Fill Out Your Np 50 Form

The Kansas NP 50 form, an essential document for not-for-profit corporations, serves multiple crucial purposes. Each entity must submit this annual report to provide updated information about its operations and structure. It's important to pay the appropriate filing fee of $40, as any submissions without the correct payment will not be accepted. Timely filing is critical; the annual report is due on the 15th day of the sixth month after your tax closing month. For example, if your tax closing month is December, you must file by June 15 of the following year. Failing to do so could result in forfeiture of your business status, requiring a reinstatement process if relaunching is necessary. If changes need to be made to previously filed reports, a corrected document will facilitate this process. The NP 50 provides space to list key corporate officers and governing body members, ensuring transparency and accountability. Additionally, if applicable, questions regarding land ownership or leasing in Kansas suitable for agricultural use may also need addressing, reinforcing the form's comprehensive nature. Overall, carefully completing the NP 50 is vital for maintaining your corporation’s good standing and complying with state requirements.

Np 50 Example

Please |

|

|||

Not |

|

|||

DoStaple |

|

kansas secretary of state |

||

NP |

||||

|

|

|||

|

|

|||

|

50 |

Annual Report |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

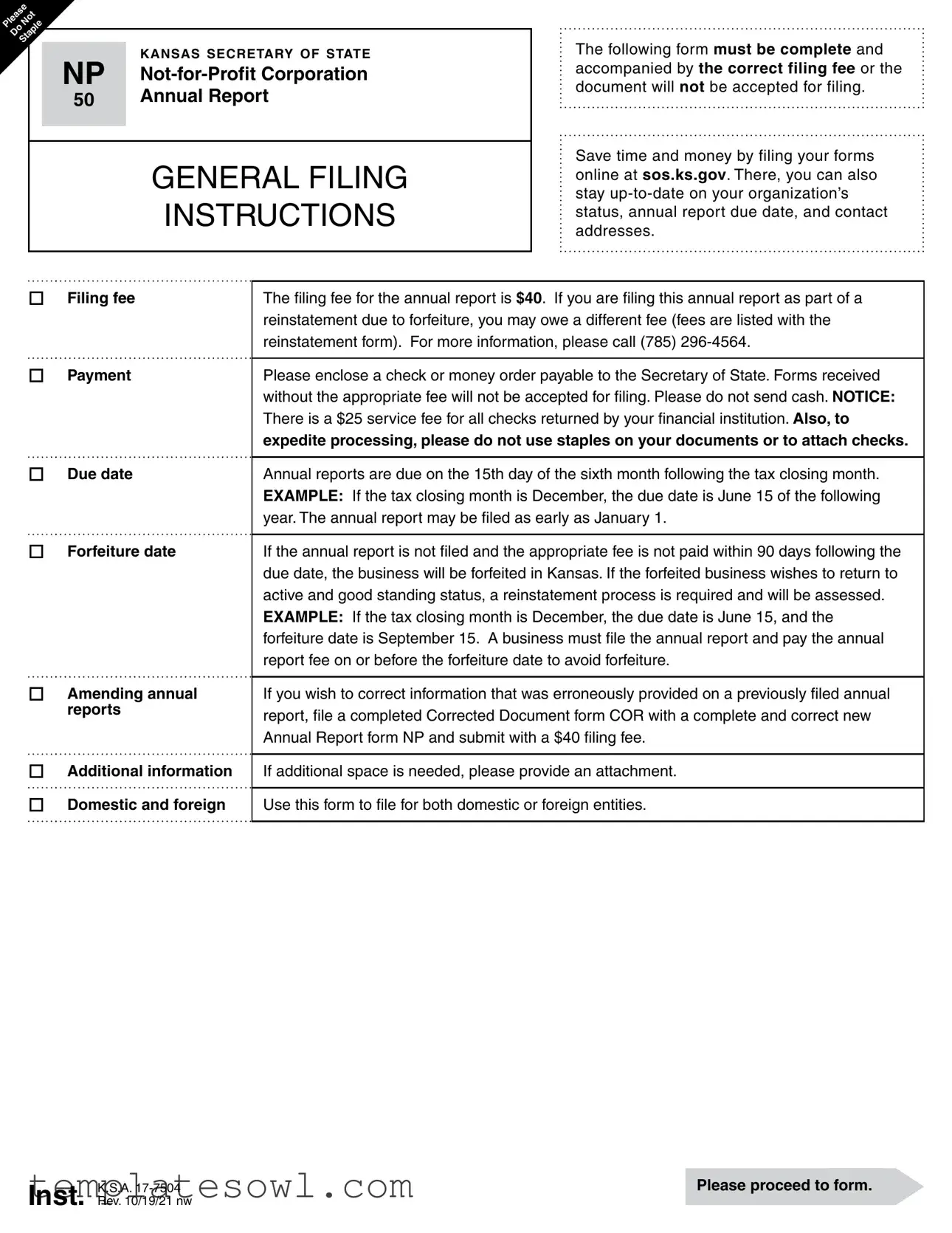

GENERAL FILING |

|

|

|

|

INSTRUCTIONS |

|

|

|

|

|

|

The following form must be complete and accompanied by the correct filing fee or the document will not be accepted for filing.

Save time and money by filing your forms online at sos.ks.gov. There, you can also stay

oFiling fee

oPayment

oDue date

oForfeiture date

oAmending annual reports

oAdditional information

oDomestic and foreign

The filing fee for the annual report is $40. If you are filing this annual report as part of a reinstatement due to forfeiture, you may owe a different fee (fees are listed with the reinstatement form). For more information, please call (785)

Please enclose a check or money order payable to the Secretary of State. Forms received without the appropriate fee will not be accepted for filing. Please do not send cash. NOTICE: There is a $25 service fee for all checks returned by your financial institution. Also, to expedite processing, please do not use staples on your documents or to attach checks.

Annual reports are due on the 15th day of the sixth month following the tax closing month. EXAMPLE: If the tax closing month is December, the due date is June 15 of the following year. The annual report may be filed as early as January 1.

If the annual report is not filed and the appropriate fee is not paid within 90 days following the due date, the business will be forfeited in Kansas. If the forfeited business wishes to return to active and good standing status, a reinstatement process is required and will be assessed.

EXAMPLE: If the tax closing month is December, the due date is June 15, and the forfeiture date is September 15. A business must file the annual report and pay the annual report fee on or before the forfeiture date to avoid forfeiture.

If you wish to correct information that was erroneously provided on a previously filed annual report, file a completed Corrected Document form COR with a complete and correct new Annual Report form NP and submit with a $40 filing fee.

If additional space is needed, please provide an attachment.

Use this form to file for both domestic or foreign entities.

Inst. |

K.S.A. |

Please proceed to form. |

Rev. 10/19/21 nw |

|

Please |

|

||

Not |

|

||

DoStaple |

|

kansas secretary of state |

|

NP |

|||

|

|||

|

|||

|

50 |

Annual Report |

|

|

|

|

|

Memorial Hall, 1st Floor |

(785) |

120 S.W. 10th Avenue |

kssos@ks.gov |

Topeka, KS |

sos.ks.gov |

|

Reset |

|

|

|

|

Please complete the form, print, sign and mail to the Kansas Secretary of State with the filing fee. Selecting 'Print'will print the form and 'Reset'will clear the entire form.

THIS SPACE FOR OFFICE USE ONLY.

1.Business entity ID/file number

2.Name of corporation

3.Principal office address

Must be a street, rural route, or highway. A P.O. box is unacceptable.

4.Tax closing date

This is not the Federal Employer ID

Number (FEIN).

Must match name on record with

Kansas Secretary of State.

Street Address

City |

|

|

State |

Zip |

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

Year |

5. State of incorporation |

|

|

||

|

|

|

|

|||

|

|

|

|

|

|

|

6a. Name, title, and address of each officer of corporation

If additional space is needed, please provide attachment.

Do not leave blank.

Name |

Title |

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

Name |

Title |

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

Name |

Title |

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

1 / 2 |

K.S.A. |

Please continue to next page. |

Rev. 10/19/21 nw |

|

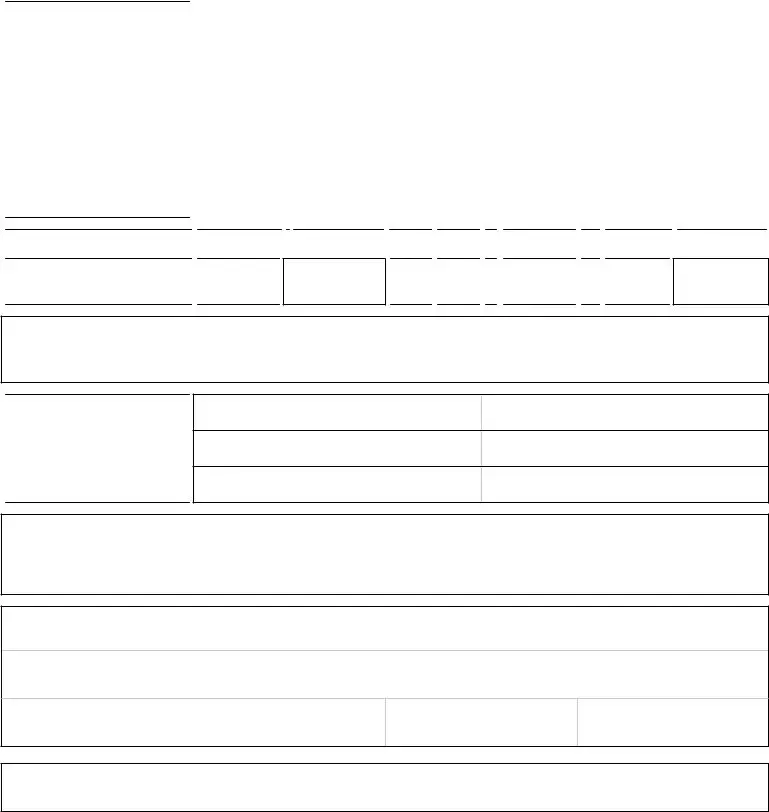

6b. Name and address of each member of governing body of corporation

If additional space is needed, please provide attachment.

Leave this question blank if the governing body members and officers are the same.

Name |

Address |

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

Name |

Address |

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

Name |

Address |

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

nAnswer either Question 7 or Question 8.

7.Total number of shares of capital stock issued

8.Total number of memberships

Must be numeric. “NA” or

9a. Does this corporation hold more than 50% equity ownership in any other business entity that is filed with the Kansas Secretary of State?

o Yes (Complete Question 9b.) o No (Skip to Question 10.)

9b. Name and ID number of each business

Name and ID # should be provided exactly as filed with Kansas Secretary of State.

Business Entity Name

Business Entity Name

Business Entity Name

Business Entity ID Number (Not FEIN)

Business Entity ID Number (Not FEIN)

Business Entity ID Number (Not FEIN)

10. Does this corporation own or lease land in Kansas that is suitable for use in agriculture?

This question does not apply to 1) tracts of land of fewer than 10 acres, 2) contiguous tracts of land that are fewer than 10 acres in aggregate, or 3)

o Yes (Complete Attachment AG.) o No (Skip to Question 11.)

11.I declare under penalty of perjury pursuant to the laws of the state of Kansas that the foregoing is true and correct.

Signature of Authorized Signer

X

Name of Signer (printed or typed)

Title/Position (Required)

Phone Number (Not required)

Please note that information provided on documents filed with the Secretary of State is public record that is subject to public access and disclosure (per K.S.A.

2 / 2 |

K.S.A. |

Please review to ensure completion. |

Rev. 10/19/21 nw |

|

|

|

kansas secretary of state |

|

|

|

|

AG |

Annual Report Agricultural Attachment |

|

for Forms AR or NP |

|

|

|

|

|

|

|

Complete this form only if the business entity owns or leases land suitable for agricultural use. All information must be complete or this document will not be accepted for filing.

Note: This form must be completed if Question 10 on annual report form is answered “yes.”

1.Provide information on each lot, tract or parcel of agricultural land in Kansas owned or leased by corporation.

Location of tract or lot

County |

Section |

Township |

Range |

Number of acres in tract or lot |

Was this tract acquired after July 1, 1981?

Yes |

No |

Purpose for which land is owned or leased.

Indicate for each tract or parcel if the tract is …

Owned by corporation |

Leased to corporation |

Leased from corporation |

If leased from corporation, indicate to whom leased. |

2.Total agricultural acres

Must be numeric values. “NA” or

3.Total number of stockholders

4.Value and location of agricultural and nonagricultural assets owned and controlled by corporation

Include all assets within and outside of Kansas.

All lines must be complete.

A. Total acres owned or operated |

B. Total acres owned or operated, and irrigated |

|

|

C. Total acres leased to the corporation |

D. Total acres leased to the corporation and irrigated |

|

|

E. Total acres leased from the corporation |

F. Total acres leased from the corporation and irrigated |

|

|

|

|

|

|

|

|

Within Kansas - Agricultural |

|

Value |

Location |

|

|

Within Kansas - Nonagricultural |

|

Value |

Location |

|

|

Outside of Kansas - Agricultural |

|

Value |

Location |

|

|

Outside of Kansas - Nonagricultural |

|

Value |

Location |

|

|

Att. |

K.S.A. |

Please review to ensure completion. |

Rev. 10/19/21 nw |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Fee | The filing fee for the NP 50 Annual Report is $40. |

| Online Filing | Forms can be submitted online at sos.ks.gov to save time and money. |

| Annual Report Due Date | Annual reports are due on the 15th day of the sixth month following the tax closing month. |

| Forfeiture Date | If not filed within 90 days of the due date, the business risks forfeiture in Kansas. |

| Reinstatement Process | A reinstatement process must be followed if a business wishes to regain active status after forfeiture. |

| Correcting Information | To correct previously provided information, a Corrected Document form (COR) must be submitted along with a new NP form and fee. |

| Public Record | Information filed is considered public record, subject to access and disclosure laws (K.S.A. 45-215 through K.S.A. 45-223). |

| Payment Method | A check or money order must be included, payable to the Secretary of State. Cash is not accepted. |

| Service Fee | There is a $25 service fee for any returned checks from the financial institution. |

| Governing Law | The NP 50 Annual Report is governed by K.S.A. 17-7504. |

Guidelines on Utilizing Np 50

After completing the NP 50 form, it is essential to ensure all information is accurate and that the form is accompanied by the appropriate filing fee. The timely submission of this document will help maintain your organization's good standing in the state of Kansas.

- Obtain the NP 50 form from the Kansas Secretary of State’s website.

- Fill in your business entity ID or file number at the top of the form.

- Enter the name of your corporation in the designated field.

- Provide the principal office address. Make sure it is a street address, not a P.O. box.

- Input the tax closing date. Ensure it aligns with the records held by the Kansas Secretary of State.

- State the incorporation date, including month and year.

- List the names, titles, and addresses of each officer of the corporation. Use an attachment if more space is needed.

- If applicable, list the names and addresses of each member of the governing body of the corporation.

- Answer either Question 7 or Question 8 by indicating the total number of shares of capital stock issued or the total number of memberships.

- Respond to Question 9 about equity ownership in other business entities. If applicable, provide the business names and ID numbers.

- Answer Question 10 regarding land ownership or lease in Kansas suitable for agriculture.

- Sign your name in the signature section and print your name and title below it. Include your phone number, if you want.

- Make sure to prepare a check or money order for the $40 filing fee, payable to the Secretary of State.

- Do not staple any documents together. Place the completed form and the payment in an envelope.

- Mail the envelope to the Kansas Secretary of State at the address provided on the form.

What You Should Know About This Form

What is the NP 50 form?

The NP 50 form is the Annual Report for Not-for-Profit Corporations in Kansas. This form is a legal requirement for any not-for-profit organization registered in the state. It provides the Kansas Secretary of State with essential information regarding the organization’s status, including its principal office address, the names and addresses of its officers, and other pertinent details necessary for maintaining good standing.

When is the NP 50 form due?

The annual report must be filed by the 15th day of the sixth month following the close of your tax year. For example, if your tax year ends in December, your NP 50 form would be due by June 15 of the following year. Organizations can file this report as early as January 1 of the following year.

What is the filing fee for the NP 50 form?

The filing fee for submitting the NP 50 form is $40. This amount must accompany your completed form; otherwise, the submission will not be accepted. If you are filing this form as part of a reinstatement due to forfeiture, the fee may differ. Always make sure to include a check or money order made out to the Secretary of State, as cash is not accepted.

What happens if I miss the filing deadline?

If you fail to file the NP 50 form and pay the filing fee within 90 days past the due date, your not-for-profit organization may face forfeiture status in Kansas. This means that your organization will no longer be recognized as active or in good standing. To regain active status, a reinstatement process must be completed, which may involve additional fees.

Can I correct errors on a previously filed NP 50 form?

Yes, if you discover that you have made errors on a previously filed NP 50 form, you need to file a Corrected Document form (COR) along with a new annual report. Ensure that the new NP form is complete and correct, and submit it alongside a $40 filing fee. If more space is needed for corrections, you can attach additional documentation.

Can both domestic and foreign entities use the NP 50 form?

Absolutely. The NP 50 form can be used by both domestic and foreign entities looking to maintain their not-for-profit status in Kansas. Regardless of where the organization was initially incorporated, this form serves the essential purpose of reporting to the Kansas Secretary of State.

Where can I find more information or assistance regarding filing the NP 50?

For further questions or assistance regarding the NP 50 form, you can contact the Kansas Secretary of State’s office directly at (785) 296-4564. Additional resources and information can also be found online at the official Secretary of State website, sos.ks.gov, where you can also file your forms electronically. Keeping informed about your organization’s status and important deadlines is crucial for compliance.

Common mistakes

Filling out the NP 50 form for the Kansas Secretary of State can seem like a straightforward task, but there are common pitfalls that many individuals and organizations encounter. Recognizing these mistakes can help ensure that the form is completed accurately and is accepted without delay.

First, many people forget to include the correct filing fee. The annual report requires a $40 fee, and submitting a form without this payment will lead to rejection. Moreover, if the form is part of a reinstatement due to forfeiture, a different fee may apply. It's vital to check and confirm the exact fee applicable to the situation.

Another frequent error involves the completion of the principal office address. Some filers fail to provide a complete street address, mistakenly opting for a P.O. box instead. Unfortunately, the Kansas Secretary of State explicitly states that a P.O. box is unacceptable. Ensuring the address is precise and adheres to the guidelines is crucial.

The tax closing date often trips up individuals as well. Misunderstandings arise regarding what constitutes the tax closing month, and some mistakenly include the Federal Employer ID Number instead. The tax closing date must be accurate and must align with the records held by the Secretary of State.

Completing the section regarding the officers and members of the governing body can be tricky. Some applicants leave this area blank or provide incomplete information. Each officer's name, title, and address must be included, and if the space is insufficient, an attachment should be provided. Avoiding blank spaces can help prevent unnecessary delays.

People often overlook the importance of numeric responses in certain sections. In questions concerning the total number of shares of capital stock or memberships, using “NA” or “—” is not acceptable; a numeral must be provided. This seemingly minor detail can impact the acceptance of the form.

Additionally, failing to answer all pertinent questions can lead to complications. For instance, if the corporation holds more than 50% equity in another business, filers must complete the corresponding section accurately. Missing such details can result in returning the form for corrections.

Another mistake involves mislabeling attachments. If a filer needs to include an attachment for additional information or because of insufficient space on the form, it is essential to label these correctly and ensure they correspond to the respective questions on the NP 50 form.

Lastly, some individuals submit their forms without reviewing them fully for accuracy. A lack of final review can allow for errors to slip through. Each section should be checked before mailing the document to reduce the chances of returning to correct mistakes.

By being mindful of these common mistakes, individuals and organizations can enhance the likelihood that their NP 50 form will be processed smoothly and efficiently, enabling them to maintain compliance with Kansas regulations.

Documents used along the form

The NP 50 form is an essential document for not-for-profit corporations in Kansas that need to submit an annual report. It helps ensure that the organization remains in good standing with the state. Alongside the NP 50, several other forms and documents may be needed to support your filing process or fulfill state requirements. Below is a list of commonly associated documents.

- AG Annual Report Agricultural Attachment: This form is necessary if the corporation owns or leases land in Kansas suitable for agricultural use. It collects details about the agricultural properties, ensuring compliance with state regulations.

- COR Corrected Document Form: Use this form to rectify any errors on previously filed annual reports. When submitting the corrected information, it's essential to include a new NP form along with the appropriate filing fee.

- Reinstatement Form: If a business has been forfeited due to non-filing, this form is required to reactivate its status. It outlines the steps and fees needed to reinstate the organization to good standing.

- Annual Report Fee Payment Form: This document is used for detailing the payment process for annual report fees. Ensure that a copy accompanies any filings to confirm the payment has been made.

- Registered Agent Change Form: This form is necessary if your corporation is changing its registered agent. It reflects the new agent’s information, ensuring proper communication with the state and legal entities.

Having the correct forms and understanding their purposes can drastically streamline the annual reporting process for not-for-profit organizations. By keeping these documents in mind, you can help your organization remain compliant and avoid any penalties associated with missed filings.

Similar forms

- Annual Report Form (Form AR): Similar to the NP 50 form, this document is also required for corporations to report financial and operational details annually. Both serve to keep the Secretary of State's records up to date and require submission alongside a filing fee.

- Certificate of Good Standing: This document confirms that a corporation is legally registered and compliant with state requirements. Similar to the NP 50, it assures that a business is in good standing with the Secretary of State.

- Change of Registered Agent Form: This form is used to officially update a corporation's registered agent. Like the NP 50, it must be submitted to the Secretary of State and affects the corporation's legal standing.

- Business License Application: Corporations may need this document to operate legally within certain jurisdictions. Both the NP 50 and business license applications require accurate information about the corporation.

- Reinstatement Application: If a business has been forfeited for non-filing, this document is necessary to restore its standing. It is closely tied to the NP 50 as it often contains the same information needed to correct previous filings.

- Foreign Entity Registration Form: Out-of-state corporations doing business in Kansas must file this form just like domestic entities file the NP 50. Both forms ensure compliance with state regulations.

- Nonprofit Organization Registration: Similar in nature, both documents are tailored for nonprofit entities. They require disclosures about operations, governance, and financial health.

- Statement of Change for Nonprofit Corporations: This document is used when a nonprofit wishes to update information on their original filing. Like the NP 50, it ensures that records reflect the current status and structure of the organization.

- Request for Exception to Annual Reporting: If a nonprofit is seeking an exemption from standard reporting, this form is required. Its purpose aligns with the NP 50 in maintaining transparency and compliance.

- Annual Financial Statement: This document provides detailed financial information, mirroring the NP 50's requirement for organizations to report their financial health annually to the Secretary of State.

Dos and Don'ts

Here are some important dos and don’ts to follow when filling out the Np 50 form:

- Do: Complete the form with all required information.

- Do: File the form online at sos.ks.gov to save time.

- Do: Pay the filing fee of $40 by check or money order.

- Do: Double-check your information for accuracy before submitting.

- Do: Use an attachment if you need more space for information.

- Don’t: Send cash as payment.

- Don’t: Leave any sections blank on the form.

- Don’t: Forget to include your principal office address, which cannot be a P.O. box.

- Don’t: Use staples to attach documents or checks.

Misconceptions

Misconceptions can lead to confusion, especially when it comes to important forms like the Np 50 for Not-for-Profit Corporations. Below are some common misconceptions, each explained for clarity.

- It can be filed without a fee. The Np 50 form must be accompanied by a filing fee of $40. If this fee is not included, the form will not be accepted.

- Stapling the documents is acceptable. In fact, you should avoid stapling the Np 50 form. Staples can interfere with processing and may cause delays.

- Filing can be done at any time without deadlines. There are specific deadlines. The Np 50 form is due on the 15th day of the sixth month following the tax closing month.

- Only domestic entities need to file. Both domestic and foreign entities are required to use this form to file their annual report.

- It is not necessary to provide correct contact information. Accurate contact information is essential. If it changes, make sure to update it through the filing process.

- Filing an annual report guarantees good standing. To maintain good standing, the report must be filed on time. Delays can result in forfeiture within 90 days of the due date.

- All questions on the form are optional. Each section must be completed according to the instructions. Leaving questions blank could lead to rejection of the form.

- Once submitted, corrections can’t be made. If errors are found after submission, you can file a Corrected Document form along with a corrected Np 50.

- Only one officer’s information is needed. The Np 50 requires information for all officers and members of the governing body of the corporation.

- The form is only available in paper format. The Np 50 form can be filed online, providing a quicker and more efficient option for submission.

Understanding the facts surrounding the Np 50 form can help ensure that your organization meets all necessary legal obligations without unnecessary complications. Always double-check the requirements and deadlines to keep your status in good standing.

Key takeaways

- Accuracy is Key: Ensure that all the information on the NP 50 form is complete and correct. Inaccuracies can lead to delays or rejection of your submission.

- Filing Timeliness: Remember that the annual report is due on the 15th day of the sixth month following your tax closing month. If, for example, your tax closing month is December, your due date will be June 15 of the following year.

- Filing Fees Matter: The standard filing fee is $40, but if you're reinstating due to forfeiture, additional fees may apply. Always include the correct payment to avoid processing issues.

- Online Advantages: Take advantage of the convenience of online filing at sos.ks.gov. This can save time and help keep track of your organization’s status and deadlines more easily.

Browse Other Templates

Maryland Offer in Compromise - Reasons for the offer can include doubt as to liability or insufficient resources.

Mcsa5889 - Submitting the form via the web can expedite the processing time.

Closed Book Test - The ARRL VEC uses the Open Book form to verify that candidates have engaged with essential materials.