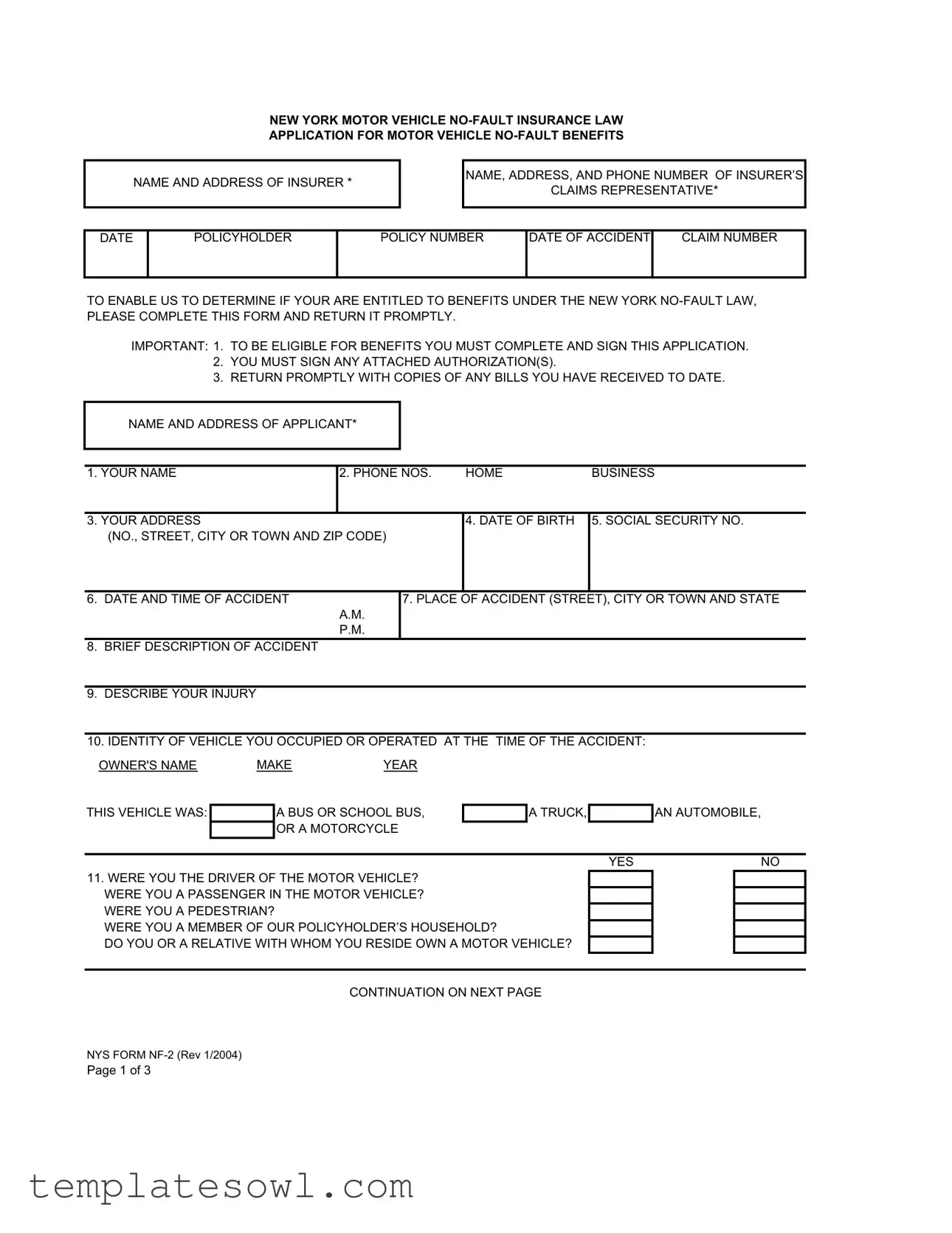

Fill Out Your Nf 2 Form

The NF-2 form plays a crucial role in the New York motor vehicle no-fault insurance system. Designed to assist individuals seeking benefits following an accident, this application gathers essential information necessary for the claims process. The form requires details such as the applicant's name, contact information, and specifics regarding the accident. It also prompts users to disclose their injuries and any medical treatment received. Furthermore, the NF-2 form asks about the applicant's employment status, potential lost wages, and any additional health-related expenses incurred due to the accident. Importantly, completeness is key; applicants must sign the form and any accompanying authorizations to ensure their eligibility for benefits. Return of the form, along with any supporting documents, is strongly encouraged to facilitate prompt processing. This structured approach not only aids the insurer in determining rights to recovery but also protects the applicant from common pitfalls associated with incomplete submissions.

Nf 2 Example

NEW YORK MOTOR VEHICLE

NAME AND ADDRESS OF INSURER *

NAME, ADDRESS, AND PHONE NUMBER OF INSURER’S

CLAIMS REPRESENTATIVE*

DATE

POLICYHOLDER

POLICY NUMBER

DATE OF ACCIDENT

CLAIM NUMBER

TO ENABLE US TO DETERMINE IF YOUR ARE ENTITLED TO BENEFITS UNDER THE NEW YORK

IMPORTANT: 1. TO BE ELIGIBLE FOR BENEFITS YOU MUST COMPLETE AND SIGN THIS APPLICATION.

2.YOU MUST SIGN ANY ATTACHED AUTHORIZATION(S).

3.RETURN PROMPTLY WITH COPIES OF ANY BILLS YOU HAVE RECEIVED TO DATE.

NAME AND ADDRESS OF APPLICANT*

1. YOUR NAME |

2. PHONE NOS. |

HOME |

BUSINESS |

|

|

|

|

3. YOUR ADDRESS |

|

4. DATE OF BIRTH |

5. SOCIAL SECURITY NO. |

(NO., STREET, CITY OR TOWN AND ZIP CODE) |

|

|

|

|

|

|

|

6. DATE AND TIME OF ACCIDENT |

7. PLACE |

OF ACCIDENT (STREET), CITY OR TOWN AND STATE |

|

|

A.M. |

|

|

|

P.M. |

|

|

8.BRIEF DESCRIPTION OF ACCIDENT

9.DESCRIBE YOUR INJURY

10.IDENTITY OF VEHICLE YOU OCCUPIED OR OPERATED AT THE TIME OF THE ACCIDENT:

OWNER'S NAME |

MAKE |

YEAR |

THIS VEHICLE WAS:

A BUS OR SCHOOL BUS, OR A MOTORCYCLE

A TRUCK,

AN AUTOMOBILE,

YESNO

11.WERE YOU THE DRIVER OF THE MOTOR VEHICLE? WERE YOU A PASSENGER IN THE MOTOR VEHICLE? WERE YOU A PEDESTRIAN?

WERE YOU A MEMBER OF OUR POLICYHOLDER’S HOUSEHOLD?

DO YOU OR A RELATIVE WITH WHOM YOU RESIDE OWN A MOTOR VEHICLE?

CONTINUATION ON NEXT PAGE

NYS FORM

Page 1 of 3

APPLICATION FOR MOTOR VEHICLE

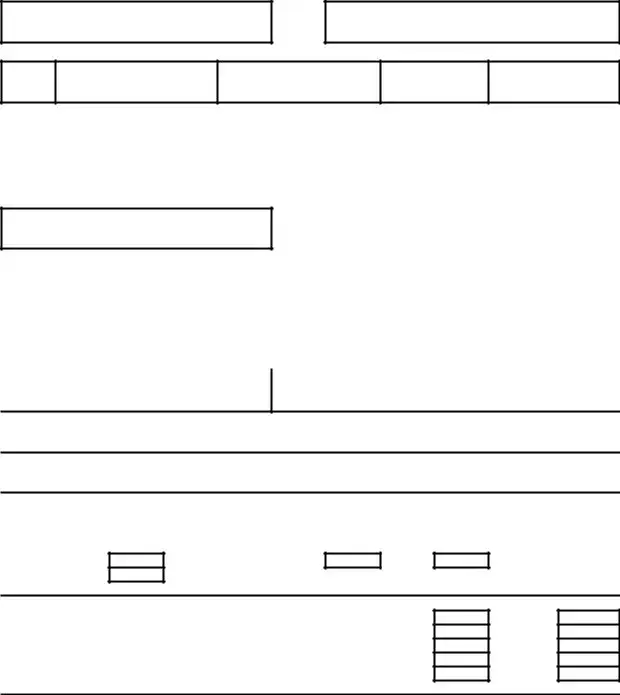

12. WERE YOU TREATED BY A DOCTOR(S) OR OTHER PERSON(S) FURNISHING HEALTH SERVICES?

|

|

|

YES |

|

NO |

|

|

|

|

|

|

|

IF YES, NAME AND ADDRESS OF SUCH DOCTOR(S) OR PERSON(S): |

|

|

||||||||

|

|

|

|

|

|

|

|

||||

13. IF YOUR WERE TREATED AT A HOSPITAL(S), WERE YOU AN |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

DATE OF ADMISSION: |

|

|

|

|

|

|

|

|||

|

HOSPITAL'S NAME AND ADDRESS: |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

14. AMOUNT OF HEALTH |

15. WILL YOU HAVE MORE HEALTH |

16. AT THE TIME OF YOUR ACCIDENT WERE |

|||||||||

BILLS TO DATE: |

|

TREATMENT(S)? |

|

|

YOU IN THE COURSE OF YOUR |

||||||

|

|

|

|

|

YES |

NO |

EMPLOYMENT? |

|

|

||

$ |

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

17. DID YOU LOSE TIME |

|

|

DATE ABSENCE FROM |

HAVE YOU RETURNED TO |

|||||||

FROM WORK? |

|

|

WORK BEGAN: |

WORK? |

|

|

|||||

|

YES |

NO |

|

|

|

|

|

YES |

NO |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

IF YES, DATE RETURNED TO |

WORK: |

|

AMOUNT |

OF TIME LOST FROM WORK: |

||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

||||||||

18. WHAT ARE YOUR GROSS AVERAGE NUMBER OF DAYS |

YOU WORK |

|

NUMBER OF HOURS YOU WORK |

||||||||

WEEKLY EARNINGS? |

|

PER WEEK: |

|

PER DAY: |

|

|

|||||

19. WERE YOU RECEIVING UNEMPLOYMENT BENEFITS AT THE TIME OF THE ACCIDENT?

YES

NO

20.LIST NAMES AND ADDRESS OF YOUR EMPLOYER AND OTHER EMPLOYERS FOR ONE YEAR PRIOR TO ACCIDENT DATE AND GIVE OCCUPATION AND DATES OF EMPLOYMENT:

EMPLOYER AND ADDRESS |

|

OCCUPATION |

FROM |

TO |

|

|

|

|

|

|

|

EMPLOYER AND ADDRESS |

|

OCCUPATION |

FROM |

TO |

|

|

|

|

|

|

|

EMPLOYER AND ADDRESS |

|

OCCUPATION |

FROM |

TO |

|

|

|

||||

21. AS A RESULT OF YOUR INJURY HAVE YOU HAD ANY OTHER EXPENSES? |

|

||||

YES |

|

NO |

|

|

|

IF YES, ATTACH EXPLANATION AND AMOUNTS OF SUCH EXPENSES.

22.DUE TO THIS ACCIDENT HAVE YOU RECEIVED OR ARE YOU ELIGIBLE FOR PAYMENTS UNDER ANY OF THE FOLLOWING:

YES NO

NEW YORK STATE DISABILITY?

WORKERS' COMPENSATION?

CONTINUATION ON NEXT PAGE

NYS FORM

Page 2 of 3

APPLICATION FOR MOTOR VEHICLE

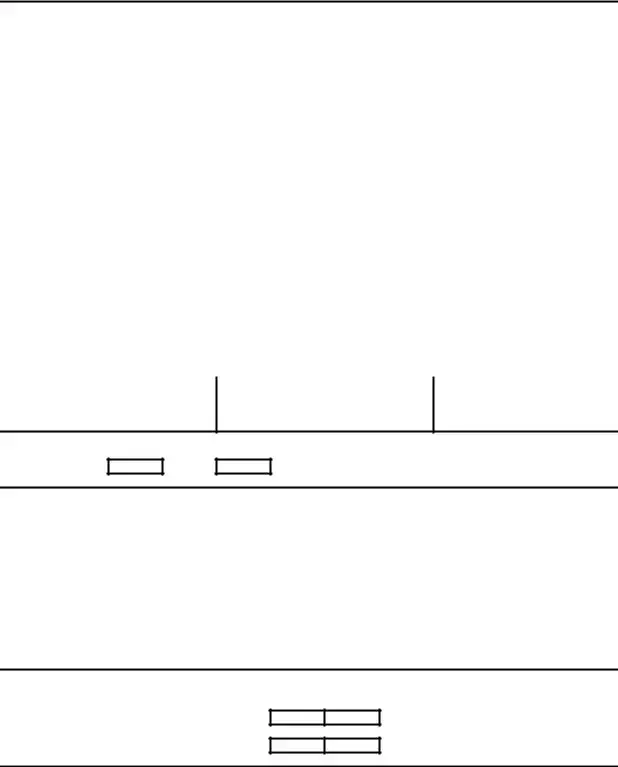

THE APPLICANT AUTHORIZES THE INSURER TO SUBMIT ANY AND ALL OF THESE FORMS TO ANOTHER PARTY OR INSURER IF SUCH IS NECESSARY TO PERFECT ITS RIGHTS OF RECOVERY PROVIDED FOR UNDER THE

THIS FORM IS SUBSCRIBED AND AFFIRMED BY THE

APPLICANT AS TRUE UNDER THE PENALTIES OF PERJURY

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR COMMERCIAL INSURANCE OR A STATEMENT OF CLAIM FOR ANY COMMERCIAL OR PERSONAL INSURANCE BENEFITS CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, AND ANY PERSON WHO, IN CONNECTION WITH SUCH APPLICATION OR CLAIM, KNOWINGLY MAKES OR KNOWINGLY ASSISTS, ABETS, SOLICITS OR CONSPIRES WITH ANOTHER TO MAKE A FALSE REPORT OF THE THEFT, DESTRUCTION, DAMAGE OR CONVERSION OF ANY MOTOR VEHICLE TO A LAW ENFORCEMENT AGENCY, THE DEPARTMENT OF MOTOR VEHICLES OR AN INSURANCE COMPANY, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME, AND SHALL ALSO BE SUBJECT TO A CIVIL PENALTY NOT TO EXCEED FIVE THOUSAND DOLLARS AND THE VALUE OF THE SUBJECT MOTOR VEHICLE OR STATED CLAIM FOR EACH VIOLATION.

SIGNATURE |

|

DATE |

DO NOT DETACH

AUTHORIZATION FOR RELEASE OF WORK AND OTHER LOSS INFORMATION

THIS AUTHORIZATION OR PHOTOCOPY THEREOF, WILL AUTHORIZE YOU TO FURNISH ALL INFORMATION YOU MAY HAVE REGARDING MY WAGES, SALARY OR OTHER LOSS WHILE EMPLOYED BY YOU. YOUR ARE AUTHORIZED TO PROVIDE THIS INFORMATION IN ACCORDANCE WITH THE NEW YORK COMPREHENSIVE MOTOR VEHICLE INSURANCE REPARATIONS ACT

NAME (PRINT OR TYPE) |

|

SOCIAL SECURITY NO. |

|

|

|

SIGNATURE |

|

DATE |

DO NOT DETACH

AUTHORIZATION FOR RELEASE OF HEALTH SERVICE OR TREATMENT INFORMATION

THIS AUTHORIZATION OR PHOTOCOPY THEREOF, WILL AUTHORIZE YOU TO FURNISH ALL INFORMATION YOU MAY HAVE REGARDING MY CONDITION WHILE UNDER YOUR OBSERVATION OR TREATMENT, INCLUDING THE HISTORY OBTAINED,

NAME (PRINT OR TYPE)

SIGNATURE |

|

DATE |

(IF THE APPLICANT IS A MINOR, PARENT OR GUARDIAN SHALL SIGN AND INDICATE CAPACITY AND RELATIONSHIP).

*LANGUAGE TO BE FILLED IN BY INSURER OR

Page 3 of 3

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The NF-2 form operates under the New York Comprehensive Motor Vehicle Insurance Reparations Act, commonly referred to as New York No-Fault Law. |

| Eligibility Requirements | To be eligible for benefits, applicants must complete and sign the application along with any necessary authorizations. |

| Return Instructions | The form must be returned promptly with copies of any bills received related to the incident. |

| Health Treatment Information | Applicants need to provide details of any health treatments received, including the name and address of the healthcare providers. |

| Fraud Warning | Submitting false information on the NF-2 form is considered a fraudulent insurance act and can lead to severe penalties. |

Guidelines on Utilizing Nf 2

Completing the NF-2 form is an essential step if you are seeking benefits under the New York No-Fault Insurance Law. Once you fill out the form accurately and return it promptly, the insurer will process your application. Gathering the required information beforehand can streamline this process significantly.

- Start by providing the name and address of the insurer at the top of the form.

- Next, fill in the name, address, and phone number of the insurer’s claims representative.

- Include the date on which you are filling out this application.

- Enter your name, phone numbers, and address as the applicant.

- Provide your date of birth and Social Security number.

- Record the date and time of the accident, specifying A.M. or P.M.

- Indicate the place of the accident, including the street, city or town, and state.

- Write a brief description of the accident.

- Describe your injury in detail.

- Identify the vehicle you occupied or operated at the time of the accident by providing the owner's name, make, and year of the vehicle.

- Answer questions about your status during the accident by indicating if you were the driver, a passenger, a pedestrian, or a member of the policyholder's household.

- State whether you or a relative residing with you owns a motor vehicle.

- Indicate if you received treatment from a doctor or health service provider and provide their name and address if applicable.

- Answer whether you were an outpatient or inpatient if treated at a hospital and provide the dates and hospital name.

- Input the amount of health bills to date.

- Indicate whether you will require further health treatments.

- State whether you were employed at the time of the accident.

- If you lost time from work, provide the amount of time lost and the date you returned to work.

- List your gross weekly earnings and the average number of hours you work per week.

- Indicate if you were receiving unemployment benefits at the time of the accident.

- Provide the names, addresses, occupation, and employment dates of your employers for the year prior to the accident.

- Note any additional expenses incurred as a result of your injury.

- Indicate if you have applied for or received payments from New York State Disability or Workers' Compensation.

- Finally, sign and date the application at the end. Make sure to sign any attached authorizations as well.

What You Should Know About This Form

What is the NF-2 form?

The NF-2 form is an application used in New York to claim motor vehicle no-fault benefits. It is specifically designed to help determine if you are eligible for benefits under New York's No-Fault Insurance Law after a motor vehicle accident.

Who should complete the NF-2 form?

The individual who sustained injuries as a result of a motor vehicle accident should complete the NF-2 form. This includes drivers, passengers, pedestrians, or household members of policyholders involved in the accident.

What information is required to fill out the NF-2 form?

You will need to provide detailed information, such as your name, contact information, date of birth, social security number, and specifics about the accident, including the date, time, description of the accident, and details of your injuries. You also need to include information about any treatment received and your work status.

What is the importance of signing the NF-2 form?

Signing the NF-2 form is crucial for verifying that the information provided is accurate and complete. Your signature is required to process the application and allows the insurer to access any necessary medical or employment information related to your claim.

What should be done if you have additional medical expenses?

If you have incurred additional medical expenses due to your injuries, you must indicate this on the NF-2 form and provide an explanation along with the amounts. Attach any relevant bills or documentation for those expenses to ensure they are considered during the claims process.

Is there a deadline for returning the NF-2 form?

Yes, it is important to return the NF-2 form promptly. Delays in submitting the form or the required documentation can result in complications or denial of benefits. Always check with your insurer about specific deadlines.

What happens if the NF-2 form is filled out incorrectly?

Filling out the NF-2 form incorrectly can lead to delays in processing or denial of your claim. Ensure all information is accurate and complete before submitting. If you are unsure, consult with a legal expert or your claims representative for assistance.

Are there any penalties for providing false information on the NF-2 form?

Yes, intentionally providing false information on the NF-2 form can result in serious penalties. This includes criminal charges for fraud and civil penalties, such as fines. Therefore, it is essential to provide truthful and accurate information.

Can the insurer access my medical records if I sign the NF-2 form?

Signing the NF-2 form gives the insurer authorization to access your medical records relevant to your claim. This is necessary for them to evaluate the extent of your injuries and the associated benefits. Ensure you understand what you are authorizing.

What should you do if you have questions while completing the NF-2 form?

If you have any questions or need clarification while filling out the NF-2 form, it's best to contact your insurer's claims representative directly. They can provide guidance and answer any specific questions you may have about the process or requirements.

Common mistakes

Filling out the NF-2 form correctly is crucial for receiving no-fault benefits after a motor vehicle accident. Many individuals make errors that can delay or jeopardize their claims. Understanding these common mistakes can help ensure that all required information is accurately provided.

One frequent mistake is failing to include accurate claim information. Applicants must ensure that policy numbers and claim numbers are stated clearly. Any discrepancies can lead to confusion and delay in processing claims. Double-checking these details can save time and frustration.

Another common oversight involves incomplete information about the accident itself. The form asks for specific details, such as the date, time, and location of the accident, along with a brief description. Skipping this information, or providing vague responses, can hinder the evaluation process. Taking the time to fill in these sections carefully is essential.

Many applicants neglect to sign the form. It may seem obvious, but skipping the signature can invalidate the application. This applies not only to the overall form but also to any attached authorizations that require signatures. Ensuring all necessary signatures are included is a simple but vital step.

Inaccurately reporting the nature of injuries presents another challenge. Applicants must describe their injuries clearly and provide accurate details about treatment. Omitting this information, or giving incomplete accounts, can lead to insufficient support for claims.

Applicants also often misrepresent their employment status. When filling out sections related to work, it’s essential to provide truthful information about job loss or receipt of benefits. Not addressing whether the applicant was in the course of employment during the accident can create complications. Transparency here is crucial.

Another mistake to be cautious of is failing to include all relevant medical expenses. Supporting documentation should accompany the application, detailing any health services received. This includes outpatient or inpatient care from doctors or hospitals. Providers of such services should be named and addressed correctly to support claims for reimbursement.

People frequently miss submitting copies of all relevant bills received to date. Along with the NF-2 form, applicants should attach any documentation that demonstrates incurred expenses. This helps in establishing a clear picture of financial impact due to the accident.

Leaving out information about other insurance benefits can also lead to issues. If applicants are eligible for those benefits, this must be disclosed in the application. Being upfront helps prevent situations where benefits overlap, which could complicate the claims process.

Finally, it’s important to remember the potential consequences of providing false information. Misleading or unverifiable information can not only lead to claims denial but could also result in legal repercussions. All statements should be truthful and can be verified if needed.

Documents used along the form

When applying for No-Fault benefits in New York, the NF-2 form is essential, but several additional documents are commonly used to support the application process. These documents can provide critical information about the accident, injuries, and any related treatments or expenses incurred. Below is a list of some frequently utilized forms and documents that complement the NF-2 application.

- NF-3 Form: This form is a detailed report of the medical treatment provided to the insured after the accident. It must be filled out by healthcare providers and submitted to ensure that all medical expenses are properly documented.

- NF-5 Form: Often needed to claim lost wages, the NF-5 serves as an employer's statement regarding the work hours and wages of the applicant. It helps determine the compensation for income lost due to the accident.

- Authorization to Release Medical Records: This document allows healthcare providers to share the applicant’s medical records with the insurer. It is crucial for the insurer to review any relevant past treatments or conditions that might relate to the claim.

- Police Report: This report provides an official account of the accident, detailing circumstances and parties involved. It can support the claims made in the NF-2 form about how the accident occurred and who was at fault.

- Witness Statements: Written accounts from individuals who witnessed the accident can add credibility to the application. These can clarify what happened and can be particularly useful when determining liability.

These documents serve to create a comprehensive case for your No-Fault benefits and help streamline the claims process. Ensuring that everything is completed accurately and promptly is key to a smoother experience and quicker access to entitled benefits.

Similar forms

The NF-2 form is an important document for claiming no-fault benefits in New York. Other similar documents serve the same purpose or support the process of applying for insurance benefits. Here are seven documents that share similarities with the NF-2 form:

- NF-3 Form: This document is also used for no-fault benefits. It gathers information related to health services received post-accident and expenses incurred, allowing for a clearer assessment of claims.

- NF-4 Form: This form helps verify the income of an injured party. It requests information about employment earnings, which can impact the benefits calculation.

- Health Insurance Claim Form (CMS-1500): Used by health providers to bill insurance carriers for services rendered, this form also contains necessary personal and treatment information relevant to no-fault claims.

- Workers' Compensation Claim Form: Similar in that it addresses injuries and payments, this form focuses on workplace injuries and facilitates compensation through the workplace insurance system.

- Accident Report Form: Often filled out by law enforcement, this document provides details about the accident, such as location and involved parties. This information can be critical for processing no-fault claims.

- Authorization for Release of Information: This document permits health care providers to share medical records with the insurer. It ensures that the insurer has the relevant health history needed to assess the claim.

- Subrogation Form: Used to recover costs from the responsible party’s insurance. This supports the no-fault system by ensuring the insurer can seek reimbursement for payments made for the claim.

Dos and Don'ts

When completing the NF-2 form for motor vehicle no-fault benefits, it is important to pay attention to detail. Here are some essential do's and don'ts:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign the application and any attached authorization forms.

- Do return the form promptly with copies of any bills you've received.

- Don’t skip any required sections; incomplete forms can cause delays.

- Don’t provide inaccurate information, as this may lead to legal penalties.

- Don’t forget to include details about any medical treatment you've received.

- Don’t detach any authorization sections; keep them intact.

By following these guidelines, applicants can ensure their forms are completed accurately, increasing the likelihood of a smooth claims process.

Misconceptions

There are several misconceptions about the Nf 2 form used for Motor Vehicle No-Fault Benefits in New York. Understanding these can help applicants complete the form correctly and efficiently.

- Misconception 1: The Nf 2 form must be submitted immediately after the accident.

- Misconception 2: Only the driver can file a claim using the Nf 2 form.

- Misconception 3: Signing the form means automatically receiving benefits.

- Misconception 4: Applicants do not need to provide supporting documents with the Nf 2 form.

- Misconception 5: The Nf 2 form must be filed in person.

While it is important to act quickly, the form does not require submission immediately. Applicants should ensure all information is accurate and complete before submission.

The form can be completed by others involved in the accident, including passengers and pedestrians. Eligibility is not limited to drivers.

Completing and signing the form does not guarantee benefits. The insurer will review the application and determine eligibility based on the submitted information.

It is necessary to attach all relevant documents, such as bills related to the accident. This information helps the insurer in processing the claim.

The form can be submitted via mail or electronic means, depending on the insurer’s guidelines. Applicants should confirm their insurer’s preferred method for submission.

Key takeaways

- Timeliness is crucial: Return the NF-2 form promptly after filling it out. Quick action can expedite your application for benefits.

- Complete all sections: Ensure you fill in every required field, including your personal information, accident details, and any medical treatment you’ve received.

- Provide accurate descriptions: In the section regarding your accident and injuries, clarity and precision will help your application process. Avoid vague terms.

- Attach necessary documents: Include copies of any medical bills you have received along with your application. Missing documents can delay your benefits.

- Authorizations are important: Sign any attached authorization forms. Failure to do so may hinder your claim from being processed efficiently.

- Understand your rights: Familiarize yourself with the New York No-Fault Law. Knowing what you are entitled to can empower you throughout the claims process.

Browse Other Templates

Ultimate Health Insurance - Denial letters from primary insurance must also be included as documentation.

School Choice Nj - Separate submissions are required for any new or modified programs not covered in the renewal application.

What Documents Do I Need to Apply for Medicare - Submitting accurate information is crucial, as inaccuracies may lead to penalties.