Fill Out Your Ri 92 19 Form

The RI 92-19 form is an essential document for former Federal employees who want to apply for their retirement annuity under the Federal Employees Retirement System (FERS). This form specifically caters to individuals seeking a deferred or postponed retirement, allowing them to initiate an annuity that begins more than a month post their separation from federal service. Applicants must meet specific criteria: they should have at least five years of creditable civilian service to qualify for a deferred retirement at age 62 or a minimum of ten years of creditable service, including five years of civilian service, to be eligible for an annuity at the Minimum Retirement Age (MRA). To ensure a smooth application process, it is recommended to submit the completed form approximately 60 days before the intended benefits commencement date. Along with the application, individuals should receive the informational pamphlet RI 92-19A, which provides valuable guidance on the retirement process. The RI 92-19 form encompasses sections that gather pertinent details about the applicant’s identifying information, military background, and federal civilian service, ensuring all necessary information is recorded for processing. Additionally, the form includes specific instructions for completing each section and provides insights regarding marital information, annuity elections, and payment instructions to facilitate the smooth flow of retirement benefits post-application.

Ri 92 19 Example

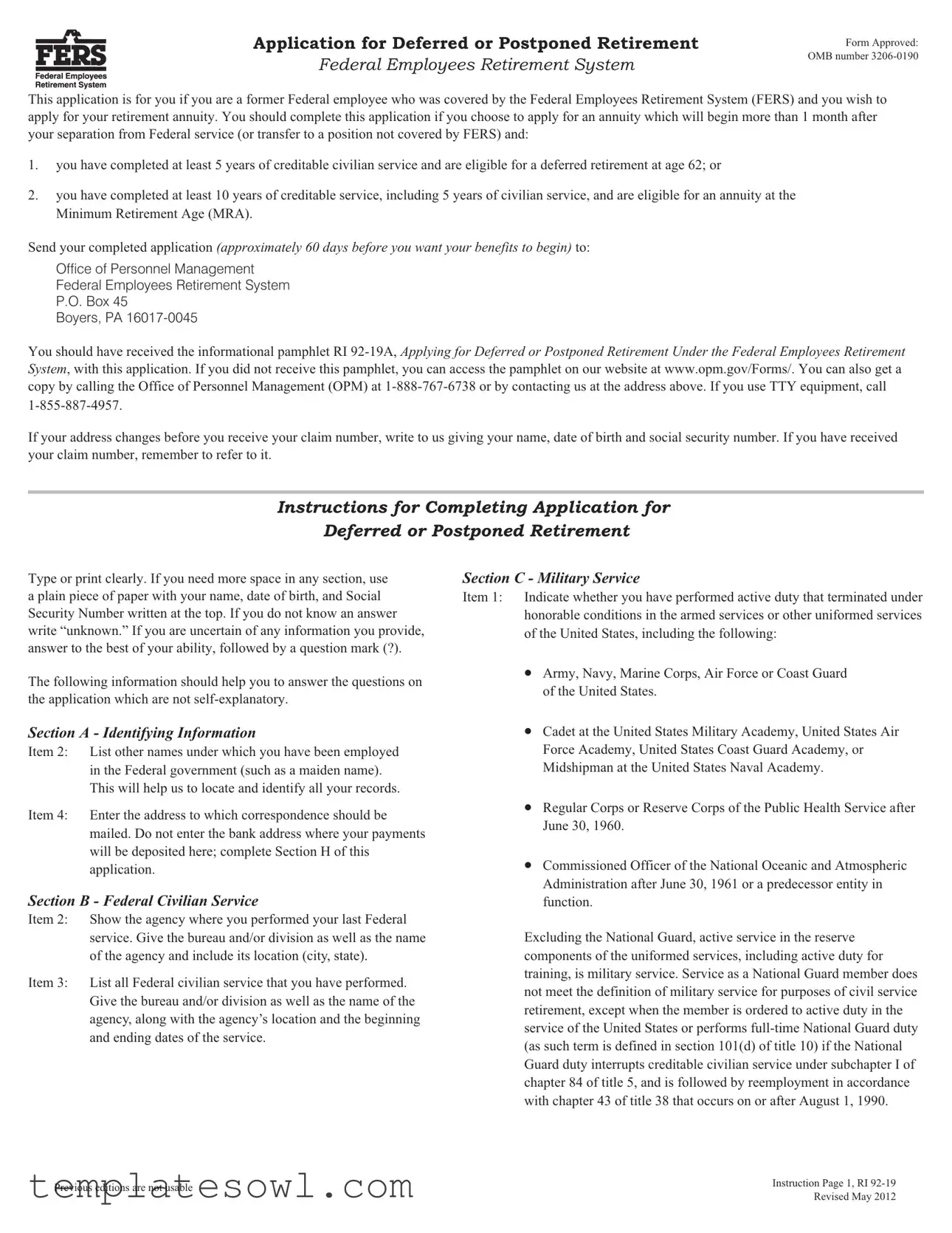

Application for Deferred or Postponed Retirement

Federal Employees Retirement System

Form Approved: OMB number

This application is for you if you are a former Federal employee who was covered by the Federal Employees Retirement System (FERS) and you wish to apply for your retirement annuity. You should complete this application if you choose to apply for an annuity which will begin more than 1 month after your separation from Federal service (or transfer to a position not covered by FERS) and:

1.you have completed at least 5 years of creditable civilian service and are eligible for a deferred retirement at age 62; or

2.you have completed at least 10 years of creditable service, including 5 years of civilian service, and are eligible for an annuity at the Minimum Retirement Age (MRA).

Send your completed application (approximately 60 days before you want your benefits to begin) to:

Office of Personnel Management

Federal Employees Retirement System

P.O. Box 45

Boyers, PA

You should have received the informational pamphlet RI

copy by calling the Office of Personnel Management (OPM) at

If your address changes before you receive your claim number, write to us giving your name, date of birth and social security number. If you have received your claim number, remember to refer to it.

Instructions for Completing Application for

Deferred or Postponed Retirement

Type or print clearly. If you need more space in any section, use a plain piece of paper with your name, date of birth, and Social Security Number written at the top. If you do not know an answer write “unknown.” If you are uncertain of any information you provide, answer to the best of your ability, followed by a question mark (?).

The following information should help you to answer the questions on the application which are not

Section A - Identifying Information

Item 2: List other names under which you have been employed in the Federal government (such as a maiden name). This will help us to locate and identify all your records.

Section C - Military Service

Item 1: Indicate whether you have performed active duty that terminated under honorable conditions in the armed services or other uniformed services of the United States, including the following:

�Army, Navy, Marine Corps, Air Force or Coast Guard of the United States.

�Cadet at the United States Military Academy, United States Air Force Academy, United States Coast Guard Academy, or Midshipman at the United States Naval Academy.

Item 4: Enter the address to which correspondence should be mailed. Do not enter the bank address where your payments will be deposited here; complete Section H of this application.

Section B - Federal Civilian Service

Item 2: Show the agency where you performed your last Federal service. Give the bureau and/or division as well as the name of the agency and include its location (city, state).

Item 3: List all Federal civilian service that you have performed. Give the bureau and/or division as well as the name of the agency, along with the agency’s location and the beginning and ending dates of the service.

�Regular Corps or Reserve Corps of the Public Health Service after June 30, 1960.

�Commissioned Officer of the National Oceanic and Atmospheric Administration after June 30, 1961 or a predecessor entity in function.

Excluding the National Guard, active service in the reserve components of the uniformed services, including active duty for training, is military service. Service as a National Guard member does not meet the definition of military service for purposes of civil service retirement, except when the member is ordered to active duty in the service of the United States or performs

Previous editions are not usable |

Instruction Page 1, RI |

|

Revised May 2012 |

||

|

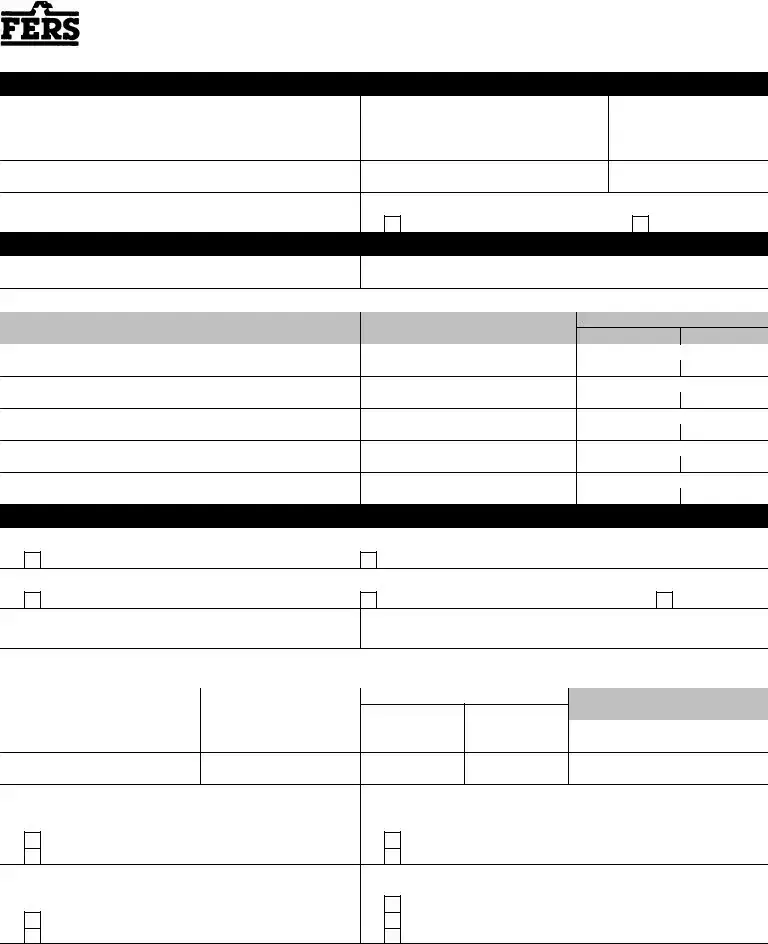

Item 2: Persons who performed active military service after December 31, 1956, must have paid a deposit to receive credit under the Federal Employees Retirement System (FERS) for their military service. You must have paid your deposit to your former employing agency. If you did not pay your deposit while you were still a Federal employee, you cannot pay it now. If you have military service performed after 1956, which is covered by a deposit you paid as an employee, check “Yes” and continue with this section. Items 2a and 2b will help us locate records of your payment.

Item 4: Indicate whether you are receiving or have applied for military retired or retainer pay (including disability retired pay and reserve retainer pay.)

If you are receiving military retired pay, your military service cannot be used for retirement purposes unless your retired pay was awarded because of a

To waive military retired pay for FERS retirement purposes, send a written request, specifying the effective date of the waiver and your Social Security Number, directly to the Military Finance Center from which you receive retired pay. Attach a copy of your letter to this application. You should mail this letter at least 60 days before your annuity will begin. Your letter might say, “I, (full name, military serial number, and Social Security Number), hereby waive my military retired pay for FERS retirement purposes, effective close of business (specify the day before annuity begins).” If you wish, add “I authorize the Office of Personnel Management to withhold from my retirement annuity any amount of military pay granted beyond the effective date of this waiver due to any delay in receiving or processing this election.” This authorization may hasten the processing of your waiver and your retirement application.

If you have already waived military retired pay in order to receive credit for your active military service for FERS retirement purposes, attach a copy of your request for waiver and of any reply you have received.

Obtain counseling from the military before waiving military retired pay for FERS retirement if you receive or may receive Combat Related Special Compensation (CRSC) or concurrent receipt of military retired pay and veterans compensation.

Reminder: Even if you have waived military retired pay or qualify for one of the exceptions to waiver, you must have paid a military deposit for your military service performed after 1956 to receive credit for the service in your FERS annuity, and the military deposit must have been paid to your employing agency before you separated from FERS covered Federal employment.

Section D - Other Claim Information

Item 3: If you have applied for or have ever received workers’ compensation from the Office of Workers’ Compensation Programs (OWCP), U.S. Department of Labor, because of a

The information requested regarding benefits from the OWCP is needed because the law prohibits payment of both FERS retirement annuity and compensation for total or partial disability under the Federal Employees’ Compensation Act at the same time. In some cases, credit for service, particularly for periods of leave without pay, may also be affected.

Section E - Marital Information

Item 2: Indicate whether you have a living former spouse to whom

a court order awards a survivor annuity or a portion of your retirement benefits based on your Federal employment. If you answer “Yes,” you must submit a copy of the divorce decree and any attachments or amendments.

Section F - Annuity Election

Read the information about survivor benefits and their associated cost found in the pamphlet “Applying for Deferred or Postponed Retirement Under the Federal Employees Retirement System” (RI

To be eligible for a survivor annuity after your death, your widow(er) must have been married to you for a total of at least 9 months or be a parent of your child. The marriage duration requirement does not apply if your death is accidental.

Survivor elections terminate upon the death of the person elected. An election of a survivor annuity for a current spouse in box 1 or 2 also terminates upon a divorce from that spouse. An election of a survivor annuity for a former spouse in box 5 also terminates if that former spouse remarries before age 55, unless the annuitant and the former spouse were married for 30 years or more. You must notify us when one of those events terminating a survivor election occurs. Also notify us if a former spouse who is entitled to a survivor annuity under a court order accept able for processing becomes ineligible for the former spouse annuity because of a reason specified in the court order or because of a remarriage prior to age 55.

Please note that, in accordance with the law, both a survivor annuity election made at retirement and survivor annuity election made before a divorce, terminate upon death or divorce and the annuitant must make a new election (reelection) within 2 years after the terminating event to provide a survivor annuity for a spouse acquired after retirement or for a former spouse. Continuing a survivor reduction, by itself, is not effective to reelect a survivor annuity for a spouse married after retirement or for a former spouse.

Item 4: If you initial box 4, a person selected by you at retirement who has an insurable interest in you, will receive a survivor annuity upon your death. Enter the requested information about that person. Insurable interest exists if the person named (such as a close relative) may reasonably expect to derive financial benefit from your continued life.

You must provide documentation that you are in good health in order to choose this type of annuity. You will be notified of the additional evidence required.

If you choose this type of annuity, the amount of the reduction in your annuity will depend upon the difference between your age and the age of the person named as survivor annuitant, as shown in the following table. The survivor’s rate will be 55% of your reduced annuity.

Reverse of Instruction Page 1, RI

Revised May 2012

Age of the Person Named |

Reduction in |

|

in Relation to That of |

Annuity of |

|

Retiring Employee |

Retiring |

|

|

Employee |

|

|

|

|

Older, same age, or less than 5 years |

10% |

|

younger |

|

|

|

|

|

5 but less than 10 years younger |

15% |

|

10 but less than 15 years younger |

20% |

|

|

|

|

15 but less than 20 years younger |

25% |

|

20 but less than 25 years younger |

30% |

|

|

|

|

25 but less than 30 years younger |

35% |

|

30 or more years younger |

40% |

|

|

|

|

|

|

You may elect this insurable interest survivor annuity in addition to a regular survivor annuity for a current or former spouse. However, if you elect an insurable interest annuity for your current spouse, you must both jointly waive the current spouse annuity. Generally, an insurable interest annuity cannot be cancelled. However, if you elect an insurable interest annuity for your current spouse because a former spouse is entitled to the regular survivor annuity (under a court order acceptable for processing or based on your election of that survivor benefit for the former spouse), you can convert the insurable interest election for your current spouse to a current spouse annuity within two (2) years of the former spouse losing entitlement to the regular survivor annuity.

Item 5: If you initial box 5, your former spouse(s) will receive a survivor annuity upon your death. The maximum survivor annuity payable to your former spouse(s) is 50% of your unreduced annuity. Your annuity will be reduced 5% or 10% according to the total benefit you want to provide.

If you are married and initial box 5, you must complete and attach Schedule A - Spouse’s Consent to Survivor Election, to your application. The law requires consent of the spouse if a married person elects a full or partial survivor annuity for a former spouse. You may not elect a combined benefit for your current and former spouse(s) which exceeds 50% of your benefit.

Section G - Information About Children

Complete Section G by providing the names and dates of birth of your unmarried dependent children under the age of 22. Also list any child over the age of 22 who is incapable of

Section H - Payment Instructions

Complete in all cases. The U. S. Department of the Treasury pays all Federal benefit payments electronically. Most Federal payments are paid by Direct Deposit into a savings or checking account at a financial institution. If you do not have a bank account, or prefer not to have your annuity payments deposited directly to your bank account, you can choose a Direct Express debit card. If you choose this option, your annuity payment will be automatically deposited to the Direct Express card on the payment date. To obtain a debit card, go to www.godirect.org or call

You cannot receive your annuity payments by direct deposit or the Direct Express debit card program if your permanent payment address is outside the United States in a country where these programs are not available.

Item 2: You may obtain your Financial Institution Routing Number by calling your bank, credit union, or savings institution. This number is very important. We cannot pay by direct deposit without it. We suggest you call your financial institution to verify this number.

If you prefer, you may attach a cancelled personal check that shows the information requested instead of filling in the requested financial institution information. If you attach your personal check, it is especially important that you contact your bank, credit union, or savings institution to confirm that the information on the check is correct information for direct deposit. (Some financial institutions, especially credit unions, use different routing numbers on checks.) We can then use this information to start paying you by direct deposit.

Section I - Applicant’s Certification

Be sure to sign (do not print) and date your application after reviewing the warning.

Schedules (Attachments)

There are three schedules attached to this application for deferred or postponed retirement. Some of these schedules may apply to you and some may not. Read the following to determine which schedules you should complete. Instructions for completing and information about each follows.

Schedule A - Spouse’s Consent to Survivor Election

Complete this schedule if you are married and, in Section F, you do not elect box 1, a maximum survivor annuity for your spouse. For any other election you must obtain your spouse’s consent. (See the pamphlet entitled “Applying for A Deferred or Postponed Retirement Benefit Under the Federal Employees Retirement System” (RI

Instruction Page 2, RI

Revised May 2012

Part 1: You must complete this section. Include your name, date of birth and social security number as shown on your application. Check the box(es) that corresponds to the selection(s) you made in Section F on your application. Check all boxes that apply.

Part 2: Your spouse completes this section, in the presence of a notary public.

Part 3: A notary public or other person authorized to administer oaths (e.g., a justice of the peace) must complete this section, after witnessing your spouse’s signature.

Schedules B & C - For Applicants Who Have At Least 10 Years of Creditable Service

If you have at least 10 years of creditable service (5 of which must be civilian) which will be used to compute your benefit, then you must complete one of these two schedules. Do not complete either of these schedules if you have less than 10 years of service.

Complete Schedule B if you had attained the Minimum Retirement Age (MRA) when you left Federal service and had at least 10 years of creditable service. You are eligible to choose when you want your benefit to begin and may be eligible to reenroll in the health benefits, life insurance and Federal Dental and Vision programs and carry them into retirement.

Complete Schedule C if you had not yet attained the MRA when you left Federal service, but you did have at least 10 years of creditable service. You are eligible to choose when you want your benefit to begin.

The MRA is based on the year of your birth and determines the earliest date you became eligible to have your retirement annuity begin. The Minimum Retirement Age Schedule is:

If your year of birth is: |

Your MRA is: |

|

Before 1948 |

55 years |

|

|

|

|

1948 |

55 years, 2 months |

|

1949 |

55 years, 4 months |

|

|

|

|

1950 |

55 years, 6 months |

|

1951 |

55 years, 8 months |

|

|

|

|

1952 |

55 years, 10 months |

|

1953 to 1964 |

56 years |

|

|

|

|

1965 |

56 years, 2 months |

|

1966 |

56 years, 4 months |

|

|

|

|

1967 |

56 years, 6 months |

|

1968 |

56 years, 8 months |

|

|

|

|

1969 |

56 years, 10 months |

|

After 1969 |

57 years |

|

|

|

|

|

|

Schedule B

Part 2: You may choose to have your annuity begin on:

1.the first day of the month following your separation from Federal service; or

2.the first day of any month which is at least 31 days after the Office of Personnel Management (OPM) receives your application for retirement (but before your 62nd birthday).

Your annuity will be reduced by 5/12 of 1% for each full month (5% per year) that the date your annuity begins precedes your 62nd birthday. You can avoid the age reduction entirely if you choose the first day of the month that you reach age 62 as your annuity commencing date. The age reduction does not apply if your annuity commences the first day of the month after your 60th birthday and you have at least 20 years of service.

Parts 3 People who leave Federal service after reaching the MRA with at least

and 4: 10 years of creditable Federal service are eligible to reenroll in the Federal Employees Health Benefits Program and the Federal Employees’ Group Life Insurance Program if they had participated in the program for the 5 years of service immediately before their separation date or continually from their earliest opportunity. If you were enrolled in either of these programs when you left Federal employment and you had already attained your MRA and had 10 years of creditable service, complete these sections. If you want information about reenrolling in either program, indicate so in item 1b.

Part 5: People who leave Federal service after reaching the MRA with at least 10 years of creditable Federal service are eligible to reenroll in the Federal Dental and Vision Insurance Program (FEDVIP). If you were enrolled in FEDVIP when you left Federal employment and you had already attained your MRA and had 10 years of creditable service, complete this section. If you want information about reenrolling, indicate so in item 1b.

Part 6: If you are enrolled in the Federal Long Term Care Insurance Program (FLTCIP), your coverage will continue. No action is required by you. However, you may choose to have your premium payments deducted from your annuity. To elect annuity deduction of premiums, please call Long Term Care Partners, at

If you are not currently enrolled in the FLTCIP, you, your spouse, and your adult children may apply for FLTCIP coverage provided you are eligible for a deferred or postponed annuity. You may request an application by calling Long Term Care Partners, at

Schedule C

Part 2: You may choose to have your annuity begin on:

1.the first day of the month following the month in which you reach your MRA; or

2.the first day of any month which is at least 31 days after OPM receives your application for retirement if you have reached your MRA (but before your 62nd birthday).

Reverse of Instruction Page 2, RI

Your annuity will be reduced by 5/12 of 1% for each full |

Part 3: |

If you are enrolled in the Federal Long Term Care Insurance Program |

|

|

|

||

month (5% per year) that the date your annuity begins |

|

(FLTCIP), your coverage will continue. No action is required by you. |

|

|

|

||

precedes your 62nd birthday. You can avoid the age |

|

However, you may choose to have your premium payments deducted |

|

|

|

||

reduction entirely if you choose the first day of the month |

|

from your annuity. To elect annuity deduction of premiums, please call |

|

|

|

||

that you reach age 62 as your annuity commencing date. |

|

Long Term Care Partners, at |

|

|

|

||

The age reduction does not apply if: |

|

|

|

a) |

Your annuity commences the first day of the month |

|

If you are not currently enrolled in the FLTCIP, you, your spouse, and |

|

your adult children may apply for FLTCIP coverage provided you are |

||

|

after your 60th birthday and you have at least 20 |

|

|

|

|

eligible for a deferred or postponed annuity. You may request an |

|

|

years of service, or |

|

|

|

|

application by calling Long Term Care Partners, at |

|

|

|

|

|

b) |

Your annuity commences the first day of the month |

|

(TTY: |

|

after you reach your MRA and you have at least 30 |

|

|

|

years of service. |

|

|

Privacy Act and Public Burden Statement

Solicitation of this information is authorized by the Federal Employees Retirement System law (Chapter 84, title 5, U.S. Code). The data furnished will be used to determine the type of annuity awarded. The information may be shared and is subject to verification, via paper, electronic media, or through the use of computer matching programs, with national, state, local or other charitable or social security administrative agencies to determine and issue benefits under those programs. It may also be shared and verified, as noted above, with law enforcement agencies when they are investigating a violation of civil or criminal law. Executive Order 9397 (November 22, 1943) authorizes use of the Social Security Number as an individual identifier to distinguish between people with the same or similar names. Failure to furnish the requested data may delay or prevent action on the retirement application.

We estimate that this form takes an average of 60 minutes per response to complete including the time for reviewing instructions, getting the needed data and reviewing the completed form. Send comments regarding our estimate or any other aspect of this form, including suggestions for reducing completion time, to the Office of Personnel Management (OPM), Retirement Services Publications Team

Instruction Page 3, RI

Revised May 2012

Application for Deferred or Postponed Retirement

Form Approved: OMB No.

Federal Employees Retirement System

Federal Employees Retirement System

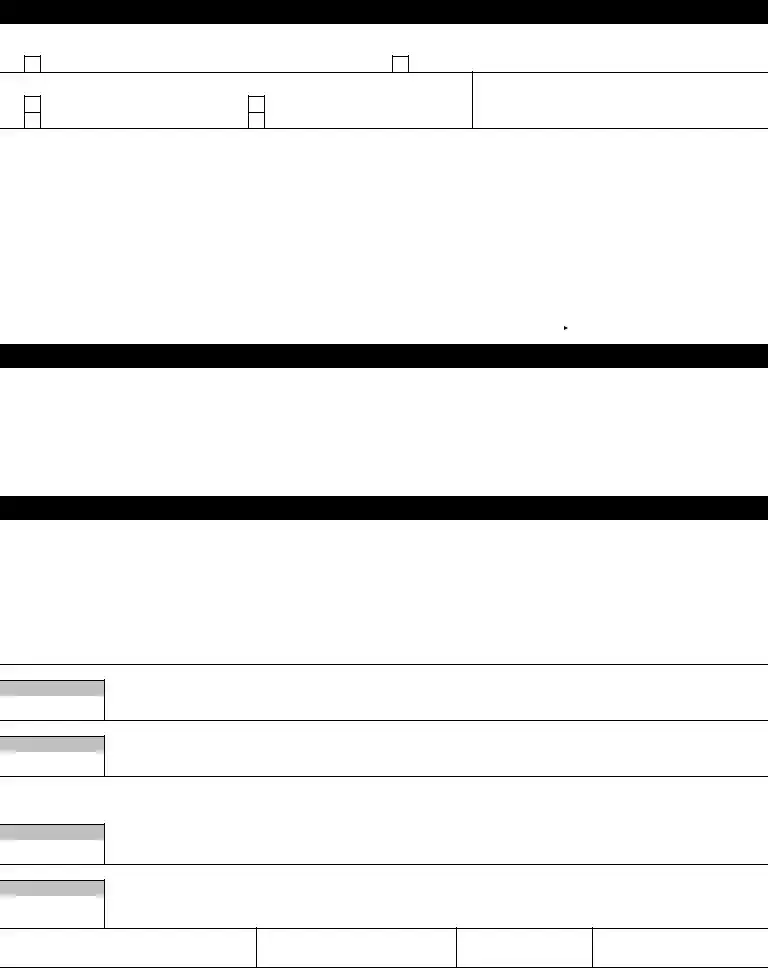

Section A - Identifying Information

1. |

Name (Last, first, middle) |

2. |

List all other names used |

3. |

Date of birth (mm/dd/yyyy) |

|

|

|

|

|

|

4. |

Address (Number, street, city, state, ZIP Code) |

5a. |

Daytime telephone number |

5b. |

Best time to reach you |

|

|

6. |

Email address |

7. |

Social Security Number |

8.Are you a citizen of the United States of America?

Yes |

No |

Section B - Federal Civilian Service

1.Date on which you separated from Federal service (mm/dd/yyyy)

2.What agency did you separate from? (Give agency, group or office)

3.List below all Federal service you have performed.

Department or Agency, including Bureau or Division

Location (City and state)

Dates of Service

From (mm/dd/yyyy) To (mm/dd/yyyy)

Section C - Military Service

1.Have you performed active, honorable service in the Armed Forces or other uniformed services of the United States? (See instructions for definition.)

Yes, go to item 2.

No, go to Section D.

2.If you have military service performed after 1956, did you pay a deposit to your former employing agency?

Not applicable, go to item 3.

Yes, go to item 2a.

No, go to item 3.

2a. When did you pay your deposit for

2b. To which agency did you make the payment? (Give agency, bureau or division and

location)

3.If you have performed active, honorable service in the Armed Forces or other uniformed services of the United States (see instructions for definition), complete

3a. Branch of Service |

3b. Serial Number |

3c. Dates of Active Duty |

3d. Last Grade or Rank |

||

From (mm/dd/yyyy) |

To (mm/dd/yyyy) |

||||

|

|

|

|||

|

|

|

|

|

|

4. Are you receiving or have you ever applied for military retired or retainer |

4a. Was your military retired or retainer pay awarded for disability incurred in combat or |

pay (including disability retired pay)? |

caused by an instrumentality of war and incurred in the line of duty during a period |

|

of war? |

Yes, complete items |

Yes, if available, attach a copy of notice of award. |

No, go to Section D. |

No |

4b. Was your military retired or retainer pay awarded for reserve service |

4c. Are you waiving your military retired pay in order to receive credit for FERS? |

under Chapter 1223, title 10, U.S. Code (formerly Chapter 67, title 10)? |

|

Yes, if available, please attach a copy of notice of award. |

Yes, see instructions for information about how to request a waiver. |

Yes, a copy of my waiver is attached. |

|

No |

No |

Office of Personnel Management |

|

RI |

|

CSRS/FERS Handbook |

Continued on reverse |

||

Previous edition is not usable |

Revised May 2012 |

||

|

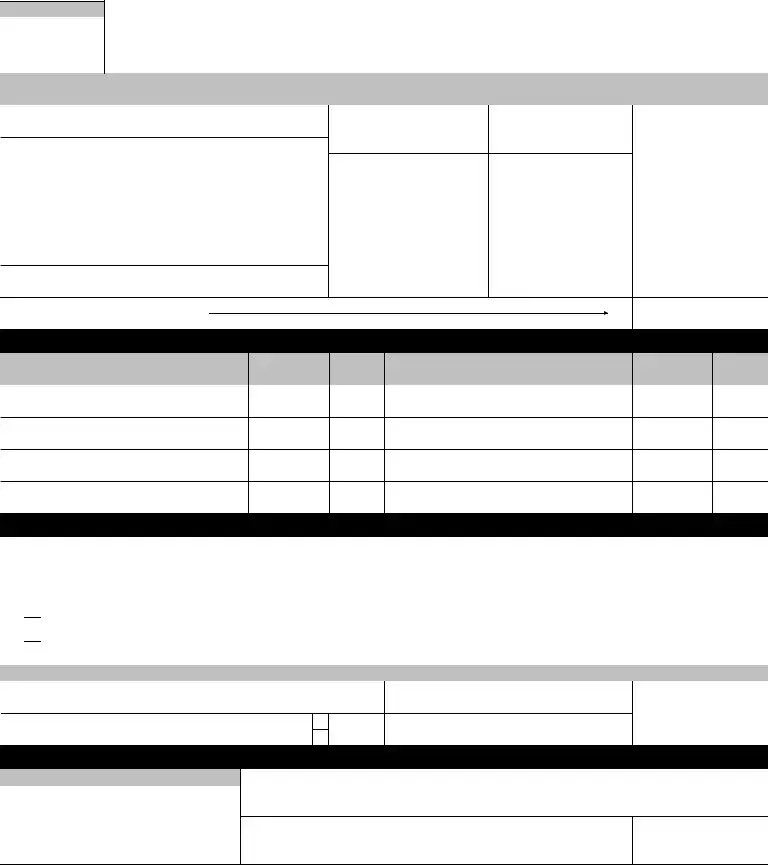

Section D - Other Claim Information

1.Have you previously filed any application under the Federal Employees Retirement System or Civil Service Retirement System (for refund, retirement, deposit, redeposit, etc.)?

Yes (Complete items 1a and 1b)

No

1a. Type of application

Retirement

Refund

Deposit/redeposit

Refund of excess deductions

1b. Claim number(s)

2.Have you ever been employed under another retirement system for Federal or District of Columbia employees?

|

|

Yes (Complete below) |

|

|

|

No |

|

|

|

|

|

|

|

2a. Name of other |

2b. Dates of Service |

2c. Location of |

|

2e. Were retirement |

|||||

|

Retirement System |

From (mm/dd/yyyy) |

To (mm/dd/yyyy) |

Employment |

2d. Title of Position |

deductions withheld? |

|||||

|

|

Yes |

No |

Refunded |

|||||||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Have you ever received workers' compensation from the Department of Labor because of a

|

|

Yes, complete 3a thru 3c. |

|

No |

|

|

|

|

|

|||

3a. Compensation Claim Number |

3b. Description of benefit |

|

Total/partial disability |

3c. Date benefits |

From (mm/dd/yyyy) |

To (mm/dd/yyyy) |

||||||

|

||||||||||||

|

|

|

|

|

|

|

received |

|

|

|

|

|

|

|

|

|

|

Scheduled Award |

|

Other |

|

|

|

|

|

Section E - Marital Information

1.Are you married? If separated from your spouse, but the marriage has not ended by divorce or annulment, answer "Yes."

|

|

|

Yes (Complete items 1a thru 1f.) |

|

|

|

No |

|

|

|

|

|

|

||

1a. |

|

Spouse's name (Last, first, middle) |

1b. |

Spouse's date of birth (mm/dd/yyyy) |

1c. |

Spouse's Social Security Number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1d. |

|

Place of marriage (City, state) |

|

1e. |

Date of marriage (mm/dd/yyyy) |

1f. |

Marriage |

|

Clergyman or Justice of the Peace |

||||||

|

|

|

|

|

|

|

|

|

|

|

performed by |

|

Other (Explain) |

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Statement regarding |

2. |

Do you have a living former spouse(s) to whom a court order gives a survivor annuity or a portion of your retirement benefits based on |

||||||||||||

|

|

Former Spouses |

|

your Federal employment? |

|

|

|

Yes |

|

|

|

No |

|

|

|

Section F - Annuity Election

Read the attached instructions before making this election.

Make your election by initialing the box beside the type of annuity you want to receive and give any other information requested. Consider your election carefully. No change will be permitted after your annuity is granted except as explained in the pamphlet Applying for Deferred or Postponed Retirement Under the Federal Employees Retirement System, RI

Your election to provide a survivor annuity for a current spouse terminates upon the death of that spouse or if the marriage ends due to divorce or annulment. You are required to make a new election (reelect) within 2 years of the terminating event if you wish to reelect a survivor annuity for a former spouse or within 2 years of a

If you want to elect a partial survivor annuity for your current spouse and a survivor benefit for a former spouse, you should complete options 2 and 5 below. The total of the survivor annuities elected cannot exceed 50 percent. An election of an insurable interest survivor in option 4, is not included when determining the 50 percent maximum.

1.I choose a reduced annuity with maximum survivor annuity for my spouse named in Section E.

Initials

If you are married at retirement you will automatically receive this type of annuity unless your spouse consents to your election not to provide maximum survivor benefits. If you receive this annuity, your annuity will be reduced by 10%. The survivor's annuity upon your death will be 50% of your unreduced annuity.

2.I choose a reduced annuity with a partial survivor annuity for my spouse named in Section E.

Initials

If you choose this option, your annuity will be reduced by 5%. Upon your death, your spouse's annuity will be 25% of your unreduced annuity. You must have your spouse's consent to choose this option. Attach Schedule A showing your spouse's consent.

3.I choose an annuity payable only during my lifetime.

Initials

No current spouse survivor annuity will be paid to your spouse after your death if he or she consents to this election. If you are married at retirement, you cannot choose this type of annuity without your spouse's consent. You should initial this box if you are electing an insurable interest benefit (Box 4) for your current spouse. Attach Schedule A showing your spouse's consent. If you are eligible to continue your health benefits coverage into retirement, your spouse's health benefits coverage will terminate upon your death. In addition, your spouse will not be eligible to enroll in the Federal Long Term Care Insurance program, if he/she is not enrolled at the time of your death.

4.I choose a reduced annuity with survivor annuity for the person named below who has an insurable interest in me.

Initials

You must be healthy and willing to provide medical evidence if you choose this type of annuity.

Name of person with insurable interest

Relationship to you

Date of birth (mm/dd/yyyy)

Social Security Number

Office of Personnel Management |

Reverse of Page 1 |

CSRS/FERS Handbook |

RI |

Previous edition is not usable |

Revised May2012 |

5.I choose a reduced annuity with survivor annuity for my former spouse(s) as follows:

Initials

You must attach: 1. Certified copies of divorce decrees for all former spouses for whom you elect to provide survivor annuity.

2.If you are married, attach a completed Schedule A (Spouse's Consent to Survivor Election). You cannot choose this option and provide a maximum survivor annuity for your spouse (Box 1).

Your election to provide a survivor annuity for a former spouse terminates upon the death of that spouse or the remarriage of your former spouse before age 55 (unless your marriage to the former spouse lasted for 30 years or longer).

This election when combined with an election in Box 2 cannot exceed 50% of your unreduced annuity.

Persons who completed Box 1 may not complete Box 5.

Name and address of former spouse |

Date of marriage (mm/dd/yyyy) |

Date of divorce (mm/dd/yyyy) |

Survivor annuity equal to this |

|

|

|

percent of my annuity |

|

|

Date of birth (mm/dd/yyyy) |

Social Security Number |

% |

|

|

|

||

|

|

|

|

|

Name and address of former spouse |

Date of marriage (mm/dd/yyyy) |

Date of divorce (mm/dd/yyyy) |

Survivor annuity equal to this |

|

|

|

|

|

percent of my annuity |

|

|

|

|

% |

|

|

|

|

|

|

|

Date of birth (mm/dd/yyyy) |

Social Security Number |

|

|

|

|

||

Total (Must equal either 25% or 50%)

0%

Section G - Information About Your Unmarried Dependent Children

Dependent Child's Name

(First, middle, last)

Date of Birth

(mm/dd/yyyy)

Disabled

Dependent Child's Name

(First, middle, last)

Date of Birth

(mm/dd/yyyy)

Disabled

Section H - Payment Instructions

1.Federal benefits payments will be made electronically by Direct Deposit into a savings or checking account or by a Direct Express debit card provided by the Department of Treasury. See page 2 of the instructions for this application and RI

Please select one of the following:

Please send my annuity payments directly to my checking or savings account. (Go to item 2)

Please send my annuity payments directly to my checking or savings account. (Go to item 2)

Please send my annuity payments to my Direct Express debit card. (Go to Section I)

Please send my annuity payments to my Direct Express debit card. (Go to Section I)

My permanent payment address is outside the United States in a country not accessible via Direct Deposit/Direct Express. (Go to Section I)

My permanent payment address is outside the United States in a country not accessible via Direct Deposit/Direct Express. (Go to Section I)

2.Please provide information about your financial institution below.

2a. |

Financial institution routing number |

2c. Name and address of financial institution |

2b. |

Account number |

Checking |

|

|

Savings |

Section I - Applicant's Certification

2d. Telephone number of your financial institution

(including area code)

Warning

Any intentionally false statement in this application or willfully misleading statement or response you provide in this application is a violation of the law punishable by a fine of not more than $10,000 or imprisonment of not more than 5 years or both (18 U.S.C. 1001).

I hereby certify that all statements made in this application are true to the best of my knowledge and that no evidence necessary to the settlement of this claim is withheld. I have read and understand all the information provided in the instructions to this application.

Signature (Do not print) |

Date (mm/dd/yyyy) |

Office of Personnel Management |

Page 2 |

CSRS/FERS Handbook |

RI |

Previous edition is not usable |

Revised May 2012 |

Schedule A - Spouse's Consent to Survivor Election

Instructions - Complete this schedule if you are married and do not elect a reduced annuity to provide a full current spouse survivor annuity. Complete Part 1. Have your spouse complete Part 2. Part 2 must be completed in the presence of a Notary Public or other person authorized to administer oaths. The Notary Public must complete Part 3.

Part 1 - To Be Completed By the Applicant

Name (Last, first, middle)

Date of birth (mm/dd/yyyy)

Social Security Number

I have elected (Mark all boxes which describe the survivor elections you have made.)

A. No regular or insurable interest survivor annuity for my current spouse. I understand that:

No survivor annuity will be paid to my spouse after my death.

If I am eligible to continue my health benefits coverage into retirement, his/her health benefits coverage will terminate upon my death, and

He/she will not be eligible to enroll in the Federal Long Term Care Insurance Program (FLTCIP) after my death.

B. A partial survivor annuity for my current spouse equal to 25% of my annuity.

C.An insurable interest survivor annuity for my current spouse, but no regular survivor annuity for my current spouse. (I have completed Section F, Box 4, on my RI

D. A maximum survivor annuity for my former spouse ________________________________________________.

(name of former spouse)

E. A partial survivor annuity for my former spouse ___________________________________________________ equal to 25% of my annuity.

(name of former spouse)

F. A partial survivor annuity for my former spouse ___________________________________________________ equal to 25% of my annuity.

(name of former spouse)

Part 2 - To Be Completed By Current Spouse of Applicant

I freely consent to the survivor annuity election described in Part 1. I understand that my consent is final (not revocable).

Name (Type or print)

Signature (Do not print)

Date (mm/dd/yyyy)

Part 3 - To Be Completed By a Notary Public or

Other Person Authorized to Administer Oaths

I certify that the person named in Part 2 presented identification (or was known to me), gave consent, signed or marked this form, and acknowledges that the consent was freely given in my presence on this the __________________________ day of ______________________________________, ____________

(Month) |

(Year) |

at ____________________________________________________________________________________________ . |

|

(City, state) |

|

|

|

Signature (Do not print) |

|

Seal

Expiration date of Commission, if Notary Public (mm/dd/yyyy)

General Information

Public Law

A court order which requires an annuitant to provide a survivor annuity for a former spouse is not an election and spousal consent is not required. In other words, such a court order does not require a current spouse to waive the right to a survivor annuity. The retiring employee can still elect to provide a survivor annuity for the current spouse even though the Office of Personnel Management (OPM) must honor the terms of the court order before it can honor the election for the current spouse. The current spouse may, therefore, receive a smaller annuity than elected, or none at all, unless the former spouse loses eligibility for the

Privacy Act and Public Burden Statement

Public Law

We estimate that this form takes an average of 60 minutes per response to complete including the time for reviewing instructions, getting the needed data and reviewing the completed form. Send comments regarding our estimate or any other aspect of this form, including suggestions for reducing completion time, to the Office of Personnel Management (OPM), Retirement Services Publications Team

Office of Personnel Management |

RI |

CSRS/FERS Handbook |

|

Previous edition is not usable |

Revised May 2012 |

Schedule B - For Applicants with Immediate MRA+10 Eligibility

(who may choose to postpone)

To be completed only by applicants who were eligible for an immediate MRA+10 annuity based on having reached the Minimum Retirement Age and having at least 10 years of creditable service at separation. Read instructions carefully to determine if you should complete this schedule.

|

Part 1 - Identifying Information |

Name (Last, first, middle) |

Date of birth (mm/dd/yyyy) |

|

Part 2 - Commencing Date |

Social Security Number

Read the instructions carefully and |

I want my benefit to begin accruing (mm/dd/yyyy) |

elect when you want your benefits to begin. |

|

|

|

Part 3 - Health Benefits Coverage

1.When you separated from service, were you enrolled (or covered as a family member) in the Federal Employees Health Benefits Program?

Yes, complete items

No, go to Part 4.

1a. What plan were you enrolled in when you separated (if known)? |

Plan Name |

|

|

|

Enrollment Code |

|||

|

|

|

|

|

||||

|

|

|

|

|

||||

1b. Do you want information on reenrolling with the |

|

Yes |

1c. Do you have a copy of your SF 2810 |

Yes, attach copy. |

||||

|

Federal Employees Health Benefits Program? |

|

No |

|

terminating your enrollment? |

No |

||

|

|

|

Part 4 - Life Insurance Coverages |

|

||||

1. When you separated from service, were you enrolled in the Federal Employees' Group Life Insurance Program? |

|

|||||||

|

|

Yes (Also complete items |

|

|

|

|

No, go to Part 5. |

|

1a. What coverage(s) did you have when you separated?

Basic |

Option B |

Additional _________# of multiples (if known) |

Option A |

Option C |

Family __________# of multiples (if known) |

1b. Do you want information on starting your coverage(s) again?

Yes |

No |

1c. Did you convert your coverage(s) to a private plan?

Yes |

No |

1d. Do you have a copy of your SF 2821 terminating your coverage(s)?

Yes, attach copy. |

No |

Part 5 - Federal Dental and Vision Program Coverage

1. When you separated from service, were you enrolled in the Federal Dental and Vision Program (FEDVIP)?

Yes (Also complete items |

No, go to Part 6. |

1a. What plan were you enrolled in when you separated (if known)? |

Plan Name |

|

1b. Do you want information on reenrolling with the Federal Dental and Vision Program?

Yes

No

Part 6 - Long Term Care Insurance Coverage

1. Are you currently enrolled in the Federal Long Term Care Insurance Program (FLTCIP)?

Yes. Your coverage will continue. If you want your premium payments deducted from your annuity, call the FLTCIP administrator, Long Term Care Partners, at

No. If you are not currently enrolled in the Federal Long Term Care Insurance Program, you, your spouse, and your adult children may apply for coverage provided you are eligible for a deferred or postponed annuity. You may request an application by contacting Long Term Care Partners, at

Part 7 - Applicant's Signature

Signature

Date (mm/dd/yyyy)

Office of Personnel Management |

CSRS/FERS Handbook |

RI |

Previous edition is not usable |

|

Revised May 2012 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form is used by former Federal employees to apply for a deferred or postponed retirement annuity under the Federal Employees Retirement System (FERS). |

| Eligibility | Applicants must have at least 5 years of creditable civilian service and either be eligible for retirement at age 62 or have 10 years of service for minimum retirement age eligibility. |

| Submission Timeline | The completed application should be sent approximately 60 days before the desired benefits start date. |

| Mailing Address | Applications should be sent to the Office of Personnel Management (OPM) at P.O. Box 45, Boyers, PA 16017-0045. |

| Supporting Documentation | Applicants must include any necessary documentation, such as divorce decrees if applicable, and ensure proper consent if married. |

| Governing Law | The form is governed by the Federal Employees Retirement System law, specifically Chapter 84, Title 5 of the U.S. Code. |

Guidelines on Utilizing Ri 92 19

Completing the RI 92-19 form is essential for former federal employees seeking deferred or postponed retirement benefits under the Federal Employees Retirement System (FERS). Make sure you have all necessary documents and information ready before starting. Follow these steps to complete and submit your form correctly.

- Fill in Section A with your identifying information. Include any other names you used while employed by the Federal government.

- Complete Section B by indicating your last agency and listing all Federal civilian service you performed, along with dates.

- In Section C, provide details about your military service, including whether it was under honorable conditions and if you're receiving or have applied for military retired pay.

- Move to Section D to disclose any workers’ compensation claims related to job-related injuries or illnesses.

- In Section E, indicate if you have a living former spouse entitled to survivor benefits. Attach necessary legal documents if applicable.

- Read carefully and choose your elections in Section F, which pertains to survivor benefits. Ensure you understand the impacts of your choices.

- List your unmarried dependent children in Section G, including any disabled children over 22 years old.

- Complete Section H for payment instructions, including your banking details for direct deposit or Direct Express debit card options.

- Sign and date your application in Section I to certify your information is accurate.

- Attach any required schedules based on your marital status, creditable service, or insurance needs.

After completing the form, review it for errors or missing information. It’s recommended to mail the completed application about 60 days prior to your intended benefits start date. Ensure you send it to the specified office address to avoid delays in processing your retirement application.

What You Should Know About This Form

What is the RI 92-19 form used for?

The RI 92-19 form is an application for deferred or postponed retirement specifically for former Federal employees covered by the Federal Employees Retirement System, or FERS. This form is intended for those who wish to apply for their retirement annuity after a separation from Federal service or when transferring to a position not covered by FERS, and when such benefits will begin more than 1 month post-separation.

Who is eligible to use the RI 92-19 form?

You can use the RI 92-19 if you have completed at least 5 years of creditable civilian service and are eligible for a deferred retirement at age 62, or if you have completed at least 10 years of creditable service that includes 5 years of civilian service and are eligible for an annuity at the Minimum Retirement Age (MRA).

When should I submit my RI 92-19 form?

It's advisable to send your completed application about 60 days before you would like your benefits to start. This will give the Office of Personnel Management ample time to process your application without delays.

Where do I send my completed RI 92-19 form?

You should send the completed form to the Office of Personnel Management at: P.O. Box 45, Boyers, PA 16017-0045. Make sure to double-check that your application is complete before mailing it to avoid unnecessary delays.

What if I change my address after submitting the application?

If your address changes before you receive a claim number, it's important to inform the Office of Personnel Management. Write to them, providing your name, date of birth, and social security number. If you already have a claim number, include that in your communication for easier tracking.

What documents should I include when applying?

A divorce decree, if applicable, and any other documentation related to survivor benefits must be included if you have a former spouse. Always check that all other sections of the application are complete to avoid processing delays.

How does the survivor annuity work in the RI 92-19 form?

The survivor annuity allows your spouse or former spouse to receive a portion of your retirement benefits upon your passing. The amount varies based on your elections and whether your spouse was married to you for a minimum of nine months or is a parent of your child. Make sure to review the pamphlet that accompanies this form for detailed information on costs and elections.

Can I apply for my annuity payments to be direct deposited?

Yes, all Federal benefit payments are typically made electronically. You will have the option to have your payments directly deposited into a bank account or onto a Direct Express debit card. You must provide your bank's routing number for direct deposit, which can often be found on your checks or by asking your bank directly.

What should I do if I have military service?

If you have military service after December 31, 1956, you are likely required to pay a deposit to receive credit for that service under FERS. Make sure to indicate whether you have paid that deposit and check the appropriate boxes regarding military retired or retainer pay. You might need to waive that pay to receive credit for your military service in your Federal retirement annuity.

Common mistakes

Filling out the RI 92-19 form can be a straightforward process, but many applicants make common mistakes that can delay their retirement benefits. One major error occurs when applicants fail to provide all necessary identifying information. For example, in Item 2 of Section A, it's critical to list any other names used in federal employment, such as a maiden name. Neglecting to include these names can hinder the retrieval of employment records and disrupt the processing of the application.

Another frequent mistake is related to military service information. In Section C, specifically Item 1, applicants must indicate whether they have performed active duty in the armed services. Many individuals forget to provide this detail or misunderstand what counts as military service. Consequently, they may fail to list crucial service that could impact their retirement annuity or fail to pay necessary deposits, which can result in reduced benefits.

In Section H, applicants often overlook the importance of providing accurate financial institution information. It's essential to include the correct Financial Institution Routing Number for direct deposits. Some applicants guess the number or fail to verify it with their bank, leading to payment delays. Without this crucial detail, the Office of Personnel Management cannot process direct deposit requests, which could lead to financial strain during retirement.

Lastly, many make errors in the survivor annuity election section. In Section F, if there is a current spouse, it’s necessary to complete Schedule A, which requires the spouse's consent for certain elections. Applicants sometimes forget to gather this consent before submitting the form, resulting in processing delays. Properly navigating these sections is crucial for ensuring timely and correct disbursement of benefits, making attention to detail paramount in this application process.

Documents used along the form

The RI 92-19 form is essential for former Federal employees applying for a deferred or postponed retirement under the Federal Employees Retirement System (FERS). To support the application process, several other forms and documents are commonly required. Here is a list of these documents, each serving a specific purpose:

- RI 92-19A: This pamphlet provides detailed information about applying for deferred or postponed retirement under FERS, outlining eligibility requirements and application instructions.

- Schedule A - Spouse’s Consent to Survivor Election: This document is necessary when a married applicant chooses not to elect a maximum survivor annuity for their spouse, as it requires the spouse’s consent.

- Schedule B: For applicants with at least 10 years of service who have reached Minimum Retirement Age (MRA), this schedule allows them to discuss options regarding the start date of their annuity and eligibility for reenrollment in certain benefits.

- Schedule C: This is similar to Schedule B, but for those who have at least 10 years of service yet have not reached MRA. It outlines annuity start dates and related benefits.

- Form SF 2821: This form is necessary for enrollees in health benefits, documenting any changes or requests related to their coverage upon retirement.

- Form SF 3100: Also known as the Federal Employees Retirement System Application, this form is used to apply for retirement benefits under FERS and must be submitted along with the RI 92-19.

- Form OWCP 1500: This form is essential for those who have received workers' compensation benefits. It documents any past claims that could potentially impact retirement benefits.

Completing the RI 92-19 form is a vital step in ensuring that your retirement benefits are processed efficiently. Having the correct supporting documents ready can facilitate a smoother transition into retirement. Be sure to gather these forms ahead of time to avoid delays in your application process.

Similar forms

- SF 3107: The SF 3107 form is used for applying for an immediate retirement under the Federal Employees Retirement System. Like the RI 92-19 form, it requires the applicant to have a specific amount of creditable service and involves similar identification information, such as social security numbers and details about military service. Both forms aim to assist eligible employees in transitioning into retirement.

- RI 20-97: This is the application for a Federal Employees Retirement System (FERS) service annuity. The comparison to the RI 92-19 lies in the requirement to provide similar documentation regarding service history and benefits choice. Both forms seek to verify the applicant’s eligibility for retirement benefits before processing their claims.

- SF 2821: The SF 2821 form is a Request for Insurance Benefits through the Federal Employees Health Benefits Program. It shares similarities with the RI 92-19 form in that both undergo a detailed assessment of prior employment to evaluate eligibility for benefits. They also require individuals to provide personal information and make specific elections regarding their benefits.

- RI 92-22: This form is specifically used for requesting information about service credit for retirement purposes. Like the RI 92-19 form, it addresses past service and includes sections designed to capture the applicant's employment history and military service, which play critical roles in determining retirement eligibility.

Dos and Don'ts

Things to Do:

- Complete the form approximately 60 days before your desired benefits start date.

- Type or print clearly to avoid any processing delays.

- Provide your Social Security Number on each page of the application.

- Include all required documentation, such as divorce decrees if applicable.

- Double-check your financial institution details for direct deposit accuracy.

Things Not to Do:

- Do not leave any section incomplete—fill out everything applicable.

- Do not use a different mailing address for correspondence other than the one listed in Section C.

- Do not submit previous editions of the form—only use the most current version.

- Do not forget to sign and date the application; failing to do so may cause delays.

- Do not hesitate to ask for help if you’re unsure about any questions—write "unknown" if necessary.

Misconceptions

- Misconception 1: The RI 92 19 form is only for current federal employees.

- Misconception 2: You cannot apply for retirement benefits until you reach age 62.

- Misconception 3: There is no need to submit the application early.

- Misconception 4: Previous editions of this form are still acceptable.

- Misconception 5: Military service does not count towards retirement eligibility.

- Misconception 6: The form can be filled out without any documentation.

- Misconception 7: You can receive both military retired pay and FERS retirement benefits simultaneously.

- Misconception 8: Your annuity payments can be received through regular mail.

- Misconception 9: Survivor benefits are automatic and do not require additional information.

- Misconception 10: Once you submit your application, there’s nothing else to do.

This form is specifically for former federal employees who have separated from service and wish to apply for a deferred or postponed retirement annuity under the Federal Employees Retirement System (FERS).

If you have completed at least 10 years of creditable service, you may qualify for an annuity at the Minimum Retirement Age (MRA), which can be younger than 62.

It is recommended that you send your completed application approximately 60 days before you want your benefits to begin to ensure timely processing.

Only the current version of the form should be used, as previous editions are not usable and may result in delays or rejections.

Under certain conditions, military service can be credited for your retirement, but you must have paid a deposit for service after December 31, 1956.

Make sure to gather any necessary documentation such as your divorce decree, claim numbers for workers' compensation, and military service details before filling out the application.

For most cases, to receive credit for military service under FERS, you must waive your military retired pay unless it is due to a service-connected disability.

All Federal benefit payments are made electronically. Direct deposit to a bank account or a Direct Express debit card is required for receiving your annuity payments.

To elect a survivor annuity, you must provide specific information and may need your spouse's consent if you are still married.

It’s crucial to follow up, especially if your address changes or if you receive any correspondence regarding your claim. Keeping track of your claim number is also essential for communication with the Office of Personnel Management.

Key takeaways

- Eligibility is Key: The RI 92-19 form is intended for former Federal employees covered by the Federal Employees Retirement System (FERS) who are seeking a retirement annuity beginning more than one month after separation.

- Service Requirements: You must have at least 5 years of creditable service for deferred retirement at age 62 or 10 years of creditable service (including 5 years of civilian service) to apply for an annuity at Minimum Retirement Age (MRA).

- Correct Timing: Submit your completed application about 60 days before the desired benefit start date to ensure timely processing.

- Address Changes Matter: If your address changes before you receive your claim number, write to the Office of Personnel Management (OPM) and provide your name, date of birth, and Social Security number.

- Direct Deposit or Debit Card Options: All Federal benefit payments are handled electronically, either via direct deposit to a bank account or through a Direct Express debit card.

- Survivor Annuity Elections: When considering survivor benefits, be aware that elections may terminate upon divorce or death of the annuity recipient, emphasizing the importance of keeping your information current.

Browse Other Templates

How to Get Power of Attorney Over a Parent in Michigan - The document outlines the responsibilities and powers the agent will have under your authority.

Tax Free Gift Limit 2024 - This form also outlines how to compute taxes based on previous years' taxable income of the beneficiary.