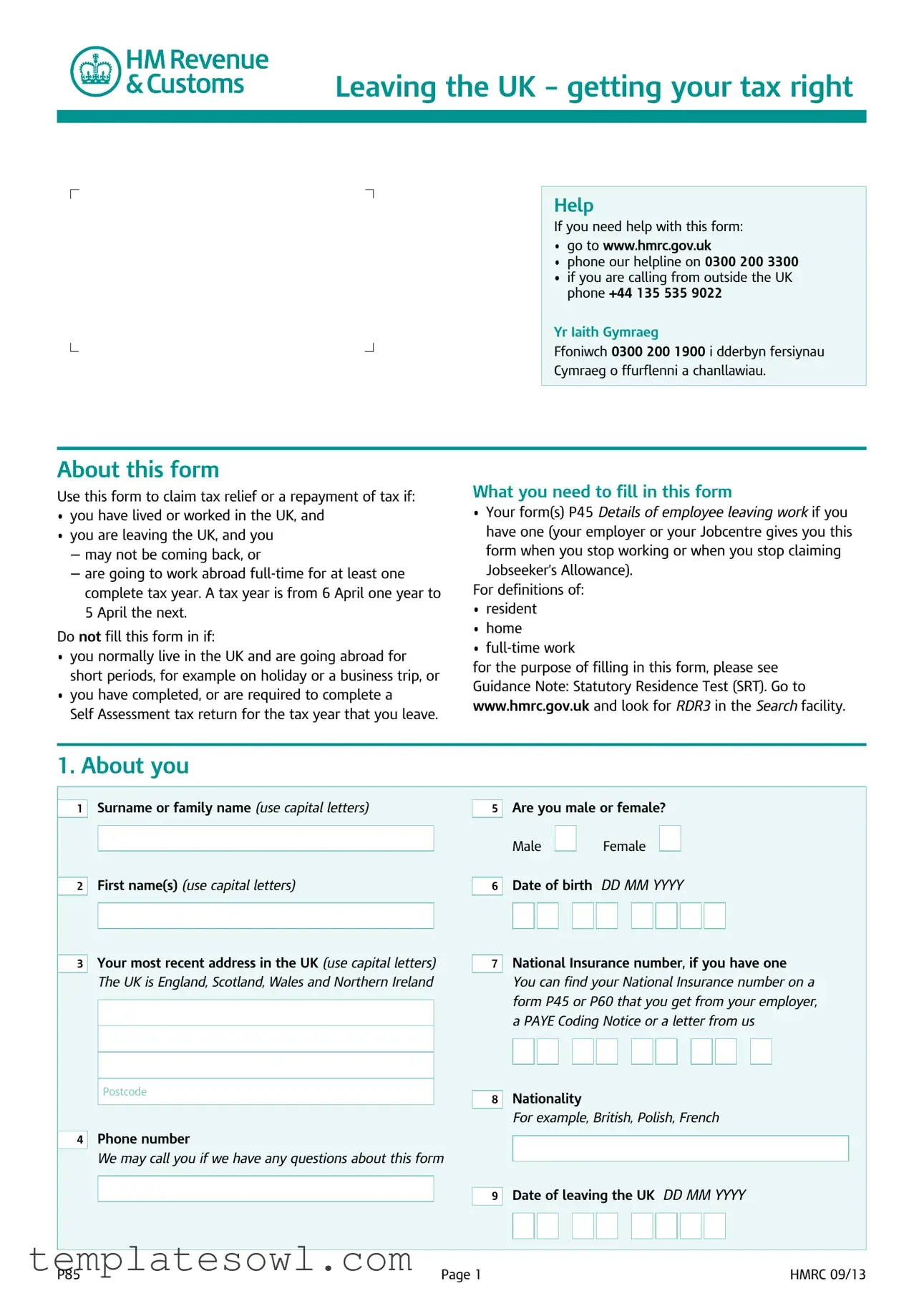

Fill Out Your P85 Form

The P85 form is an essential document for individuals who are leaving the UK and want to ensure they are fulfilling their tax obligations correctly. It serves the purpose of claiming tax relief or a repayment of tax if someone has lived or worked in the UK and is departing, possibly for an extended period or permanently. This form is particularly relevant for individuals planning to work abroad full-time for at least one complete tax year, which runs from April 6 to April 5 of the following year. Those who only live in the UK temporarily or are leaving for short trips, such as vacations or business obligations, do not need to complete it. The P85 requires personal information, such as the individual’s name, date of birth, and National Insurance number, alongside details regarding their residence history and income sources post-departure. This includes information on any UK income expected after leaving, such as rental income or pensions. Furthermore, how one wishes to receive any tax refunds must be indicated, whether through a UK bank account or via cheque. Guidance is available for completing the form through the HMRC website or their helplines, underscoring the importance of accurate and complete information to avoid complications with tax repayments.

P85 Example

Leaving the UK – getting your tax right

Help

If you need help with this form:

• go to www.hmrc.gov.uk

• phone our helpline on 0300 200 3300

• if you are calling from outside the UK phone +44 135 535 9022

Yr Iaith Gymraeg

Ffoniwch 0300 200 1900 i dderbyn fersiynau

Cymraeg o ffurflenni a chanllawiau.

About this form

Use this form to claim tax relief or a repayment of tax if:

•you have lived or worked in the UK, and

•you are leaving the UK, and you

—may not be coming back, or

—are going to work abroad

Do not fill this form in if:

•you normally live in the UK and are going abroad for short periods, for example on holiday or a business trip, or

•you have completed, or are required to complete a

Self Assessment tax return for the tax year that you leave.

What you need to fill in this form

•Your form(s) P45 Details of employee leaving work if you

have one (your employer or your Jobcentre gives you this form when you stop working or when you stop claiming Jobseeker’s Allowance).

For definitions of:

•resident

•home

•

for the purpose of filling in this form, please see Guidance Note: Statutory Residence Test (SRT). Go to www.hmrc.gov.uk and look for RDR3 in the Search facility.

1. About you

|

Surname or family name (use capital letters) |

|

|

|

Are you male or female? |

|||||||||||||||||||||

1 |

|

5 |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

Male |

|

|

|

|

Female |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

First name(s) (use capital letters) |

|

|

|

Date of birth |

DD MM YYYY |

||||||||||||||||||||

2 |

|

6 |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your most recent address in the UK (use capital letters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

National Insurance number, if you have one |

||||||||||||||||||||||

3 |

|

7 |

|

|||||||||||||||||||||||

|

The UK is England, Scotland, Wales and Northern Ireland |

|

|

You can find your National Insurance number on a |

||||||||||||||||||||||

|

|

|

|

|

|

|

form P45 or P60 that you get from your employer, |

|||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

a PAYE Coding Notice or a letter from us |

|||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

Nationality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

For example, British, Polish, French |

|||||||||||||||||||

4 |

Phone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

We may call you if we have any questions about this form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Date of leaving the UK DD MM YYYY |

|||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

9 |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P85 |

|

|

Page 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HMRC 09/13 |

||

1.About you continued

10How long had you lived in the UK before the date you left (or the date you intend to leave)?

11From the 6 April in the tax year you left the UK up to the date you left, were you resident in the UK?

Yes No

12Were you resident in the UK in the tax year before the tax year you left? see example below

Example

Your date of leaving the UK was 10 August 2013

For question |

|

11 |

use tax year 6 April 2013 to |

||||

5 April 2014 |

|

|

|

|

|||

|

|

|

|

|

use tax year 6 April 2012 to |

||

For question |

|

12 |

|||||

5 April 2013 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|||

13How many days do you expect to spend in the UK between your date of leaving the UK and the following 5 April?

days

14How many days do you expect to spend in the UK in each of the next three tax years?

(From 6 April one year to 5 April the next) For example, 81 days between 6 April 2014 and 5 April 2015

Year 1 |

days |

|

|

Year 2 |

days |

|

|

Year 3 |

days |

|

|

15Which country are you going to?

16What is your full address in that country?

17Will you (or your spouse, civil partner or someone you are living with as a spouse or civil partner) have a home in the UK while you are abroad?

Yes No

If Yes, what is the UK home address

Postcode

18Will you be working

Yes No

19Will you continue to have your salary paid from the UK?

Yes

No

No

2. Income you get from the UK after you leave

Fill in this section if you will get any income from the UK after you leave the UK.

Income includes income from property, earnings you get from UK work, a

|

|

Will you get any income from a property in the UK? |

If you have a property in the UK that you get income |

|||||||||||||

20 |

|

|||||||||||||||

|

|

For example, rent, property fees, interest premiums |

from you may have to pay UK income tax. |

|||||||||||||

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

For more information go to www.hmrc.gov.uk and look |

||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

for The |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If Yes, tell us the date from which you first started to |

Search facility. |

||||||||||||||

|

receive rental income, if appropriate DD MM YYYY |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2

2. Income you get from the UK after you leave continued

21

Give details of any other income you will get from the UK after you leave

If you do not know the actual amount, give an estimate

Type of income For example, rent, |

Annual |

Date started |

Payroll/pension |

Name of payer |

pension, employment, interest |

amount (£) |

DD MM YYYY |

or account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you will be working when you leave the UK, go to section 3 ‘Your employment’.

If not, go to section 4 ‘How you want to be paid any money due back to you’ on page 4.

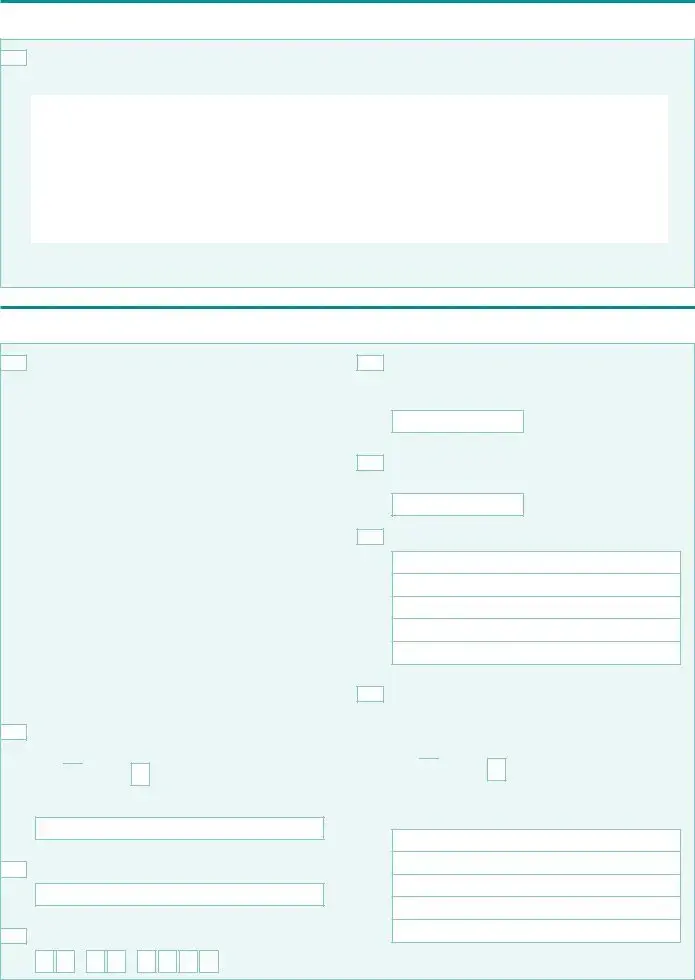

3. Your employment

22Will you perform any duties in the UK from either the date you:

•left the UK

•started a job abroad

whichever is the later?

No |

|

If No, go to question 23 |

||||

|

||||||

Yes |

|

|

If Yes, use that date to calculate the |

|||

|

|

|||||

|

|

|||||

|

|

|

estimated number of days you will work |

|||

|

|

|

more than 3 hours each day in the UK: |

|||

|

|

|

|

between that date and 5 April following |

||

|

|

|

|

that date |

||

|

|

|

|

|

|

|

|

|

|

|

days |

|

|

|

|

|

|

|

|

|

|

|

|

in the next tax year after that date |

|||

|

|

|

(A tax year is from 6 April one year to |

|||

|

|

|

5 April the next) |

|||

|

|

|

|

|

||

|

|

|

|

days |

|

|

|

|

|

|

|

|

|

23Do you work for the UK Government as a Crown servant or in Crown employment?

Yes

No

No

If Yes, tell us your department’s name

24What job will you do in the country you are going to?

26How many days do you expect to spend in the UK between the date you started your job abroad and the 5 April immediately following that date?

days

27On average, how many hours each week will you work in your job abroad?

hours

28Your employer’s name and address

Name

Address

29Will any of your employment income be paid through either:

•a UK employer through a UK payroll, or

•an office or agent in the UK?

Yes

No

No

If Yes, tell us the name and address of the person paying you

Name

25

What date will you start your job abroad? DD MM YYYY

Postcode

Page 3

4. How you want to be paid any money due back to you

Not everyone gets a refund. It is not always possible to issue a payment to a

|

Option one – Pay into a UK bank or building |

|

Option two – Pay by cheque direct to me or |

|

|

||

|

society account |

|

my nominee |

Bank sort code |

Put ‘X’ in one box |

||

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

Make the cheque payable to me |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

I authorise the cheque to be payable to my nominee |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of nominee |

|

||

Account holder’s name |

|

|||||||||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address to send cheque to |

|

||

Bank or building society name and address |

|

|||||||||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Put ‘X’ in one box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

This is my account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||||||||

This is my nominee’s account |

|

|

|

|

|

|

|

|

||||||||||

Declaration

You must sign this declaration.

If you give information which you know is not correct or complete, action may be taken against you.

I declare that:

•the information I have given on this form is correct and complete to the best of my knowledge.

•I claim repayment of any tax due back to me.

Signature |

|

Date DD MM YYYY |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What to do now

Put an ‘X’ in relevant box

I have enclosed parts 2 and 3 of my form P45 Details of employee leaving work

Do not send photocopies. If you have not yet received your P45 from your employer please get it before you return this form.

I can’t get a form P45

Please tell us why in the box below, for example because you are retired or a UK Crown servant employed abroad. If you have a form P45 and don’t send it to us, any repayment due to you cannot be made.

Please send this form to your tax office. You can find your tax office address by:

•going to www.hmrc.gov.uk selecting Contact us and choosing Income Tax

•asking your employer.

We will let you know the outcome of this claim as soon as we can.

Page 4

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The P85 form is used to claim tax relief or a repayment of tax when leaving the UK for work abroad. |

| Eligibility | You are eligible to fill out this form if you have lived or worked in the UK and are not returning or will work abroad full-time for at least one complete tax year. |

| Documentation Needed | You must provide your P45 form, which shows details of your employment status when leaving. |

| Tax Year Definition | A tax year runs from 6 April one year to 5 April the next, impacting how the P85 form is completed. |

Guidelines on Utilizing P85

Once you have gathered the necessary information, filling out the P85 form can be straightforward. It's essential to complete this process carefully, as it helps ensure that any tax refund you might be due is processed efficiently. Below are the steps to help you fill out the form accurately.

- Personal Information: Start by entering your surname in capital letters, along with your first name(s) also in capital letters. Indicate your gender, date of birth, and provide your UK address, including the postcode.

- National Insurance Number: If you have one, include your National Insurance number. You can find this on your P45 or P60 forms.

- Leaving Date: Specify your date of leaving the UK. Mention how long you had lived in the UK before this date.

- Residency Status: Answer if you were a resident in the UK from 6 April of the tax year you left up to your leaving date. Also, state if you were a resident in the previous tax year.

- Future UK Days: Estimate how many days you expect to spend in the UK between your leaving date and the following 5 April. Do the same for the next three tax years.

- Future Address: Fill in the country you are moving to, along with your full address there. Indicate if you will maintain a home in the UK while living abroad.

- Employment Information: Indicate if you will work full-time abroad and whether your salary will still be paid from the UK.

- UK Income: If you will receive any income from the UK after you leave, provide details about it, including property income or pension details.

- Your Employment Abroad: Describe the job you will undertake abroad and how many hours you expect to work each week.

- Payment Information: Decide how you would like to receive any tax refund due to you — either directly to your UK bank account or via cheque.

- Signature and Submission: Finally, sign the declaration to confirm the accuracy of the information and indicate whether you have enclosed parts 2 and 3 of your P45. If you do not have a P45, explain the reason why.

Once you have completed the form, ensure that you send it to the correct tax office address, which can be found on the HMRC website or by asking your employer. Keep a copy for your records just in case you need to refer to it later.

What You Should Know About This Form

What is the purpose of the P85 form?

The P85 form is used to claim tax relief or a repayment of tax for individuals who have lived or worked in the UK and are leaving the country. This form is particularly relevant for those who may not return or who will be working abroad full-time for at least one complete tax year. It is essential for those transitioning out of UK residency to ensure that any overpayment of tax can be refunded appropriately.

Who should fill out the P85 form?

This form is intended for people who are officially leaving the UK and will not be returning, or who are moving abroad for work and will not be in the UK for a full tax year. It is important to note that individuals who are simply going on holiday or taking short business trips do not need to complete this form. Additionally, if a Self Assessment tax return is already required for the tax year of departure, the P85 should not be submitted.

What information do I need to provide when completing the P85 form?

To properly complete the P85 form, you will need basic personal information such as your name, date of birth, and address in the UK. It is also essential to provide your National Insurance number, if applicable. Details of your departure date, the country you are moving to, and information about any income you will still receive from the UK will also be required. If you have received a P45 from your employer, you should include those parts with your submission.

How will I receive any tax repayment due to me?

If you are eligible for a repayment, you may choose how to receive it. The P85 allows you to select a payment into a UK bank account or a cheque made payable to yourself or a nominee. It is crucial to fill in the appropriate section carefully to ensure that the repayment is processed correctly and efficiently. If you are outside the UK, you must be aware that not all banks can facilitate payments, so ensure to check your preferred method.

Common mistakes

Filling out the P85 form can be challenging, and many people make mistakes that can lead to delays or issues with their tax relief or refund. One common error is not using capital letters for names and addresses. When details are unclear or improperly formatted, it can slow down the processing of your claim.

Another mistake to avoid is failing to provide accurate dates. This includes the date of birth and the date of leaving the UK. If these dates are incorrect, it can create confusion and lead to further complications in your tax filings. Additionally, people often forget to attach their P45 forms, or they may send photocopies instead of the original document.

Some also overlook the importance of specifying their residency status in the tax years leading up to their departure. Providing inaccurate information regarding residency can lead to incorrect assessments of your tax obligation, which may have serious implications for future tax filings.

Another frequent error involves underestimating how many days one will spend in the UK during the subsequent tax years. Providing estimates that are either too high or too low can impact the outcome of your claim.

People sometimes neglect to indicate whether they will be working full-time outside the UK. This information is crucial for the claim process, and omitting it can lead to delays. Also, some may fail to specify how they would like their refund processed, whether through a UK bank or via cheque to a nominee. Not making a choice can result in a return that doesn’t reach you.

Overseeing the income section can also pose problems. Many individuals mistakenly believe they do not have any income from the UK after leaving, overlooking rental properties or dividends. Providing complete income information is vital to ensure that your tax obligations are correctly calculated.

Additionally, some mistakenly believe they can leave out their National Insurance number. This number is crucial for identification and can affect the speed at which your claims are processed. If you do not have one, it’s important to explain why in the form.

Communication errors can occur as well. Leaving the phone number section blank can hinder potential contact from tax officials who may need clarification on your application. Finally, failing to read the declaration carefully before signing can lead to unintentional inaccuracies. It's essential to understand that signing the form means you agree with all the information provided.

Documents used along the form

When navigating the process of leaving the UK and addressing tax matters, you may encounter several important documents beyond the P85 form. Each of these documents plays a vital role in ensuring that your tax obligations are met and that you can correctly claim any reliefs or repayments due to your situation. Here's a list of commonly associated forms and documents:

- P45: This form details the tax you've paid on your income while in employment. Your employer provides it when you leave, and it's essential for filing your tax claims.

- P60: Issued at the end of the tax year, this document summarizes your total earnings and the tax paid, serving as a useful reference for your tax status when leaving the UK.

- Self Assessment Tax Return: If you've completed one for the tax year that you leave, it provides the HMRC with an overview of your income and taxes due, which can influence your tax claim.

- P85S: Similar to the P85, this short form is used specifically for individuals claiming tax refunds without leaving the UK permanently, but its guidelines can guide those moving abroad.

- Form R43: This is applicable if you are claiming tax relief on pension income received from the UK after moving abroad, allowing you to specify the amount and your tax residency status.

- Tax Residence Certificate: Often required by foreign tax authorities, this certificate confirms your tax residency in the UK and helps avoid double taxation.

- Non-Resident Landlords Scheme (NRL): If you earn rental income from UK property after moving, registering under this tax scheme is necessary for tax treatment of your income.

- P86: This form is needed if you are a UK resident who earns income abroad, helping to explain your tax situation to HMRC.

- Crown Servants Tax Return: If you're a Crown servant, this is an important document providing specific guidance on how to file your tax return while serving abroad.

- Form SA106: This additional form supplements the Self Assessment, providing details on foreign income, crucial for individuals with multi-country financial interests.

These documents, when collected and filled out correctly, play a crucial role in smoothening your transition and ensuring that your tax matters are settled before leaving the UK. Understanding each form's purpose can make the process less daunting and more manageable.

Similar forms

- P45: This form is used to report the details when you leave a job. Like the P85, it provides important information about your income and tax deductions during your employment in the UK.

- Self Assessment Tax Return: If you are self-employed or have complex tax affairs, you will need to complete this return. Similar to the P85, it helps determine your tax obligation and any refunds due.

- P60: This document summarizes your annual earnings and tax deductions at the end of the tax year. It serves a similar purpose as the P85: providing information needed for tax assessments.

- NT (No Tax) Code Notification: This form tells HMRC that you are not liable to pay tax on your income. Like the P85, it deals with tax obligations when your residency status changes.

- Tax Refund Claim Form (R40): You can use this form to claim a tax refund if you believe you have overpaid tax. This is akin to the P85 in that it addresses refund issues and tax status outside of the UK.

- Residence Tax Return: This form details your residency status for tax purposes. Similar to the P85, it reveals how residency affects your tax filings and potential reliefs.

- Form SRT (Statutory Residence Test): This form assesses your residency status based on various factors. Much like the P85, it helps determine tax liabilities based on where you live and work.

Dos and Don'ts

When filling out the P85 form, there are essential points to keep in mind. Here are four things you should and shouldn’t do:

- Do: Ensure you have your P45 form if applicable. It’s crucial for processing your claim.

- Do: Use capital letters when entering your name and address to avoid any misunderstandings.

- Do: Respond to every question honestly and accurately. Incomplete forms can delay your process.

- Do: Make sure your contact information is current so that the tax office can reach you if needed.

- Don’t: Fill out the form if you plan to return to the UK shortly. This form is for those leaving long-term.

- Don’t: Forget to provide all required supporting documents. Missing documentation can lead to complications.

- Don’t: Use estimates for income unless you genuinely do not know the amount. Be as precise as possible.

- Don’t: Send photocopies of your P45. Always submit the original to ensure processing accuracy.

Misconceptions

- Misconception 1: The P85 form is meant for all individuals leaving the UK.

- Misconception 2: You must fill out the P85 form if you are leaving for a short holiday.

- Misconception 3: The P85 form guarantees a tax refund.

- Misconception 4: You can submit the P85 form at any time after leaving the UK.

- Misconception 5: A P45 is not needed to complete the P85 form.

- Misconception 6: You cannot report further income from the UK after leaving.

This form is specifically designed for those who have lived or worked in the UK and are leaving the UK for an extended period, potentially not returning. It is not intended for individuals going abroad temporarily, such as for vacations or short business trips.

Only individuals who are leaving the UK and will not be returning for at least one complete tax year should complete this form. Short trips do not require a P85 submission.

Filling out the P85 does not guarantee that a refund will be issued. Whether or not a refund is provided depends on individual tax circumstances and the information provided on the form.

The P85 form should be submitted as soon as possible after leaving the UK. Delaying the submission may complicate the process of obtaining any potential tax relief or refund.

The P45, which provides details of your employment, is an essential document when filling out the P85. Without it, your claim may be incomplete, and any refund cannot be processed.

Individuals who continue to receive income from the UK after leaving must report this on the P85 form. This includes income from properties, pensions, and other sources, which may still be subject to UK tax.

Key takeaways

When it comes to filling out the P85 form, understanding a few key points can make the process smoother. Here are essential takeaways to keep in mind:

- Purpose of the P85: This form is for individuals who have lived or worked in the UK and are leaving the country, either permanently or for full-time work abroad for at least one tax year.

- Not for Short Trips: If you typically live in the UK and are just going on holiday or taking a short business trip, do not fill out this form.

- Required Documents: Before filling out the P85, gather your P45, which your employer provides when you leave your job. This document will contain crucial information about your employment status.

- Residential Status: You will need to answer questions about your residency status concerning the UK for the tax years involved. This information helps determine your tax liability.

- Expectations of UK Visits: Be prepared to provide estimates of how many days you plan to spend in the UK in the upcoming tax years after leaving.

- Income Reporting: If you will receive any income from the UK after leaving, detail it on the form. This can include rent, pensions, or any other earnings.

- Refund Options: If you’re due a tax refund, choose how you want it paid: to a UK bank account or via cheque.

Completing the P85 accurately is important for ensuring you receive any tax relief or refund due to you. Make sure to review your information before sending the form to the appropriate tax office. Following these key points can help you navigate the process with ease.

Browse Other Templates

Florida Prepaid Transfer Authorization Form - Consider all financial implications carefully prior to submitting the cancellation form.

Free Diabetes Record Book - Presents a clear format for recording important health data.

Policy Loans Life Insurance - The owner should initially indicate the purpose of the loan on the form if applicable.