Fill Out Your Nc4 Ez Form

The NC-4 EZ form serves as an essential tool for North Carolina employees to optimize their state income tax withholding. This streamlined certificate is primarily designed for individuals who plan to claim the North Carolina Standard Deduction and the N.C. Child Deduction Amount, without any other deductions or tax credits. By utilizing the NC-4 EZ, taxpayers can establish the appropriate number of allowances based on their filing status, income, and the number of children under 17. The form is straightforward, providing clear instructions that emphasize necessary details, such as the use of blue or black ink and the importance of not mixing different form types. Moreover, compliance with the guidelines helps ensure that employers withhold the correct amount of tax, mitigating the risk of penalties associated with improper claims. For those who may qualify as exempt from withholding, specific certifications are included, reflecting the requirements of both the state tax laws and federal provisions for servicemembers and their spouses. While this condensed version of the withholding certificate is advantageous for many, it’s crucial for individuals with more complex tax situations—such as those who intend to itemize deductions—to utilize the comprehensive NC-4 form instead.

Nc4 Ez Example

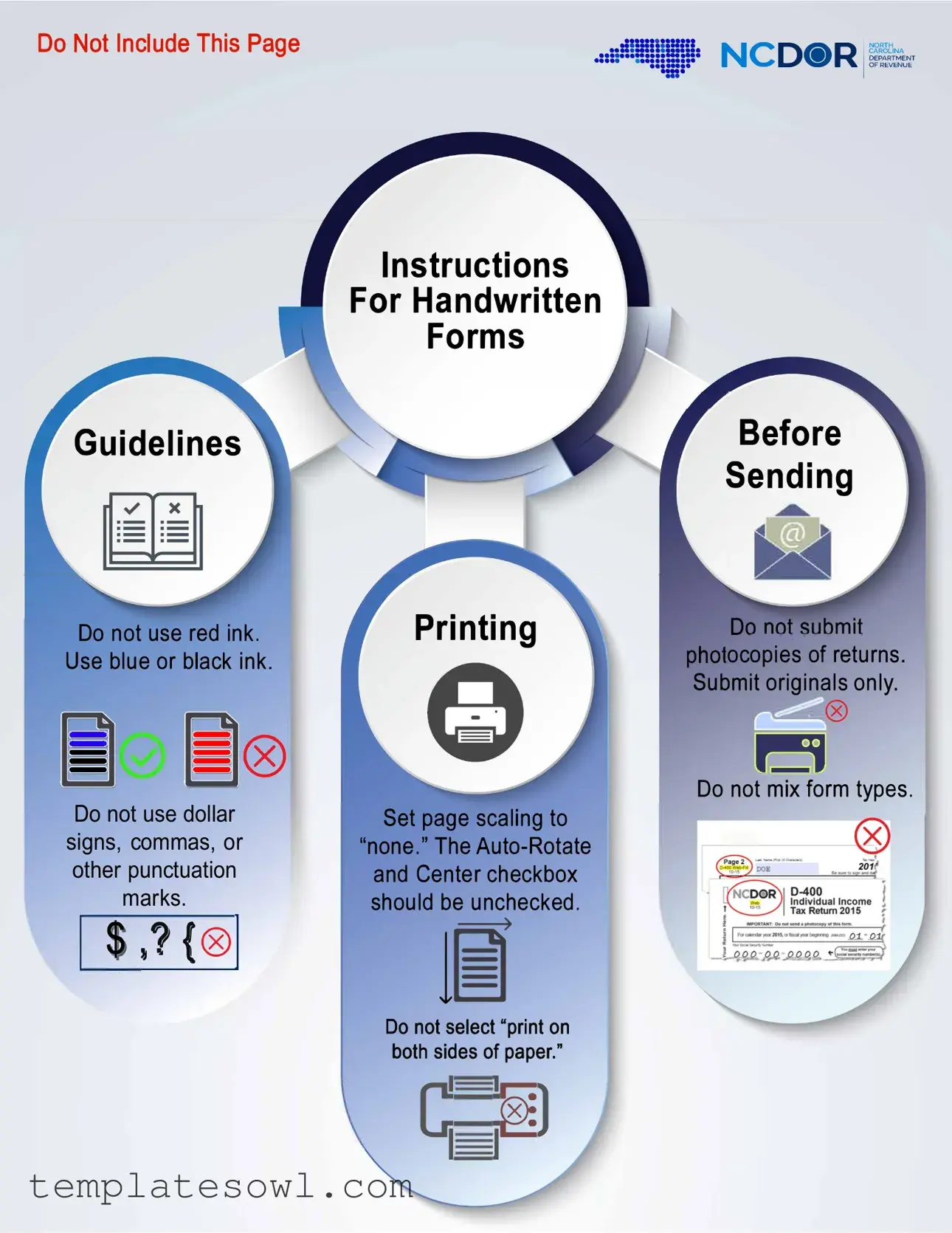

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

|

|

|||||

|

|

|||||

Web |

|

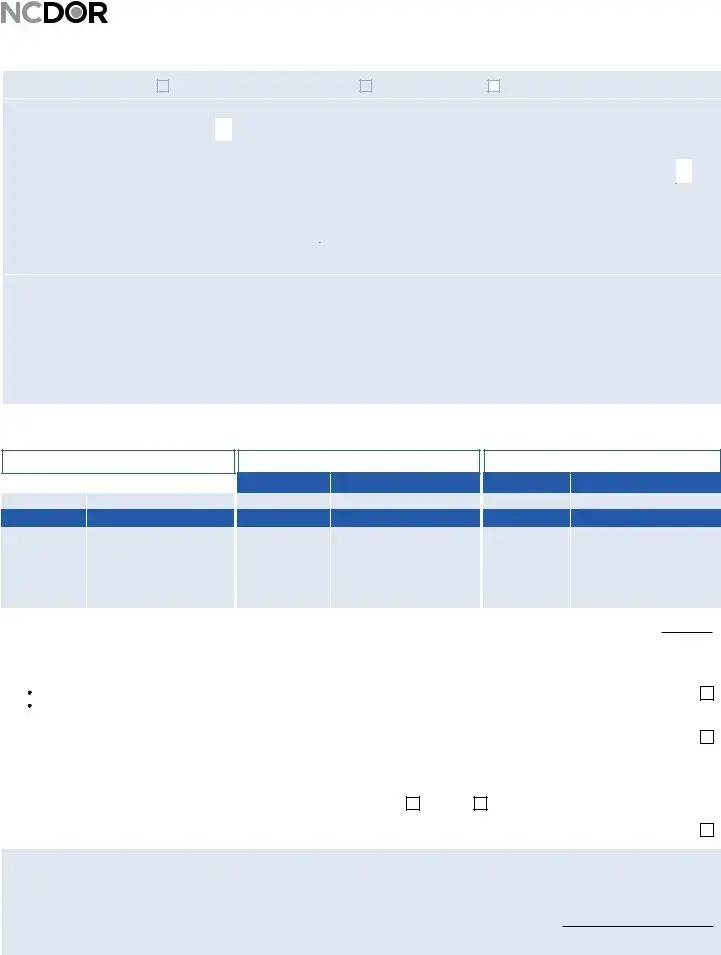

Employee’s Withholding |

||||

|

Allowance Certificate |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status (Mark one box only) |

|

|

Single or Married Filing Separately |

|

Head of Household |

|

|

|

|

||||

Married Filing Jointly or Surviving Spouse

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

M.I. |

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County (Enter first five letters) |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|

Country (If not U.S.) |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions. Use Form

•Plan to claim the N.C. Standard Deduction

•Plan to claim the N.C. Child Deduction Amount (but no other N.C. deductions)

•Do not plan to claim N.C. tax credits

•Qualify to claim exempt status (See Lines 3 or 4 below)

Important. If you plan to claim N.C. itemized deductions or plan to claim other N.C. deductions (other than the N.C. Child Deduction Amount), you must complete Form

If you plan to claim the N.C. Child Deduction Amount, use the table below for your filing status, amount of income, and number of children under age 17 to determine the number of allowances to enter on Line 1. For married taxpayers, only one spouse may claim the allowance for the N.C. Child Deduction Amount for each child.

Single & Married Filing Separately

Married Filing Jointly & Surviving Spouse

Head of Household

Income |

# of Children under age 17 |

|

|

1 2 3 4 5 6 7 8 9 10

# of Allowances

0 - 20,000 1 2 3 4 5 6 7 8 9 10 20,001 - 30,000 0 1 2 3 4 4 5 6 7 8 30,001 - 40,000 0 1 1 2 3 3 4 4 5 6 40,001 - 50,000 0 0 1 1 2 2 2 3 3 4 50,001 - 60,000 0 0 0 0 1 1 1 1 1 2 60,001 and over 0 0 0 0 0 0 0 0 0 0

Income |

# of Children under age 17 |

1 2 3 4 5 6 7 8 9 10

# of Allowances

0 - 40,000 1 2 3 4 5 6 7 8 9 10 40,001 - 60,000 0 1 2 3 4 4 5 6 7 8 60,001 - 80,000 0 1 1 2 3 3 4 4 5 6 80,001

Income

0 - 30,000

30,001 - 45,000

45,001 - 60,000

60,001 - 75,000

75,001 - 90,000

90,001 and over

# of Children under age 17

1 2 3 4 5 6 7 8 9 10

# of Allowances

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

0 |

1 |

2 |

3 |

4 |

4 |

5 |

6 |

7 |

8 |

0 |

1 |

1 |

2 |

3 |

3 |

4 |

4 |

5 |

6 |

0 |

0 |

1 |

1 |

2 |

2 |

2 |

3 |

3 |

4 |

0 |

0 |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

2 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from the table above)

2. |

Additional amount, if any, you want withheld from each pay period (Enter whole dollars) |

|

.00 |

|||

|

|

|

|

|

|

|

3. |

I certify that I am exempt from North Carolina withholding because I meet both of the following conditions: |

|

||||

|

|

|||||

|

• Last year I was entitled to a refund of all State income tax withheld because I had no tax liability; and |

Check Here |

||||

|

• This year, I expect a refund of all State income tax withheld because I expect to have no tax liability. |

|

|

|||

4. |

IcertifythatIamexemptfromNorthCarolinawithholdingbecauseImeettherequirementssetforthintheServicemembers |

Check Here |

||||

|

Civil Relief Act, as amended by the Military Spouses Residency Relief Act and Veterans Benefits and Transition Act. |

|||||

|

|

|

||||

|

(See Form |

|

|

|||

|

If an exemption on Line 3 or Line 4 applies to you, enter the year the exemption became effective |

|

|

|

|

|

|

|

YYYY |

|

|

||

5. I certify that I no longer meet the requirements for an exemption on Line 3

or Line 4

(Check applicable box)

Therefore, I revoke my exemption and request that my employer withhold North Carolina income tax based on the

number of allowances entered on Line 1 and any additional amount entered on Line 2.

Check Here

CAUTION: If you furnish an employer with an Employee’s Withholding Allowance Certificate that contains information which has no reasonable basis and results in a lesser amount of tax being withheld than would have been withheld had you furnished reasonable information, you are subject to a penalty of 50% of the amount not properly withheld.

Employee’s Signature |

Date |

|

|

|

|

I certify, under penalties provided by law, that I am entitled to the number of withholding allowances claimed on Line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on Line 3 or 4, whichever applies.

Form Characteristics

| Fact | Description |

|---|---|

| Form Title | NC-4EZ is the Employee’s Withholding Allowance Certificate used in North Carolina. |

| Eligibility | Use NC-4EZ if you plan to claim the N.C. Standard Deduction and the N.C. Child Deduction Amount only. |

| Exemption Criteria | Claim exempt status if you had no tax liability last year and expect the same this year. |

| Filing Requirement | If itemized deductions are planned, you must complete Form NC-4 instead of NC-4EZ. |

| Governing Law | North Carolina General Statutes, specifically § 105-163.1 to § 105-163.15. |

Guidelines on Utilizing Nc4 Ez

Completing the NC-4 EZ form is an essential step for individuals who need to provide information regarding their withholding allowances to their employer. Correctly filling out this form ensures that the right amount of state tax is withheld from your paychecks. Below are the straightforward steps to complete the NC-4 EZ form effectively.

- Gather your personal information, such as your Social Security Number, first name, middle initial, last name, address, county, city, state, zip code, and country (if not U.S.).

- Mark your filing status by selecting one of the designated boxes: Single or Married Filing Separately, Head of Household, or Married Filing Jointly or Surviving Spouse.

- Refer to the income and number of children table to determine the number of allowances you will claim. Record this number on Line 1.

- If you wish to have an additional amount withheld from each paycheck, specify that amount on Line 2.

- If you are claiming exempt status, ensure you check the box for Line 3 and provide the relevant confirmation. Add the year the exemption became effective on Line 4 if applicable.

- If you no longer qualify for the exemption claimed on Line 3 or 4, check the corresponding box on Line 5 to revoke your exempt status and ensure withholding based on the allowances listed on Line 1.

- Sign and date the form at the bottom. This certifies that all provided information is accurate and truthful.

After completing these steps, submit the form to your employer only. Do not send it to the North Carolina Department of Revenue unless instructed to do so. Always keep a copy of the completed NC-4 EZ form for your records.

What You Should Know About This Form

What is the NC-4 EZ form?

The NC-4 EZ form is the Employee’s Withholding Allowance Certificate for North Carolina. It's used primarily by individuals to inform their employer about the number of allowances they are claiming for tax purposes. This helps determine the amount of state income tax that should be withheld from their paychecks.

Who should use the NC-4 EZ form?

You should use the NC-4 EZ if you plan to claim the North Carolina Standard Deduction or the North Carolina Child Deduction Amount and do not intend to claim other state deductions or tax credits. It's a simplified option for those with fewer tax situations.

What if I qualify for exempt status?

If you qualify for exempt status, you can use the NC-4 EZ form and must check the relevant boxes to indicate your exemption. The conditions for exemption include having no tax liability for the previous year and expecting none for the current year.

Can I change my withholdings after submitting the NC-4 EZ?

Yes, you can change your withholdings. If you want to revoke your exemption or alter your allowances, simply submit a new NC-4 EZ form to your employer. Make sure to indicate the updated information accordingly.

Are there penalties for incorrect information on the NC-4 EZ?

Indeed, there are penalties for providing inaccurate information. If you furnish an Employee’s Withholding Allowance Certificate with unreasonable details that lead to less tax being withheld, you could face a penalty of 50% of the amount that should have been withheld.

What income levels are relevant for determining allowances on the NC-4 EZ?

The form includes specific income levels that dictate how many allowances you can claim, based on your income and number of children under age 17. Make sure to refer to the table in the form to see which allowances apply to your situation.

Do I need to submit the NC-4 EZ annually?

You do not need to submit the NC-4 EZ each year unless your situation changes. For example, if your income increases or decreases significantly, or if you need to adjust your allowances, you should submit a new form reflecting those changes.

How can I be sure I'm completing the NC-4 EZ correctly?

To ensure you complete the form correctly, carefully follow the instructions provided, make sure not to use red ink, and avoid dollar signs or commas. If you have any questions, consulting a tax professional can also provide clarity.

What happens if I don’t submit a withholding certificate?

If you do not submit any withholding certificate, your employer will typically withhold taxes at the highest rate, which may lead to larger deductions from your paycheck. It’s best to fill out the NC-4 EZ to avoid over-withholding and reduce your tax burden throughout the year.

Where can I find the NC-4 EZ form?

You can find the NC-4 EZ form on the North Carolina Department of Revenue's official website. It’s available for download and print, making it easy to fill out and submit to your employer.

Common mistakes

When completing the NC-4EZ form, individuals often make key errors that can lead to complications with their tax withholding. One common mistake is using the wrong ink. The instructions clearly state that only blue or black ink should be used. Opting for red ink, which may seem visually appealing, can render the form illegible and may result in delays or refusals in processing.

Another frequent error is mixing different form types. The NC-4EZ is intended for specific situations, and if taxpayers inadvertently combine it with other forms, their submissions may be deemed invalid. It is crucial to ensure that the form is printed in isolation and not selected to print on both sides of the paper. This could lead to confusion and complicate the review process.

Inaccurate reporting of allowances presents yet another issue. Claiming too many allowances may initially seem advantageous, but it could lead to under-withholding and unexpected tax liabilities at the end of the year. Taxpayers must carefully refer to the provided tables, considering their income and number of children, to determine the correct number of allowances to enter on Line 1.

Finally, many individuals fail to provide their social security number correctly. An incorrect or missing social security number can result in the form being rejected or delayed. It is critical for taxpayers to check their information for accuracy and confirmation before finalizing the form. A simple oversight in this area can lead to significant complications during tax season.

Documents used along the form

The NC-4 EZ form is commonly used by employees in North Carolina to determine the amount of state income tax to be withheld from their paychecks. However, there are several other forms and documents that may be used alongside this form to support tax filing, tax withholding adjustments, or to claim specific deductions or exemptions. Below is a list of these forms, along with a brief description of each.

- Form NC-4: This form is for employees who wish to claim additional allowances or deductions not covered by the NC-4 EZ. It is typically used by people who plan to claim itemized deductions or tax credits.

- Form NC-4 NRA: Nonresident aliens must complete this form if they have withholding allowances to claim. The NC-4 NRA requires specific documentation to validate tax status.

- Form D-400: This is the North Carolina Individual Income Tax Return, where taxpayers report their earnings, deductions, and determine their tax liability for the year. It's typically filed after the tax year ends.

- Form D-400TC: This form is used to claim the North Carolina Standard or Itemized Deductions. Taxpayers decide between these deductions when calculating their income tax return on Form D-400.

- Form D-410: This is the form for the North Carolina Child Deduction. Taxpayers use it to apply for additional child-related tax benefits when filing their tax returns.

- Form NC-20: This is a Certificate of Withholding, which is used to project or report any additional withholding that may be requested by the taxpayer throughout the tax year.

- W-4 Form: Although not specific to North Carolina, the IRS W-4 form is essential for employees to let their employers know how much federal tax to withhold from their paychecks. It may affect state withholding as well.

- Form NC-3: This is the annual reconciliation form that employers must file to report total wages paid and withholding for all employees in a calendar year. It ensures proper reporting to the North Carolina Department of Revenue.

Understanding these documents is crucial for accurately managing personal tax situations and ensuring compliance with state tax laws. Each form has its purpose and importance, and utilizing them correctly can help individuals optimize their tax withholding and potential refunds.

Similar forms

- Form NC-4: Like the NC-4EZ, this form is also an Employee’s Withholding Allowance Certificate. However, it is used by taxpayers claiming additional deductions beyond the basic allowances, making it more suitable for individuals with complex tax situations.

- Form NC-4 NRA: This form applies to nonresident aliens. Similar to the NC-4EZ, it allows individuals to report exemptions from North Carolina tax withholding, but it is specifically designed for nonresident aliens and includes additional stipulations relevant to them.

- W-4 Form: The federal equivalent of the NC-4EZ, the W-4 allows employees to claim allowances and indicate extra withholding. Both forms serve as guidelines for determining how much tax to withhold from paychecks, though the W-4 is for federal income tax.

- W-4P Form: Used for pension or annuity payments, this document is similar as it also determines tax withholding based on allowances. It is specific to retirement income, establishing a parallel in contexts where withholding differs.

- W-4S Form: This form allows for withholding on sick pay. Like the NC-4EZ, it simplifies reporting for specific income types. Both documents are focused on accurate withholding based on unique income situations.

- Form 1040-ES: This form allows for estimated tax payments, reminiscent of the NC-4EZ’s focus on predicting tax liabilities. While the 1040-ES is for self-employed individuals or those with non-wage income, both documents address tax obligations.

- Form D-400: This is North Carolina's Individual Income Tax Return. While the NC-4EZ functions for withholding allowances, both documents ultimately tie into reporting income and tax liability for state taxes.

Dos and Don'ts

When filling out the NC-4 EZ form, it is essential to follow certain guidelines to ensure that your submission is accurate and accepted. Below is a list of dos and don’ts to consider:

- Use blue or black ink. Avoid using red ink, as it may not be processed correctly.

- Submit only the original form. Do not send copies or duplicates of your return.

- Be cautious with allowances. Ensure that you properly calculate and enter the number of allowances based on the given tables.

- Do not use commas, dollar signs, or other punctuation marks in your entries.

- Do not select options like "print on both sides of paper," as this can create complications in processing.

- Do not mix form types. Only use the NC-4 EZ form if you meet the criteria outlined.

Following these simple yet critical guidelines will help in facilitating a smooth process when submitting your NC-4 EZ form.

Misconceptions

- Misconception 1: The NC-4EZ form is for all taxpayers.

- Misconception 2: You can use any color ink to fill out the NC-4EZ form.

- Misconception 3: You must include dollar signs and commas when reporting amounts.

- Misconception 4: The form can be printed on both sides of a page.

- Misconception 5: You can submit copies of the form instead of originals.

- Misconception 6: Anyone can claim exemptions from withholding on the NC-4EZ form.

- Misconception 7: All spouses can claim the N.C. Child Deduction Amount allowances.

- Misconception 8: The number of allowances is the same for all income levels.

- Misconception 9: You can submit the NC-4EZ without signing it.

This form is specifically for those who plan to claim the N.C. Standard Deduction, the N.C. Child Deduction Amount, or qualify for exempt status. If you intend to itemize deductions or claim other N.C. deductions, you need a different form.

Only blue or black ink is acceptable. This ensures that the form is processed correctly and efficiently.

The NC-4EZ form explicitly states that you should not include dollar signs, commas, or other punctuation marks in your entries.

The instructions clearly advise against printing on both sides. Submit the form on single-sided pages to avoid confusion during processing.

Only original forms are accepted. Ensure that you do not mix forms and send the correct version.

Exemptions are only available to individuals who meet specific criteria. Carefully review the requirements outlined in the form before claiming exempt status.

Only one spouse may claim the allowance for each child under age 17. It's essential to coordinate this with your partner to avoid errors.

The form provides a detailed table that links income levels and the number of children under 17 to the number of allowances you can claim. Ensure you reference this table accordingly.

Your signature is required to certify that the information you provided is accurate. Without a signature, the form may be considered invalid.

Key takeaways

Filling out the NC-4 EZ form is a straightforward process, but it requires attention to detail. Here are six key takeaways to keep in mind:

- Use only blue or black ink and avoid red ink when completing the form.

- You should stick to the adjustments specified; do not include dollar signs, commas, or other punctuation marks.

- Before submitting, ensure you submit original copies only and do not mix different form types.

- Select your filing status correctly, as it affects your withholding allowances significantly.

- If you plan to claim exemptions, ensure you meet the specific conditions outlined in the form.

- It is important to sign the form, certifying that the information is accurate to avoid potential penalties.

Browse Other Templates

Llc-12 Online - Contact information for the Chief Executive Officer should also be provided if applicable.

Workers Comp Idaho - Employers should keep accurate records to ease the completion of the IC 4010 form.