application is submitted at least 21 days prior to the closing date to avoid delays.

- Do clearly indicate whether the property was used for rental or commercial purposes, as this can affect your exemption.

- Don't leave any sections of the form blank. Each question needs an answer, even if it’s just “not applicable.”

- Don't forget to sign the form. Your application won’t be processed without a signature!

By following these guidelines, you'll complete the MW506AE form with greater confidence and reduce the chances of complications down the road. Remember, attention to detail can make all the difference!

Misconceptions

Misconceptions about the Maryland Form MW506AE

- Application Deadline Is Flexible: Many individuals believe there is no strict deadline for submitting the MW506AE form. However, the completed form and all required documents must be received by the Comptroller of Maryland at least 21 days before the closing date of the sale. Late submissions may not be processed.

- Single Application Covers Multiple Sellers: It is a common assumption that one application can suffice for multiple sellers. In reality, unless the sellers are spouses filing a joint tax return, each seller must submit a separate MW506AE form to apply for their exemption.

- Exemption Certificates Are Automatically Granted: Some people think that submitting the form will guarantee the issuance of a Certificate of Exemption. The decision is not automatic. The Comptroller's Office reviews the documentation to determine whether to grant or deny the exemption, and this decision is final.

- All Property Types Qualify for Exemption: Not every property qualifies for exemption under the MW506AE form. The property must be classified appropriately, and if it has ever been used as rental or commercial property without proper tax documentation, the application could be denied.

- Informal Documentation Is Sufficient: Some believe that they can provide informal or incomplete documentation for their claims. However, attachments such as settlement statements, appraisal documents, and tax returns are necessary to substantiate the information presented on the form. Incomplete submissions can lead to delays or denials.

- Tax Proceeds Go Directly to the Seller: There is often a misunderstanding regarding where the proceeds from the sale go. In cases where other parties are involved, such as a co-owner, and the seller receives no proceeds, this must be clearly indicated in the application, along with supporting documentation.

Understanding these misconceptions can help navigate the application process with clarity and confidence. Ensuring accurate and timely submissions increases the likelihood of a favorable outcome.

Key takeaways

When it comes to completing the Maryland MW506AE form, there are several important points to keep in mind. This form is crucial for nonresident individuals or entities seeking a certificate of exemption related to the sale of real property in Maryland. Here are key takeaways to consider:

- Timely Submission is Essential: To ensure the processing of your application, it is vital to submit the MW506AE form along with all required documentation at least 21 days prior to the closing date of the sale. Missing this deadline could mean delays or denial of your exemption certificate.

- Correct Information is Key: Fill out the form carefully, ensuring that all provided information, such as names, addresses, and identification numbers, is accurate. This will help avoid complications during processing.

- Support Your Claims: Attach all necessary documentation that supports your application, including settlement statements, tax returns, and proof of any capital improvements. The more thorough your documentation, the smoother the approval process will be.

- Understanding Exemption Types: Familiarize yourself with the special situations that may apply to your case. Different exemptions are available based on factors like military status or primary residence status, which can affect the outcome of your application.

Being informed about these aspects of the MW506AE form process can aid in successfully navigating your real estate transactions in Maryland.

Browse Other Templates

Crsc - Seek clarification from the VA if the instructions are unclear.

Wells Fargo Beneficiary Form - It lays out the necessary details that Wells Fargo requires for processing subordination requests.

Passport Forms - Applicants must print or type their information in capital letters using black or dark blue ink.