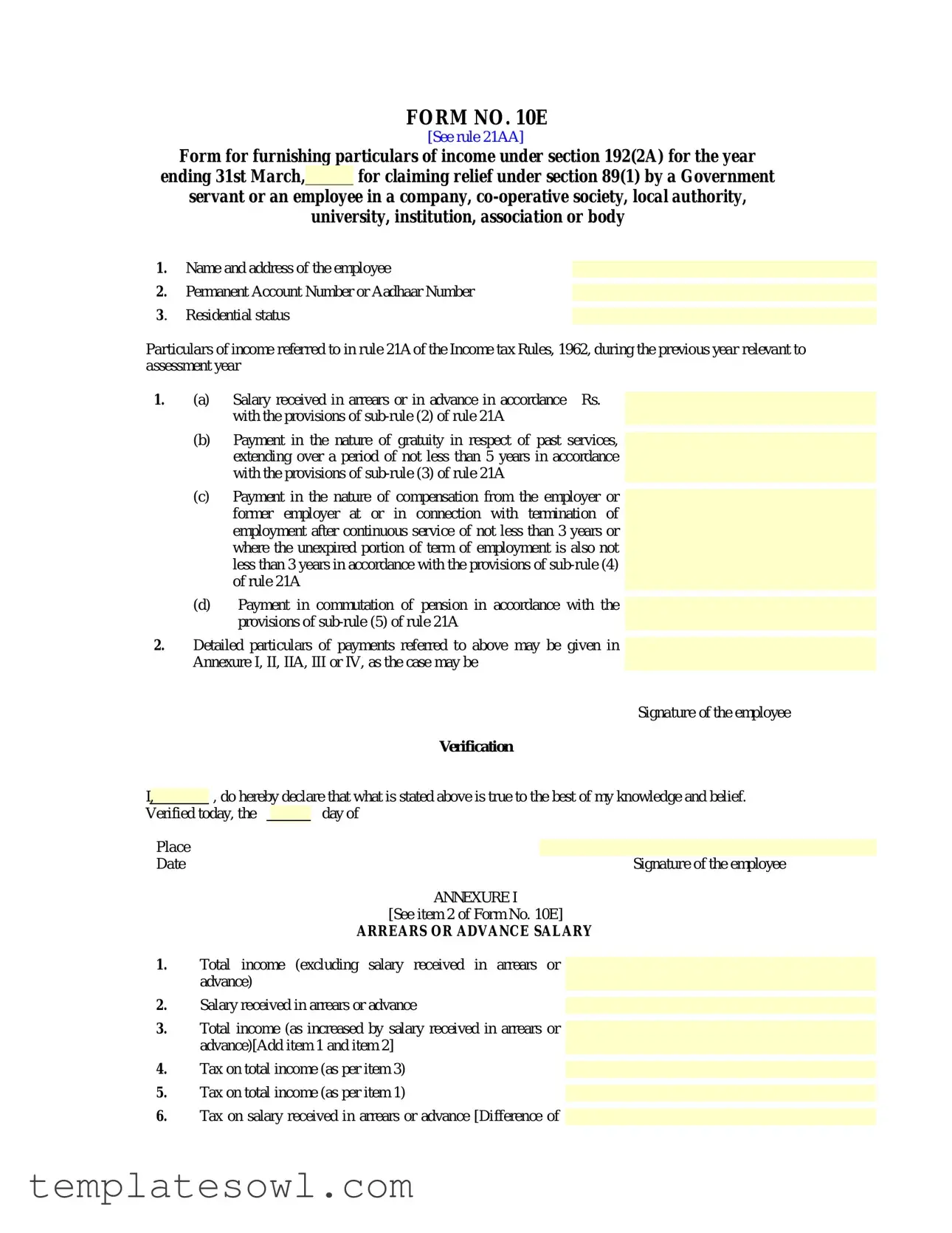

Fill Out Your No 10E Form

The No 10E form serves as a crucial instrument for Government employees and employees from a range of organizations, including private companies and local authorities, to account for specific types of income. This form is used primarily for providing information under section 192(2A) for the financial year ending March 31st, and it facilitates the claim for relief under section 89(1) of the Income Tax Act. Key sections within the form require personal details, such as the employee's name, address, and identification numbers, along with their residential status. A more detailed account of various income types must be provided, including salary received in arrears, gratuity payments for long service, compensation received upon termination of employment, and pension commutation. The structure of the form includes annexures that allow for detailed computations necessary to determine tax liability and applicable reliefs. Employees are required to affirm the accuracy of their reported income and calculations through a signature, establishing the credibility of the submitted information. Such thoroughness not only aids individuals in complying with tax regulations but also ensures they receive the correct financial relief they are entitled to.

No 10E Example

FORM NO. 10E

[See rule 21AA]

Form for furnishing particulars of income under section 192(2A) for the year

ending 31st March, for claiming relief under section 89(1) by a Government

for claiming relief under section 89(1) by a Government

servant or an employee in a company,

university, institution, association or body

1. Name and address of the employee

2. Permanent Account Number or Aadhaar Number

3. Residential status

Particulars of income referred to in rule 21A of the Income tax Rules, 1962, during the previous year relevant to assessment year

1. |

(a) |

Salary received in arrears or in advance in accordance Rs. |

|

|

with the provisions of |

(b)Payment in the nature of gratuity in respect of past services, extending over a period of not less than 5 years in accordance with the provisions of

(c)Payment in the nature of compensation from the employer or former employer at or in connection with termination of employment after continuous service of not less than 3 years or where the unexpired portion of term of employment is also not less than 3 years in accordance with the provisions of

(d)Payment in commutation of pension in accordance with the provisions of

2.Detailed particulars of payments referred to above may be given in Annexure I, II, IIA, III or IV, as the case may be

|

|

|

|

|

|

|

Signature of the employee |

|

|

|

|

|

|

|

Verification |

||

I, |

|

, do hereby declare that what is stated above is true to the best of my knowledge and belief. |

||||||

|

|

|

|

|

|

day of |

||

Verified today, the |

|

|||||||

|

||||||||

|

|

Place |

|

|

|

|||

|

|

|

|

|

||||

|

|

Date |

|

|

Signature of the employee |

|||

ANNEXURE I

[See item 2 of Form No. 10E]

ARREARS OR ADVANCE SALARY

1.Total income (excluding salary received in arrears or advance)

2. Salary received in arrears or advance

3. Total income (as increased by salary received in arrears or advance)[Add item 1 and item 2]

4. Tax on total income (as per item 3)  5. Tax on total income (as per item 1)

5. Tax on total income (as per item 1)  6. Tax on salary received in arrears or advance [Difference of

6. Tax on salary received in arrears or advance [Difference of

item 4 and item 5]

7. Tax computed in accordance with Table "A" [Brought from column 7 of Table "A"]

8. Relief under section 89(1) [Indicate the difference between the amounts mentioned against items 6 and 7]

TABLE "A"

[See item 7 of Annexure I]

Previous |

Total income of |

Salary recieved in |

Total income (as |

Tax on total income |

Tax on total income |

Difference in tax |

|

year(s) |

the relevant |

arrears or advance |

increased by salary |

[as per column(2)] |

[as per column(4)] |

[Amount under column |

|

|

previous year |

relating to the |

received in arrears or |

|

|

(6) minus amount under |

|

|

|

relevant previous |

advance) of the |

|

|

column (5)] |

|

|

|

year as mentioned |

relevant previous year |

|

|

|

|

|

|

in column(1) |

mentioned in |

|

|

|

|

|

|

|

column(1) [Add |

|

|

|

|

|

|

|

columns (2) and (3)] |

|

|

|

|

|

(Rs.) |

(Rs.) |

(Rs.) |

(Rs.) |

(Rs.) |

(Rs.) |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note : In this Table, details of salary received in arrears or advance relating to different previous years may be furnished.

ANNEXURE II

[See item 2 of Form No. 10E]

GRATUITY

Past services extending over a period of 5 years or more but less than 15 years

1. Gratuity received

2. Total income (including gratuity)

3. Tax on total income mentioned against item 2

4.Average rate of tax applicable on total income [Divide amount mentioned against item 3 by amount mentioned against item 2]

5.Tax payable on gratuity by applying the average rate of tax [Multiply average rate of tax mentioned against item 4 with amount of gratuity mentioned against item 1]

6.Total income of two previous years immediately preceding the previous year in which gratuity is received

(i)  (ii)

(ii)

7.Add

(i)  (ii)

(ii)

8. Tax on total income of each of the preceding previous years mentioned against item 7

(i)

(ii)

9.Average rate of tax on the total income of each of the two preceding previous years as increased by ½ of gratuity calculated for that year as mentioned against item 7

[Divide the amounts mentioned against items 8(i) and 8(ii) by the amount mentioned against items 7(i) and 7(ii) respectively]

(i)  (ii)

(ii)

10. Average of average rates of tax mentioned against item 9 [Add the averages of tax mentioned against items 9(i) and (ii) and divide it by 2]

11. Tax payable on gratuity by applying the average of average rates of tax [Multiply the average against item 10 by the amount of gratuity mentioned against item 1]

12.Relief under section 89(1) [Indicate the difference between the amounts mentioned against items 11 and 5]

ANNEXURE IIA

[See item 2 of Form No. 10E]

GRATUITY

Past services extending over a period of 15 years and more

1. |

Gratuity received |

|

2. |

Total income (including gratuity) |

|

3. |

Tax on total income mentioned against item 2 |

|

4. |

Average rate of tax applicable on total income [Divide |

amount |

|

mentioned against item 3 by amount mentioned against item 2] |

|

5. |

Tax payable on gratuity by applying the average rate of tax |

|

|

[Multiply average rate of tax mentioned against item 4 with |

|

|

amount of gratuity mentioned against item 1] |

|

6. |

Total income of three previous years immediately preceding the |

|

|

previous year in which gratuity is received |

(i) |

|

|

|

|

|

(ii) |

|

|

(iii) |

7. |

Add |

|

|

income of each of the three preceding previous years mentioned |

|

|

against item 6 |

(i) |

|

|

|

|

|

(ii) |

|

|

(iii) |

8. |

Tax on total income of each of the preceding previous years |

|

|

mentioned against item 7 |

(i) |

|

|

|

|

|

(ii) |

|

|

(iii) |

9. |

Average rate of tax on the total income of each of the three |

|

|

preceding previous years as increased by |

|

|

calculated for that year as mentioned against item 7 [Divide the |

|

|

amounts mentioned against items 8(i), 8(ii) and 8(iii) by the |

|

|

amount mentioned against items 7(i), 7(ii) and 7(iii) respectively] |

|

|

|

(i) |

(ii)  (iii)

(iii)

10. Average of average rates of tax mentioned against item 9 [Add the averages of tax mentioned against items 9(i) to (iii) and divide it by 3]

11. Tax payable on gratuity by applying the average of average rates of tax [Multiply the average against item 10 by the amount of gratuity mentioned against item 1]

12.Relief under section 89(1) [Indicate the difference between the amounts mentioned against items 11 and 5]

ANNEXURE III

COMPENSATION ON TERMINATION OF EMPLOYMENT

Condition : After continuous service of three years and where unexpired portion of term of employment is also

not less than three years

1. Compensation received

2.

3.

4.Average rate of tax applicable on total income [Divide amount mentioned against item 3 by amount mentioned against item 2]

5. Tax payable on compensation by applying the average rate of tax [Multiply average rate of tax mentioned against item 4 with amount of compensation mentioned against item 1]

6.Total income of three previous years immediately preceding the previous year in which compensation is received

(i)  (ii)

(ii)

(iii)

7.Add

(i)  (ii)

(ii)

(iii)

8.Tax on total income of each of the preceding previous years mentioned against item 7

(i)  (ii)

(ii)

(iii)

9.Average rate of tax on the total income of each of the three preceding previous years as increased by

(i)  (ii)

(ii)

(iii)

10. Average of average rates of tax mentioned against item 9 [Divide by three, the total of averages of tax mentioned against items 9(i) to

(iii)]

11. Tax payable on compensation by applying the average of average rates of tax [Multiply the average against item 10 by the amount of compensation mentioned against item 1]

12.Relief under section 89(1) [Indicate the difference between the amounts mentioned against items 11 and 5]

ANNEXURE IV

COMMUTATION OF PENSION

1. Amount in commutation of pension received

2.

3.

4. Average rate of tax applicable on total income

[Divide amount mentioned against item 3 by amount mentioned against item 2]

5. Tax payable on amount in commutation of pension by applying the average rate of tax

[Multiply average rate of tax mentioned against item 4 with amount in commutation of pension mentioned against item 1]

6.Total income of each of the three previous years immediately preceding the previous year in which amount in commutation of pension is received

(i)  (ii)

(ii)

(iii)

7.Add

(i)  (ii)

(ii)

(iii)

8.Tax on total income of each of the preceding previous years mentioned against item 7

(i)  (ii)

(ii)

(iii)

9.Average rate of tax on the total income of each of the three preceding previous years as increased by

[Divide the amount mentioned against items 8(i), 8(ii) and 8(iii) by the amount mentioned against items 7(i),7(ii) and 7(iii), respectively]

(i)  (ii)

(ii)

(iii)

10. Average of average rates of tax mentioned against item 9 [Divide by three, the total of averages of tax mentioned against items 9(i) to (iii)]

11.Tax payable on amount in commutation of pension by applying the average of average rates of tax

[Multiply the average against item 10 by the amount in commutation of pension mentioned against item 1]

12.Relief under section 89(1)

[Indicate the difference between the amounts mentioned against items 11 and 5]

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The No 10E form is used for submitting details of income to claim relief under section 89(1) for government employees and employees of certain organizations. |

| Applicable Laws | This form is governed by the Income Tax Act and the Income Tax Rules, specifically rule 21AA and section 192(2A). |

| Income Types | It encompasses salary in arrears, gratuity, compensation, and commutation of pension. |

| Filing Year | The form must be filled out for the income pertaining to the year that ends on March 31st. |

| Documentation Requirement | Supports detailed particulars of income through annexures, which help clarify specific income types mentioned. |

| Verification | Employee signature is required on the form, indicating that the provided information is true to the best of their knowledge. |

| Relief Calculation | Relief under section 89(1) is calculated based on the difference in tax from income received in arrears or advance versus the overall taxable income for prior years. |

Guidelines on Utilizing No 10E

Filling out the No 10E form can seem daunting, but with a clear process, it becomes much easier. This form is essential for employees seeking relief under certain tax regulations. By carefully following the steps, you can ensure that all necessary information is provided accurately, facilitating a smoother submission.

- Start by entering your name and address in the designated section at the top of the form.

- Provide your Permanant Account Number (PAN) or Aadhaar Number in the next field.

- Indicate your residential status as prompted.

- For the particulars of income, fill in the amount of:

- Salary received in arrears or in advance according to rule 21A(2).

- Compensation or gratuity you received, ensuring it meets the required time frame.

- Any payment in commutation of pension you have received per rule 21A(5).

- If needed, provide detailed particulars of your payments in the appropriate annexure sections.

- Sign where indicated, confirming the accuracy of the information provided.

- Fill in the verification section with your name and the date of verification.

Once completed, the No 10E form can be submitted according to your organization's guidelines or local tax authority requirements. Make sure to keep copies for your records, and consider consulting a tax professional if any doubts arise during the process. Being thorough and accurate now will save you time and potential issues later on.

What You Should Know About This Form

What is the No 10E form?

The No 10E form is a document required under Indian tax regulations, specifically for those seeking relief under section 89(1) of the Income Tax Act. This form is primarily for government employees or employees from registered organizations, including companies and local authorities, who have received income that falls under certain categories such as salary in arrears, gratuity, or compensation after termination of employment.

Who needs to fill out the No 10E form?

Individuals who must fill out the No 10E form include government servants and employees of various organizations who have received income in the form of salary arrears, gratuity for past services, compensation upon termination, or commutation of pension. If any of these payments subject the individual to additional tax, the form serves to claim relief.

What details are required to complete the No 10E form?

When completing the No 10E form, employees need to provide essential details such as their name, address, Permanent Account Number (PAN) or Aadhaar Number, and their residential status. Additionally, they need to specify particulars of the qualifying income received during the relevant assessment year, further detailed in annexures related to salary arrears, gratuity, compensation, and commutation of pension.

How do I determine if I am eligible for relief under section 89(1)?

Eligibility for relief under section 89(1) mainly depends on the nature of the income received. If you have received salary in arrears, gratuity for services extending beyond five years, or compensation due to termination after a continuous service of at least three years, you may qualify. Each case should be carefully assessed against these provisions to ensure eligibility.

What are the consequences of not submitting the No 10E form?

If the No 10E form is not submitted despite receiving qualifying income, an employee may face higher tax liabilities. The government may not consider any possible relief when calculating tax on the additional income, which could result in overpayment of taxes. It’s crucial to complete and submit this form to properly account for any relief due to specific income categories.

Can I submit the No 10E form electronically?

Yes, individuals can often submit the No 10E form electronically through the online portal provided by the income tax department. However, confirm the latest submission methods as these may change. Ensuring that you have all required information at hand will facilitate the electronic filing process.

Is there a deadline for submitting the No 10E form?

The deadline for submitting the No 10E form typically aligns with the income tax return filing deadlines set by the government. It’s advisable to submit it well before this date to avoid complications and ensure you receive the relief in time. Consult the tax department’s guidelines or a tax expert if you have specific queries regarding the deadlines.

What happens after I submit my No 10E form?

Upon submission of the No 10E form, the income tax department will review the details provided. If approved, any applicable relief will be factored into your tax calculations. This may impact your overall tax liabilities and any refunds you might be eligible for. It’s important to retain copies of your submission for your records.

Common mistakes

Filling out the No 10E form can be a straightforward process, but many people make critical mistakes that can lead to delays or complications in receiving relief under section 89(1). Here are four common errors to be aware of as you complete this form.

First, many applicants fail to accurately report their Permanent Account Number (PAN) or Aadhaar Number. This number is crucial for identification. If this information is incorrect or missing, the submission is likely to be rejected. Always double-check that you have entered the correct number, as any discrepancies can create problems.

Second, individuals often overlook the requirement for detailed calculations within the annexures. Each annexure requests specific income details and tax calculations. For example, when reporting gratuity, all relevant figures must be filled out correctly and completely. Failing to provide this information can lead to incorrect assessments and possible loss of relief.

Additionally, some people inaccurately determine their average rate of tax. The form requires a precise calculation based on total income, including various forms of income like salary, gratuity, or compensation. Miscalculating this average can result in claiming less relief than you are entitled to or, worse, requesting an incorrect amount that may raise red flags with tax authorities.

Lastly, the verification section is often hastily completed. Applicants may forget to sign or improperly fill in the verification statement. A missing or incorrect signature can lead to further delays in processing your request. It’s vital to ensure that all sections of the form, especially those relating to verification, are completed thoroughly and accurately.

Avoiding these common mistakes can facilitate a smoother process when dealing with the No 10E form. Take your time to review every detail before submission, ensuring all sections are complete and accurate.

Documents used along the form

Understanding the various forms and documents associated with Form No. 10E can significantly streamline the process of claiming income relief. Employees and government servants often need to navigate through several forms, all of which serve different purposes. Below is a list of essential documents that frequently accompany the No 10E form.

- Permanent Account Number (PAN) Card: This document serves as proof of identity and is essential for tax purposes. It uniquely identifies taxpayers and links them to their financial transactions.

- Aadhaar Card: Similar to the PAN card, the Aadhaar card is a government-issued document that contains a unique identification number. It has become increasingly important for various financial processes and tax filing.

- Form 16: An annual tax document issued by employers, Form 16 summarizes an employee's earnings and the taxes deducted at source. It serves as a crucial reference for filing income tax returns.

- Calculation Sheet for Tax Relief: This sheet details the calculations used to determine the tax relief amount. It breaks down how the relief under section 89(1) is computed, providing clarity to the taxpayer.

- Salary Slips: These documents provide evidence of salary payments received by employees. They are essential for verifying income and ensuring that the amounts listed in tax submissions are accurate.

- Previous Year Tax Returns: Copies of tax returns filed in previous years can assist in the current year’s filings by offering a comparative understanding of income trajectories.

- Gratuity Payment Statements: When claiming relief related to gratuity, any statements or documentation evidencing gratuity payments will substantiate the claims made in Form No. 10E.

- Pension Commute Statements: For retirees claiming relief for pension commutation, statements detailing the amount and details of pension commutation will be required.

Understanding these documents and their relevance can empower individuals to effectively claim their rightful income relief. Each piece of documentation plays a pivotal role in substantiating income claims and ensuring compliance with tax regulations. Proper preparation leads to a smoother taxation experience.

Similar forms

The No 10E form is utilized for specific income declarations, particularly for individuals claiming relief under certain tax regulations. It shares similarities with other forms and documents commonly used in income tax contexts. Below is a list detailing six such documents that bear similarities to the No 10E form:

- Form 1040: This is the standard individual income tax return form used in the United States. Like the No 10E, Form 1040 gathers personal information from the taxpayer, including income details and deductions to determine overall tax liability.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Similar to the No 10E, it provides details about income received, which is essential for calculating taxes owed.

- Schedule A: Used to report itemized deductions on Form 1040, Schedule A allows taxpayers to detail various expenses that may reduce taxable income. The requirement for accurate income reporting parallels what's expected on the No 10E form.

- W-2 Form: Issued by employers, the W-2 form reports annual wages and the amount withheld for taxes. This document is comparable to the No 10E as both require details regarding income earned during a year.

- Form 8862: This form is used to claim the Earned Income Tax Credit (EITC) after it was previously denied. It demands information about income and eligibility, much like the income particulars detailed in the No 10E form.

- Form 843: This form is a claim for refund or request for abatement. It often requires similar personal income and tax details as the No 10E form when individuals seek to rectify previous tax filings or request refunds.

Dos and Don'ts

When filling out the No. 10E form, it’s essential to approach the process with care. Here’s a helpful list of things to do and avoid.

- Do: Provide accurate details about your name and address.

- Do: Ensure your Permanent Account Number or Aadhaar Number is correct.

- Do: Clearly state your residential status.

- Do: Include all relevant information regarding salary received in arrears or advance.

- Do: Submit detailed particulars in the appropriate annexures as required.

- Don't: Leave any fields blank if they are mandatory.

- Don't: Forget to verify the information before submitting.

- Don't: Ignore the tax computation details requested in the form.

- Don't: Provide false information under any circumstances.

Completing the No. 10E form accurately can help ensure you receive the relief you may be entitled to. Careful attention to detail is key!

Misconceptions

-

Misconception 1: The No 10E form is only for government employees.

This idea is misleading. The No 10E form is applicable not only to government servants but also to employees of companies, universities, local authorities, and associations. It accommodates various workers seeking to claim relief under specific income tax provisions.

-

Misconception 2: You only need to fill out the No 10E form if you receive a large arrear salary.

This is not accurate. The form is necessary whenever an employee receives certain types of payments, such as gratuities or compensation, regardless of the amount. Individuals should fill it out whenever they are eligible for the benefits it offers.

-

Misconception 3: The No 10E form is complex and hard to understand.

While it might seem daunting at first glance, the form is designed to be straightforward. It lists categories of income and calculations required for tax relief, making it easier for individuals to organize and report their earnings for the relevant year.

-

Misconception 4: There is no deadline for submitting the No 10E form.

This is incorrect. The form must be submitted within a specified time frame, typically when filing tax returns. Individuals may face penalties if they fail to submit the form on time.

-

Misconception 5: Filling out the No 10E form guarantees tax relief.

Filling out the form does not automatically secure tax relief. It must be completed accurately and supported by the necessary documentation. The relief is granted based on compliance with conditions outlined in the tax laws and regulations.

-

Misconception 6: You don't need to include details of previous years' income on the No 10E form.

This misconception often leads to errors. The form requires information about income from previous years related to arrears, gratuities, and other compensations. Providing this context is essential for accurately calculating tax liability and relief.

Key takeaways

Form No. 10E is designed specifically for individuals claiming relief under section 89(1) of the Income Tax Act. It's essential for both government servants and employees of various organizations.

Complete the form accurately, providing details such as name and address, Permanent Account Number (PAN) or Aadhaar Number, and residential status.

Income details must include specific payments like salary in arrears, gratuity payments, and compensation related to termination of employment.

For each income type, make sure to refer to the appropriate annexure, such as Annexure I for salary, Annexure II for gratuity, and Annexure III for compensation.

Before filing, verify the calculations of tax on total income, considering any applicable adjustments for arrears or gratuities.

It's advisable to maintain accurate records of all calculations, as these will support the claims made on the form.

Be mindful of deadlines for submitting the form. Timely filing ensures that your claims for tax relief are processed without delay.

A declaration of truthfulness must be signed by the employee. This step is crucial and reflects the importance of honesty in tax matters.

Seeking professional guidance can be beneficial if you're uncertain about any details or calculations related to Form No. 10E.

Browse Other Templates

How to Pay a Cell Phone Ticket in California - Evidence and witnesses can be presented in your defense.

Netspend All Access Phone Number - If the form is incomplete, it may slow down the process.