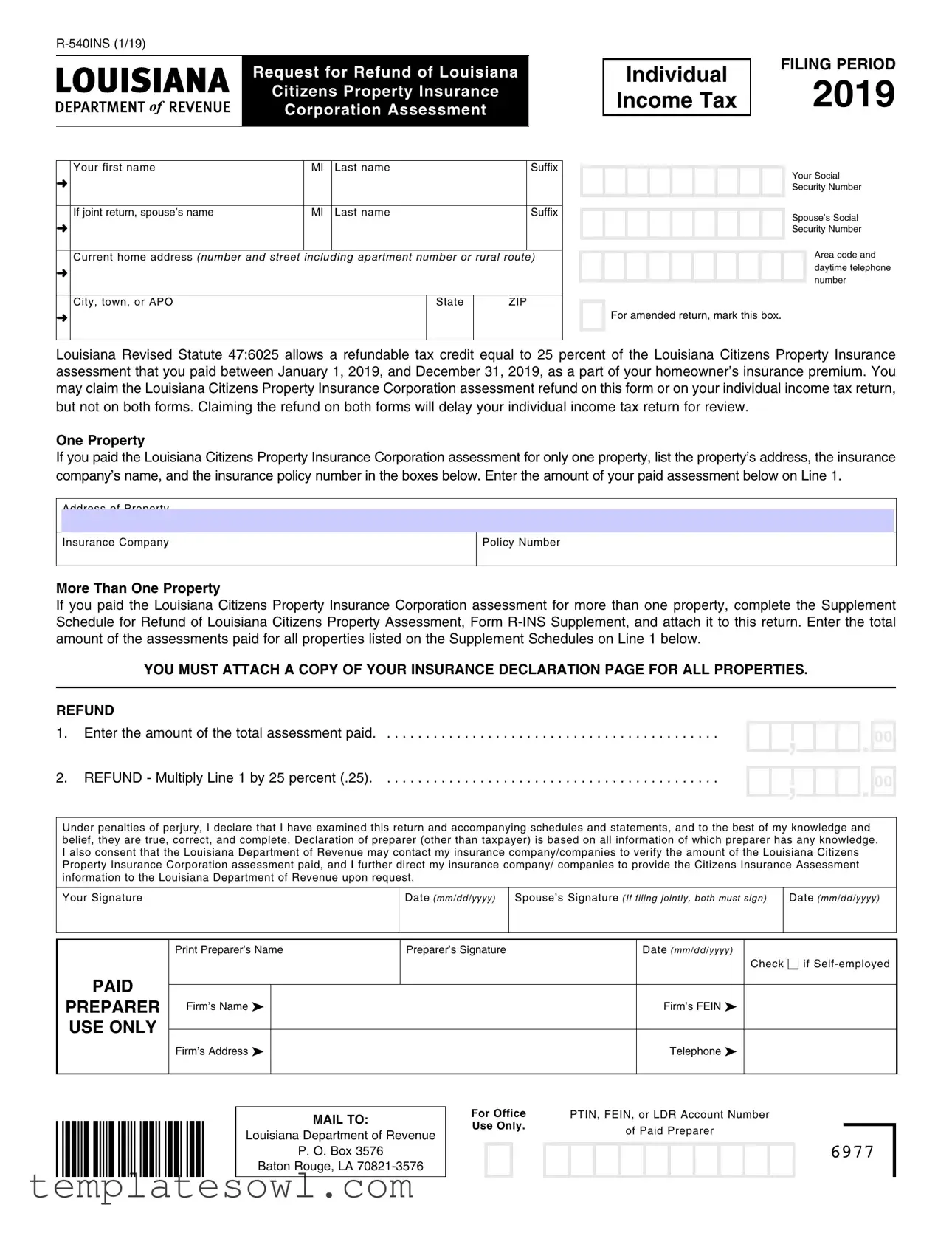

Fill Out Your R 540Ins Louisiana Form

The R 540Ins Louisiana form is an essential document for homeowners seeking to reclaim a portion of their insurance assessments through a refundable tax credit. Specifically, this form allows individuals to claim a credit amounting to 25 percent of what they paid in Louisiana Citizens Property Insurance assessments during the calendar year 2019. These assessments may have been included as part of their homeowner’s insurance premiums. Taxpayers must complete the form with accurate details, including their personal information, property addresses, and applicable insurance details. If an individual has multiple properties, additional supplemental schedules must be attached. It is crucial to note that the Louisiana Department of Revenue allows the refund to be claimed exclusively on either this form or the individual's income tax return, preventing claims on both to avoid processing delays. The importance of attaching the Insurance Declaration Page for each property cannot be understated, as failure to do so will result in the form being rejected. By maintaining thorough and precise records along with their submissions, homeowners can facilitate a smoother processing of their refund requests.

R 540Ins Louisiana Example

|

|

|

|

|

Request for Refund of Louisiana |

|

|||

|

|

|

|

|

|

||||

|

|

|

|

|

Citizens Property Insurance |

|

|

||

|

|

|

|

|

|

|

|||

|

|

|

|

|

Corporation Assessment |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your first name |

|

MI |

Last name |

|

Suffix |

||||

➜ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s name |

|

MI |

Last name |

|

Suffix |

||||

➜ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||

Current home address (number and street including apartment number or rural route) |

|||||||||

➜ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

City, town, or APO |

|

|

State |

ZIP |

|||||

Individual

Income Tax

FILING PERIOD

2019

Your Social

Security Number

Spouse’s Social

Security Number

Area code and daytime telephone number

➜ |

For amended return, mark this box.

Louisiana Revised Statute 47:6025 allows a refundable tax credit equal to 25 percent of the Louisiana Citizens Property Insurance assessment that you paid between January 1, 2019, and December 31, 2019, as a part of your homeowner’s insurance premium. You may claim the Louisiana Citizens Property Insurance Corporation assessment refund on this form or on your individual income tax return, but not on both forms. Claiming the refund on both forms will delay your individual income tax return for review.

One Property

If you paid the Louisiana Citizens Property Insurance Corporation assessment for only one property, list the property’s address, the insurance company’s name, and the insurance policy number in the boxes below. Enter the amount of your paid assessment below on Line 1.

Address of Property

Insurance Company

Policy Number

More Than One Property

If you paid the Louisiana Citizens Property Insurance Corporation assessment for more than one property, complete the Supplement Schedule for Refund of Louisiana Citizens Property Assessment, Form

YOU MUST ATTACH A COPY OF YOUR INSURANCE DECLARATION PAGE FOR ALL PROPERTIES.

REFUND

1. Enter the amount of the total assessment paid. . . . . . . . . . . . . . . . . . 對 . . . .

2. REFUND - Multiply Line 1 by 25 percent (.25). . . . . . . . . . . . . . . . . . 對 . . . .

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. I also consent that the Louisiana Department of Revenue may contact my insurance company/companies to verify the amount of the Louisiana Citizens Property Insurance Corporation assessment paid, and I further direct my insurance company/ companies to provide the Citizens Insurance Assessment information to the Louisiana Department of Revenue upon request.

Your Signature

Date (mm/dd/yyyy)

Spouse’s Signature (If filing jointly, both must sign)

Date (mm/dd/yyyy)

PAID

PREPARER USE ONLY

Print Preparer’s Name |

Preparer’s Signature |

Date (mm/dd/yyyy) |

|

|

|

|

|

|

Check ■ if |

|

|

|

|

|

Firm’s Name ➤ |

|

|

Firm’s FEIN ➤ |

|

|

|

|

|

|

Firm’s Address ➤ |

|

|

Telephone ➤ |

|

|

|

|

|

|

MAIL TO:

Louisiana Department of Revenue

P. O. Box 3576

Baton Rouge, LA

For Office |

|

PTIN, FEIN, or LDR Account Number |

||||||||||

Use Only. |

|

|

|

of Paid Preparer |

||||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6977

Instructions for Preparing your 2019 Louisiana Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment

Mail return to:

Louisiana Department of Revenue

P. O. Box 3576

Baton Rouge, LA

About this Form

The return has been designed for electronic scanning, which permits faster processing with fewer errors. In order to avoid unnecessary delays caused by manual processing, taxpayers should follow the guidelines listed below:

1.An individual may file this form to claim the refund of the Louisiana Citizens Property Insurance Corporation assessment(s) that was paid during calendar year 2019.

2.Enter the amount only on the line that is applicable.

3.Complete the form by using a pen with black ink.

4. Because this form is read by a machine, please enter your numbers inside the boxes like this: 1 2 3 4 5

5.All numbers should be rounded to the nearest dollar.

6.Numbers should NOT be entered over the

7. If you are filing an amended return, mark an “X” in the “Amended Return” box.

8.Failure to attach the Insurance Declaration Page(s) will result in this form being returned to you.

Name(s), address, and Social Security Number(s) – Enter your name(s), address, and Social Security Number(s) in the space provided. If married, please enter Social Security Numbers for both you and your spouse.

Information concerning the assessment amounts and Insurance Declaration Page – The amount of this assessment may appear as separate line items on what is referred to as the “Declaration Page” of your property insurance premium notice. The Declaration Page names the policyholder, describes the property or liability to be insured, type of coverage, and policy limits. Depending on the location of the insured property, these line item charges may be listed as: Louisiana Citizens FAIR Plan REGULAR Assessment, Louisiana Citizens FAIR Plan EMERGENCY Assessment, Louisiana Citizens Coastal Plan REGULAR Assessment, and/or Louisiana Citizens Coastal Plan EMERGENCY Assessment. Your total assessment paid is the total of these amounts, if they are shown on the Declaration Page.

Important note: If you are a customer of the Louisiana Citizens Insurance Corporation and you paid the Tax Exempt Surcharge, this surcharge may not be claimed.

•Enter the address of the property, the insurance company’s name, and the policy number in the spaces provided.

•Do you own more than one property that incurred an assessment?

If you had more than one property during 2019 that incurred an assessment, prepare and attach Form

9.Sign and date the return. Mail the return to the address at the top of this form.

Paid Preparer Instructions

If your return was prepared by a paid preparer, that person must also sign in the appropriate space, complete the information in the “Paid Preparer Use Only” box and enter his or her identification number in the space provided under the box. If the paid preparer has a Preparer Tax Identification Number (PTIN), the PTIN must be entered in the space provided under the box, otherwise enter the Federal Employer Identification Number (FEIN) or LDR account number. If the paid preparer represents a firm, the firm’s FEIN must be entered in the “Paid Preparer Use Only” box. The failure of a paid preparer to sign or provide an identification number will result in the assessment of the unidentified preparer penalty on the preparer. The penalty of $50 is for each occurrence of failing to sign or failing to provide an identification number.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | This form is used to request a refund for Louisiana Citizens Property Insurance Corporation assessments paid in 2019. |

| Applicable Law | The form is governed by Louisiana Revised Statute 47:6025. |

| Refund Percentage | Taxpayers can receive a refundable tax credit equal to 25% of the assessment paid. |

| Filing Period | The assessments claimed must be for the calendar year 2019. |

| Form Submission | Taxpayers can submit the refund request using this form or their individual income tax return, but not both. |

| Single Property Submission | If only one property is involved, the taxpayer needs to provide the property address, insurance company name, and policy number. |

| Multiple Properties | For multiple properties, taxpayers must complete and attach the R-INS Supplement form and the Declaration Page for each property. |

| Signature Requirement | Both spouses must sign the form if filing jointly. |

| Common Mistakes | Failing to attach the Insurance Declaration Page may lead to the return being rejected. |

| Mailing Address | All returns must be sent to the Louisiana Department of Revenue, P.O. Box 3576, Baton Rouge, LA 70821-3576. |

Guidelines on Utilizing R 540Ins Louisiana

Submitting the R 540Ins Louisiana form requires careful attention to detail. This form allows individuals to request a refund for the Louisiana Citizens Property Insurance Corporation assessment they paid during 2019. Ensure that you have all necessary documents, particularly the Insurance Declaration Page, before proceeding with the completion of the form. Follow these steps to accurately fill out the R 540Ins form.

- Write your first name, middle initial (if applicable), last name, and any suffix in the designated spaces.

- If you are submitting a joint return, enter your spouse’s name, middle initial, last name, and suffix.

- Fill in your current home address, including the apartment number or rural route, city, state, and ZIP code.

- Indicate the filing period for individual income tax (2019).

- Enter your Social Security Number and your spouse’s Social Security Number if filing jointly.

- Provide your area code and daytime telephone number.

- If this is an amended return, mark the appropriate box.

- If you paid the assessment for only one property, list the property’s address, the name of the insurance company, and the insurance policy number.

- For properties with multiple assessments, complete and attach the Supplement Schedule for Refund and summarize the total assessments on Line 1.

- Calculate the total assessment paid and enter it on Line 1.

- Multiply the amount on Line 1 by 25 percent and enter the result on Line 2.

- Sign and date the return, ensuring both you and your spouse sign if filing jointly.

- If a paid preparer filled out the form, they must sign and provide their identification number.

- Finally, mail the completed form and any attachments to the Louisiana Department of Revenue at the specified address.

Once you have submitted your form, it will be processed by the Louisiana Department of Revenue. Keeping a copy for your records is advisable, as it can facilitate future inquiries about your refund status. Be aware that processing times may vary, and it is prudent to follow up if you do not receive a response within a reasonable timeframe.

What You Should Know About This Form

What is the purpose of the R 540Ins Louisiana form?

The R 540Ins Louisiana form is designed for individuals seeking a refund for assessments paid to the Louisiana Citizens Property Insurance Corporation during the 2019 calendar year. It allows residents of Louisiana to claim a refundable tax credit, which equals 25% of the amount paid in assessment as part of their homeowner’s insurance premium.

Who is eligible to use this form?

Individuals who paid the Louisiana Citizens Property Insurance Corporation assessment on their property insurance in 2019 are eligible to use this form. This includes homeowners who made such payments, as well as those filing jointly with a spouse. It is important to note that the assessment can only be claimed once, either via this form or on an individual tax return, but not both.

How do I fill out the R 540Ins Louisiana form?

Begin by entering your name, address, and Social Security numbers in the designated fields. If filing jointly, you will need to input your spouse's details as well. Calculate the total assessment paid, and provide the relevant property information. For anyone claiming multiple properties, use the Supplement Schedule for Refund (Form R-INS Supplement) and ensure all declarations are attached. Lastly, sign and date the form before mailing it to the Louisiana Department of Revenue.

What happens if I file the form incorrectly?

Filing the R 540Ins form incorrectly can lead to delays in processing. Common issues include failing to include required attachments, such as the Insurance Declaration Page, or miscalculating assessment amounts. If the form is returned due to errors, an individual may need to correct and resubmit it, which can extend the time before any refund is received.

Where should I mail the completed form?

Once you have completed the R 540Ins Louisiana form, mail it to the Louisiana Department of Revenue at P.O. Box 3576, Baton Rouge, LA 70821-3576. This ensures that your request for a refund is directed to the appropriate department for processing.

Common mistakes

Filling out the R 540Ins Louisiana form can seem straightforward, but many people make common mistakes that can delay their refund. One frequent error is neglecting to attach the necessary **Insurance Declaration Page**. This page is crucial as it verifies the amount paid in assessments. If it’s missing, the entire submission may be returned, causing unnecessary delays.

Another common mistake involves entering amounts incorrectly. For example, individuals often do not round numbers to the nearest dollar as required. It's essential to ensure that numbers are neatly placed in the designated boxes. Additionally, avoid writing over the pre-printed zeros. This error can lead to misinterpretations by the scanning equipment.

Many taxpayers forget to include both Social Security numbers when filing jointly. This missing information can create confusion and potential issues with processing the return. Each person filing jointly needs to provide their respective Social Security number. Without both numbers, the submission will face delays in processing.

Additionally, some individuals do not mark the box for an amended return when necessary. If you are filing an amended return, failing to check this box can result in the return being processed incorrectly. Be sure to indicate this important detail to avoid complications.

Another mistake involves how homeowners report their property information. If you own multiple properties that incurred assessments, it's crucial to use the **R-INS Supplement** form accurately. Failing to attach the supplement or listing properties incorrectly can result in receiving only a partial refund, as the total assessments for all properties must be combined and reported correctly.

Lastly, a significant oversight happens during the signature process. Both taxpayers must sign the form if filing jointly. Skipping a signature can lead to the form being rejected outright, as signatures are required for validation. It's a simple, but essential step that shouldn’t be overlooked.

Documents used along the form

The R-540INS form is an essential document for homeowners seeking a refund on their Louisiana Citizens Property Insurance Corporation assessment. However, there are several other forms and documents that may accompany this request, helping to streamline the process and ensure compliance with Louisiana tax regulations. Understanding these documents can help avoid unnecessary complications when filing for a refund.

- Form R-INS Supplement: This document is needed if you paid the Louisiana Citizens Property Insurance Corporation assessment for more than one property. It allows you to list additional properties and provide details necessary for calculating the total refund. Be sure to attach it to your R-540INS form.

- Insurance Declaration Page: This page summarizes your insurance policy details, including the assessments paid. It is crucial as it verifies the assessment amount you are claiming. Each property linked to the refund must have its respective declaration page attached.

- Louisiana Individual Income Tax Return (Form IT-540): If you choose to claim your assessment refund on your tax return instead of using the R-540INS form, you will need to file this form. Ensure that you don’t claim the refund on both documents, as it can cause delays in processing your return.

- Amended Tax Return (if applicable): If you have already submitted your individual income tax return but later discover an error or wish to claim the assessment refund, you will need to file an amended return. Make sure to mark the appropriate box to indicate that you are filing this as an amended return.

By being aware of these accompanying forms and documents, you can better navigate the refund process associated with the Louisiana Citizens Property Insurance assessment. Proper preparation and adherence to guidelines can help facilitate a smooth experience, allowing you to maximize your refund efficiently.

Similar forms

- Form 1040 - The individual income tax return form allows taxpayers to report their income and other relevant tax information. Similar to the R 540Ins form, it includes spaces for personal details, filing status, and deductions or credits. Both forms must be filed with the appropriate tax authority to claim refunds or report assessments.

- Form 8888 - This form is used to allocate your tax refund to different accounts or to purchase U.S. savings bonds. Like the R 540Ins, it facilitates the processing of tax refunds, allowing individuals to decide how they want to receive their money after taxes are calculated.

- Schedule A (Form 1040) - This supplementary form allows taxpayers to itemize deductions instead of taking a standard deduction. It is similar to the R 540Ins form in that it is used to claim specific financial benefits and is submitted alongside the main tax return form for a complete accounting of one’s financial situation.

- Form R-INS Supplement - This specific supplement works in conjunction with the R 540Ins form when a taxpayer has multiple properties. Much like the main form, it gathers data about assessments paid, ensuring that all relevant deductions are accounted for when claiming a refund.

Dos and Don'ts

When completing the R 540Ins Louisiana form, careful attention to detail can help ensure a smooth process. Below is a list of important dos and don'ts to keep in mind.

- Do provide accurate personal information, including full names and Social Security Numbers for you and your spouse if filing jointly.

- Don't forget to attach a copy of your Insurance Declaration Page for all properties listed.

- Do round all numbers to the nearest dollar to avoid processing errors.

- Don't enter numbers over the pre-printed zeros when filling out the form.

- Do mark the "Amended Return" box if you are submitting an amended return.

- Don't leave any fields blank; provide information for each required section.

- Do sign and date the return in the spaces provided to ensure it is valid.

- Don't submit the form without checking for any typos or errors that may have occurred.

- Do mail the completed form to the address specified to prevent delays in processing.

- Don't claim the Tax Exempt Surcharge if you paid it, as it is not eligible for refund.

Misconceptions

- Misconception 1: The R-540Ins form is only for individuals with one property.

- Misconception 2: You can claim a refund on both R-540Ins and your tax return.

- Misconception 3: Any type of insurance assessment qualifies for a refund.

- Misconception 4: You do not need to include supporting documents.

- Misconception 5: The R-540Ins form can be filled out in any ink color.

- Misconception 6: Only the primary homeowner's information needs to be filled out.

- Misconception 7: You can round any amount to the nearest dollar freely.

- Misconception 8: The form does not have a deadline.

- Misconception 9: Signature is not mandatory for joint filings.

- Misconception 10: It is unnecessary to keep a copy of the submitted form.

This form can be used by individuals who own multiple properties. If you have several properties, you should complete the Supplement Schedule for Refund of Louisiana Citizens Property Assessment.

It's important to note that claiming the refund on both this form and your individual income tax return is not allowed. Doing so will likely delay the review of your tax return.

Only those payments related to the Louisiana Citizens Property Insurance Corporation assessment can be claimed. Surcharges, such as the Tax Exempt Surcharge, do not qualify.

Failure to attach a copy of your Insurance Declaration Page will result in the return being sent back. This is a crucial part of the filing process.

This form must be completed using black ink. Using different ink colors may lead to processing delays.

If filing jointly, you must provide the name and Social Security Number for both the homeowner and the spouse. This helps ensure accurate processing of the refund.

While rounding to the nearest dollar is acceptable, be cautious to ensure that all amounts are rounded properly, as incorrect rounding can cause issues.

Timely submission is essential. Refer to the guidelines to ensure you do not miss any applicable deadlines that could affect your refund eligibility.

Both homeowners must sign the return if filing jointly. Missing signatures will delay processing of your refund request.

Always keep a copy of your submitted form and any supporting documents for your records. This can be useful for future reference or if any questions arise regarding your submission.

Key takeaways

When filling out the R 540Ins Louisiana form, several key points are essential for a smooth and successful process. Understanding these takeaways can help ensure accurate completion and submission.

- Eligibility for Refund: You can request a refund for the Louisiana Citizens Property Insurance Corporation assessment if you paid it during the calendar year 2019. The refund amounts to 25 percent of the assessment you’ve paid.

- Single vs. Multiple Properties: If you only make claims for one property, you should enter its details directly on the form. However, if you have multiple properties, use the Supplement Schedule for Refund (Form R-INS Supplement) to summarize assessments for all properties.

- Accuracy of Information: Ensure that your Social Security number, current home address, and insurance information are correctly entered. Any discrepancies may lead to delays in processing.

- Attachment Requirements: Always attach a copy of your Insurance Declaration Page for each property claimed. Missing documents could result in the form being returned without processing.

- Filing an Amended Return: If you need to make changes to a previously submitted return, check the box indicating that your submission is an amended return. This step is crucial to prevent delays in processing.

- Submission Instructions: After completing the form, mail it to the Louisiana Department of Revenue at the designated address. Ensure the form is filled out in black ink and that all numbers are rounded to the nearest dollar.

By keeping these takeaways in mind, you can enhance the likelihood of a successful refund request and improve your overall experience with the Louisiana tax system.

Browse Other Templates

Workers Comp Insurance Application,Employee Liability Insurance Request,Workers Compensation Coverage Form,Compensation Insurance Application,Employer’s Liability Application,Workplace Injury Insurance Request,Workers Comp Enrollment Form,Occupationa - This form collects essential information about the applicant, including business details and contact information.

Key Solutions Insurance - Additional support is offered through clear instructions for completing each section.

Cms 802 - Proper documentation on the CMS 802 enhances communication among the care team.