Fill Out Your Nf 6 Form

The NF-6 form serves as a vital tool within New York's motor vehicle no-fault insurance framework, specifically designed to facilitate the wage verification process for employees who have sustained injuries in auto accidents. This report is completed by an employer or former employer, providing essential information about the employee's earnings, absence from work, and overall job status. It requests detailed data, including the employee's occupation, the period of employment, and gross earnings prior to the accident. Additionally, the form inquires about the employee's eligibility for various benefits, such as workers' compensation and state disability benefits, which might impact the benefits they are entitled to receive under New York's Comprehensive Motor Vehicle Insurance Reparations Act. Timeliness is crucial; the completed form must be submitted to the insurer within 90 days of the work loss. Failure to do so could impede the worker's access to necessary financial support during recovery. Completing the NF-6 accurately not only aids in determining the employee's benefits but also ensures compliance with state regulations, ultimately supporting a smoother claims process.

Nf 6 Example

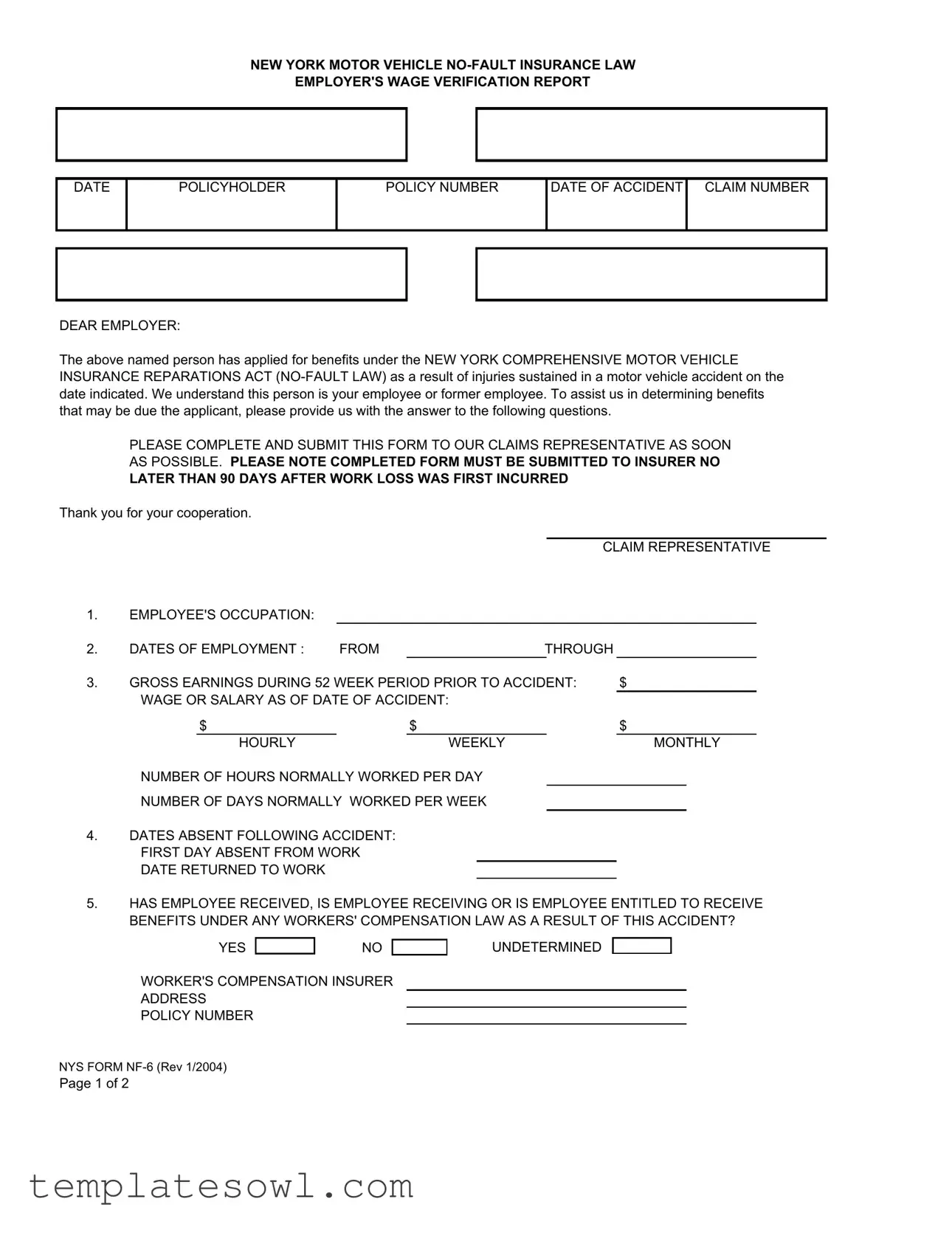

NEW YORK MOTOR VEHICLE

EMPLOYER'S WAGE VERIFICATION REPORT

NAME AND ADDRESS OF INSURER OR SELF-

INSURER*

NAME, ADDRESS, AND PHONE NUMBER OF INSURER’S CLAIMS REPRESENTATIVE*

DATE

POLICYHOLDER

POLICY NUMBER

DATE OF ACCIDENT

CLAIM NUMBER

NAME AND ADDRESS OF EMPLOYER*

DEAR EMPLOYER:

EMPLOYEE'S NAME, ADDRESS AND SOCIAL

SECURITY NO.

The above named person has applied for benefits under the NEW YORK COMPREHENSIVE MOTOR VEHICLE INSURANCE REPARATIONS ACT

PLEASE COMPLETE AND SUBMIT THIS FORM TO OUR CLAIMS REPRESENTATIVE AS SOON AS POSSIBLE. PLEASE NOTE COMPLETED FORM MUST BE SUBMITTED TO INSURER NO

LATER THAN 90 DAYS AFTER WORK LOSS WAS FIRST INCURRED

Thank you for your cooperation.

CLAIM REPRESENTATIVE

1.EMPLOYEE'S OCCUPATION:

2. |

DATES OF EMPLOYMENT : |

FROM |

THROUGH |

|

|

|

|

|

|

3.GROSS EARNINGS DURING 52 WEEK PERIOD PRIOR TO ACCIDENT: WAGE OR SALARY AS OF DATE OF ACCIDENT:

$$

HOURLYWEEKLY

NUMBER OF HOURS NORMALLY WORKED PER DAY

NUMBER OF DAYS NORMALLY WORKED PER WEEK

4.DATES ABSENT FOLLOWING ACCIDENT: FIRST DAY ABSENT FROM WORK DATE RETURNED TO WORK

$

$

MONTHLY

5.HAS EMPLOYEE RECEIVED, IS EMPLOYEE RECEIVING OR IS EMPLOYEE ENTITLED TO RECEIVE BENEFITS UNDER ANY WORKERS' COMPENSATION LAW AS A RESULT OF THIS ACCIDENT?

YES |

|

NO |

WORKER'S COMPENSATION INSURER ADDRESS

POLICY NUMBER

UNDETERMINED

NYS FORM

Page 1 of 2

EMPLOYER'S WAGE VERIFICATION REPORT

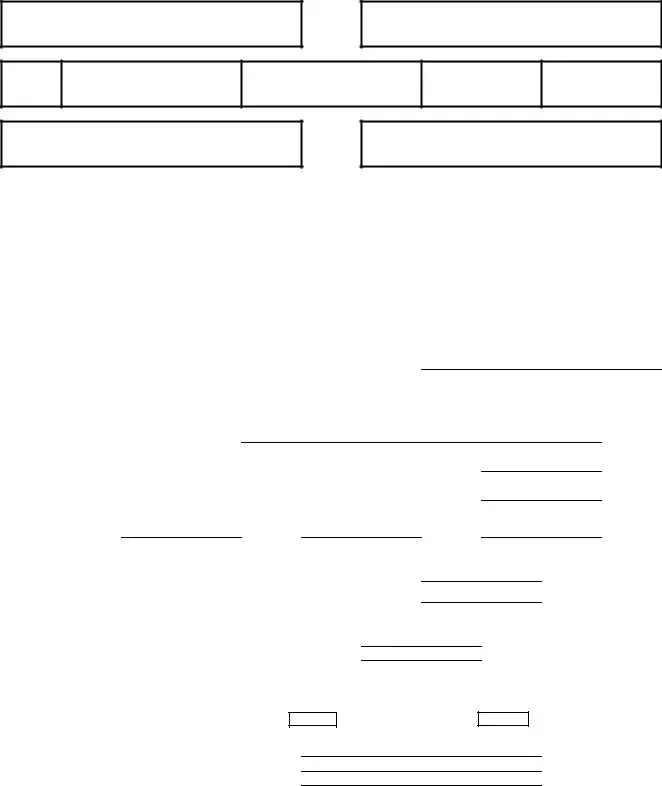

6.HAS EMPLOYEE RECEIVED, IS EMPLOYEE RECEIVING OR IS EMPLOYEE ENTITLED TO RECEIVE NEW YORK STATE DISABILITY BENEFITS AS A RESULT OF THIS ACCIDENT?

YES

NO

UNDETERMINED

IS THE EMPLOYEE REQUIRED TO PAY FOR DBL COVERAGE THROUGH PAYROLL DEDUCTION?

YES

NYS DISABILITY INSURER ADDRESS

POLICY NUMBER

NO

7.WAS OR WILL EMPLOYEE BE PAID BY EMPLOYER FOR THIS ABSENCE FROM WORK?

YES

NO

IF ANSWER TO QUESTION 7 IS "YES" PLEASE ANSWER QUESTIONS 8, 9, 10 and 11.

8. |

HOW MUCH WAS OR WILL EMPLOYEE BE PAID |

$ |

$ |

|

|

|

WEEKLY |

|

MONTHLY |

9.WILL THE EMPLOYEE BE REQUIRED TO REIMBURSE YOU ANY OF THE ABOVE AMOUNT?

YES

NO

10.WILL THE EMPLOYEE LOSE ACCUMULATED LEAVE CREDITS AS A RESULT OF THE FOREGOING PAYMENT?

YES

NO

11.WILL THE EMPLOYEE'S ELIGIBILITY FOR FUTURE WAGE BENEFITS BE AFFECTED BY PAYMENTS INDICATED IN QUESTION 8 ABOVE?

YES

NO

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR COMMERCIAL INSURANCE OR A STATEMENT OF CLAIM FOR ANY COMMERCIAL OR PERSONAL INSURANCE BENEFITS CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, AND ANY PERSON WHO, IN CONNECTION WITH SUCH APPLICATION OR CLAIM, KNOWINGLY MAKES OR KNOWINGLY ASSISTS, ABETS, SOLICITS OR CONSPIRES WITH ANOTHER TO MAKE A FALSE REPORT OF THE THEFT, DESTRUCTION, DAMAGE OR CONVERSION OF ANY MOTOR VEHICLE TO A LAW ENFORCEMENT AGENCY, THE DEPARTMENT OF MOTOR VEHICLES OR AN INSURANCE COMPANY, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME, AND SHALL ALSO BE SUBJECT TO A CIVIL PENALTY NOT TO EXCEED FIVE THOUSAND DOLLARS AND THE VALUE OF THE SUBJECT MOTOR VEHICLE OR STATED CLAIM FOR EACH VIOLATION.

PRINT NAME |

|

TITLE |

|

PHONE NO. |

|

|

|

|

|

SIGNATURE |

|

FEDERAL EMPLOYER I.D. NO. |

|

DATE |

*LANGUAGE TO BE FILLED IN BY INSURER OR

Page 2 of 2

Form Characteristics

| Fact Title | Details |

|---|---|

| Governing Law | The NF-6 form is governed by the New York Comprehensive Motor Vehicle Insurance Reparations Act (No-Fault Law). |

| Purpose of the Form | This form is used for verifying an employee's wages when they apply for no-fault insurance benefits due to a motor vehicle accident. |

| Submission Deadline | The completed form must be submitted to the insurer within 90 days after the employee first incurs work loss. |

| Information Required | Employers must provide details such as employee's occupation, dates of employment, and gross earnings prior to the accident. |

| Employee's Absence | The form includes questions regarding the dates the employee was absent from work due to the accident. |

| Workers' Compensation | Employers are asked whether the employee has received or is entitled to workers' compensation benefits related to the accident. |

| Disability Benefits | Questions regarding the employee's entitlement to New York State disability benefits due to the accident are also included. |

| Employer Payments | Employers must disclose if and how much they have paid the employee for absences related to the accident. |

| Fraud Warning | The form includes a warning about the legal consequences of insurance fraud, emphasizing the seriousness of truthful reporting. |

Guidelines on Utilizing Nf 6

Once you have the NF-6 form in hand, gather the necessary information to complete it. This document serves as a verification of an employee’s wages in relation to a motor vehicle accident claim. Make sure to have the following details ready as you methodically fill in each section to ensure accuracy and completeness.

- Name and Address of Insurer or Self-Insurer: Enter the name and address of the insurance provider or self-insured employer at the top of the form.

- Name, Address, and Phone Number of Insurer’s Claims Representative: Fill in the details for the claims representative who will be handling this case.

- Date: Indicate today’s date.

- Policyholder Information: Provide the name of the policyholder, policy number, date of the accident, and claim number.

- Name and Address of Employer: Record the employer’s name and address, ensuring it matches official records.

- Employee's Information: Include the employee's name, address, and Social Security number.

- Employee's Occupation: Specify the occupation of the employee at the time of the accident.

- Dates of Employment: Fill in the employment dates, stating when the employee started and ended their employment.

- Gross Earnings: Indicate the gross earnings the employee received during the 52-week period leading up to the accident. Provide the wage or salary as of the date of the accident as well, including normal hours worked per day and typical workdays in a week.

- Absence Due to Accident: Document the first day the employee was absent from work and the date they returned.

- Workers' Compensation Benefits: Answer whether the employee has received, is receiving, or is entitled to receive workers' compensation benefits due to the accident. If applicable, include the name and address of the workers' compensation insurer and policy number.

- State Disability Benefits: Similar to the previous question, determine if the employee has received, is currently receiving, or is entitled to New York State disability benefits as a result of the accident. Indicate if the employee is required to pay for DBL coverage through payroll deduction.

- Employer Paid Absence: Respond whether the employer will pay the employee for the absence from work. If "Yes," provide details about the payment amount.

- Reimbursement Requirements: Clarify if the employee will need to reimburse any of the paid amounts.

- Leave Credits: Confirm whether the employee will lose any accumulated leave credits due to these payments.

- Future Wage Benefits: Lastly, indicate if the payments will affect the employee's eligibility for future wage benefits.

- Declaration: Acknowledge that any false information can lead to serious consequences. Provide your name, title, contact number, signature, federal employer ID number, and the date, ensuring all information is accurately provided.

After completing the form, submit it to the claims representative promptly. Remember that the completed form must be submitted to the insurer within 90 days of the first work loss incurred to ensure that assistance can be effectively processed.

What You Should Know About This Form

What is the NF-6 form?

The NF-6 form, also known as the Employer's Wage Verification Report, is a document used in New York to verify an employee's wages in connection with a no-fault insurance claim. It helps insurers determine the amount of benefits an injured employee may be entitled to after a motor vehicle accident.

Who is required to complete the NF-6 form?

This form must be completed by the employer of the injured employee or former employee. The employer provides vital information regarding the employee’s wages, dates of employment, and any benefits related to the accident.

What information is included in the NF-6 form?

The form gathers essential details such as the employee's name, social security number, occupation, gross earnings, dates of absence, and information regarding any workers' compensation or disability benefits the employee might receive. This data is crucial for evaluating the employee's claim for benefits.

When must the NF-6 form be submitted?

The completed NF-6 form should be submitted as soon as possible. Employers must ensure that it reaches the insurer no later than 90 days after the employee's work loss first occurred. Timeliness is key to avoiding potential delays in benefit processing.

What happens if I don't submit the NF-6 form on time?

If the NF-6 form is not submitted within the specified 90-day timeframe, the insurer may deny the claims related to the employee's work loss. This can adversely affect the financial support that the injured employee might require.

Can an employee receive workers' compensation and no-fault benefits at the same time?

Yes, it is possible for an employee to receive both workers' compensation and no-fault benefits. However, the form will ask for clarification on whether the employee is receiving any such benefits related to the accident. This information is crucial in determining the total benefits owed.

How does the form impact the employee's future benefits?

The NF-6 form assesses whether the payments made to the employee will affect their eligibility for future wage benefits. Employers are required to answer specific questions about this to provide a clear understanding of the employee’s financial situation moving forward.

What are the consequences of providing false information on the NF-6 form?

Providing false information with the intent to deceive on the NF-6 form is considered fraud. This could lead to criminal charges and civil penalties, which may include fines and legal repercussions. Accuracy and honesty are paramount.

Is there a specific way to fill out the NF-6 form?

Yes, the NF-6 form has specific fields that must be completed accurately. It's important to follow the instructions provided on the form, ensuring all relevant information is included. Be sure to check for completeness before submission to avoid processing delays.

Where can I get the NF-6 form?

The NF-6 form can typically be obtained from your insurance company's claims representative or downloaded from the New York State Department of Financial Services website. Ensure you are using the most current version of the form when submitting it.

Common mistakes

Filling out the NF-6 form correctly is crucial for ensuring that insurance claims are processed smoothly. However, many people fall into common traps that can delay or even derail their claims. One of the most frequent mistakes is incomplete information. Missing details, such as the employer's name or the policyholder's policy number, can lead to processing delays. Always double-check that all required fields are filled out before submitting the form.

Another common error involves incorrect dates. Applicants often enter the wrong dates for employment or the accident itself. These discrepancies can raise red flags and lead to additional scrutiny. Make sure to verify the dates provided to ensure they accurately reflect the employment timeline and the incident date.

Additionally, confusion around earnings can create problems. Many individuals mistakenly report gross earnings instead of net pay and may not provide a complete breakdown of their usual work hours. This lack of clarity could impact the benefits awarded. It’s best to clarify whether you are reporting weekly, monthly, or annual amounts and ensure you include the average hours worked.

A significant oversight occurs with questions regarding disability benefits and workers' compensation. Some people fail to accurately indicate whether the employee has received these benefits, which can complicate the claims process. If the employee is entitled to any type of compensation, this information must be disclosed to avoid complications or potential penalties.

Lastly, people overlook the importance of timely submission. The NF-6 form must be submitted within 90 days of the work loss. Many claimants either forget this deadline or miscalculate the necessary timeline. A simple reminder on the calendar can help ensure that submissions are completed promptly and correctly, preventing unnecessary stress down the line.

Documents used along the form

The NF-6 form is used in New York to verify wage information for employees applying for benefits under the No-Fault Insurance Law after a motor vehicle accident. It is part of a series of documents that may be necessary to process insurance claims and determine eligibility for benefits. Here are five other forms and documents that are commonly associated with the NF-6.

- NYS Form NF-2: This form is a No-Fault Application for benefits. It is used by claimants to provide details about the accident, injuries, and other relevant information. Completing this form is a crucial step for individuals seeking compensation under the New York No-Fault Law.

- NYS Form NF-3: The No-Fault Verification Form is used by insurers to review claims submitted. It helps confirm the details provided in the NF-2 and assesses eligibility for benefits. This document ensures accuracy and accountability in the claims process.

- NYS Form NF-5: This is the Wage Loss Benefit Claim form. Employees use it to request wage loss benefits directly from their insurer if they have lost earnings as a result of the accident. It gathers essential information on the employee's earnings and work history.

- NYS Workers' Compensation Claim Form (C-3): In cases where injuries lead to a claim under Workers' Compensation laws, this form documents the claim for benefits. It is necessary when injuries overlap with work-related issues, ensuring that all potential benefits are considered.

- Employer's Payroll Records: Employers may need to submit payroll records to confirm the employee's earnings. These records help insurers validate the information provided on the NF-6 and other related forms, supporting the claims process.

Utilizing these documents effectively can facilitate the claims process for individuals and their employers. It's essential for all parties involved to complete the necessary forms accurately and submit them in a timely manner to ensure compliance with regulations and smooth benefit disbursement.

Similar forms

The NF-6 form is used within the context of New York's No-Fault Insurance system, particularly for obtaining employer wage verifications following a motor vehicle accident. Several documents serve similar functions or share common purposes in the world of insurance and claims management. Below is a list highlighting ten such documents along with their similarities to the NF-6 form.

- Workers' Compensation Claim Form: Like the NF-6, this form collects information about an employee's work status and income after an injury, helping determine compensation benefits for lost wages.

- Disability Benefits Application: This application is similar in that it requests employment and income information to evaluate eligibility for disability pay, motivating quick assistance for employees who cannot work due to an accident.

- Request for Medical Information: This document seeks further details about an employee's medical condition, paralleling the NF-6's role in gathering necessary information to support claims.

- Claim for Unemployment Benefits: This form allows individuals to present their employment history and income to find out if they qualify, sharing the primary goal of ensuring financial support post-accident.

- Insurance Policy Declaration Page: Just like the NF-6, this page outlines coverage and benefits, providing vital information to determine what protections the employee has in the event of an accident.

- Benefits Verification Form: This form verifies if the employee has received any benefits from other sources, aligning with the NF-6's focus on income recovery post-accident.

- Employer's Certificate of Wage and Status: Similar in purpose, this verifies an employee's current wage and job status, effectively assessing the situation after an injury occurs.

- Loss of Income Affidavit: This document is used to affirm that an individual has lost income due to circumstances similar to those outlined in the NF-6, aiming for validations of lost wages.

- Accident Report Form: This form captures details surrounding the incident, just as the NF-6 requests accident dates and circumstances affecting wage recovery.

- Hospitalization Verification Form: Like the NF-6, this verifies hospital stays and related absences from work, supporting claims for benefits tied to lost income from a medical event.

Each of these documents plays a critical role in navigating the complexities of worker injuries and insurance claims, and a swift response to submissions is paramount for affected individuals seeking support.

Dos and Don'ts

Here are four critical actions to take and avoid when completing the NF-6 form:

- Do include accurate information: Ensure that all details about the employee, their wages, and the accident are precise.

- Do submit the form promptly: Send the completed form to the claims representative within 90 days of the employee's first work loss.

- Do answer all questions: Every question has its importance. Omitting any response could delay processing.

- Do keep copies: Retain a copy of the submitted form for your records.

- Don’t guess any answers: If you are unsure about a response, seek clarification instead of providing inaccurate information.

- Don’t delay submission: Missing the deadline could adversely affect the employee's benefits.

- Don’t provide incomplete information: Incomplete responses can lead to processing delays or rejections of the claim.

- Don’t ignore sections: Every part of the form must be filled out to the best of your ability.

Misconceptions

Misconceptions about the Nf 6 form can lead to confusion regarding its purpose and requirements. Here are ten common misunderstandings, accompanied by clarifications:

- This form is only for employers. Many believe that the Nf 6 form is exclusively for employers. In reality, it is also for employees who have been involved in accidents and are seeking benefits under the New York No-Fault Law.

- It must be submitted immediately after an accident. Some individuals think the Nf 6 form needs to be completed right after an accident. However, it should be submitted within 90 days after the first work loss is incurred, allowing time for accurate information gathering.

- All injuries require this form. Not every injury results in the necessity of an Nf 6 form. This form is specifically for employees applying for benefits because of injuries sustained in a motor vehicle accident.

- The employee must complete the form. A common belief is that the injured employee must fill out the Nf 6 form. Instead, the employer is responsible for completing this report as part of verifying the employee's wage information.

- The Nf 6 form is only for those receiving wage payments. Some think that if an employee does not receive any pay during their absence, the Nf 6 form is unnecessary. Conversely, the form is needed regardless of wage compensation to provide documentation for insurance claims.

- There is no penalty for late submission. Many assume that submitting the Nf 6 form late presents no risks. In actuality, failing to submit the form within the 90-day window can jeopardize an employee's eligibility for benefits.

- Anyone can fill out the form. It's a misconception that any person can complete the Nf 6 form. Proper completion must come from the employer or their authorized representative to ensure accurate information about the employee’s wage status.

- This does not involve personal data. Some people think personal data is irrelevant when filling out the Nf 6. However, accurate details about the employee, including their name and Social Security number, are crucial for processing the benefits appropriately.

- Filling out the form guarantees benefits. A common misunderstanding is that simply submitting the Nf 6 form ensures that benefits will be granted. Benefits are contingent upon multiple factors, including the nature of the injury and compliance with all legal requirements.

- The qualifications for benefits are the same for all employees. Lastly, some believe that all employees have the same qualifications for benefits. However, eligibility can vary based on job type, hours worked, and other individual factors that affect the No-Fault Law's application.

Key takeaways

When filling out the NF-6 form, consider these important points:

- Timeliness is crucial: Submit the completed form to the insurer no later than 90 days after the work loss occurs.

- Accurate information: Ensure that all details about the employee, such as their occupation and dates of employment, are correct and complete.

- Include earnings details: Report the gross earnings for the 52-week period before the accident, along with the wage or salary as of the accident date.

- Benefits under other laws: Indicate whether the employee has received or is entitled to workers' compensation or disability benefits related to the accident.

- Payment for absences: Clearly state if the employee will be paid for their absence from work, including amounts and any need for reimbursement.

By keeping these takeaways in mind, the form can be completed accurately, helping ensure proper processing of the claim.

Browse Other Templates

Ohp - You can apply even if you are already covered by another health plan.

Kcmo Liquor License - It is important to submit the form well in advance of the planned event to allow for review and consideration.