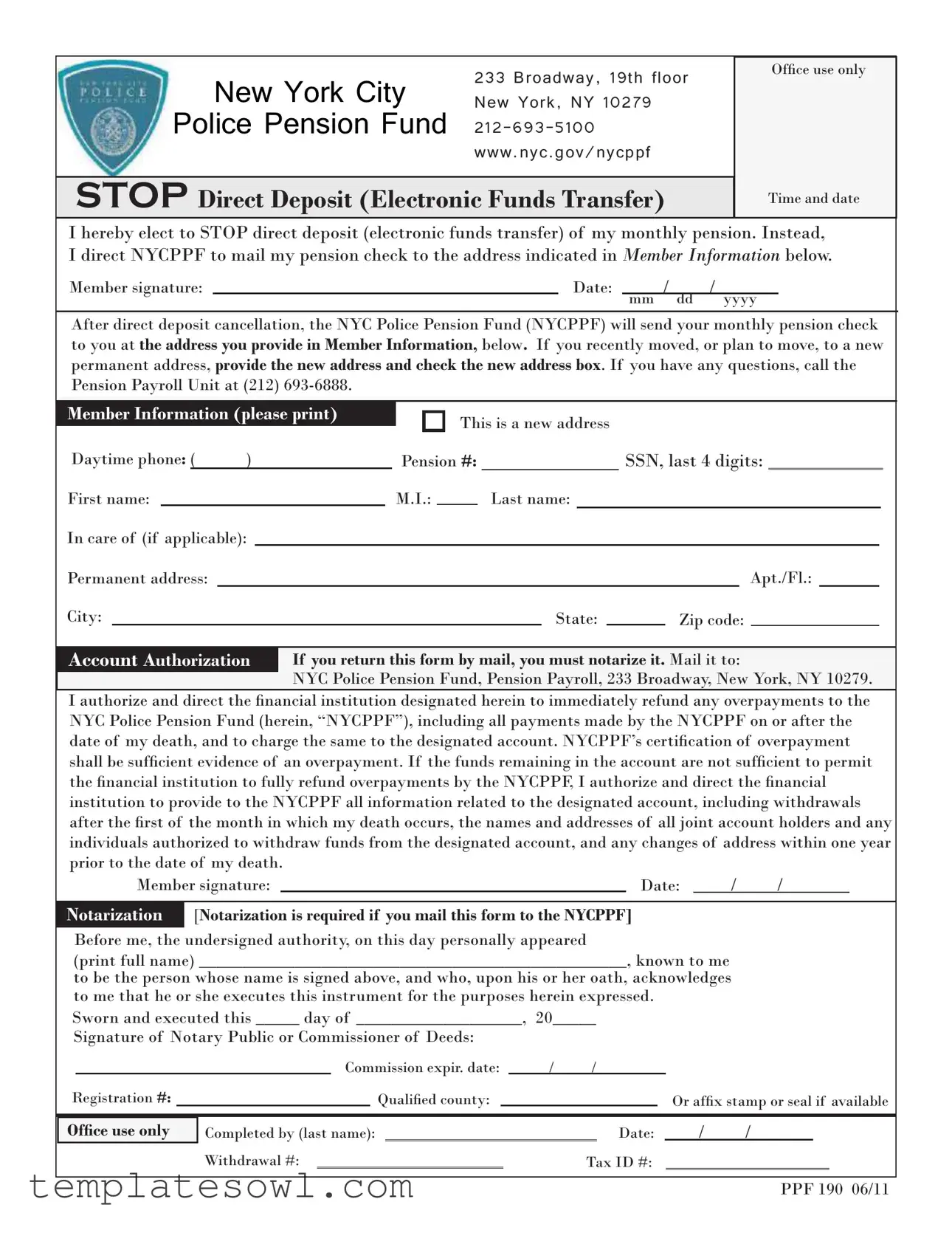

Fill Out Your Ppf 190 Form

The PPF 190 form is an important document for members of the New York City Police Pension Fund (NYCPPF) who wish to make changes to how they receive their monthly pension. This form allows members to stop direct deposit and request that their pension checks be mailed to a specified address. When filling out the form, essential information such as the member’s personal details, contact numbers, and the new mailing address must be provided. If a member has recently changed their living arrangements or plans to do so, it’s critical to indicate this on the form. Furthermore, a notarization is required if the form is submitted by mail, adding an extra layer of verification to ensure the authenticity of the request. The form also includes authorization clauses concerning overpayments, ensuring that any excess funds are promptly returned, particularly in the event of the member's passing. By understanding all these aspects, pension members can effectively manage their benefits and ensure timely and accurate receipt of their pensions.

Ppf 190 Example

New York City |

233 Broadway, 19th floor |

Ofice use only |

New York, NY 10279 |

|

|

Police Pension Fund |

|

|

|

www.nyc.gov/nycppf |

|

|

|

|

STOP Direct Deposit (Electronic Funds Transfer) |

Time and date |

|

|

|

|

I hereby elect to STOP direct deposit (electronic funds transfer) of my monthly pension. Instead, I direct NYCPPF to mail my pension check to the address indicated in MEMBER INFORMATION below.

Member signature: |

|

Date: |

/ / |

|

mm dd yyyy |

After direct deposit cancellation, the NYC Police Pension Fund (NYCPPF) will send your monthly pension check to you at the address you provide in Member Information, below. If you recently moved, or plan to move, to a new permanent address, provide the new address and check the new address box. If you have any questions, call the Pension Payroll Unit at (212)

Member Information (please print) |

This is a new address |

|

Daytime phone: ( |

) |

|

|

|

Pension #: |

|

|

|

|

|

SSN, last 4 digits: |

||||||||||||

First name: |

|

|

|

|

|

|

M.I.: |

|

|

Last name: |

|

|

|

|

|

|

|

|

|

|

|||

In care of (if applicable): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Permanent address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt./Fl.: |

|

|

|||||||

City: |

|

|

|

|

|

|

|

|

|

State: |

|

|

Zip code: |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Authorization |

If you return this form by mail, you must notarize it. Mail it to: |

||||||||||||||||||||||

|

|

|

|

|

|

NYC Police Pension Fund, Pension Payroll, 233 Broadway, New York, NY 10279. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I authorize and direct the inancial institution designated herein to immediately refund any overpayments to the

NYC Police Pension Fund (herein, “NYCPPF”), including all payments made by the NYCPPF on or after the date of my death, and to charge the same to the designated account. NYCPPF’s certiication of overpayment shall be suficient evidence of an overpayment. If the funds remaining in the account are not suficient to permit the inancial institution to fully refund overpayments by the NYCPPF, I authorize and direct the inancial

institution to provide to the NYCPPF all information related to the designated account, including withdrawals after the irst of the month in which my death occurs, the names and addresses of all joint account holders and any

individuals authorized to withdraw funds from the designated account, and any changes of address within one year prior to the date of my death.

|

|

Member signature: |

|

|

|

|

|

Date: |

/ |

/ |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notarization |

[Notarization is required if you mail this form to the NYCPPF] |

|

|

|

|

|

|||||||||||||||||

|

Before me, the undersigned authority, on this day personally appeared |

|

|

|

|

|

||||||||||||||||||

|

(print full name) _________________________________________________, known to me |

|

|

|

|

|||||||||||||||||||

|

to be the person whose name is signed above, and who, upon his or her oath, acknowledges |

|

|

|

|

|||||||||||||||||||

|

to me that he or she executes this instrument for the purposes herein expressed. |

|

|

|

|

|

||||||||||||||||||

|

Sworn and executed this _____ day of ___________________, 20_____ |

|

|

|

|

|

||||||||||||||||||

|

Signature of Notary Public or Commissioner of Deeds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Commission expir. date: |

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|||

|

Registration #: |

|

|

|

|

|

|

Qualiied county: |

|

|

|

|

|

|

|

|

Or afix stamp or seal if available |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Ofice use only |

|

Completed by (last name): |

|

|

|

|

|

Date: |

|

/ |

/ |

|

|

|

|||||||||

|

|

|

|

|

Withdrawal #: |

|

|

|

|

|

Tax ID #: |

|

|

|

|

|

|

|||||||

PPF 190 06/11

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The PPF 190 form allows members of the NYC Police Pension Fund to stop direct deposit of their monthly pension and request a mailed check instead. |

| Address of NYCPPF | This form should be sent to the NYC Police Pension Fund at 233 Broadway, 19th Floor, New York, NY 10279. |

| Contact Information | Members can call the Pension Payroll Unit at (212) 693-6888 if they have questions regarding this form. |

| Notarization Requirement | If the form is mailed, it must be notarized for it to be valid. |

| Address Update | Members should provide their new permanent address along with the completed form if they have recently moved. |

| Authorization Clauses | By signing the form, members authorize the designated financial institution to refund any overpayments to NYCPPF. |

| Effective Date | The current version of this form is dated June 2011, as noted by the code PPF 190 06/11. |

Guidelines on Utilizing Ppf 190

Filling out the PPF 190 form requires careful attention to detail, as this form is used to stop direct deposit of your monthly pension payments and request that those payments be mailed to you instead. Ensuring that all the information is accurately provided helps prevent any disruptions in receiving your pension checks.

- Begin by clearly indicating your intent to stop direct deposit by filling in the box or section provided for this purpose.

- Write your signature and the date on the designated lines to authenticate your request.

- In the "Member Information" section, print your details clearly:

- First Name

- Middle Initial

- Last Name

- If applicable, include 'In care of'

- Permanent Address (include Apt/Fl and zip code)

- City and State

- Last four digits of your Social Security Number

- Your Pension Number

- Your daytime phone number

- If you have moved or will be moving soon, check the box indicating this is a new address.

- Complete the "Account Authorization" section by providing authorization for the financial institution to manage any overpayments related to your account.

- Sign and date the "Member signature" area again in the Account Authorization section.

- As the form needs to be notarized if mailed, ensure that you either find a notary public or a commissioner of deeds to witness your signature. Fill in the notary section with the required information and obtain their signature and seal.

- Before mailing, double-check that all information is accurate and complete.

- Mail the completed form to: NYC Police Pension Fund, Pension Payroll, 233 Broadway, New York, NY 10279.

What You Should Know About This Form

What is the purpose of the PPF 190 form?

The PPF 190 form is used to stop direct deposit of monthly pension payments from the New York City Police Pension Fund (NYCPPF). By completing this form, you will ask NYCPPF to mail your pension checks to a new address rather than depositing them electronically into your bank account.

How do I complete the PPF 190 form?

Fill out the member information section clearly, providing your new mailing address, daytime phone number, pension number, and the last four digits of your Social Security Number. Ensure your signature and the date are included. If you are sending the form by mail, it must be notarized.

Where do I send the completed PPF 190 form?

Mail the completed and notarized form to the NYC Police Pension Fund, Pension Payroll, 233 Broadway, 19th Floor, New York, NY 10279. This ensures that your request will be processed in a timely manner.

What should I do if I recently moved but forgot to indicate my new address?

If you have moved but did not provide your new address on the form, you will need to complete a new PPF 190 form with the correct information. Be sure to check the box indicating that it is a new address to avoid any disruptions in receiving your pension checks.

Is notarization required for the PPF 190 form?

Yes, notarization is required if you are mailing the PPF 190 form. This is to verify your identity and ensure that the request is legitimate. If you submit the form in person, notarization is not necessary.

What happens after I submit the PPF 190 form?

Once you submit the completed PPF 190 form, the NYCPPF will process your request. You will begin receiving your pension checks at the new address specified on the form. If you have further questions or need assistance, you can contact the Pension Payroll Unit at (212) 693-6888.

What if I need assistance while completing the PPF 190 form?

If you need help while filling out the PPF 190 form, do not hesitate to reach out to the Pension Payroll Unit at the phone number provided above. They can guide you through the process and answer any of your questions.

Common mistakes

Filling out the PPF 190 form correctly is crucial for ensuring that your pension payments are processed smoothly. However, many people make common mistakes that can delay this process or lead to complications. Understanding these pitfalls can help you avoid them.

One frequent error is neglecting to update the address section. If you've recently moved, it's essential to fill out your new permanent address accurately. Failing to do so may result in pension checks being sent to your old address, creating potential access issues and misunderstandings.

Another mistake relates to the absence of a signature. Each section of the form requiring a signature must be signed by the member. Forgetting this step can halt the processing of your request and delay your pension payments.

Incorrect dates also present a challenge. When writing down the dates in the signature section, make sure they are formatted correctly and match the current year. A simple oversight here can raise flags during processing.

Moreover, some individuals forget to provide a daytime phone number. If questions arise regarding your application, the Pension Payroll Unit will need to reach you for clarification. Without a contact number, resolving any issues can take significantly longer.

Another area of concern is notarization. It is essential to notarize the form if you plan to mail it. Skipping this step means your form will be returned, causing unnecessary delays and frustration.

People often make mistakes in the account authorization section, particularly in providing clear bank information. Ensure that the designated financial institution is properly identified and that all account details are accurate. Inaccuracies can lead to complications with refunds or processing payments.

Failure to provide the last four digits of the Social Security Number is another common mistake. This information helps to verify identity and is crucial for processing your application. Double-check that you have entered it correctly.

Some individuals overlook the importance of being thorough in the "In care of" section. If applicable, ensure that this section is completed correctly to avoid delays in mail processing.

Lastly, many people do not take the time to review their entire application before submitting it. A thorough review can catch small inaccuracies that might cause big problems down the road. Taking a few extra minutes to double-check your submission can save a lot of headaches later.

Documents used along the form

When dealing with your pension, a variety of forms and documents may accompany the Ppf 190 form to ensure accurate processing and compliance. Below is a list of some commonly used forms that might also be necessary.

- Direct Deposit Authorization Form: This document establishes your preference for receiving pension payments through direct deposit. It collects your banking information for reliable and secure transactions.

- Change of Address Form: If you have recently moved or have plans to move, this form must be submitted to update your address in the pension records, ensuring you receive important documents and payments at the correct location.

- Tax Withholding Certificate: This form allows you to determine how much federal tax will be withheld from your pension payments. Adjustments can be made based on your current tax situation.

- Beneficiary Designation Form: This document lets you specify who will receive your pension benefits in the event of your passing. It’s crucial to keep this updated to reflect your wishes.

- Pension Application Form: Required for those applying for pension benefits, this form collects essential information about your employment history, service time, and other details to calculate your pension eligibility.

- Withdrawal Request Form: If you wish to withdraw from the pension plan, this document is necessary. It formally requests the withdrawal and outlines any implications this may have on your benefits.

- Medical Certification Form: If your pension is tied to disability benefits, this form needs completion by a healthcare provider to certify your medical condition and its impact on your ability to work.

Utilizing the appropriate forms ensures that your requests are processed smoothly. It reduces the chances of delays and complications regarding your pension benefits. Always keep copies for your records and consult the pension fund if you have any questions.

Similar forms

The PPF 190 form shares similarities with several other documents used for various purposes related to retirement plans or pension management. Each document serves a distinct function, but they all facilitate the management of benefits or payments. Below is a list of these similar documents and how they relate to the PPF 190 form:

- Withdrawal Form: Similar to the PPF 190, a withdrawal form is utilized when an individual requests to stop receiving funds through one system, opting instead for a different payment method. This can include switching from direct deposit to a physical check, much like the election to stop electronic funds transfer on the PPF 190 form.

- Change of Address Form: This form is essential for updating personal information. When a member moves and needs to ensure that their communication or pension checks reach the correct place, they may use a change of address form. The PPF 190 also accommodates this by allowing members to specify a new address for check delivery.

- Direct Deposit Authorization Form: While the PPF 190 is concerned with stopping direct deposits, a direct deposit authorization form allows a member to initiate deposits into their bank account. Both forms involve communication with financial institutions regarding the management of funds.

- Pension Payment Authorization Form: This form allows individuals to authorize their pension provider to issue payments to a third party or change how their benefits are distributed. The PPF 190 form involves a member directing payments and thus is closely related in its purpose.

- Beneficiary Designation Form: Similar to the PPF 190, which contains provisions about overpayment refunds upon death, a beneficiary designation form outlines who will receive benefits should something happen to the account holder. Both documents seek to clarify how funds are managed in critical situations.

- IRS W-4P Form: Used for federal tax withholding for pension or annuity payments, the IRS W-4P form is analogous to the PPF 190 in that both involve financial management aspects to ensure that members’ funds are handled properly and comply with federal regulations.

Dos and Don'ts

When filling out the PPF 190 form, there are several best practices to keep in mind. Here’s a helpful list to guide you:

- Do print clearly in the Member Information section to ensure all details are accurate.

- Do provide your daytime phone number so that the Pension Payroll Unit can reach you if needed.

- Do sign the form in the designated area to validate your request.

- Do ensure you check the box for a new address if you have recently moved.

- Do include your last four digits of your Social Security Number for identification purposes.

However, there are also some common pitfalls to avoid:

- Don't forget to notarize the form if you are submitting it by mail.

- Don't leave any section incomplete, as this can delay processing your request.

- Don't use any abbreviations in your address or name to prevent confusion.

- Don't submit the form without double-checking all entries for accuracy.

Misconceptions

There are several misconceptions about the PPF 190 form, which can lead to confusion for users. Below are some of the most common misunderstandings.

- The PPF 190 form is only for new applicants. Many believe this form is exclusively for those applying for the Police Pension Fund. In fact, it serves as a request to stop direct deposit for current pensioners.

- Notarization is optional for mailing the form. Some think notarization can be skipped. However, if you choose to mail the form, notarization is required for it to be valid.

- Changing my address on the form is enough. Users often assume that providing a new address suffices. It's crucial to mark the new address box to ensure it's processed correctly.

- You can submit the form by email. Many mistakenly believe they can email the PPF 190 form. This form must be mailed to the NYC Police Pension Fund.

- Overpayments are automatically refunded. There is a misconception that overpayments will be handled automatically. The form includes a clause for authorization to refund any overpayments, which must be signed by the member.

- The PPF 190 form is the only paperwork needed. Some think that submitting just this form settles all matters. Depending on individual circumstances, additional forms or documentation may be required.

- A phone call is enough to cancel direct deposit. Individuals often believe a phone call to the NYCPPF can stop the direct deposit process. The PPF 190 form must be filled out and submitted to make this official.

- You can change bank accounts without any additional steps. It is a common belief that simply filling out the form allows for an immediate bank account change. The form includes specific instructions and may require additional authorization from your bank.

- There is no deadline for submitting the form. Some think that they can submit the PPF 190 form at any time. It is essential to check for any deadlines or time frames to ensure that the request is processed promptly.

Key takeaways

Here are some key takeaways about filling out and using the PPF 190 form:

- Direct Deposit Cancellation: This form allows you to stop the direct deposit of your monthly pension.

- Provide Accurate Information: Make sure to provide your current address and contact details in the Member Information section.

- Notarization Requirement: If you mail the form, it must be notarized to be accepted by the NYC Police Pension Fund.

- Refunds for Overpayments: You consent to refund any overpayments made to you after your death directly to the Pension Fund.

- Contact Information: For assistance, you can reach the Pension Payroll Unit at (212) 693-6888 if you have questions.

- Submission Address: Mail the completed form to the NYC Police Pension Fund at 233 Broadway, New York, NY 10279.

Browse Other Templates

Utah Abandoned Vehicle Form - The TC 569A also asks why a certificate of title was not obtained.

Citi Bank Address for Direct Deposit - Consider checking your account regularly to confirm deposits are made.

How to Fill Form A2 Application for Remittance Abroad - The applicant must specify the currency and the amount of foreign exchange required.