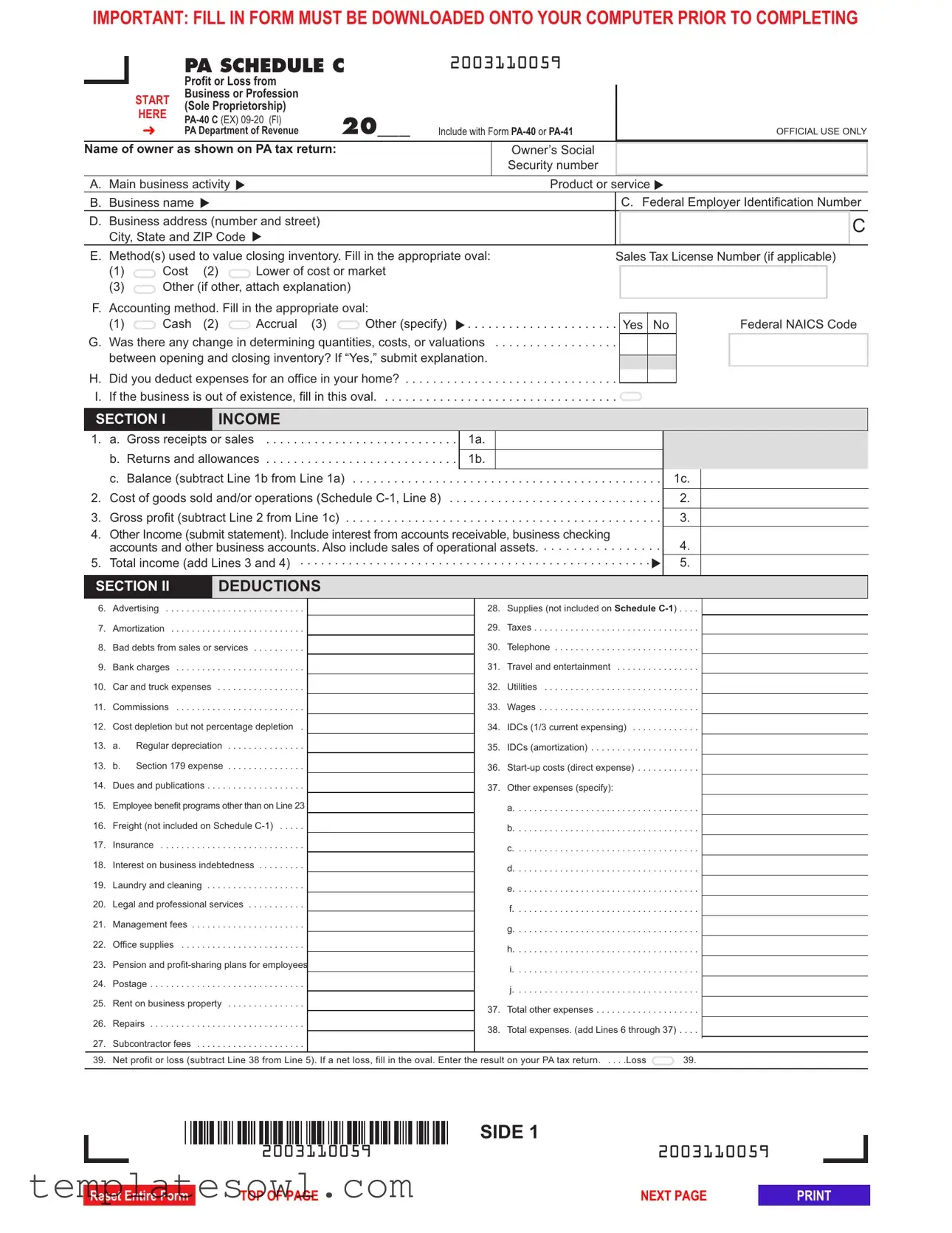

Fill Out Your Pa 40 C Form

The PA-40 C form is an essential document for sole proprietors in Pennsylvania who need to report income or losses from their business operations or professional practices. This form encapsulates various critical elements, including the owner's name, Social Security number, and Federal Employer Identification Number, which are necessary for identification purposes. Sole proprietors must detail their main business activities and provide the business's name and address. Additionally, the form requires information regarding the accounting methods used, inventory valuations, and any deductions for home office expenses. Income reporting encompasses gross receipts, returns and allowances, and various types of income that contribute to the total revenue of the business. Moreover, it lays out expenses in categories such as advertising, supplies, and legal services, allowing for a comprehensive view of the financial activities throughout the year. Understanding how to accurately complete the PA-40 C form is crucial for compliance with state tax regulations and for ensuring that business owners maximize their allowable deductions. As such, it serves as a valuable tool in the preparation and filing of personal income tax returns for Pennsylvania's sole proprietors.

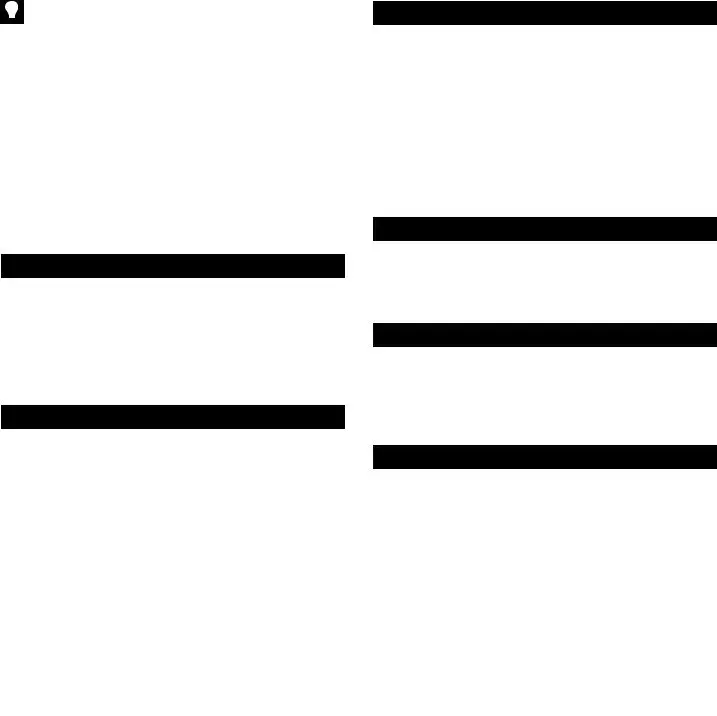

Pa 40 C Example

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

|

PA SCHEDULE C |

2003110059 |

|

|

Profit or Loss from |

|

|

START |

Business or Profession |

|

|

(Sole Proprietorship) |

|

|

|

HERE |

20___ |

|

|

➜ |

PA Department of Revenue |

Include with Form |

|

Name of owner as shown on PA tax return:

OFFICIAL USE ONLY

A. Main business activity t |

|

|

|

|

|

|

B. Business name t |

|

|

|

|

|

|

D. Business address (number and street) |

|

|

|

C |

||

City, State and ZIP Code |

t |

|

|

|

||

|

|

|

|

|||

E. Method(s) used to value closing inventory. Fill in the appropriate oval: |

Sales Tax License Number (if applicable) |

|||||

(1) |

Cost (2) |

Lower of cost or market |

|

|

|

|

|

|

|

|

|||

(3)  Other (if other, attach explanation)

Other (if other, attach explanation)

F.Accounting method. Fill in the appropriate oval:

(1) |

Cash (2) |

Accrual (3) |

Other (specify) |

t |

Yes No |

Federal NAICS Code |

G.Was there any change in determining quantities, costs, or valuations . . . . . . . . . . . . . . . . . .

between opening and closing inventory? If “Yes,” submit explanation.

H.Did you deduct expenses for an office in your home? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I.If the business is out of existence, fill in this oval. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SECTION I |

INCOME |

|

|

|

|

|

|

|

|

|||

1. |

a. Gross receipts or sales |

1a. |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Returns and allowances |

1b. |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

c. Balance (subtract Line 1b from Line 1a) |

. . |

. . . |

. |

. . . . . . . . . . . . . . . . . . |

. . . . . |

1c. |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Cost of goods sold and/or operations (Schedule |

. . |

. . . |

. |

. . . . . . . . . . . . . . . . . . |

. . . . . |

|

2. |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Gross profit (subtract Line 2 from Line 1c) |

. . |

. . . |

. |

. . . . . . . . . . . . . . . . . . |

. . . . . |

|

3. |

|

|||

4. Other Income (submit statement). Include interest from accounts receivable, business checking |

|

|

|

|

||||||||

|

|

4. |

|

|||||||||

|

accounts and other business accounts. Also include sales of operational assets |

. . . . . |

|

|

||||||||

5. |

Total income (add Lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .t |

|

5. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

SECTION II |

DEDUCTIONS |

|

|

|

|

|

|

|

|

|||

6. |

Advertising |

. . . . . . . . . . . . . . . . . . |

|

|

28. |

Supplies (not included on Schedule |

. . . . |

|

||||

7. |

. . . . . . . .Amortization |

. . . . . . . . . . . . . . . . . . |

|

|

29. |

. .Taxes |

. . . . . . . |

. . . |

. . . . |

|

||

8. |

. . . . . . . . . .Bad debts from sales or services |

|

|

30. |

. .Telephone |

. . . . . . . |

. . . |

. . . . |

|

|||

9. |

. . . . . . .Bank charges |

. . . . . . . . . . . . . . . . . . |

|

|

31. |

. .Travel and entertainment |

. . . . . . . |

. . . |

. . . . |

|

||

10. |

Car and truck expenses |

. . . . . . . . . . . . . . . . . |

|

|

32. |

. .Utilities |

. . . . . . . |

. . . |

. . . . |

|

||

11. |

. . . . . . .Commissions |

. . . . . . . . . . . . . . . . . . |

|

|

33. |

. .Wages |

. . . . . . . |

. . . |

. . . . |

|

||

12. |

Cost depletion but not percentage depletion . |

|

|

34. |

. . . . . . . . .IDCs (1/3 current expensing) |

. . . . |

|

|||||

13. |

a. |

. . . . . . . . . . . . . . .Regular depreciation |

|

|

35. |

. .IDCs (amortization) |

. . . . . . . |

. . . |

. . . . |

|

||

13. |

b. |

Section 179 expense |

|

|

36. |

|

|

|||||

|

|

. . . . |

|

|||||||||

14. |

Dues and publications |

|

|

|

37. |

Other expenses (specify): |

|

|

|

|

||

. . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

||||||

15. |

Employee benefit programs other than on Line 23 |

|

|

|

|

a |

|

|

|

|

||

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

|||||

16. |

Freight (not included on Schedule |

|

|

|

|

b |

|

|

|

|

||

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

|||||

17. |

Insurance |

|

|

|

|

|

c |

|

|

|

|

|

. . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

||||

18. |

Interest on business indebtedness |

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

|||

|

|

|

|

d |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

19. |

Laundry and cleaning |

|

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

||

|

|

|

|

|

e |

|

|

|

|

|||

. . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

||||

20. |

Legal and professional services |

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

|||

|

|

|

|

f |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

21. |

Management fees |

|

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

||

|

|

|

|

|

|

|

|

|

||||

. . . . . . . . . . . . . . . . . . |

|

|

|

|

g |

|

|

|

|

|||

22. |

Office supplies |

|

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

||

|

|

|

|

|

|

|

|

|

||||

. . . . . . . . . . . . . . . . . . |

|

|

|

|

h |

|

|

|

|

|||

23. |

Pension and |

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

i |

|

|

|

|

||||

24. |

Postage |

|

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

||

|

|

|

|

|

|

|

|

|

||||

. . . . . . . . . . . . . . . . . . |

|

|

|

|

j |

|

|

|

|

|||

25. |

Rent on business property |

|

|

|

|

. . . . . . . |

. . . |

. . . . |

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

37. |

Total other expenses . . . . |

|

|

|

|

|||||

26. |

Repairs |

|

|

|

. . . . . . . |

. . . |

. . . . |

|

||||

|

|

|

|

|

|

|

||||||

. . . . . . . . . . . . . . . . . . |

|

|

38. |

Total expenses. (add Lines 6 through 37) |

|

|

||||||

27. |

Subcontractor fees |

|

|

|

. . . . |

|

||||||

|

|

|

|

|

||||||||

. . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

39. |

Net profit or loss (subtract Line 38 from Line 5). If a net loss, fill in the oval. Enter the result on your PA tax return |

Loss |

39. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIDE 1 |

2003110059 |

2003110059 |

Reset Entire Form

TOP OF PAGE |

NEXT PAGE |

|

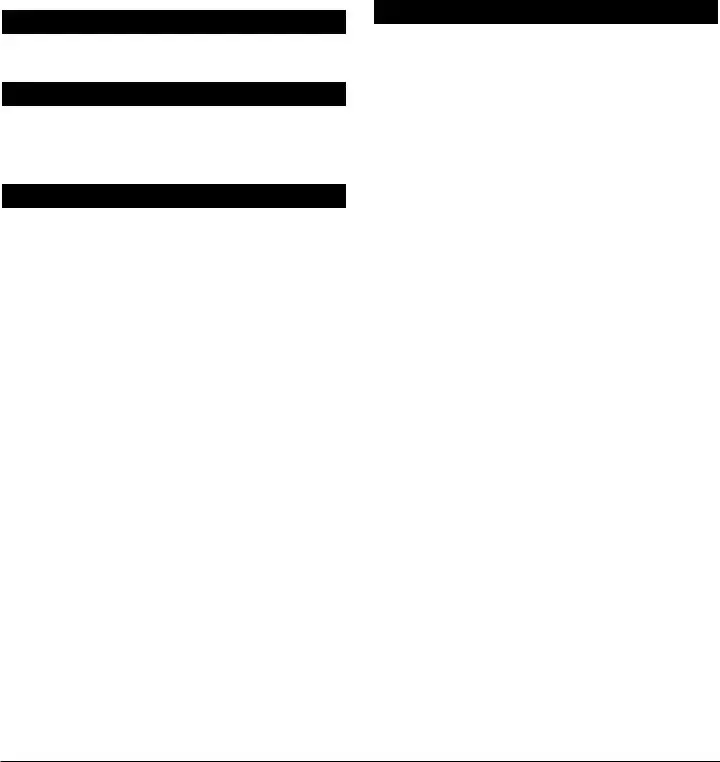

PA SCHEDULE C |

2003210057 |

|

|

|

Profit or Loss from |

|

|

|

|

|

|

|

|

|

Business or Profession |

|

|

|

|

(Sole Proprietorship) |

|

|

|

|

20___ |

|

|

|

|

PA Department of Revenue |

|

OFFICIAL USE ONLY |

|

Name of owner as shown on PA tax return: |

|

|

Social Security Number |

|

START

➜

SCHEDULE

1. |

Inventory at beginning of year (if different from last year’s closing inventory, include explanation) . . . . |

||

|

|

|

|

2. |

a. Purchases |

2a. |

|

|

|

|

|

|

b. Cost of items withdrawn for personal use |

2b. |

|

|

c. Balance (subtract Line 2b from Line 2a) |

|

|

|

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

|

3. |

Cost of labor (do not include salary paid to yourself or subcontractor fees) |

||

4. |

Materials and supplies |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

5. |

Other costs (include schedule) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

6. |

Add Lines 1, 2c, 3, 4 and 5 |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

7. |

Inventory at end of year |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

8. |

Cost of goods sold and/or operations (subtract Line 7 from Line 6) Enter here and on Section I, Line 2 .t |

||

|

|

|

|

1.

2c.

3.

4.

5.

6.

7.

8.

SCHEDULE C- 2 - Depreciation

PA PIT law does not permit any of the bonus depreciation elections added to the Internal Revenue Code (IRC). PA PIT law limits IRC Section 179 current expensing to the expensing allowed at the time you placed the asset into service or in effect under the IRC of 1986 as amended Jan. 1, 1997. For each asset, you must also report

1. |

Total Section 179 depreciation (do not include in items below) . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . t |

1. |

|

||

|

|

|

|

|

|

||

2. |

Less: Section 179 depreciation included in Schedule |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . t |

2. |

|

||

|

|

|

|

|

|||

3. |

Balance (subtract Line 2 from Line 1). Enter here and on Section II, Line 13b |

. . . . . . . . . t |

3. |

|

|||

|

|

|

|

|

|

|

|

|

Description of property |

Date acquired |

Cost or other basis |

Depreciation allowed or |

Method of calcu- |

Life |

Depreciation for this year |

|

|

|

|

allowable in prior years |

lating depreciation |

or rate |

|

|

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

|

|

||||||

MM/DD/YY

4.Other depreciation:

Buildings . . . . . . . . . . . .

Furniture and fixtures . . .

Transportation equipment

Machinery and other equipment

Other (specify) . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

5. |

Totals (add all Line 4 amounts) |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

5. |

|

6. |

Any depreciation included in Schedule |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . |

6. |

|

7. |

Balance (subtract Line 6 from Line 5). Enter here and on Section II, Line 13a |

. t |

7. |

||

|

|||||

|

SIDE 2 |

2003210057 |

2003210057 |

Reset Entire Form

PREVIOUS PAGE |

NEXT PAGE |

Instructions for

Profit or Loss from Business or Profession (Sole Proprietorship)

|

|

|

OVERVIEW |

|

Maintain separate books and records for PA PIT purposes |

||||

|

|

|

|

and file PA Schedule C. Even if you have no differences |

|||||

|

|

|

|

|

|||||

|

Use PA Schedule C to report income or loss from a business |

between your federal and Pennsylvania expenses, you must |

|||||||

|

you operate or a profession you practice as a sole proprietor. |

complete and include PA Schedule C to report your income |

|||||||

|

Your activity qualifies as a business if your primary purpose |

for Pennsylvania personal income tax purposes. |

|

|

|

||||

|

for engaging in the activity is income or profit, you conduct |

|

|

|

|

|

|||

|

your activity with continuity and regularity and you satisfy |

IMPORTANT DIFFERENCES BETWEEN |

|

|

|||||

|

the “Commercial Enterprise” test. Certain rental activity may |

|

|

||||||

|

FEDERAL AND PENNSYLVANIA RULES |

|

|

||||||

|

be business income and not rental income. If you are a sole |

|

|

||||||

|

|

|

|

|

|

||||

|

member of an LLC, complete PA Schedule C. |

You may use any accounting method for PA purposes, as |

|

|

|||||

|

For additional information regarding the definition of a business |

long as you apply your accounting methods consistently. |

|

|

|||||

|

PA law does not have material participation rules. Report |

|

|

||||||

|

or profession, and for Pennsylvania’s requirements for report- |

|

|

||||||

|

all transactions that are directly related to your business |

||||||||

|

ing income and expenses, refer to the PA Personal Income Tax |

||||||||

|

or profession on your PA Schedule C. |

|

|

|

|||||

|

Guide – Net Income or (Loss) from the Operation of a Busi- |

|

|

|

|||||

|

|

|

|

|

|

||||

|

ness, Profession or Farm section for additional information. |

If you own or operate more than one business, you must |

|||||||

|

|

|

|

|

|||||

|

|

NOTE: Pennsylvania determines income and (loss) |

submit a separate PA Schedule C for each business operation. |

||||||

|

|

||||||||

|

|

|

|

|

|

|

|||

|

|

under accepted accounting principles, systems or |

The following federal schedules and instructions do not |

||||||

|

|

||||||||

|

practices that are acceptable by standards of the accounting |

||||||||

|

apply for PA Schedule C: |

|

|

|

|||||

|

profession and consistent with regulations of the department. |

|

|

|

|||||

|

|

|

|

|

|

||||

|

● You may use any accounting method for PA purposes, |

SCHEDULE A |

|

|

|

||||

|

You may not deduct |

||||||||

|

|

as long as you apply your accounting methods consis- |

|||||||

|

|

taxes and casualty losses on any PA PIT return. |

|

|

|

||||

|

|

tently, it clearly reflects income and is not inconsistent |

|

|

|

||||

|

|

|

|

|

|

|

|||

|

|

with Pennsylvania law or regulations of the department. |

SCHEDULE E |

|

|

|

|||

|

● PA law does not contain provisions for statutory employ- |

Report rental and royalty income on PA Schedule E, unless |

|||||||

|

engaged in the business of making your property or rights |

||||||||

|

|

ees. Federal statutory employees may be required to |

|||||||

|

|

available in a public market place with intention to realize a |

|||||||

|

|

report PA taxable income on Line 1a, |

|||||||

|

|

profit. |

|

|

|

||||

|

|

PA Schedule UE to deduct expenses. However, you |

|

|

|

||||

|

|

|

|

|

|

|

|||

|

|

may use PA Schedule C to provide the type and amount |

SCHEDULE F |

|

|

|

|||

|

|

of expenses that are included as Miscellaneous |

|

|

|

||||

|

|

Report farming activity on PA Schedule F. |

|

|

|

||||

|

|

Expenses on PA Schedule UE when there are similar |

|

|

|

||||

|

|

SCHEDULE SE |

|

|

|

||||

|

|

types of expenses for your occupation or position. In |

|

|

|

||||

|

|

such cases, the business will report the business name |

Do not report |

|

|

||||

|

|

and activity as “Schedule UE Miscellaneous Expenses” |

FORM 4562 |

|

|

|

|||

|

|

with zero amounts reported as Gross receipts or sales |

|

|

|

||||

|

|

If using bonus depreciation, do not use Form 4562. Use |

|||||||

|

|

and Total income. You must also include “See PA |

|||||||

|

|

Schedule |

|||||||

|

|

Schedule C for expenses” on Section III, Line 16 of PA |

|||||||

|

|

deduction PA income tax law permits under IRC Section 179 |

|||||||

|

|

Schedule UE. If using PA Schedule C to report PA |

|||||||

|

|

is $25,000. If you have income or loss from more than one |

|||||||

|

|

Schedule UE expense types and amounts, you must |

|||||||

|

|

business, profession or farm, you may not deduct more than |

|||||||

|

|

follow PA Schedule UE rules for allowable and unallow- |

|||||||

|

|

$25,000 for all business activities. |

|

|

|

||||

|

|

able expenses. See the PA Personal Income Tax Guide |

|

|

|

||||

|

|

|

|

|

|

|

|||

|

|

– Gross Compensation section for more information. |

FORM 4684 |

|

|

|

|||

|

● Unless a loss results from an activity where a net profit |

Report gain or (loss) from all business activity on PA Schedule |

|||||||

|

C. Include a casualty or theft loss of business property (or |

||||||||

|

|

has not been realized in at least two years of a five |

|||||||

|

|

gain, if insurance proceeds exceed the basis of the property |

|||||||

|

|

period, an owner may deduct all |

|||||||

|

|

lost or taken) on Line 4 of PA Schedule C. You may refer to |

|||||||

|

|

losses from a business or profession in the taxable year |

|||||||

|

|

the federal schedule for an explanation of gain or (loss) |

|||||||

|

|

realized. Report all transactions directly related to your |

|||||||

|

|

items, but do not submit the federal schedule. |

|

|

|

||||

|

|

business or profession on PA Schedule C. |

|

|

|

||||

|

|

|

|

|

|

|

|||

|

● Do not use the installment method for sales of inventory |

FORM 4797 |

|

|

|

||||

|

|

if you sell such inventory in the regular and ordinary |

Report other sales, exchanges and involuntary conversions |

||||||

|

|

course of a business or profession. Include interest on |

of business property on Line 4 of PA Schedule C if the prop- |

||||||

|

|

such sales in gross receipts. |

erty sold was replaced. Refer to the federal schedule for an |

||||||

|

|

|

|

|

|

|

|

||

|

www.revenue.pa.gov |

|

1 |

||||||

|

|

|

|

|

|

|

|||

|

RETURN TO PAGE 1 |

PREVIOUS PAGE |

NEXT PAGE |

|

|

|

|||

explanation of gain/loss items, but do not submit the federal |

any differences in depreciation related to differences in basis |

||||

schedule. |

of assets, amount of allowable Section 179 expense, or |

||||

FORM 8271 |

method of depreciation for federal or PA purposes; and any |

||||

other reductions in federal expenses allowed at 100 percent |

|||||

Do not report or deduct any transactions related to tax |

|||||

for PA personal income tax purposes. |

|||||

shelters. |

|||||

|

|

||||

FORM 8594 |

Examples of items that Pennsylvania requires as reductions |

||||

in federal income or expenses include: income taxes based |

|||||

Report the acquisition or disposition of business assets on |

|||||

upon gross or net income; any differences in depreciation |

|||||

Line 4 of PA Schedule C. Refer to the federal schedule for |

|||||

related to differences in basis of assets, amount of allowable |

|||||

an explanation for gain/loss items, but do not submit the |

|||||

Section 179 expense, or method of depreciation for federal |

|||||

federal schedule. |

|||||

or PA purposes; recognition of cancellation of debt income; |

|||||

|

|

|

|||

FORM 8824 |

recognition of income from IRC Section 481(a) spread |

||||

Do not report a |

adjustments; payments for owner pension, |

||||

law does not have |

plans, deferred, or welfare benefit plans; percentage deple- |

||||

include the gain or loss from a sale, exchange or disposition |

tion; direct expensing of organizational expenses or syndi- |

||||

of a business asset on Line 4 of PA Schedule C if the trans- |

cation fees; losses from the sale of property where PA basis |

||||

action was a normal business transaction. You must report |

is different than federal basis; and any other income or |

||||

any gain or loss from the sale of a nonbusiness asset or |

expenses where there is a specialized federal treatment that |

||||

property or the sale of a business or segment thereof on PA |

is not specifically addressed or allowed by PA personal |

||||

Schedule D if the property sold was not replaced. |

income tax law that might involve additional expensing, |

||||

FORM 8829 |

expensing verses capitalization, carry back or carry forward |

||||

of losses, income recognition, or other special treatments. |

|||||

Include your allowable expenses for the business use of |

|||||

Other differences between Pennsylvania and federal income |

|||||

your home on Line 37 of PA Schedule C. Refer to the federal |

|||||

schedule for an explanation of this expense, but do not sub- |

tax include the following: |

||||

mit the federal schedule. Pennsylvania does not recognize |

IDCs. Special rules apply for the direct expensing of intan- |

||||

the federal safe harbor method for determining the allowable |

gible drilling & development costs (IDCs). Up to |

||||

deduction for business use of a residence for Pennsylvania |

the amount of IDCs incurred in tax years beginning after |

||||

Personal Income Tax purposes. All home office expenses |

Dec. 31, 2013 may be directly expensed, with the remaining |

||||

must be determined by using actual costs incurred. |

amount amortized over 10 years. Taxpayers may also elect |

||||

|

|

|

to amortize the full amount of the IDCs over 10 years. The |

||

|

OTHER PENNSYLVANIA AND FEDERAL |

|

election to expense any IDCs is made by including an |

||

|

|

amount on Line 34 of PA Schedule C. Amortization of the |

|||

|

INCOME TAX DIFFERENCES |

|

|||

|

|

IDCs must be reported separately on Line 35 of PA Schedule |

|||

|

|

|

|||

PA income from the operation of business generally differs |

C. IDCs incurred prior to Jan. 1, 2014 must be amortized |

||||

over the life of the well. |

|||||

from the income determined for federal income tax purposes. |

|||||

|

|

||||

Further, Pennsylvania will no longer accept a PA Schedule |

Qualified Joint Ventures. Pennsylvania is not a community |

||||

property state. Therefore, for PA personal income tax |

|||||

business income to PA business income. Therefore, the |

purposes, a taxpayer and the taxpayer’s spouse must each |

||||

items which were previously included as additions to PA |

report on a separate PA Schedule C their share of income |

||||

income or expense on the PA Schedule |

from a business entity they own that is considered a qualified |

||||

should be included with the specific line of income or |

joint venture for federal income tax purposes. |

||||

expense on the PA Schedule C. In addition, those items |

|

|

|||

which Pennsylvania does not require be reported as income |

LINE INSTRUCTIONS |

|

|||

or does not allow as expense in determining net business |

|

|

|||

|

|

||||

income, which are allowed in the determination of net federal |

IDENTIFICATION INFORMATION |

||||

business income, should not be included in the specific |

Complete each line. |

||||

business income or expenses on PA Schedule C. |

OWNER'S NAME |

||||

|

|

|

|||

Examples of items that Pennsylvania requires as additions |

Enter the name of the business owner. If you are married |

||||

to income include: any advance receipts for goods or serv- |

and you jointly owned the business with your spouse, you |

||||

ices; working capital interest or dividend income including |

must complete separate PA Schedule C’s. If you and your |

||||

spouse have separate business activities, complete separate |

|||||

tions of other states; gains from the sale of business assets |

PA Schedule(s) C. |

||||

where the property is replaced by similar property; gains |

SALES TAX LICENSE NUMBER |

||||

from |

|||||

Enter your Pennsylvania Sales Tax License Number if you |

|||||

sions (such as those from IRC Section 1033); and gains |

|||||

have one. Otherwise, leave this space blank. |

|||||

from the sale of property where PA basis is different than |

|||||

|

|

||||

federal basis. |

FEDERAL NAICS CODE |

||||

Examples of items that Pennsylvania allows as additions to |

Provide your Federal NAICS Code as identified on your |

||||

Federal Schedule C. |

|||||

expenses that require a reduction for federal tax purposes |

|||||

|

|

||||

include: meals, travel and entertainment expense deduction |

SOCIAL SECURITY NUMBER (SSN) |

||||

of 100 percent by Pennsylvania for the expenses incurred; |

Enter the SSN of the business owner. |

||||

|

|

|

|

|

|

2 |

www.revenue.pa.gov |

||||

RETURN TO PAGE 1 |

PREVIOUS PAGE |

NEXT PAGE |

|

|

|

|

|

LINE A |

|

LINE 1a |

|

|

|

MAIN BUSINESS ACTIVITY

Describe the business or professional activity that provided your principal source of income for Line 1. Use the same description you use for your Federal Schedule C. Enter the principal business or professional code you use on your Federal Schedule C.

LINE B

BUSINESS NAME

Enter the name of the business as you registered with the IRS.

LINE C

TAXPAYER IDENTIFICATION NUMBERS

Enter the Federal Employer Identification Number (FEIN) assigned to the business. If you do not have an FEIN for your federal Schedule C, leave this space blank.

LINE D

BUSINESS ADDRESS

Enter the complete address of the business.

GROSS RECEIPTS OR SALES

Include all amounts you received in operating your business or profession. PA law does not contain provisions for statutory employees. A statutory employee reports his or her PA tax- able income on Line 1a,

INSTALLMENT SALES

You may use the installment method for sales of inventory. Include interest on such sales in gross receipts.

LAND AND BUILDINGS

For PA purposes, you may not include the sales of land and buildings on PA Schedule C unless the property sold is replaced. When the property sold is not replaced, the department deems such sales as dispositions of a segment of a business to be reflected on PA Schedule D.

LINE 1b

RETURNS AND ALLOWANCES

This amount is the same for both Pennsylvania and federal purposes. If you report a different amount for Pennsylvania, submit an explanation.

LINE E

LINE 2

CLOSING INVENTORY VALUATION

Fill in the appropriate oval. Submit an explanation if necessary.

LINE F

ACCOUNTING METHOD

Fill in the oval for the accounting method you use for this business. Submit an explanation if necessary.

LINE G

INVENTORY CHANGES

Check “Yes” or “No” for this question. Submit an explanation if necessary.

COST OF GOODS SOLD

This amount is the same for Pennsylvania and federal pur- poses. If you report a different amount for Pennsylvania, submit an explanation.

LINE 4

OTHER INCOME

Enter gross proceeds you may have to report elsewhere on your federal tax return, including but not limited to:

●The sale of business assets when you reinvest the proceeds in business operations;

●The gain (loss) on replacing business property, including land or buildings used in operating your business or profession; and

|

LINE H |

● Interest and dividend income from |

|||

|

|

|

|||

OFFICE |

ments to generate working capital. |

|

|

||

|

|

|

|||

Check “Yes” if you deduct expenses for an office |

Submit a statement explaining the amount you enter. See |

||||

Check “No” if you do not deduct expenses for an office |

various sections of the PA Personal Income Tax Guide for |

||||

explanations of allocable interest, dividends and gains to |

|||||

|

|

|

business or professions. Include other income you enter on |

||

|

LINE I |

|

Line 6, Federal Schedule C, but not refunds of federal taxes |

||

|

|

|

and credits you did not deduct for PA purposes. |

|

|

OUT OF BUSINESS |

|

|

|||

|

|

|

|||

SECTION II |

|

|

|||

If the business is |

|

|

|||

for which you are filing, fill in the oval. |

|

|

|

||

DEDUCTIONS |

|

|

|||

|

|

|

|

|

|

|

SECTION I |

|

Use generally accepted accounting principles and practices |

||

|

|

|

to maintain your books and records and report your expenses |

||

|

|

|

|||

INCOME |

from your business or professional activity. PA law does not |

||||

Use generally accepted accounting principles and practices |

impose dollar or percentage limitations on allowable expenses. |

||||

to maintain your books and records, and report your income |

You may deduct 100 percent of the PA allowable business |

||||

from your business or professional activity. |

or professional expenses incurred during the taxable year. |

||||

|

|

|

|

|

|

|

www.revenue.pa.gov |

3 |

|||

RETURN TO PAGE 1 |

PREVIOUS PAGE |

NEXT PAGE |

NOTE: You may have incurred other expenses for  entertainment facilities (boat, resort, ranch, etc.), living accommodations (except for employees on business) or vacations for yourself, your employees or their families. Reduce your total business expenses in Section II by the

entertainment facilities (boat, resort, ranch, etc.), living accommodations (except for employees on business) or vacations for yourself, your employees or their families. Reduce your total business expenses in Section II by the

total of these personal expenses.

Generally, you may usually use your federal Schedule C expenses for PA PIT purposes. See the other Pennsylvania and federal income tax differences explanation beginning on Page 1 of the instructions for more information.

You may not use federal amounts after making certain elec- tions to accelerate or defer expenses or spread expenses over more than one taxable year. These instructions explain those expense categories where PA PIT rules and federal rules differ.

LINE 7

AMORTIZATION

Pennsylvania generally follows federal rules. You have the option to use any amortization method allowable under gen- erally accepted accounting principles and practices. Include the amortization of any

LINE 10

CAR AND TRUCK EXPENSES

You may deduct 100 percent of your actual vehicle expenses or you may use the federal standard mileage rate. If you use the federal standard mileage rate, you may not deduct any actual operating expenses, including depreciation and lease costs. Follow the Federal Schedule C rules for these expenses. If you use your car or truck for both business and personal travel, you may only deduct the business portion of your expenses.

LINE 13b

SECTION 179 EXPENSE

PA PIT law limits IRC Section 179 current expensing to the expensing allowed at the time you placed the asset into serv- ice or in effect under the IRC of 1986 as amended to Jan. 1, 1997. The maximum deduction that PA Income Tax law permits under IRC Section 179 is $25,000. Pennsylvania follows the federal definitions for listed property. If you use Section 179 for federal purposes, you must use Section 179 for Pennsylvania personal income tax purposes. See Infor- mational Notice, Personal Income Tax

LINE 14

DUES AND PUBLICATIONS

You may deduct dues and publications, but only to the extent directly used for ordinary business purposes. You must exclude any personal use of such expenses.

LINE 15

EMPLOYEE BENEFIT PROGRAMS OTHER THAN ON LINE 23

You may not deduct any payments you make for your own personal coverage. Pennsylvania does not allow any personal expenses on any PA tax return.

LINE 17

INSURANCE

You may deduct life insurance on yourself or your spouse only if the business is the beneficiary (not your spouse, other family members or other persons). The business must use the insurance proceeds to continue business operations. If deducting insurance premiums, the proceeds are business income on Line 4 of Section I.

|

|

LINE 13a |

|

|

|

|

|

|

|

|

|

LINE 18 |

|

||

REGULAR DEPRECIATION |

|

|

|||||

INTEREST ON BUSINESS INDEBTEDNESS |

|||||||

Use any depreciation method permissible under generally |

|||||||

Deduct interest on business debt only. If you personally |

|||||||

accepted accounting principles and practices as long as you |

|||||||

borrow money to acquire a business interest or to improve |

|||||||

consistently apply the method. |

|||||||

your business, you may not deduct the interest on any PA |

|||||||

|

|

NOTE: PA PIT law does not permit any of the bonus |

|||||

|

|

schedule or PA tax return. |

|||||

|

|

depreciation elections added to the Internal Revenue |

|||||

|

|

|

|

|

|||

|

|

|

|

|

|||

Code. |

|

|

|

||||

|

LINE 20 |

|

|||||

|

|

|

|

|

|

||

For each asset, you must also report |

LEGAL AND PROFESSIONAL SERVICES |

||||||

tion, unless not using an optional accelerated depreciation |

|||||||

Only deduct those expenses you incur in operating your |

|||||||

method. You need |

|||||||

business or profession. You may not deduct any personal |

|||||||

tage of Pennsylvania’s Depreciation and Basis Adjustment |

|||||||

expenses. You may include business accounting and tax |

|||||||

rule when you sell the asset. See the PA Personal Income |

|||||||

return preparation expenses, but not the costs for personal |

|||||||

Tax Guide – Net Gains or Losses from the Sale, Exchange |

|||||||

accounting and tax returns. |

|||||||

or Disposition of Property section for the Depreciation and |

|||||||

|

|

|

|||||

Basis Adjustment rule. |

|

|

|

||||

|

LINE 21 |

|

|||||

Pennsylvania Law requires that taxpayers use |

|

|

|||||

|

|

|

|||||

depreciation if an asset’s basis for determining Pennsylvania |

MANAGEMENT FEES |

||||||

depreciation is different from its basis for federal income tax |

Include any management fees paid in conjunction with the |

||||||

purposes. |

operation of the business to any related or |

||||||

|

|

|

|

|

|

|

|

|

4 |

|

www.revenue.pa.gov |

||||

RETURN TO PAGE 1 |

PREVIOUS PAGE |

NEXT PAGE |

LINE 23 |

|

LINE 33 |

|

|

|

PENSION AND

Only deduct those expenses directly related to pension and

WAGES

Do not reduce your wage expense for any federal credits you claim. Add back any wage expense excluded in order to claim a federal credit. Do not deduct the costs of your own participation.

|

|

|

|

|

|

|

|

|

|

|

LINE 34 |

|

|

|

|

|

|

LINE 25 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

IDCS (1/3 CURRENT EXPENSING) |

|||||

RENT ON BUSINESS PROPERTY |

|

|

|

||||||||||

|

|

|

If the business includes an amount on this line, it elects to |

||||||||||

Only deduct those expenditures you incurred in the operation |

|||||||||||||

directly expense up to |

|||||||||||||

of your business or profession. |

|

|

|

|

|||||||||

|

|

|

|

Drilling and Development Costs (IDCs) incurred for the tax |

|||||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

year for any tax year beginning after Dec. 31, 2013. See |

||||

|

|

|

LINE 27 |

|

|

|

|

||||||

|

|

|

|

|

|

|

Informational Notice, Personal Income Tax |

||||||

SUBCONTRACTOR FEES |

|

|

|

|

additional information. |

||||||||

|

|

|

|

|

|

|

|

||||||

Deduct subcontractor fees that were not included in your |

|

|

|

|

|||||||||

|

|

LINE 35 |

|

||||||||||

calculation of cost of labor from Line 3 of Schedule |

|

|

|

||||||||||

include any fees paid to payees not included as employees |

IDCS (AMORTIZATION) |

||||||||||||

to whom regular wages were paid. |

|

|

|

|

|||||||||

|

|

|

|

Report the amortization expense of IDCs incurred for all tax |

|||||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

years on this line. IDCs incurred in tax years beginning prior |

||||

|

|

|

LINE 29 |

|

|

|

|

||||||

|

|

|

|

|

|

|

to Jan. 1, 2014 must be amortized over the life of the well. |

||||||

TAXES |

|

|

|

|

|

|

IDCs incurred in tax years beginning after Dec. 31, 2013 |

||||||

|

|

|

|

|

|

may be amortized over 10 years (120 months). |

|||||||

Deduct tax expenses other than taxes based on income. You |

|||||||||||||

|

|

|

|

||||||||||

may not deduct taxes based on net income, federal income |

|

|

|

|

|||||||||

|

|

LINE 36 |

|

||||||||||

taxes or the |

|

|

|

||||||||||

allows. Do not deduct taxes paid to other states or foreign |

|||||||||||||

countries based on income. Do not deduct estate, inheri- |

|||||||||||||

Up to $5,000 of |

|||||||||||||

tance, legacy, succession or gift taxes. Assessments for |

|||||||||||||

the first year in which the business begins operations for tax |

|||||||||||||

betterments and improvements are not allowed. Business |

|||||||||||||

years beginning after Dec. 31, 2013. The department will |

|||||||||||||

privilege taxes and/or gross receipts taxes are acceptable |

|||||||||||||

follow IRC Section 195(b)(1)(A) regarding business |

|||||||||||||

deductions. |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

costs where expenses over $5,000 must be amortized over |

|||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

180 months and any amount of expenses over $50,000 |

||||

|

|

|

|

LINE 31 |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

requires a direct reduction in the direct expense amount. For |

|||||

TRAVEL AND ENTERTAINMENT |

|

|

|

|

tax years prior to Jan. 1, 2014, |

||||||||

|

|

|

|

to be amortized over 180 months. Record only the direct |

|||||||||

PA law does not follow federal law. Deduct 100 percent of |

|||||||||||||

expense amount of |

|||||||||||||

your actual travel and entertainment expenses. You may |

|||||||||||||

C. Report the amortization of any |

|||||||||||||

never deduct the personal portion of your travel and enter- |

|||||||||||||

PA Schedule C. |

|||||||||||||

tainment expenses, whether for yourself, your spouse, your |

|||||||||||||

|

|

|

|

||||||||||

dependents or any other person. You must calculate your |

|

|

|

|

|||||||||

|

|

LINE 37 |

|

||||||||||

expenses using actual expense amounts. You may not use |

|

|

|

||||||||||

federal |

OTHER EXPENSES |

||||||||||||

expenses. |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Deduct any other costs of doing business or providing |

|||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

professional services if such costs are permitted under |

||||

|

|

|

LINE 32 |

|

|

|

|

||||||

|

|

|

|

|

|

|

generally accepted accounting principles and practices. |

||||||

|

|

|

|

|

|

|

|

|

|||||

UTILITIES |

|

|

|

|

|

|

Itemize the additional expenses you claim, and enter the |

||||||

Certain utilities, which are not subject to sales and use tax |

total on Line 37, Total other expenses. You may deduct: |

||||||||||||

when purchased exclusively for residential use, become |

|

● |

100 percent of the PA sales tax paid on a depreciable |

||||||||||

subject to sales and use tax when used for commercial |

|

|

business asset. However, on disposition, your Penn- |

||||||||||

purposes. If you are including electricity, natural gas, fuel oil, |

|

|

sylvania basis and federal basis for that asset will be |

||||||||||

or kerosene in your calculation of the business use of your |

|

|

different. |

||||||||||

home, you should report use tax due on the prorated expense |

|

● |

Expenses using the capitalization rules established by |

||||||||||

amount. The use tax on these utilities should be paid via a |

|

||||||||||||

|

|

your trade, profession, or industry, under its generally |

|||||||||||

|

|

||||||||||||

|

|

accepted accounting principles and practices. Once |

|||||||||||

tax return, as part of that return. If you have a regular recur- |

|

|

|||||||||||

|

|

elected, use this method consistently. |

|||||||||||

ring use tax liability on utilities, you should register for a use |

|

|

|||||||||||

|

|

|

|

||||||||||

tax |

account |

using |

the |

Online |

at |

|

● 100 percent of expenses incurred for removing barriers |

||||||

www.pa100.state.pa.us. |

|

|

|

|

|

|

|

to individuals with disabilities and the elderly. This is not |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

www.revenue.pa.gov |

|

|

|

|

|

|

|

|||||

RETURN TO PAGE 1 |

PREVIOUS PAGE |

NEXT PAGE |

a credit but a direct expense in arriving at the net income or loss.

●Home office expenses. Pennsylvania generally follows the federal rules for determining the portion of the expenses for a home office. Pennsylvania does not follow the federal safe harbor rules for determining the allowable expense amount. See Line 32, Utilities, for additional information.

●Any other expenses allowed under generally accepted accounting principles or financial accounting standards board rules but are not allowable or limited under federal rules. Itemize these expenses.

LINE 38

TOTAL EXPENSES

Add Lines 6 through 37.

LINE 39

NET PROFIT OR LOSS

Subtract Line 38 from Line 5. In calculating net profit or loss from your business or profession, report your entire loss in this taxable year.

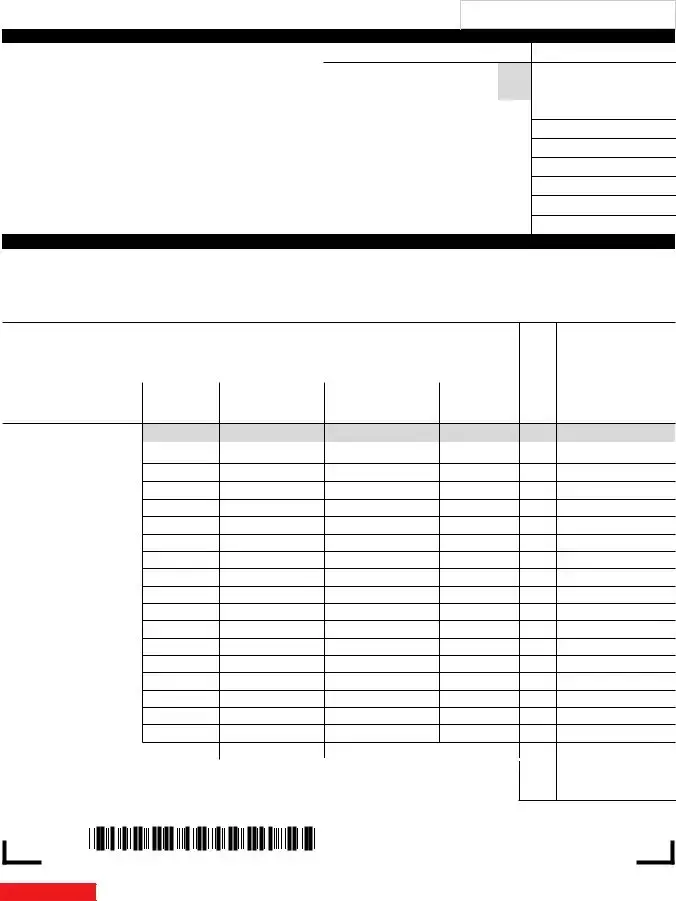

SCHEDULE

COST OF GOODS SOLD AND/OR OPERATIONS Generally, if you engaged in a trade or business in which the production, purchase or sale of merchandise was an

In determining inventory value, use the cost, lower of cost or market or other method allowable under generally accepted accounting principles and practices. If you change methods of valuing inventory, restate the value at the beginning of the year based on the changed method, and include an expla- nation. There is no provision under PA PIT law similar to IRC Section 481(a) that permits taxpayers to spread the income effect of a change in method over a specified period. PA PIT rules also do not permit valuing inventory using uniform capitalization rules under IRC section 263 A (a) and (b) and inventories calculated using this method for federal purposes must be recalculated for PA PIT purposes.

SCHEDULE

DEPRECIATION

Complete this schedule if you are using a depreciation method other than federal depreciation reported on your fed- eral Schedule C. See the instructions for Line 13 on Page 4.

6 |

www.revenue.pa.gov |

RETURN TO PAGE 1 |

PREVIOUS PAGE |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The PA-40 C form is used to report profit or loss from a sole proprietorship in Pennsylvania. |

| Governing Law | This form adheres to Pennsylvania Personal Income Tax Law (PA PIT Law), which outlines regulations for income determination. |

| Filing Requirements | Taxpayers must complete the PA-40 C if they have a business or profession in Pennsylvania generating income. |

| Documents | The form must be downloaded and filled out electronically. Handwritten forms are not accepted. |

| Owner Identification | It requires the owner's name, Social Security Number, and Federal Employer Identification Number (FEIN). |

| Income Calculation | Gross receipts minus returns and allowances determine the income balance reported on line 1. |

| Deductions | Taxpayers can deduct allowable business expenses, following principles recognized by the accounting profession. |

| Inventory Valuation | The form includes sections for reporting business inventory methods and changes related to inventory between the start and end of the year. |

Guidelines on Utilizing Pa 40 C

Preparing to fill out the PA-40 C form requires careful attention to detail. This form is essential for reporting income or loss from a business or profession operated as a sole proprietorship. Ensure you have all required information at hand before starting, as this will streamline the process and help in accurately completing the form.

- Download the PA-40 C form onto your computer to fill it out electronically.

- Enter the owner's name as it appears on the PA tax return in the designated area.

- Provide the Owner's Social Security number in the appropriate field.

- Input the Federal Employer Identification Number (FEIN) for your business, if applicable.

- Indicate the main business activity by selecting the corresponding oval and briefly describing it.

- Fill in your business name as registered with the IRS.

- Enter the business address, including the number, street, city, state, and ZIP Code.

- If applicable, provide your Pennsylvania Sales Tax License number.

- Choose a method for valuing closing inventory, marking the appropriate selection: cost, lower of cost or market, or other.

- Select your accounting method by marking cash, accrual, or other.

- Answer if there were changes in determining quantities, costs, or valuations of inventory between opening and closing by checking yes or no.

- Indicate if home office expenses were deducted by selecting yes or no and providing necessary details if applicable.

- Mark if the business is out of existence by checking the oval option.

- In the income section, fill out gross receipts or sales, returns and allowances, and calculate the balance accordingly.

- Report the cost of goods sold, and compute gross profit by subtracting the cost of goods from total income.

- Document other income, if applicable, providing any necessary statements.

- In the deductions section, list eligible expenses such as advertising, supplies, taxes, and more for a proficient assessment.

- Calculate total expenses and subtract from total income to find your net profit or loss, marking accordingly if it's a loss.

What You Should Know About This Form

What is the purpose of the PA-40 C form?

The PA-40 C form is used to report income or losses from a business or profession operated as a sole proprietorship in Pennsylvania. This form is essential for individuals who are filing their state tax returns and need to document earnings from their business activities while adhering to Pennsylvania's specific guidelines and requirements.

Who needs to fill out the PA-40 C form?

Individuals operating a sole proprietorship in Pennsylvania must complete the PA-40 C form. This includes self-employed persons who provide products or services for profit. If you are a sole member of an LLC, you also should fill out this form to report your business income. It's important to note that each business must use a separate form for reporting purposes.

What information is required on the PA-40 C form?

To properly complete the PA-40 C form, you need to provide various details, including your name, Social Security number, and the nature of your business activity. You must also report your gross receipts, deductions, and net profit or loss, among other financial figures. Properly documenting income and expenses according to Pennsylvania's guidelines is crucial for accurate reporting.

How does the PA-40 C form differ from federal tax reporting?

The PA-40 C form has specific requirements that may differ from federal forms. For example, Pennsylvania does not allow certain deductions and reserves the right to require separate reporting for some items that may be treated differently under federal law. It is crucial to adhere to Pennsylvania's accounting principles and regulations, ensuring that you report income and deductions that are allowable under state law.

What should I do if my business is no longer operational?

If your business is no longer operational by the end of the tax year, you should indicate this on the PA-40 C form. There is an option to mark that the business is out of existence. It's essential to report this accurately, as it may affect your tax obligations and eligibility for certain deductions or credits. Providing an explanation in the designated sections can help clarify your situation to the Pennsylvania Department of Revenue.

Common mistakes

Completing the PA-40 C form can be a complex task, and many individuals encounter various pitfalls along the way. Here are seven common mistakes to watch out for when filling out this important document.

One frequent error is failing to provide complete identification information. It's essential to enter the owner's Social Security number, business name, and business address accurately. If any of these details are missing or incorrect, it can cause significant delays in processing your form and potentially lead to penalties.

Another mistake is not selecting an appropriate accounting method. It’s important to choose from options like Cash, Accrual, or Other. If you skip this step or check the wrong box, it could affect how your income and expenses are reported, complicating your tax situation further.

Many people also overlook the importance of reporting inventory values correctly. When filling out the section regarding closing inventory valuation, ensure you specify the method you used—Cost, Lower of Cost or Market, or Other. Failing to do so could result in inaccurate income reporting, which may cause issues with your tax return.

Additionally, errors in reporting gross receipts or sales can lead to complications. Make sure to include all income received from your business activities. Providing incomplete information or miscalculating these figures can have serious tax implications.

Another common oversight is how to address other income. Many individuals do not include additional income sources that are relevant. If you have interest from accounts or proceeds from selling operational assets, you must report these accurately. Again, missing this information can disrupt the accuracy of your return.

It’s also crucial to remember to submit an explanation when asked about inventory changes. If there are any changes in the valuation of your inventory between the beginning and the end of the year, you must address them. Often, individuals forget this step, leading to confusion and potential audits.

Finally, a mistake that can derail your entire filing is neglecting to submit the correct documentation. It's essential to attach any explanations or supplemental information as needed. If you simply send the PA-40 C without the required documents, it may result in processing delays or rejections from the tax department.

By being mindful of these common mistakes, you can ensure a smoother and more accurate filing process for your PA-40 C form.

Documents used along the form

The PA-40 C form is crucial for individuals in Pennsylvania who operate a sole proprietorship and need to report income or loss from their business activities. This form details the financial performance of the business and is essential for calculating personal income tax obligations. Accompanying the PA-40 C form are several other documents that taxpayers may also need to submit, each serving a specific purpose in the reporting process.

- PA Schedule C-1: This form is used to report the costs of goods sold or operations. It provides detailed information about inventory levels, purchases, and costs of labor, helping to calculate the total direct costs associated with generating revenue for the business.

- PA Schedule C-2: This schedule documents depreciation expenses for assets used in the business. It is essential for reporting any straight-line depreciation taken, ensuring compliance with Pennsylvania’s specific rules regarding asset depreciation.

- PA Schedule E: This form is for reporting rental and royalty income. If a taxpayer has income from rental activities related to their business, this form provides the necessary details to report that income accurately.

- PA Schedule F: This document is designated for farmers to report income, expenses, and profits or losses from farming activities. It is vital for those involved in agriculture as part of their business operations.

Each of these forms and schedules provides additional details that support the income and expense claims made on the PA-40 C form. Together, they ensure that taxpayers fulfill their reporting requirements and help the state accurately assess individual tax liabilities based on business activities.

Similar forms

- PA Schedule E: This form is used for reporting rental and royalty income, similar to the PA-40 C which is utilized for sole proprietorship income. Both forms require specific income details, although Schedule E is focused on passive income rather than active business income.

- PA Schedule F: This schedule is designated for farmers and is used to report income and deductions related to farming activities. Like PA-40 C, it collects profit or loss figures and requires detailed income reporting, but specifically caters to agricultural businesses.

- PA Schedule UE: This form is for employees who want to deduct unreimbursed business expenses. PA-40 C includes expenses related specifically to self-employment, while Schedule UE is designed for employees who incur expenses in their line of work that are not reimbursed by their employer.

- Federal Schedule C: The federal version is similar in purpose, as both forms report income and expenses for businesses. However, while Federal Schedule C can include various business types, the PA-40 C specifically addresses Pennsylvania's tax regulations and compliance requirements for state purposes.

Dos and Don'ts

When filling out the PA-40 C form, there are some important dos and don'ts to keep in mind. Follow these guidelines to ensure your completion is accurate and efficient.

- Do download the form onto your computer before filling it out to avoid losing any progress.

- Do provide your Social Security number and Federal Employer Identification Number clearly.

- Do accurately report all gross receipts and income from your business activities.

- Do choose the correct accounting method applicable to your business when prompted.

- Don't skip sections or leave any required fields blank. Every piece of information is crucial.

- Don't report numbers that don’t correlate with your federal filings without submitting an explanation.

- Don't forget to include any business losses or deductions, as they can significantly impact your tax return.

- Don't overlook to provide an explanation if there are changes in your closing inventory valuations.

Misconceptions

- Misconception 1: The PA-40 C form is only for large businesses.

- Misconception 2: I can submit the PA-40 C form without additional documentation.

- Misconception 3: The PA-40 C form must mirror my federal tax forms exactly.

- Misconception 4: Filing the PA-40 C is optional for self-employed individuals.

- Misconception 5: I do not need to report income from online sales on the PA-40 C form.

- Misconception 6: I can use federal accounting methods without consideration of state rules.

- Misconception 7: Home office expenses cannot be deducted.

- Misconception 8: As a sole proprietor, I do not need to maintain any formal records.

The PA-40 C form is designed for sole proprietors of any size. Small businesses and self-employed individuals must use this form to report their business income or loss, regardless of their revenue level.

It is essential to attach any required documentation that supports your entries on the PA-40 C form. This includes details about deductions and any income that should be reported separately.

While there might be similarities between state and federal forms, differences exist due to Pennsylvania's specific tax regulations. Therefore, the PA-40 C may include items or adjustments that are not present in federal returns.

Filing the PA-40 C form is mandatory for self-employed individuals operating a sole proprietorship. Failure to file can lead to penalties and fines from the Pennsylvania Department of Revenue.

Income derived from online sales must be reported on the PA-40 C just like any other business income. Pennsylvania tax law recognizes online sales as taxable income.

While federal methods can often guide your reporting, Pennsylvania has its own accounting principles. It is crucial to ensure compliance with state-specific rules to avoid discrepancies.

You can deduct home office expenses if you meet specific criteria. However, the documentation required and calculations differ between federal and Pennsylvania requirements, emphasizing the need for careful record-keeping.

Sole proprietors are required to maintain accurate and detailed records of all income and expenses relevant to their business activities. This record-keeping is crucial not only for filing the PA-40 C but also for substantiating claims in the event of an audit.

Key takeaways

The PA-40 C form pertains to reporting income and losses from a business or profession operated as a sole proprietorship in Pennsylvania. Below are key takeaways regarding the completion and usage of this form.

- The form must be downloaded to your computer before filling it out; it cannot be completed in your browser.

- Include all relevant identification information, such as your name, social security number, and the business's federal employer identification number.

- The method used for valuing closing inventory needs to be indicated, with options for cost, lower of cost or market, or other methods requiring explanation.

- For income reporting, all gross receipts, including sales and other income, must be documented, ensuring consistency with federal tax reporting where applicable.

- Deductible expenses should reflect allowable business costs, including advertising, supplies, and utilities, which can be reported without imposed dollar limits by Pennsylvania state law.

Browse Other Templates

Project Deserve Application - For any application inquiries, contact the project via provided email or fax.

Lien Release Statement - State regulations require that all fields be filled completely.

Usps Form - Signatures from USPS verification employees are necessary for confirmation.