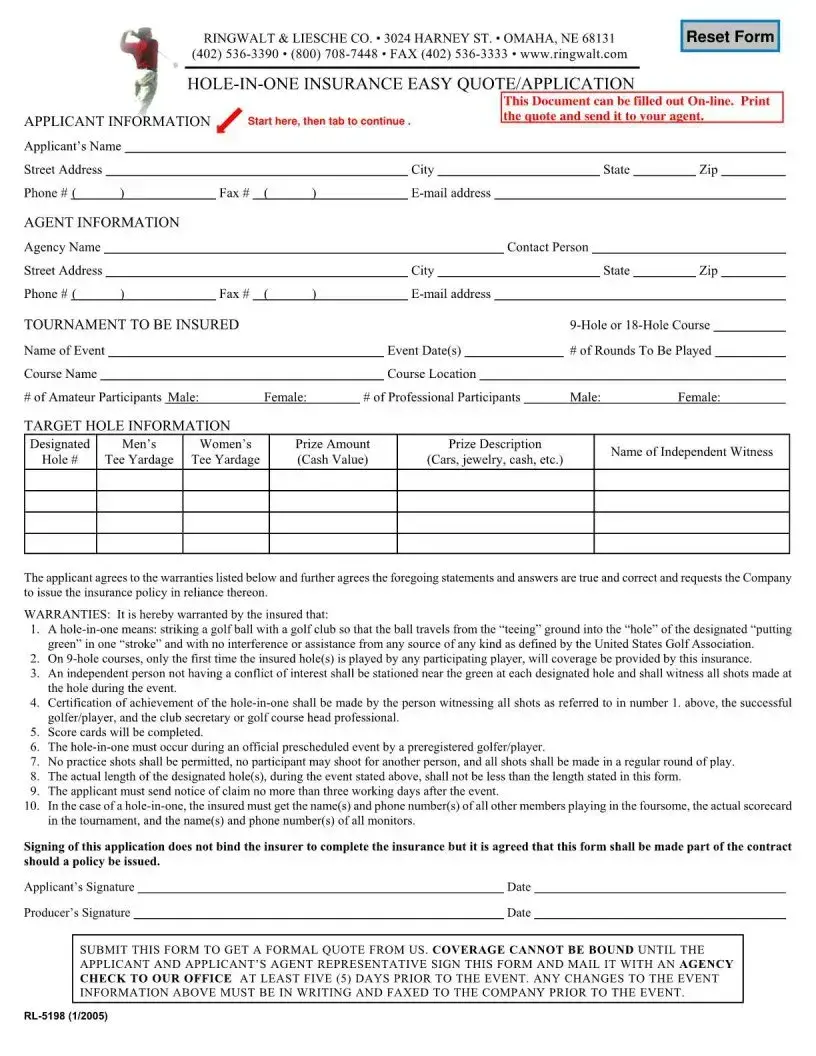

Fill Out Your Rl 5198 Form

The Rl 5198 form is a crucial document for individuals and organizations seeking hole-in-one insurance coverage for golf tournaments. This form simplifies the application process by collecting essential details from both the applicant and their agent. It captures information about the event, such as the name of the tournament, the course location, and the number of participants, including both amateur and professional golfers. Key requirements and warranties are outlined to ensure compliance with specific guidelines established by the United States Golf Association. These guidelines clarify what constitutes a hole-in-one and set conditions for coverage, such as the need for independent witnesses during the event. The form also specifies that notice of a claim must be sent within three working days following the event. Additionally, it emphasizes the importance of using the designated hole's actual length and prohibits practice shots. By submitting this form, applicants initiate the process of obtaining a quote while agreeing that the information provided is accurate. As it serves as part of the contract, careful completion is essential for those pursuing this specialized coverage.

Rl 5198 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Identifier | The Rl 5198 form is specifically designed for Hole-in-One insurance applications. |

| Insurance Provider | This form is issued by R1NGWALT & LIESCHE CO., based in Omaha, Nebraska. |

| Application Process | Applicants fill out the form online, print it, and send it to their insurance agent. |

| Event Requirement | The coverage is for specific events where golfers are pre-registered to participate. |

| Independent Witness | An independent witness must be present at designated holes to validate the hole-in-one achievement. |

| Claim Notification | Claims must be reported to the insurer within three working days after the event takes place. |

| Warranties | The form includes several warranties that must be agreed to by the applicant, affecting coverage eligibility. |

| Submission Deadline | Completed forms must be submitted at least five days prior to the event for coverage to take effect. |

| Regulatory Compliance | This form adheres to the governing laws applicable in Nebraska and the rules of the United States Golf Association. |

Guidelines on Utilizing Rl 5198

Filling out the Rl 5198 form is straightforward but requires attention to detail. This form is essential for requesting a quote for hole-in-one insurance coverage for any golf tournament. Once completed, you will need to submit the form according to the instructions below to ensure timely processing.

- Begin by entering your Applicant Information. This includes your name, street address, city, state, zip code, phone number, fax number, and email address.

- Next, proceed to Agent Information. Fill in the agency name, street address, contact person, city, state, zip code, phone number, fax number, and email address related to the insurance agent.

- Then, move on to the Tournament to be Insured section. Provide the name of the event, course name, and the number of amateur participants for both males and females.

- Add details regarding the Target Hole Information. Indicate the event date(s), course location, whether it’s a 9-hole or 18-hole course, and the number of rounds to be played. Provide the number of professional participants for both males and females as well.

- Fill in the Designated Hole section. Specify the prize amount, prize description (e.g., cars, jewelry, cash), and the tee yardage for both men and women.

- Include the name of an Independent Witness who will be present during the tournament.

- Carefully read and acknowledge the warranties listed to ensure compliance with the insurance policy terms. Agreement to the warranties is mandatory.

- Sign and date the application form both as the applicant and the producer (agent).

- Once completed, make sure to submit the form for a formal quote. Remember, submission must include a check and should be sent at least five days before the event.

- If there are any changes to the event information after submission, they must be communicated in writing and faxed to the company prior to the event.

What You Should Know About This Form

What is the purpose of the RL 5198 form?

The RL 5198 form is primarily used to apply for hole-in-one insurance for golfing events. This insurance provides coverage in case an amateur golfer successfully sinks a hole-in-one during a scheduled tournament. By completing this form, applicants provide essential details about the event and participants, allowing the insurance provider to assess the risk associated with offering coverage. It ensures that all necessary information is documented and helps facilitate a smooth claims process if a hole-in-one occurs.

What information do I need to provide on the RL 5198 form?

You will need to enter several key pieces of information on the RL 5198 form. First, details about the applicant, including their name, address, contact information, and email address must be filled out. Next, you must provide information about your insurance agent or agency. The tournament specifics are also vital, such as the event name, course name, participant details, the number of rounds of golf being played, and prize information. Lastly, the designated hole information, including tee yardage and prize descriptions, must be clearly noted. Accurate and complete information is crucial for securing the insurance coverage you need for your event.

How do I submit the RL 5198 form?

To submit the RL 5198 form, complete it thoroughly and make sure all required signatures are included. Once everything is filled out, the form should be mailed to the specified company address along with an agency check. Remember, this needs to be done at least five days prior to your event. It's important to double-check that all details are accurate, as any changes to the event information must also be submitted in writing prior to the tournament. Prompt submission of this form will secure the coverage needed for a successful event.

What happens if a hole-in-one is made during the tournament?

If a participant scores a hole-in-one during the covered event, specific procedures must be followed to file a claim for the insurance coverage. The applicant is required to notify the insurance company within three working days after the event. The successful golfer must also collect essential information such as the names and phone numbers of fellow participants, the scorecard from the tournament, and details of any witnesses. This information is crucial for verifying the event and processing the insurance claim. Following the established protocols ensures that you receive the appropriate prizes and recognition for the achievement.

Common mistakes

When filling out the RL 5198 form, avoiding common mistakes is crucial for ensuring a smooth application process. First, many applicants neglect to include all requested contact information. This includes not just their name, but also their complete street address, phone number, and email address. Missing this information can lead to unnecessary delays in processing.

Another frequent error lies in the failure to accurately fill out the tournament details. Prospective applicants sometimes overlook the need to provide specific information such as the name of the event, the course name, and the number of participants. Omitting or misrepresenting these details can result in complications during the verification process.

A significant mistake occurs when the designated hole information is incorrectly specified. Applicants might forget to indicate the precise tee yardage or prize amount. Ensuring this information is accurate is essential, as incorrect details can impact eligibility for coverage.

The form requires a witness to validate the claims. However, applicants often fail to include the name of an independent witness. This oversight can render any claims invalid, as the witness plays a vital role in confirming the hole-in-one achievement.

Another common error is neglecting the warranties agreement section. Applicants may either skip reading this section or misunderstand its importance. By not acknowledging the warranties, applicants risk invalidating their policy.

A lack of adherence to event timelines is also common. Some applicants forget to submit their claims within the three-day notice period after the event. Late submissions can lead to claim denials and unnecessary frustration.

Additionally, some individuals misinterpret the rules surrounding practice shots. A misunderstanding can lead to violations of the coverage terms, putting their insurance at risk.

Failing to sign the application can delay processing. Applicants must remember that both the applicant and the producer need to sign the form for it to be considered complete.

Lastly, submitting the form without reviewing for accuracy is a mistake too many make. Errors in any section can lead to significant complications in policy issuance. A careful review will ensure the application is as complete and correct as possible.

Documents used along the form

When organizing a golf tournament that involves hole-in-one insurance, specific forms and documents support the process efficiently and ensure compliance. Here’s a list of key documents often used alongside the Rl 5198 form to help streamline your event planning. Each document serves a distinct purpose, making them essential for both the applicants and the insurance providers.

- Insurance Policy Document: This official document outlines the terms, coverage, and conditions associated with the hole-in-one insurance. It is crucial for participants to understand their rights and obligations under this policy.

- Event Information Sheet: A comprehensive form that captures details about the tournament, such as event date, location, participant information, and prize details, ensuring a clear understanding of the logistics involved.

- Claim Notification Form: Used by the insured to report a hole-in-one claim. This form requires details of the event and the golfer's achievement and must be submitted within the specified time frame after the event.

- Scorecards: Essential for documenting the performance of players, scorecards serve as a record of scores that can validate claims for a hole-in-one. Properly filled scorecards help maintain transparency and accuracy.

- Witness Statement Form: A document filled by the independent witness during the tournament. It confirms that the hole-in-one occurred as per the event rules, providing validation essential for the claim process.

- Registration Forms: Each participant may be required to fill out a registration form before the tournament. This document collects personal information, ensuring that all participants are accounted for and eligible for coverage.

- Agency Agreement: A contract between the insurer and the insurance agent that formalizes their relationship and defines their roles. This document is important for establishing responsibilities in managing the insurance policy.

- Amendment Request Form: Should any changes to the tournament details arise before the event, this form allows for communication between the applicant and the insurance company, ensuring that accurate and updated information is on record.

Each of these documents plays a vital role in facilitating a successful tournament while ensuring participants are adequately protected. Keeping these forms organized and accessible will make the process smoother, allowing everyone to focus on enjoying the event.

Similar forms

The Rl 5198 form, used for requesting hole-in-one insurance, shares similarities with various other forms that also pertain to insurance and event management. Here is a list of similar documents:

- Event Insurance Application Form: Like Rl 5198, this form collects essential information about an upcoming event, such as dates, location, and details about participants. It also seeks to establish coverage for event-related risks.

- Liability Waiver Form: This document ensures that participants acknowledge the risks involved in activities and agree not to hold the organizers responsible for any incidents. Much like the Rl 5198, it captures participant information and requires signatures as an agreement to the terms.

- Accidental Death and Dismemberment Insurance Application: Both forms emphasize the importance of participant information, coverage details, and the need for accurate reporting to ensure valid claims in case of unforeseen events.

- Tournament Entry Form: This type of form gathers participant data and event details, similar to Rl 5198. It is essential for organizing events and ensuring everyone is properly registered for participation.

- Certificate of Insurance Request Form: Just as Rl 5198 is used to initiate an insurance policy, this form is used to request proof of coverage for specific events, ensuring that all parties involved are informed of the insurance details.

- Registration Form for Sporting Events: This document requests essential participant information and event specifics. Both forms aim to ensure that organizers have the necessary data for planning and managing events effectively.

- Deposit Agreement Form for Events: Similar to Rl 5198, a deposit agreement outlines the financial commitment of participants or sponsors, establishing clear expectations regarding payment and event participation.

- Claim Form for Insurance Policies: While Rl 5198 initiates a potential claim, this form is utilized after an event has occurred to formally request compensation, focusing on detailed documentation of the incident.

- Participant Liability Agreement: This document requires participants to accept the risks associated with an event, similar to the warranties found in Rl 5198, ensuring that organizers are protected legally.

- Emergency Contact Information Form: Like Rl 5198, this form collects vital information regarding participants that may be needed during emergencies, emphasizing the safety and security of all involved.

Dos and Don'ts

When completing the Rl 5198 form, it is important to follow these guidelines to ensure that all necessary information is provided accurately.

- Do fill in all required fields completely.

- Do double-check the applicant's contact information for accuracy.

- Do ensure that the event information is current and matches your plans.

- Do gather all necessary documentation, such as scorecards and witness information.

- Don't skip any sections of the form.

- Don't assume that verbal agreements will be sufficient; everything needs to be documented.

- Don't submit the form without the required signatures.

- Don't delay sending the form; submit it at least five days before the event.

Misconceptions

There are many misconceptions surrounding the Rl 5198 form. Understanding the truth can help streamline the process of obtaining hole-in-one insurance. Here are seven common misunderstandings:

- It's just a standard insurance form. Many believe this form is like any other insurance application. In reality, it contains specific warranties and requirements tailored for golf tournaments.

- Filling it out online guarantees coverage. Some think that simply completing the form online guarantees insurance. Coverage only starts once the form is signed and submitted with an agency check.

- The number of rounds played doesn’t matter. The form specifically asks for the number of rounds. This is important as it impacts the insurance coverage provided.

- Amateur players are not covered. There's a misconception that only professional players can qualify. However, amateur participants do qualify, but there are specific conditions they must meet.

- The witness requirement is optional. Some assume that having an independent witness isn't necessary. The rules clearly state that a witness is required to validate the hole-in-one claim.

- Any player can take practice shots. Many think practice shots are allowed during the event. The form explicitly states that practice shots are not permitted.

- Submitting the form late is acceptable. It’s a common belief that late submissions are fine. However, the insurance cannot be bound unless the form is submitted at least five days before the event.

Understanding these points will help ensure that the process of applying for hole-in-one insurance goes smoothly and successfully.

Key takeaways

Here are key takeaways about filling out and using the Rl 5198 form for hole-in-one insurance:

- Applicant Information: Start the form by providing your name, address, and contact details. Ensure all fields are accurately filled out.

- Agent Information: Include details about your insurance agency. This section helps facilitate communication and manage the insurance process.

- Event Details: Clearly state the name and date of your event. Specify the course location and the number of rounds to be played to avoid confusion.

- Participant Information: Accurately list the number of participants, differentiating between male and female participants. This helps assess potential risk and coverage needs.

- Independent Witness: An independent witness is essential. Their role is to monitor the event and verify that all conditions for coverage are met.

- Claims Process: It's important to notify the insurance company of a claim within three working days following the event. Gather all necessary documentation to support the claim.

- Signature Requirement: The form must be signed by both the applicant and the agent. Without these signatures and a check submitted at least five days before the event, coverage cannot be bound.

Browse Other Templates

I Need a Doctor's Note to Go Back to Work - Advance health care directives facilitate informed decision-making.

Amerigroup Prior Authorization Form - Patients’ medication allergies are required on the form to ensure safety during treatment.