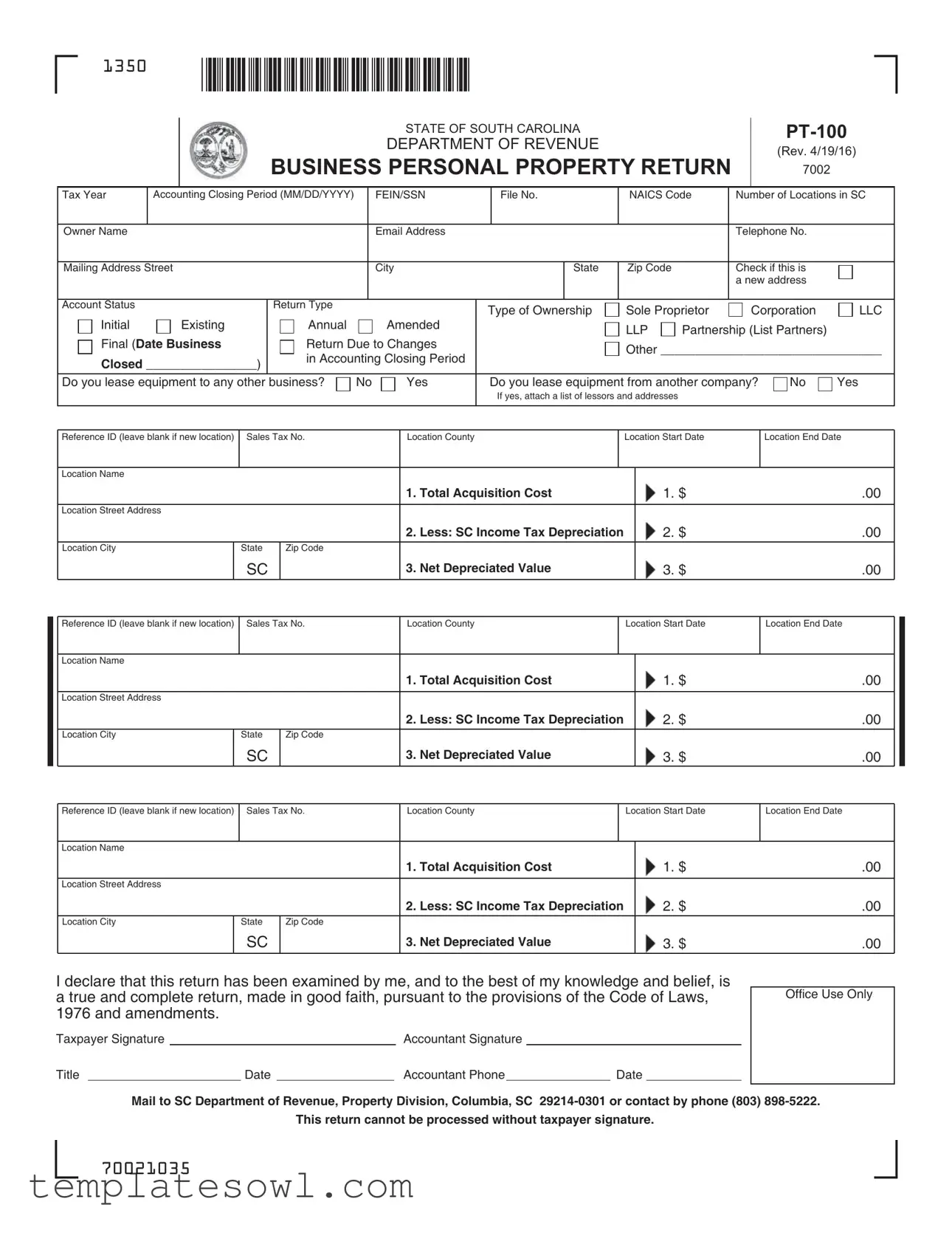

Fill Out Your Pt 100 Form

The PT-100 form is a crucial document for businesses operating in South Carolina, specifically used to report business personal property. This return must be accurately completed each tax year and includes essential details such as the business's owner name, federal employer identification number (FEIN), and the North American Industry Classification System (NAICS) code. Businesses need to provide information about their accounting closing period and indicate whether they are a sole proprietor, corporation, or partnership. Each location where the business owns property must be listed, along with total acquisition costs and any applicable state income tax depreciation. Importantly, the form also requires business owners to confirm whether they lease equipment to or from other businesses, further impacting the assessment and taxation of personal property. Signatures from both the taxpayer and accountant, if applicable, ensure that the information is accurate and submitted in good faith. The completed form must be mailed to the South Carolina Department of Revenue for processing by the designated deadline.

Pt 100 Example

1350

|

|

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

|

|

|

|

(REV. 4/19/16) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

BUSINESS PERSONAL PROPERTY RETURN |

|

|

7002 |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Tax Year |

Accounting Closing Period (MM/DD/YYYY) |

|

|

FEIN/SSN |

|

File No. |

|

NAICS Code |

|

Number of Locations in SC |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner Name |

|

|

|

|

|

|

|

|

|

Email Address |

|

|

|

|

|

|

|

|

Telephone No. |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address Street |

|

|

|

|

|

|

City |

|

|

|

State |

|

Zip Code |

|

Check if this is |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a new address |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Status |

|

|

|

|

|

Return Type |

|

|

|

|

|

Type of Ownership |

Sole Proprietor |

|

Corporation |

LLC |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Initial |

|

Existing |

|

|

|

Annual |

|

|

Amended |

|

|

|

|

LLP |

Partnership (List Partners) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Final (Date Business |

|

|

|

Return Due to Changes |

|

|

|

|

Other ________________________________ |

|||||||||||||||

|

|

|

|

|

|

|

in Accounting Closing Period |

|

|

|

|

|||||||||||||

Closed ________________) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Do you lease equipment to any other business? |

No |

|

Yes |

Do you lease equipment from another company? |

No |

Yes |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, attach a list of lessors and addresses |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Reference ID (leave blank if new location) |

Sales Tax No. |

|

|

|

Location County |

|

|

|

|

Location Start Date |

|

|

Location End Date |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

|

1. $ |

|

|

|

|

.00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

|

2. $ |

|

|

|

|

.00 |

||||

Location City |

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SC |

|

|

|

|

|

3. |

Net Depreciated Value |

|

|

3. $ |

|

|

|

|

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Reference ID (leave blank if new location) |

Sales Tax No. |

|

|

|

Location County |

|

|

|

|

Location Start Date |

|

|

Location End Date |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

|

1. $ |

|

|

|

|

.00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

|

2. $ |

|

|

|

|

.00 |

||||

Location City |

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SC |

|

|

|

|

|

3. |

Net Depreciated Value |

|

|

3. $ |

|

|

|

|

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Reference ID (leave blank if new location) |

Sales Tax No. |

|

|

|

Location County |

|

|

|

|

Location Start Date |

|

|

Location End Date |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

|

1. $ |

|

|

|

|

.00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

|

2. $ |

|

|

|

|

.00 |

||||

Location City |

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SC |

|

|

|

|

|

3. |

Net Depreciated Value |

|

|

3. $ |

|

|

|

|

.00 |

|||||

I declare that this return has been examined by me, and to the best of my knowledge and belief, is a true and complete return, made in good faith, pursuant to the provisions of the Code of Laws, 1976 and amendments.

Taxpayer Signature |

|

|

|

|

Accountant Signature |

|

|

|

||

Title |

|

Date |

|

|

Accountant Phone |

|

|

Date |

|

|

Office Use Only

Mail to SC Department of Revenue, Property Division, Columbia, SC

This return cannot be processed without taxpayer signature.

70021035

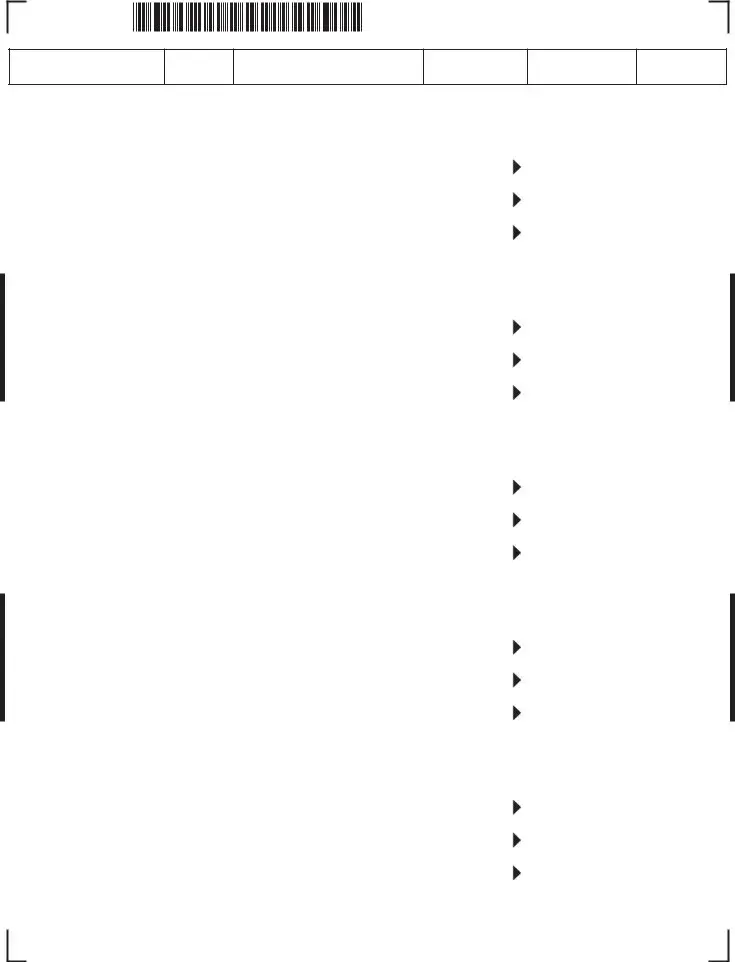

Owner Name

Tax Year

Accounting Closing Period Date (MM/DD/YY)

FEIN/SSN

File No.

Page ____ of ____

Reference ID (leave blank if new location) |

Sales Tax No. |

Location County |

|

Location Start Date |

Location End Date |

||||

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

1. $ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

2. $ |

.00 |

|

Location City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

SC |

|

3. |

Net Depreciated Value |

|

3. $ |

.00 |

|

|

|

|

|

|

|||||

Reference ID (leave blank if new location) |

Sales Tax No. |

Location County |

|

Location Start Date |

Location End Date |

||||

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

1. $ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

2. $ |

.00 |

|

Location City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

SC |

|

3. |

Net Depreciated Value |

|

3. $ |

.00 |

|

|

|

|

|

|

|||||

Reference ID (leave blank if new location) |

Sales Tax No. |

Location County |

|

Location Start Date |

Location End Date |

||||

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

1. $ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

2. $ |

.00 |

|

Location City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

SC |

|

3. |

Net Depreciated Value |

|

3. $ |

.00 |

|

|

|

|

|

|

|||||

Reference ID (leave blank if new location) |

Sales Tax No. |

Location County |

|

Location Start Date |

Location End Date |

||||

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

1. $ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

2. $ |

.00 |

|

Location City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

SC |

|

3. |

Net Depreciated Value |

|

3. $ |

.00 |

|

|

|

|

|

|

|||||

Reference ID (leave blank if new location) |

Sales Tax No. |

Location County |

|

Location Start Date |

Location End Date |

||||

|

|

|

|

|

|

|

|

|

|

Location Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Acquisition Cost |

|

1. $ |

.00 |

|

|

|

|

|

|

|

|

|

|

|

Location Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Less: SC Income Tax Depreciation |

|

2. $ |

.00 |

|

Location City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

SC |

|

3. |

Net Depreciated Value |

|

3. $ |

.00 |

|

70022033

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The PT-100 form is governed by the Code of Laws of South Carolina, 1976 and amendments. |

| Purpose | This form serves as the Business Personal Property Return for reporting property owned by businesses in South Carolina. |

| Tax Year | Taxable years must be reported on the PT-100 form, which requires the Tax Year accounting period. |

| Ownership Types | Businesses can choose from several ownership types, including Sole Proprietor, Corporation, LLC, LLP, and Partnership. |

| Depreciation Reporting | Businesses need to report SC Income Tax Depreciation to calculate the Net Depreciated Value of assets. |

| New Address Check | The form includes a check box to indicate if the mailing address has changed. |

| Filing Requirement | The return is incomplete without the taxpayer's signature, emphasizing accountability in reporting. |

| Mailing Instructions | Completed forms should be mailed to the SC Department of Revenue, Property Division in Columbia, SC. |

| Contact Information | Businesses can contact the SC Department of Revenue by phone for assistance at (803) 898-5222. |

Guidelines on Utilizing Pt 100

Completing the PT-100 form requires attention to detail, but it can be done step by step. Once you've filled out the form, you can submit it to the South Carolina Department of Revenue for processing. Here’s how to fill it out accurately:

- Enter the tax year and the accounting closing period using the format MM/DD/YYYY.

- Provide your FEIN or SSN and the file number.

- Fill in the NAICS code relevant to your business.

- Indicate the number of locations you have in South Carolina.

- Enter your owner name, email address, and telephone number.

- Complete your mailing address, including street, city, state, and zip code.

- Check the box if your address is new.

- Select your account status (initial, existing, annual, amended, final). If applicable, provide additional details under "Return Type" and "Type of Ownership."

- Answer whether you lease equipment to or from another business.

- If leasing, attach a list of lessors and their addresses.

- Fill in the reference ID, leaving it blank if this is a new location.

- Provide your sales tax number and county for each location.

- For each location, fill in the start and end dates and the location name.

- Record the total acquisition cost for each location.

- Deduct the SC Income Tax Depreciation from the acquisition cost for each location.

- Calculate and write down the net depreciated value for each location.

- Sign the return to declare that it has been reviewed and is accurate.

- If applicable, have your accountant sign and provide their details.

- Mail the completed form to the SC Department of Revenue, Property Division, Columbia, SC 29214-0301.

What You Should Know About This Form

What is the purpose of the PT-100 form?

The PT-100 form is a Business Personal Property Return required by the State of South Carolina Department of Revenue. This document serves to report the acquisition costs and depreciated values of personal property owned by a business within the state. Accurate completion of this form ensures compliance with state tax laws and helps determine the appropriate tax liabilities for the business personal property held during the specified tax year.

Who is required to file the PT-100 form?

Any business operating in South Carolina that holds personal property must file the PT-100 form. This includes various ownership types such as sole proprietorships, corporations, limited liability companies (LLCs), partnerships, and limited liability partnerships (LLPs). Additionally, if a business leases equipment, it must indicate this on the form and provide the necessary details regarding the lessors as specified in the instructions.

What information is needed to complete the PT-100 form?

To successfully complete the PT-100 form, a business must gather several pieces of information. This includes the tax year, accounting closing period, Federal Employer Identification Number (FEIN) or Social Security Number (SSN), as well as the North American Industry Classification System (NAICS) code. The business must also detail each property location, its acquisition cost, applicable depreciation, and the net depreciated value of that property. Furthermore, a signature from the taxpayer and/or accountant is necessary to validate the information provided.

Where should the completed PT-100 form be sent?

After completing the PT-100 form, the business must mail it to the South Carolina Department of Revenue's Property Division. The mailing address is Columbia, SC 29214-0301. For any additional inquiries or clarifications, businesses can contact the Department of Revenue directly at (803) 898-5222. It is important to note that the form cannot be processed without the necessary signatures, so those must be obtained before submission.

Common mistakes

Completing the Pt 100 form can seem daunting, but common mistakes can be easily avoided. Awareness of these pitfalls is crucial for ensuring accurate and timely submissions. One frequent error is failing to report the correct Tax Year and Accounting Closing Period. This section is essential, as errors can lead to processing delays or incorrect tax calculations.

Another mistake often made involves overlooking the definition of ownership type. Marking the correct Type of Ownership—whether it’s Sole Proprietor, Corporation, LLC, or another—ensures proper classification and tax treatment. Misclassification can result in penalties or additional scrutiny from tax authorities.

Address inaccuracies can create significant problems. Providing a current and accurate Mailing Address, as well as the physical Location Address where equipment is used, is crucial. If authorities need to contact you, having the wrong address could obstruct communication and cause compliance issues.

Neglecting to declare whether equipment is leased from or leased to another business is another common oversight. If an answer is not provided, it raises questions during audits or reviews. Complete and truthful disclosures are necessary to maintain clarity and avoid complications later on.

In addition, failing to calculate the Total Acquisition Cost correctly is a common error. This figure must reflect accurate valuations of equipment that your business owns. Discrepancies in amounts can lead to inaccurate tax assessments, which can become costly.

Overlooking the section for SC Income Tax Depreciation can negatively affect your Net Depreciated Value. Properly documenting all applicable depreciation ensures that you reduce your taxable assets correctly. Miscalculations here can lead to inflated values, resulting in higher tax obligations.

Lastly, be sure to provide a proper signature on the return. The form cannot be processed without a taxpayer's signature. This seems simple, yet it is a frequent reason why forms are returned or delayed. Take a moment to review your submission before sending it in, ensuring that all necessary details are filled out completely and accurately.

Documents used along the form

When completing the Pt 100 form for business personal property tax in South Carolina, several other documents may be necessary. Each of these forms serves a specific purpose, providing additional information or required specifics relevant to your business. Below is a list of commonly used forms that may accompany the Pt 100.

- Pt 100A - This form is for businesses claiming exemptions for personal property. It details the specific items exempt from taxation.

- Pt 100B - Used to report and seek valuation adjustments on machinery and equipment that have changed in value.

- Form SC2848 - This is the Power of Attorney form, allowing a representative to act on behalf of the business regarding tax matters.

- Form SC502 - This form is needed if the business is requesting a refund for overpaid personal property taxes.

- Property Lease Agreement - If leasing property or equipment, this agreement outlines the terms and conditions of the lease for documentation purposes.

- Business Privilege License - Proof of your business license may be required to show that your business is registered and operating legally.

- Financial Statements - Recent income statements or balance sheets may be necessary to support the values reported on the Pt 100.

- Form ST-3 - This certificate verifies that the business is exempt from sales tax, if applicable, particularly when equipment is purchased.

- Amended Return Form - If you are making modifications to a previously filed return, this form is essential for clarity on changes made.

- Receipt for Payment - Providing proof of payment can help in tracking tax payments and confirming compliance.

Gathering and submitting these documents alongside the Pt 100 can ensure a smoother process during tax filing. Always check for the most current version of each form to avoid any issues.

Similar forms

The PT-100 form is similar to several other documents that businesses may encounter in managing their property and tax filings. Here’s a breakdown of nine documents that share characteristics with the PT-100 form:

- PPT-23 Form: This form is used to report personal property tax in South Carolina, similar in purpose to the PT-100, as both deal with business personal property.

- IRS Form 4562: This document is utilized for claiming depreciation on business property, like the PT-100, which also requires information on depreciation for state tax purposes.

- SC Tax Return Form 1040: This personal income tax return includes reporting taxable income, which may involve personal property details akin to those on the PT-100.

- Form 1065: This is for partnership tax returns and includes information on assets, drawing a parallel to the asset representation found in PT-100.

- Form 1120: Corporations use this to report income tax, and similar to PT-100, it accounts for business assets and liabilities.

- Form 1120-S: This form is for S corporations to declare income and deductions, which may include personal property, reflecting similarities with PT-100.

- SC Department of Revenue Business License Application: This document also requires information about business assets, much like the PT-100.

- Form M-2: Used for partnerships, this form involves capital accounts which can relate to asset training on the PT-100.

- Self-Assessment Tax Return: This may require property details that can be compared to the PT-100’s aim of property declaration and tax assessment.

Dos and Don'ts

When filling out the PT 100 form, there are certain best practices to follow and some common mistakes to avoid. Here are helpful tips:

- Do double-check all entered information for accuracy before submitting the form.

- Do include your Taxpayer Signature and ensure it's placed in the correct section.

- Do attach any required documentation, such as a list of lessors if applicable.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank, as this can delay processing.

- Don't forget to indicate if the address has changed by checking the appropriate box.

- Don't use ink that cannot be read by scanners, such as gel or glitter pens.

- Don't wait until the last minute to submit your form, as processing may take time.

Misconceptions

Misconceptions about the Pt 100 form can lead to errors and confusion when filing. Here are eight common misunderstandings:

- It’s only for corporations. The Pt 100 form is for various business structures, including sole proprietors and LLCs, not just corporations.

- You don't need to include all locations. Every business location that has equipment must be reported on the form. Omitting a location can result in penalties.

- It's the same as personal property tax. The Pt 100 form specifically applies to business personal property returns in South Carolina. Personal property tax filings may differ.

- The form can be filed without a signature. A taxpayer's signature is mandatory for processing. Without it, the form cannot be accepted.

- You can file it anytime. The Pt 100 has specific due dates. Filing late can incur penalties, so it’s essential to stay on schedule.

- Depreciation calculations are optional. Accurate depreciation must be reported. It affects the net value of the equipment and ultimately impacts tax liabilities.

- Leased equipment doesn't need to be reported. Equipment leased from or to other businesses must be declared. This is important for accurate valuations.

- All businesses pay the same rates. Tax rates and regulations can vary based on business structure, location, and equipment type. It's important to understand your specific situation.

Key takeaways

The PT 100 form is an essential document for reporting business personal property in South Carolina. Properly completing and utilizing this form can help ensure compliance with state requirements. Here are nine key takeaways regarding the PT 100 form:

- Identify the Tax Year: Always fill in the appropriate tax year and accounting closing period at the top of the form.

- Owner Information: Provide accurate owner details, including name, mailing address, email, and phone number.

- Account Status: Clearly indicate whether this is a new address or a change to an existing account.

- Type of Ownership: Specify the business ownership type—options include sole proprietorship, corporation, LLC, and several others.

- Leasing Information: Indicate if the business leases equipment to others or if it leases equipment from another company, attaching a list of lessors if applicable.

- Location Details: For each business location, include total acquisition costs, SC income tax depreciation, and net depreciated value.

- Taxpayer Signature: Ensure the form is signed by the taxpayer, as it cannot be processed without this signature.

- File It Properly: Mail the completed form to the SC Department of Revenue, Property Division, to avoid delays.

- Contact Information: If there are questions or uncertainties about completing the form, contacting the SC Department of Revenue can provide clarification.

Adhering to these points can facilitate accurate and timely reporting of business personal property in South Carolina, ultimately aiding in compliance and financial accuracy.

Browse Other Templates

Renew Registration Pa - The application form is intended for Pennsylvania residents only.

Household Inventory List for Insurance - Each category prompts you to think about various aspects of your home’s contents.