Fill Out Your Mw508 Form

The Maryland Annual Employer Withholding MW508 Reconciliation Return is a critical document for employers in Maryland. It serves as an essential tool for reporting total Maryland payroll for the calendar year, along with detailed information about tax withholdings. Employers must submit this form by January 31 each year to avoid potential penalties. Central to the MW508 is the requirement to report not only the number of W-2s and 1099 forms issued but also the total withholding tax for the year. It requires an accurate reconciliation of state and local taxes as reflected on the submitted forms. Key fields on the form include the employer's Federal Employer Identification Number (FEIN) and North American Industry Classification System (NAICS) code, both of which facilitate proper categorization and processing of the information. Additionally, provisions exist for electronic filing, which is mandatory for those submitting 25 or more W-2 or 1099 forms. Employers may face penalties for incorrect submissions or failure to comply with filing requirements, making accurate reporting and adherence to guidelines essential. Understanding the complete MW508 process is vital for employers to ensure compliance and mitigate any risks associated with tax reporting and payments.

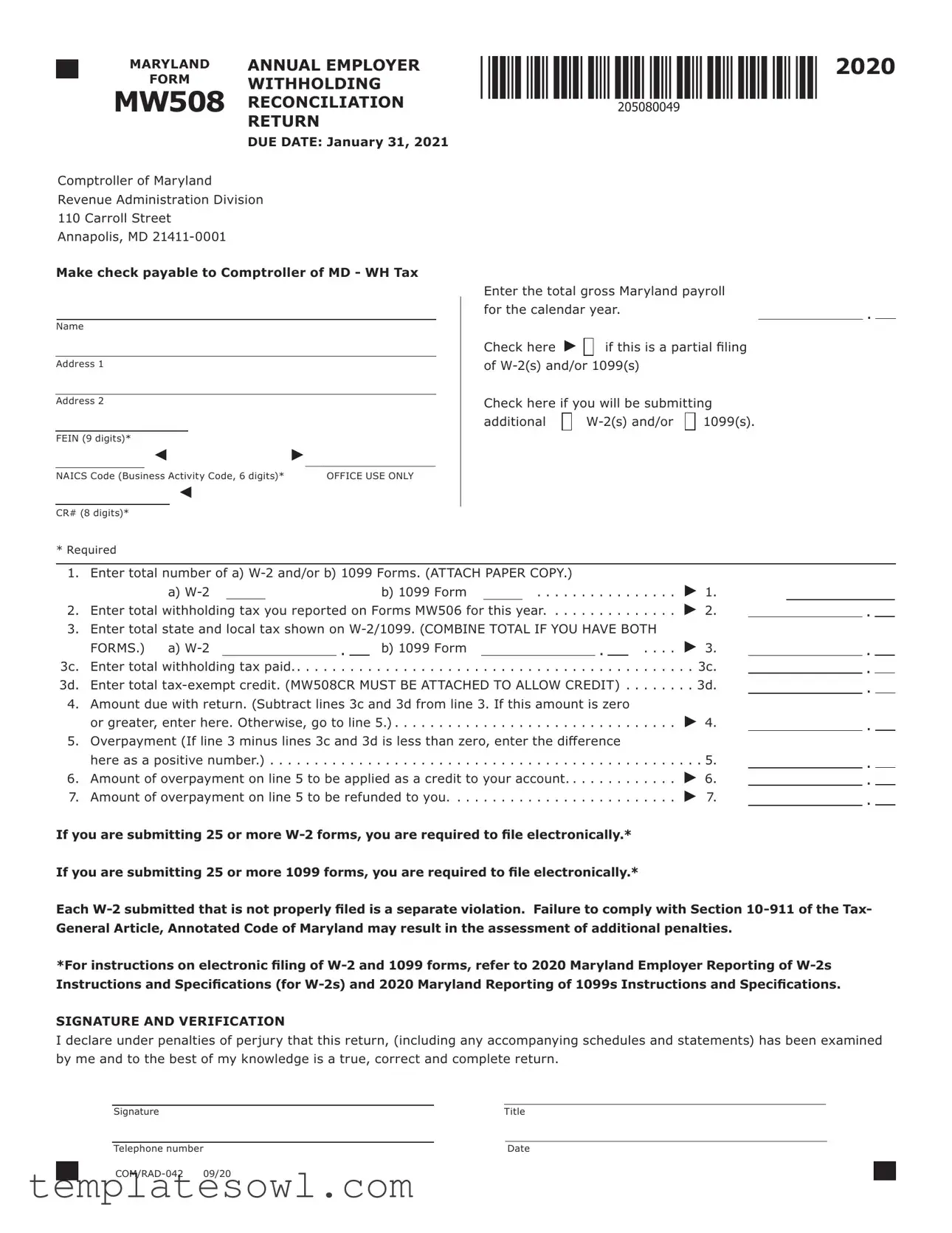

Mw508 Example

MARYLAND ANNUAL EMPLOYER

FORM WITHHOLDING MW508 RECONCILIATION

RETURN

DUE DATE: January 31, 2021

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, MD

Make check payable to Comptroller of MD - WH Tax

Name

Address 1

Address 2 |

|

|||

|

|

|

|

|

FEIN (9 digits)* |

|

|||

|

|

|

|

______________________ |

NAICS Code (Business Activity Code, 6 digits)* |

OFFICE USE ONLY |

|||

|

|

|

||

CR# (8 digits)* |

|

|||

Enter the total gross Maryland payroll for the calendar year.

Check here |

if this is a partial filing |

of

Check here if you will be submitting additional

1099(s).

1099(s).

2020

.

*Required

1. Enter total number of a)

|

a) |

|

|

|

|

b) 1099 Form |

. |

. . . . |

. . . . |

1. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

2. |

Enter total withholding tax you reported on Forms MW506 for this year |

. |

. . . . |

. . . . |

2. |

||||||||||

3. |

Enter total state and local tax shown on |

|

|||||||||||||

|

FORMS.) a) |

|

. |

|

b) 1099 Form |

|

. |

|

|

. . . . |

3. |

||||

3c. |

Enter total withholding tax paid.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3c. |

||||||||||||||

3d. |

Enter total |

3d. |

|||||||||||||

4. |

Amount due with return. (Subtract lines 3c and 3d from line 3. If this amount is zero |

|

|

||||||||||||

|

or greater, enter here. Otherwise, go to line 5.) |

. . . . |

4. |

||||||||||||

5. |

Overpayment (If line 3 minus lines 3c and 3d is less than zero, enter the difference |

|

|

||||||||||||

|

here as a positive number.) |

. |

. . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. |

. . . . |

. . . . . . |

. 5. |

|||||||

6. |

Amount of overpayment on line 5 to be applied as a credit to your account. . . . |

. |

. . . . |

. . . . |

6. |

||||||||||

7. |

Amount of overpayment on line 5 to be refunded to you |

. . . . |

7. |

||||||||||||

If you are submitting 25 or more

If you are submitting 25 or more 1099 forms, you are required to file electronically.*

.

.

.

.

.

.

.

.

Each

*For instructions on electronic filing of

SIGNATURE AND VERIFICATION

I declare under penalties of perjury that this return, (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge is a true, correct and complete return.

Signature |

Title |

|

|

|

|

Telephone number |

|

Date |

|

|

|

MARYLAND |

ANNUAL EMPLOYER WITHHOLDING |

2020 |

|

FORM |

RECONCILIATION RETURN |

||

|

|||

MW508 |

INSTRUCTIONS |

|

If you are submitting 25 or more

For options 1 and 2 you will need to access the current

Maryland Employer Reporting of

Maryland Taxes, Business Tax Forms and Instructions.*

1.You may use our free bFile Bulk Upload Application that allows you to upload a text file in the “modified EFW2 format”, described in the Specification booklet mentioned above. Once the text file is generated it can be uploaded at www.marylandtaxes.gov under Maryland Taxes. No Excel formats are accepted.

2.You may generate a text file in the “modified EFW2 format”, as described in the Specification booklet and copy this file to a CD or 3 1/2 inch diskette and send to Comptroller of Maryland, Revenue Administration Division, Attn: Electronic

3.You may use our free bFile Withholding Reconciliation Application which allows you to manually key data from your

can be keyed using this method. This can be found at www.marylandtaxes.gov under Maryland Taxes.

If you have questions with regard to filing your MW508 Withholding Reconciliation return, contact Taxpayer Services Division at

If you are submitting 25 or more 1099 forms, you are required to file electronically; two options are available. *

1.You may generate a “modified 1099 format” file as described in the current Maryland Reporting of 1099s Instructions and Specifications which can be found

on our website under Maryland Taxes, Business Tax

Forms and Instructions. Copy this file to a CD or 3 1/2

inch diskette and send it to Comptroller of Maryland,

Revenue Administration Division, Attn: Electronic

2.If you participate in the Combined Federal/State program, the 1099s will automatically be forwarded to Maryland and will include your MW508.

If you have questions with regard to filing your MW508 Withholding Reconciliation return, contact Taxpayer Services

Division at

If you are submitting less than 25

If you are filing the MW508 by paper, complete Form MW508,

Employer’s Annual Withholding Reconciliation Return. Send this form, accompanied by the STATE copy of Form

errors. Send your completed MW508 Return, STATE copies of

Administration Division, 110 Carroll Street, Annapolis, MD

Enter the total gross Maryland payroll for the calendar year 2020 on the line provided.

Line 1. Enter the number of

Line 2. Enter total Maryland withholding tax reported for the year.

Line 3. Enter the total amount of State and local tax shown on Form(s)

Line 3c. Enter total amount of withholding tax paid this year.

Line 3d. Enter total eligible business tax credits if you are a

Line 4. Amount Due. (Subtract lines 3c and 3d from line 3. If this amount is zero or greater, enter here; otherwise, go to line 5.)

Line 5. Overpayment (If line 3 minus lines 3c and 3d combined is less than zero, enter the difference here

as a positive number.)

Line 6. Enter the amount of line 5 you wish to have applied as a credit.

Line 7. Enter the amount of line 5 you wish to have refunded. (Line 6 plus line 7 cannot exceed line 5.)

*Electronic filers submitting via Maryland Bfile or by Magnetic Media do not need to file a paper Form MW508 as this may cause duplicate filing. The MW508 will be included in the data received. Duplicate filing may result in erroneous balance due notices and/or penalty notices.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The MW508 form is the Maryland Annual Employer Withholding Reconciliation Return, used for reconciling withholding taxes from employee wages for a calendar year. |

| Filing Due Date | The MW508 form must be filed by January 31 of the following year, allowing employers to report their withholding tax obligations for the previous calendar year. |

| Electronic Filing Requirement | Employers submitting 25 or more W-2 or 1099 forms are required to file electronically to streamline processing and reduce errors. |

| State Requirements | This form is governed by Maryland Tax General Article, Section 10-911. Compliance is essential to avoid penalties. |

| Attachments | Employers must attach copies of the submitted W-2 and/or 1099 forms to the MW508, along with any required documentation for credits. |

| Potential Overpayment | If the total withholding tax paid exceeds the reported amount, employers can request a refund or apply the overpayment as a credit for future filings. |

Guidelines on Utilizing Mw508

Filling out the MW508 form is a necessary step for Maryland employers to reconcile their withholding taxes for the year. Once the form is completed, be sure to send it, along with required W-2 and 1099 forms, to the Comptroller of Maryland to meet your filing obligations.

- Gather necessary information: Collect the names, addresses, and tax identification numbers for your business. Obtain all W-2 and 1099 forms for individuals paid throughout the year.

- Complete business information: Write your name, address, FEIN, NAICS Code, and phone number at the top of the MW508 form.

- Enter total gross payroll: In the designated section, input the total gross Maryland payroll for the calendar year.

- List number of forms: Complete line 1 by entering the total number of W-2s and 1099s you are submitting separately. Make sure to attach paper copies for accuracy.

- Enter withholding tax amounts: Fill out line 2 with the total withholding tax reported on the MW506 forms for the year.

- Fill in state and local tax amounts: For line 3, specify the total state and local taxes reported on W-2 and 1099 forms.

- Calculate withholding tax paid: On line 3c, enter the total amount of withholding tax that you paid during the year.

- Include tax-exempt credits: If applicable, list the total tax-exempt credits on line 3d. Attach MW508CR if claiming any credits.

- Determine amount due or overpayment: Perform calculations for lines 4 and 5 to determine if you owe money or are due a refund.

- Enter credit and refund amounts: If applicable, enter the amounts you wish to apply as a credit or have refunded on lines 6 and 7.

- Sign and date the form: Don’t forget to declare under penalty of perjury that the information is accurate; sign and date the form.

- Submit your form: Send the completed MW508 form along with the STATE copies of W-2s and/or 1099s to the Comptroller of Maryland.

What You Should Know About This Form

What is the MW508 form and when is it due?

The MW508 form, or Maryland Annual Employer Withholding Reconciliation Return, is a document that employers in Maryland must submit to report their withholding tax for the previous calendar year. It's crucial for tracking how much tax has been withheld from employee wages and ensuring compliance with state tax laws. The form is due annually on January 31. It's important to meet this deadline to avoid penalties.

Who needs to file the MW508 form?

Any employer who has withheld Maryland state income taxes from their employees must file the MW508 form. If you’ve issued W-2 or 1099 forms, you need to complete this form, especially if you have withheld taxes during the year. If you're submitting 25 or more W-2 or 1099 forms, electronic filing is required. However, if you have fewer than 25 forms, you can file electronically or on paper.

What information do I need to provide when filing the MW508?

When filling out the MW508, you'll need to enter several key pieces of information. Start by providing your business details, including your name, address, and Federal Employer Identification Number (FEIN). You'll need to report your total gross payroll for the year and specify the number of W-2 and 1099 forms you're submitting. Additionally, you'll report the total withholding tax you’ve already paid and any tax credits you may want to apply. Keeping accurate records will help ensure everything is submitted correctly.

What happens if I miss the deadline or submit the form incorrectly?

Missing the deadline for submitting your MW508 can lead to penalties and interest on any taxes owed. If you submit the form incorrectly, it could result in the state believing you owe more taxes than you actually do, leading to unwanted notices or additional penalties. If you realize you've made a mistake, you should correct it as soon as possible. It’s always a good idea to keep records of what you submit and consult with a tax professional if you’re unsure about the process.

Common mistakes

Filling out the MW508 form correctly is crucial for Maryland employers to ensure compliance and avoid costly penalties. However, many people make common mistakes when completing this important document. Recognizing these pitfalls can help prevent unnecessary delays and ensure that your information is processed accurately.

One frequent error is failing to double-check the Employer Identification Number (FEIN). This nine-digit number is critical for the proper identification of your business. If the number is incorrect, it could lead to misdirected tax credits and potential confusion with the state. Ensure that you have the correct FEIN listed before submitting your form.

Another mistake involves overlooking the signatures and verification requirement. The MW508 form requires a signature to validate the information submitted. Without a signature, the form may be considered incomplete, resulting in delays or rejections. Take the extra moment to review the form and ensure that it is properly signed and dated.

It's also common for filers to underestimate the importance of including accurate payroll totals. When entering the total gross Maryland payroll for the year, any inaccuracies can significantly affect tax calculations. Make sure to review payroll records carefully to provide the correct figures, as this will help avoid discrepancies once your form is reviewed.

Lastly, many individuals neglect to account for the additional documentation that must accompany the form. Specific supporting documents, such as copies of W-2s and 1099s, should be included with the submission. Failure to provide these documents can lead to penalties and complications with your filing. Always attach all necessary paperwork to the MW508 before sending it to the Comptroller of Maryland.

Addressing these mistakes before submitting the MW508 can save time, prevent penalties, and ensure a smoother tax filing experience. Employers should approach this process with diligence, double-checking all entries and ensuring they meet the requirements set forth by the state.

Documents used along the form

The MW508 form is essential for employers in Maryland to reconcile and report their withholding tax for the year. However, several other documents may also be necessary when submitting this form. Below is a brief list of additional forms and documents commonly used alongside the MW508.

- W-2 Forms: These forms report the annual wages paid to employees and the taxes withheld from their paychecks. Employers must submit a copy for each employee alongside the MW508.

- 1099 Forms: Similar to W-2s, 1099 forms report income paid to independent contractors or other non-employees. They must also be submitted when applicable.

- MW506 Forms: This form summarizes withholding tax reported throughout the year. Employers will include totals from this form on the MW508.

- MW508CR Form: Used to claim a business tax credit, this form is necessary if the employer is a tax-exempt organization and wishes to receive credits against the withholding tax.

- Maryland Employer Reporting of W-2s Instructions: This document provides guidelines on how to correctly file W-2 forms electronically, including format specifications.

- Maryland Reporting of 1099s Instructions: Similar to the W-2 instructions, this guide outlines the requirements for proper electronic submission of 1099 forms.

- Contact Information Sheet: A document that includes the employer's FEIN, NAICS Code, and a contact phone number. This helps ensure proper credit and prevents posting errors.

Employers should gather all necessary forms and documents to ensure a smooth filing process. Timely and accurate submission can help avoid penalties and maintain compliance with Maryland tax regulations.

Similar forms

- Form 941: This form is used for reporting quarterly federal payroll taxes. Similar to MW508, it requires employers to report the total amount of wages paid and the withholding taxes collected. Both forms ensure compliance with tax regulations and provide a summary of withholdings for a specific period.

- Form W-3: This is the transmittal form that accompanies Form W-2 when submitted to the Social Security Administration. Like the MW508, it summarizes total wages and taxes withheld from all employees for the year, making it crucial for accurate reporting to authorities.

- Form 1096: This form serves as a summary of various 1099 forms submitted to the IRS. Similar to the MW508, it consolidates information on payments made to non-employees and allows for tracking of tax liabilities associated with those payments.

- Form MW506: This is the Maryland Employer Withholding Tax Return form, filed on a more frequent basis (quarterly). The MW508 builds on the data reported in MW506, compiling the annual totals of withheld taxes, thus reflecting the same underlying information on a different scale.

- Form 940: This form is used to report annual Federal Unemployment Tax Act (FUTA) taxes. Similar to the MW508, it helps employers track and report their employment tax liabilities over a specific period of time, thereby ensuring compliance with federal regulations.

Dos and Don'ts

When filling out the MW508 form, adherence to specific guidelines can help ensure a smooth submission process. Here are six things to remember:

- Do ensure accuracy: Double-check all numbers and information before submission. Errors can lead to penalties or miscommunication with the tax authority.

- Don’t forget required attachments: Attach the STATE copies of W-2s and/or 1099s for each employee or independent contractor. Missing documents can delay processing.

- Do file electronically if applicable: If you have 25 or more W-2 or 1099 forms, you must file electronically. This is essential for compliance.

- Don’t overlook deadlines: Late filings can result in penalties. Ensure your submission is postmarked by January 31 each year.

- Do keep copies: Retain a copy of the MW508 form and all related documents for your records. This can be crucial for reference in case of future inquiries.

- Don’t ignore communication: If you have any questions or uncertainties while filling out the form, reach out to Taxpayer Services. They can provide guidance and clarity.

Misconceptions

The MW508 form is an important document for employers in Maryland, but several misconceptions often arise regarding its purpose and requirements. Here are five common misconceptions, clarified for better understanding:

- Misconception 1: The MW508 form must be filed even if there are no employees.

- Misconception 2: The MW508 form can only be filed on paper.

- Misconception 3: The MW508 reconciliation covers only state withholding taxes.

- Misconception 4: Overpayments reported on the MW508 automatically result in refunds.

- Misconception 5: Filing the MW508 is optional for small businesses.

Employers who do not have any employees for the reporting year are not required to submit the MW508. However, if there were any withholdings or payments made during the year, filing is necessary.

While employers have the option to file the MW508 on paper, those submitting 25 or more W-2 or 1099 forms are required to file electronically. This streamlines the process and can help avoid penalties for improper filings.

The MW508 form reconciles both state and local withholding taxes. Employers need to report all relevant tax information found on W-2 and 1099 forms to ensure compliance with state regulations.

While overpayments can be indicated on the MW508, employers must explicitly state the amount they wish to have refunded or applied as a credit. This does not happen automatically and requires clear communication on the form.

All employers who have withheld taxes from employees or made payments that require reporting must file the MW508, regardless of the size of the business. Even small employers have reporting obligations that must be met to avoid fines.

Key takeaways

1. Timely Submission: The MW508 form is due on January 31 every year. Ensure your submission is on time to avoid penalties.

2. Filing Methods: If you submit 25 or more W-2 or 1099 forms, you must file electronically. Different methods are available, including using the free bFile Bulk Upload Application or submitting a text file on a CD.

3. Required Attachments: When filing the MW508, attach the STATE copies of all W-2s and 1099s. Confirm that your name, FEIN, and NAICS Code are present on all documents.

4. Understand Overpayments and Amount Due: Calculate the amount due or overpayment carefully. Follow the steps provided to ensure accuracy, and remember that electronic filers do not need to submit a paper MW508 to avoid duplicate filings.

Browse Other Templates

Can You Work If You Are Totally and Permanently Disabled - VA benefits may include comprehensive medical and dental care as part of the rehabilitation process.

Irs Form 8949 Instructions - The amounts calculated will help determine your adjusted taxable income related to qualified dividends.