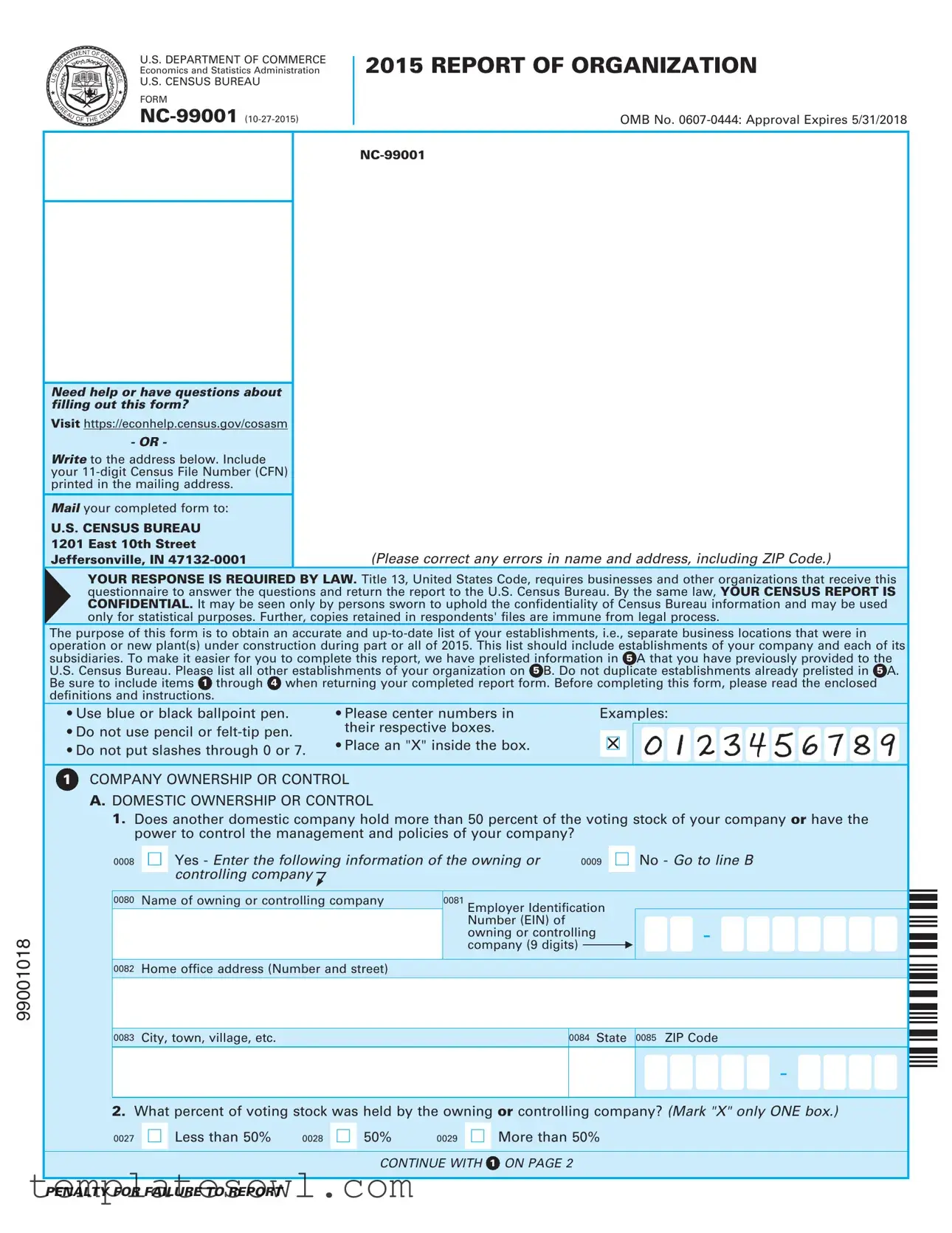

Fill Out Your Nc99001 Form

The NC99001 form is an essential document required by the U.S. Census Bureau that plays a crucial role in gathering vital statistical information about businesses operating in the United States. This form is part of the government's efforts to maintain an accurate and comprehensive list of establish-ments, including those in operation and those under construction during a specific reporting period, in this case, the year 2013. Businesses are mandated by law to fill out and return this questionnaire, as dictated by Title 13 of the United States Code. The collected data helps inform economic policy and business planning at both local and national levels. The form requests a variety of information, including details about company ownership, research and development expenditures, operating revenues, and manufacturing activities. Importantly, respondents may find prelisted information from prior submissions to facilitate completion. Compliance is not merely a bureaucratic obligation; it is a legal requirement with strict confidentiality protections in place for the data provided. Questions cover domestic and foreign ownership structures, R&D expenditures, and operational specifics, reflecting a wide array of business practices. With this information, the Census Bureau aims to foster informed economic decision-making supporting the U.S. economy's growth and development.

Nc99001 Example

Economics and Statistics Administration |

2015 REPORT OF ORGANIZATION |

U.S. DEPARTMENT OF COMMERCE |

|

U.S. CENSUS BUREAU |

|

FORM |

|

OMB No. |

Need help or have questions about filling out this form?

Visit https://econhelp.census.gov/cosasm

- OR -

Write to the address below. Include your

Mail your completed form to:

U.S. CENSUS BUREAU

1201 East 10th Street

Jeffersonville, IN

(Please correct any errors in name and address, including ZIP Code.)

99001018

YOUR RESPONSE IS REQUIRED BY LAW. Title 13, United States Code, requires businesses and other organizations that receive this questionnaire to answer the questions and return the report to the U.S. Census Bureau. By the same law, YOUR CENSUS REPORT IS CONFIDENTIAL. It may be seen only by persons sworn to uphold the confidentiality of Census Bureau information and may be used only for statistical purposes. Further, copies retained in respondents' files are immune from legal process.

The purpose of this form is to obtain an accurate and

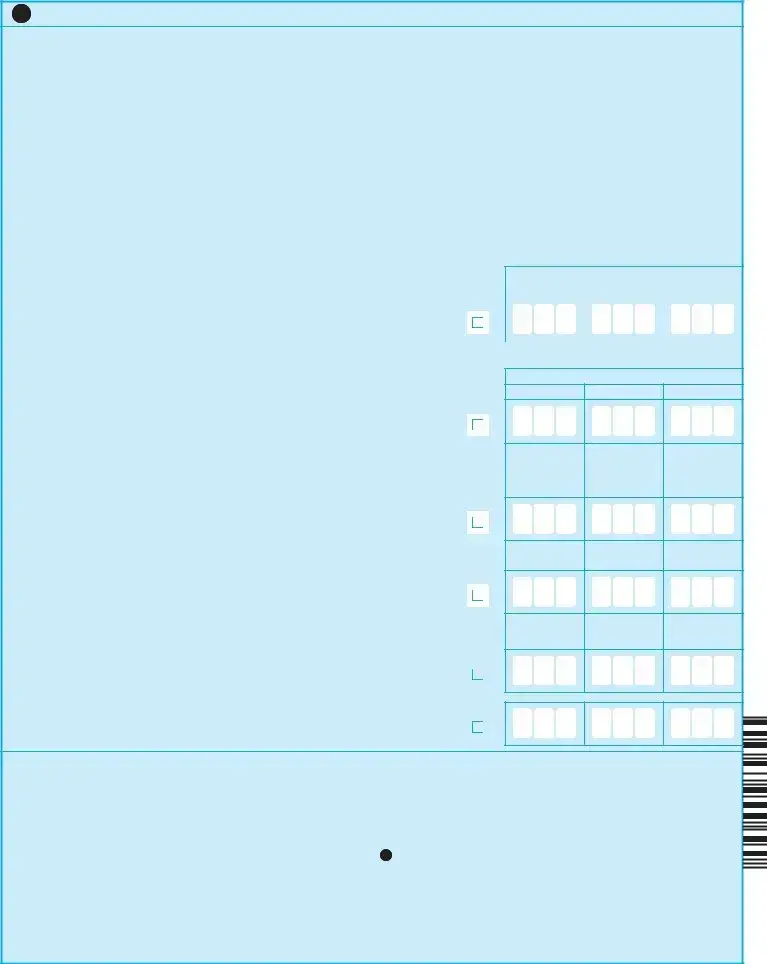

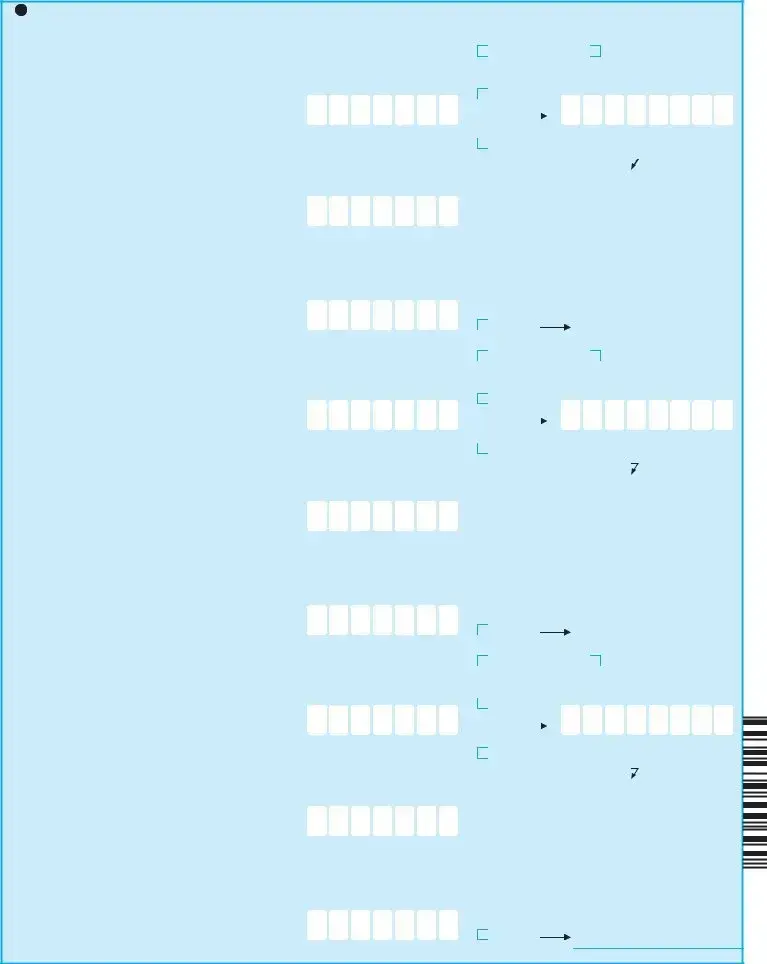

• Use blue or black ballpoint pen. |

• Please center numbers in |

Examples: |

|

|||||||||||||||||||||||

• Do not use pencil or |

their respective boxes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Place an "X" inside the box. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Do not put slashes through 0 or 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1COMPANY OWNERSHIP OR CONTROL A. DOMESTIC OWNERSHIP OR CONTROL

1.Does another domestic company hold more than 50 percent of the voting stock of your company or have the power to control the management and policies of your company?

0008 |

|

|

Yes - Enter the following information of the owning or |

0009 |

|

|

No - Go to line B |

|

||

|

|

|

controlling company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

0080 |

Name of owning or controlling company |

0081 |

Employer Identification |

|

|

|

|

|||

|

|

|

|

|

Number (EIN) of |

|

|

|

- |

|

|

|

|

|

|

owning or controlling |

|

|

|

||

|

|

|

|

|

company (9 digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0082 Home office address (Number and street)

|

|

|

|

|

0083 |

City, town, village, etc. |

0084 |

State |

0085 ZIP Code |

|

|

|

|

|

-

-

2.What percent of voting stock was held by the owning or controlling company? (Mark "X" only ONE box.)

0027 |

|

Less than 50% |

0028 |

|

50% |

0029 |

|

|

More than 50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

CONTINUE WITH 1 |

ON PAGE 2 |

|||

PENALTY FOR FAILURE TO REPORT

99001026

Form

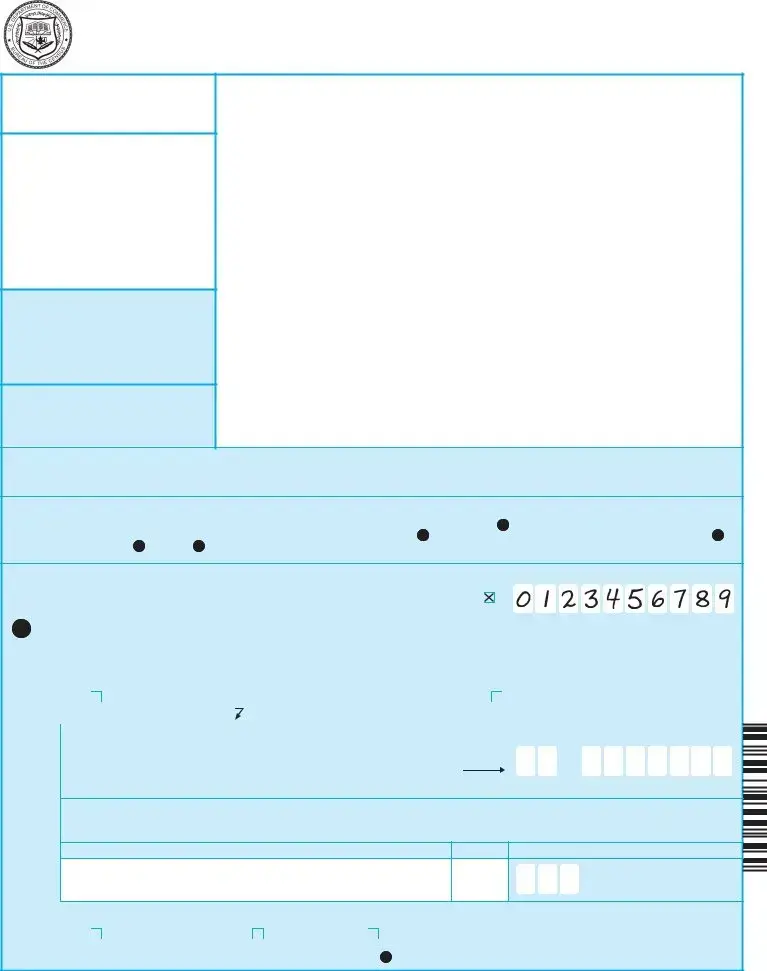

1COMPANY OWNERSHIP OR CONTROL - Continued

B.FOREIGN OWNERSHIP OR CONTROL

Does a foreign entity (company, individual, government, etc.) own directly or indirectly 10 percent or more of the voting stock or other equity rights of your company?

6101 |

|

|

Yes - Enter the following information of the owning |

6102 |

|

No - Go to line C |

|

|

|

|

entity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6103 |

Name of foreign beneficial owner |

|

|

|

|

||

|

|

|

|

|

|

|

|

6104 Home office address (Number and street)

|

|

|

|

|

6105 |

City |

6106 |

Country |

|

|

|

|

|

|

What was the percent |

6111 |

|

10% - 24% |

6113 |

|

|

50% |

6115 |

|

|

100% |

|

|

|

|

|

|||||||

ownership (direct and |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

indirect)? (Mark "X" |

|

|

25% - 49% |

|

|

|

51% - 99% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

only ONE box.) |

6112 |

|

6114 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

C.FOREIGN AFFILIATES

Does this company alone, or with its domestic affiliates, own 10 percent or more of the voting stock of an incorporated foreign business enterprise, or an equivalent interest in an unincorporated business enterprise, including ownership of real estate?

6126  Yes

Yes

6127  No

No

2RESEARCH AND DEVELOPMENT

A.Did your company perform or fund research and development (R&D) in 2015?

6129  Yes - Go to line B

Yes - Go to line B

6130  No - Go to 3 on the next page

No - Go to 3 on the next page

B.What were your company's worldwide expenses for research and development (R&D) in 2015?

6132  Less than $3 million

Less than $3 million

6133  $3 million or more

$3 million or more

Form

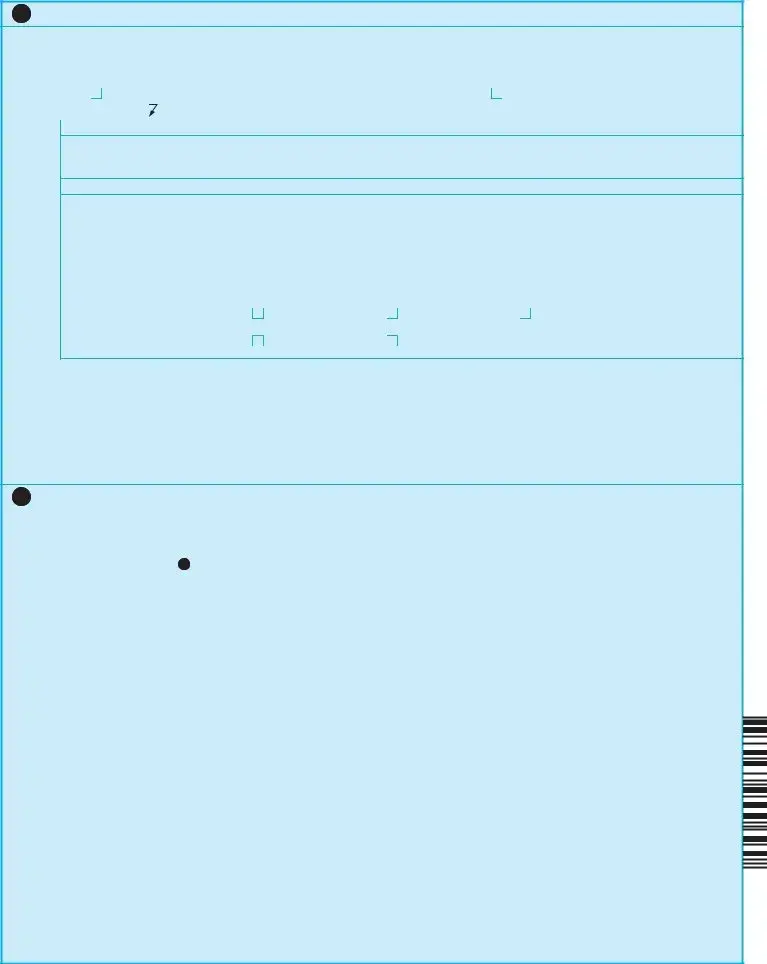

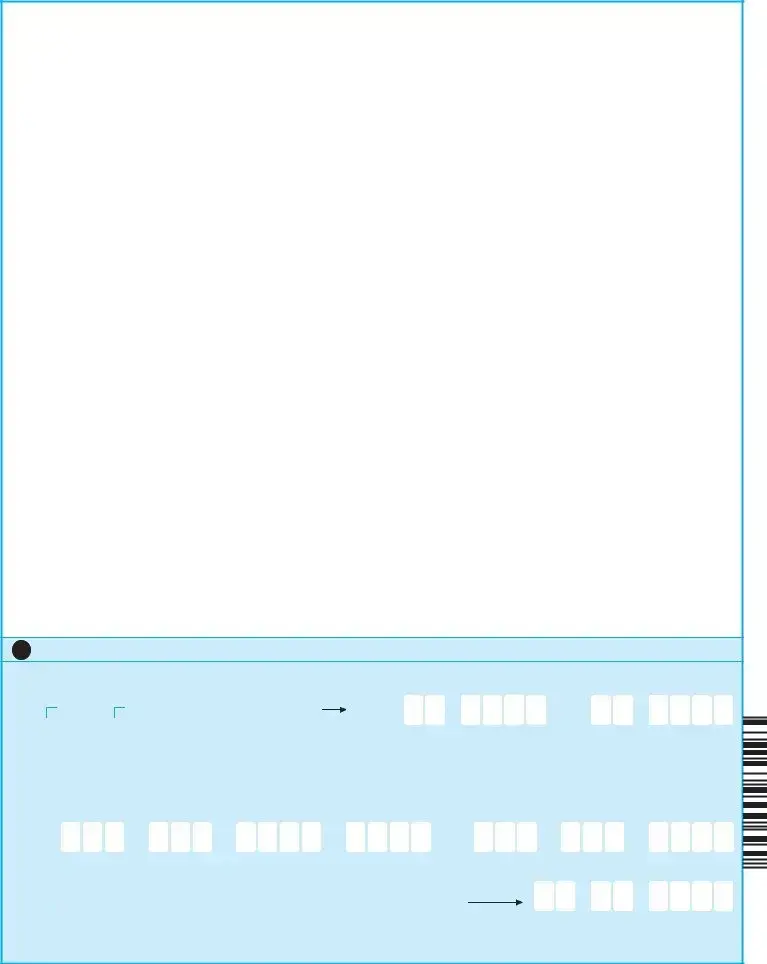

HOW TO REPORT DOLLAR FIGURES

Mark "X"

Dollar figures should be rounded toif None thousands of dollars.

If a figure is $2,035,628.79: |

Report |

|

|

|

|

If a value is "0" (or less than $500.00): Report

2015

$ Bil. |

Mil. |

Thou. |

|

|

2 |

0 3 6 |

|

|

|

|

|

EXAMPLE

EXAMPLE

3COMPANY ACTIVITIES

A.EMPLOYEES FROM A PROFESSIONAL EMPLOYER ORGANIZATION

Did your company lease 50 percent or more of its permanent full- and

0244  Yes

Yes

0245 No

B.OPERATING REVENUES AND NET SALES

1.Your company's operating revenues and net sales generated from U.S. operations (i.e., located in the 50 states and the District of Columbia) in 2015.

Include:

•Sales of goods and services to foreign firms.

•Revenues of discontinued operations.

•Sales to a foreign parent firm and its affiliates not owned by your company.

•Sales by your company's domestic operations to foreign subsidiaries.

Exclude:

•Sales generated by your company's foreign operations.

•Domestic

Special instructions for

Mark "X"

if None

Operating revenues and net sales . . . . . . . . . . . . . 0100

2.Did your company have foreign subsidiaries in 2015?

9760  Yes - Go to line 3

Yes - Go to line 3

9761  No - Go to line 1 on the next page

No - Go to line 1 on the next page

2015

$ Bil. |

Mil. |

Thou. |

|

|

|

|

|

99001034

3.Does the amount reported on line 1 include

9755  Yes - Go to line 1 on the next page

Yes - Go to line 1 on the next page

9756  No - Go to line 4

No - Go to line 4

|

Mark "X" |

|

2015 |

|

|

|

if None |

$ Bil. |

Mil. |

Thou. |

|

|

|

|

|

|

|

4.Report

operations to foreign subsidiaries . . . . . . . . . . . . . 9758

CONTINUE WITH 3 ON PAGE 4

Form

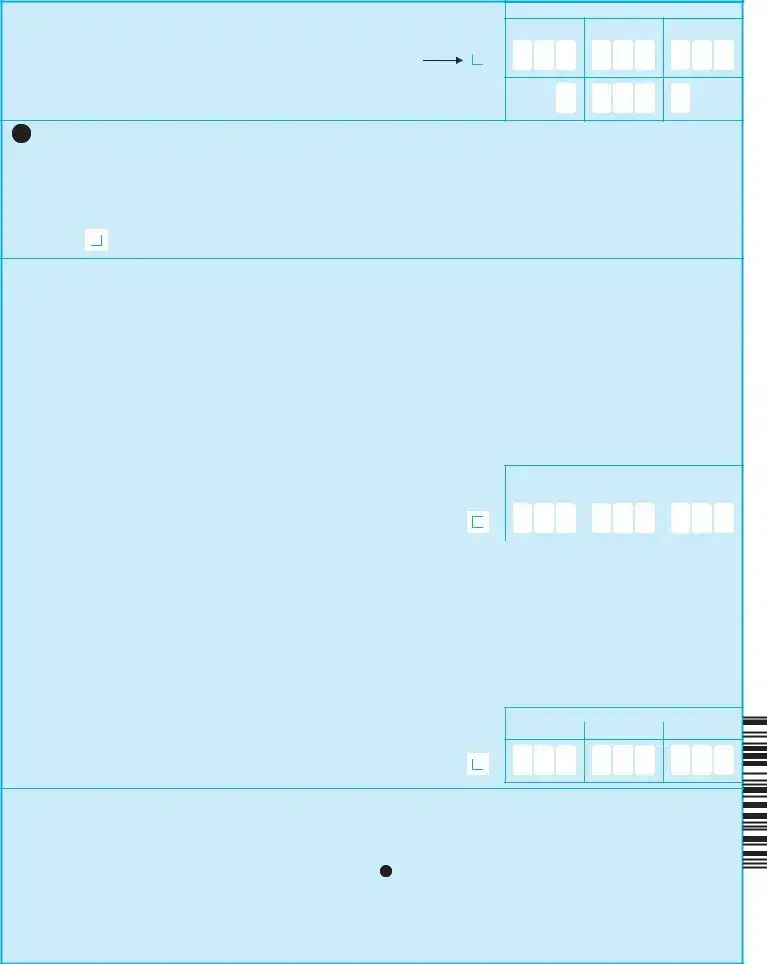

3COMPANY ACTIVITIES - Continued

C. ROYALTIES AND LICENSE FEES FOR THE USE OF INTELLECTUAL PROPERTY

1.Did your company's U.S. operations earn revenue in 2015 from royalties or license fees for rights to use intellectual property?

Include:

•Revenues from royalties and license fees for intellectual property owned by your domestic company's domestic operations (i.e., located in the 50 states and the District of Columbia).

•Royalties and license fees paid to your company's domestic operations by foreign subsidiaries.

Exclude:

•Sales involving the transfer of ownership rights.

•Sales of and products sold with

•Franchise fees.

9701  Yes - Go to line 2

Yes - Go to line 2

9702  No - Go to line 1 on the next page

No - Go to line 1 on the next page

Mark "X"

if None

2. Revenues from royalties and license fees in 2015 for

rights to use intellectual property . . . . . . . . . . . . . 9703

3.Revenues from your company's U.S. operations, as reported in line 2, for the following types of royalties

and license fees in 2015: |

Mark "X" |

|

if None |

a.Technological or industrial processes (Include patents, trade secrets, and proprietary technology. Exclude

computer software.) . . . . . . . . . . . . . . . . . . 9704

b.Entertainment, artistic, educational, and literary original works (Include royalties and license fees for rights to perform, broadcast, reproduce, and sell copyrighted materials and other intellectual property such as films, television and radio programs, written works, and musical and other artistic works. Exclude computer

software.) . . . . . . . . . . . . . . . . . . . . . . . 9705

c.Software - Rights to reproduce, distribute, or use software protected by copyright and owned or controlled by the licensor (Exclude sales of software sold with

programming services.) . . . . . . . . . . . . . . . . 9706

d.Other revenues from royalties and license fees for rights to use intellectual property - Specify

2015

$ Bil. |

Mil. |

Thou. |

|

|

|

|

|

2015

$ Bil. |

Mil. |

Thou. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99001042

9752 |

|

9751 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

e. TOTAL revenues from royalties and license fees in 2015 |

|

|

|

|

for rights to use intellectual property (Sum of lines 3a |

|

|

|

|

|

|

|

||

through 3d should equal line 2.) |

9708 |

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTINUE WITH 3 ON PAGE 5

99001059

Form

3COMPANY ACTIVITIES - Continued

D.MANUFACTURING ACTIVITIES - Please respond even if you are not a manufacturer. In 2015, did your company do any of the following activities related to manufacturing?

1.Operate manufacturing facilities (such as a factory, plant, or mill) where products are completed or partially produced?

9709  Yes - Go to line 2

Yes - Go to line 2

9710  No - Go to line 3

No - Go to line 3

2.Provide contract manufacturing services to other companies incorporating their patents, trade secrets, or proprietary technology?

9711  Yes

Yes

9712  No - Go to line 3

No - Go to line 3

Estimate the percent of operating revenues and net sales, as reported in 3 B, OPERATING REVENUES AND NET SALES, from contract manufacturing services.

9713  Less than 25%

Less than 25%

9714  25% - 49%

25% - 49%

9715  50% - 74%

50% - 74%

9716  75% - 99%

75% - 99%

9717  100%

100%

3.Purchase contract manufacturing services from other companies or foreign subsidiaries of your company incorporating your company's patents, trade secrets, or proprietary technology?

9718  Yes

Yes

9719  No - Go to 4 on the next page

No - Go to 4 on the next page

a.Use 3rd party contract manufacturing services inside the United States (i.e., located in the 50 states and the District of Columbia)?

9720  Yes

Yes

9721  No

No

b.Use 3rd party contract manufacturing services outside the United States (i.e., located outside the 50 states and the District of Columbia)?

9722  Yes

Yes

9723  No

No

c.Use your company's foreign subsidiaries' or affiliates' contract manufacturing services at locations outside the United States (i.e., located outside the 50 states and the District of Columbia)?

9724  Yes

Yes

9725  No

No

d.Estimate the percent of the cost of sales from expenses for contract manufacturing services.

9726  Less than 25%

Less than 25%

9727  25% - 49%

25% - 49%

9728  50% - 74%

50% - 74%

9729  75% - 99%

75% - 99%

9730  100%

100%

99001067

Form

REMARKS (Please use this space for any explanations that may be essential in understanding your reported data.)

$$CENSUS_REMARKS$$

4CERTIFICATION - This report is substantially accurate and was prepared in accordance with the instructions.

|

|

Is the time period covered by this report a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Month |

|

|

Year |

|

|

Month |

|

Year |

|

||||||||||

|

|

calendar year? |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Yes |

|

|

|

No - Enter time period covered |

|

|

FROM |

|

|

|

|

|

|

TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of person to contact regarding this report |

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area code |

|

|

Number |

|

|

Extension |

|

|

|

Area code |

|

|

Number |

|

|||||

|

Tele- |

|

|

|

- |

- |

- |

|

|

Fax |

|

|

|

- |

|

|

- |

|

|

|||||

|

phone |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

Year |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

completed |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thank you for completing your 2015 REPORT OF ORGANIZATION form.

PLEASE PHOTOCOPY THIS FORM FOR YOUR RECORDS AND RETURN THE ORIGINAL.

|

FORM |

U.S. DEPARTMENT OF COMMERCE |

Refer to this |

|

|

Economics and Statistics Administration |

|

||

|

U.S. CENSUS BUREAU |

CENSUS FILE NUMBER |

|

|

|

|

|

||

|

2015 REPORT OF ORGANIZATION |

in any correspondence |

|

|

|

pertaining to this report |

|

||

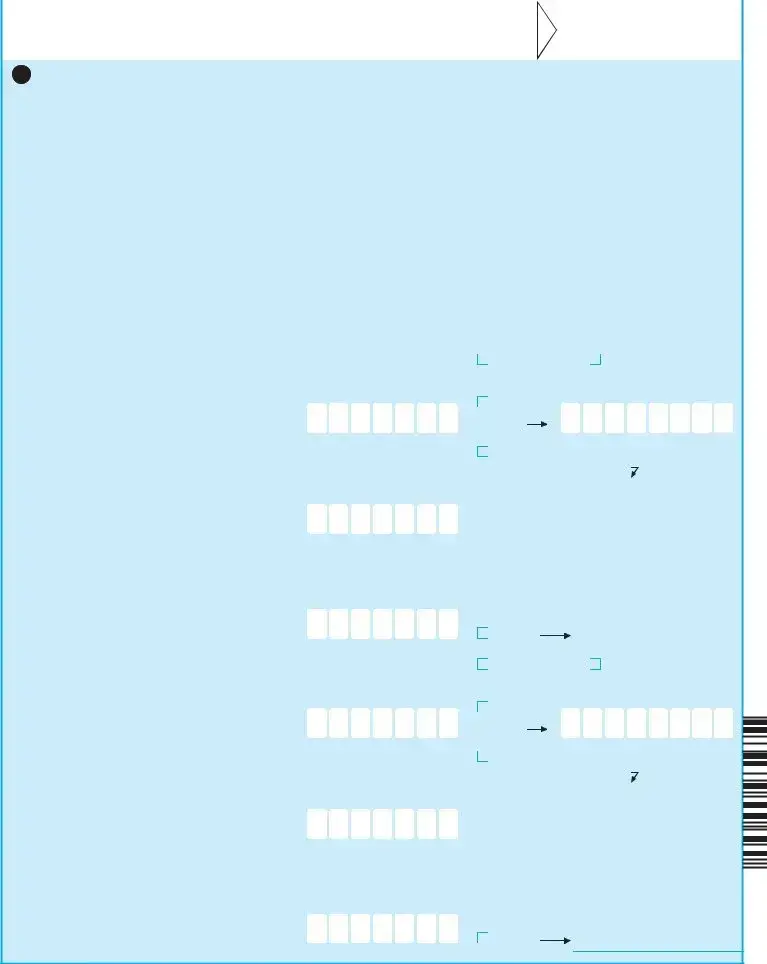

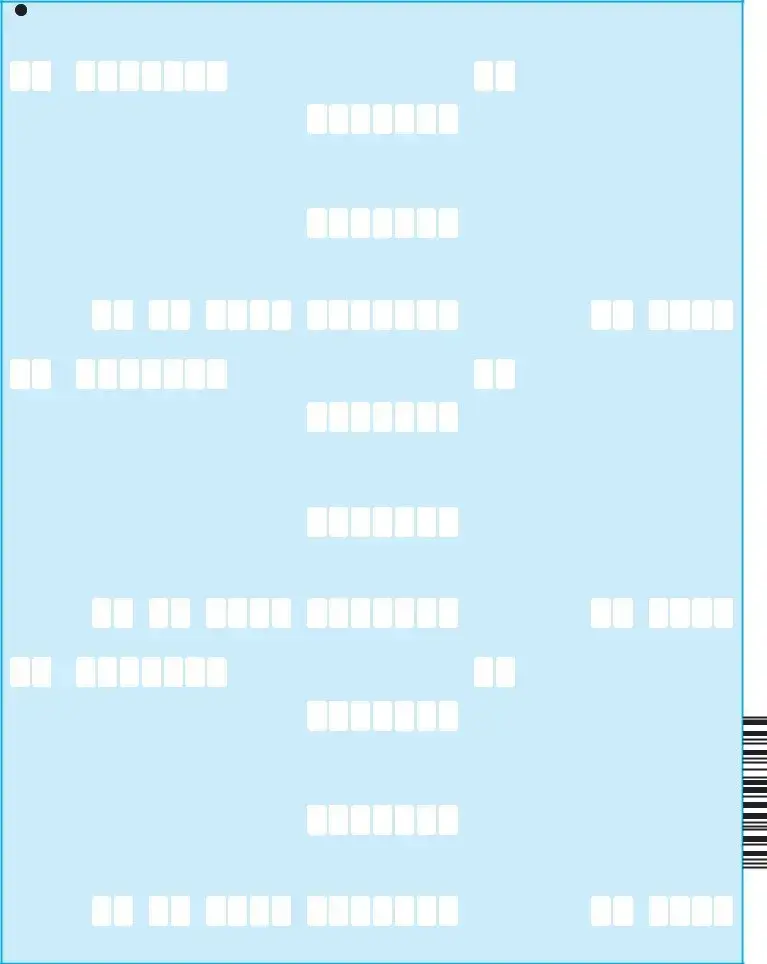

5A.

We have listed establishments of your company based on Census records. Please update this list as follows:

Column (a) - Correct any errors or omissions in the information. The establishments are listed in the following sequence: Employer Identification Number (EIN), major activity, and geographic location.

Column (b) - Report the number of employees and payroll for full- and

Column (c) - Report operational status of each establishment at the end of 2015.

99002016

|

Company Establishments and Subsidiaries |

Employment and Payroll |

|

|

|

Operational Status at the End of 2015 |

|

||||||||||||||

|

|

(Add store or plant number, if any, and |

|

|

|

|

|||||||||||||||

|

|

|

|

|

(Mark "X" only ONE box.) |

|

|||||||||||||||

|

|

correct any errors or omissions.) |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

(a) |

|

|

(b) |

|

|

|

|

|

|

|

|

(c) |

|

|

|||

|

Line No. |

EIN |

|

|

NAICS |

|

2015 |

|

|

|

|

In |

|

|

|

|

Temporarily or |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Number of employees for pay |

|

|

|

operation |

|

|

|

|

seasonally inactive |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Ceased |

Month |

|

Day |

Year |

|

||||||

|

Major activity |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

operation |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Give |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

First quarter payroll |

|

|

|

Sold or leased to another operator - Give date |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

above AND enter name and address of new |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

owner or operator below |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Secondary name |

|

|

Store/Plant No. |

$Bil. |

Mil. |

|

Thou. |

Name of new owner or operator |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical location (Number and street) |

|

|

|

|

|

Mailing address (Number and street, P.O. box, etc.) |

|

|||||||||||||

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

|

|

|

||

|

City, town, village, etc. |

|

State |

ZIP Code |

|

City, town, village, etc. |

|

State |

ZIP Code |

|

|||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

$Bil. |

Mil. |

|

Thou. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify |

|

|

|

|

|

|

|

|

Line No. |

EIN |

|

|

NAICS |

|

2015 |

|

|

|

|

In |

|

|

|

|

Temporarily or |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Number of employees for pay |

|

|

|

operation |

|

|

|

|

seasonally inactive |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Ceased |

Month |

|

Day |

Year |

|

||||||

|

Major activity |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

operation |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Give |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

First quarter payroll |

|

|

|

Sold or leased to another operator - Give date |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

above AND enter name and address of new |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

owner or operator below |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Secondary name |

|

|

Store/Plant No. |

$Bil. |

Mil. |

|

Thou. |

Name of new owner or operator |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical location (Number and street) |

|

|

|

|

|

Mailing address (Number and street, P.O. box, etc.) |

|

|||||||||||||

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

|

|

|

||

|

City, town, village, etc. |

|

State |

ZIP Code |

|

City, town, village, etc. |

|

State |

ZIP Code |

|

|||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

$Bil. |

Mil. |

|

Thou. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify |

|

|

|

|

|

|

|

99002024

Form

5A.

|

(a) Company Establishments and Subsidiaries |

(b) Employment and Payroll |

|

|

(c) Operational Status at the End of 2015 |

|

||||||||||||||

|

Line No. |

EIN |

|

NAICS |

|

2015 |

|

|

|

|

In |

|

|

|

|

Temporarily or |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Number of employees for pay |

|

|

|

operation |

|

|

|

|

seasonally inactive |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Ceased |

Month |

|

Day |

Year |

|

||||||

|

Major activity |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

operation |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Give |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

First quarter payroll |

|

|

|

Sold or leased to another operator - Give date |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

above AND enter name and address of new |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

owner or operator below |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Secondary name |

|

Store/Plant No. |

$Bil. |

Mil. |

|

Thou. |

Name of new owner or operator |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical location (Number and street) |

|

|

|

|

|

Mailing address (Number and street, P.O. box, etc.) |

|

||||||||||||

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

|

|

|

||

|

City, town, village, etc. |

State |

ZIP Code |

|

City, town, village, etc. |

State |

ZIP Code |

|

||||||||||||

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

$Bil. |

Mil. |

|

Thou. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify |

|

|

|

|

|

|

|

|

Line No. |

EIN |

|

NAICS |

|

2015 |

|

|

|

|

In |

|

|

|

|

Temporarily or |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Number of employees for pay |

|

|

|

operation |

|

|

|

|

seasonally inactive |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Ceased |

Month |

|

Day |

Year |

|

||||||

|

Major activity |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

operation |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Give |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

First quarter payroll |

|

|

|

Sold or leased to another operator - Give date |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

above AND enter name and address of new |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

owner or operator below |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Secondary name |

|

Store/Plant No. |

$Bil. |

Mil. |

|

Thou. |

Name of new owner or operator |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical location (Number and street) |

|

|

|

|

|

Mailing address (Number and street, P.O. box, etc.) |

|

||||||||||||

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

|

|

|

||

|

City, town, village, etc. |

State |

ZIP Code |

|

City, town, village, etc. |

State |

ZIP Code |

|

||||||||||||

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

$Bil. |

Mil. |

|

Thou. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify |

|

|

|

|

|

|

|

|

Line No. |

EIN |

|

NAICS |

|

2015 |

|

|

|

|

In |

|

|

|

|

Temporarily or |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Number of employees for pay |

|

|

|

operation |

|

|

|

|

seasonally inactive |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Ceased |

Month |

|

Day |

Year |

|

||||||

|

Major activity |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

operation |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Give |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

First quarter payroll |

|

|

|

Sold or leased to another operator - Give date |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

above AND enter name and address of new |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

owner or operator below |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Secondary name |

|

Store/Plant No. |

$Bil. |

Mil. |

|

Thou. |

Name of new owner or operator |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical location (Number and street) |

|

|

|

|

|

Mailing address (Number and street, P.O. box, etc.) |

|

||||||||||||

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

|

|

|

||

|

City, town, village, etc. |

State |

ZIP Code |

|

City, town, village, etc. |

State |

ZIP Code |

|

||||||||||||

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

$Bil. |

Mil. |

|

Thou. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99003014

|

FORM |

U.S. DEPARTMENT OF COMMERCE |

Refer to this |

|

|

Economics and Statistics Administration |

|

||

|

U.S. CENSUS BUREAU |

CENSUS FILE NUMBER |

|

|

|

|

|

||

|

2015 REPORT OF ORGANIZATION |

in any correspondence |

|

|

|

pertaining to this report |

|

||

5B. ADDITIONAL LOCATIONS OF OPERATION

|

|

|

Column (a) - List separately any establishments |

|

MAJOR ACTIVITY CODES FOR COLUMN (c1) |

|

|

||||||||||||||||||

|

|

|

of your company and its subsidiaries that were not |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

included on the |

|

01 |

- Agricultural production |

|

|

|

|

|

|

|||||||||||||

|

|

|

OPERATION. If your company operates at locations for |

02 |

- Agricultural services |

|

|

|

|

|

|

||||||||||||||

|

|

|

which you have received separate report forms, do not |

|

|

|

|

|

|

||||||||||||||||

|

|

|

03 |

- Minerals extraction/ore processing |

|

|

|

|

|

|

|||||||||||||||

|

|

|

list them, instead complete those forms. For acquired |

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

establishments that you list, complete column (c2). |

|

04 |

- Mining services/oil and gas field services |

|

|

|||||||||||||||||

|

|

|

Column (b) - Report the number of employees and |

|

05 |

- Utilities |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

06 |

- Construction |

|

|

|

|

|

|

||||||||||||||

|

|

|

payroll for full- and |

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

each establishment whose payroll was reported on |

|

07 |

- Manufacturing |

|

|

|

|

|

|

|||||||||||||

|

|

|

your Internal Revenue Service Forms 941, Employer's |

|

08 |

- Merchant wholesaler |

|

|

|

|

|

|

|||||||||||||

|

|

|

Quarterly Federal Tax Return. Include |

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

09 |

- Commission merchant/broker/agent/electronic marketer |

|

|||||||||||||||||||

|

|

|

operations. Do not combine data for establishments. |

|

|

||||||||||||||||||||

|

|

|

If book figures are not available for employment and |

|

|

|

(business to business) |

|

|

|

|

|

|

||||||||||||

|

|

|

payroll for each establishment, please provide your |

|

10 |

- Manufacturers' sales branch/manufacturers' sales office |

|

||||||||||||||||||

|

|

|

best estimates. |

|

|

|

|

|

11 |

- Retail |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Column (c1) - |

Enter the code from the MAJOR |

|

12 |

- Transportation/public warehousing |

|

|

||||||||||||||||

|

|

|

ACTIVITY CODES list that best describes the activity of |

13 |

- Information services/publishing/telecommunications |

|

|||||||||||||||||||

|

|

|

each establishment and specify the principal products |

|

14 |

- Finance/insurance |

|

|

|

|

|

|

|||||||||||||

|

|

|

or services. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

15 |

- Real estate/renting/leasing |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Column (c2) - Complete for acquired establishments. |

|

16 |

- Professional/scientific/technical service |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

- Waste management/remediation service/administrative/ |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

support service |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

- Educational service |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

- Health care |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

- Social assistance |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

- Arts/entertainment/recreation |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

- Accommodation/food service |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

- Corporate/subsidiary/regional/managing office |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

- Other - Specify major activity along with principal products |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or services in column (c1) below. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT - DO NOT DUPLICATE ESTABLISHMENTS PRELISTED IN 5 A. |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Company Establishments and Subsidiaries |

|

|

|

|

|

|

|

Major Activity in 2015 |

|

|||||||||||||

|

|

(Enter Employer Identification Number (EIN), |

Employment and Payroll |

|

|

||||||||||||||||||||

|

|

(Enter code from the MAJOR ACTIVITY CODES list |

|

||||||||||||||||||||||

|

establishment name, your store or plant number, if any, |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

and specify the principal products or services.) |

|

|||||||||||||||||

|

address of physical location, including ZIP Code.) |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

(a) |

|

|

|

|

|

(b) |

|

|

|

|

(c1) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

Code |

Specify |

|

|

|

|

|

|

||

|

|

- |

|

|

|

|

|

|

|

Number of employees for pay |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c2) Former Owner or Operator |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Secondary name |

|

|

|

|

Store/Plant No. |

|

First quarter payroll |

Name of former owner or operator |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Physical location (Number and street) |

|

|

$Bil. |

|

Mil. |

|

|

Thou. |

Mailing address (Number and street, P.O. Box, etc.) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, village, etc. |

|

|

State |

ZIP Code |

|

|

|

|

|

|

City, town, village, etc. |

|

State |

|

ZIP Code |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

|

||||

|

Date |

|

|

|

Month |

|

Day |

|

Year |

$Bil. |

|

Mil. |

|

|

Thou. |

|

|

|

Month |

|

|

Year |

|

||

|

establishment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

opened or is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

expected to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

open . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date acquired . . . |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99003022

Form

5B. ADDITIONAL LOCATIONS OF OPERATION - Continued

|

(a) Company Establishments and Subsidiaries |

(b) |

Employment and Payroll |

|

(c1) Major Activity in 2015 |

|

|||||||||||||

|

EIN |

|

|

|

|

|

|

|

2015 |

Code |

Specify |

|

|

|

|

|

|||

|

- |

|

|

|

|

|

|

Number of employees for pay |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c2) Former Owner or Operator |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secondary name |

|

|

|

Store/Plant No. |

|

First quarter payroll |

Name of former owner or operator |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Physical location (Number and street) |

|

|

$Bil. |

Mil. |

|

Thou. |

Mailing address (Number and street, P.O. Box, etc.) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, village, etc. |

|

State |

ZIP Code |

|

|

|

|

City, town, village, etc. |

|

State |

ZIP Code |

|

||||||

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

||

|

Date |

|

Month |

Day |

|

Year |

$Bil. |

Mil. |

|

Thou. |

|

|

|

Month |

|

Year |

|

||

|

establishment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

opened or is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

expected to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

open . . . . |

|

|

|

|

|

|

|

|

|

|

Date acquired . . . |

|

|

|

|

|

|

|

|

EIN |

|

|

|

|

|

|

|

2015 |

Code |

Specify |

|

|

|

|

|

|||

|

- |

|

|

|

|

|

|

Number of employees for pay |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c2) Former Owner or Operator |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secondary name |

|

|

|

Store/Plant No. |

|

First quarter payroll |

Name of former owner or operator |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Physical location (Number and street) |

|

|

$Bil. |

Mil. |

|

Thou. |

Mailing address (Number and street, P.O. Box, etc.) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, village, etc. |

|

State |

ZIP Code |

|

|

|

|

City, town, village, etc. |

|

State |

ZIP Code |

|

||||||

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

||

|

Date |

|

Month |

Day |

|

Year |

$Bil. |

Mil. |

|

Thou. |

|

|

|

Month |

|

Year |

|

||

|

establishment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

opened or is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

expected to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

open . . . . |

|

|

|

|

|

|

|

|

|

|

Date acquired . . . |

|

|

|

|

|

|

|

|

EIN |

|

|

|

|

|

|

|

2015 |

Code |

Specify |

|

|

|

|

|

|||

|

- |

|

|

|

|

|

|

Number of employees for pay |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

period including March 12 |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c2) Former Owner or Operator |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secondary name |

|

|

|

Store/Plant No. |

|

First quarter payroll |

Name of former owner or operator |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Physical location (Number and street) |

|

|

$Bil. |

Mil. |

|

Thou. |

Mailing address (Number and street, P.O. Box, etc.) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, village, etc. |

|

State |

ZIP Code |

|

|

|

|

City, town, village, etc. |

|

State |

ZIP Code |

|

||||||

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual payroll |

|

|

|

|

|

|

|

|

||

|

Date |

|

Month |

Day |

|

Year |

$Bil. |

Mil. |

|

Thou. |

|

|

|

Month |

|

Year |

|

||

|

establishment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

opened or is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

expected to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

open . . . . |

|

|

|

|

|

|

|

|

|

|

Date acquired . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The NC-99001 form collects comprehensive information about business establishments active during 2013, as required by federal law. |

| Confidentiality Assurance | Your responses are confidential and may only be viewed by authorized personnel, assuring that the information is used solely for statistical purposes. |

| Legal Requirement | Responding to this form is mandatory under Title 13 of the United States Code, meaning all businesses must comply. |

| Reporting Deadline | The completed form must be submitted by businesses to the U.S. Census Bureau as part of their legal obligation. |

| Use of Pen | Fill out the form using a blue or black ballpoint pen. Avoid using pencil or felt-tip pens. |

| Establishment Listing | The form requests a detailed list of all company establishments, including subsidiaries, ensuring a comprehensive data pool. |

| Prelisted Information | Information in Section 5A has been prelisted to assist businesses, minimizing the burden of data entry. |

| Global Reach | Questions on the form address not only U.S. operations but also any foreign subsidiaries and their relationships. |

| Operating Revenues | Businesses must report their U.S. operating revenues without including domestic inter-company sales or foreign operations. |

| Intellectual Property Revenue | The form includes queries on revenues generated from royalties and licenses related to intellectual property rights during 2013. |

Guidelines on Utilizing Nc99001

Filling out the NC99001 form is an important step in providing necessary information about your organization's activities and ownership. Once completed, it should be submitted to the U.S. Census Bureau as required by law. Below are the steps to guide you through the process of completing this form.

- Gather all necessary information, including your 11-digit Census File Number (CFN), ownership details, and financial data.

- Use a blue or black ballpoint pen to fill out the form. Avoid using pencil or felt-tip pens.