Fill Out Your P 1 Form

When it comes to managing employee information, compliance with IRS regulations is crucial for any business. One important tool in this process is the P-1 form, a Reasonable Cause Affidavit by Payor. This form is specifically designed for situations where an employer or payor has requested an identifying number, such as a Social Security number, from an employee or payee, but the individual has declined to provide it. By completing the P-1 form, the employer certifies that they made a legitimate request for the necessary identifying information and were met with refusal. This affidavit not only helps in documenting the employer’s good faith efforts but also serves as a protective measure against potential penalties, as outlined in Section 6724 of the Internal Revenue Code. If the IRS determines that the employer acted reasonably and without willful neglect, they may waive the $50 penalty typically imposed for failing to submit an identifying number. This form requires signatures from both the employer and the employee, along with detailed information about each party, establishing an official record of the situation. Properly utilizing the P-1 form ensures that employers remain compliant while also protecting their interests when faced with employee reluctance to provide sensitive information.

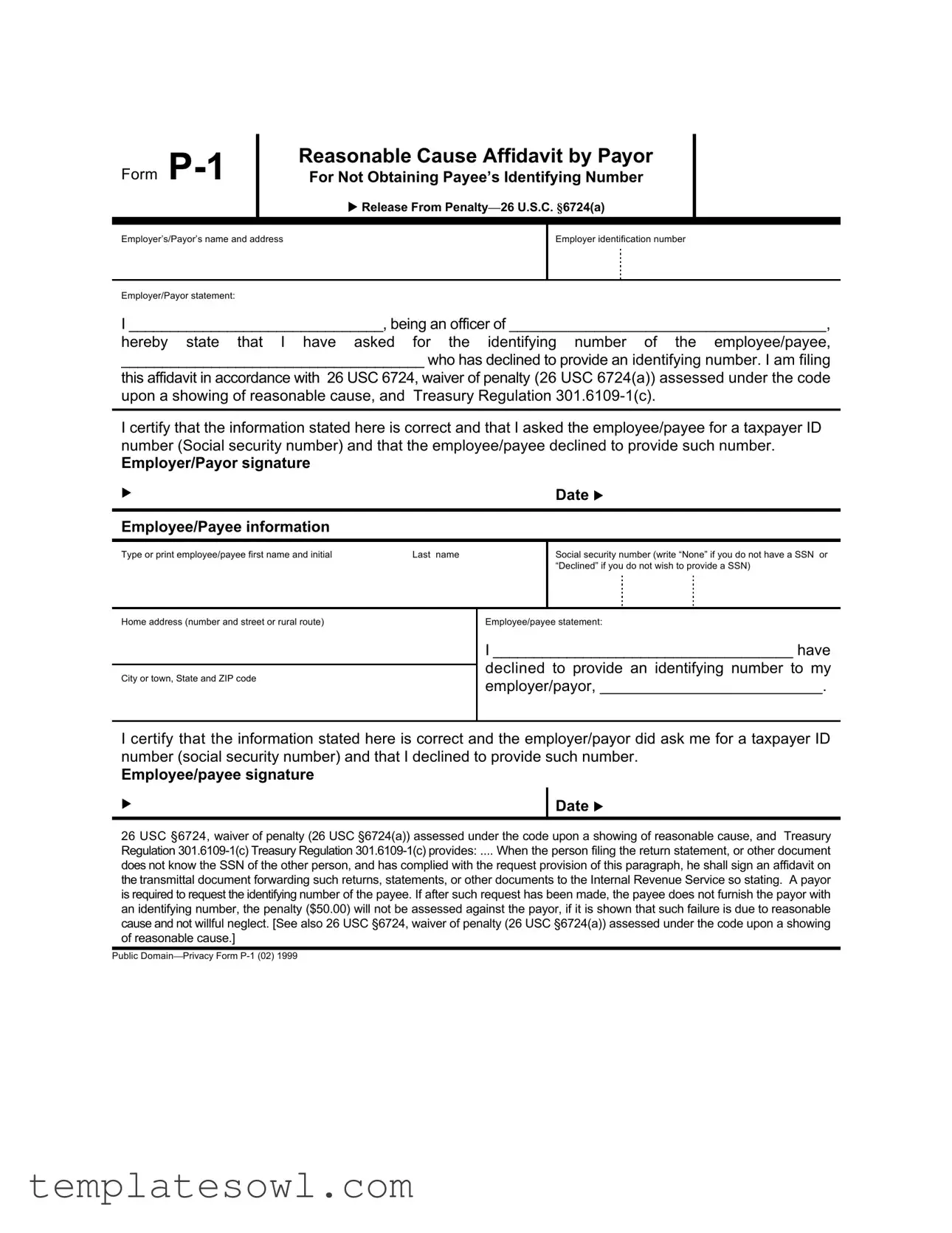

P 1 Example

Form

Reasonable Cause Affidavit by Payor

For Not Obtaining Payee’s Identifying Number

uRelease From

Employer’s/Payor’s name and address

Employer identification number

Employer/Payor statement:

I _______________________________, being an officer of _____________________________________,

hereby state that I have asked for the identifying number of the employee/payee,

_____________________________________ who has declined to provide an identifying number. I am filing

this affidavit in accordance with 26 USC 6724, waiver of penalty (26 USC 6724(a)) assessed under the code upon a showing of reasonable cause, and Treasury Regulation

I certify that the information stated here is correct and that I asked the employee/payee for a taxpayer ID number (Social security number) and that the employee/payee declined to provide such number.

Employer/Payor signature

u |

Date u |

|

Employee/Payee information

Type or print employee/payee first name and initial |

Last name |

Social security number (write “None” if you do not have a SSN or “Declined” if you do not wish to provide a SSN)

Home address (number and street or rural route)

City or town, State and ZIP code

Employee/payee statement:

I ____________________________________ have

declined to provide an identifying number to my employer/payor, __________________________.

I certify that the information stated here is correct and the employer/payor did ask me for a taxpayer ID number (social security number) and that I declined to provide such number.

Employee/payee signature

u

Date u

26 USC §6724, waiver of penalty (26 USC §6724(a)) assessed under the code upon a showing of reasonable cause, and Treasury Regulation

does not know the SSN of the other person, and has complied with the request provision of this paragraph, he shall sign an affidavit on the transmittal document forwarding such returns, statements, or other documents to the Internal Revenue Service so stating. A payor is required to request the identifying number of the payee. If after such request has been made, the payee does not furnish the payor with an identifying number, the penalty ($50.00) will not be assessed against the payor, if it is shown that such failure is due to reasonable cause and not willful neglect. [See also 26 USC §6724, waiver of penalty (26 USC §6724(a)) assessed under the code upon a showing of reasonable cause.]

Public

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The P-1 Form serves as a Reasonable Cause Affidavit by Payor, allowing employers to explain why they could not obtain a payee's identifying number. |

| Legal Basis | This affidavit is filed under 26 U.S.C. §6724(a), providing a waiver of penalty when reasonable cause can be demonstrated. |

| Affidavit Requirement | The payor must state that they requested the identifying number from the payee, who declined to provide it. A signature is required from both parties to validate the affidavit. |

| Penalty Waiver | If the payee does not provide the identifying number after a request, a penalty of $50 will not be assessed if the payor shows reasonable cause under the applicable tax regulations. |

Guidelines on Utilizing P 1

Filling out the P 1 Form is a straightforward process, but it's important to do it carefully to ensure accuracy and completeness. This form serves a specific purpose, and the details you provide will help in addressing any potential penalties related to the absence of a payee's identifying number.

- Obtain the Form: First, make sure you have the correct P 1 form. You can usually download it from the IRS website or obtain a hard copy from your employer.

- Fill in Employer Details: At the top of the form, write the name and address of the employer or payor. Then, include the Employer Identification Number (EIN).

- Complete the Employer/Payor Statement: In the designated area, fill in your name and title. Also, write the name of the employee or payee who declined to provide their identifying number.

- Certify the Information: Confirm that you asked the employee/payee for their taxpayer ID number. You’ll want to ensure your statement is truthful and accurate.

- Sign and Date: Make sure you sign the form and date it in the appropriate sections.

- Add Employee/Payee Information: Now, provide details about the employee or payee. This includes their first name, last name, and social security number (enter “None” or “Declined” if they opted not to provide it).

- Complete Home Address: Fill in the home address of the employee or payee, including city, state, and ZIP code.

- Employee/Payee Statement: The employee/payee must write their name in the appropriate space, confirming that they have declined to provide their identifying number.

- Employee/Payee Signature and Date: Ensure that the employee or payee signs and dates the form.

Once the form is filled out, it should be submitted according to your organization’s procedures. Keeping a copy for your records is also a smart move. This will help avoid any misunderstandings in the future.

What You Should Know About This Form

What is Form P-1 used for?

Form P-1 is a Reasonable Cause Affidavit that allows employers or payors to explain why they could not obtain the identifying number of a payee. This could be a Social Security Number or another taxpayer ID. If an employee or payee declines to provide their identifying number, the employer can use this form to request a waiver of the penalty for not having the number. The form is filed in accordance with IRS guidelines, specifically 26 USC §6724(a).

Who needs to fill out Form P-1?

Both the employer or payor and the employee or payee must fill out sections of Form P-1. The employer completes the affidavit attesting that they requested the identifying number and that the payee declined to provide it. The employee then confirms this by signing their own section of the form. This ensures that both parties agree on the circumstances surrounding the lack of the identifying number.

What happens if the payee refuses to provide their identifying number?

If a payee refuses to provide their identifying number, the employer should still request it formally. If the payee continues to decline, the employer fills out Form P-1 and submits it to the IRS with appropriate documentation. By demonstrating that the lack of the number is due to reasonable cause rather than willful neglect, the employer can avoid a $50 penalty that would typically apply in such situations.

Is it mandatory to submit Form P-1 for every payee without an identifying number?

No, it is not mandatory to submit Form P-1 for every payee that does not provide their identifying number. However, it is advisable to do so if the lack of the number could lead to penalties. If the employer can show reasonable cause for not obtaining the identifying number, filling out and submitting Form P-1 can protect them from penalties enforced by the IRS.

Common mistakes

Filling out the P-1 form can be a straightforward task, yet many people make mistakes that could lead to complications. One common mistake is failing to provide the correct employer identification number. It is essential to double-check this number to ensure it matches official records.

Another frequent issue is incorrect information about the employee or payee. People sometimes make errors in spelling the names or entering the wrong Social Security number. Such mistakes can create delays and problems with the IRS.

Some individuals skip the section where they need to explain the reason for not obtaining the payee’s identifying number. This step is crucial. Without it, the form lacks context, which can result in misunderstandings or additional questions from the IRS.

Leaving fields blank is another mistake often made. For instance, not providing the home address can lead to the form being considered incomplete. Completing all required fields helps ensure the submission is processed.

Another pitfall is not signing and dating the form. Many forget this step, which is necessary for the document to be valid. It’s easy to overlook but very important.

People may also misinterpret the instructions regarding the use of “None” or “Declined” for the Social Security number. Clarity is key, as using the wrong term can lead to confusion during processing.

Failing to keep a copy of the completed form is something that can complicate matters later on. Having a record can assist if there are follow-up questions from the IRS or if clarification is needed.

There are instances where individuals submit the form without verifying it against the current regulations. Changes in tax law can affect how the P-1 form should be filled out. Staying updated helps prevent misunderstandings.

Finally, many overlook the importance of communicating with the payee. If the payee is not properly informed about the necessity of providing their identifying number, it can lead to frustration on both sides. Clear communication can often resolve many issues ahead of time.

Documents used along the form

The P-1 form is a critical document in the context of tax identification and compliance. However, several other forms and documents may be used in conjunction with the P-1 to ensure proper filing and adherence to tax obligations. Understanding these associated documents can streamline the process and help maintain compliance.

- W-9 Form: This form is used by individuals and entities in the United States to provide their taxpayer identification number (TIN) to a requester. Typically, businesses request a W-9 from independent contractors, enabling them to report payments to the IRS accurately.

- 1099-MISC Form: This document is issued to report various types of income to the IRS, including payments to non-employees. It is crucial for businesses to file this form for any contractor whom they have paid $600 or more during the tax year.

- Form 941: This quarterly tax form is required for employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It also details the employer’s share of those taxes, ensuring accurate contribution reporting to the IRS.

- Form SS-4: This application for an Employer Identification Number (EIN) is necessary for businesses and organizations. An EIN is often required for tax administration, banking, and hiring employees, serving as a unique identifier for the business entity.

- Form 1023: Nonprofit organizations use this form to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This document outlines the organization's purpose, activities, and compliance with tax-exempt regulations.

- Form 4868: This form is filed to request an automatic extension of time to file an individual income tax return. It allows taxpayers to have an additional six months to complete their filings, though it does not extend the time to pay owed taxes.

- Form 1040: This is the individual income tax return form used by U.S. taxpayers to report their annual income. It includes details about income, deductions, and credits, ultimately calculating tax liability or refund eligibility.

- Form 656: Individuals looking to settle their tax debts through an Offer in Compromise will need to use this form. It formalizes the request to settle for less than the total amount owed to the IRS under specific conditions.

Each of these forms plays a pivotal role in tax compliance and reporting. When used together with the P-1 form, they create a comprehensive framework for managing tax obligations, protecting employers, and ensuring that payees fulfill their responsibilities.

Similar forms

The P 1 form, specifically designed for providing reasonable cause for not obtaining a payee’s identifying number, shares similarities with several other documents used in tax and compliance scenarios. Below is a list of documents that exhibit notable resemblances to Form P 1:

- W-9 Form: This form is used by businesses to request the Taxpayer Identification Number (TIN) of a vendor or contractor. Like the P 1 form, it requires the payee to provide identifying information but is typically completed when the payee is willing to disclose their TIN.

- W-4 Form: Employees use this form to indicate their tax withholding preferences. While distinct from the P 1 form, both documents necessitate employee verification and signatures regarding tax identification.

- Form 1040X: This is an amended tax return form. Similar to the P 1 form, it allows taxpayers to explain discrepancies or changes, including failure to previously provide adequate identifying information.

- Form 1099-MISC: Used to report payments made to independent contractors, the 1099-MISC requires the payer to obtain a TIN, paralleling the P 1 form’s focus on identifying numbers for tax reporting.

- Form SS-4: This form is for applying for an Employer Identification Number (EIN). While its purpose differs, like the P 1 form, it involves identification requirements and official declarations to the IRS.

- Form 4506-T: This form allows for the request of a transcript of tax returns. In a similar vein to the P 1 form, it involves authorizing the IRS to share taxpayer information with the requester.

- Form 4868: This is an application for an extension of time to file a tax return. While its primary focus is on timing, it also involves providing identifying information, linking it back to compliance standards like those outlined in the P 1 form.

Dos and Don'ts

When filling out the P 1 form, it's important to be careful and thorough. Here is a list to guide you in the process:

- Do provide complete and accurate information.

- Do ensure the employer/payor's name and address are correct.

- Do include the employer identification number.

- Do use clear handwriting if filling it out by hand.

- Do specify “None” or “Declined” for the social security number if applicable.

- Don't leave any required fields blank.

- Don't add unnecessary details or information that is not requested.

- Don't rush when signing the affidavit; your signature must match your name.

- Don't submit the form without verifying all information is correct.

Misconceptions

Understanding the P 1 form, also known as the Reasonable Cause Affidavit by Payor, is vital for both employers and employees. However, several misconceptions can create confusion. Here are eight common misunderstandings about this important document:

- The P 1 form is only for large businesses. This is not true. Any payor, regardless of size, may need to file this form if they encounter an issue with obtaining a payee's identifying number.

- The P 1 form eliminates all penalties. While the form can help waive certain penalties if reasonable cause is shown, it does not guarantee that all penalties will be released.

- You do not need to make an attempt to obtain the payee's identifying number. On the contrary, the payor must document their efforts to request this information before submitting the P 1 form.

- It’s fine to leave the payee's identifying number blank. Incorrect. The form must explicitly state if the number was declined or is unavailable. Merely leaving it blank can lead to challenges.

- Using the P 1 form is optional. If a payor has made a legitimate request for the identifying number but was met with refusal, using the P 1 form becomes necessary to avoid penalties.

- Only the employee/payee signs the P 1 form. Both the payor and the employee must sign the form. Each party's acknowledgement is crucial for validation.

- The P 1 form must be filed with the IRS immediately. It's important to file the form in conjunction with related tax documents when appropriate, rather than rushing to submit it separately.

- The P 1 form is the only way to address penalties for missing identifying numbers. There are different routes a payor may take, but the P 1 form provides a specific solution under the provisions of the IRS when reasonable cause is shown.

Being informed about these misunderstandings is the first step in navigating the complexities surrounding the P 1 form. Understanding its requirements can help both payors and payees handle their tax affairs more effectively.

Key takeaways

Understanding the details of Form P-1 can help ensure proper compliance and minimize penalties when an employee or payee declines to provide their identifying number. Here are key takeaways that every payor should consider:

- The form serves as an affidavit that allows a payor to declare reasonable cause for not obtaining a payee's identifying number.

- It is essential to provide accurate information in the form, including both the employer’s and employee’s names and addresses.

- This affidavit functionally supports a claim for a waiver of a potential penalty under 26 U.S.C. §6724 when reasonable cause is demonstrated.

- Declining to provide an identifying number does not absolve a payor of the responsibility to request it. This request should be documented clearly.

- Visibility is critical; you must include signatures from both the employer/payor and the employee/payee on the form.

- If an employee declines to provide their Social Security number, the payor can write “None” or “Declined” in the appropriate section.

- Filing the Form P-1 appropriately can prevent a $50 penalty that may otherwise be assessed for not having the payee's identifying number.

- It is vital that the payor confirms their request for the identifying number has been made and documented.

- Keep a copy of the completed Form P-1 for your records, as this may be needed for future reference or audits.

Browse Other Templates

Ssi Payee - This documentation acts as a safeguard for both the claimant and the representative payee.

California Gun Permit - Applications are reviewed according to Arizona state law and regulations.

Affidavit of Paternity Form - A separate acknowledgment is needed if both parents cannot sign together.