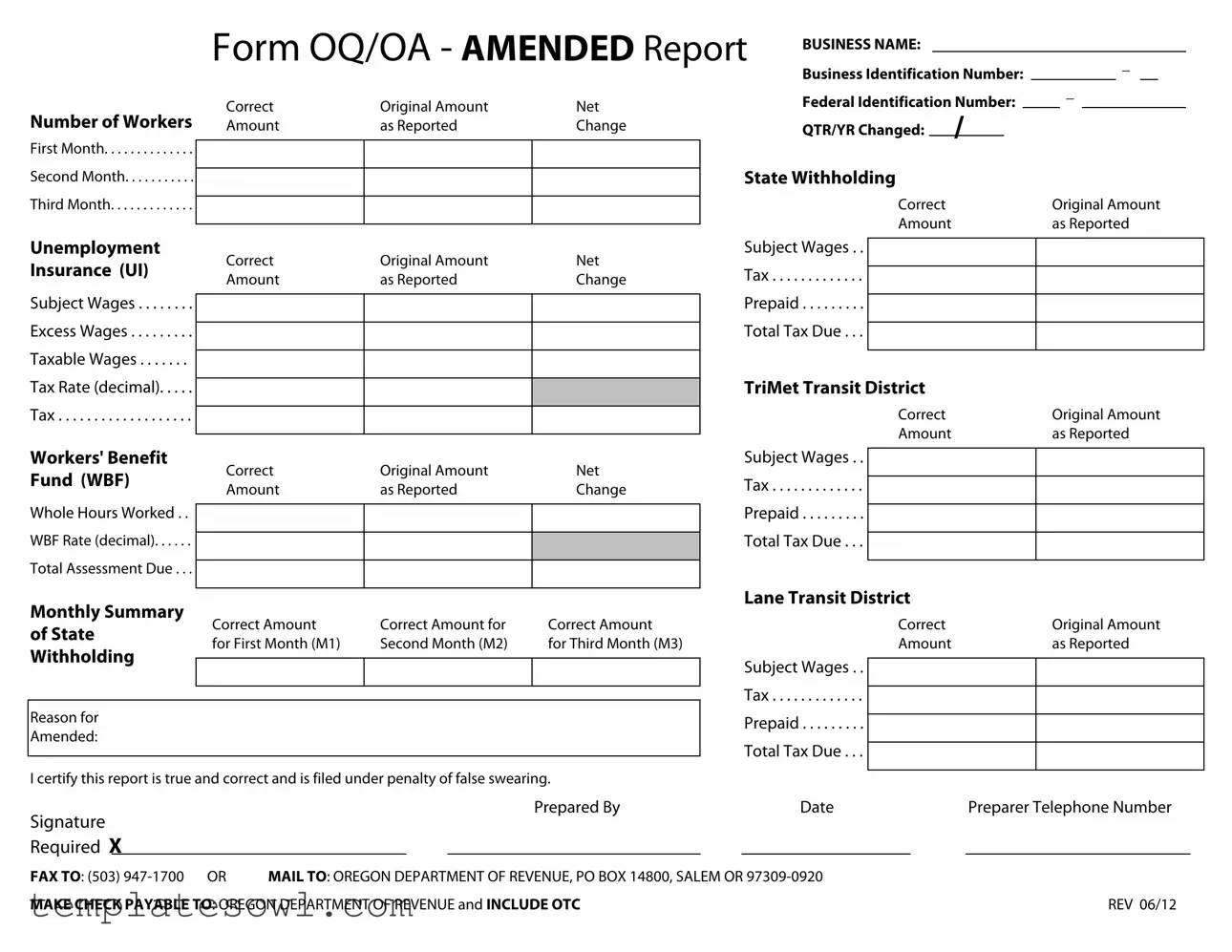

Fill Out Your Oq Form

The Oq form plays a crucial role in tracking and reporting various essential financial aspects of a business's workforce. It includes detailed sections covering the number of workers across three consecutive months, providing a comprehensive overview of staffing changes. Businesses must accurately report their identification information, including the Business Name and Federal Identification Number. As part of the submission, users must disclose changes to wages over the specified quarters, including taxable wages, excess wages, and subject wages. An essential part of this form is its function in managing state withholding for taxes, unemployment insurance, and contributions to vital funds such as the Workers' Benefit Fund. Additionally, the form requires a certification statement, ensuring that all reported data is truthful and correct, underlining the importance of accuracy in financial reporting. To complete the form, preparers must include their contact information, highlighting the role of personnel in ensuring compliance and clarity in communication with state authorities. Finally, once completed, it must be submitted via fax or mail to the Oregon Department of Revenue, facilitating timely processing and record-keeping.

Oq Example

Number of Workers

First Month. . . . . . . . . . . . . .

Second Month. . . . . . . . . . .

Form OQ/OA - AMENDED Report |

BUSINESS NAME: |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Business Identification Number: |

_ |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||

Correct |

Original Amount |

Net |

Federal Identification Number: |

_ |

|

|

|

|

|||||

|

|

|

|

|

|

||||||||

|

|

/ |

|

|

|

|

|

|

|

|

|||

Amount |

as Reported |

Change |

QTR/YR Changed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

State Withholding

Third Month. . . . . . . . . . . . .

Unemployment Insurance (UI)

Subject Wages . . . . . . . .

Excess Wages . . . . . . . . .

Taxable Wages . . . . . . .

Correct |

Original Amount |

Net |

Amount |

as Reported |

Change |

Correct |

Original Amount |

Amount |

as Reported |

Subject Wages . .

Tax . . . . . . . . . . . . .

Prepaid . . . . . . . . .

Total Tax Due . . .

Tax Rate (decimal). . . . .

Tax . . . . . . . . . . . . . . . . . . .

Workers' Benefit Fund (WBF)

Whole Hours Worked . .

WBF Rate (decimal). . . . . .

Total Assessment Due . . .

Correct |

Original Amount |

Net |

Amount |

as Reported |

Change |

|

|

|

|

|

|

|

|

|

|

|

|

TriMet Transit District

Correct |

Original Amount |

Amount |

as Reported |

Subject Wages . .

Tax . . . . . . . . . . . . .

Prepaid . . . . . . . . .

Total Tax Due . . .

Monthly Summary

of State |

Correct Amount |

Correct Amount for |

Correct Amount |

|

for First Month (M1) |

Second Month (M2) |

for Third Month (M3) |

||

Withholding |

||||

|

|

|

||

|

|

|

||

|

|

|

|

Reason for

Amended:

I certify this report is true and correct and is filed under penalty of false swearing.

Lane Transit District

Correct |

Original Amount |

Amount |

as Reported |

Subject Wages . .

Tax . . . . . . . . . . . . .

Prepaid . . . . . . . . .

Total Tax Due . . .

Signature |

|

|

Prepared By |

|

Date |

|

Preparer Telephone Number |

|

|

|

|

|

|

|

|

||

Required X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FAX TO: (503) |

MAIL TO: OREGON DEPARTMENT OF REVENUE, PO BOX 14800, SALEM OR |

|

|

|||||

MAKE CHECK PAYABLE TO: OREGON DEPARTMENT OF REVENUE and INCLUDE OTC |

|

|

|

REV 06/12 |

||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Name | The form is known as Form OQ, which is used for reporting amended wage and tax information. |

| Governing Law | This form is governed by the laws of the State of Oregon. |

| Filing Purpose | It serves to correct previously reported wages and taxes for a specific quarter and year. |

| Monthly Breakdown | The form includes columns for reporting data for up to three months, including wages and taxes. |

| Tax Types | It covers various types of state taxes, such as withholding and unemployment insurance taxes. |

| Signature Requirement | A signature is needed from the preparer, affirming that the report is accurate and true. |

| Submission Options | The completed form can be submitted via fax or mail to the Oregon Department of Revenue. |

| Payment Instructions | Any payment due should be made payable to the Oregon Department of Revenue. |

Guidelines on Utilizing Oq

Completing the OQ form requires careful attention to detail to ensure accurate reporting. Follow these steps sequentially to fill out the form correctly.

- Enter the Business Name at the top of the form.

- Fill in the Business Identification Number.

- Provide your Net Federal Identification Number.

- In the section labeled Correct Original Amount, input the amounts for the first, second, and third months under Subject Wages, Excess Wages, and Taxable Wages.

- Report the Total Tax Due for each month, including any prepaid amounts.

- For Workers' Benefit Fund (WBF), list the Whole Hours Worked and corresponding WBF Rate.

- Input the Total Assessment Due for the WBF.

- Fill out the TriMet Transit District section with the Correct Original Amount, Subject Wages, Total Tax Due, and any prepaid amounts.

- Complete the Lane Transit District section in the same manner.

- State the Reason for Amended in the designated area.

- Sign and date the form, ensuring you include your Prepared By name and Telephone Number.

- Fax the completed form to (503) 947-1700 or mail it to the Oregon Department of Revenue, PO Box 14800, Salem OR 97309-0920.

- If you are sending a check, make it payable to the Oregon Department of Revenue. Include the OTC REV 06/12 with your submission.

What You Should Know About This Form

What is the purpose of the Oq form?

The Oq form is used to report and amend unemployment insurance and state withholding information for businesses operating in Oregon. It helps ensure accurate documentation of employees' wages and the taxes owed on those wages.

Who needs to fill out the Oq form?

Any business in Oregon that employs workers is required to fill out this form, especially if there have been changes in the reported wages or tax information. This applies to various industries and sectors, regardless of the size of the business.

How do I obtain the Oq form?

The Oq form can be accessed online through the Oregon Department of Revenue website. You can also request a physical copy by contacting their office directly. Make sure to use the most recent version to ensure compliance.

When is the Oq form due?

Typically, the Oq form must be submitted by the last day of the month following the end of each quarter. However, if you are making an amendment, be sure to check if there are specific deadlines for submitting corrections.

What information do I need to complete the Oq form?

You will need your business name, business identification number, federal identification number, and accurate wage information for each month being reported. It is also necessary to provide details regarding any tax payments made and the corresponding amounts.

What should I do if I made an error in my initial filing?

If you find an error in your initial filing, you should fill out the Oq form to amend the report. Clearly mark the section that indicates you are making a correction, and provide the correct figures as instructed on the form.

Can I submit the Oq form electronically?

Currently, the Oq form must be submitted via fax or traditional mail to the Oregon Department of Revenue. Ensure that you follow the directions provided on the form for proper submission.

What happens if I don’t file the Oq form?

Failure to file the Oq form can result in penalties and interest on unpaid taxes. It may also lead to issues with your business’s tax compliance status, potentially impacting your ability to operate smoothly.

How can I check the status of my Oq form submission?

You can check the status of your submission by contacting the Oregon Department of Revenue directly. Be prepared to provide relevant information, such as your business name and identification number, to facilitate the inquiry.

What are the penalties for false reporting on the Oq form?

Submitting false information on the Oq form is considered a serious offense. Penalties may include fines, interest on taxes owed, and possible criminal charges for fraud. Always ensure accuracy when completing the form to avoid these consequences.

Common mistakes

Completing the OQ form can be challenging. Many people make mistakes that could lead to delays or other complications. Here are five common errors to avoid.

One frequent mistake is incorrectly reporting business identification numbers. Ensure that your Federal Identification Number is accurate. An oversight here can cause significant issues with processing your report. Double-check the number and make sure it aligns with official records.

Another prevalent error involves miscalculating the subject wages for each month. Without accurate calculations, the resulting taxes and assessments will also be incorrect. Review your payroll records carefully and ensure that all figures are properly totaled before entering them on the form.

People often forget to specify a reason for amending the form. This section is crucial, as it provides context for the amendments made. If this is omitted, it could raise questions and lead to further inquiries from the department. Always provide a clear and specific reason to clarify any adjustments being made.

Failing to sign and date the form is another critical mistake. This signature is not just a formality; it serves as a declaration that the information provided is true and correct. Without it, your form may be considered incomplete, delaying its processing. Always remember to sign and date the report before submission.

Lastly, make sure to submit the form properly. Many people neglect to check the submission guidelines, such as the correct mailing address or fax number. Sending to the wrong location can cause unnecessary delays. Familiarize yourself with the specific instructions and ensure your report reaches the appropriate department.

Documents used along the form

The OQ form serves as a critical tool for reporting various payroll-related data and amendments. However, it is often accompanied by other forms and documents that ensure comprehensive reporting and compliance with state regulations. Below is a list of additional forms commonly used alongside the OQ form, each serving a unique purpose in addressing payroll and taxation matters.

- Quarterly Tax Report (Form 941): This form is used to report income taxes, social security tax, and Medicare tax withheld from employee wages. It captures the total wages paid as well as the corresponding federal tax liability for a specific quarter.

- Employer's Annual Federal Unemployment (FUTA) Tax Return (Form 940): Every employer must file this form annually to report and pay unemployment taxes to the federal government. It summarizes the total taxable wages for unemployment tax purposes.

- State Withholding Tax Form: Different states require employers to submit forms detailing the amounts withheld for state income tax. This document ensures that proper state tax obligations are met and reported accurately.

- Employee Wage and Tax Statement (Form W-2): This important form reports an employee's annual wages and the amount of taxes withheld. It is issued to employees at year-end and is essential for their personal tax filings.

- Amended State Tax Returns: If errors are found in a previously filed state tax return, this form allows employers to correct those errors. This ensures that tax liabilities are accurate and compliant with state regulations.

- Workers' Compensation Insurance Documentation: This includes forms and proof of insurance that protects employees injured on the job. Employers must maintain documentation of compliance with state workers' compensation laws.

- Payroll Change Forms: Whenever there is a change in an employee’s payroll status—like a raise, a change in deductions, or new hire forms—these are necessary. They document adjustments to ensure payroll records remain accurate.

- Local Tax Forms: Depending on the jurisdiction, employees may be subject to local taxes, which may require specific forms. These documents help employers remain accountable to local tax laws.

Understanding these accompanying forms and documents enhances clarity in compliance, ensuring that both employers and employees meet their responsibilities. Accurate and thorough reporting not only fulfills legal requirements but also fosters trust and transparency within the workforce.

Similar forms

- W-2 Form - Like the OQ form, the W-2 reports an employee's earnings and tax withholdings. It is required for tax filing purposes and must be provided to both the employee and the IRS.

- 1099 Form - The 1099 form is used to report income received by non-employees, such as independent contractors. It shares similarities with the OQ form in that both track payments made for services and help in proper tax reporting.

- Quarterly Tax Form (941) - This form is filed quarterly by employers to report income taxes, social security tax, and Medicare tax withheld from employees' paychecks. It parallels the OQ form's reporting of wages and tax obligations over specified time periods.

- State Payroll Tax Form - This document is filed by employers to report state income tax withheld from employee wages. The function of tracking tax withholdings is similar to that of the OQ form.

- Unemployment Insurance Report - This report provides details on wages subject to unemployment tax. Like the OQ form, it focuses on employer reporting obligations for state unemployment insurance programs.

- Business Tax Return - A business tax return summarizes a company's income, deductions, and credits. Similar to the OQ form, it is essential for accurate tax reporting and reflects financial activity within a specific timeframe.

Dos and Don'ts

When filling out the OQ form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do double-check all entries for accuracy before submission.

- Do provide complete information for each month, including the number of workers and detailed taxable wages.

- Do confirm that the business name and identification numbers are correct and match your records.

- Do file the form on time to avoid penalties or interest charges.

- Don't leave any sections of the form blank; ensure every relevant field is filled out.

- Don't make assumptions about tax rates or amounts; refer to official resources for the most current information.

- Don't forget to sign and date the form before submission, as this is required for processing.

- Don't ignore deadlines; ensure you submit the form within the allocated time frame to maintain compliance.

Misconceptions

Misconceptions about the OQ form can lead to confusion and errors in reporting. Here are ten common misunderstandings:

- Only large businesses need to fill out the OQ form. Many believe that only large companies are required to submit this form. In reality, any business with employees must complete it, regardless of size.

- The OQ form only reports state taxes. Some think this form is solely for state tax reporting. However, it covers various aspects, including unemployment insurance and other local assessments.

- Amending the OQ form is unnecessary. People often assume that once the form is submitted, it cannot be changed. In fact, amendments are allowed and may be necessary if errors are found.

- The OQ form is complex and difficult to complete. While it may seem overwhelming, the form is designed to be straightforward. Dividing the sections and focusing on one at a time helps simplify the process.

- Submitting the OQ form is optional. Some businesses think filing is at their discretion. On the contrary, it is a mandatory requirement for reporting wages and taxes.

- Calculating taxable wages is not necessary for the OQ form. This misconception ignores the importance of accurate calculations. Reporting incorrect wages can lead to penalties and disputes.

- The OQ form can be submitted any time without deadlines. Many believe they can submit the form at their leisure. However, it has specific deadlines that must be adhered to for compliance.

- Only one person in a business can prepare the OQ form. This is false. Anyone knowledgeable about the business's payroll can prepare and file the form, not just a designated employee.

- Filing electronically is not an option. Some think that the form must be submitted by mail. Electronic submission is actually an accepted and often preferred method.

- The OQ form and the quarterly report are the same. This assumption can lead to errors. The OQ form serves different purposes than the quarterly report, and both must be handled appropriately.

Understanding these misconceptions can help ensure accurate reporting and compliance with regulations.

Key takeaways

When dealing with the OQ form, there are several important aspects to keep in mind for smooth completion and compliance. Here are key takeaways to guide you through the process:

- Understand the Purpose: The OQ form is primarily used to report details regarding quarterly wages and tax liabilities related to unemployment insurance and withholdings.

- Accurate Information: Ensure that all fields, especially the business name and identification numbers, are filled out correctly. Inaccuracies can lead to complications down the line.

- Reporting Period: Be aware of the different months reported in the form. Each section corresponds to specific months, and all details must be accurately represented.

- Amendment Reason: If submitting an amended form, clearly state the reason for the amendment. This ensures that your adjustments are accurately understood by the authority.

- Calculating Taxes: Calculate the taxable wages and taxes owed meticulously. Mistakes in calculations can result in penalties or additional fees.

- Certification: Do not forget to sign the form. Without a signature, the document is considered incomplete, which can lead to delays in processing.

- Submission Method: Decide whether to fax or mail the completed form. Both options are valid, but ensure that it is sent to the correct address or fax number.

- Keep Records: Once submitted, retain a copy of the completed form and any related documents. This can serve as evidence if questions arise about your filings.

By adhering to these guidelines, you can help ensure that the process goes smoothly, reducing the likelihood of errors and complications. Take the time to review every detail before submission.

Browse Other Templates

Ca $800 Llc Fee Due Date - The LLC must be active to file this particular amendment form.

How to Get Allodial Title - This resource details the necessary steps to remove property from tax rolls definitively.