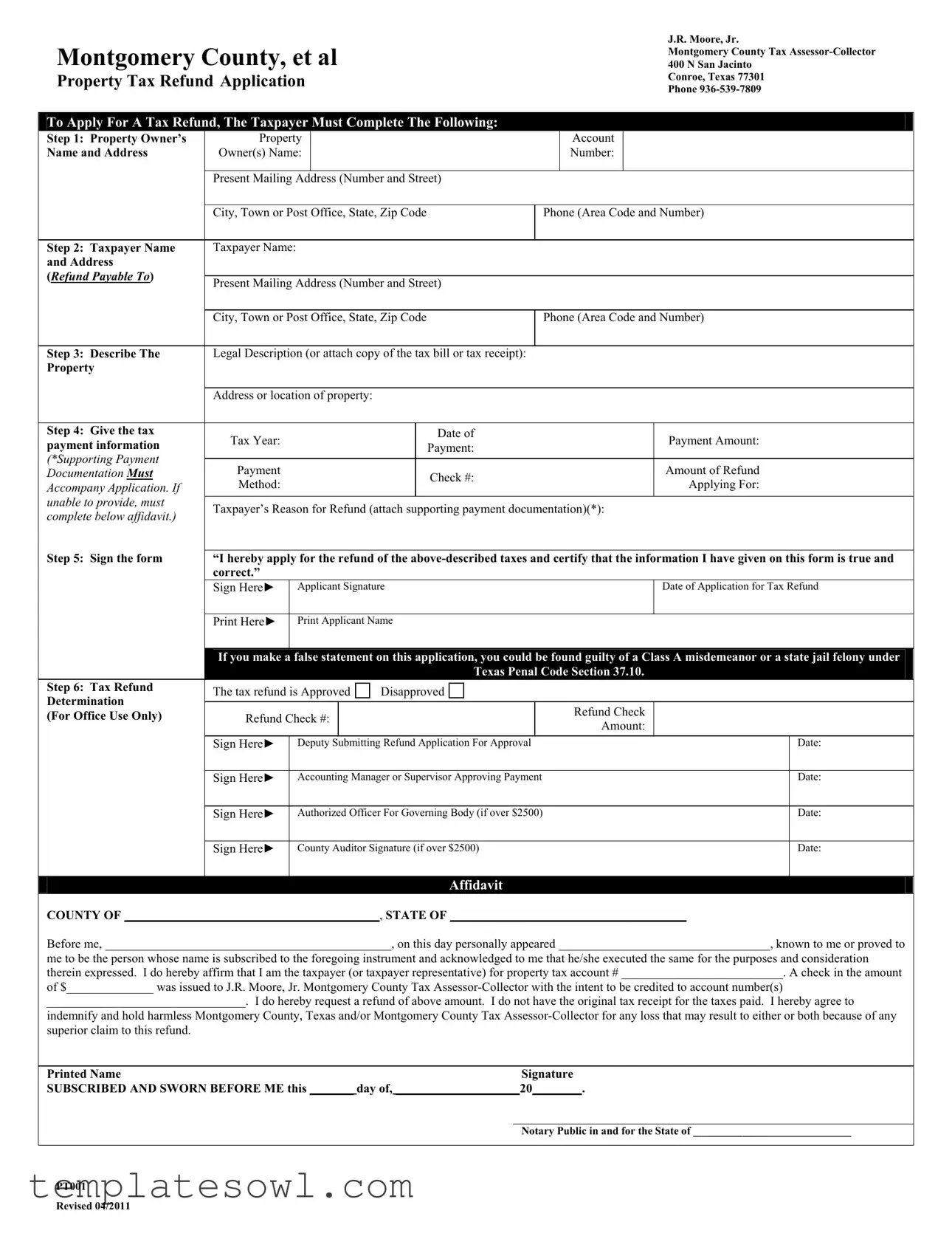

Fill Out Your Pt001 Form

The Pt001 form serves as a vital tool for taxpayers in Montgomery County, Texas, seeking a refund on property taxes paid. This form streamlines the application process, guiding individuals through several key steps. First, it requires the property owner's account name and mailing address, ensuring accurate identification. Following this, the taxpayer must provide their name and address, designating where the refund should be sent. Detailed information about the property, including its legal description, can either be written in or supplemented with documentation, such as a tax bill or receipt. Additionally, applicants need to provide payment details from the previous tax year, specifying the amount they are requesting to refund. Verification of the application is important, as the form demands an applicant's signature and a declaration of the truthfulness of provided information. To finalize the refund request, there are sections designated for official use, allowing county personnel to approve or disapprove the application. The Pt001 form helps facilitate tax refund requests efficiently while ensuring accountability and data integrity throughout the process.

Pt001 Example

Montgomery County, et al

Property Tax Refund Application

J.R. Moore, Jr.

Montgomery County Tax

400 N San Jacinto

Conroe, Texas 77301

Phone

To Apply For A Tax Refund, The Taxpayer Must Complete The Following:

Step 1: Property Owner’s |

Property |

|

|

|

|

Account |

|

|

|||

Name and Address |

Owner(s) Name: |

|

|

|

|

Number: |

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

Present Mailing Address (Number and Street) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|||||

|

City, Town or Post Office, State, Zip Code |

|

Phone (Area Code and Number) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Step 2: Taxpayer Name |

Taxpayer Name: |

|

|

|

|

|

|

|

|

||

and Address |

|

|

|

|

|

|

|

|

|

|

|

(Refund Payable To) |

|

|

|

|

|

|

|

|

|

|

|

Present Mailing Address (Number and Street) |

|

|

|

|

|||||||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||

|

City, Town or Post Office, State, Zip Code |

|

Phone (Area Code and Number) |

||||||||

|

|

|

|

|

|

|

|

||||

Step 3: Describe The |

Legal Description (or attach copy of the tax bill or tax receipt): |

|

|

|

|

||||||

Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Address or location of property: |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Step 4: Give the tax |

Tax Year: |

|

|

|

Date of |

|

|

|

Payment Amount: |

||

payment information |

|

|

|

Payment: |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

(*Supporting Payment |

|

|

|

|

|

|

|

|

|

|

|

Payment |

|

|

|

|

|

|

|

Amount of Refund |

|||

Documentation Must |

|

|

|

Check #: |

|

|

|

||||

Method: |

|

|

|

|

|

|

Applying For: |

||||

Accompany Application. If |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

unable to provide, must |

Taxpayer’s Reason for Refund (attach supporting payment documentation)(*): |

||||||||||

complete below affidavit.) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

||||||||

Step 5: Sign the form |

“I hereby apply for the refund of the |

||||||||||

|

correct.” |

|

|

|

|

|

|

|

|

||

|

Sign Here► |

|

Applicant Signature |

|

|

|

|

Date of Application for Tax Refund |

|||

|

|

|

|

|

|

|

|

|

|||

|

Print Here► |

|

Print Applicant Name |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

If you make a false statement on this application, you could be found guilty of a Class A misdemeanor or a state jail felony under

Texas Penal Code Section 37.10.

Step 6: Tax Refund

Determination

(For Office Use Only)

The tax refund is Approved |

|

Disapproved |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Refund Check #: |

|

|

|

|

|

|

Refund Check |

|

|

|

|

|

|

|

|

|

Amount: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sign Here► |

Deputy Submitting Refund Application For Approval |

|

|

Date: |

||||||

|

|

|

|

|

||||||

Sign Here► |

Accounting Manager or Supervisor Approving Payment |

|

|

Date: |

||||||

|

|

|

|

|

||||||

Sign Here► |

Authorized Officer For Governing Body (if over $2500) |

|

|

Date: |

||||||

|

|

|

|

|

||||||

Sign Here► |

County Auditor Signature (if over $2500) |

|

|

Date: |

||||||

|

|

|

|

|

|

|

|

|

|

|

Affidavit

COUNTY OF _________________________________________, STATE OF ______________________________________

Before me, ______________________________________________, on this day personally appeared __________________________________, known to me or proved to

me to be the person whose name is subscribed to the foregoing instrument and acknowledged to me that he/she executed the same for the purposes and consideration therein expressed. I do hereby affirm that I am the taxpayer (or taxpayer representative) for property tax account # __________________________. A check in the amount

of $______________ was issued to J.R. Moore, Jr. Montgomery County Tax

________________________________. I do hereby request a refund of above amount. I do not have the original tax receipt for the taxes paid. I hereby agree to

indemnify and hold harmless Montgomery County, Texas and/or Montgomery County Tax

Printed NameSignature

SUBSCRIBED AND SWORN BEFORE ME this _______ day of, ____________________20________.

Notary Public in and for the State of _____________________________

PT001

Revised 04/2011

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The PT001 form is used to apply for a property tax refund in Montgomery County, Texas. |

| Governing Law | The application is governed by Texas property tax laws. |

| Submitter Details | The form must be submitted to J.R. Moore, Jr., Montgomery County Tax Assessor-Collector. |

| Required Information | Applicants must provide owner names, addresses, and tax payment details. |

| Affidavit Requirement | A signed affidavit is required if original tax receipts are unavailable. |

| Signature Necessity | Applicants must sign the form to certify that the provided information is accurate. |

| Refund Limits | Additional approvals are needed for refunds exceeding $2,500. |

| Legal Implications | Providing false information can result in criminal charges under Texas Penal Code Section 37.10. |

| Office Use Section | The form includes sections for office personnel to approve or disapprove refund requests. |

Guidelines on Utilizing Pt001

Filling out the Pt001 form for a property tax refund can seem daunting at first, but taking it step by step can help ease any concerns. This application allows taxpayers to formally request a refund they believe they are due. Follow the outline below to ensure you provide all necessary information correctly.

-

Step 1: Fill in the Property Owner’s Account Information.

- Owner(s) Name

- Account Number

- Present Mailing Address (Number and Street)

- City, Town or Post Office, State, Zip Code

- Phone (Area Code and Number)

-

Step 2: Provide the Taxpayer Name and Address (where the refund will be sent).

- Taxpayer Name

- Present Mailing Address (Number and Street)

- City, Town or Post Office, State, Zip Code

- Phone (Area Code and Number)

-

Step 3: Describe the Legal Description of the property, or attach a copy of the tax bill or tax receipt.

- Property Address or location of property

-

Step 4: Enter the Tax Payment Information.

- Tax Year

- Date of Payment

- Amount Paid

- Payment Method

- Check Number (if applicable)

- Taxpayer’s Reason for Refund

-

Step 5: Sign the form to certify the information.

- Applicant Signature

- Date of Application for Tax Refund

- Print Applicant Name

If you make a false statement on this application, you could face serious legal consequences.

-

Step 6: Leave the Tax Refund Determination section for office use only.

- Field for Approval/Disapproval and related signatures

Once you have completed these steps, your form is ready for submission. Be sure to double-check all entries for accuracy. This attention to detail will assist in a timely and smooth processing of your refund request.

What You Should Know About This Form

What is the PT001 form?

The PT001 form is the Property Tax Refund Application specific to Montgomery County, Texas. It is designed for property owners who seek to reclaim taxes that have been overpaid or for various reasons where a refund is justified. By completing this form, taxpayers can submit requests to the Montgomery County Tax Assessor-Collector, ensuring their claims are officially documented and processed.

How do I fill out the PT001 form?

To fill out the PT001 form, follow a series of clearly defined steps. Begin with providing your property account name and address, including your present mailing information. Next, input the taxpayer name and the address to which the refund should be sent. Describe the legal description of the property clearly or attach a copy of the relevant tax documentation. You must then indicate the tax year, payment date, amount paid, and the method of payment. Lastly, ensure the form is signed and dated to certify the accuracy of the information provided.

What information do I need to provide about the property?

You will need to provide the legal description of the property as well as its physical address. This helps identify the property for which you are seeking a tax refund. If you have a tax bill or receipt, attaching a copy will strengthen your application.

Is supporting documentation required?

Yes, supporting documentation is necessary when applying for a refund. This may include copies of payment receipts or any other relevant documents that substantiate your claim. If you cannot provide original documentation, you may need to complete an affidavit explaining the circumstances.

What should I do if I do not have the original tax receipt?

If you do not have the original tax receipt, your option is to complete the affidavit portion of the PT001 form, which provides a statement affirming your identity as the taxpayer. You will agree to hold Montgomery County harmless regarding any claim to the refund. It is crucial to be truthful and thorough in your affidavit to avoid potential legal issues.

What happens after I submit the PT001 form?

Once you have submitted the PT001 form, it will undergo processing by the Tax Assessor-Collector’s office. The refund request will be reviewed, and you will receive notification regarding the status of your application. Should the request be approved, you will be issued a refund check, with details recorded in the office's system.

Are there any penalties for providing false information?

Providing false information on the PT001 form can lead to significant consequences. Under Texas law, it may be classified as a Class A misdemeanor or a state jail felony. It is essential to ensure that all information provided is accurate and honest to avoid any legal repercussions.

Who can assist me if I have questions about the PT001 form?

If you have questions or need assistance while filling out the PT001 form, you can contact the Montgomery County Tax Assessor-Collector’s office directly. They can provide guidance and support on any aspect of the application process. Their contact number is 936-539-7809, and they are there to help ensure your application is completed correctly.

Common mistakes

Completing the Pt001 form, which is essential for property tax refunds, may seem straightforward. However, many individuals make mistakes that can complicate or even derail their application. Being aware of these common errors can significantly enhance the chances of a successful submission.

The first mistake often involves omitting crucial information. When filling out the form, it is imperative to include the property owner’s name, address, and account number. Inaccuracies here can lead to delays or disapproval of the refund. For example, failing to provide a current mailing address means that any correspondence or refund check may not reach the intended recipient, creating unnecessary confusion.

Secondly, many applicants neglect to provide supporting documentation. The form clearly states that applicants must attach copies of payment receipts or related documentation. Without this evidence, the application may be rejected outright. This documentation is not just a formality; it verifies the legitimacy of the refund request. Therefore, ensuring all supporting documents are included with the application is critical.

An additional frequent error lies in inaccuracies within the tax payment details. When reporting the tax year, payment amount, or check number, double-checking these entries is essential. Misstating these figures not only jeopardizes the application but could also lead to legal complications. Emphasizing attention to detail in this section cannot be overstated.

Finally, failing to sign the form correctly is a prevalent mistake. The applicant must not only sign the application but also print their name and date it accordingly. An unsigned form is incomplete and will likely be returned. It is a simple step, but one that often gets overlooked in the rush to submit the application.

By being mindful of these common pitfalls—omitting essential information, neglecting supporting documentation, providing incorrect payment details, and failing to sign the form—applicants can streamline their refund process. Thoroughness and attention to detail will ultimately serve the best interests of those seeking a property tax refund.

Documents used along the form

When applying for a property tax refund using the PT001 form, there are several additional forms and documents that may be needed. Each of these helps clarify your application and supports your request. Below is a list of commonly used documents that you might encounter during the process.

- Tax Bill or Receipt: This document serves as proof of payment for the property taxes in question. It typically contains details like the property address, tax amount, and payment date.

- Affidavit of Indemnity: In instances where the original tax receipt is unavailable, this affidavit allows the taxpayer to affirm their request for a refund and acknowledges any associated risks.

- Property Deed: The property deed establishes legal ownership and can be required to confirm the identity of the taxpayer applying for the refund.

- Power of Attorney (if applicable): If a representative is filing on behalf of the taxpayer, this document grants them the authority to act on the taxpayer’s behalf in matters related to the refund application.

- Taxpayer Identification Number (TIN): Providing a TIN can expedite the refund process. This number is unique to each taxpayer and helps the tax office process applications more efficiently.

- Supporting Documentation of Payment: Any additional proof of prior payments can bolster your case for a refund. This may include bank statements or transaction records indicating payment made for taxes.

- Prior Refund Requests: If applicable, copies of prior refund requests can provide insight into consistent claims and their outcomes, helping to establish a clearer context for your current request.

Collecting and submitting these documents alongside the PT001 form can streamline your property tax refund application. Being thorough in your preparation often leads to a more efficient review process.

Similar forms

IRS Form 1040: This form is used for individual income tax returns. Like the Pt001 form, it requires personal information and details about payments made, which are essential for processing refunds.

State Tax Refund Form: Similar in function, this form may vary by state but typically involves requesting a refund for state taxes overpaid, just like the Pt001 for property taxes.

Claim for Refund (Form 843): This IRS form allows taxpayers to claim refunds for various types of taxes, echoing the process of applying for a property tax refund.

Property Tax Exemption Application: This document is filed to request exemptions from property taxes. Both forms require detailed property information and taxpayer identification.

Taxpayer Identification Number (TIN) Application: While this form is for obtaining a TIN, both forms involve legal identities and share the goal of facilitating smoother tax transactions.

Certificate of Abatement: This document is used to request the removal of a tax liability. Similar to the Pt001, it requires thorough documentation and clear justification for the request.

Request for Taxpayer Advocate Service (Form 911): This form is used to seek help with tax issues, highlighting the taxpayer's rights, much like the Pt001 emphasizes accountability and legal compliance in refund requests.

Dos and Don'ts

When filling out the Pt001 form, it's crucial to ensure accuracy and completeness. Here’s a helpful list to guide you on what to do and what to avoid:

- Do read the entire form carefully before starting.

- Do fill out all required fields completely.

- Do include supporting documentation as needed.

- Do double-check your information for typos or errors.

- Don’t leave any sections blank; this could delay the processing.

- Don’t submit without signing the application—your signature is essential.

- Don’t forget to keep a copy of the completed form for your records.

- Don’t provide false information; it can lead to severe consequences.

Following these guidelines can help make the process smoother and increase the likelihood of a successful refund application.

Misconceptions

-

Misconception 1: The Pt001 form is only for homeowners.

In reality, any taxpayer who has made a payment that they believe is eligible for a refund can use this form, regardless of ownership status.

-

Misconception 2: You need to provide the original tax receipt to apply for a refund.

The form itself states that if the original tax receipt is unavailable, you can still apply by completing an affidavit affirming the payment.

-

Misconception 3: Filling out the Pt001 form guarantees a tax refund.

Submitting the form does not automatically result in a refund. The application must be reviewed and approved by the appropriate officials.

-

Misconception 4: You must be a resident of Montgomery County to apply.

Anyone who has paid property taxes in Montgomery County, even non-residents, can file for a refund using this form.

-

Misconception 5: It's only necessary to sign the form, and nothing else.

In addition to signing, the applicant must provide detailed information about the payment and the reason for the refund request.

-

Misconception 6: The form can be submitted without any supporting documentation.

Supporting payment documentation is essential unless an affidavit is submitted justifying the lack of documentation.

-

Misconception 7: There is no deadline for filing the Pt001 form.

Filing deadlines may be imposed, and it is important to check local regulations to ensure compliance.

Key takeaways

Filling out the Pt001 form accurately is crucial for a successful property tax refund application. Here are some key takeaways:

- Complete the personal information sections carefully, including both the property owner’s and taxpayer's name and address.

- Provide a clear legal description of the property. This can include a copy of the tax bill or tax receipt.

- Detail the payment information, including the tax year, date of payment, and the amount paid.

- Attach all necessary supporting documentation. This is critical to avoid delays in processing the refund.

- Sign the form to certify the truthfulness of the information provided. Remember, false statements have serious legal consequences.

- Check the refund determination section for office use after submitting the application for proper processing.

- Familiarize yourself with the affidavit section. If you lack the original tax receipt, you must provide a statement affirming your request for a refund.

Browse Other Templates

Mobile Liquor License - The simple layout streamlines communication between construction parties.

Trauma Patient - Gathering relevant information and being thorough improves patient outcomes.