Fill Out Your Nys 45 Att Mn Form

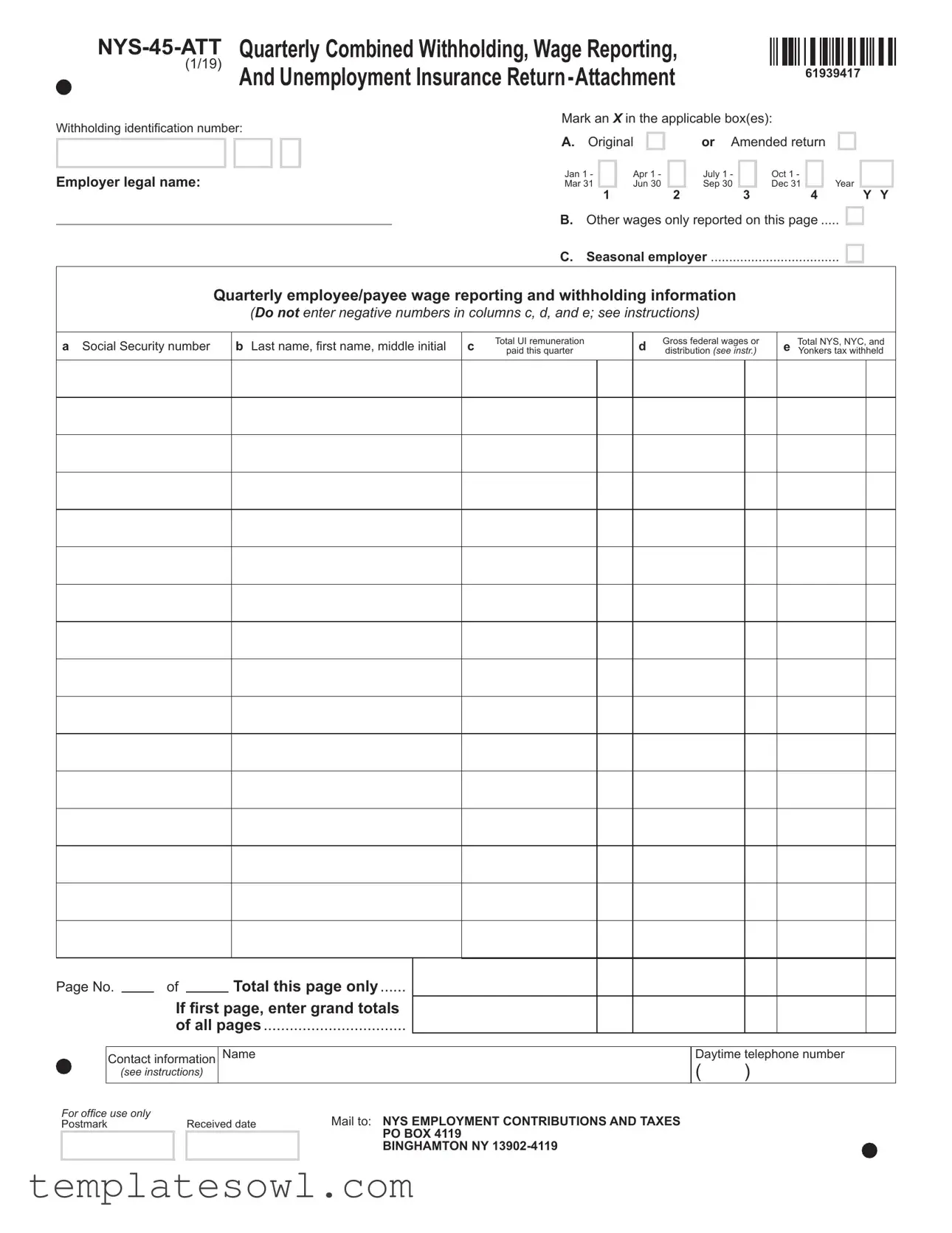

The NYS 45 Att Mn form plays a crucial role in the compliance landscape for employers operating in New York State. This quarterly return combines important reporting requirements for withholding taxes, wage data, and unemployment insurance contributions. Employers use this form to report employee wages and taxes withheld to the state, ensuring adherence to legal obligations. It consists of various sections where employers must indicate the type of return—whether it is original or amended—and provide details such as the employer's legal name and the applicable quarter. Each report includes critical employee information, including Social Security numbers and wages earned, ensuring accurate tracking of compensation and taxes. This form streamlines the process for seasonal employers, identifies other reported wages, and mandates clear reporting without negative numbers for certain categories. Filing the form timely protects both employers and employees who rely on proper tax withholding and unemployment insurance systems.

Nys 45 Att Mn Example

(1/19)

Quarterly Combined Withholding, Wage Reporting, And Unemployment Insurance

61939417

Withholding identification number: |

|

|

Mark an X in the applicable box(es): |

|

||||||||||

|

|

A. Original |

|

or Amended return |

|

|||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan 1 - |

|

Apr 1 - |

|

July 1 - |

|

Oct 1 - |

|

|

|

Employer legal name: |

|

|

|

|

|

|

|

|

||||||

|

|

Mar 31 |

|

Jun 30 |

|

Sep 30 |

|

Dec 31 |

|

|

Year |

|||

1 |

2 |

3 |

4 |

|||||||||||

Y Y

B. Other wages only reported on this page .....

C. Seasonal employer ....................................

Quarterly employee/payee wage reporting and withholding information

(Do not enter negative numbers in columns c, d, and e; see instructions)

aSocial Security number

bLast name, first name, middle initial

cTotal UI remuneration

paid this quarter

dGross federal wages or distribution (see instr.)

eTotal NYS, NYC, and

Yonkers tax withheld

Page No. of Total this page only ......

If first page, enter grand totals

of all pages .................................

Contact information Name

(see instructions)

Daytime telephone number

( )

For office use only |

|

Received date |

Mail to: NYS EMPLOYMENT CONTRIBUTIONS AND TAXES |

|

Postmark |

|

|||

|

|

|

|

PO BOX 4119 |

|

|

|

|

|

|

|

|

|

BINGHAMTON NY |

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The NYS-45-ATT form is used for quarterly reports regarding withholding, wage reporting, and unemployment insurance mandated for employers in New York State. |

| Filing Frequency | This form must be filed quarterly, covering wages paid during the specific quarters ending March 31, June 30, September 30, and December 31. |

| Applicable Laws | The NYS-45-ATT is governed by New York State Tax Law, specifically under sections relevant to withholding and unemployment insurance. |

| Identification Number | Employers must provide their withholding identification number on the form, ensuring accurate tracking and processing by the state. |

| Contact Information | Employers are required to include their contact information, such as name and daytime telephone number, ensuring that the state can easily reach them if needed. |

Guidelines on Utilizing Nys 45 Att Mn

Completing the NYS 45 Att Mn form requires careful attention to detail. This form involves reporting withholding information and wages for employees during a specific quarter. To ensure accuracy, follow these steps when filling out the form.

- Locate the withholding identification number and enter it at the top of the form.

- Mark an X in the box to indicate whether this is an original or amended return.

- Select the relevant quarter for which you are reporting: January 1 to March 31, April 1 to June 30, July 1 to September 30, or October 1 to December 31.

- Fill in the employer legal name in the designated section.

- If applicable, mark an X in the box for "Other wages only reported on this page" or "Seasonal employer."

- For each employee or payee, provide the following information in the respective columns:

- a. Enter the social security number.

- b. Write the last name, first name, and middle initial.

- c. Enter the total unemployment insurance (UI) remuneration paid this quarter.

- d. Report gross federal wages or distribution.

- e. Indicate the total New York State, New York City, and Yonkers tax withheld.

- At the bottom of the page, indicate the page number out of the total pages.

- If this is the first page, provide the grand totals from all pages.

- Fill in your contact information, including your name and daytime telephone number.

- Submit the completed form by mailing it to the designated address provided on the form.

What You Should Know About This Form

What is the NYS-45-ATT form?

The NYS-45-ATT form is a quarterly report used by employers in New York State. It consolidates information on withholding taxes, employee wages, and unemployment insurance contributions. This form helps ensure that the state has accurate records of employee remuneration and tax withholdings for the quarter.

Who needs to file the NYS-45-ATT form?

Employers in New York State who withhold taxes from employees' wages must file this form. This includes businesses of all sizes that have employees, whether full-time or part-time. If you are a seasonal employer, you will also need to file, indicating your seasonal status on the form.

When is the NYS-45-ATT form due?

The NYS-45-ATT is typically due on the last day of the month following the end of each quarter. For example, the deadlines are April 30 for the first quarter (January through March), July 31 for the second quarter (April through June), October 31 for the third quarter (July through September), and January 31 for the fourth quarter (October through December).

What information is required on the NYS-45-ATT form?

Detailed employee information is required, including each employee's Social Security number, name, total unemployment remuneration, gross federal wages, and the total amount of state and local taxes withheld. Employers must ensure to calculate everything accurately and provide totals for all pages if the form consists of more than one.

How should the NYS-45-ATT form be submitted?

The completed NYS-45-ATT form should be mailed to the New York State Employment Contributions and Taxes office. The mailing address is PO BOX 4119, Binghamton, NY 13902-4119. It is important to follow the instructions provided on the form to ensure it is filled out correctly and sent on time.

Common mistakes

Completing the NYS-45-ATT form can be a straightforward task if the correct steps are followed. However, many make mistakes that can lead to delays or issues with their submissions. Understanding these common pitfalls is crucial for ensuring a smooth process.

One common mistake is not properly marking the box for whether the return is original or amended. Failure to do so can confuse the tax authority regarding the nature of the submission. It's vital to clearly indicate whether you are submitting a new return or correcting a previously submitted one.

Another frequent error involves incorrect reporting of wages. People often enter negative numbers in columns where they should not. Specifically, columns c, d, and e must reflect only positive figures. Reading the instructions carefully will prevent this oversight and help ensure accuracy.

Overlooking the requirement for seasonal reporting is another mistake. Individuals who qualify as seasonal employers sometimes fail to check the appropriate box. This oversight can lead to unnecessary complications if the tax authority determines that the information provided does not align with their records.

Additionally, inaccuracies in social security numbers can create significant problems. Every individual’s social security number must be entered correctly. An error here can result in delays in processing or misallocation of funds, so double-checking these numbers is essential.

People often forget to include the required contact information. Leaving out a name or daytime telephone number can hinder communication if any issues arise during the review of the form. Including complete contact details on the form makes it easier for tax authorities to reach you if needed.

Finally, failing to send the form to the correct address is a mistake that can impact timely submissions. Ensure that the form is mailed to the appropriate PO Box as listed in the instructions. Confirming the address helps avoid unnecessary complications and delays, ensuring that the return is processed in a timely manner.

Documents used along the form

The NYS 45 Att Mn form is a critical document used by employers in New York State for reporting withholding taxes, wage information, and unemployment insurance contributions. Several other documents often accompany this form to ensure compliance with state laws and tax regulations. Below is a list of commonly used forms and documents that may be necessary in conjunction with the NYS 45 Att Mn form.

- NYS-45: This form is used for filing the quarterly combined withholding tax, wage reporting, and unemployment insurance return. It summarizes the wages and taxes withheld from employees for the reporting period.

- NYS-45-ATT: It provides detailed wage reporting and tax information for additional employees not reported on the NYS-45 form. This is particularly useful for seasonal or temporary employees.

- Form W-2: Employers must provide this form to employees annually. It reports the total wages paid and taxes withheld during the previous year, and a copy must also be filed with the Social Security Administration.

- Form 1099-MISC: Used to report payments made to independent contractors and other non-employee remuneration. This form is crucial for employers who may hire freelancers or contractors.

- NYS IT-2104: Employees use this form to establish withholding allowances. It helps employers determine the correct amount of personal income tax to withhold from their employees’ wages.

- NYS IT-2104-E: This form allows employees to claim exemption from NYS withholding. Employers need this form for employees who qualify for exemption status.

- NYS-5014: Employers use this form to register for a New York State employer identification number, which is necessary for filing tax forms and paying employee benefits.

- NYS ST-100: This sales tax form is used by businesses to report and pay sales tax collected. While not directly related to employee withholding, it is commonly filed alongside payroll documents.

- NYS-45-X: This is the amended return form for NYS-45, used to correct previously filed returns if any errors are discovered in wage reporting or withholding amounts.

- Form NYS-100: This form is included for new businesses to register for various taxes. It provides foundational information critical for compliance at the commencement of business operations.

Understanding these documents is vital for employers to maintain proper compliance with state regulations regarding payroll and employee taxes. Each form serves a specific purpose and ensures that reporting is accurate and complete.

Similar forms

The NYS-45-ATT form is a crucial document for employers in New York. Several other forms share similarities with it regarding wage reporting, withholding, and unemployment insurance. Below is a list of these documents and how they relate to the NYS-45-ATT form:

- NYS-45: This is the main filing form used to report quarterly withholding, wage data, and unemployment insurance contributions. Like the NYS-45-ATT, it provides a comprehensive overview of wages paid and taxes withheld but without the attachment details.

- W-2 Form: Employers use this form to report annual wages and tax withheld for each employee. Similar to the NYS-45-ATT, it tracks earnings and withholdings but focuses on the entire year instead of quarterly reporting.

- 100-Employer's Quarterly Unemployment Insurance Report: This form is specifically for reporting unemployment insurance contributions. Both this form and the NYS-45-ATT require reporting on wages paid, though this form is dedicated solely to unemployment insurance.

- Form 941: This federal document is used for reporting income taxes withheld from employees, Social Security, and Medicare taxes. Like the NYS-45-ATT, Form 941 also includes information about wages, but it is for quarterly federal tax reporting.

- Form 1099-NEC: This form is used to report non-employee compensation. While it serves a different purpose than the NYS-45-ATT, both documents require detailing compensation paid, though the 1099-NEC is for independent contractors rather than employees.

- NYS- Online Wage Reporting: This is an electronic method for employers to report employee wages and withholding taxes directly to the state. It functions similarly to the NYS-45-ATT in that it captures real-time wage reporting but utilizes a digital platform for ease and efficiency.

Employers should stay informed about these forms to ensure they are compliant with both state and federal regulations.

Dos and Don'ts

When it comes to submitting your NYS-45-ATT form, following the right steps can make the process smoother and help you avoid mistakes. Here’s a handy list of what to do and what to avoid.

- Do double-check all information before submitting. Accuracy is crucial.

- Do read the instructions thoroughly. They provide valuable guidance.

- Do enter information in the correct columns. Misplaced data can lead to issues.

- Do ensure you include your withholding identification number. It is essential for processing your return.

- Don’t leave any boxes blank that require a response. Every section must be filled out appropriately.

- Don’t enter negative numbers in reporting columns. This can lead to confusion and errors in your reporting.

Remember, attention to detail is key. Following these guidelines can help ensure your submission is correct and timely.

Misconceptions

Here are some common misconceptions about the NYS 45 Att Mn form, along with clarifications to help you better understand its purpose and requirements.

- It’s only for employers with a large number of employees. Many believe the NYS 45 Att Mn form applies only to larger companies. In reality, any employer who has employees subject to New York State withholding must complete this form, regardless of the size of the business.

- You can report negative numbers for wages or tax withheld. Some people think it’s acceptable to enter negative numbers on this form. However, this is not allowed. Only positive figures should be reported for wages and taxes withheld.

- Amended returns are not necessary. There is a misconception that once a return is submitted, it cannot be changed. If errors are identified after filing, employers can and should file an amended return to correct the information.

- Seasonal employers do not need to report all quarters. Seasonal employers might think they only need to file during their active months. However, they still must file the NYS 45 Att Mn form for any quarter they have employees, even if no wages were paid.

- If you filed electronically, you don’t need to submit a paper form. Some employers believe electronic submission means they can skip submitting a paper form. However, it is crucial to check the specific requirements, as some agencies may require a paper form to reconcile electronic submissions.

- The form is the same every year. The NYS 45 Att Mn form may change from year to year, so it’s a misconception that the same version can be used indefinitely. Employers should always use the most current version available to ensure compliance.

- Filing late won’t lead to penalties or interest. There is a belief that late filing of the NYS 45 Att Mn form is not a big issue. It's important to understand that failing to file on time can result in penalties and accrue interest on any unpaid taxes.

By addressing these misconceptions, employers can ensure they meet their obligations more effectively and avoid unnecessary complications.

Key takeaways

When filling out the NYS 45 ATT MN form, follow these key takeaways to ensure a smooth process.

- Select the correct return type: Make sure to mark an X in the appropriate box for either an original or amended return. Choose the correct period: Jan 1, Apr 1, Jul 1, or Oct 1.

- Accurate wage reporting is crucial: Enter employee information carefully. This includes Social Security numbers, names, and wages. Avoid using negative numbers in the specified columns.

- Use total estimates when necessary: If this is your first page, include the grand totals of all pages. This helps in reporting and processing your information more efficiently.

- Provide correct contact information: Include a name and daytime telephone number. This ensures that any issues can be addressed promptly.

Remember, taking your time and verifying the details can prevent unnecessary complications down the line.

Browse Other Templates

Tax Exempt Form Massachusetts - It’s important to indicate any special conditions that apply to the property listed on the ST-12 form.

Alcohol Sales Agent Registration - Misrepresentation on the application can lead to license revocation.

Long Shoreman Jobs - The Casual Lottery form reflects cooperation between ILWU and PMA for transparency.