Fill Out Your Ri Str Eft Form

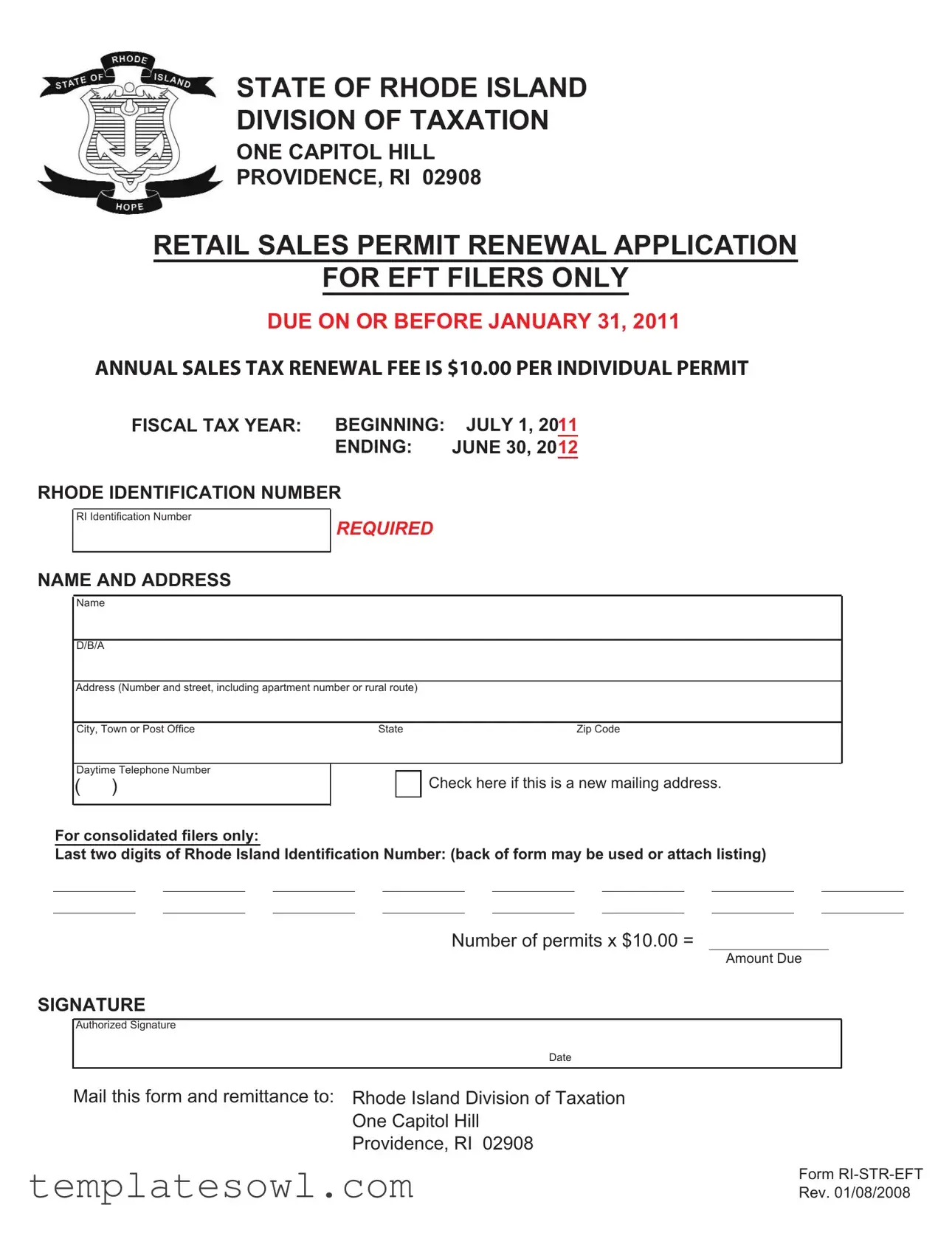

The Ri Str Eft form is an essential document for businesses in Rhode Island that need to manage their sales tax obligations. Designed specifically for Retail Sales Permit renewal applications from Electronic Funds Transfer (EFT) filers, this form must be submitted annually. The deadline for submission is January 31, 2011, and an annual sales tax renewal fee of $10.00 applies to each individual permit. This form covers the fiscal tax year beginning on July 1, 2011, and ending on June 30, 2012. The basic requirements include providing the Rhode Island Identification Number, business name, and address details, along with a daytime contact number. It’s essential for filers to indicate if they have a new mailing address. For those filing consolidated forms, the last two digits of the Rhode Island Identification Number must also be included. Completing the form requires an authorized signature and a clear indication of the total amount due, calculated based on the number of permits held. Ensure to send the completed form along with payment to the Rhode Island Division of Taxation at their designated address in Providence.

Ri Str Eft Example

STATE OF RHODE ISLAND

DIVISION OF TAXATION

ONE CAPITOL HILL

PROVIDENCE, RI 02908

RETAIL SALES PERMIT RENEWAL APPLICATION

FOR EFT FILERS ONLY

DUE ON OR BEFORE JANUARY 31, 2011

ANNUAL SALES TAX RENEWAL FEE IS $10.00 PER INDIVIDUAL PERMIT

FISCAL TAX YEAR: BEGINNING: |

JULY 1, 2011 |

ENDING: |

JUNE 30, 2012 |

RHODE IDENTIFICATION NUMBER |

|

RI Identification Number

NAME AND ADDRESS

REQUIRED

Name

D/B/A

Address (Number and street, including apartment number or rural route)

City, Town or Post Office |

State |

Zip Code |

Daytime Telephone Number

()

Check here if this is a new mailing address.

For consolidated filers only:

Last two digits of Rhode Island Identification Number: (back of form may be used or attach listing)

Number of permits x $10.00 =

Amount Due

SIGNATURE

Authorized Signature

Date

Mail this form and remittance to: Rhode Island Division of Taxation

One Capitol Hill

Providence, RI 02908

Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The RI STR EFT form is a Retail Sales Permit Renewal Application specifically for those who file electronically. |

| Submission Deadline | This form must be submitted on or before January 31, 2011, to ensure compliance with state regulations. |

| Fee Structure | The annual sales tax renewal fee is set at $10.00 for each individual permit. |

| Fiscal Tax Year | The fiscal tax year for this form runs from July 1, 2011, to June 30, 2012. |

| Identification Requirements | Applicants must provide their Rhode Island Identification Number along with the name and address details. |

| Mailing Instructions | Completed forms should be mailed to the Rhode Island Division of Taxation at One Capitol Hill, Providence, RI 02908. |

Guidelines on Utilizing Ri Str Eft

Filling out the Ri Str Eft form is an important step in ensuring your retail sales permit is renewed correctly. This process can seem daunting, but with a clear understanding of each step, you will be able to complete it smoothly. Below are the steps to guide you through the process.

- Obtain the Ri Str Eft Form: Make sure you have the most recent version of the form. You can usually find it on the Rhode Island Division of Taxation's website or request it from their office.

- Fill in Your Rhode Island Identification Number: This number is crucial for identifying your business.

- Provide Your Name and Address: Include your full name (or business name if applicable), and provide your complete mailing address, including the apartment number or rural route if necessary.

- Fill in City, State, and Zip Code: Ensure that this information matches your official records for accuracy.

- Enter Your Daytime Telephone Number: This number should be one where you can be reached during business hours.

- Indicate a New Mailing Address if Applicable: If your mailing address has changed, check the box provided.

- Consolidated Filers Section: If you are a consolidated filer, enter the last two digits of your Rhode Island Identification Number. If additional space is needed, you can use the back of the form or attach a listing.

- Calculate the Amount Due: Multiply the number of permits by the annual renewal fee of $10.00. Write this amount in the designated area.

- Sign the Form: An authorized person must sign and date the form, confirming that the information provided is accurate.

- Mail the Form: Send the completed form along with your payment to the Rhode Island Division of Taxation at the provided address.

What You Should Know About This Form

What is the RI Str EFT form?

The RI Str EFT form is a Retail Sales Permit Renewal Application specifically for electronic funds transfer (EFT) filers in Rhode Island. It allows businesses to renew their sales tax permits to continue operations without interruption. This renewal must be submitted annually to ensure compliance with the state's taxation regulations.

When is the RI Str EFT form due?

This form is due on or before January 31, 2011. Deadlines are crucial for maintaining your sales permit. If the form is not submitted by this date, businesses may face penalties or may not be authorized to collect sales tax.

What is the renewal fee for the RI Str EFT form?

The annual sales tax renewal fee is $10.00 for each individual permit. This fee is essential for processing your renewal and ensuring your business remains in good standing with the Rhode Island Division of Taxation.

Can I change my business address on the form?

Yes, you can update your mailing address on the form. Simply check the box provided if you have a new mailing address. It is important that the Rhode Island Division of Taxation has your current information to send any relevant communications.

Where should I send the completed RI Str EFT form?

After filling out the form, mail it along with your payment to the Rhode Island Division of Taxation at One Capitol Hill, Providence, RI 02908. Make sure to send it early enough to meet the January 31 deadline.

What information is required to complete the form?

You must provide your Rhode Island Identification Number, the name of your business, a "doing business as" (D/B/A) name if applicable, your business address, and a daytime telephone number. If you are a consolidated filer, include the last two digits of your Rhode Island Identification Number as well.

Is the RI Str EFT form applicable to all businesses?

No, this form is specifically for businesses that file their sales taxes electronically. If you do not file electronically, you will need to use a different form for your sales permit renewal.

What happens if I fail to file the RI Str EFT form on time?

If you miss the deadline for submitting the form, you may face late fees, or your business might not be allowed to collect sales tax until your permit is renewed. It’s advisable to submit your renewal on time to avoid any disruptions.

How many permits can be renewed with one form?

You can renew multiple permits on one form. Just indicate the number of permits you are renewing and multiply that by the renewal fee, which is $10.00 per permit. This allows for a more efficient process if you manage several permits.

Is this form available for download online?

Yes, the RI Str EFT form can generally be found on the Rhode Island Division of Taxation's official website. You may download and print it for use, ensuring you comply with the latest version and requirements.

Common mistakes

Filling out the RI STR EFT form can seem straightforward, but there are several common mistakes that individuals frequently make. First and foremost, one of the most common errors is the omission of the Rhode Identification Number. Without this unique identifier, the application cannot be processed, leading to unnecessary delays.

Another frequent mistake involves providing incorrect contact information. Many applicants either enter a wrong telephone number or fail to indicate a new mailing address when applicable. It's crucial to double-check this information to ensure the Rhode Island Division of Taxation can reach you if any issues arise.

People also tend to miscalculate the annual sales tax renewal fee. The form clearly states that the fee is $10.00 per individual permit, but some applicants forget to multiply this amount by the number of permits being renewed. This can lead to underpayment, resulting in further complications and potential penalties.

A fourth mistake is improper completion of the identification section. Applicants sometimes neglect to write their name as it appears on their official documents or misspell the name. Consistency in this information is vital for smooth processing.

Moreover, the signature line can pose problems. If an authorized signature is missing or if the signer dates the form incorrectly, the application might be rejected. It is essential to ensure that the form is signed and dated in the appropriate places.

Applicants often ignore essential instructions or details mentioned on the back of the form. The back of the form can provide valuable guidance on how to fill out the document accurately, so it should not be overlooked.

The timing of the application is also important. Some individuals fail to submit the form by the due date of January 31, 2011, which can lead to penalties and complications with their filing status.

Lastly, submitting the form without proper payment can cause significant delays. Always ensure that payment is included and check that it is the correct amount before mailing your application. Taking these steps will help ensure a smoother renewal process for your retail sales permit.

Documents used along the form

When renewing your retail sales permit in Rhode Island, completing the Ri Str Eft form is just one part of the process. There are several other important documents that can complement or support your application. Understanding these forms will help ensure a smooth renewal process. Here’s a list of some commonly used documents along with brief descriptions of each:

- Sales Tax Return (Form T-204): This document is necessary for reporting your monthly or quarterly sales tax collections. It's essential for illustrating your tax compliance and cash flow status.

- Application for a New Retail Sales Permit: If you are starting a new business, this application is required to obtain your first permit. It captures all the necessary business information and identification details.

- Business Registration Form (Form BR-1): This form provides the state with essential data about your business entity. It includes details like business structure and ownership, which can be vital for tax purposes.

- Proof of Previous Year’s Sales Tax Payments: Documentation reflecting your sales history and tax payments from the previous year can strengthen your current application. It assures the state of your compliance with tax obligations.

- Bank Authorization Form: For businesses using electronic funds transfer (EFT), this form authorizes the state to withdraw sales tax payments directly from your bank account, making payments more streamlined.

- Certificate of Good Standing: This certificate verifies that your business is compliant with state regulations and is eligible to conduct business in Rhode Island, essential for maintaining your retail sales permit.

By gathering these forms alongside the Ri Str Eft form, you can enhance your application and alleviate potential delays. Staying organized and informed is key to navigating the renewal process effectively.

Similar forms

The Ri Str Eft form shares similarities with several other documents commonly used for tax and business-related purposes. Below is a list of eight forms that have comparable elements to the Ri Str Eft form:

- Business License Application: Like the Ri Str Eft form, a business license application requires specific identification and contact information. Both forms necessitate a renewal process at regular intervals.

- Sales Tax Registration Form: This form serves to register for sales tax collection and includes details about the business. Similar to the Ri Str Eft form, it also requires the Rhode Island Identification Number.

- Annual Franchise Tax Return: Both documents necessitate the payment of a fee and provide details regarding business operations. Each form also requires confirmation of the fiscal year.

- Exempt Use Certificate: An exempt use certificate documents qualifying purchases for sales tax exemption. Both this certificate and the Ri Str Eft form rely on proper identification of the business entity.

- Employment Tax Registration Form: This form is critical for businesses with employees. Similar to the Ri Str Eft form, it mandates reporting information and payment of applicable fees.

- Tangible Personal Property Tax Form: This form is used for assessing property. Both forms embody relevant financial details related to the business and its operations.

- State Corporate Income Tax Return: Much like the Ri Str Eft form, this return includes specific tax obligations and requires a timeline for filing and payment.

- Monthly Sales Tax Return: A monthly sales tax return, while more frequent in filing, still aligns with the Ri Str Eft form in that it documents sales transactions and affirms the associated tax payment.

Dos and Don'ts

When filling out the Ri Str EFT form, it's essential to follow specific guidelines. Here are some do's and don'ts to ensure the process goes smoothly:

- Do ensure you enter your Rhode Identification Number correctly.

- Do provide accurate personal details, including your full name and address.

- Do complete the form before the due date, which is January 31, 2011.

- Do calculate the total amount due based on the number of permits accurately.

- Do sign and date the form before submitting it.

- Don't forget to check the box if you have a new mailing address.

- Don't leave any section of the form incomplete.

- Don't submit the form without double-checking for any errors.

- Don't mail the form without including your remittance.

Misconceptions

Misconceptions can often create confusion, especially regarding forms and procedures that are required by state taxation authorities. Below is a list of common misconceptions about the Rhode Island Retail Sales Permit Renewal Application for EFT Filers, also known as the Ri Str Eft form.

- The form is only for new businesses. Many believe that the Ri Str Eft form applies solely to startups. In reality, it is used to renew existing permits as well, so established businesses must also complete this form annually.

- The renewal fee is much higher than $10. Some people may think that the fee for renewing their retail sales permit is exorbitant. However, the annual renewal fee is actually just $10.00 per individual permit.

- Filers can wait until after the due date to submit the form. It's a common misconception that late submissions are acceptable. In fact, the form and the renewal fee are strictly due on or before January 31 of each year to avoid penalties.

- The information on the form is optional. It may seem that certain fields on the Ri Str Eft form aren’t required, but all information requested, including the Rhode Identification Number and address, must be provided to process the application accurately.

- Only one permit can be renewed at a time. Some individuals assume they can only renew a single permit each time they submit the Ri Str Eft form. In contrast, if a business has multiple permits, they can renew them all simultaneously on the same form by providing the total number of permits.

- Changing the mailing address is not important. Another misconception is that updating the mailing address is unnecessary if nothing has changed. It's crucial to check the box indicating a new mailing address to ensure that future correspondence reaches you without issues.

- The form can be submitted online. Some filers believe they can complete the renewal online. However, the Ri Str Eft form must be mailed in along with the payment, as specified in the instructions on the form.

- A signature is not required for submission. There is a common misunderstanding that an authorized signature is optional. This is not the case; the form must be signed by an authorized individual to be considered valid.

- The form is the same every year. Many individuals assume that the Ri Str Eft form does not change from year to year. However, it's important to check for any updates or revisions that may occur each fiscal year and to use the most recent version of the form.

Clarifying these misconceptions will help ensure that individuals and businesses meet their renewal obligations accurately and timely, thus avoiding any unnecessary penalties or issues.

Key takeaways

Successfully filling out and using the Ri Str Eft form requires attention to detail and understanding the requirements. Here are some key takeaways to keep in mind:

- The form is specifically for renewing retail sales permits for electronic funds transfer (EFT) filers.

- Complete the form by January 31, 2011, to avoid potential penalties.

- Each permit renewal incurs a fee of $10.00.

- Clearly indicate the fiscal tax year you are applying for, which runs from July 1, 2011, to June 30, 2012.

- Your Rhode Island Identification Number must be entered accurately.

- Provide your name and full address, including apartment number if applicable.

- Include a daytime telephone number so that the tax division can reach you if necessary.

- If you have a new mailing address, be sure to check the designated box on the form.

- For consolidated filers, list the last two digits of your Rhode Island Identification Number on the form.

- Calculate the total amount due by multiplying the number of permits by $10.00.

- Finally, don’t forget to sign and date the form before mailing it to the Rhode Island Division of Taxation.

Filling out forms can feel daunting, but following these guidelines will make the process smoother and more efficient.

Browse Other Templates

Epaystubaccess Login - Keep a copy of your completed application for your own records.

Vehicle Ownership Declaration,Watercraft Title Certification,ORV Registration Affidavit,Snowmobile Ownership Affidavit,Michigan Vehicle Certification Form,Title Recovery Statement,Ownership Verification Form,Certificate of Vehicle Custody,Vehicle Tit - For vehicles, an appraisal showing the value must be submitted for those worth $2,500 or less.