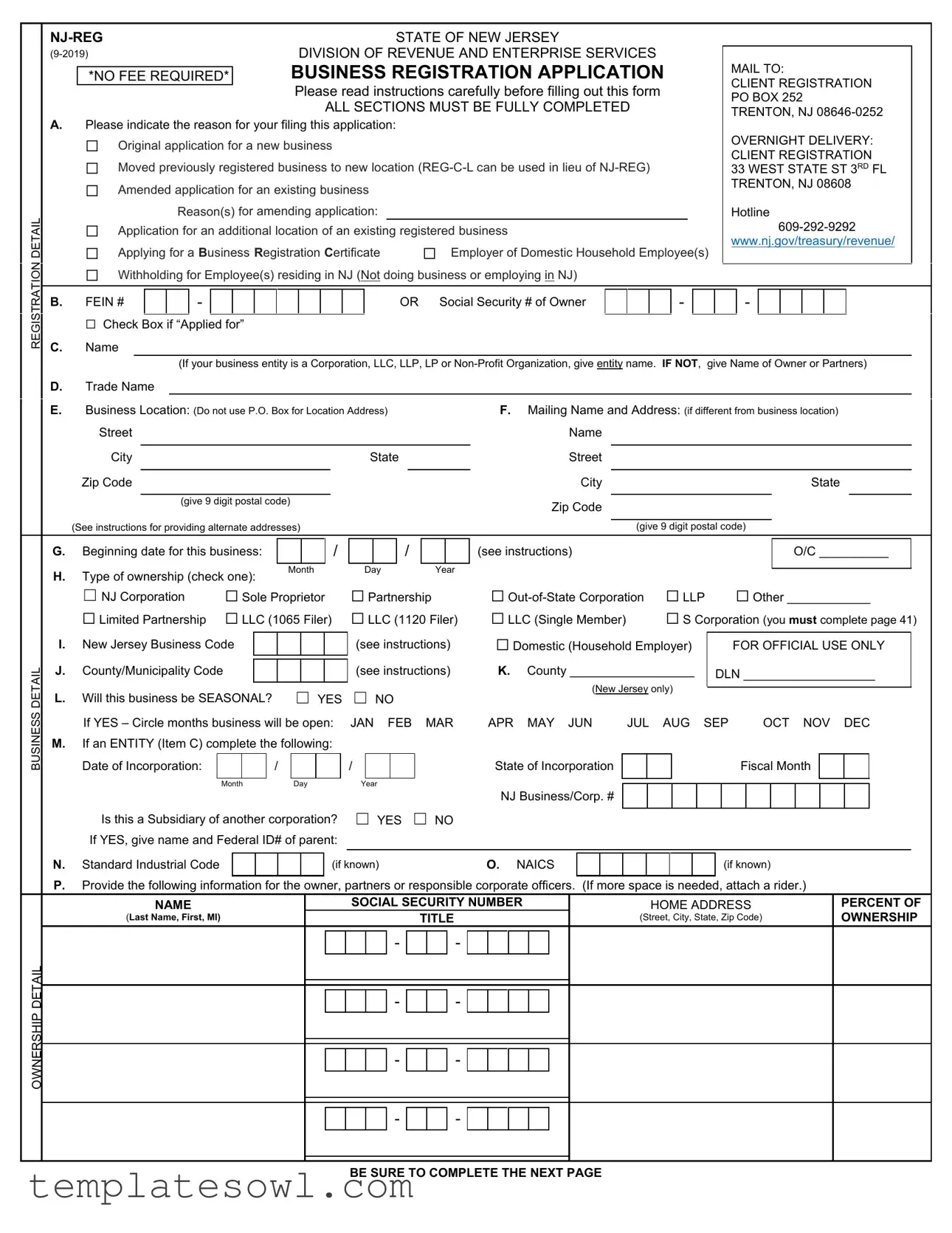

Fill Out Your Nj Reg Form

The NJ-REG form, a critical component for business registration in New Jersey, serves various purposes for individuals and entities looking to establish or update their business status. It caters to a range of circumstances, such as original applications for new businesses, amendments to existing registrations, and applications for a Business Registration Certificate. Essential details are required throughout the form, including the identification of the business type, whether it is a corporation, partnership, or sole proprietorship. Applicants must also provide information on ownership, operational details, and the specific reasons for their application. For those with employees, questions regarding wage payments and compliance with state tax regulations come into play. Moreover, the form includes inquiries about various types of business activities, such as sales tax collection and specific industry classifications. This emphasis on comprehensive data underscores the importance of following the instructions carefully and ensuring that all sections are completed fully to avoid processing delays. Furthermore, applicants must be attentive to various categories related to their operations, including seasonal business functions and any affiliations with prior employing units. Ultimately, successful completion and submission of the NJ-REG form are foundational steps in establishing a compliant business presence within New Jersey.

Nj Reg Example

DETAIL

STATE OF NEW JERSEY |

|

DIVISION OF REVENUE AND ENTERPRISE SERVICES |

|

*NO FEE REQUIRED* |

|

BUSINESS REGISTRATION APPLICATION |

|

|

||

|

|

|

Please read instructions carefully before filling out this form |

|

|

|

ALL SECTIONS MUST BE FULLY COMPLETED |

A.Please indicate the reason for your filing this application:

☐Original application for a new business

☐Moved previously registered business to new location

☐Amended application for an existing business

Reason(s) for amending application:

☐Application for an additional location of an existing registered business

☐ Applying for a Business Registration Certificate |

☐ Employer of Domestic Household Employee(s) |

☐Withholding for Employee(s) residing in NJ (Not doing business or employing in NJ)

MAIL TO:

MAIL TO:

CLIENT REGISTRATION PO BOX 252 TRENTON, NJ

OVERNIGHT DELIVERY: CLIENT REGISTRATION

33 WEST STATE ST 3RD FL TRENTON, NJ 08608

Hotline

REGISTRATION

B. |

FEIN # |

|

|

- |

|

|

|

|

|

|

|

OR Social Security # of Owner |

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Check Box if “Applied for”

C.Name

(If your business entity is a Corporation, LLC, LLP, LP or

D.Trade Name

E. |

Business Location: (Do not use P.O. Box for Location Address) |

F. Mailing Name and Address: (if different from business location) |

||||||

|

Street |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Street |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Zip Code |

|

|

City |

|

State |

||

|

|

|

|

|

|

|

|

|

|

|

(give 9 digit postal code) |

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions for providing alternate addresses) |

|

|

|

(give 9 digit postal code) |

|||

BUSINESS DETAIL

G. |

Beginning date for this business: |

|

|

/ |

|

|

/ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

H. |

Type of ownership (check one): |

Month |

Day |

Year |

|||||||

|

|

|

|

|

|

|

|

||||

|

☐ NJ Corporation |

☐ Sole Proprietor |

☐ Partnership |

||||||||

|

☐ Limited Partnership |

☐ LLC (1065 Filer) |

☐ LLC (1120 Filer) |

||||||||

|

|

|

|

|

|

|

|

|

|||

I. |

New Jersey Business Code |

|

|

|

|

(see instructions) |

|||||

J. |

County/Municipality Code |

|

|

|

|

|

(see instructions) |

||||

|

|

|

|

|

|||||||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||

L. |

Will this business be SEASONAL? |

☐ YES |

☐ NO |

|

|

||||||

|

If YES – Circle months business will be open: |

JAN FEB |

MAR |

||||||||

M.If an ENTITY (Item C) complete the following:

Date of Incorporation: |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

Year |

|||

(see instructions) |

|

O/C __________ |

|

|

|

|

|

|

☐ |

☐ Other ____________ |

|

☐LLC (Single Member) ☐ S Corporation (you must complete page 41)

☐ Domestic (Household Employer) |

|

|

FOR OFFICIAL USE ONLY |

|

||||||||

K. |

County __________________ |

|

DLN ___________________ |

|

||||||||

|

|

|||||||||||

|

|

|

|

|

|

|

||||||

|

(New Jersey only) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

APR |

MAY JUN |

JUL AUG |

SEP |

|

OCT NOV DEC |

|

||||||

State of Incorporation |

|

|

|

|

|

Fiscal Month |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNERSHIP DETAIL

|

|

|

|

|

|

|

NJ Business/Corp. # |

|

|

|

|

|

|

||

Is this a Subsidiary of another corporation? |

☐ YES |

☐ NO |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

||||||||||

If YES, give name and Federal ID# of parent: |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N. Standard Industrial Code |

|

|

|

|

(if known) |

O. NAICS |

|

|

|

|

|

|

(if known) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.Provide the following information for the owner, partners or responsible corporate officers. (If more space is needed, attach a rider.)

NAME |

|

|

SOCIAL SECURITY NUMBER |

HOME ADDRESS |

PERCENT OF |

||||||||||

(Last Name, First, MI) |

|

|

|

|

|

TITLE |

(Street, City, State, Zip Code) |

OWNERSHIP |

|||||||

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BE SURE TO COMPLETE THE NEXT PAGE

FEIN#: _______________________________________ |

NAME: _______________________________________ |

|||||||||

|

||||||||||

Each Question Must Be Answered Completely |

|

|||||||||

1. a. Have you or will you be paying wages, salaries or commissions to employees working in New Jersey within the next 6 months? …… |

☐ Yes ☐ No |

|||||||||

Give date of first wage or salary payment: |

|

|

/ |

|

|

/ |

|

|

|

|

|

Month |

|

Day |

|

Year |

|

||||

If you answered “No” to question 1.a., please be aware that if you begin paying wages you are required to notify the Client Registration Bureau |

|

|||||||||

at PO Box 252, Trenton NJ |

|

|

|

|

|

|

|

|

|

|

b. Give date of hiring first NJ employee: |

|

|

|

|

|

/ |

|

|

|

|

|

|

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

Year |

|

||||

c. Date cumulative gross payroll exceeds $1,000 |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

Year |

|||

d.Will you be paying wages, salaries or commissions to New Jersey residents working outside New Jersey?....................................................

e.Will you be the payer of pension or annuity income to New Jersey residents? .................................................................................................

f.Will you be holding legalized games of chance in New Jersey (as defined in Chapter 47 Rules of Legalized Games of Chance) where proceeds from any one prize exceed $1,000? ...................................................................................................................................................

g.Is this business a PEO (Employee Leasing Company)? (If yes, see page 6.) .....................................................................................................

2. Did you acquire ☐ Substantially all the assets; ☐ Trade or business; ☐ Employees; of any previous employing units? …………..…......

If answer is “No” go to question 4.

If answer is “Yes” indicate by a check whether ☐ in whole or ☐ in part, and list business name, address and registration number of predecessor or acquired unit and the date business was acquired by you. (If more than one, list separately. Continue on separate sheet if necessary).

Name of Acquired |

|

|

- |

|

|

|

|

|

|

|

ACQUIRED |

||

Unit |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

PERCENTAGE

ACQUIRED

|

|

|

|

|

NJ Employer ID |

|

|

☐ Assets |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

/ |

|

|

|

/ |

|

|

☐ Trade or Business |

|

|

|

Month |

|

|

Day |

Year |

☐ Employees |

||||

|

|

|

|

|

|

Date Acquired |

|

|

||||

3.Subject to certain regulations, the law provides for the transfer of the predecessor’s employment experience to a successor where the whole of a business is acquired from a subject predecessor employer. The transfer of the employment experience is required by law.

Are the predecessor and successor units owned or controlled by the same interests? ………………………………………………………………...…

4. Is your employment agricultural? ……………………………………………………………………………………………………………………..…….……

5. Is your employment household? ……………………………………………………………………………………………………………………..…………..

%

%

%

|

a. If yes, please indicate the date in the calendar quarter in which gross cash wages totaled $1,000 or more |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

6. |

Are you a 501(c)(3) organization? ….………………………………………………………………………………………………………...…………………. |

☐ Yes |

☐ No |

||||||||||

|

If “Yes” to apply for sales tax exemption, obtain form |

|

|

|

|||||||||

7. |

Were you subject to the Federal Unemployment Tax Act (FUTA) in the current or preceding calendar year? …………………………………..…..… |

☐ Yes |

☐ No |

||||||||||

|

(See instruction sheet for explanation of FUTA.) If “Yes” indicate year: |

|

|

|

|

|

|

|

|

|

|

|

|

8. |

a. Does this employing unit claim exemption from liability for contributions under the Unemployment Compensation Law of New Jersey? ...… |

☐ Yes |

☐ No |

||||||||||

If “Yes” please state reason. (Use additional sheets if necessary.)

b. If exemption from the mandatory provisions of the Unemployment Compensation Law of New Jersey is claimed, does this employing unit |

☐ Yes |

☐ No |

||||||||

wish to voluntarily elect to become subject to its provisions for a period of not less than two complete calendar years? ……………………… |

||||||||||

9. Type of business |

☐ |

1. |

Manufacturer |

☐ |

2. Service |

☐ |

3. |

Wholesale |

|

|

|

☐ |

4. |

Construction |

☐ |

5. Retail |

☐ |

6. |

Government |

|

|

Principal product or service in New Jersey only

Type of Activity in New Jersey only

10.List below each place of business and each class of industry in New Jersey, even though you may have only one place of business or engage in only one class of industry.

a. Do you have more than one employing facility in New Jersey ……………………………………………………………………..…………………. ☐ Yes ☐ No

NJ WORK LOCATIONS(Physical location, not mailing address) |

|

NATURE OF BUSINESS (See Instructions) |

|

||

|

|

|

|

|

|

Street Address, City, Zip Code |

County |

NAICS |

Principal Product or Service Complete Description |

% |

|

Code |

|||||

|

|

|

|

||

|

|

|

|

|

|

No. of Workers at Each

Location and/in Each Class

of Industry

(Continue on separate sheet, if necessary)

BE SURE TO COMPLETE THE NEXT PAGE

FEIN#: _______________________________________ NAME: _______________________________________

Each Question Must Be Answered Completely

11. a. Will you collect New Jersey Sales Tax and/or pay Use Tax? ……………………………………………………………..……... ☐ Yes ☐ No

GIVE EXACT DATE YOU EXPECT TO MAKE FIRST SALE |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

Month Day Year

b.Will you need to make exempt purchases for your inventory or to produce your product? ……………………..…………….

c. Is your business located in (check applicable box(es)): |

☐ Atlantic City |

☐ Salem County |

|

|

☐ North Wildwood |

☐ Wildwood Crest |

☐ Wildwood |

d.Do you have more than one location in New Jersey that collects New Jersey Sales Tax? (If yes, see instructions.)...…....

e.Do you, in the regular course of business, sell, store, deliver or transport natural gas or electricity to users or customers in this state whether by mains, lines or pipes located within this state or by any other means of delivery?.………..……….

12.Do you intend to sell cigarettes? …………………………………………………………………………………………………..…

Note: If yes, complete the

13.a. Are you a distributor or wholesaler of tobacco or nicotine products other than cigarettes?.………………………………...

b.Do you purchase tobacco or nicotine products other than cigarettes from outside the State of New Jersey? If yes, you are required to provide supplemental information directly to the Division of Taxation on Form

c.Do you intend to sell Container

d.Are more than 50% of your retail business’s sales derived from Container

Note: If yes, complete the Vapor Business License Application (form

This form is available at https://www.nj.gov/treasury/taxation/prnttobacco.shtml.

14.Are you a manufacturer, wholesaler, distributor or retailer of

15.Are you an owner or operator of a sanitary landfill facility in New Jersey?.………………………………………………..……. IF YES, indicate D.E.P. Facility # and type (See instructions)

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

16.a. Do you operate a facility that has the total combined capacity to store 200,000 gallons or more of petroleum products?

b.Do you operate a facility that has the total combined capacity to store 20,000 gallons (equals 167,043 pounds) of hazardous chemicals?.………………………………………………………………………………..……………………………….

c.Do you store petroleum products or hazardous chemicals at a public storage terminal?.…………………………………..… Name of terminal

17.a. Will you be involved with the sale of petroleum products?…………………………………………………………………………

Note: If yes, complete the

b.Will your company be engaged in the refining and/or distributing of petroleum products for distribution in this state or the importing of petroleum products into New Jersey for consumption in New Jersey?.........……………………………………..

c.Will your business activity require you to issue a Direct Payment Permit in lieu of payment of the Petroleum Products Gross Receipts Tax on your purchases of petroleum products?.……………………………………………………..…………..

18.Will you be providing goods and services as a direct contractor or subcontractor to the State, other public agencies including local governments, colleges and universities and school boards, or to casino licensees?.………………..……….

19.Will you be engaged in the business of renting motor vehicles for the transportation of persons or

20.Is your business a hotel, motel, bed & breakfast or similar facility (or do you provide other transient accommodation rentals (e.g., vacation rental, house, room, or similar lodging used on a transient basis) in the State of New Jersey?........

21.Will this business be operating in the Sports and Entertainments District of Millville, NJ?..……………………………..…….

If yes, will the business be engaged in obtaining gross receipts from any of the following (Circle all that apply if “Yes")

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

☐ Yes |

☐ No |

|

a. Sales, rental or leases of tangible personal property |

b. Sales of food & drink c. Charges of admission d. Rental charges for hotel occupancies |

|

||||||||||

22. |

Do you make retail sales of new motor vehicle tires, or sell or lease motor vehicles?.………………………………………... |

☐ Yes |

☐ No |

||||||||||

23. |

Do you sell voice grade access telecommunications or mobile telecommunications to a customer with a primary place of |

☐ Yes |

☐ No |

||||||||||

|

use in this State?.………………………………………………………………………………………………………… |

||||||||||||

24. |

Contact Information |

Person: |

|

Title: |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime Phone: ( |

)______ - ___________ |

Ext._______________ |

|

|

||||||||

|

Signature of Owner, Partner or Officer: |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title: |

|

|

|

|

|

|

|

Date: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO FEE IS REQUIRED TO FILE THIS FORM

IF YOU ARE A SOLE PROPRIETOR OR A PARTNERSHIP WITHOUT EMPLOYEES - STOP HERE -

IF YOU HAVE EMPLOYEES PROCEED TO THE STATE OF NJ NEW HIRE REPORTING FORM ON PAGE 29

IF YOU ARE FORMING A CORPORATION, LIMITED LIABILITY COMPANY, LIMITED PARTNERSHIP, OR A LIMITED LIABILITY PARTNERSHIP, YOU

MUST CONTINUE ANSWERING APPLICABLE QUESTIONS ON PAGES 23 AND 24

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The NJ REG form is a Business Registration Application required for businesses operating in New Jersey. |

| State Laws | This form is governed by the New Jersey Division of Revenue and Enterprise Services regulations, particularly under New Jersey State Administrative Code. |

| No Filing Fee | There is no fee required for filing this form, which encourages businesses, especially sole proprietors, to register. |

| Complete Sections | All sections of the NJ REG form must be fully completed to ensure proper business registration. |

| Mailing Information | Completed forms should be sent to the Client Registration address in Trenton, NJ, as specified in the instructions. |

| Seasonal Operation | Businesses must indicate if they operate seasonally and specify the months of operation, if applicable. |

Guidelines on Utilizing Nj Reg

To complete the NJ Reg form, individuals and businesses must follow specific steps to ensure accurate submission. This process involves providing essential information about the business, its ownership, and operational details. The NJ Reg form is critical for facilitating business registration in New Jersey and must be filled thoroughly to prevent any delays in processing.

- Identify the reason for filing: Check the appropriate box for your filing, such as an original application, amended application, or business registration certificate.

- Provide identification numbers: Enter the Federal Employer Identification Number (FEIN) or Social Security Number for the owner. If applied for, check the corresponding box.

- Enter business names: If applicable, fill in the name of the business entity, owner, or partners, along with the trade name.

- Input business locations: Write the physical address of the business, avoiding P.O. Box addresses. Include mailing address if it differs from the business location.

- Specify business details: Indicate the starting date of the business and check the type of ownership that applies to your situation.

- Fill out industry information: Enter the New Jersey Business Code and County/Municipality Code as instructed.

- Provide seasonal business details: If the business operates seasonally, indicate the months of operation.

- State involvement with employment: Answer questions regarding employment, employee payments, and any acquisition of previous business units.

- Complete additional questions: Address various inquiries that pertain to the type of business, involvement with tobacco, petroleum products, sales tax collection, and more.

- List ownership details: Fill out the information for owners, partners, or responsible corporate officers, including names, titles, and ownership percentages.

- Contact information: Provide the contact person's title, phone number, and email address.

- Sign and date the form: Ensure the owner, partner, or officer of the business signs and dates the document.

Upon completing all sections, the form must be submitted to the Client Registration via the appropriate mailing address. It is imperative to check that all information is accurate and complete to avoid any processing issues.

What You Should Know About This Form

What is the NJ-REG form?

The NJ-REG form is the Business Registration Application for the State of New Jersey. It is required for businesses looking to register or make updates to their business status. This includes those starting a new business, moving an existing one, or making amendments to their registration details. You don’t need to pay a fee to file this form.

Who needs to fill out the NJ-REG form?

If you are starting a new business, changing the location of an existing one, or if you need to amend your current business registration, you need to fill out the NJ-REG form. It is also necessary if you will be paying wages and have employees in New Jersey.

Where do I send the NJ-REG form once it's completed?

You can mail the completed NJ-REG form to the Client Registration at PO Box 252, Trenton, NJ 08646-0252. If you prefer overnight delivery, use the address 33 West State St, 3rd Floor, Trenton, NJ 08608.

What information do I need to provide on the NJ-REG form?

The form requires various details including your business's reason for registering, ownership type, business location, and owner information. You will also have to answer questions about whether you will pay wages, and if applicable, provide details about your business activities and locations in New Jersey.

Is there a fee required to file the NJ-REG form?

No fee is required to file the NJ-REG form, especially if you are a sole proprietor or partnership without employees. This applies to submissions made by individuals starting their businesses or making basic registration updates.

What should I do if I hire employees after filing the NJ-REG form?

If you hire employees after you file the NJ-REG form, you need to notify the Client Registration Bureau. You can do this by sending a letter to the mailing address or by calling their hotline at 609-292-9292. Keep records of when you start paying wages.

Can I use the NJ-REG form to apply for a Business Registration Certificate?

Yes, one of the reasons you can file the NJ-REG form is to apply for a Business Registration Certificate. This certificate confirms that your business is registered and in compliance with New Jersey regulations.

What if I have questions while filling out the NJ-REG form?

If you have questions while completing the NJ-REG form, you can contact the Client Registration Bureau. They have a hotline at 609-292-9292 and are available to assist you with any concerns or clarifications you may need regarding the form or the registration process.

Common mistakes

Filling out the NJ Reg form can be straightforward, but many people make common mistakes that can lead to unnecessary delays or complications. One frequent error is failing to check the appropriate box that indicates the reason for filing the application. Missing this step means the application may be processed incorrectly or not at all.

Another common mistake is leaving the Federal EIN or Social Security Number blank. This number is crucial for identifying your business in the state system. Without it, your application cannot be processed. It's also essential to check the box if you have applied for one. Ignoring this can create confusion regarding your status.

Many applicants also forget to include the full legal name of their business or provide the name of the owner or partners when applicable. In cases where your business is an entity, list the correct name, or your application may be returned.

Some people mistakenly use a P.O. Box for the business location instead of a street address. This is not permitted on the form; a physical address is required. Failing to adhere to this guideline can result in rejection of your application or delay in processing.

In the business detail section, individuals sometimes overlook stating the correct beginning date for business operations. Ensure this information is accurate as it helps the state understand your business timeline and compliance obligations.

Another area where applicants tend to falter is in selecting the type of ownership. This choice is important and must be accurately identified, either as a Corporation, Sole Proprietor, Partnership, or LLC. Misclassification can lead to incorrect tax implications and legal responsibilities.

Inadequate responses to ownership detail can lead to problems as well. It's critical to provide full information about all owners, partners, or responsible corporate officers. Leaving any fields blank or providing insufficient details can result in a complete application rejection.

Many applicants fail to answer all questions fully. Each section must be completed for the application to move forward smoothly. It's advisable to double-check the form before submission to ensure all fields have been filled correctly.

Lastly, another common mistake involves not understanding the specific requirements related to state tax obligations. Individuals may overlook important questions related to sales tax collection or other tax liabilities. This oversight can lead to significant issues down the line if not addressed up front.

Documents used along the form

The NJ REG form is a vital document for businesses registering in New Jersey. However, several other forms and documents often accompany this application, each serving a specific purpose in the registration process. Below is a list of these common forms, along with a brief description of their intended use. Familiarizing yourself with these documents can streamline your business registration experience.

- REG-C-L: This form is utilized when a registered business moves to a new location. It serves as an alternative to the NJ REG form in such cases, ensuring that the business’s registration information stays up-to-date.

- REG-1E: Non-profit organizations use this form to apply for sales tax exemption in New Jersey. It is essential for organizations wanting to avoid sales tax on certain purchases related to their charitable activities.

- CM-100: This application is needed for those intending to sell cigarettes in New Jersey. It is essential for compliance with state regulations regarding tobacco sales.

- TPT-R: Tobacco and Nicotine Products Registration Form TPT-R is required for individuals or businesses that purchase tobacco or nicotine products from outside New Jersey. It ensures compliance with local tax requirements.

- VB-R: The Vapor Business License Application, or VB-R, must be completed by businesses engaged in selling e-liquids or electronic smoking devices. This form verifies that the business adheres to New Jersey's vaping regulations.

- MFA-1: If a business plans to distribute or refine petroleum products in New Jersey, this application for a motor fuel license is necessary. It establishes compliance with laws governing petroleum products.

Understanding the purpose of each of these forms will help you navigate the business registration process in New Jersey more effectively. Always ensure that all documents are completed fully to avoid delays in your registration and compliance efforts.

Similar forms

- Business License Application: Similar to the NJ Registration Form, both documents serve to formally establish a business. They require detailed information about the business structure, ownership, and type of business activities.

- Employer Identification Number (EIN) Application: The EIN application and the NJ Registration Form both necessitate the disclosure of business ownership details, including social security numbers or tax identification numbers for compliance and identification purposes.

- Sales Tax Registration: Like the NJ Registration Form, this document is essential for businesses planning to collect sales tax. It also covers basic information about the business's location and type of operation.

- Professional License Application: This application shares similarities with the NJ Registration Form as both require applicants to provide essential business information and personal details of the owners or partners involved in the business.

- Business Privilege License: Comparable to the NJ Registration Form, this document ensures that a business is legally recognized and compliant with local regulations, requiring detailed operational and ownership information.

- State Contractor Registration Form: Both forms require information related to the business structure, ownership details, and types of services provided. This is particularly relevant for businesses looking to engage as contractors with state agencies.

- New Jersey Domestic Employer Registration: This registration overlaps with the NJ Registration Form in that both address employment practices and require information about employer identification and the nature of work being done.

- Nonprofit Organization Registration: Similar to the NJ Registration Form, this document requires detailed insights into the organization’s structure and governance while ensuring compliance with state regulations.

- Liquor License Application: Both the liquor license application and the NJ Registration Form demand comprehensive business-related information, including the ownership structure and address, as part of the licensing process.

- Home Occupation Permit Application: This document also parallels the NJ Registration Form in that it necessitates business details and seeks to ensure that all applicable zoning laws and regulations are observed.

Dos and Don'ts

When filling out the NJ Reg form, it is essential to follow specific guidelines to ensure accuracy and compliance.

- Read the instructions thoroughly before starting to fill out the form.

- Complete all sections fully, as incomplete applications may delay processing.

- Provide a physical address for your business location instead of a P.O. Box.

- Use accurate and current information, including your Federal Employer Identification Number or Social Security Number.

- Indicate any seasonal business operations by checking 'YES' and specifying the months of operation.

- Double-check for any errors or omissions before sending the form.

- Mail the completed form to the correct address provided for both regular and overnight delivery options.

Avoid the following common mistakes when completing the NJ Reg form:

- Do not leave any mandatory fields unanswered.

- Avoid using the form to report changes in business status without indicating the correct reason for filing.

- Do not assume prior registration information is still valid; update all information as necessary.

- Refrain from submitting the form without thorough proofreading.

- Do not delay sending the form, especially if you plan to hire employees soon.

- Avoid sending your application without proper accompanying documentation when applicable.

- Do not forget to include the contact information of a responsible person for any inquiries.

Misconceptions

- All sections of the NJ REG form are optional. Many believe that filling out the NJ REG form is a casual process, but this is not the case. Every section must be completed fully to ensure the registration is valid and processed without delays.

- You need to pay a fee to file the NJ REG form. Contrary to popular belief, there is no fee required to submit this application. This misconception can deter potential business owners from completing their registration.

- The NJ REG form is only for new businesses. This form is not limited to new businesses. Existing businesses moving to a new location or those making amendments also need to fill it out to maintain compliance.

- You can use a P.O. Box for your business location. The form specifically prohibits using a P.O. Box as the business location. Providing an accurate physical address is crucial for effective communication and service delivery.

- Your application will be processed quickly regardless of accuracy. Some think that as long as they submit the application, it will be processed quickly. Inaccuracies or incomplete information can lead to significant delays.

- Only corporations need to file the NJ REG. Individuals and partnerships also need to submit the NJ REG form when conducting business in New Jersey. It's essential to understand that all business entities require registration.

- Deadline adherence is not critical. Ignoring deadlines is a common mistake. Timely filing of the NJ REG form is essential to avoid fines and legal issues in the future.

- The information provided is kept confidential. While personal data has some privacy protections, certain information is public. This misconception may lead people to overlook disclosing accurate information.

- You do not have to update your registration if changes occur. If there are changes in ownership or business operations, failing to update your registration can lead to compliance and legal issues.

- Filing for multiple businesses is the same as filing for one. Each business requires a separate registration process. Failing to register a new business individually can lead to significant issues with local regulations.

Key takeaways

When navigating the NJ Reg form, attention to detail is crucial. Here are key takeaways to keep in mind:

- Complete the Form Thoroughly: All sections must be filled out completely. Incomplete submissions can lead to delays.

- Understand the Filing Purpose: Identify why you are filling out the form—whether it is for a new business, a move, or an amendment.

- Correct Mailing Address: Ensure you provide the correct mailing address for your business; do not use a P.O. Box for the business location.

- Business Identification: Provide your Federal Employer Identification Number (FEIN) or Social Security number as needed.

- Ownership Type: Clearly indicate the type of ownership, as this impacts your registration process.

- Seasonal Operations: If your business is seasonal, specify the months of operation. This affects tax and reporting obligations.

- Employee Information: Be prepared to respond to questions about any wages paid to employees in New Jersey within the next six months.

- Multiple Locations: If your business has multiple locations, provide details for each site, including their respective business activities.

- Sales Tax Collection: If applicable, indicate whether your business will collect New Jersey Sales Tax or will need to make exempt purchases.

- Consult Resources: Don’t hesitate to reach out to the Client Registration Bureau for any concerns or questions you may have.

Using the NJ Reg form properly sets the foundation for your business operations in New Jersey. Ensure to follow these steps thoughtfully to facilitate a smooth registration process.

Browse Other Templates

Sky Zone Donation Request - We appreciate the valuable work of every non-profit we work with.

Trampoline Arena Participant Waiver,Airheads Liability Release Form,Trampoline Activity Agreement,Airheads Safety and Risk Acknowledgment,Trampolining Participation Agreement,Airheads Risk Acceptance Form,Trampoline Arena Waiver of Liability,Airheads - The agreement emphasizes voluntary acceptance of all activity-related risks.