Fill Out Your Nc 4 Form

The NC-4 form is a vital document for North Carolina employees, serving as the Employee’s Withholding Allowance Certificate. Its primary purpose is to help employers calculate the correct amount of state income tax to withhold from employee paychecks. This ensures that withholding aligns with the employee’s financial situation. To fill out the NC-4 accurately, employees must determine their rightful number of allowances using the NC-4 Allowance Worksheet, which considers factors like federal and state adjustments to gross income, itemized deductions, and tax credits. There are specific versions of the form for different circumstances, such as the NC-4 EZ for those who plan to claim standard deductions only, and the NC-4 NRA for nonresident aliens. Additionally, it is crucial for individuals with multiple jobs or significant nonwage income to follow specific instructions to optimize their withholding. Employees must also update their NC-4 whenever their circumstances change, especially if their number of allowances decreases. Overall, the NC-4 form plays a significant role in ensuring proper tax withholding and compliance with state regulations.

Nc 4 Example

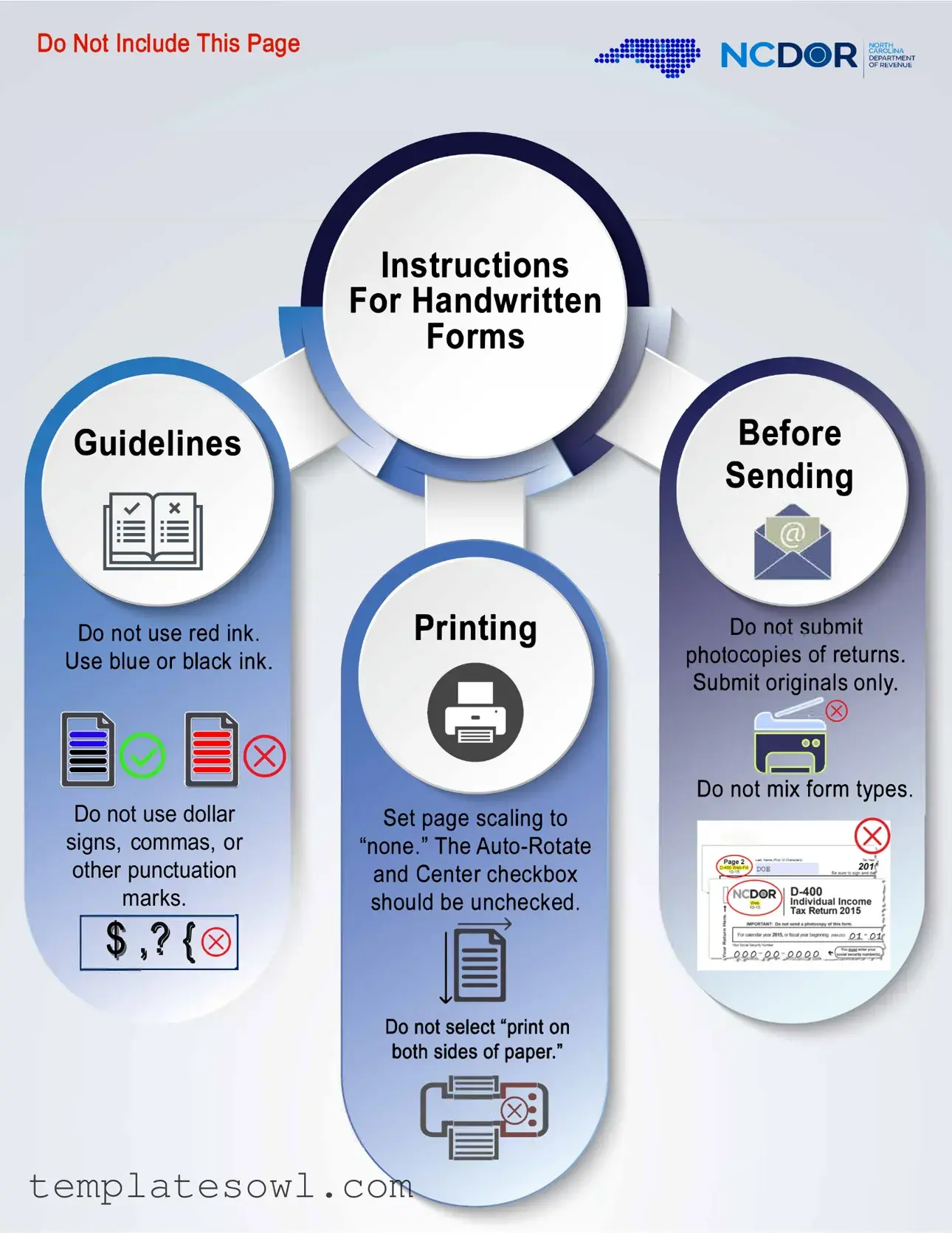

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

Web

Employee’s Withholding Allowance Certificate

PURPOSE - Complete Form

FORM

FORM

FORM

including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than

you are entitled to if you wish to increase the tax withheld during the tax year. If your withholding allowances decrease, you must file a new

When an individual ceases to be “Head of Household” after maintaining the household for the major portion of the year, a new

TWO OR MORE JOBS - If you have more than one job, determine the total number of allowances you are entitled to claim on all jobs using one Form

“Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form

NONWAGE INCOME - If you have a large amount of nonwage income, such as interest or dividends, you should consider making estimated tax

payments using Form

ncdor.gov.

HEAD OF HOUSEHOLD - Generally you may claim “Head of Household” filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your dependent(s)

or other qualifying individuals.

SURVIVING SPOUSE - You may claim “Surviving Spouse” filing status only if your spouse died in either of the two preceding tax years and you meet the following requirements:

1.Your home is maintained as the main household of a child or stepchild for whom you can claim a federal exemption; and

2.You were entitled to file a joint return with your spouse in the year of your spouse’s death.

MARRIED TAXPAYERS - For married taxpayers, both spouses must agree as to whether they will complete the

the filing status, “Married Filing Jointly” or “Married Filing Separately.”

•Married taxpayers who complete the worksheet based on the filing status, “Married Filing Jointly” should consider the sum of both spouses’ income, federal and State adjustments to income, and State tax credits to determine the number of allowances.

•Married taxpayers who complete the worksheet based on the filing status, “Married Filing Separately” should consider only his or her portion of income, federal and State adjustments to income, and State tax credits to determine the number of allowances.

All

CAUTION: If you furnish an employer with an Employee’s Withholding Allowance Certificate that contains information which has no reasonable basis and results in a lesser amount of tax being withheld than would have been withheld had you furnished reasonable information, you are subject to a penalty of 50% of the amount not properly withheld.

Cut here and give this certificate to your employer. Keep the top portion for your records.

Cut here and give this certificate to your employer. Keep the top portion for your records.

WebEmployee’s Withholding Allowance Certificate

1.Total number of allowances you are claiming

(Enter zero (0), or the number of allowances from Page 2, Line 17 of the

2. Additional amount, if any, withheld from each pay period (Enter whole dollars)

,.00

Social Security Number

Filing Status |

|

|

Single or Married Filing Separately |

Head of Household |

Married Filing Jointly or Surviving Spouse |

First Name (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS) |

M.I. |

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County (Enter first five letters) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

Zip Code (5 Digit) |

|

|

Country (If not U.S.) |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s Signature |

Date |

I certify, under penalties provided by law, that I am entitled to the number of withholding allowances claimed on Line 1 above.

|

|

|

|

|

PART I |

||

|

Answer all of the following questions for your filing status. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single - |

|

|

|

|

|

|

|

1. |

Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $13,249? |

Yes |

o |

No |

o |

|

|

2. |

Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? |

Yes |

o |

No |

o |

|

|

3. |

Will you have federal adjustments or State deductions from income? |

Yes |

o |

No |

o |

|

|

4. |

Will you be able to claim any N.C. tax credits or tax credit carryovers? |

Yes |

o |

No |

o |

|

|

If you answered “No” to all of the above, STOP HERE and enter ZERO (0) as total allowances on Form |

|

|||||

|

If you answered “Yes” to any of the above, you may choose to go to Page 2, Part II to determine if you qualify for |

|

|||||

|

additional allowances. Otherwise, enter ZERO (0) on Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Married Filing Jointly - |

|

|

|

|

|

|

|

1. |

Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $23,999? |

Yes |

o |

No |

o |

|

|

2. |

Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? |

Yes |

o |

No |

o |

|

|

3. |

Will you have federal adjustments or State deductions from income? |

Yes |

o |

No |

o |

|

|

4. |

Will you be able to claim any N.C. tax credits or tax credit carryovers? |

Yes |

o |

No |

o |

|

|

5. |

Will your spouse receive combined wages and taxable retirement benefits of |

|

|

|

|

|

|

|

less than $8,250 or only retirement benefits not subject to N.C. income tax? |

Yes |

o |

No |

o |

|

|

If you answered “No” to all of the above, STOP HERE and enter ZERO (0) as total allowances on Form |

|

|||||

|

If you answered “Yes” to any of the above, you may choose to go to Page 2, Part II to determine if you qualify for |

|

|||||

|

additional allowances. Otherwise, enter ZERO (0) on Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Married Filing Separately - |

|

|

|

|

|

|

|

1. |

Will your portion of N.C. itemized deductions from Page 3, Schedule 1 exceed $13,249? |

Yes |

o |

No |

o |

|

|

2. |

Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? |

Yes |

o |

No |

o |

|

|

3. |

Will you have federal adjustments or State deductions from income? |

Yes |

o |

No |

o |

|

|

4. |

Will you be able to claim any N.C. tax credits or tax credit carryovers? |

Yes |

o |

No |

o |

|

|

If you answered “No” to all of the above, STOP HERE and enter ZERO (0) as total allowances on Form |

|

|||||

|

If you answered “Yes” to any of the above, you may choose to go to Page 2, Part II to determine if you qualify for |

|

|||||

|

additional allowances. Otherwise, enter ZERO (0) on Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Head of Household- |

|

|

|

|

|

|

|

1. |

Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $18,624? |

Yes |

o |

No |

o |

|

|

2. |

Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? |

Yes |

o |

No |

o |

|

|

3. |

Will you have federal adjustments or State deductions from income? |

Yes |

o |

No |

o |

|

|

4. |

Will you be able to claim any N.C. tax credits or tax credit carryovers? |

Yes |

o |

No |

o |

|

|

If you answered “No” to all of the above, STOP HERE and enter ZERO (0) as total allowances on Form |

|

|||||

|

If you answered “Yes” to any of the above, you may choose to go to Page 2, Part II to determine if you qualify for |

|

|||||

|

additional allowances. Otherwise, enter ZERO (0) on Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1

Surviving Spouse - |

|

|

|

|

|

1. |

Will your N.C. itemized deductions from Page 3, Schedule 1 exceed 23,999? |

Yes |

o |

No |

o |

2. |

Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? |

Yes |

o |

No |

o |

3. |

Will you have federal adjustments or State deductions from income? |

Yes |

o |

No |

o |

4. |

Will you be able to claim any N.C. tax credits or tax credit carryovers? |

Yes |

o |

No |

o |

If you answered “No” to all of the above, STOP HERE and enter FOUR (4) as total allowances on Form |

|||||

If you answered “Yes” to any of the above, you may choose to go to Part II to determine if you qualify for additional |

|||||

allowances. Otherwise, enter FOUR (4) on Form |

|

|

|

|

|

1. |

Enter your total estimated N.C. itemized deductions from Page 3, Schedule 1 |

..................................................... |

1. |

_______________________$ |

. |

|||

|

|

|

||||||

2. |

Enter the applicable |

{ |

$10,750 if Single |

|

|

|

|

|

|

N.C. standard deduction |

$21,500 if Married Filing Jointly or Surviving Spouse |

|

|

|

|||

|

based on your filing status. |

$10,750 if Married Filing Separately |

|

|

|

_______________________$ |

. |

|

|

|

$16,125 if Head of Household |

|

2. |

||||

3. |

Subtract Line 2 from Line 1. If Line 1 is less than Line 2, enter ZERO (0) |

|

3. |

_______________________$ |

. |

|||

|

|

|||||||

4. |

Enter an estimate of your total N.C. Child Deduction Amount from Page 3, Schedule 2 |

4. |

_______________________$ |

. |

||||

|

||||||||

5. |

Enter an estimate of your total federal adjustments to income and State deductions from |

|

_______________________$ |

. |

||||

|

federal adjusted gross income |

................................................................................................................................ |

|

|

5. |

|||

|

|

|

|

|

|

|||

6. |

Add Lines 3, 4, and 5 |

|

|

|

6. |

_______________________$ |

. |

|

|

|

|

|

|||||

7. |

Enter an estimate of your nonwage income (such as dividends or interest) |

7. |

$_____________________ |

. |

|

|

||

|

|

|

||||||

8.Enter an estimate of your State additions to federal adjusted gross

|

income |

8. |

$ |

. |

|

|

|

|

|

|

|||

9. |

Add Lines 7 and 8 |

|

9. |

$ |

. |

|

|

|

|||||

10. |

Subtract Line 9 from Line 6 (Do not enter less than zero) |

|

10. |

$ |

. |

|

|

|

|||||

11. |

Divide the amount on Line 10 by $2,500 . Round down to whole number |

|

11. |

_______________________ |

||

|

Ex. $3,900 ÷ $2,500 = 1.56 rounds down to 1 |

|

|

|

|

|

12. |

Enter the amount of your estimated N.C. tax credits |

12. |

$ |

. |

|

|

|

|

|

||||

13. |

Divide the amount on Line 12 by $134. Round down to whole number |

|

13. |

_______________________ |

||

|

Ex. $200 ÷ $134 = 1.49 rounds down to 1 |

|

|

|

|

|

14. If filing as Single, Head of Household, or Married Filing Separately, enter zero (0) on this line. If filing as Surviving Spouse, enter 4.

If filing as Married Filing Jointly, enter the appropriate number from either (a), (b), (c), (d), or (e) below.

(a)Your spouse expects to have combined wages and taxable retirement benefits of $0 for N.C. purposes, enter 4. (Taxable retirement benefits do not include: Bailey, Social Security, and Railroad retirement)

(b)Your spouse expects to have combined wages and taxable retirement benefits of more than $0 but less than or equal to $3,250, enter 3.

(c)Your spouse expects to have combined wages and taxable retirement benefits of more than $3,250 but less than or equal to $5,750, enter 2.

(d)Your spouse expects to have combined wages and taxable retirement benefits of more than $5,750 but less than or equal to $8,250, enter 1.

(e)Your spouse expects to have combined wages and taxable retirement benefits of more than

$8,250, enter 0 |

14. |

_______________________ |

|

|

15. Add Lines 11, 13, and 14, and enter the total here |

15. |

_______________________ |

|

|

16. If you completed this worksheet on the basis of Married Filing Jointly, the total number of allowances determined |

|

|

|

|

on Line 15 may be split between you and your spouse, however, you choose. Enter the number of allowances |

|

|

|

|

from Line 15 that your spouse plans to claim |

16. |

_______________________ |

|

|

17. Subtract Line 16 from Line 15 and enter the total number of allowances here and on Line 1 of your |

|

|

|

|

Form |

17. |

_______________________ |

|

|

|

|

|

|

|

|

|

Page |

|

2 |

|

|

|

|

|

Important: If you cannot reasonably estimate the amount to enter in the schedules below, you should enter ZERO (0) on Line 1,

Schedule 1 |

Estimated N.C. Itemized Deductions |

|

|

|

Qualifying mortgage interest |

$ |

. |

|

|

Real estate property taxes |

$ |

. |

|

. |

Total qualifying mortgage interest and real estate property taxes* |

$ |

|||

Charitable Contributions (Same as allowed for federal purposes) |

$ |

. |

||

Medical and Dental Expenses (Same as allowed for federal purposes) |

$ |

. |

||

Total estimated N.C. itemized deductions. Enter on Page 2, Part II, Line 1 |

|

$ |

. |

|

*The sum of your qualified mortgage interest and real estate property taxes may not exceed $20,000. For married taxpayers, the $20,000 limitation applies to the combined total of qualified mortgage interest and real estate property

taxes claimed by both spouses, rather than to each spouse separately.

Schedule 2 |

Estimated N.C. Child Deduction Amount |

A taxpayer who is allowed a federal child tax credit under section 24 of the Internal Revenue Code is allowed a deduction for each dependent child unless adjusted gross income exceeds the threshold amount shown below.

The N.C. Child Deduction Amount can be claimed only for a child who is under 17 years of age on the last day of the year.

|

|

|

Deduction |

|

|

|

No. of |

Amount per |

Estimated |

Filing Status |

Adjusted Gross Income |

Children |

Qualifying Child |

Deduction |

Single |

Up to |

$ |

20,000 |

|

Over |

$ |

20,000 |

|

Over |

$ |

30,000 |

|

Over |

$ |

40,000 |

|

Over |

$ |

50,000 |

|

Over |

$ |

60,000 |

MFJ or SS |

Up to |

$ |

40,000 |

|

Over |

$ |

40,000 |

|

Over |

$ |

60,000 |

|

Over |

$ |

80,000 |

|

Over |

$ |

100,000 |

|

Over |

$ |

120,000 |

HOH |

Up to |

$ |

30,000 |

|

Over |

$ |

30,000 |

|

Over |

$ |

45,000 |

|

Over |

$ |

60,000 |

|

Over |

$ |

75,000 |

|

Over |

$ |

90,000 |

MFS |

Up to |

$ |

20,000 |

|

Over |

$ |

20,000 |

|

Over |

$ |

30,000 |

|

Over |

$ |

40,000 |

|

Over |

$ |

50,000 |

|

Over |

$ |

60,000 |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

30,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

40,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

50,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

80,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

100,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

120,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

45,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

75,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

90,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

|

|

|

_____________ |

$ |

2,500 |

______________ |

Up to |

$ |

30,000 |

_____________ |

$ |

2,000 |

______________ |

Up to |

$ |

40,000 |

_____________ |

$ |

1,500 |

______________ |

Up to |

$ |

50,000 |

_____________ |

$ |

1,000 |

______________ |

Up to |

$ |

60,000 |

_____________ |

$ |

500 |

______________ |

|

|

|

_____________ |

$ |

- |

______________ |

Page 3

Multiple Jobs Table

Find the amount of your estimated annual wages from your lowest paying job(s) in the left hand column. Follow across to find the amount of additional tax to be withheld for each pay period. Enter the additional amount to be withheld on Line 2 of your Form

Additional Withholding for Single, Married, or Surviving Spouse with Multiple Jobs

Estimated Annual Wages |

|

Payroll Period |

|

||

At Least |

But Less Than |

Monthly |

Semimonthly |

Biweekly |

Weekly |

|

|

|

|

|

|

0 |

1000 |

2 |

1 |

1 |

1 |

1000 |

2000 |

7 |

3 |

3 |

2 |

|

|

|

|

|

|

2000 |

3000 |

11 |

6 |

5 |

3 |

|

|

|

|

|

|

3000 |

4000 |

16 |

8 |

7 |

4 |

|

|

|

|

|

|

4000 |

5000 |

20 |

10 |

9 |

5 |

|

|

|

|

|

|

5000 |

6000 |

25 |

12 |

11 |

6 |

|

|

|

|

|

|

6000 |

7000 |

29 |

14 |

13 |

7 |

7000 |

8000 |

33 |

17 |

15 |

8 |

|

|

|

|

|

|

8000 |

9000 |

38 |

19 |

17 |

9 |

9000 |

10000 |

42 |

21 |

20 |

10 |

10000 |

10750 |

46 |

23 |

21 |

11 |

|

|

|

|

|

|

10750 |

Unlimited |

48 |

24 |

22 |

11 |

Additional Withholding for Head of Household Filers with Multiple Jobs

Estimated Annual Wages |

|

Payroll Period |

|

||

At Least |

But Less Than |

Monthly |

Semimonthly |

Biweekly |

Weekly |

|

|

|

|

|

|

0 |

1000 |

2 |

1 |

1 |

1 |

|

|

|

|

|

|

1000 |

2000 |

7 |

3 |

3 |

2 |

2000 |

3000 |

11 |

6 |

5 |

3 |

|

|

|

|

|

|

3000 |

4000 |

16 |

8 |

7 |

4 |

4000 |

5000 |

20 |

10 |

9 |

5 |

5000 |

6000 |

25 |

12 |

11 |

6 |

6000 |

7000 |

29 |

14 |

13 |

7 |

7000 |

8000 |

33 |

17 |

15 |

8 |

8000 |

9000 |

38 |

19 |

17 |

9 |

9000 |

10000 |

42 |

21 |

20 |

10 |

10000 |

11000 |

47 |

23 |

22 |

11 |

11000 |

12000 |

51 |

26 |

24 |

12 |

12000 |

13000 |

56 |

28 |

26 |

13 |

13000 |

14000 |

60 |

30 |

28 |

14 |

14000 |

15000 |

65 |

32 |

30 |

15 |

15000 |

16000 |

69 |

35 |

32 |

16 |

16000 |

Unlimited |

71 |

36 |

33 |

16 |

Page 4

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The NC-4 form helps employers withhold the correct amount of North Carolina state income tax from employee paychecks. |

| Filing Requirement | If an employee does not submit an NC-4, the employer must withhold based on “Single” status with zero allowances. |

| Form Variants | There are different versions of the NC-4: NC-4 EZ for specific circumstances, and NC-4 NRA for nonresident aliens. |

| Withholding Allowance Worksheet | The NC-4 Allowance Worksheet assists in determining the number of allowances based on various deductions and credits. |

| Changes in Circumstances | Employees must submit a new NC-4 within 10 days of decreasing their withholding allowances, except for certain circumstances. |

| Governing Laws | The NC-4 form is governed by the North Carolina General Statutes related to the state income tax, particularly Chapter 105, Article 4. |

Guidelines on Utilizing Nc 4

Completing the NC-4 form is an important step in ensuring that your employer withholds the correct amount of North Carolina state income tax from your paycheck. Once you fill out the form, provide it to your employer so they can process it along with your payroll information.

- Gather Necessary Information: Collect your personal details including your name, address, and Social Security number.

- Choose Your Filing Status: Indicate whether your filing status is Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Surviving Spouse.

- Determine Your Allowances: Use the NC-4 Allowance Worksheet to help you calculate the total number of allowances you can claim. Refer to each section based on your filing status.

- Complete the Worksheet: Answer all questions on the worksheet honestly to ensure accurate withholding. Follow instructions to determine if you qualify for additional allowances.

- Transfer Allowances to Form NC-4: Write the total number of allowances on Line 1 of the NC-4 and enter any additional amount you wish to have withheld on Line 2.

- Sign and Date the Form: At the bottom of the NC-4, sign your name and include the date to certify that the information is accurate.

- Submit the Form: Provide the completed form to your employer. Keep a copy for your records.

What You Should Know About This Form

What is the purpose of the NC-4 form?

The NC-4 form is a crucial document that allows employees to communicate their withholding allowances to their employers. By filling out this form, employees enable their employers to calculate the appropriate amount of North Carolina state income tax to withhold from their paychecks. If an employee fails to submit an NC-4, the employer is compelled to withhold taxes at the highest rate, treating the employee as Single with zero allowances. This can lead to an over-withholding of taxes throughout the year, which may result in a larger than necessary refund or a tax bill at the end of the tax year.

Who should use the NC-4 EZ form?

The NC-4 EZ form is a simplified version of the standard NC-4, designed specifically for individuals who wish to claim the N.C. Standard Deduction or the N.C. Child Deduction Amount, among others. To qualify for this form, one should not plan to claim any additional N.C. deductions or tax credits. This makes it an ideal option for employees with straightforward tax situations, allowing for a simpler process in determining withholding allowances without getting into complex calculations.

What should I do if my withholding allowances change?

If there is a change in your financial situation that affects your withholding allowances, such as a change in employment or a change in filing status, you must submit a new NC-4 form to your employer within 10 days of the change. This is vital as it ensures that the correct amount of state tax is withheld from your pay. Notably, there's an exception for individuals who cease to be "Head of Household." In such cases, a new NC-4 is not required until the next tax year, which can alleviate some administrative burdens.

How should I handle non-wage income when filling out the NC-4 form?

Employees with substantial non-wage income, such as investment earnings like dividends or interest, should consider this income when determining their overall tax situation. To avoid underpayment and potential penalties, these individuals might want to make estimated tax payments utilizing Form NC-40. It’s wise to consult this option to ensure that sufficient tax is paid throughout the year, especially if non-wage income contributes significantly to one’s overall earnings.

Common mistakes

When filling out the NC-4 form, many individuals tend to overlook critical details, leading to common mistakes that can affect their tax withholding. One prominent error is using the wrong ink color. It's crucial to use either blue or black ink, as red ink can cause issues with readability and may even lead to processing delays. Ensuring that the form is clear and legible is essential for accurate processing.

Another frequent mistake involves entering information with punctuation marks. People often forget to omit dollar signs, commas, or even periods when listing figures on the form. This seems minor, yet it can lead to confusion during data entry, which may result in incorrect withholding amounts from your paycheck. Adhering to these specific formatting guidelines is vital.

Many individuals fail to properly assess their withholding allowances, especially those with multiple jobs. The NC-4 guidelines suggest that you determine the total number of allowances across all jobs rather than filling out separate forms for each position. By neglecting this advice, individuals may end up over-claiming allowances on one job and under-claiming on another, resulting in either too much or too little tax withheld throughout the year.

Lastly, a major mistake occurs when individuals do not update their NC-4 form promptly after a change in their circumstances, such as a decrease in allowances or a change in filing status. If your status changes, you must file a new NC-4 with your employer within ten days to ensure the correct amount of tax is withheld. Failing to do so could mean unauthorized amounts being deducted from your pay, leading to potential tax complications down the line.

Documents used along the form

In conjunction with the NC-4 form, several other forms and documents may be required for accurate payroll and tax withholding processes. Each serves a specific purpose related to ensuring that taxes are withheld correctly based on personal financial circumstances. Below is a brief description of these forms to assist you in understanding their use.

- Form NC-4 EZ: This simplified version of the NC-4 form is available for individuals who plan to claim only the N.C. Standard Deduction or the N.C. Child Deduction Amount, without any additional deductions or tax credits.

- Form NC-4 NRA: Designed specifically for nonresident aliens, this form adjusts the withholding requirements in accordance with their specific tax obligations, ensuring compliance with federal and state regulations.

- Form NC-40: This form is used to make estimated tax payments. It is particularly relevant for individuals with substantial nonwage income, helping to prevent underpayment penalties throughout the tax year.

- Form W-4: A federal form used by employees to indicate their tax situation to their employer, which in turn helps determine the appropriate amount of federal income tax to withhold from each paycheck.

- Form NC-3: The annual reconciliation form submitted by employers to the North Carolina Department of Revenue. It summarizes the amount of state income tax withheld from employee wages over the year.

- Form 1040: This is a federal income tax return form. It is filed annually by individuals to report their income and calculate their tax obligations, which may influence their withholding allowances on the NC-4 form.

- Form C-255: Also known as the Quarterly Tax Return form, this is used by businesses to report and pay state taxes on a quarterly basis. It is crucial for corporate employees to be aware of this if they are employees of a business.

Each of these forms is crucial in managing tax responsibilities accurately and responsibly. If there are any questions or concerns about completing these documents, seeking guidance can ensure that all obligations are met without undue stress. Understanding these forms can empower individuals to take charge of their financial well-being during the tax process.

Similar forms

-

Form NC-4 EZ: This document is designed for individuals who only plan to claim the N.C. Standard Deduction or the N.C. Child Deduction Amount without additional deductions. Like the NC-4, it assists employees in determining how much state income tax to withhold from their wages but simplifies the process for straightforward tax situations.

-

Form NC-4 NRA: Nonresident aliens must use this form to report their state tax withholding. Similar to the NC-4, it assists in calculating the appropriate withholding amount, but it caters specifically to the unique tax regulations affecting nonresident aliens.

-

Form NC-40: This form is used for making estimated tax payments. While the NC-4 form determines withholding amounts from each paycheck, NC-40 is for individuals who anticipate additional nonwage income and want to avoid penalties for underpayment throughout the tax year.

-

IRS Form W-4: Employees use this federal form to indicate their tax situation to their employer for federal income tax withholding. Like the NC-4, it facilitates the accurate withholding of taxes based on allowances, yet it is meant for federal taxes rather than state income taxes.

Dos and Don'ts

When filling out the NC-4 form, it is crucial to follow certain guidelines to ensure accuracy and compliance with state regulations. Below are eight important do's and don'ts.

- Do use blue or black ink when completing the form.

- Do ensure that you submit the original form only; copies are not accepted.

- Do complete the NC-4 Allowance Worksheet to accurately calculate your withholding allowances.

- Do indicate your total number of allowances on Line 1 of the NC-4.

- Don't use red ink or any other colors that may not be recognized.

- Don't mix different types of forms in your submission.

- Don't include punctuation marks, such as dollar signs or commas, in your figures.

- Don't forget to file a new NC-4 if your withholding allowances decrease within 10 days.

Misconceptions

Understanding the NC-4 form can help clarify its purpose and usage. There are several common misconceptions associated with it. Below is a list that outlines these misconceptions:

- Misconception 1: The NC-4 form is optional for all employees.

- Misconception 2: Nonresident aliens can use the standard NC-4 form.

- Misconception 3: All deductions and credits can be claimed on the NC-4 form.

- Misconception 4: There are no consequences for providing incorrect information on the NC-4.

- Misconception 5: If I have multiple jobs, I must fill out separate NC-4 forms for each job.

- Misconception 6: Once filed, the NC-4 form does not need updating.

This is inaccurate. Employees must complete the NC-4 so that employers can withhold the correct amount of state income tax from their paychecks. If an employee does not provide this form, the employer is required to withhold based on a default status of “Single” with zero allowances.

Nonresident aliens must use the NC-4 NRA form specifically designed for their situation. Regular NC-4 forms do not apply to individuals who are not U.S. citizens and who have not met specific residency tests.

Only certain deductions and credits can be included. The NC-4 form accommodates adjustments based on federal and state parameters but not all possible deductions or credits.

This is false. If an employee provides information that lacks a reasonable basis and results in a lower amount of tax being withheld, a penalty of 50% on the under-withheld amount may be applied.

Employees can use one NC-4 Allowance Worksheet to determine the total allowances for all jobs. However, it is recommended to claim all allowances on the form for the higher paying job to ensure accurate withholding.

This is incorrect. Changes in personal circumstances that affect withholding allowances require employees to fill out a new NC-4 within ten days of the change, ensuring that withholding is accurate for the remainder of the tax year.

Key takeaways

Filling out and using the NC-4 form correctly is essential for ensuring accurate state income tax withholding from your paycheck. Below are key takeaways to consider when completing and submitting this form.

- Purpose of the NC-4: The NC-4 form enables your employer to withhold the correct amount of state income tax from your earnings. Without it, the default withholding will be based on "Single" status with zero allowances.

- Use of Clear Ink: Always complete the NC-4 using blue or black ink. Avoid red ink, as it is not acceptable.

- Form Types: Depending on your situation, you may need to use different forms, such as NC-4-EZ for claiming basic deductions or NC-4 NRA if you are a nonresident alien.

- Allowances Calculation: Use the NC-4 Allowance Worksheet to accurately determine your withholding allowances. You can claim fewer allowances if you wish to increase your withheld tax.

- Multiple Jobs: If you have more than one job, you should generally use one NC-4 to claim all your allowances for the job with the highest pay to ensure accurate tax withholding.

- Nonwage Income: If you earn a significant amount from nonwage sources, consider making estimated tax payments using Form NC-40 to avoid underpayment penalties.

- Change in Allowances: If your circumstances change and your withholding allowances decrease, you must submit a new NC-4 form within 10 days of the change.

- Filing Status Considerations: Married couples must agree on the filing status as well as how to complete the allowances worksheet, whether jointly or separately.

- Review and Penalties: The North Carolina Department of Revenue may review all submitted NC-4 forms. Providing incorrect information could result in a penalty based on improperly withheld taxes.

Browse Other Templates

Cms 802 - It assists facilities in identifying at-risk residents promptly for timely interventions.

Difference Between Akc and Aca - This form registers a litter with the American Canine Association, ensuring your puppies receive official recognition.