Fill Out Your R0717G Form

The R0717G form is an essential document for state employees who have served in the military and wish to apply for service credit during their time of active duty. This form is specifically designed for participants in Michigan's Defined Contribution Retirement Plan. It allows individuals to request both service credit and employer contributions while they were on military leave. When properly submitted, it can help ensure that service members receive recognition and financial support for their time spent in uniform. The form prompts applicants to provide their personal information, including their name, identification number, and military service details, to facilitate the review process by the Office of Retirement Services. Eligible applicants may receive an employer contribution of 4% of their state pay equivalent had they not been called to duty. Furthermore, there are options to make elective contributions that can enhance retirement savings even after a military leave. Understanding the R0717G form is crucial for those affected, as it not only supports their financial future but also acknowledges their service to the country.

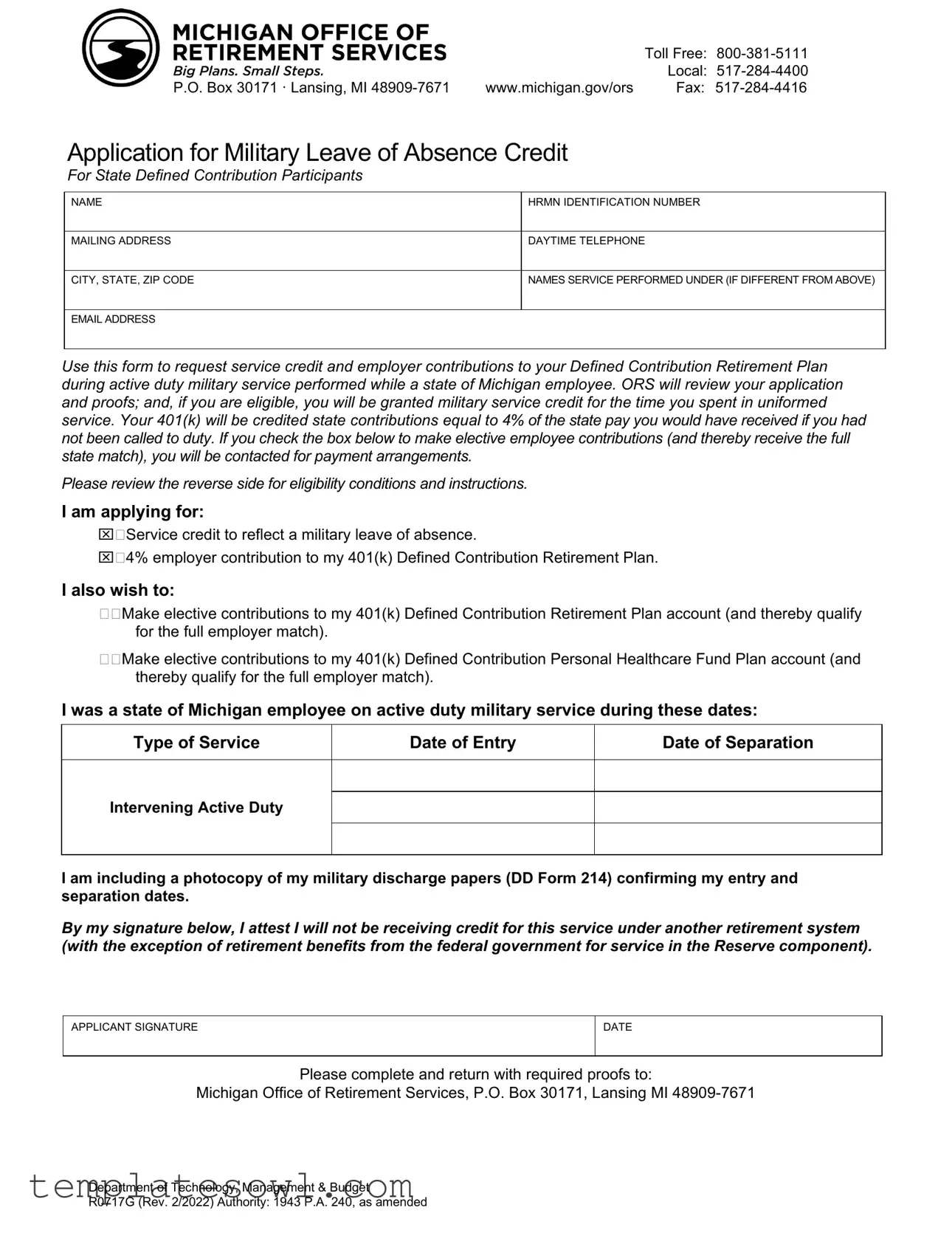

R0717G Example

|

|

Toll Free: |

|

|

|

Local: |

|

P.O. Box 30171 · Lansing, MI |

www.michigan.gov/ors |

Fax: |

|

Application for Military Leave of Absence Credit

For State Defined Contribution Participants

NAME

HRMN IDENTIFICATION NUMBER

MAILING ADDRESS

DAYTIME TELEPHONE

CITY, STATE, ZIP CODE

NAMES SERVICE PERFORMED UNDER (IF DIFFERENT FROM ABOVE)

EMAIL ADDRESS

Use this form to request service credit and employer contributions to your Defined Contribution Retirement Plan during active duty military service performed while a state of Michigan employee. ORS will review your application and proofs; and, if you are eligible, you will be granted military service credit for the time you spent in uniformed service. Your 401(k) will be credited state contributions equal to 4% of the state pay you would have received if you had not been called to duty. If you check the box below to make elective employee contributions (and thereby receive the full state match), you will be contacted for payment arrangements.

Please review the reverse side for eligibility conditions and instructions.

I am applying for:

Service credit to reflect a military leave of absence.

4% employer contribution to my 401(k) Defined Contribution Retirement Plan.

I also wish to:

Make elective contributions to my 401(k) Defined Contribution Retirement Plan account (and thereby qualify for the full employer match).

Make elective contributions to my 401(k) Defined Contribution Personal Healthcare Fund Plan account (and thereby qualify for the full employer match).

I was a state of Michigan employee on active duty military service during these dates:

Type of Service |

Date of Entry |

Date of Separation |

Intervening Active Duty

I am including a photocopy of my military discharge papers (DD Form 214) confirming my entry and separation dates.

By my signature below, I attest I will not be receiving credit for this service under another retirement system (with the exception of retirement benefits from the federal government for service in the Reserve component).

APPLICANT SIGNATURE

DATE

Please complete and return with required proofs to:

Michigan Office of Retirement Services, P.O. Box 30171, Lansing MI

Department of Technology, Management & Budget

R0717G (Rev. 2/2022) Authority: 1943 P.A. 240, as amended

Eligibility Conditions and Instructions

Eligibility

A participant in the state of Michigan’s 401(k) Defined Contribution Retirement Plan is eligible to receive service credit for time spent on a military leave of absence in accordance with the Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA).

Service credit for time you spent on military leave can be used to meet the vesting requirement for both employer contributions (a

If you meet the criteria for a military leave of absence as described by the Department of Civil Service, the state will increase your service credit hours and contribute an amount equal to 4% of the state pay you would have received if you had not been called to duty.

Conditions

•If eligible, you will receive service credit when you return to work and submit this form with your military discharge papers (DD Form 214).

•After discharge, you must return to employment within the allowed decompression time as set forth by the Department of Civil Service.

•You must have left state employment to serve in one of the uniformed services: Army, Navy, Marine Corps, Air Force, Coast Guard, Reserves, National Guard, and the Commissioned Corps of the Public Health Service.

•Cumulative absences from your job for military service cannot exceed five years unless the additional service falls under one of the exceptions in Civil Service Regulation 2.04, Military Leaves of Absence and Return to Work: Basic Rights.

•You cannot receive credit for military service if you receive credit for the same service under another retirement system. However, this restriction doesn’t apply if you will be eligible to retire from the federal government for service in the Reserve component.

•If your military leave of absence meets the criteria established under the Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA*), you will be

granted service credit for the time you served in the military (subject to statutory limits) and any creditable decompression time allowed under the following guidelines: Less than 31 days. Your military service and travel time from the place of service to your residence, plus 8 hours. 31 to 180 days. Your military service and up to 14 days of decompression time. 181 or more. Your military service and up to 90 days of decompression time. *USERRA is a federal law that provides reemployment rights for individuals who have served in the military.

Elective Contributions

You can make up the elective contributions you missed while on military leave. If you choose to make up your elective contributions to your 401(k) account, the state will match those contributions up to 3% or 5% if you are in the Personal Health Care Fund.

If you check the elective contributions box on the front of this form, the Office of Retirement Services will contact you to explain your payment options.

Payment of elective contributions must take place within a period equal to three times the length of your immediate past military service, but not longer than five years. For example, if you returned to work on May 1, 2021, after one year of military duty, you must make up any elective contributions within three years, which would be May 1, 2024.

For copies of your military papers, write to: National Personnel Records Center, Military Personnel Records, 9700 Page Avenue, St. Louis, MO 63132- 5100. You can also request your discharge papers online by visiting www.archives.gov.

R0717G (Rev. 2/2022) Page 2

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | This form is used to request service credit and employer contributions during active duty military service for state-defined contribution plan participants. |

| Governing Law | The form is governed by the Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA) and state law 1943 P.A. 240 as amended. |

| Contact Information | For queries, users can reach the Michigan Office of Retirement Services by calling toll-free at 800-381-5111 or locally at 517-284-4400. |

| Eligibility Criteria | Participants must have been a state employee on active military duty to qualify for service credit and contributions. |

| Contributions | If eligible, the state will contribute an amount equal to 4% of the state pay the applicant would have received if not deployed. |

| Documentation Requirement | An applicant must include a photocopy of DD Form 214 as proof of their military service. |

| Elective Contributions | Participants can make up missed elective contributions to their 401(k) accounts during their military absence. |

| Submission Address | Completed forms should be sent to Michigan Office of Retirement Services, P.O. Box 30171, Lansing MI 48909-7671. |

Guidelines on Utilizing R0717G

After completing the R0717G form, it must be submitted along with supporting documents to the Michigan Office of Retirement Services. This application is pivotal for obtaining service credit and employer contributions during your military leave as a state employee. Follow these steps to ensure your form is filled out correctly.

- Fill in your name in the designated space.

- Enter your HRMN identification number.

- Complete your mailing address including street, city, state, and ZIP code.

- Provide your daytime telephone number.

- Write your email address.

- If your name differs from your application name, input it under NAMES SERVICE PERFORMED UNDER.

- Indicate the military leave of absence by checking the appropriate box.

- Select whether you wish to receive the 4% employer contribution to your 401(k) by checking the corresponding box.

- If you want to make elective contributions to your 401(k) or your healthcare fund, check the desired box(es).

- Fill out the dates of your military service, including type of service, date of entry, and date of separation.

- Attach a photocopy of your military discharge papers (DD Form 214) to confirm your service dates.

- Sign and date the form at the bottom to attest your eligibility.

- Finally, mail the completed form and attachments to the Michigan Office of Retirement Services at the provided address.

What You Should Know About This Form

What is the R0717G form used for?

The R0717G form is an application for military leave of absence credit specifically for participants in the state of Michigan’s Defined Contribution Retirement Plan. If you were on active duty military service while a Michigan state employee, this form allows you to request service credit and employer contributions during your time in uniformed service.

Who is eligible to apply using the R0717G form?

If you were a participant in the Michigan 401(k) Defined Contribution Retirement Plan and were called to active duty, you may be eligible to apply. Eligibility also hinges on compliance with the criteria outlined by the Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA). This includes having left state employment to serve in one of the uniformed services and returning to work within the permitted decompression time.

What kind of service credit can I receive?

If your application is approved, you will receive service credit for the time spent on your military leave. This credit can help you meet the vesting requirements needed for employer contributions and retiree health insurance. The state will also contribute an amount equal to 4% of what your state pay would have been had you not been on duty.

What documents do I need to submit with my application?

You should include a photocopy of your military discharge papers, commonly known as DD Form 214. This document verifies your entry and separation dates and is essential for processing your application.

Can I make elective contributions while on military leave?

Yes, you have the option to make up elective contributions that you might have missed during your military service. If you select this option on the form, the Office of Retirement Services will provide guidance on your payment choices. The state will match your contributions, helping you fully benefit from the employer match program.

What is the timeframe for making up missed contributions?

You must make up any missed elective contributions within a period equal to three times your length of military service, but this must not exceed five years. For example, if you returned to work after one year of service, you have three years to make up the contributions needed.

What happens if my military service exceeds five years?

Cumulative absences for military service generally cannot exceed five years unless you meet specific exceptions laid out in Civil Service Regulation 2.04. It's important to consult these regulations if you believe your situation might qualify as an exception.

How can I get a copy of my military discharge papers?

You can obtain copies of your military papers from the National Personnel Records Center. They can be reached at 9700 Page Avenue, St. Louis, MO 63132-5100. Additionally, you have the option to request your discharge papers online by visiting the National Archives website at www.archives.gov.

Common mistakes

Filling out the R0717G form can be a straightforward process, but many individuals make mistakes that can delay their requests for military leave of absence credit. One common error is failing to provide accurate personal information. Ensuring that your name, HRMN identification number, and contact details are correct is essential. Inaccuracies could lead to confusion and processing delays.

Another frequent mistake is not including the required military discharge papers, specifically the DD Form 214. This document serves as proof of military service and is mandatory for the application. Without it, your request may be denied. Always remember to make a photocopy of your discharge papers before submission to avoid losing the original document.

People often forget to sign the application. A missing signature can result in rejection of the form. Ensure your signature is present at the bottom of the page, alongside the date. A reviewed application can’t proceed without this key requirement.

Providing incomplete dates of service can also lead to complications. Applicants must clearly state their date of entry and date of separation. Failure to complete this section leaves ambiguity in your application. Be precise with the timeline of your military service to avoid unnecessary back-and-forth communication.

Some individuals neglect to review the eligibility conditions outlined on the form, causing a mismatch in expectations. Understanding the criteria set forth by the Department of Civil Service is crucial for qualifying for service credit. Take the time to read these conditions thoroughly to avoid applying when you are not eligible.

Another common error pertains to contributing to the retirement plan. Applicants must check all relevant boxes concerning their wishes for contributions. Failing to indicate an intention to make elective contributions may lead to loss of potential employer matches that can significantly benefit your retirement savings.

Often, individuals misinterpret the decompression time requirements after returning from service. It’s important to be aware of the timeline for returning to employment and submitting the application. Missing the deadline can jeopardize your eligibility for credit.

Lastly, people may overlook instructions for submission of the form. Ensuring that you send your completed application and required documents to the correct address is vital. Double-check the mailing details to avoid processing delays. Adhering to these guidelines can ensure your application is handled smoothly and efficiently.

Documents used along the form

The R0717G form is an essential document for state employees in Michigan who are looking to receive credit for military service during a leave of absence. It allows them to apply for service credit and employer contributions to their Defined Contribution Retirement Plan. Additional forms and documents often accompany this application to facilitate the process and ensure compliance with regulations. Below are other commonly utilized documents.

- DD Form 214: This military discharge document serves as proof of service, detailing the dates of entry and separation from military duty. It is required for applying for service credits.

- Form W-4: This is a withholding certificate used to determine the correct amount of federal income tax to withhold from an employee’s paychecks. If elective contributions are made, adjustments might be necessary.

- State Employee Transmittal Form: Used to notify appropriate state departments about a change in employment status, such as transitioning to military leave or returning after service.

- Health Insurance Portability Form: This document allows service members to maintain health insurance benefits during and after military service. It may be necessary for ensuring continued healthcare coverage.

- Retirement Plan Election Form: Essential for participants to choose how their defined contribution retirement benefits will be managed or withdrawn upon retirement or separation from service.

- Verification of Employment Form: Sometimes needed to confirm current employment status and service history for retirement and military credit processing.

- Elective Contributions Payment Agreement: If voluntary contributions to the 401(k) plan are chosen, this agreement outlines payment arrangements for the contributions missed during military service.

- USERRA Information Sheet: This educational document provides details about the Uniformed Services Employment and Reemployment Rights Act (USERRA), outlining rights and obligations related to military service and employment protections.

These additional forms and documents work together with the R0717G to ensure that military service members receive the benefits and credits due to them. Proper completion and submission help streamline the process and maintain compliance with state regulations.

Similar forms

-

DD Form 214: Like the R0717G form, this document confirms military service details, including entry and separation dates. It is crucial for veterans applying for various benefits, including retirement credits.

-

USERRA Rights Notification: This document outlines the rights provided under the Uniformed Services Employment and Reemployment Rights Act. Similar to the R0717G form, it ensures individuals know their entitlements related to military service.

-

Application for Military Service Credit: This application allows service members to request credit for military service in retirement accounts, much like the R0717G form does for the Defined Contribution Retirement Plan.

-

Retirement System Election Form: Participants can select between different retirement plans. This form bears similarities to the R0717G in that it facilitates choices directly related to military service credit.

-

Employer Contribution Matching Request: This document can help recipients request matching employer contributions during military leave, akin to the contributions stipulated in the R0717G form.

-

Request for Contributions Recalculation: This form allows individuals to adjust or recalculate contributions made during periods of military leave, paralleling the intent of the R0717G form to ensure proper retirement account management.

-

Military Leave of Absence Application: This form requests an official leave due to military service. Like the R0717G, it documents the reason for absence and the intent to return to work.

-

Post-Military Transition Form: This form assists transitioning service members seeking to re-enter the civilian workforce. It shares a similar goal with the R0717G of ensuring a smooth re-employment process after military service.

Dos and Don'ts

When filling out the R0717G form, it’s important to pay attention to certain guidelines to ensure a smooth process. Here are some things you should and shouldn’t do:

- Do carefully review all instructions provided on the form.

- Do include a photocopy of your military discharge papers (DD Form 214).

- Do double-check that your contact information is accurate, including your mailing address and phone number.

- Do sign and date the application to confirm your eligibility.

- Don’t leave any required fields blank, as incomplete forms may delay processing.

- Don’t forget to send the completed form and required documents to the specified address.

Misconceptions

There are several common misconceptions about the R0717G form. Understanding the facts can help clarify its purpose and the benefits it offers.

- It can be used by anyone. The R0717G form is specifically for state employees who have served in the military. Non-state employees do not qualify.

- Service credit is automatic. Service credit is not granted automatically. You must submit the form and provide necessary documentation for review.

- All military service counts. Only certain military services count for credit. You must have left state employment to serve in the specified uniformed services.

- Credit can be claimed even if employed elsewhere. If you receive credit for your military service under another retirement system, you cannot claim it with the R0717G form.

- There is no time limit for making contributions. Contributions must be made within a time window that does not exceed five years from the end of your military service.

- All military leaves are treated the same. The criteria for qualifying can vary based on the duration of service and specific eligibility conditions.

- Military service has no impact on retirement benefits. Military service does affect the vesting requirements for both employer contributions and retiree health insurance.

- Submitting the form is the only step. You must also provide your military discharge papers (DD Form 214) along with the application.

- The process is quick and straightforward. The review process can take time, and applicants should be prepared for possible follow-ups and additional information requests.

- Elective contributions are optional. While you can choose to make elective contributions, doing so can maximize your benefits and employer match.

Key takeaways

1. This form, R0717G, is used by state of Michigan employees to request service credit and contributions to their Defined Contribution Retirement Plan for active duty military service.

2. Applicants must provide personal information, including their name, HRMN identification number, mailing address, daytime telephone number, and email address.

3. A photocopy of military discharge papers (DD Form 214) is required to confirm the entry and separation dates for military service.

4. Filling out the form accurately is crucial. Service credit is granted only if the applicant has not received credit for the same service under another retirement system.

5. After submitting the form, it will be reviewed by the Office of Retirement Services (ORS) to determine eligibility for service credit.

6. If eligible, applicants can receive a contribution equivalent to 4% of the state pay they would have earned if they had not been called to military duty.

7. There are specific time frames for returning to work after military service, and applicants must adhere to the allowed decompression time set by the Department of Civil Service.

8. Making elective contributions to the 401(k) plan can qualify the participant for enhanced employer matching contributions.

9. The completed form should be sent to the Michigan Office of Retirement Services at the address specified, ensuring all requirements and proofs are included for a smoother processing experience.

Browse Other Templates

Usa Draft - This communication template could be used by others in similar situations.

What Is 1095 C - Understanding Form 1095-C can aid employees in making informed health care decisions.