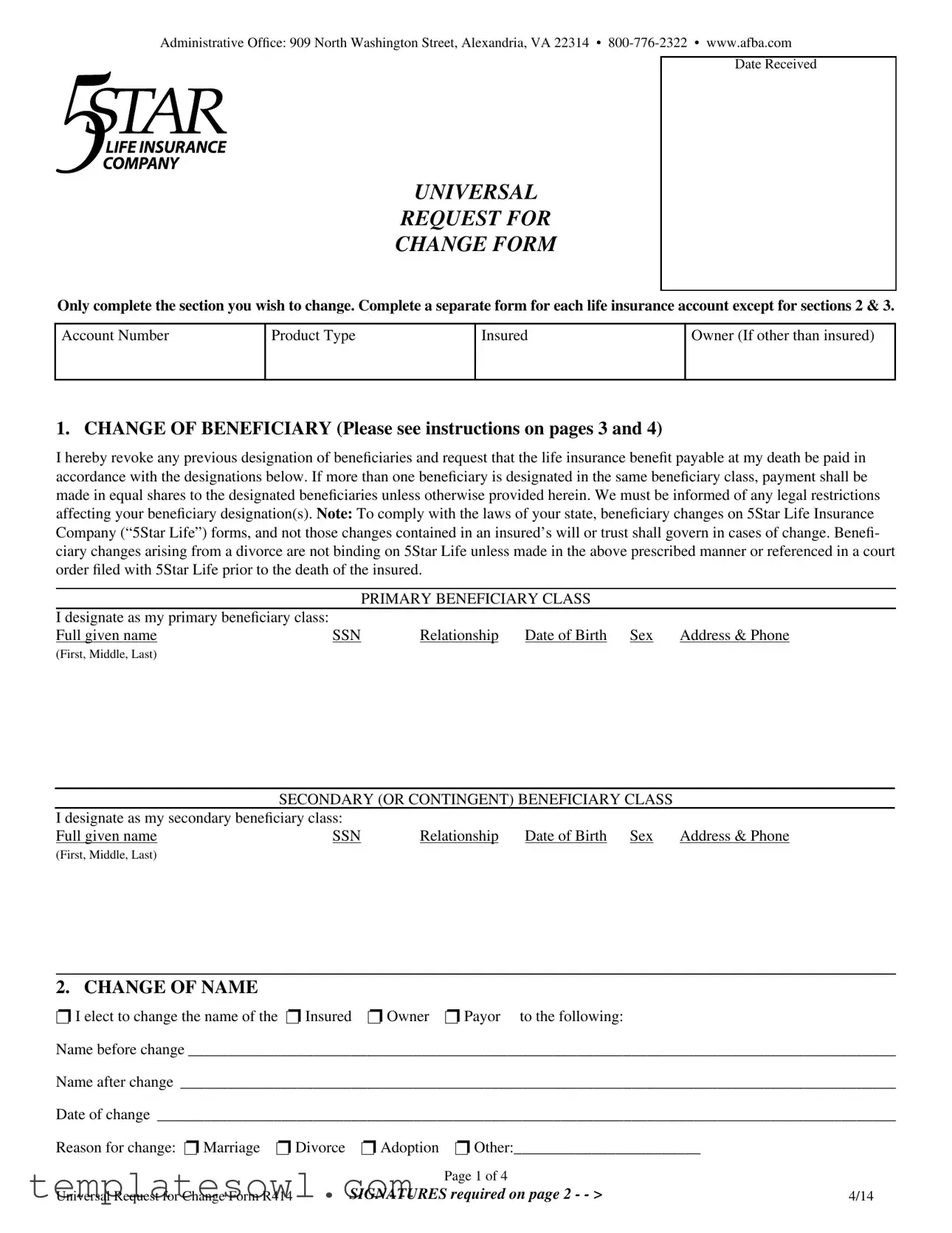

Fill Out Your R414 Form

The R414 form, officially known as the Universal Request for Change Form, serves a vital function for policyholders wishing to update their life insurance accounts. Located at the Administrative Office in Alexandria, Virginia, this form allows individuals to initiate changes related to beneficiaries, names, addresses, and ownership of life insurance policies. Understanding the significant sections of the form is crucial for ensuring that requests are processed efficiently. For instance, in the Change of Beneficiary section, policyholders can appoint new beneficiaries, while revoking previously designated individuals. It is important to note that the form stipulates that any changes must comply with state laws, particularly in cases such as divorce, where special requirements may apply. The Change of Name and Change of Address sections address any updates regarding the insured or policy owner’s personal information, promoting accurate record-keeping. Furthermore, it allows for a formal change of ownership, enabling a new individual to hold all rights associated with the policy. If further adjustments are needed, such as decreasing coverage or requesting duplicate policy documents, the form contains provisions for these options as well. Ultimately, the R414 form is a comprehensive tool that allows individuals to navigate necessary changes in their life insurance holdings while maintaining clarity and order in their accounts.

R414 Example

Administrative Ofice: 909 North Washington Street, Alexandria, VA 22314 •

UNIVERSAL

REQUEST FOR CHANGE FORM

Date Received

Only complete the section you wish to change. Complete a separate form for each life insurance account except for sections 2 & 3.

Account Number

Product Type

Insured

Owner (If other than insured)

1. CHANGE OF BENEFICIARY (Please see instructions on pages 3 and 4)

I hereby revoke any previous designation of beneiciaries and request that the life insurance beneit payable at my death be paid in accordance with the designations below. If more than one beneiciary is designated in the same beneiciary class, payment shall be made in equal shares to the designated beneiciaries unless otherwise provided herein. We must be informed of any legal restrictions affecting your beneiciary designation(s). Note: To comply with the laws of your state, beneiciary changes on 5Star Life Insurance Company (“5Star Life”) forms, and not those changes contained in an insured’s will or trust shall govern in cases of change. Benei- ciary changes arising from a divorce are not binding on 5Star Life unless made in the above prescribed manner or referenced in a court order iled with 5Star Life prior to the death of the insured.

|

|

PRIMARY BENEFICIARY CLASS |

I designate as my primary beneiciary class: |

|

|

Full given name |

SSN |

Relationship Date of Birth Sex Address & Phone |

(First, Middle, Last) |

|

|

SECONDARY (OR CONTINGENT) BENEFICIARY CLASS

I designate as my secondary beneiciary class: |

|

|

|

|

Full given name |

SSN |

Relationship |

Date of Birth Sex |

Address & Phone |

(First, Middle, Last)

2. CHANGE OF NAME

p I elect to change the name of the p Insured p Owner p Payor to the following:

Name before change ___________________________________________________________________________________________

Name after change ____________________________________________________________________________________________

Date of change _______________________________________________________________________________________________

Reason for change: p Marriage p Divorce |

p Adoption p Other:________________________ |

|

|

Page 1 of 4 |

|

Universal Request for Change Form R414 |

SIGNATURES required on page 2 - - > |

4/14 |

Account Number

Product Type

Insured

Owner (If other than insured)

3. CHANGE OF ADDRESS

p Insured p Owner p Payor

Complete Address (including Zip Code)___________________________________________________________________________

Phone Numbers (including Area Code): Daytime _________________ Cell _________________ Evening ___________________

Email Address____________________________________________________________________________________________

4. OWNERSHIP CHANGE

pI elect to change the owner of this certiicate/policy to the following individual and understand that all beneits, rights, and privi- leges incident to ownership of this certiicate/policy will be vested in the new owner.

New Owner (First, Middle, Last) __________________________________________________ Relationship ______________________

New Owner’s Date of Birth (MM/DD/YYYY) _____________________ SSN __________________

Phone Numbers (including Area Code): Daytime _________________ Cell __________________ Evening _______________________

New Owner’s Complete Address (including Zip Code) ___________________________________________________________________

5. REQUEST TO DECREASE COVERAGE

(Not applicable for Group, Individual, or Executive Select Term. Please contact us with questions.)

pI ____________________________, owner of this certiicate/policy would like to decrease my coverage amount to $ ________

6.LOST STATEMENT COVERAGE REQUEST

pPlease send Statement of Insurance Coverage.

pPlease send complete duplicate certiicate/policy.

Reason for request p Cannot locate p Never received p Other ___________________________

SIGNATURES

Sign and date this form and forward to 5Star Life. We will acknowledge receipt by returning a date stamped copy to you.

Signature of Insured _________________________________________________________ Date ____________________________

(Parent or guardian, if insured is a minor)

Signature of Owner _________________________________________________________ Date ____________________________

(Required if other than Primary Insured)

Owner’s Name (Please Print) ____________________________________________________________________________________

Signature of New Owner _______________________________________________________________________________________

Contingent Owner (in the event owner predeceases insured)____________________________________

Please Note: The CURRENT owner MUST sign above to request this ownership change.

The current owner’s spouse must also sign if current owner lives in a community property state (AZ, CA, ID, LA, NV, NM, TX, WA, & WI).

Spouse’s Signature __________________________________

Phone Numbers (including Area Code): Daytime _________________ Cell__________________ Evening _______________________

Owner’s Complete Mailing Address ______________________________________________________________________________

Universal Request for Change Form R414 |

Page 2 of 4 |

Administrative Ofice: 909 North Washington Street, Alexandria, VA 22314 •

Instructions for Beneiciary Designation

Only the owner of the life insurance coverage may change the beneiciary(ies).

Naming A Beneiciary

The complete name (including middle name), Social Security number, date of birth, current residential address, and telephone number must be included for all beneiciaries. Always use full names, for example: “Susan Ann Smith” not “Mrs. John Smith.”

If more than one person or entity is named in the same beneiciary class, use percentages or fractions to denote the pro- ceeds to be designated to each person (such as 50%) so that the proportion remains consistent in the event the insurance amount changes.

Do not use words such as “or,” and the terms “and/or,” “by law,” “descendents,” “heirs.”

Secondary (or Contingent Beneiciary)

After the primary beneiciary is named, a secondary (or contingent) beneiciary may also be designated. The secondary beneiciary will receive the beneit if no beneiciary in the primary class survives the insured.

Divorce

In order to determine the true and appropriate beneiciary in the event of a divorce between the insured and a spouse ben- eiciary, 5Star Life requires a copy of the divorce decree and property settlement agreement since many state divorce laws automatically void the designation of a spouse as beneiciary, unless the divorce decree expressly retains the designation.

Children

Minor children may be named as beneiciaries. Guardians for the children should not be named because most states will not recognize a guardian unless appointed by a court. In the event that a beneiciary is a minor when he/she is entitled to insurance beneits, payment will not be made until the court appoints a guardian or conservator. Exceptions:

a.State laws where the minor lives may allow the minor to give a discharge for the proceeds (some states deine age of majority as age 21; others age 18; and others if the child is married).

b.A Trust established for the beneit of the minor beneiciary(ies).

For people who want all of their children or grandchildren to have an equal share in the proceeds, there is a way to desig- nate the children as beneiciaries without actually naming each child.

• Children of the insured.

This designation includes all born, adopted, and

•Children of the insured’s marriage with ______________________(name of spouse). This designation would include any born, adopted, and

For people who want to split the proceeds unevenly among their children, it is necessary to include each child’s name and, using percentages or fractions, indicate the designated proceeds that each child is to receive. Use this designation when completing the primary or secondary beneiciary class sections of the form.

Universal Request for Change Form R414 |

Page 3 of 4 |

4/14 |

Estate

If an Estate is named, specify whose Estate, such as “Estate of Susan Ann Smith.” Please be aware that at time of claim, “Letters Testamentary”, that is, a document issued by the court of proper jurisdiction indicating what person, bank, or or- ganization has been appointed as Executor, Administrator, or Personal Representative of a deceased insured’s estate, will be required in order to release proceeds.

Trust

A Trustee under a Trust Agreement or Living Trust may be named as beneiciary by use of the following wording: “To

__________ (person, bank, or trust company) as Trustee under Trust Agreement dated _____.”

If proceeds are paid to a Trustee beneiciary, 5Star Life and/or the Master Policyholder of any group coverage is not bound by the terms of a Will.

Will

If a Will is named, use the following wording: “To the Executor or Personal Representative named in my Last Will and Testament dated ________.”

Please be aware, designations of proceeds by a Will can cause delays in processing a claim.

Absolute Assignment

If an assignment of ownership of the life insurance coverage has been made, only the assignee (the person or group the insurance proceeds were assigned to) may designate a new beneiciary(ies).

Instructions for Changing Ownership

Only the current owner of the life insurance coverage may change ownership.

Signatures

In order to accept a change of ownership, the Ownership Change section of the Universal Request for Change Form must be completed in full and the current owner, as well as the new owner, must sign the form. If the current owner lives in a community property state, the current owner’s spouse must also sign the Universal Request for Change Form. (Commu- nity property states are AZ, CA, ID, LA, NV, NM, TX, WA, & WI.)

Change Due to Death of Owner

In the event of death of the owner, ownership of the life insurance coverage may be changed by a

Ownership change can also be accomplished through a fully executed and notarized Power of Attorney (POA). The change must be performed by the grantor’s representative

Contingent Owner

The owner of the life insurance coverage may name a contingent owner who will be granted all the rights of ownership in the event the owner predeceases the insured.

Beneiciary Checklist

rDid you sign and date your designation?

rDid you provide all demographic information requested on the form for your beneiciary(ies)?

rDid you sign and date all attachments that require signatures?

rHave you

Universal Request for Change Form R414 |

Page 4 of 4 |

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The R414 form is a Universal Request for Change Form used to request changes to life insurance policies, such as beneficiary designations, ownership, and contact details. |

| Beneficiary Designation | Any changes to beneficiaries must be made using the official form. Changes noted in a will or trust are not sufficient unless a court order is provided. |

| Ownership Change | Only the current owner of the life insurance policy can request an ownership change. Signatures from the current and new owners are required. |

| State-Specific Requirements | In community property states such as California and Texas, the spouse of the current owner must also sign the change request for ownership alterations. |

| Signature Requirements | The form requires signatures from the insured, owner, and potentially a spouse, depending on the context of the request. |

| Contact Information | For assistance or inquiries, the form directs individuals to contact the Administrative Office at 800-776-2322 or via their website. |

Guidelines on Utilizing R414

Filling out the R414 form is an important step in managing your life insurance account. It's essential to provide complete and accurate information, as this ensures that your changes are processed correctly. Follow these steps to make the process smooth and straightforward.

- Download or obtain the R414 form from the 5Star Life website or administrative office.

- Fill in the Account Number and Product Type at the top of the form.

- Select the section you need to complete. You can only fill out the parts relevant to your requested change.

- If changing a beneficiary, provide the following for each:

- Full Name: Include first, middle, and last names.

- Social Security Number: Enter the SSN of the beneficiary.

- Relationship: Specify your relationship with the beneficiary.

- Date of Birth: Fill in the beneficiary’s date of birth.

- Gender: Indicate the beneficiary’s sex.

- Address and Phone: Provide contact details.

- For a name change, select whether it’s for the Insured, Owner, or Payor. Enter the name before and after the change, along with the date and reason for the change.

- If changing the address, provide the complete new address, along with daytime, cell, and evening phone numbers, and an email address if possible.

- For ownership change, fill out the new owner’s full information, including relationship to the insured and contact details.

- For a request to decrease coverage, specify the new coverage amount.

- If requesting a lost statement or coverage duplicate, indicate the reason for the request and check the appropriate box.

- Sign and date the form. Ensure that the required signatures are included for all parties as needed.

- Finally, send the completed form to 5Star Life, where they’ll acknowledge receipt by returning a stamped copy.

By following these steps carefully, you can ensure that your R414 form is filled out properly. When you submit the form, expect a timely acknowledgment from 5Star Life, confirming that your request is being processed. Stay proactive about your life insurance management to protect your beneficiaries and your interests.

What You Should Know About This Form

What is the purpose of the R414 form?

The R414 form, also known as the Universal Request for Change Form, is designed to facilitate various requests related to life insurance accounts. These requests include changing beneficiaries, updating names or addresses, changing ownership of a policy, and decreasing coverage amounts. It allows the policyholder to communicate their wishes clearly and ensures that all changes are documented properly.

Who is authorized to make changes using the R414 form?

Only the current owner of the life insurance policy is allowed to make changes using this form. This includes modifications to beneficiaries and ownership. If the policyholder is deceased, the changes may be made by a court-appointed personal representative or through a properly executed power of attorney.

Can I change my beneficiary using my will?

No, changes to beneficiaries must be made directly on the R414 form to be recognized by 5Star Life. Changes documented in a will or trust do not supersede the designation made on this specific form and may not be recognized in case of a claim.

What information is required to change a beneficiary?

To change a beneficiary, you must provide the full name (including middle name), Social Security number, date of birth, relationship to the insured, and current address and phone number for each designated beneficiary. It is essential to use complete names and provide accurate information for all entries.

What if I want to name my children as beneficiaries?

You can name your children as beneficiaries by specifying their complete names or by using a description that includes all children. However, if the proceeds are to be divided unevenly among them, you must state each child’s name and the percentage or amount they will receive. This ensures clarity in the distribution of benefits.

How do I change my address or name on the policy?

To change your address or name, you need to complete the appropriate section of the R414 form. Provide the previous name or address as well as the new information. Additionally, you should state the reason for the change, such as marriage or divorce. Ensure that you sign and date the form before submitting it.

What happens if I want to decrease my coverage?

You can request a decrease in coverage by indicating the new coverage amount on the R414 form. However, this request is not applicable for specific policy types, such as Group, Individual, or Executive Select Term. If you have questions regarding your specific policy, contacting customer service is advised.

Is a signature required on the R414 form?

Yes, signatures are required to validate the changes requested on the R414 form. Both the insured and the owner (if different) must sign it. If you live in a community property state, your spouse’s signature is also needed to authorize ownership changes.

What should I do if I cannot locate my insurance policy?

If you are unable to find your policy, you can request a lost statement or a complete duplicate policy using the R414 form. Indicate the reason for the request, and ensure that all required details are filled out accurately to facilitate the process.

Common mistakes

Completing the R414 form for life insurance management can be a straightforward task. However, many individuals make mistakes that can lead to complications later. One common error is failing to include required demographic information for beneficiaries. Each beneficiary must have their full name, Social Security number, date of birth, and current address documented. Omitting even one of these details can render the designation incomplete, leading to delays or disputes in claims processing.

Another significant mistake is not following the proper naming conventions for beneficiaries. It is essential to use complete names, including middle names. For instance, writing “Susan Ann Smith” instead of “Mrs. John Smith” is a requirement. This error can create confusion and might complicate the beneficiary designation verification process.

People often overlook the need to designate a secondary or contingent beneficiary. While a primary beneficiary is crucial, having a secondary beneficiary ensures that the benefits are paid if the primary beneficiary does not survive the insured. Neglecting this step could lead to unintended consequences and ownership disputes that could have been easily avoided.

Additionally, many individuals fail to understand the implications of divorce on their beneficiary designations. Automatic revocation of beneficiary status often occurs upon divorce in many jurisdictions. Not submitting a copy of the divorce decree may result in the named spouse retaining their beneficiary status inadvertently. This situation can create confusion and complications when claims are filed after the insured's death.

Completing the 'Change of Ownership' section incorrectly is another prevalent mistake. If the current owner and new owner do not fully sign the form, the change may be invalidated. Furthermore, in community property states, both parties must sign to confirm the change. Failure to do so may inhibit the new owner's ability to manage the policy as intended.

It is important to be cautious about vague beneficiary designations, such as stating "my children." Such general titles can lead to ambiguity during the claims process. Instead, specifying each child's name, preferably with designated percentages or shares, ensures clarity in how benefits are distributed.

People also frequently forget to include necessary signatures and dates. Each section that requires a signature must be completed thoroughly to avoid processing delays. This includes signing and dating the form to reflect the current date of submission. Missing a signature can result in a complete rejection of the request.

Finally, failing to periodically review and update the R414 form is a crucial oversight. Life events such as marriage, divorce, or the birth of a child should prompt a review of beneficiary designations. Regularly updating the form ensures that it reflects current intentions and changes in family dynamics.

Documents used along the form

When navigating changes related to life insurance policies such as those documented in the R414 form, several additional forms may be required to ensure a smooth process. Each document serves its unique purpose and facilitates various adjustments relevant to life insurance accounts. Understanding these forms can help you approach your requests more effectively.

- Beneficiary Designation Form: Used to officially name or change beneficiaries for a life insurance policy. This form must be filled out according to specific guidelines to ensure that beneficiaries receive the intended benefits.

- Ownership Change Form: This document allows the current owner of a life insurance policy to transfer ownership to another individual. Proper signatures and identification must accompany this form.

- Change of Address Form: When either the insured, owner, or payor changes residence, this form is necessary to update contact information on the policy.

- Request for Statement of Coverage: If a policyholder needs to obtain or confirm the details of their coverage, this form can be submitted to request a statement or duplicate policy.

- Lost Policy Claim Form: If the original insurance document is lost, this form is necessary to initiate a claim for a replacement document.

- Divorce Decree Submission Form: In the event of a divorce, this document is crucial for establishing what happens to the beneficiary designations and may require submission alongside the divorce decree.

- Minor Beneficiary Designation Form: This form is specific to naming minors as beneficiaries, outlining how the proceeds will be managed until the child reaches legal adulthood.

- Power of Attorney (POA): A legal document that grants authority to another person to act on behalf of the policy owner, which is especially useful when requesting ownership changes due to incapacitation.

- Trust Agreement Submission: If insurance proceeds are to be directed to a trust, this document specifies the terms of the trust and must be included with the beneficiary form.

- Executor Appointment Form: If the beneficiary is the estate, this form may be needed to document the appointment of an executor who will manage the disbursement of the insurance proceeds.

Being well-informed about these additional forms can significantly ease the complexities surrounding life insurance changes. Always ensure that each document is completed accurately to avoid delays in processing your requests.

Similar forms

The R414 form serves to request changes related to life insurance accounts, including beneficiary updates, ownership transfers, and address changes. Several other documents operate similarly in various contexts, sharing functions with the R414 form. Below is a list that outlines ten such documents and their similarities:

- Change of Beneficiary Form: Like the R414 form, this document allows the policyholder to update the designated beneficiaries for a life insurance policy. It emphasizes the need for specific information about the new beneficiaries.

- Name Change Request Form: This form is used to officially change a person's name on various legal documents. Similar to the R414, it requires valid reasoning for the change, such as marriage or divorce.

- Address Change Notification: This document enables individuals to update their addresses with relevant institutions. The process is akin to the R414 in that it requires personal details and affects account management.

- Ownership Transfer Form: This document facilitates the transfer of ownership for a property or asset. Like the ownership change section of the R414, it necessitates signatures from both the current and new owners.

- Policy Cancellation Request: This form prompts the formal cancellation of a life insurance policy. It is similar to the R414 because it allows individuals to initiate a change to their insurance accounts.

- Trust Beneficiary Designation Form: This document enables individuals to designate beneficiaries for a trust, functioning similarly to the beneficiary sections of the R414 form by demanding precise identifying information for each beneficiary.

- Financial Power of Attorney: This form provides authority for an agent to manage a person's financial affairs. It resembles the R414 in that it can affect ownership and beneficiary designations under certain circumstances.

- Divorce Decree: This legal document outlines the terms of a divorce. It is comparable to the R414 in matters of beneficiary designation, particularly when divorce repercussions on insurance policies need to be addressed.

- Medical Power of Attorney: This document allows an individual to designate someone to make healthcare decisions on their behalf. Its function mirrors that of the R414 in establishing clear lines of authority over personal matters.

- Estate Planning Document: These documents state how an individual's assets will be handled after their death. They share similarities with the R414 since they also involve beneficiary designations and ownership issues for life insurance proceeds.

Each of these documents plays a distinct role but shares common threads with the R414 form in terms of changing or asserting personal rights regarding insurance and financial matters.

Dos and Don'ts

When filling out the R414 form, it is crucial to ensure accuracy and clarity. Here is a list of key dos and don’ts to keep in mind:

- Do: Fill out only the section relevant to your change. Save time and reduce confusion by completing a separate form for each life insurance account.

- Don't: Use abbreviations or nicknames. Provide full names when designating beneficiaries to avoid processing issues later.

- Do: Double-check that all required demographic information is included for each beneficiary, like Social Security numbers and addresses.

- Don't: Forget to sign and date the form. Ensure that all necessary signatures are provided to avoid delays in processing your request.

Misconceptions

Understanding the R414 form can be challenging, and misconceptions may lead to mistakes during the completion process. Below is a list of common misunderstandings about the R414 form, along with explanations to clarify each point.

- Only one form is needed for all changes. Many people believe one form can handle multiple changes. However, a separate form must be completed for each life insurance account to ensure clarity.

- Beneficiary changes made in a will are sufficient. It’s a common myth that designating beneficiaries in a will suffices. Beneficiary designations on the R414 form override any changes made in a will, which means it’s critical to follow the prescribed procedure.

- All family members can be named without complete details. Providing complete information is essential. Each beneficiary must have their full name, Social Security number, date of birth, and contact information to avoid delays in processing.

- Divorce automatically changes beneficiaries. While many assume that a divorce revokes beneficiary designations, this is not always the case. To ensure a beneficiary’s designation changes due to divorce, the new designation must be made via the form or through a court order.

- Minor children can be directly designated as beneficiaries without an adult guardian. Many think it’s acceptable to name minor children directly. However, payment cannot be released until a court-appointed guardian is established if the child is under the age of majority.

- Ownership can be transferred without signatures. Some individuals assume they can simply fill out the form to transfer ownership. Signatures from the current owner and the new owner are required to make the change valid.

- There’s no need to notify the insurance company about legal restrictions. People often overlook the importance of disclosing legal restrictions. If there are any limitations on beneficiary designations, the insurance provider must be informed to comply with state laws.

- The R414 form can be completed by anyone. A common belief is that anyone can fill out the form to make changes. Only the current owner of the policy has the authority to request changes to beneficiaries or ownership.

- Signature requirements are minimal. It is a misconception that not all signatures must be present for changes to take effect. Proper signatures from all relevant parties are necessary, particularly in community property states, to validate the requested changes.

By understanding and addressing these misconceptions, individuals can better navigate the R414 form and ensure their life insurance accounts reflect their current wishes. Clear communication and proper procedures are vital for the peace of mind of all involved.

Key takeaways

- Complete Change Sections: Fill out only the sections of the R414 form that require changes. A separate form must be completed for each life insurance account, except for Sections 2 and 3, which allow for changes on one form.

- Accurate Information is Essential: Make sure to include full names, Social Security numbers, dates of birth, and current addresses for all beneficiaries. Incorrect or incomplete information can delay processing.

- Signatures Required: Signatures of both the insured and the owner are necessary to validate the form. If a change of ownership occurs, both the current owner and the new owner must sign. In community property states, the spouse of the current owner must also sign.

- Legal Considerations for Divorces: Changes in beneficiary designations due to divorce are not effective unless properly documented through the designated form or an accompanying court order that is filed before the insured's death.

Browse Other Templates

Target Non Profit Donations - Donations must be arranged directly with the Donations Coordinator at local stores.

Cover Letter for Childcare Job - It helps streamline the application process for both parents and providers.

Epw Army - The DD 2745 enhances operational readiness in dealing with enemy combatants.